公司简介

| 艾德金融 评论摘要 | |

| 成立时间 | 2015 |

| 注册国家/地区 | 香港 |

| 监管 | SFC |

| 市场工具 | 证券、期货、外汇、股票、基金、债券和结构化产品以及私募股权 |

| 模拟账户 | ❌ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | Eddid One、Eddid Lite和Eddid Pro交易平台 |

| 最低存款 | / |

| 客户支持 | 联系表单 |

| 电话:+852 2655 0300 / +852 3572 0052 | |

| 电子邮件:info@eddid.com.hk | |

| Instagram、Facebook、Linkedin | |

| 地址:香港中环添美道1号中信大厦21楼 | |

艾德金融是一家于2015年在香港成立的金融机构,受SFC监管。艾德金融通过Eddid One、Eddid Lite和Eddid Pro交易平台提供广泛的服务,包括金融科技、资产管理、投资银行、财富管理、证券、期货、外汇投资等。

优点和缺点

| 优点 | 缺点 |

| 受SFC监管 | 无模拟账户账户 |

| 多种交易产品和相关金融服务 | 有关账户、资金方式和手续费的信息有限 |

| 多种设备上的交易平台 | |

| 社交媒体存在 | |

| 多种联系方式 |

艾德金融是否合法?

是的,艾德金融受证券及期货事务监察委员会(SFC)监管。它持有编号为BHT550的期货合约交易和杠杆外汇交易所交易许可证。

| 证券及期货事务监察委员会(SFC) |

| 监管状态 | 受监管 |

| 监管机构 | 香港 |

| 许可机构 | Eddid证券期货有限公司 |

| 许可类型 | 期货合约交易和杠杆外汇交易所交易 |

| 许可编号 | BHT550 |

产品和服务

艾德金融 提供证券、期货、外汇、股票、基金、债券和结构化产品以及私募股权投资。其基金包括货币基金、债券基金、股票基金和互惠基金。

此外,它还提供相关的金融服务,包括财务咨询、首次公开募股、资产管理等。

交易平台

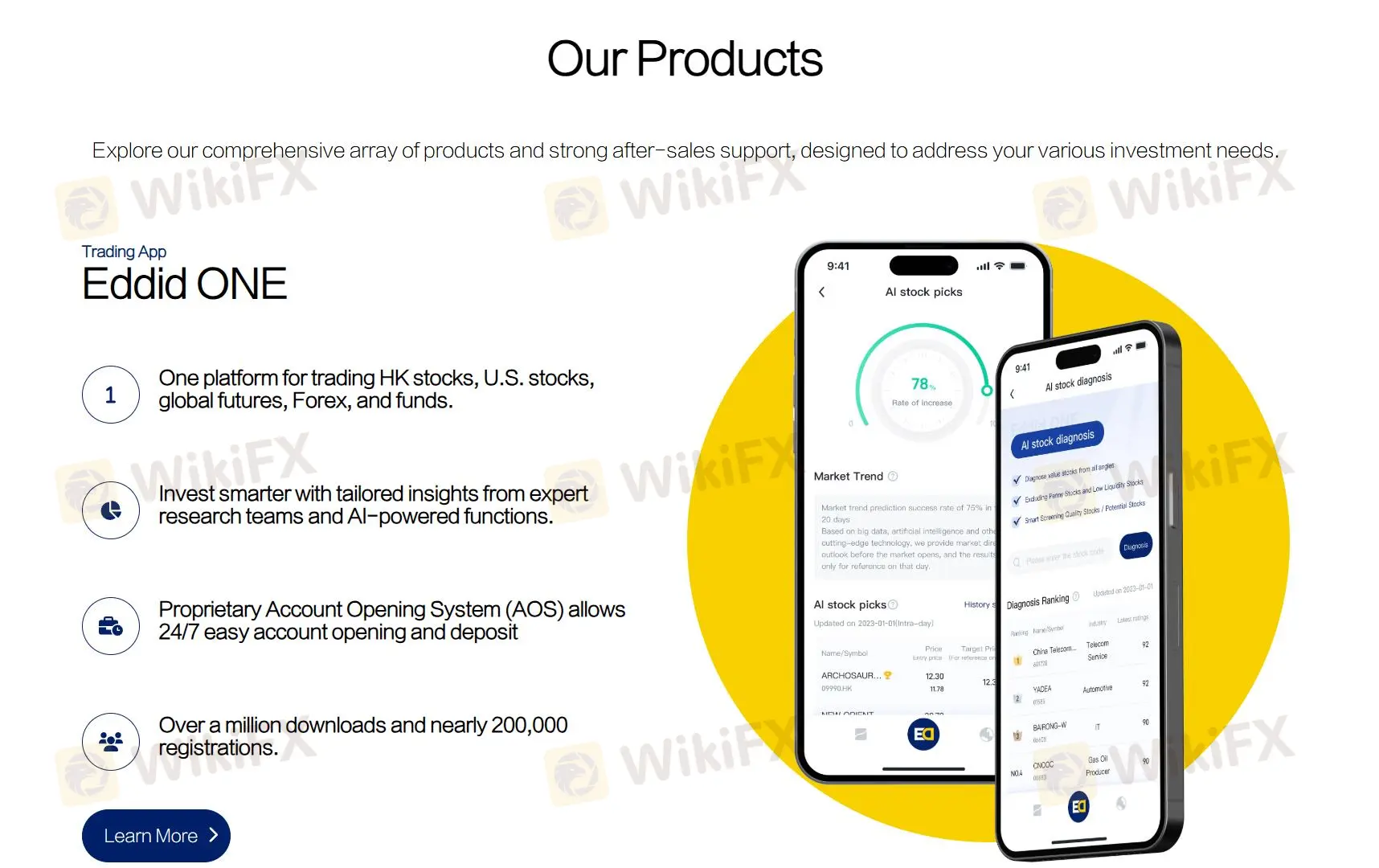

