Perfil de la compañía

| Resumen de la reseña de Topstep | |

| Fecha de fundación | 2012 |

| País/Región registrado | Estados Unidos |

| Regulación | Sin regulación |

| Instrumentos de mercado | Futuros de acciones del CME, futuros de divisas, futuros agrícolas, futuros de energía, metales, futuros de tasas de interés |

| Cuenta demo | ✅ |

| Apalancamiento | / |

| Spread | / |

| Plataforma de trading | TopstepX™, NinjaTrader, Quantower, Tradovate, TradingView, T4 by CTS, R|Trader Pro (Rithmic), ATAS – Plataforma de trading de flujo de órdenes, MotiveWave, VolFix, Bookmap, Investor/RT de Linn Software, Jigsaw Daytradr, MultiCharts, Sierra Chart y Trade Navigator. |

| Depósito mínimo | / |

| Soporte al cliente | Tel: 1-888-407-1611 |

| Email: support@topstep.com | |

Información sobre Topstep

Topstep es una firma de trading propietario con sede en Estados Unidos que ofrece a los traders de futuros la oportunidad de operar con capital de la firma después de pasar una evaluación simulada (Trading Combine). Los traders pueden acceder a productos de futuros, incluyendo futuros de acciones del CME, futuros de divisas, futuros agrícolas, futuros de energía, metales y futuros de tasas de interés. La plataforma tiene costos de entrada bajos y es compatible con muchas plataformas de trading de grado profesional, pero carece de regulación.

Pros y contras

| Pros | Contras |

| Varios instrumentos de trading | Sin regulación |

| Cuentas demo | Falta de transparencia |

| Compatible con más de una docena de plataformas de trading avanzadas |

¿Es Topstep legítimo?

Topstep no es un broker legítimo. Está registrado en Estados Unidos pero actualmente no posee una licencia regulatoria válida de los EE. UU. o de ninguna autoridad financiera internacional. Organismos reguladores conocidos como la FCA (Reino Unido), ASIC (Australia) y NFA (EE. UU.) no regulan a Topstep.

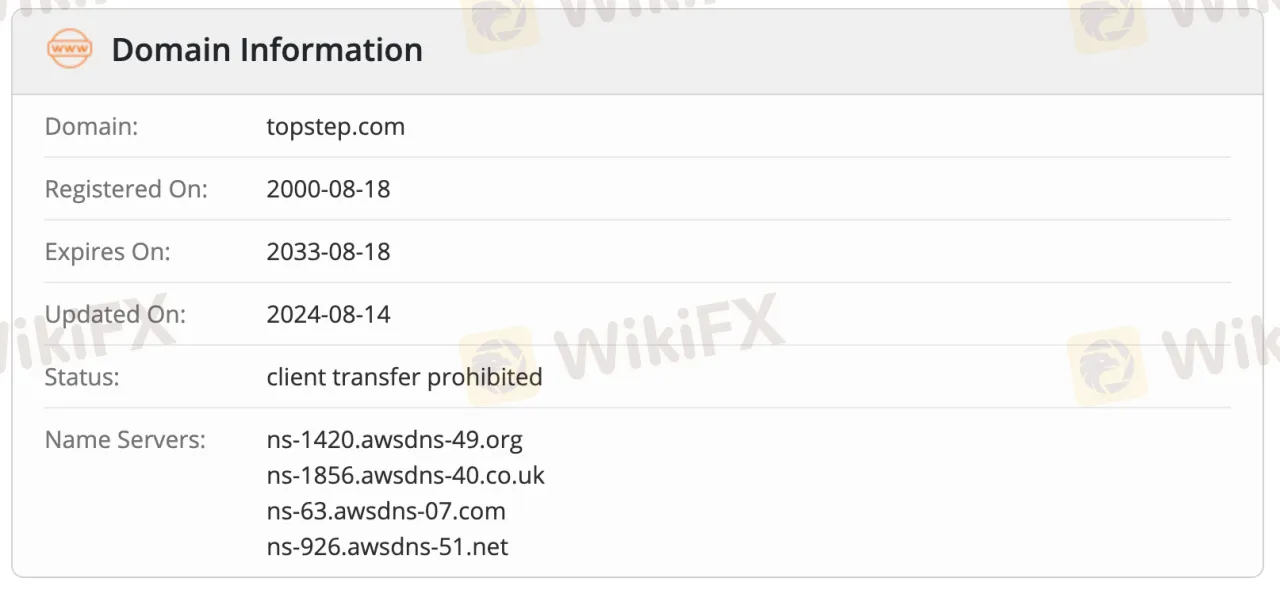

El dominio topstep.com fue registrado el 18 de agosto de 2000 y está programado para expirar el 18 de agosto de 2033. El dominio se encuentra en un estado bloqueado "prohibido el traslado del cliente", lo que evita que sea transferido a otro registrador, asegurando cierto nivel de seguridad administrativa.

