Profil perusahaan

| Topstep Ringkasan Ulasan | |

| Dibentuk | 2012 |

| Negara/Daerah Terdaftar | Amerika Serikat |

| Regulasi | Tidak diatur |

| Instrumen Pasar | CME ekuitas futures, forex futures, pertanian futures, energi futures, logam, bunga futures |

| Akun Demo | ✅ |

| Leverage | / |

| Spread | / |

| Platform Perdagangan | TopstepX™, NinjaTrader, Quantower, Tradovate, TradingView, T4 by CTS, R|Trader Pro (Rithmic), ATAS – Order Flow Trading Platform, MotiveWave, VolFix, Bookmap, Investor/RT by Linn Software, Jigsaw Daytradr, MultiCharts, Sierra Chart, dan Trade Navigator. |

| Deposit Minimum | / |

| Dukungan Pelanggan | Tel: 1-888-407-1611 |

| Email: support@topstep.com | |

Informasi Topstep

Topstep adalah perusahaan perdagangan properti berbasis AS yang menawarkan para pedagang futures kesempatan untuk berdagang dengan modal perusahaan setelah lulus evaluasi simulasi (Trading Combine). Pedagang dapat mengakses produk futures, termasuk CME ekuitas futures, forex futures, pertanian futures, energi futures, logam, dan bunga futures. Platform ini memiliki biaya masuk rendah dan mendukung banyak platform perdagangan berkelas profesional, namun tidak diatur.

Pro dan Kontra

| Pro | Kontra |

| Berbagai instrumen perdagangan | Tidak diatur |

| Akun demo | Kurangnya transparansi |

| Mendukung lebih dari selusin platform perdagangan canggih |

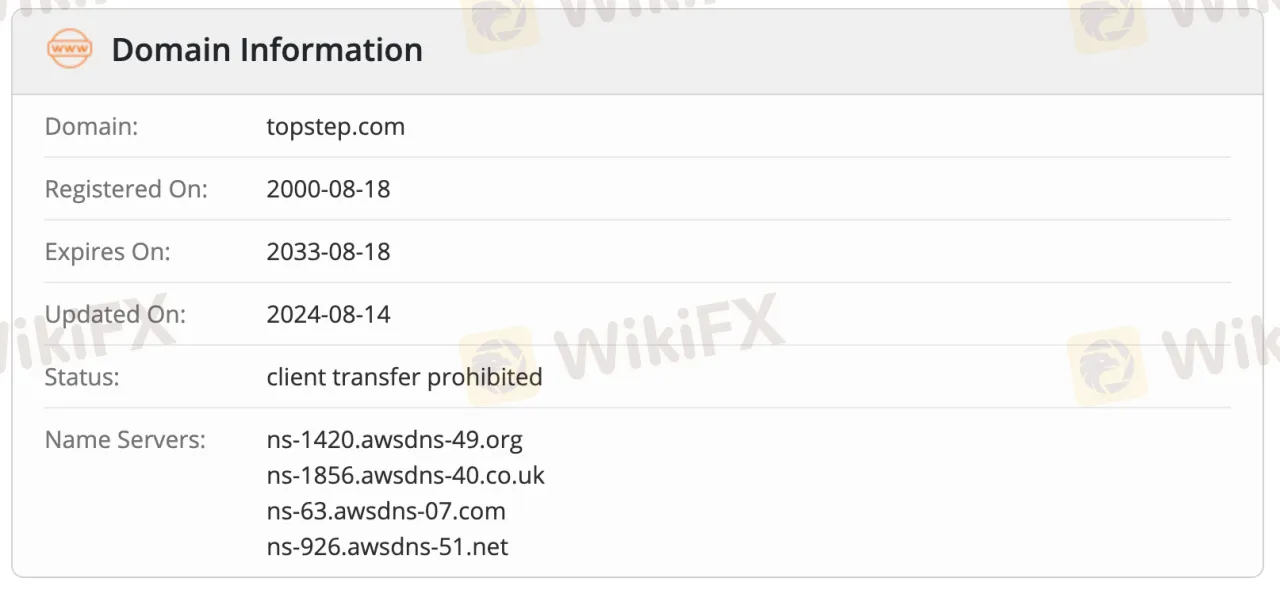

Apakah Topstep Legal?