艾德金融 支持 Eddid One、Eddid Lite 和 Eddid Pro 交易平台。

Eddid ONE 是一种多资产交易平台,具有人工智能驱动的洞察力和用户友好的开户系统,适用于广泛的投资者。

Eddid Lite 是一种专注于期货交易的平台,具有高效交易所需的基本功能,非常适合喜欢简单性的用户。

另一方面,Eddid Pro 是一种专为需要复杂工具和自定义选项的专业交易员设计的高级期货交易平台。

| 特点/平台 | Eddid ONE | Eddid Lite | Eddid Pro |

| 资产类别 | 多资产(股票、期货、外汇、基金) | 期货 | 期货 |

| 人工智能驱动的洞察力 | ✔ | ❌ | ❌ |

| 用户友好的开户系统 | ✔(全天候开户和存款服务) | ❌ | ❌ |

| 目标用户 | 广泛的投资者 | 喜欢简单性的用户 | 专业交易员 |

| 平台 | iPhone/Android/Windows | Windows | Windows |

| 用户手册 | 中文 | ||

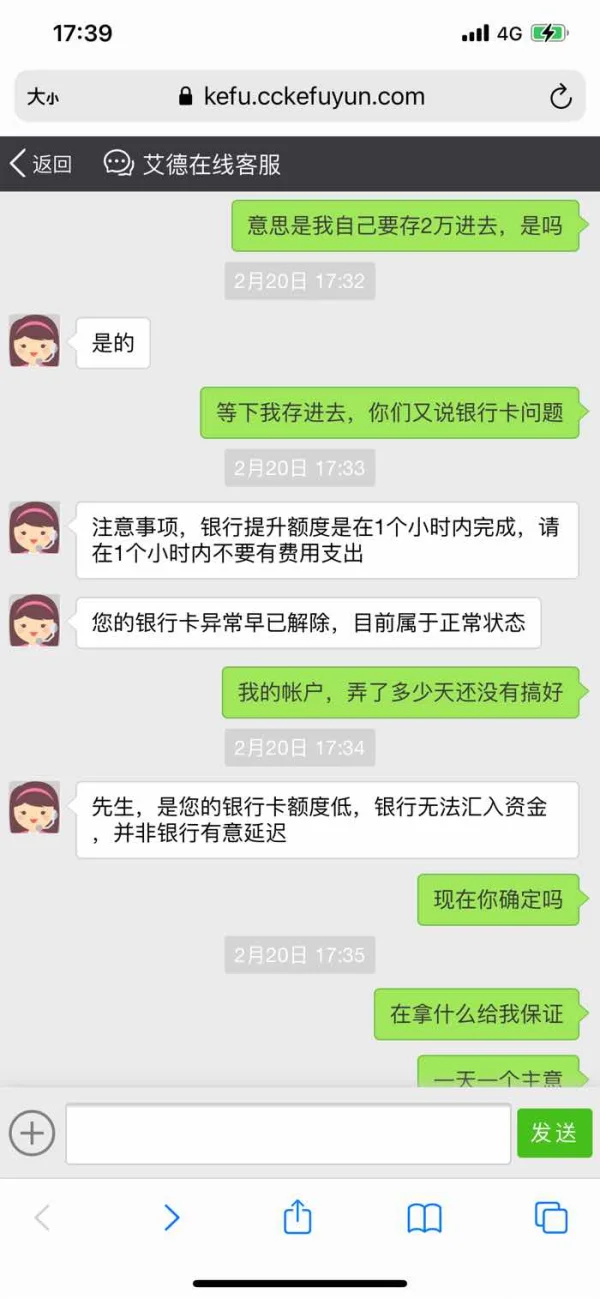

凡人36855