¿Qué puedo operar en Topstep?

Topstep ofrece trading solo en contratos de futuros, no en trading al contado. Los traders pueden acceder a productos de futuros, incluyendo futuros de acciones del CME, futuros de divisas, futuros agrícolas, futuros de energía, metales, futuros de tasas de interés.

| Instrumentos Negociables | Soportados |

| Futuros de acciones del CME | ✔ |

| Futuros de divisas | ✔ |

| Futuros agrícolas | ✔ |

| Futuros de energía | ✔ |

| Metales | ✔ |

| Futuros de tasas de interés | ✔ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

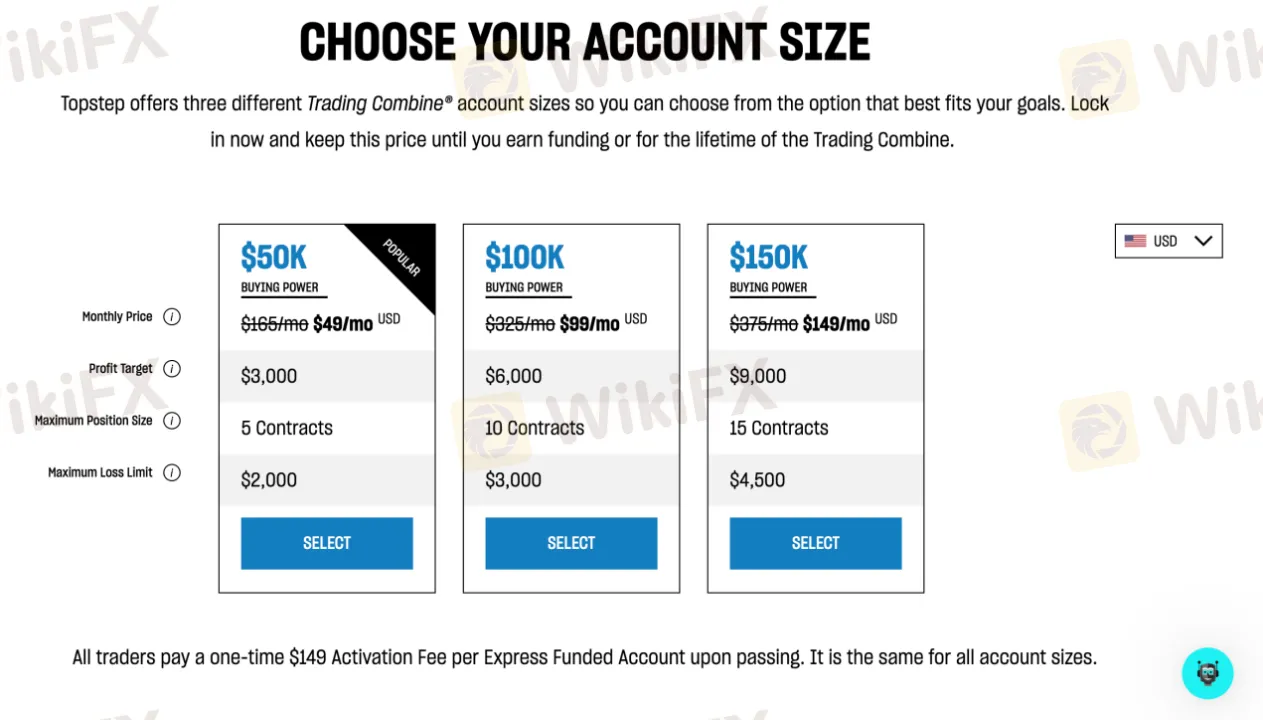

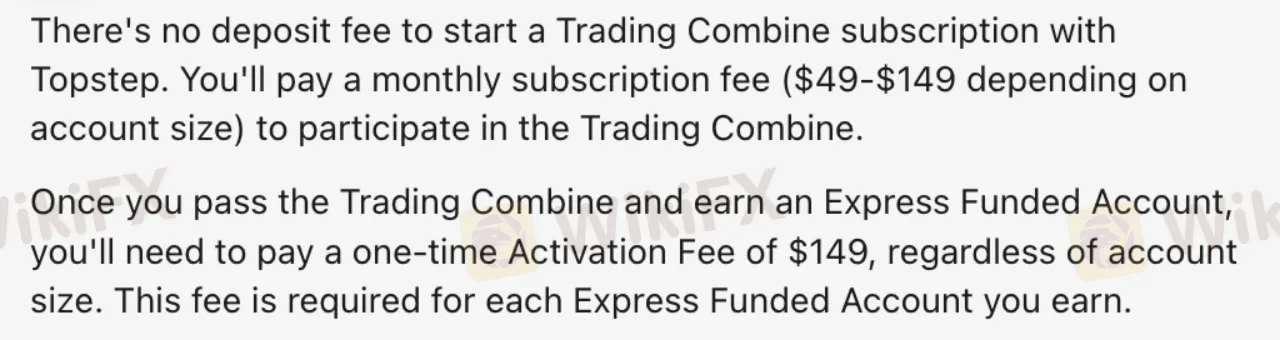

Tipo de Cuenta

Topstep no ofrece cuentas reales tradicionales como la mayoría de los brokers. En su lugar, proporciona tres niveles de cuentas de evaluación (Trading Combine®): cuentas de $50K, $100K y $150K de poder adquisitivo. Estas son cuentas simuladas utilizadas para evaluar el rendimiento de un trader antes de ofrecer capital real. Una vez que un trader pasa la fase de evaluación, puede obtener acceso a una Cuenta Financiada Express.

