Présentation de l'entreprise

| CHIEFRésumé de l'examen | |

| Fondé | 1979 |

| Pays/Région enregistré | Hong Kong |

| Régulation | Réglementé |

| Instruments de marché | SecuritiesFutures |

| Compte de démonstration | ❌ |

| Effet de levier | / |

| Spread | / |

| Plateforme de trading | Chief Deal |

| Dépôt minimum | / |

| Assistance clientèle | Email: cs@chiefgroup.com.hk |

| Réseaux sociaux: Facebook, Linkedin, Youtube, Whatsapp, Wechat | |

Informations sur CHIEF

CHIEF, créé à Hong Kong en 1979. Il est actuellement réglementé par la SFC, fournit principalement des services de trading de titres et de contrats à terme, et dispose de sa propre plateforme de trading.

Avantages et inconvénients

| Avantages | Inconvénients |

| Réglementé par la SFC | MT4/5 n'est pas pris en charge |

| Les comptes de démonstration ne sont pas disponibles |

CHIEF est-il légitime ?

| Pays/Région réglementé(e) |  |

| Autorité de régulation | SFC |

| Entité réglementée | Chief Commodities Limited |

| Type de licence | Opérations sur contrats à terme |

| Numéro de licence | AAZ607 |

| Statut actuel | Réglementé |

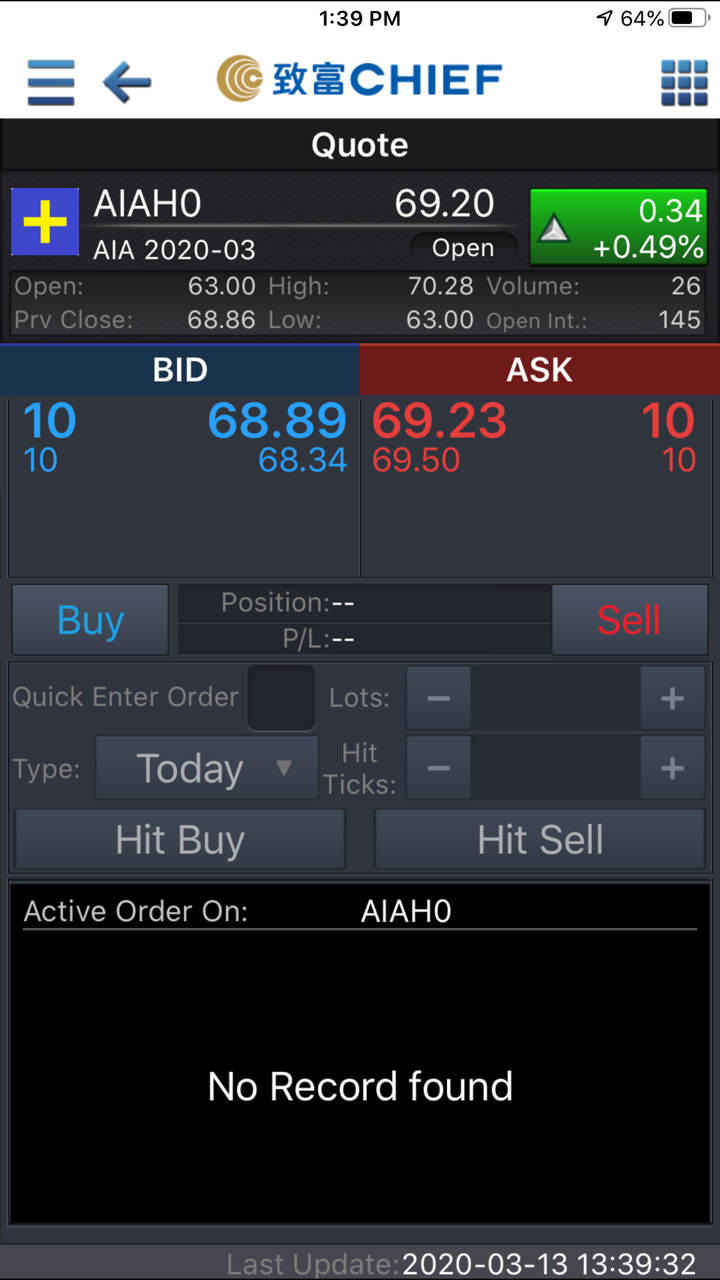

