公司简介

| Barclays 评论摘要 | |

| 成立时间 | 1997 |

| 注册国家/地区 | 保加利亚 |

| 监管 | 无监管 |

| 金融服务 | 资本市场解决方案、投资银行、外汇交易、衍生品交易、基金管理 |

| 客户支持 | Barclays Securities Co., Ltd.东京都港区六本木6-10-1六本木希尔斯森大厦31楼,邮编106-6131 电话:03-4530-1100 |

| Barclays 银行东京分行,东京都港区六本木6-10-1六本木希尔斯森大厦31楼,邮编106-6131 电话:03-4530-5100 | |

| Barclays 投资管理有限公司,东京都港区六本木6-10-1六本木希尔斯森大厦31楼,邮编106-6131 电话:03-4530-2400 | |

| Barclays 服务日本有限公司,东京都港区六本木6-10-1六本木希尔斯森大厦31楼,邮编106-6131 电话:03-4530-1190 | |

Barclays 信息

Barclays 在日本作为其全球网络的重要组成部分,通过 Barclays Securities Co., Ltd.、Barclays 银行东京分行和 Barclays 投资管理有限公司向日本客户提供金融服务,包括商业公司、金融机构、机构投资者和公共机构。

在全球扩张,特别是在2008年收购雷曼兄弟北美业务后,Barclays 已经确立自己作为日本领先投资银行之一。

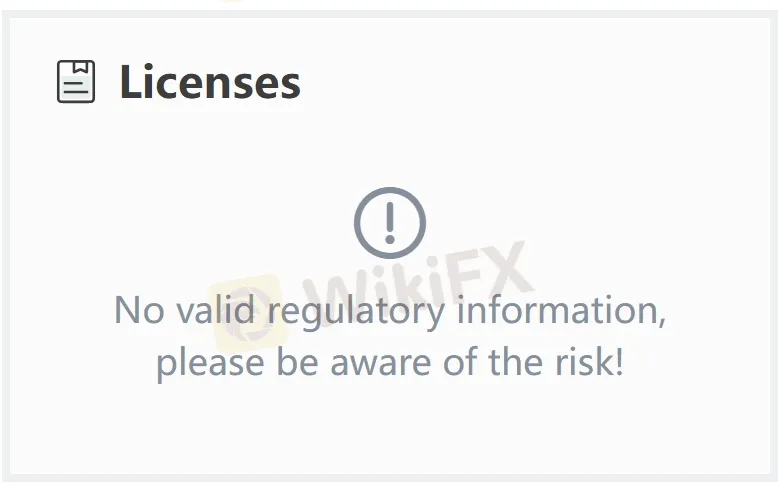

然而,Barclays 在日本没有受到任何官方机构的监管,这可能降低了其可信度和信誉,值得您关注。

优缺点

| 优点 | 缺点 |

| 全球存在 | 在日本没有监管 |

| 声誉良好的母公司 | |

| 提供各种金融服务 |

Barclays 是否合法?