| Tipo de Cuenta | Trading en Vivo | Trading de Demostración | Mejor para |

| Combine de $50K | ❌ | ✔ | Principiantes o traders de bajo riesgo |

| Combine de $100K | ❌ | ✔ | Traders intermedios |

| Combine de $150K | ❌ | ✔ | Traders experimentados cómodos con el riesgo |

| Cuenta Financiada Express | ✔ | ❌ | Traders que pasaron la evaluación |

Tarifas de Topstep

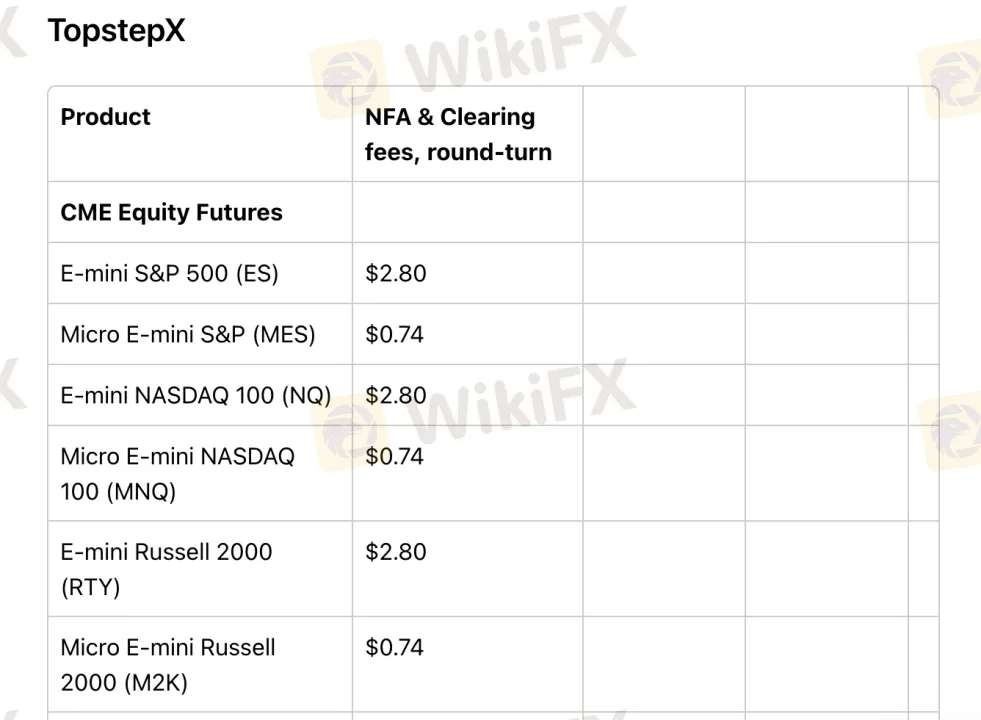

| Producto de Trading | Comisiones NFA y de Compensación (Round-turn) |

| E-mini S&P 500 (ES) | $2.80 |

| Micro E-mini S&P (MES) | $0.74 |

| E-mini NASDAQ 100 (NQ) | $2.80 |

| Micro E-mini NASDAQ 100 (MNQ) | $0.74 |

Las comisiones de trading de Topstep son bajas a moderadas en comparación con los estándares de la industria, especialmente al utilizar su propia plataforma, TopstepX.

Tasas de Swap

Topstep no cobra tasas de swap ni tarifas por rollover nocturno, ya que todas las operaciones deben realizarse durante el horario regular de trading. No se permite el swing trading, las posiciones deben cerrarse diariamente.