香港

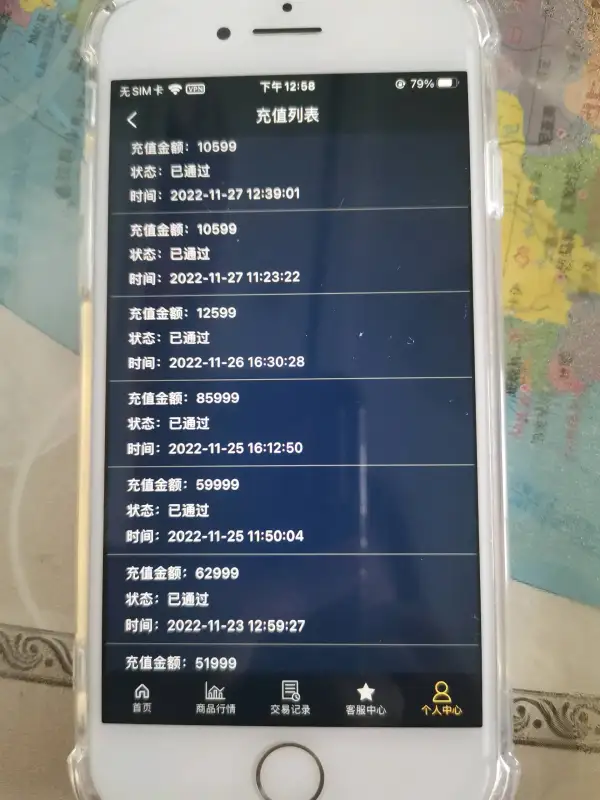

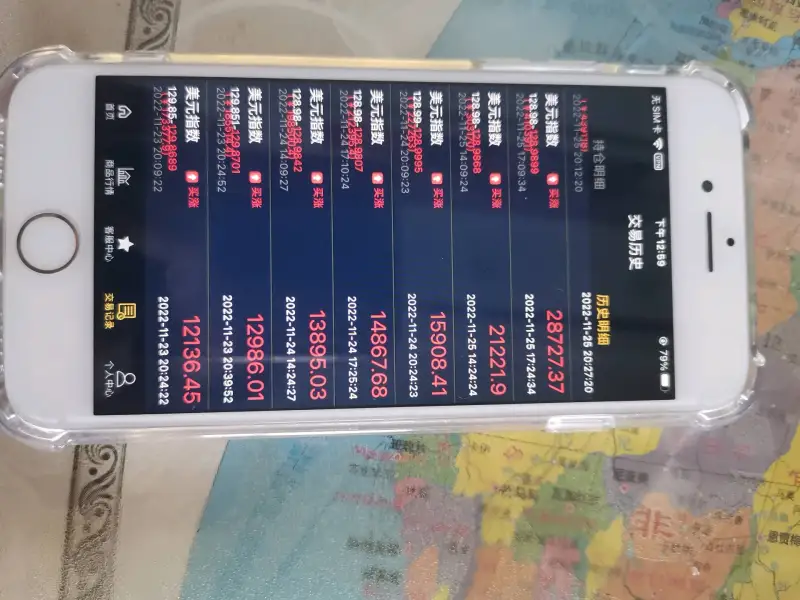

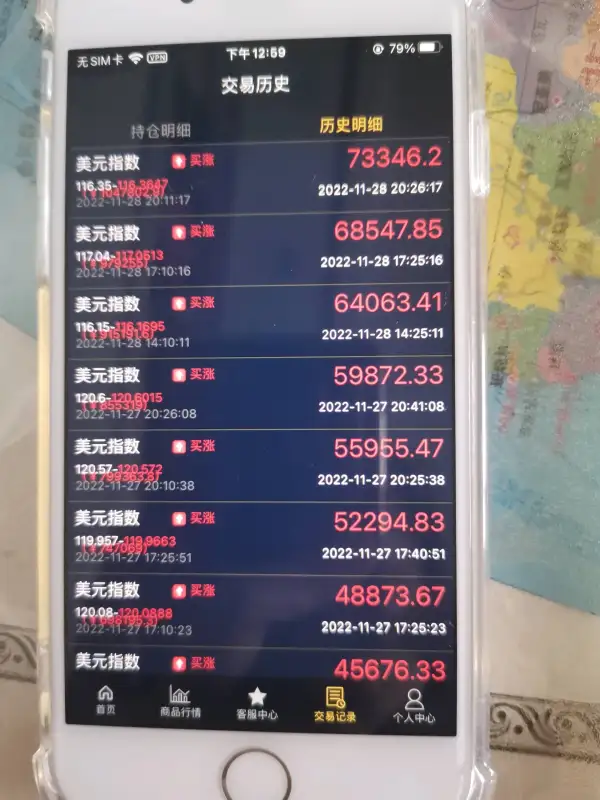

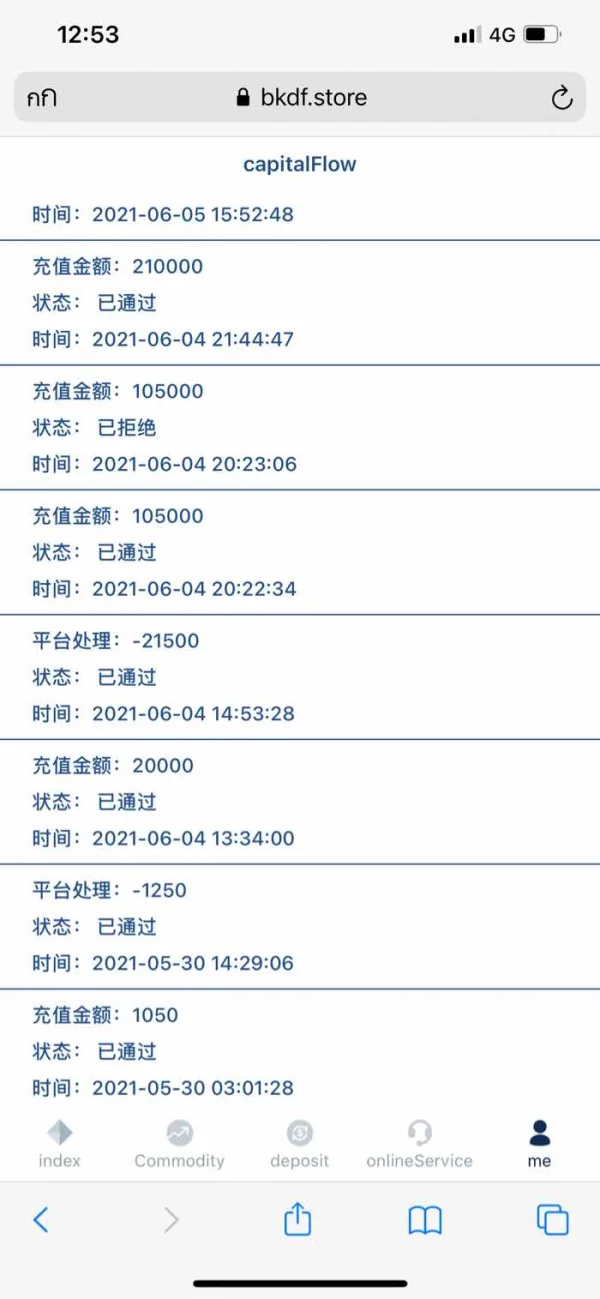

我本金交了30万,礼金礼包给了6万多,被人带着挣了4万,这样有40万多点,第一次,二次都是小金额入金每次做完了就给直接提了,这次就不行了,各种理由一堆,就是被骗了

曝光

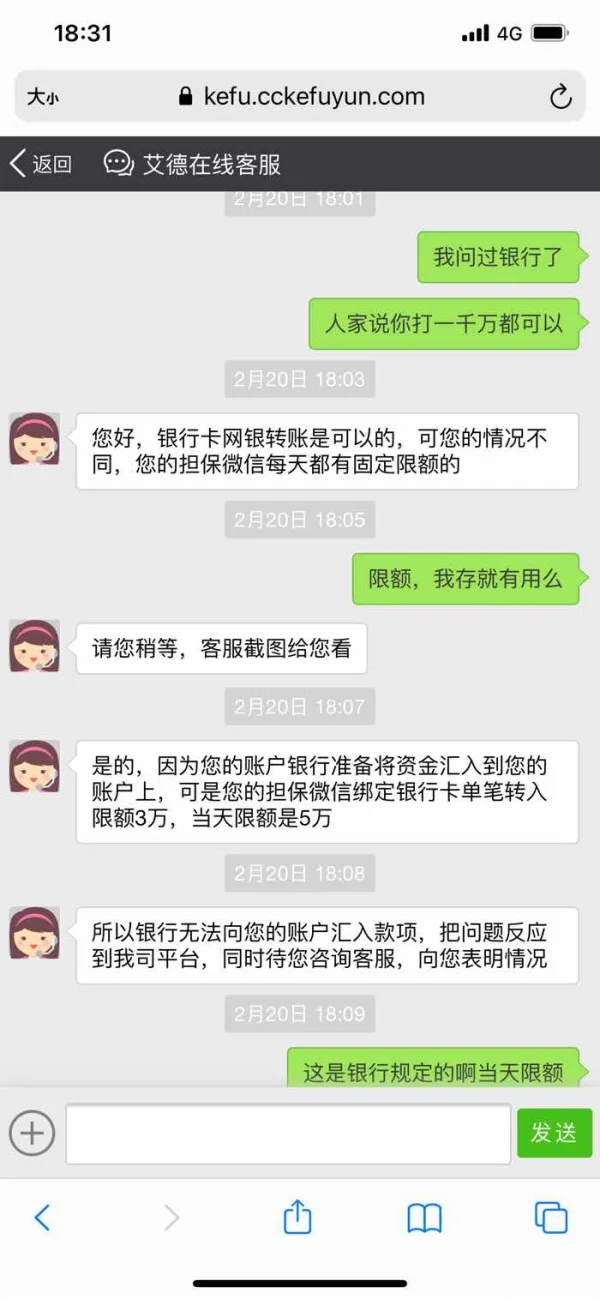

Jian96812

台湾

這黑台根本就是吸血鬼 1.要求你要先繳納稅金及跨境手續費 2.突然客服無故告知你說外匯局認定你帳戶異常 3.接著需要需要繳納一大筆保證金才行 4.然而繳納完畢變相說外匯局不同意提領方式 5.要求改變提領方式但需重新打流水 6.最後變成系統判定異常反覆打流水凍結帳戶 7.完美從本金、盈利、稅金、保證金、跨境手續費 一條龍殺到尾 果然是一個連骨頭都不放過的黑台!