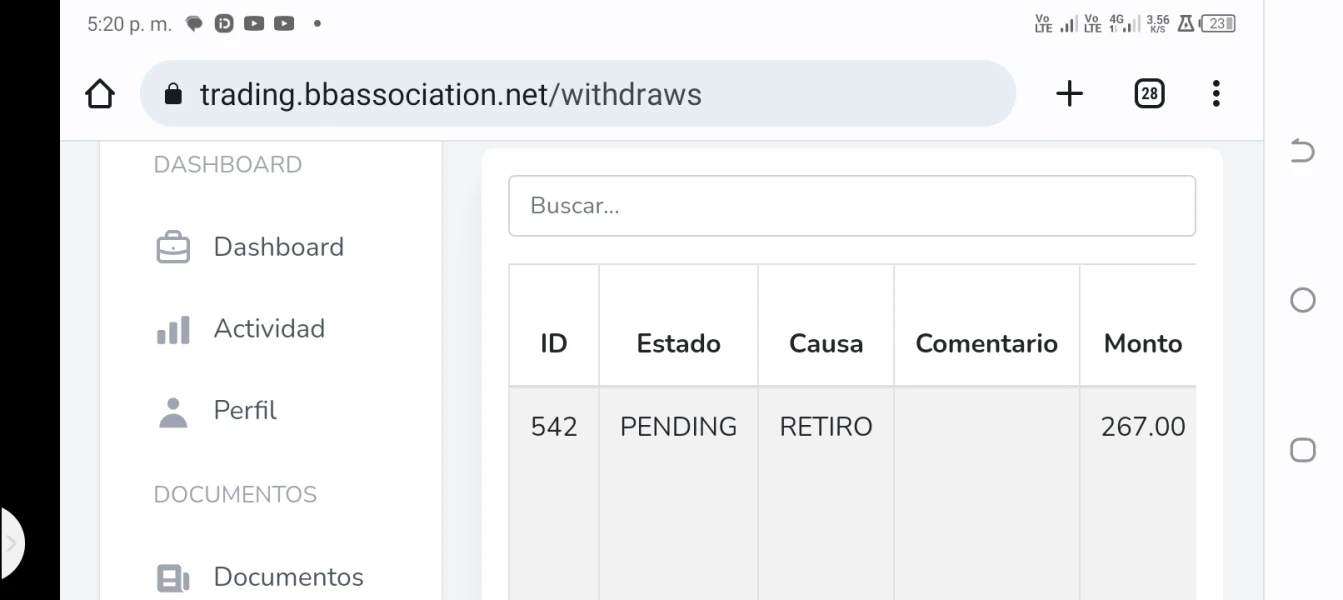

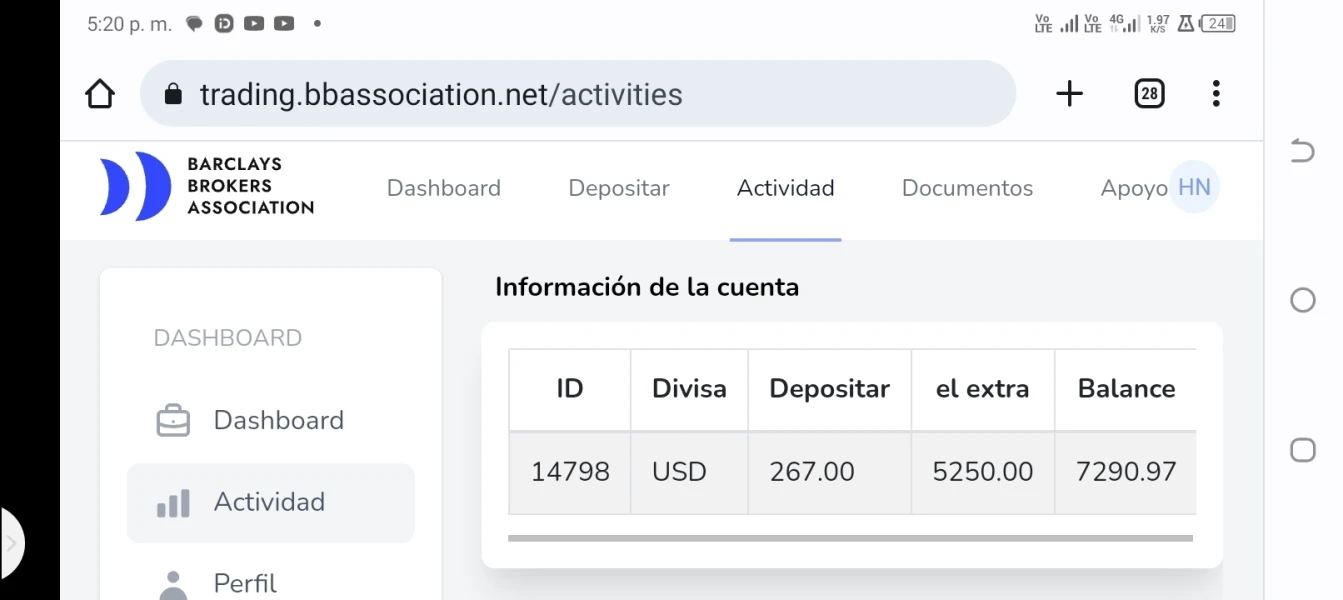

衡量经纪平台安全性最重要的因素是它是否受到正式监管。Barclays 是一家 未受监管的 经纪商,这意味着用户资金和交易活动的安全性得不到有效保护。投资者应谨慎选择 Barclays。

Barclays 服务

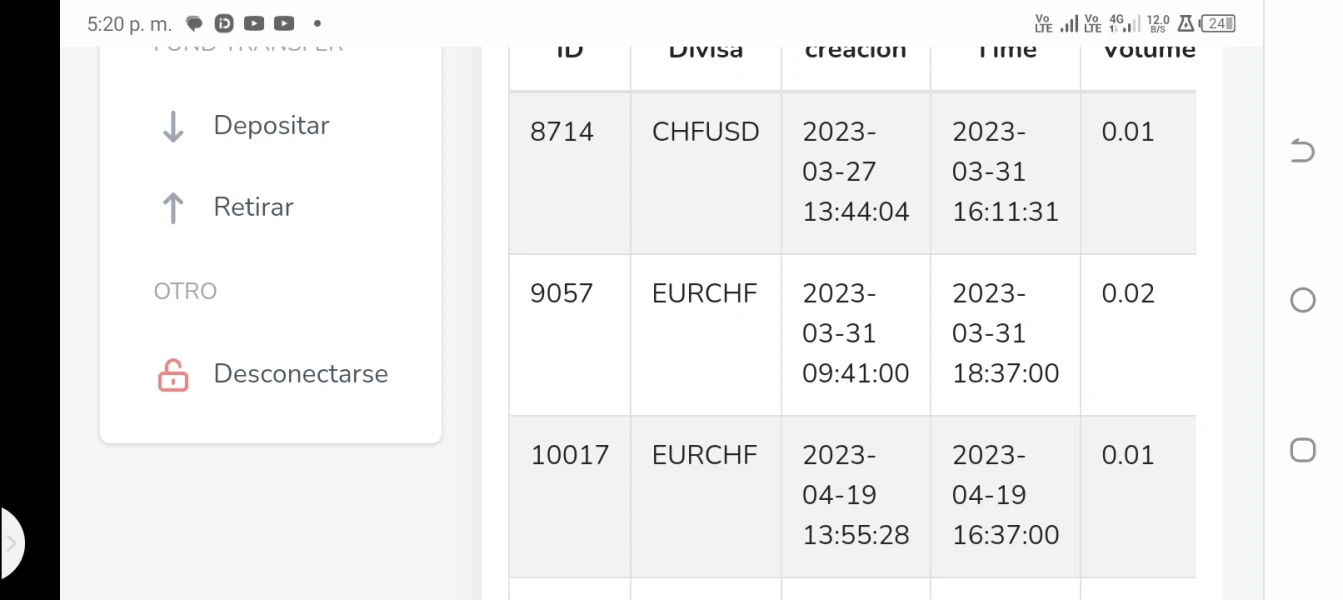

Barclays 日本提供包括 资本市场解决方案、投资银行、外汇交易、衍生品交易 和 基金管理 在内的全面金融服务。

Barclays 证券专注于 融资、资产管理 和 咨询服务;

东京分行提供 批发市场接入,特别是外汇 和 衍生品;

Barclays投资管理管理各种资产类别的共同基金,以满足机构投资者的需求。