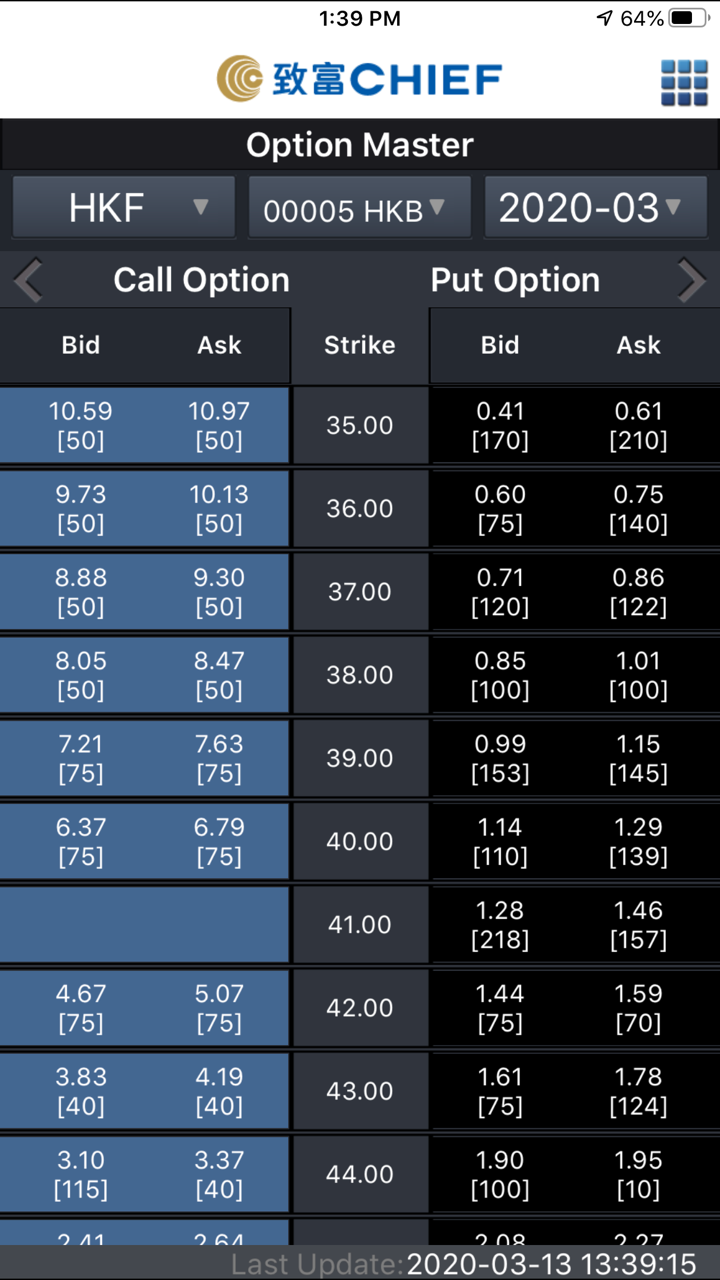

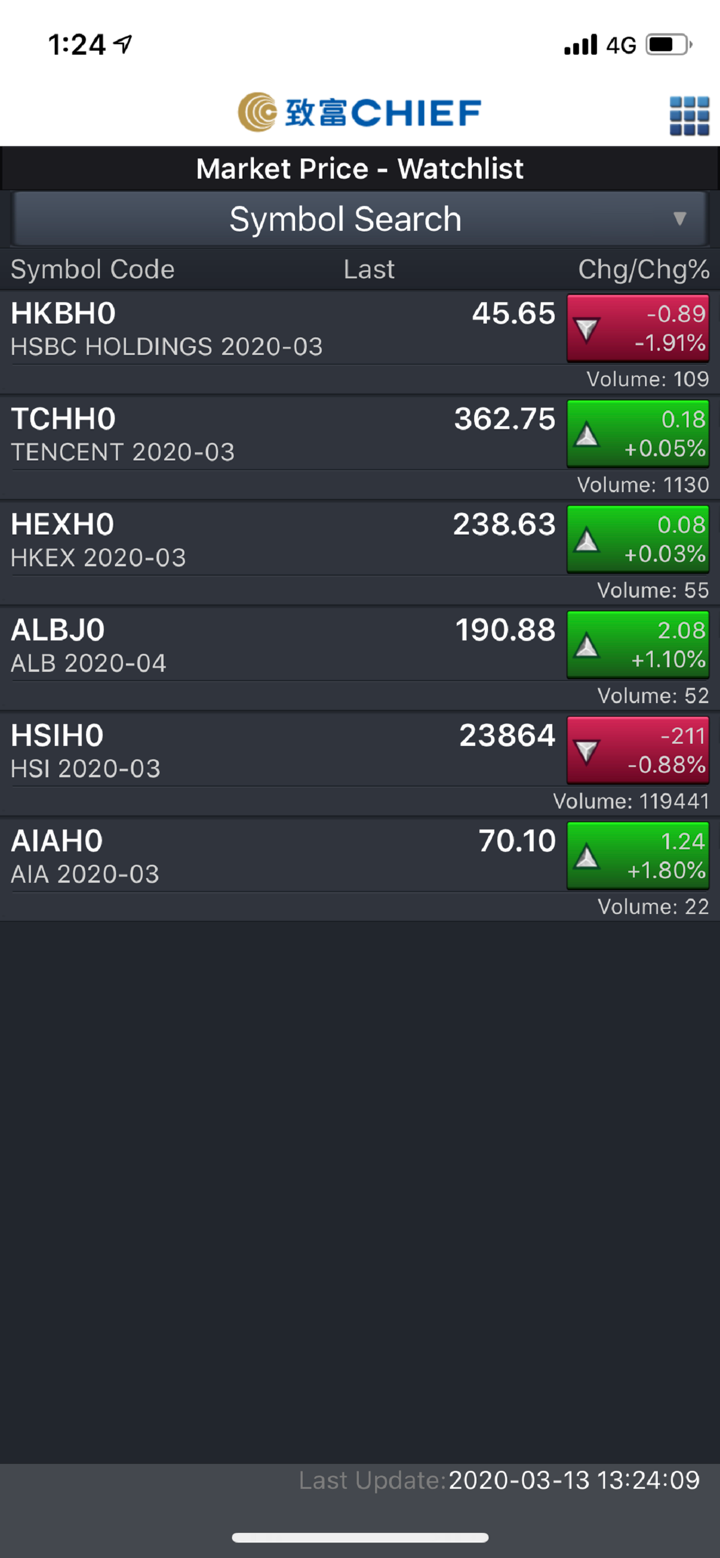

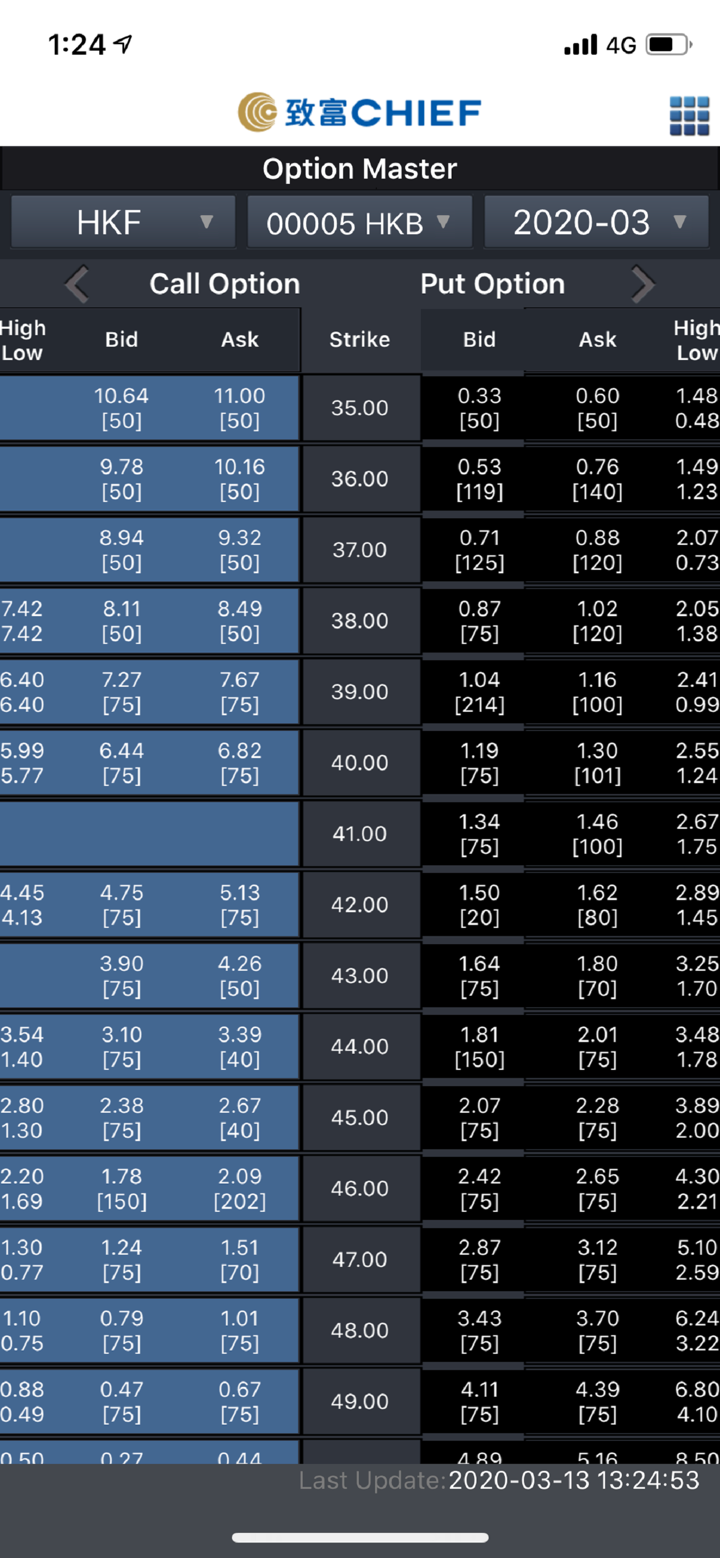

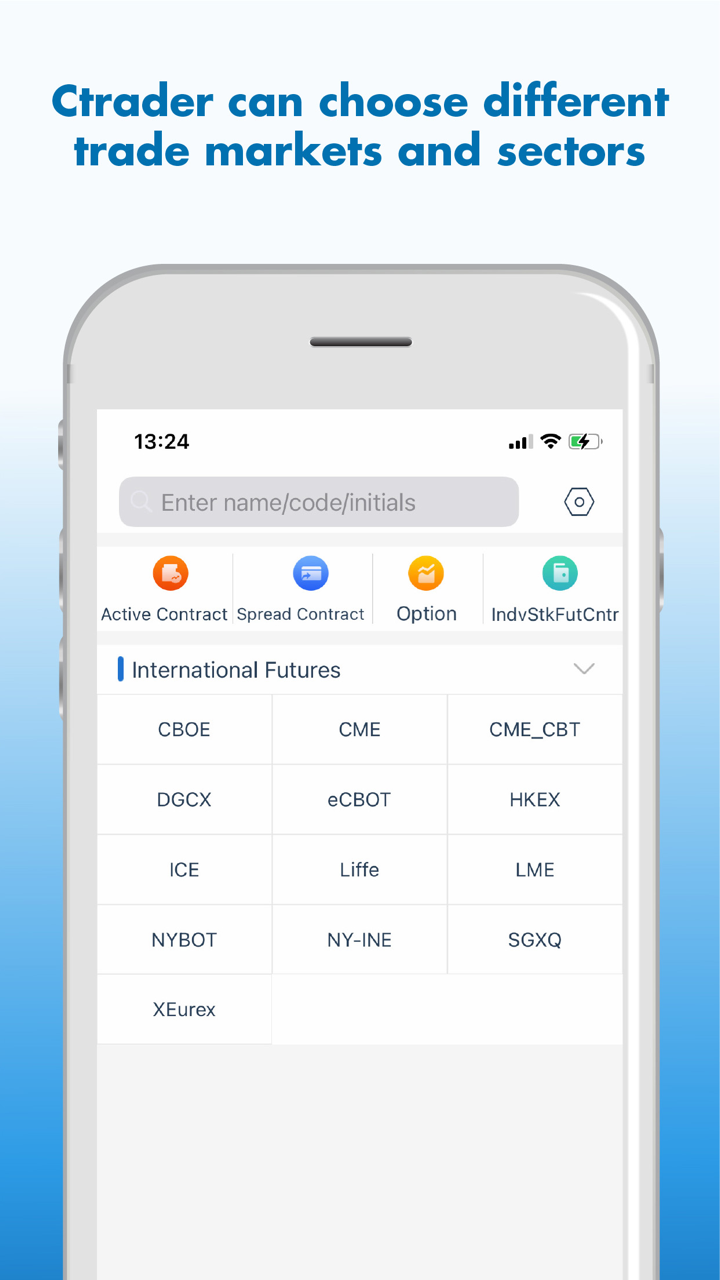

Que puis-je trader sur CHIEF ?

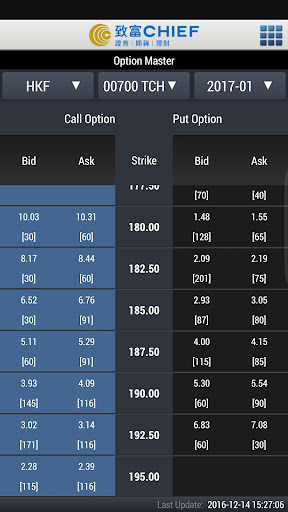

CHIEF vous permet de trader des titres et des contrats à terme.