Comisiones no relacionadas con operaciones

| Comisiones no relacionadas con operaciones | Detalles |

| Comisión de depósito | ❌ |

| Comisión de retiro | ❌ |

| Comisión por inactividad | No mencionado |

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| TopstepX | ✔ | Móvil, Mac | Principiante a intermedio |

| NinjaTrader | ✔ | Escritorio | Experimentado |

| Quantower | ✔ | Escritorio | Experimentado |

| Tradovate | ✔ | Móvil | Amigable para principiantes |

| TradingView | ✔ | Mac | Traders enfocados en gráficos |

| T4 | ✔ | Móvil | Operadores básicos de futuros |

| R|Trader Pro | ✔ | Móvil | Operadores profesionales |

| ATAS OrderFlow Trading | ✔ | Escritorio | Operadores de flujo de órdenes |

| MotiveWave | ✔ | Móvil, Mac | Analistas técnicos |

| VolFix | ✔ | Móvil, Mac | Operadores de volumen |

| Bookmap | ✔ | Mac | Visualización avanzada |

| Investor/RT | ✔ | – | Análisis profesional |

| Jigsaw Daytradr | ✔ | – | Operadores de scalping |

| MultiCharts | ✔ | – | Operadores cuantitativos |

| Sierra Chart | ✔ | – | Usuarios de estrategias personalizadas |

| Trade Navigator | ✔ | – | Profesionales de gráficos |

Depósito y Retiro

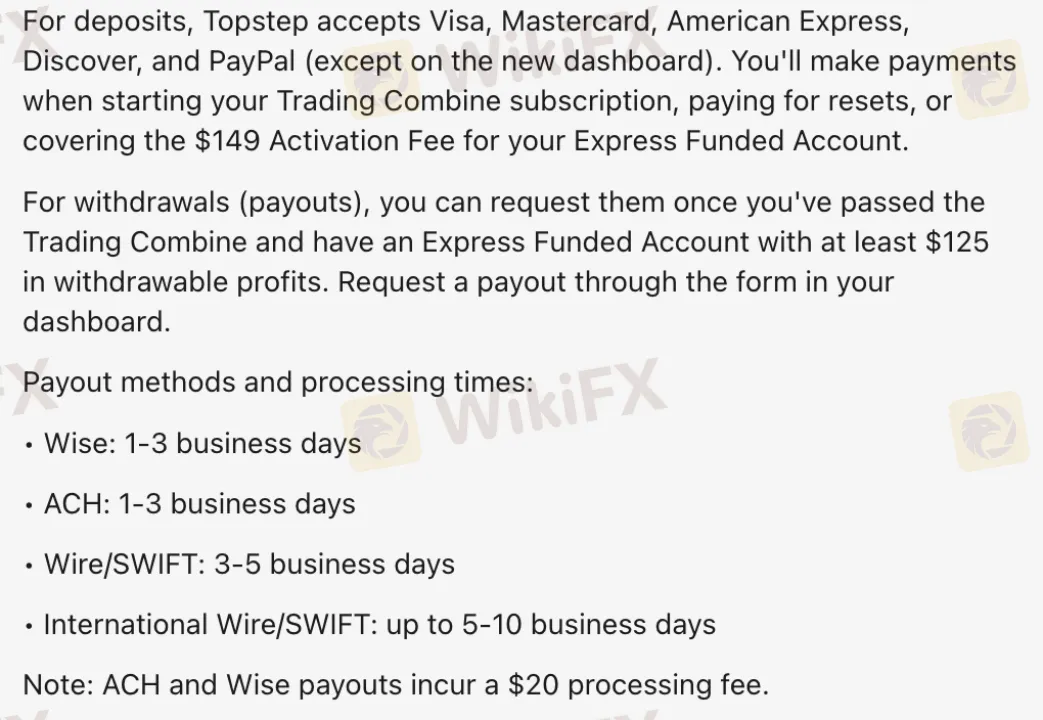

Topstep no cobra tarifas de depósito. Sin embargo, algunos métodos de retiro sí incurren en una tarifa. La cantidad mínima de retiro es de $125.

Opciones de Depósito

| Opciones de Depósito | Tarifas de Depósito | Tiempo de Depósito |

| Visa | ❌ | Instantáneo |

| Mastercard | ||

| American Express | ||

| Discover | ||

| PayPal (solo antiguo panel de control) |

Opciones de Retiro

| Opciones de Retiro | Retiro Mínimo | Tarifas de Retiro | Tiempo de Retiro |

| Wise | $125 | $20 | 1–3 días hábiles |

| ACH | |||

| Transferencia bancaria/SWIFT | No especificado | 3–5 días hábiles | |

| Transferencia bancaria internacional/SWIFT | 5–10 días hábiles |