Riepilogo dell'azienda

Informazioni generali

Kontakperkasa Futuresè una società finanziaria con sede in Indonesia, che offre ai propri clienti una serie di servizi di intermediazione su derivati su indici azionari e transazioni su derivati su materie prime attraverso i suoi uffici e filiali in diverse città dell'Indonesia, tra cui Jakarta, Yogyakarta, Bali, Balikpapan Banjarmasin, Pekanbaru Makassar, Surabaya , e altro ancora. Kontakperkasa Futures dice che è un membro della borsa dei futures di Jakarta e un membro della camera di compensazione dei futures dell'Indonesia.

Dettagli normativi

in materia di regolamento, Kontakperkasa Futures è autorizzata e regolamentata dall'agenzia di supervisione del commercio di futures su materie prime (bappebti), titolare della licenza di licenza forex al dettaglio, con licenza regolamentare n. 41/bappebti/si/xii/2000. tieni presente che possedere una licenza legittima non significa questo Kontakperkasa Futures è un broker forex affidabile al 100%. gli investitori dovrebbero anche prendere in considerazione alcuni altri fattori importanti come i costi di negoziazione, la piattaforma di trading, il tempo di prelievo e l'assistenza clienti.

prodotti e servizi

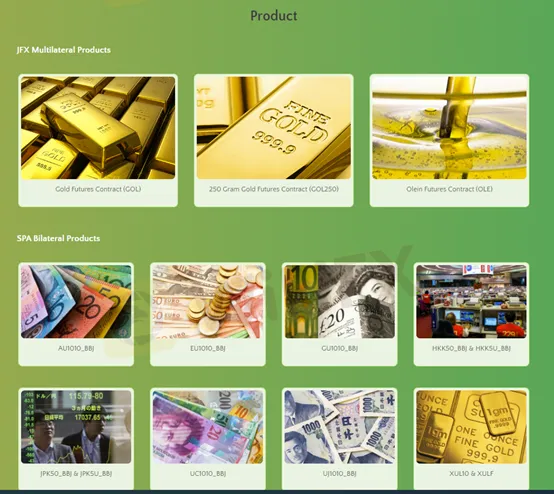

con Kontakperkasa Futures , gli investitori possono accedere a una serie di strumenti di trading, tra cui contratto futures oro (gol), contratto futures olein (ole) e prodotti bilaterali spa, indici, materie prime, indici uk&us, cambi, indici asia/pacifico.

Tipi di conto

Kontakperkasa Futuresoffre a tutti gli investitori un conto demo e un conto live. un account demo è uno strumento essenziale per i principianti per avere un'idea di questa piattaforma e testare i suoi prodotti senza rischiare i loro soldi veri.

Si diffonde

Kontakperkasa Futuresliste sparse su alcuni strumenti:

UN. 16 punti per i prodotti HKK

B. 20 punti per i prodotti JPK

C. 0,8 USD per i prodotti XUL

D. 8 punti/pip per i prodotti forex

Ritiro

con Kontakperkasa Futures , il prelievo può essere effettuato ovunque e in qualsiasi momento dai clienti durante l'orario di apertura delle banche con condizioni che non superano il margine effettivo nel rapporto o nell'estratto conto giornaliero delle transazioni dei clienti nei seguenti passaggi:

Compila il modulo di recesso.

Invia il modulo di recesso che è stato compilato e firmato a questa società.

I fondi prelevati possono essere trasferiti sul conto a nome del cliente che apre la domanda di conto e firma il libro degli accordi di transazione.

lIl prelievo richiede in genere tre giorni lavorativi per l'elaborazione.

Servizio Clienti

I trader con qualsiasi domanda o problema relativo al trading possono mettersi in contatto con l'assistenza clienti di questo broker attraverso i seguenti canali:

Telefono: (021) 57936555

Fax: (021) 57793 56550

E-mail: corporate@knotak-perkasa-futures.co.id

Oppure puoi anche seguire questa intermediazione su Twitter e Facebook.

Risorse educative

Kontakperkasa Futuresoffre alcune risorse educative per aiutare i clienti a smussare le loro curve di trading, che includono meccanismo di trading, glossario, simbolo dell'indice, loco london gold, nonché strumenti di marketing.

Si prega di notare che le informazioni contenute nell'Introduzione sono solo a scopo informativo generale.