Topstep tidak merupakan broker yang sah. Perusahaan ini terdaftar di Amerika Serikat namun saat ini tidak memiliki lisensi regulasi yang valid dari AS atau otoritas keuangan internasional manapun. Badan regulasi terkemuka seperti FCA (Inggris), ASIC (Australia), dan NFA (AS) tidak mengatur Topstep.

Domain topstep.com didaftarkan pada 18 Agustus 2000, dan dijadwalkan akan kedaluwarsa pada 18 Agustus 2033. Domain ini berada dalam status terkunci "client transfer prohibited", yang mencegahnya untuk dipindahkan ke registrar lain, memastikan tingkat keamanan administratif tertentu.

Apa yang Dapat Saya Perdagangkan di Topstep?

Topstep menawarkan perdagangan kontrak berjangka saja, bukan perdagangan spot. Para trader dapat mengakses produk berjangka, termasuk CME equity futures, forex futures, agricultural futures, energy futures, metals, interest rate futures.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| CME equity futures | ✔ |

| Forex futures | ✔ |

| Agricultural futures | ✔ |

| Energy futures | ✔ |

| Metals | ✔ |

| Interest rate futures | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

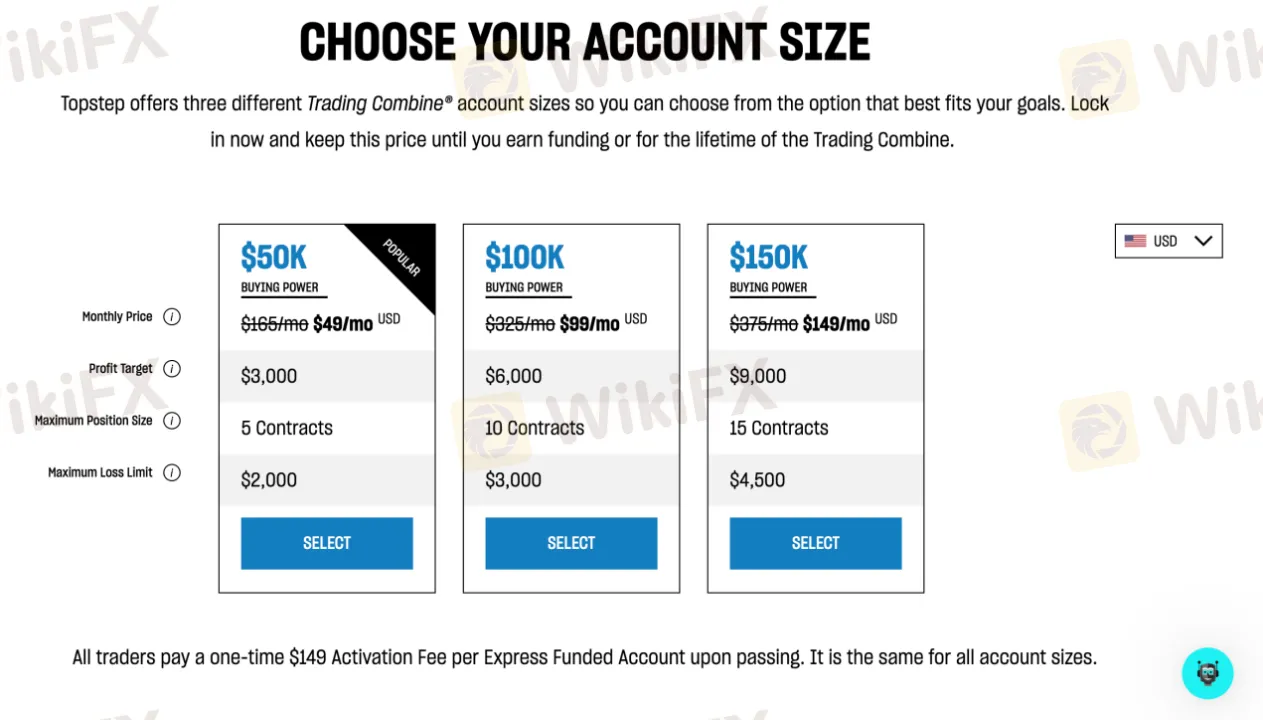