曝光

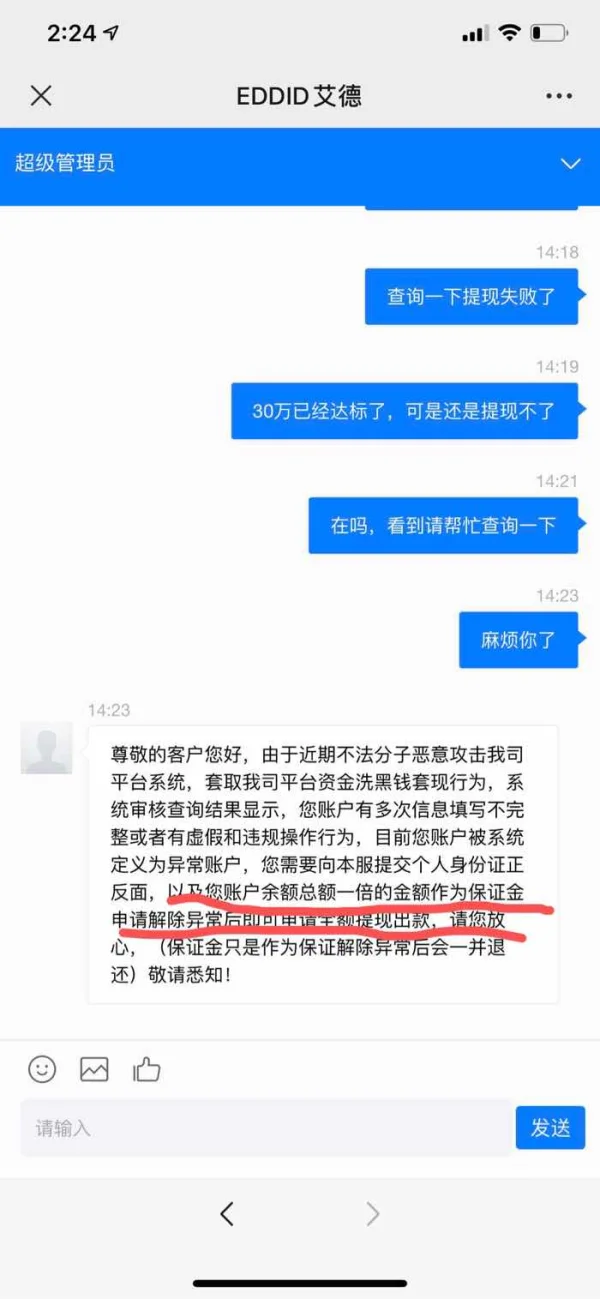

FX3263285483

香港

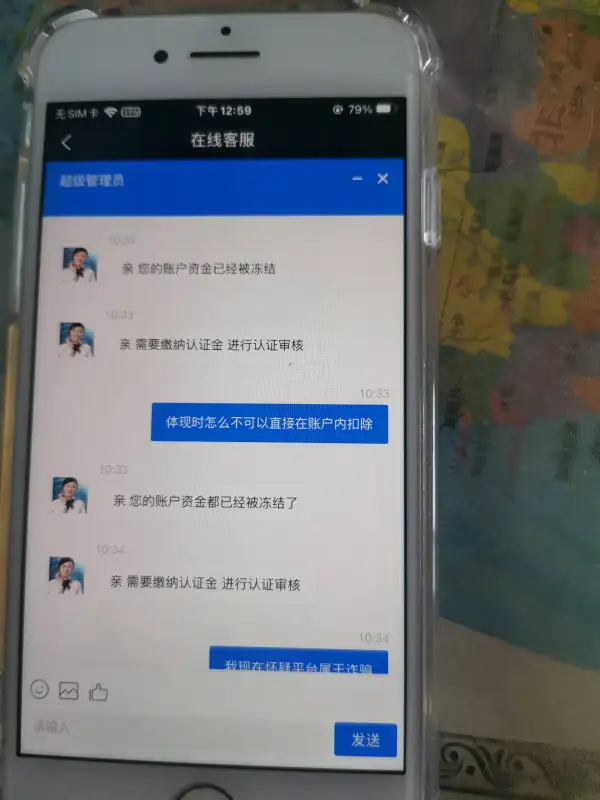

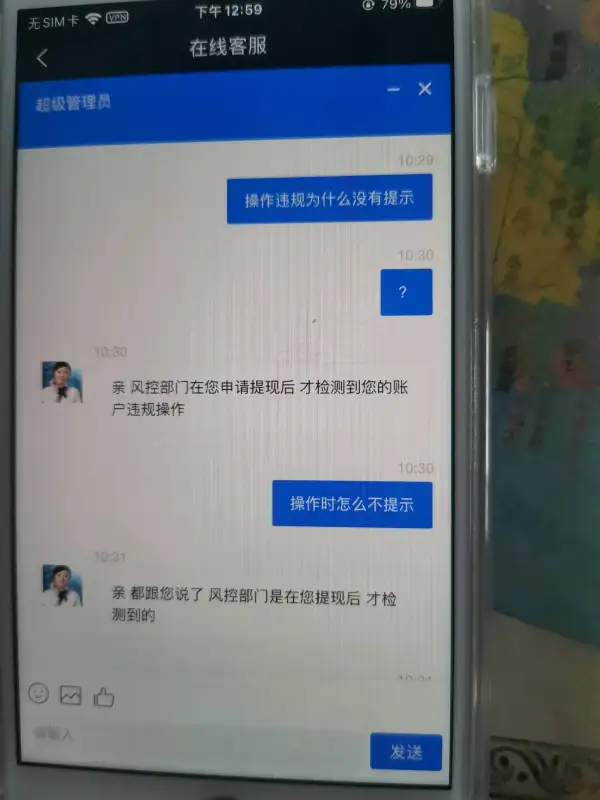

一开始冻结帐户,然后叫交保证金,一步步套钱,现在也提不了现,骗子公司?

曝光

俊杰

澳大利亚

到目前为止,这家公司对我来说还不错。我在这家公司做交易已经 3 年多了。我也能退出一段时间。但是他们最近的新平台存在一些问题。您不能在波动时开仓,此时只能使用(买入/卖出止损/限价)订单开仓。否则,一切都很好。

好评

風亦飛

马来西亚

Eddid Financial 的交易应用程序灵活且易于使用。作为一名股票交易员,我喜欢使用这家公司,它有多种投资组合可供选择。 Eddid Financial确实是一家值得信赖的公司。

