公司简介

| PGM 评论摘要 | |

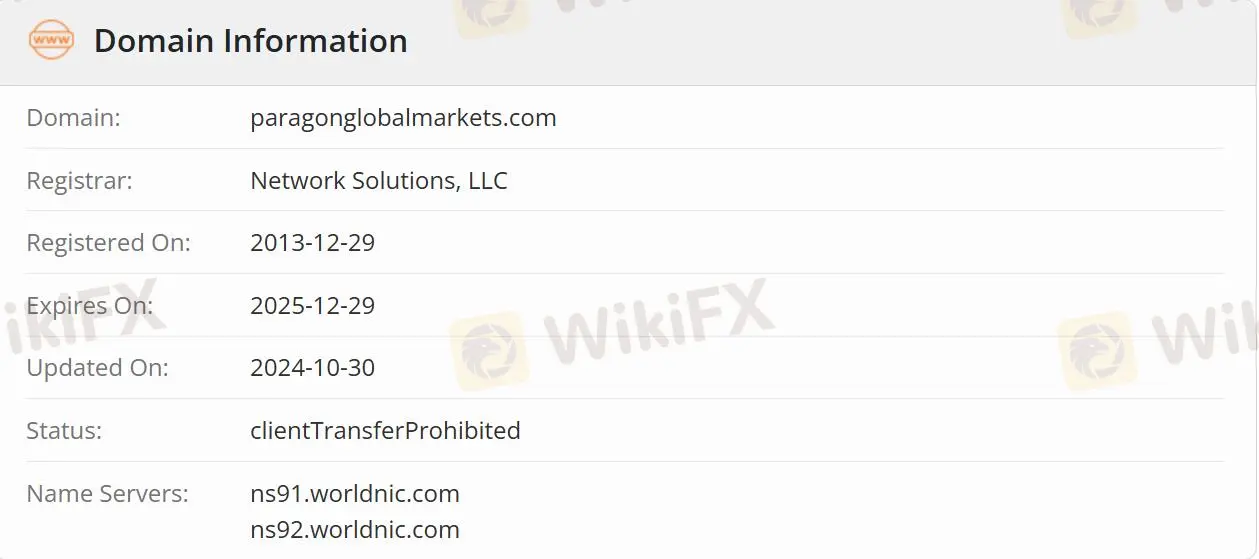

| 成立日期 | 2013-12-29 |

| 注册国家/地区 | 美国 |

| 监管 | 未受监管 |

| 产品和服务 | 产品/管理期货/客户解决方案。 |

| 交易平台 | CQG/CTS/Trading Technology/QST/Bloomberg/FFastFil/InfoReach/CME Group/Ice |

| 客户支持 | 电话:+1 (212) 590-1900 |

| 电子邮件:info@paragonglobalmarkets.com | |

PGM 信息

Paragon Global Markets (PGM) 是一个独立的介绍经纪人,为在全球衍生品市场交易的期货、外汇、执行和结算客户提供服务。

PGM 是否合法?

PGM 没有受到监管,相比受监管的经纪人来说,安全性较低。

PGM 提供哪些产品和服务?

产品和服务包括三个类别:产品、管理期货和客户解决方案。

产品:为客户提供全球交易所交易的期货和外汇执行服务,包括所有主要全球期货交易所的领先电子执行平台、算法、伦敦金属交易所专业知识、大宗订单管理、护理订单和期权策略管理。

管理期货:作为替代投资领域中与传统投资(如股票和债券)不同的一类资产。投资组合经理,即商品交易顾问(CTAs),使用期货合约作为其投资策略的一部分,并通过在金融工具、货币和商品中建立多头和/或空头头寸来获利。

客户解决方案:包括头寸、买卖、现金活动、余额、保证金、交易等。

交易平台

PGM 提供多种在线和可下载的交易平台,如Trading Technology、Bloomberg、FFastFill等。

| 交易平台 | 支持 |

| CQG | ✔ |

| CTS | ✔ |

| Trading Technology | ✔ |

| QST | ✔ |

| Bloomberg | ✔ |

| FFastFill | ✔ |

| InfoReach | ✔ |

| CME Group | ✔ |

| Ice | ✔ |