| Instruments tradables | Pris en charge |

| Titres | ✔ |

| Contrats à terme | ✔ |

| Forex | ❌ |

| Métaux précieux et matières premières | ❌ |

| Indices | ❌ |

| Obligations | ❌ |

| ETF | ❌ |

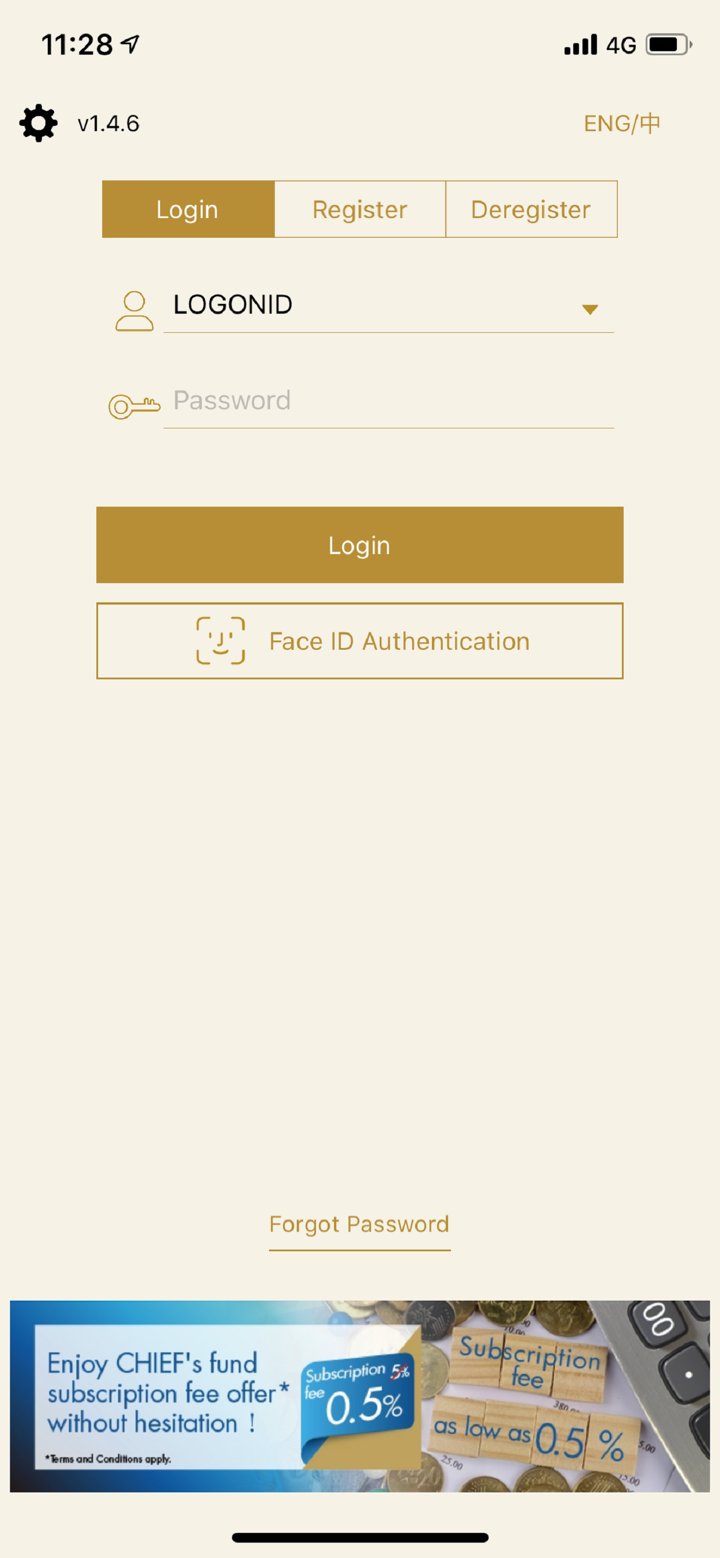

Types de compte

CHIEF n'a pas fourni d'informations sur le compte. Cependant, les méthodes d'ouverture de compte prises en charge sont les rendez-vous "ouverture de compte à distance", en personne et par courrier. Vous pouvez vous référer à: https://www.chiefgroup.com.hk/hk/account?apply=e-account