中评

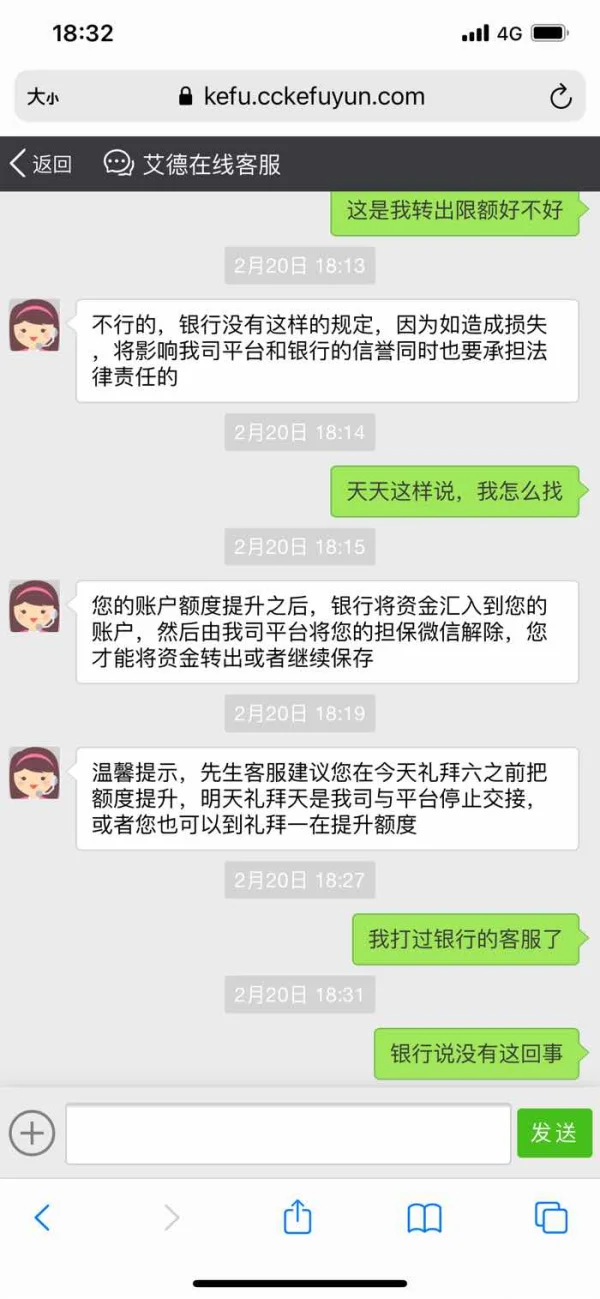

小栗子3124

香港

犯罪分子利用艾德金业获取暴利,冻结账户资金,公司不作为,不追究,不处理

曝光

小栗子3124

香港

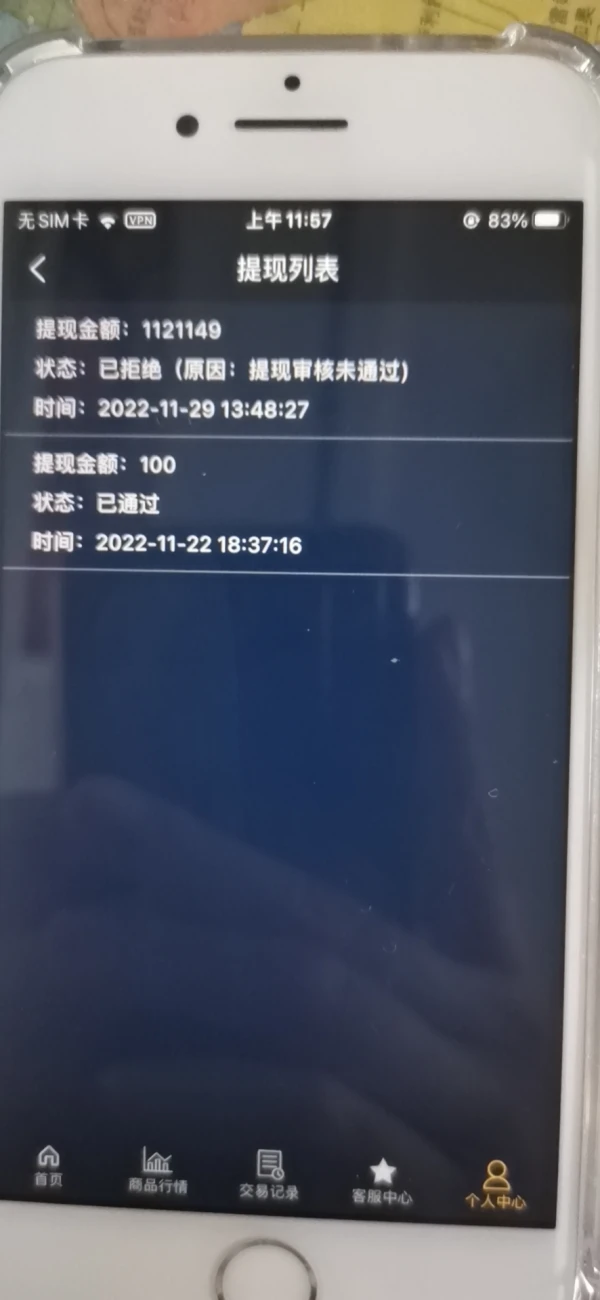