Jenis Akun

Topstep tidak menawarkan akun live tradisional seperti kebanyakan broker. Sebaliknya, ia menyediakan tiga tingkat akun evaluasi (Trading Combine®): akun kekuatan beli $50K, $100K, dan $150K. Ini adalah akun simulasi yang digunakan untuk menilai kinerja seorang trader sebelum menawarkan modal riil. Setelah seorang trader lulus tahap evaluasi, mereka dapat mendapatkan akses ke Akun Pendanaan Express.

| Jenis Akun | Live Trading | Demo Trading | Terbaik untuk |

| $50K Combine | ❌ | ✔ | Pemula atau trader berisiko rendah |

| $100K Combine | ❌ | ✔ | Trader menengah |

| $150K Combine | ❌ | ✔ | Trader berpengalaman yang nyaman dengan risiko |

| Akun Pendanaan Express | ✔ | ❌ | Trader yang lulus evaluasi |

Biaya Topstep

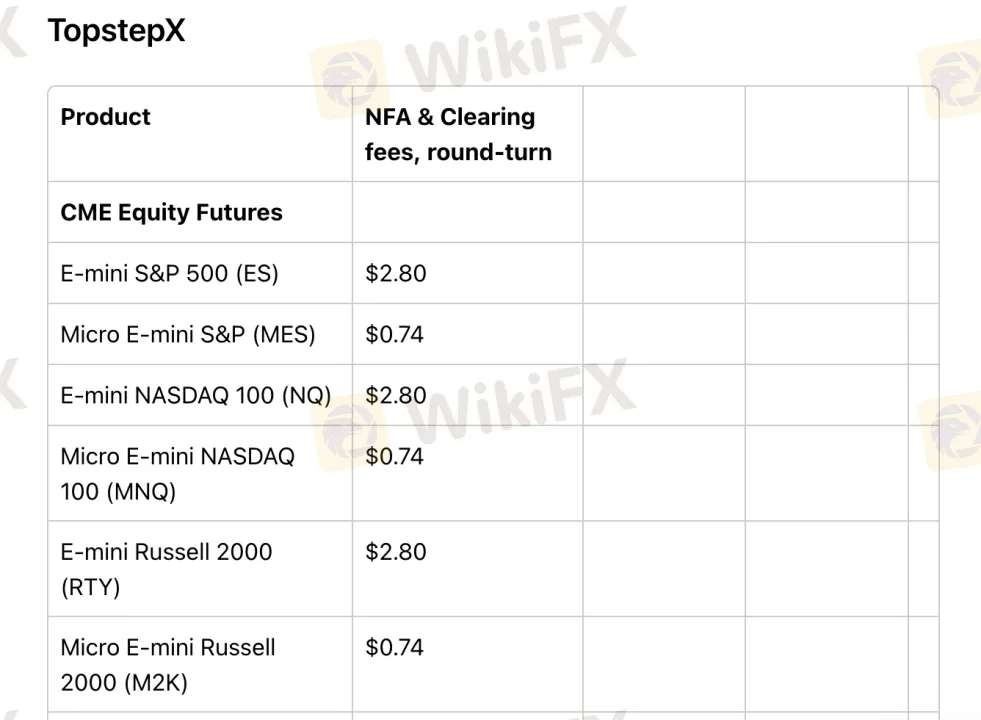

| Produk Perdagangan | Biaya NFA & Clearing (Round-turn) |

| E-mini S&P 500 (ES) | $2.80 |

| Micro E-mini S&P (MES) | $0.74 |

| E-mini NASDAQ 100 (NQ) | $2.80 |

| Micro E-mini NASDAQ 100 (MNQ) | $0.74 |

Biaya perdagangan Topstep rendah hingga sedang dibandingkan dengan standar industri, terutama saat menggunakan platformnya sendiri, TopstepX.