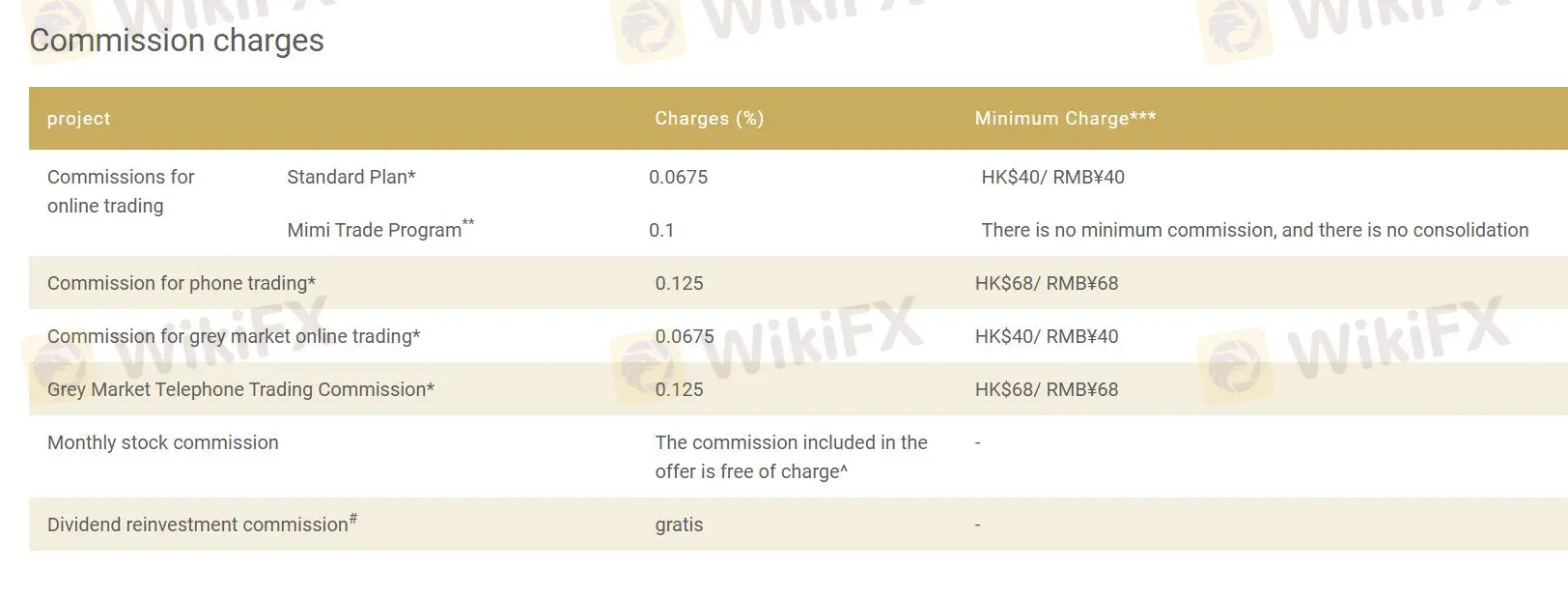

Frais CHIEF

CHIEF prend en charge certains projets sans commission, et le taux de commission du projet n'est pas supérieur à 0,2%. Les frais minimums varient de HK $40 à HK $68 et de RMB ¥40 à RMB ¥68.

| Projet | Frais (%) | Frais minimum**** |

| Commissions pour le trading en ligne | ||

| Plan standard* | 0,0675 | HK$40 / RMB¥40 |

| Programme de trading Mimi** | 0,1 | Pas de commission minimum, pas de consolidation |

| Commission pour le trading par téléphone* | 0,125 | HK$68 / RMB¥68 |

| Commission pour le trading en ligne sur le marché gris* | 0,0675 | HK$40 / RMB¥40 |

| Commission pour le trading téléphonique sur le marché gris* | 0,125 | HK$68 / RMB¥68 |

| Commission mensuelle sur les actions | La commission incluse dans l'offre est gratuite* | - |

