Описание компании

| Kontakperkasa Futures Обзор | |

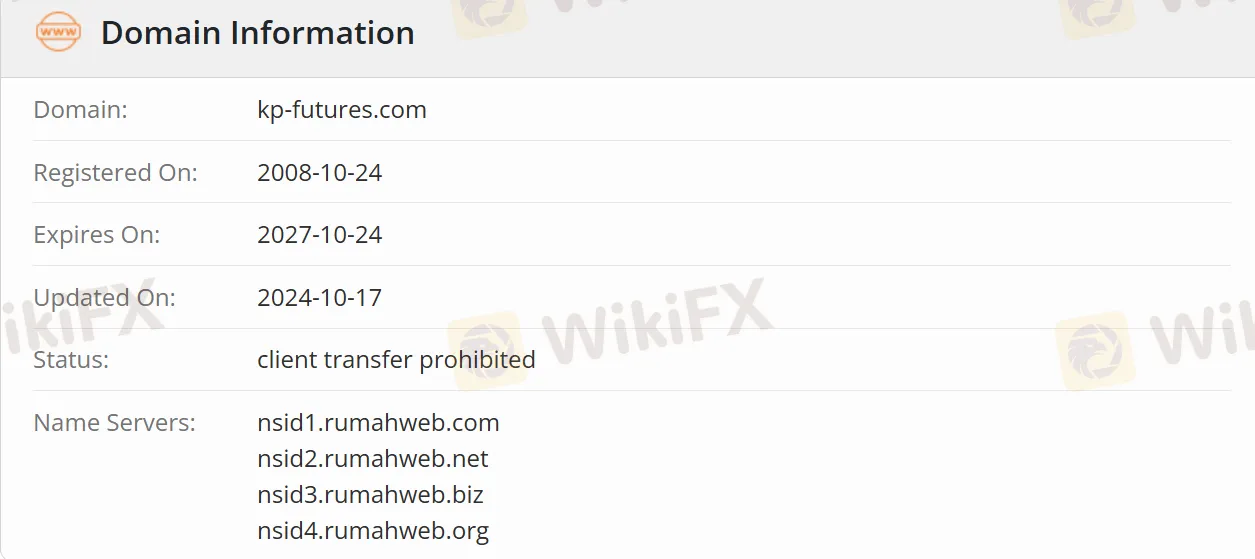

| Основана | 2008-10-24 |

| Страна/Регион регистрации | Индонезия |

| Регулирование | Регулируется |

| Инструменты рынка | Товарные фьючерсы, Деривативы фондовых индексов, Валютный рынок и Драгоценные металлы |

| Демо-счет | ✅ |

| Торговая платформа | TradingView |

| Поддержка клиентов | customer.care@kontak-perkasa-futures.co.id |

| Тел: (021) 5793 6555 | |

| Факс: (021) 5793 6550 | |

| Sudirman Plaza, Gedung Plaza Marein Lt. 7 & 19 Jl. Jend. Sudirman Kav. 76-78, Джакарта 12910 | |

Kontakperkasa Futures Информация

PT Kontak Perkasa Futures - это регулируемая фьючерсная брокерская фирма в Индонезии. С главным офисом в Джакарте, она предоставляет услуги торговли товарными фьючерсами, деривативами фондовых индексов, валютой и т. д., а также поддерживает онлайн-открытие счета и торговлю в реальном времени. Подходит для инвесторов, заинтересованных в индонезийском рынке или конкретных товарах, таких как золото и пальмовое масло.

Плюсы и минусы

| Плюсы | Минусы |

| Регулируется | Основная цель - внутренний рынок Индонезии |

| Несколько торговых инструментов | Ночные комиссии |

| Доступен демо-счет | Языковой барьер |

| Доступна TradingView | Плечо не раскрывается |

Является ли Kontakperkasa Futures законным?

Kontakperkasa Futures имеет лицензию на брокерскую деятельность на фьючерсном рынке (№ 41/BAPPEBTI/SI/XII/2000), выданную BAPPEBTI, и зарегистрирована на Джакарской фьючерсной бирже и Индонезийской фьючерсной клиринговой палате.

На что я могу торговать на Kontakperkasa Futures?

| Категория продукта | Название/Код продукта | Спецификации контракта |

| Товарные фьючерсы | Фьючерсы на золото (GOL) | 1 кг/лот, чистота ≥99.99% стандарт LBMAМинимальное изменение цены: Rp50/грамм |

| Фьючерсы на 250 грамм золота (GOL250) | 250 граммов/лотДоставка требует ≥4 лотов | |

| Фьючерсы на олеин (OLE) | 20 тонн/лотМинимальное изменение цены: Rp5/кг | |

| Деривативы фондовых индексов | Индекс Хан Сенг (HKK50_BBJ) | $5/индексный пункт |

| Никкей 225 (JPK50_BBJ) | $5/индексный пункт | |

| Валютный рынок и драгоценные металлы | EURUSD/GBPUSD/USDJPY и т. д. | Стандартные лоты/мини-лоты |

| Фьючерсы на серебро (XAG10_BBJ) | 10 унций/лот |

Тип счета

Kontakperkasa Futures предоставляет демо-счета для начинающих трейдеров для практики торговли. Реальные счета разделяются на индивидуальные счета и корпоративные счета.

Kontakperkasa Futures Сборы

| Тип | Структура сборов |

| Базовая комиссия | $15 за сделку$30 за полный лот (покупка + продажа) |

| Налог на добавленную стоимость (НДС)(11% от комиссии) | $3.3 за полный лот |

| Ночной сбор | $3 за лот за ночь (HKK5U) |

| $2 за лот за ночь (JPK50) | |

| $5 за лот за ночь (XUL10) |

Депозит и Снятие

Банковские переводы поддерживают счета IDR и USD основных индонезийских банков (таких как BCA, Mandiri и CIMB Niaga). Время обработки вывода составляет 1 рабочий день (T+1), и необходима верификация личности и транзакционных записей.