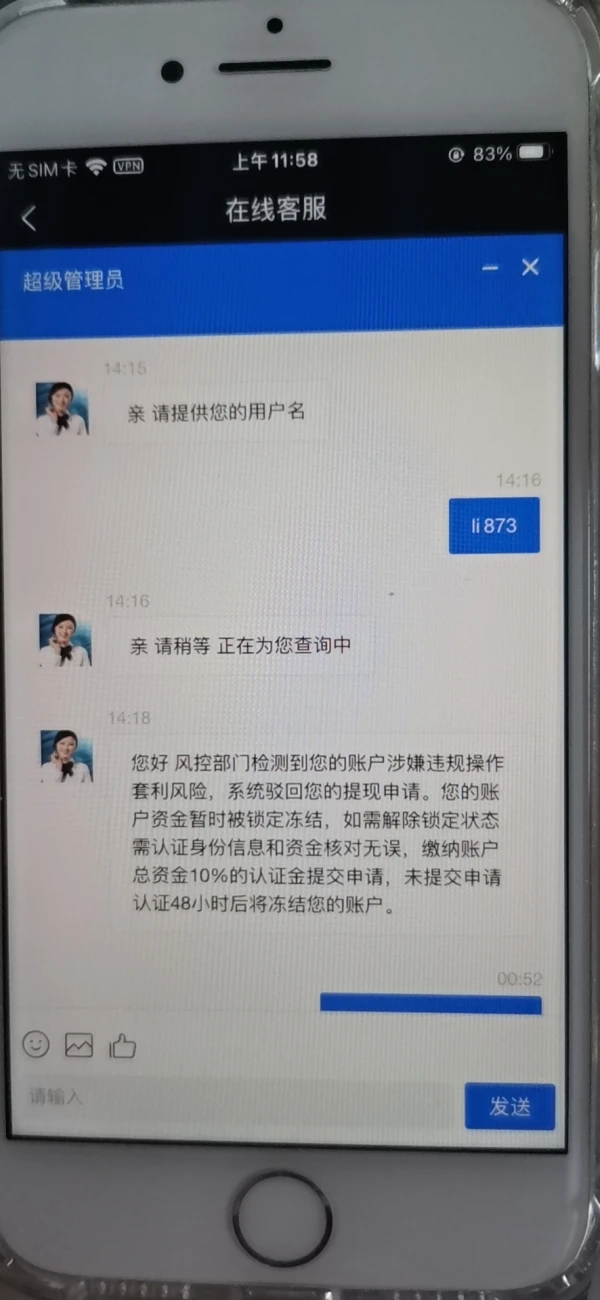

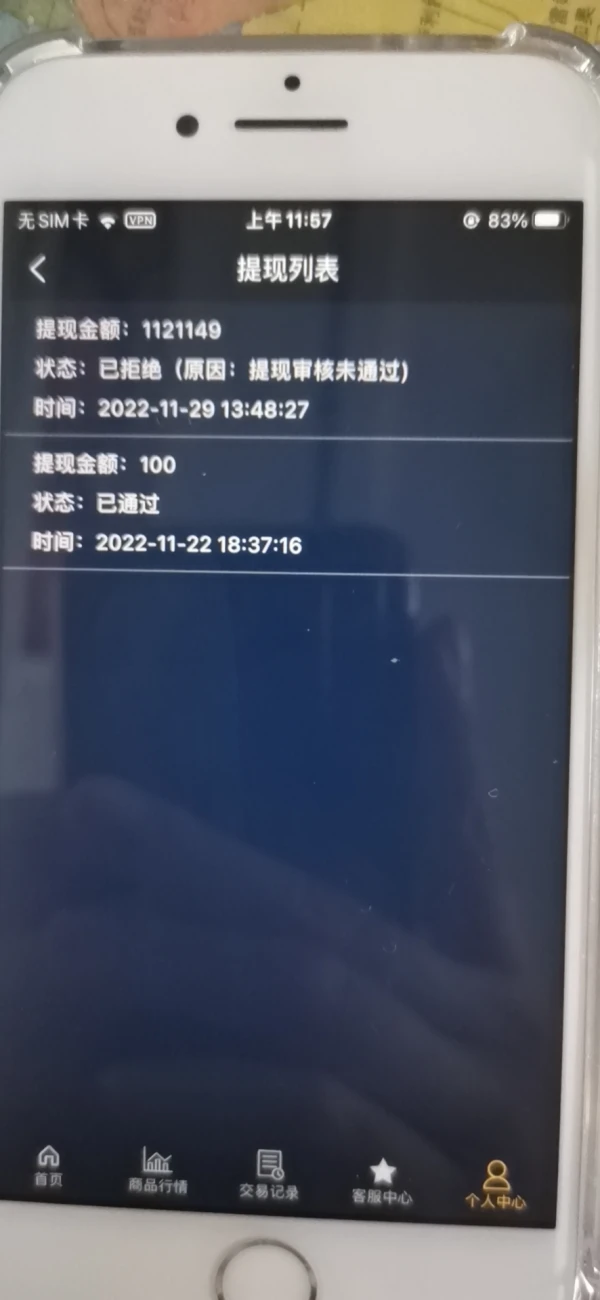

充值正常,买入正常,提现时,提示风险部门检测到账户涉嫌违规操作套利风险,系统驳回提现申请。账户资金暂时锁定冻结,如需解除锁定状态,需要认证身份信息和资金核对,缴纳账户总资金10%的认证金提交申请,未提交申请认证就会48小时冻结账户