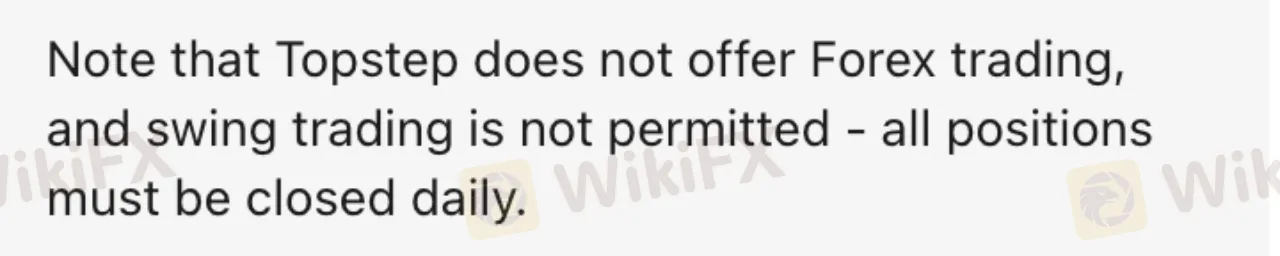

Swap Rates

Topstep tidak mengenakan biaya swap atau biaya rollover semalam, karena semua perdagangan harus dilakukan selama jam perdagangan reguler. Swing trading tidak diperbolehkan, posisi harus ditutup setiap hari.

