Profil perusahaan

| Kontakperkasa Futures Ringkasan Ulasan | |

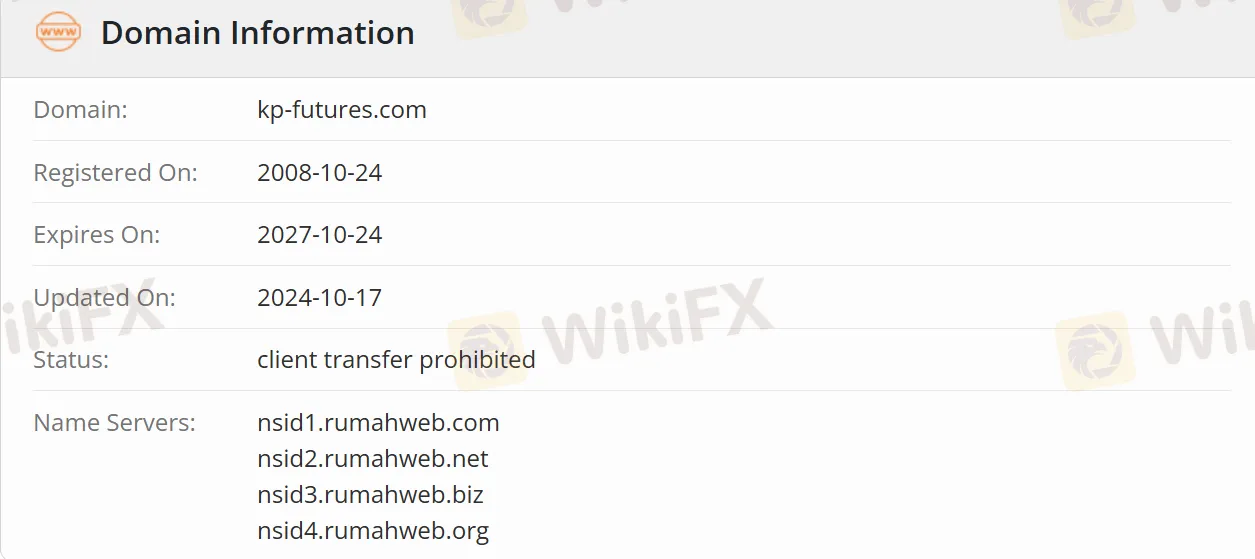

| Dibentuk | 2008-10-24 |

| Negara/Daerah Terdaftar | Indonesia |

| Regulasi | Teregulasi |

| Instrumen Pasar | Komoditas Berjangka, Derivatif Indeks Saham, Forex, dan Logam Mulia |

| Akun Demo | ✅ |

| Platform Perdagangan | TradingView |

| Dukungan Pelanggan | customer.care@kontak-perkasa-futures.co.id |

| Telp: (021) 5793 6555 | |

| Fax: (021) 5793 6550 | |

| Sudirman Plaza, Gedung Plaza Marein Lt. 7 & 19 Jl. Jend. Sudirman Kav. 76-78, Jakarta 12910 | |

Kontakperkasa Futures Informasi

PT Kontak Perkasa Futures adalah perusahaan pialang berjangka yang teregulasi di Indonesia. Berkantor pusat di Jakarta, menyediakan layanan perdagangan untuk komoditas berjangka, derivatif indeks saham, valuta asing, dll., dan mendukung pembukaan akun online dan perdagangan real-time. Cocok untuk investor yang tertarik pada pasar Indonesia atau komoditas tertentu seperti emas dan minyak kelapa sawit.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Teregulasi | Lebih banyak menargetkan pasar domestik Indonesia |

| Beragam instrumen perdagangan | Biaya menginap |

| Akun demo tersedia | Hambatan bahasa |

| TradingView tersedia | Leverage tidak diungkapkan |

Apakah Kontakperkasa Futures Legal?

Kontakperkasa Futures memiliki Izin Usaha Pialang Berjangka (No 41/BAPPEBTI/SI/XII/2000) yang dikeluarkan oleh BAPPEBTI dan terdaftar di Bursa Berjangka Jakarta dan Kliring Berjangka Indonesia.

Apa yang Bisa Saya Perdagangkan di Kontakperkasa Futures?

| Kategori Produk | Nama Produk/Kode | Spesifikasi Kontrak |

| Komoditas Berjangka | Emas Berjangka (GOL) | 1 kg/lot, kemurnian ≥99.99% standar LBMAPerubahan harga minimum: Rp50/gram |

| Emas 250 Gram (GOL250) | 250 gram/lotPengiriman memerlukan ≥4 lot | |

| Olein Berjangka (OLE) | 20 ton/lotPerubahan harga minimum: Rp5/kg | |

| Derivatif Indeks Saham | Indeks Hang Seng (HKK50_BBJ) | $5/titik indeks |

| Nikkei 225 (JPK50_BBJ) | $5/titik indeks | |

| Forex dan Logam Mulia | EURUSD/GBPUSD/USDJPY, dll. | Opsi lot standar/mini |

| Perak Berjangka (XAG10_BBJ) | 10 ons/lot |

Jenis Akun

Kontakperkasa Futures menyediakan akun demo untuk pemula berlatih trading. Akun riil terbagi menjadi akun individu dan akun institusi.

Kontakperkasa Futures Biaya

| Tipe | Struktur Biaya |

| Komisi Dasar | $15 per sisi$30 per lot penuh (beli + jual) |

| Pajak Pertambahan Nilai (PPN)(11% dari komisi) | $3.3 per lot penuh |

| Biaya Menginap | $3 per lot per malam (HKK5U) |

| $2 per lot per malam (JPK50) | |

| $5 per lot per malam (XUL10) |

Deposit dan Penarikan

Transfer bank mendukung akun IDR dan USD dari bank-bank besar di Indonesia (seperti BCA, Mandiri, dan CIMB Niaga). Waktu pemrosesan penarikan adalah 1 hari kerja (T+1), dan identitas serta catatan transaksi perlu diverifikasi.