曝光

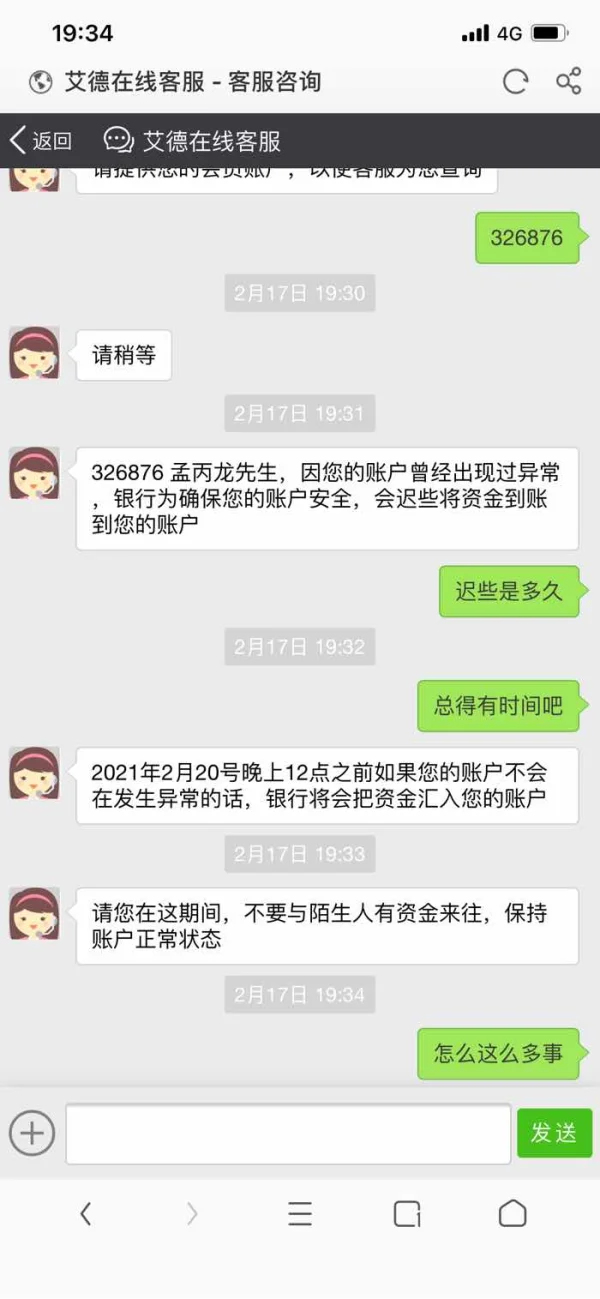

Kanchaya Tamkuan

泰国

我在 Tinder 上找到了一个朋友,他邀请我投资。毕竟,我的钱不能被大量提取。

曝光

梅琳达航航妈妈

香港

出金审核不通过一会说系统繁忙,一会又说放假

曝光