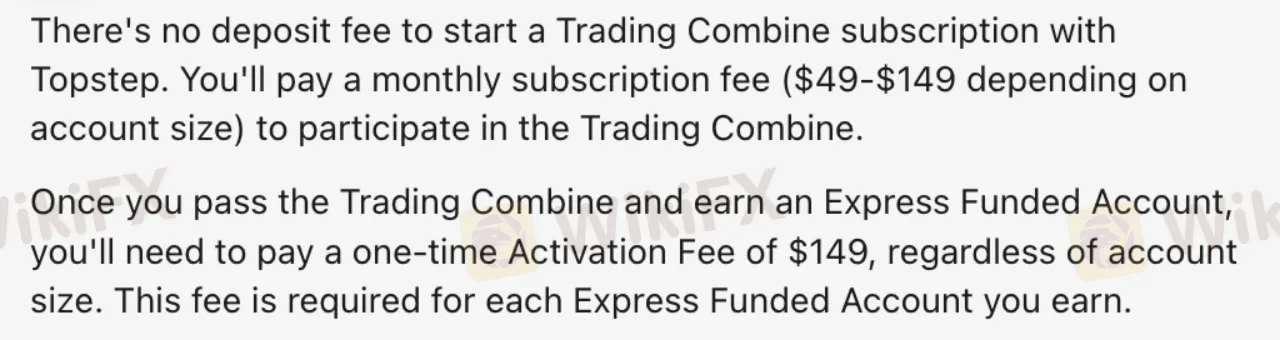

Biaya Non-Trading

| Biaya Non-Trading | Detail |

| Biaya Deposit | ❌ |

| Biaya Penarikan | ❌ |

| Biaya Tidak Aktif | Tidak disebutkan |

Platform Perdagangan

| Platform Perdagangan | Dukungan | Perangkat Tersedia | Cocok untuk |

| TopstepX | ✔ | Mobile, Mac | Pemula hingga menengah |

| NinjaTrader | ✔ | Desktop | Berpengalaman |

| Quantower | ✔ | Desktop | Berpengalaman |

| Tradovate | ✔ | Mobile | Ramah pemula |

| TradingView | ✔ | Mac | Pedagang fokus grafik |

| T4 | ✔ | Mobile | Pedagang futures dasar |

| R|Trader Pro | ✔ | Mobile | Pedagang profesional |

| ATAS OrderFlow Trading | ✔ | Desktop | Pedagang aliran pesanan |

| MotiveWave | ✔ | Mobile, Mac | Analis teknis |

| VolFix | ✔ | Mobile, Mac | Pedagang volume |

| Bookmap | ✔ | Mac | Visualisasi lanjutan |

| Investor/RT | ✔ | – | Analisis profesional |

| Jigsaw Daytradr | ✔ | – | Scalper |

| MultiCharts | ✔ | – | Pedagang kuantitatif |

| Sierra Chart | ✔ | – | Pengguna strategi kustom |

| Trade Navigator | ✔ | – | Profesional charting |

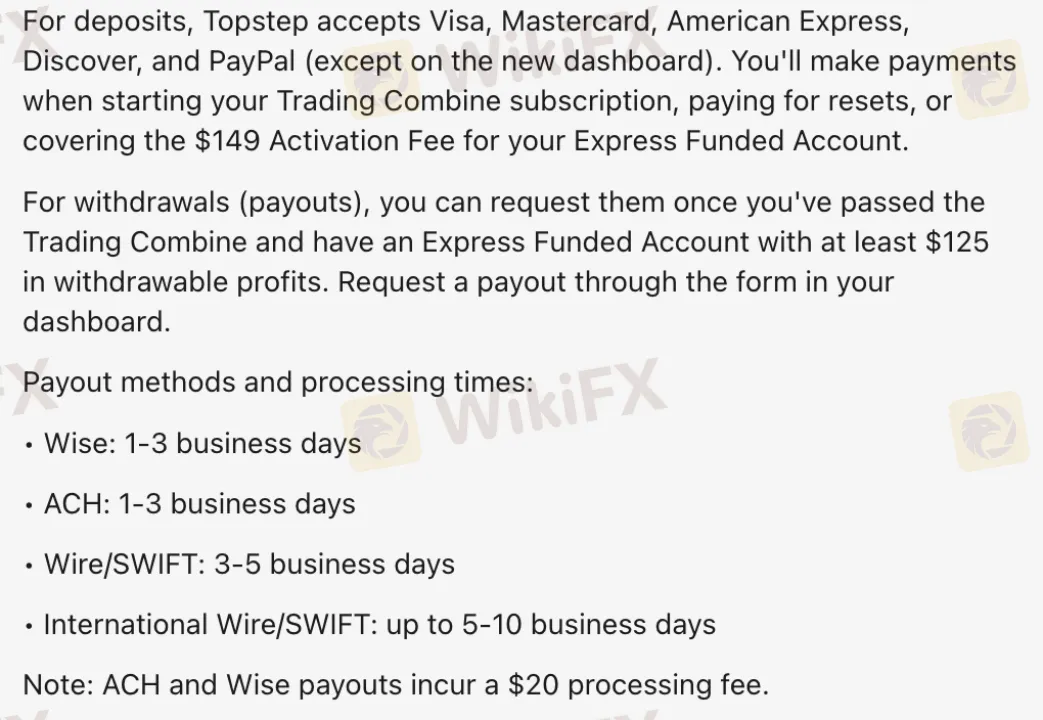

Deposit dan Penarikan

Topstep tidak mengenakan biaya deposit. Namun, beberapa metode penarikan dikenakan biaya. Jumlah penarikan minimum adalah $125.

Opsi Deposit

| Opsi Deposit | Biaya Deposit | Waktu Deposit |

| Visa | ❌ | Instan |

| Mastercard | ||

| American Express | ||

| Discover | ||

| PayPal (hanya dashboard lama) |

Opsi Penarikan

| Opsi Penarikan | Penarikan Minimum | Biaya Penarikan | Waktu Penarikan |

| Wise | $125 | $20 | 1–3 hari kerja |

| ACH | |||

| Wire/SWIFT | Tidak disebutkan | 3–5 hari kerja | |

| International Wire/SWIFT | 5–10 hari kerja |