| Commission de réinvestissement des dividendes# | gratuit | - |

Plateforme de trading

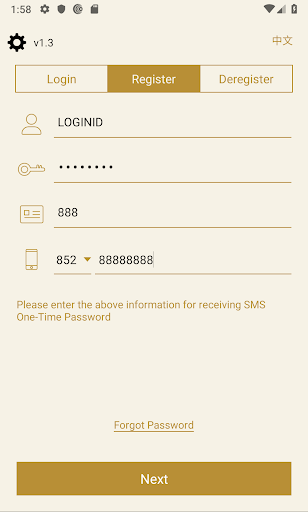

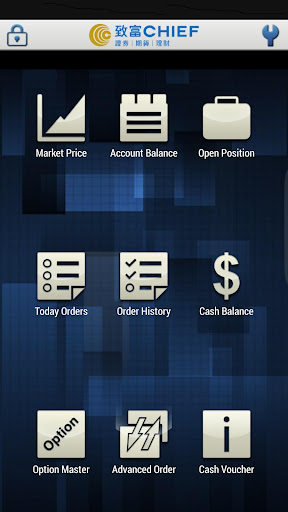

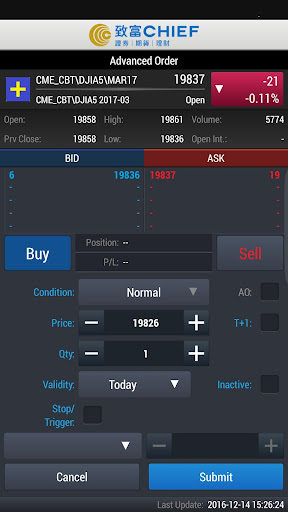

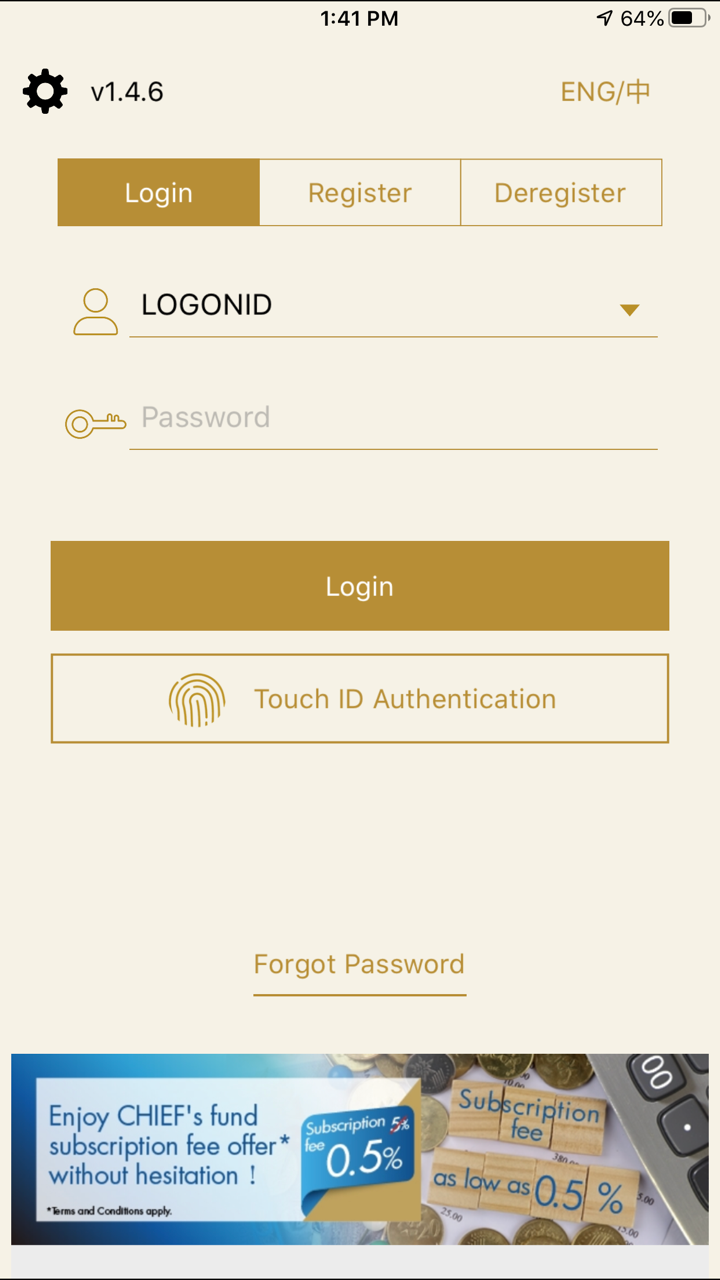

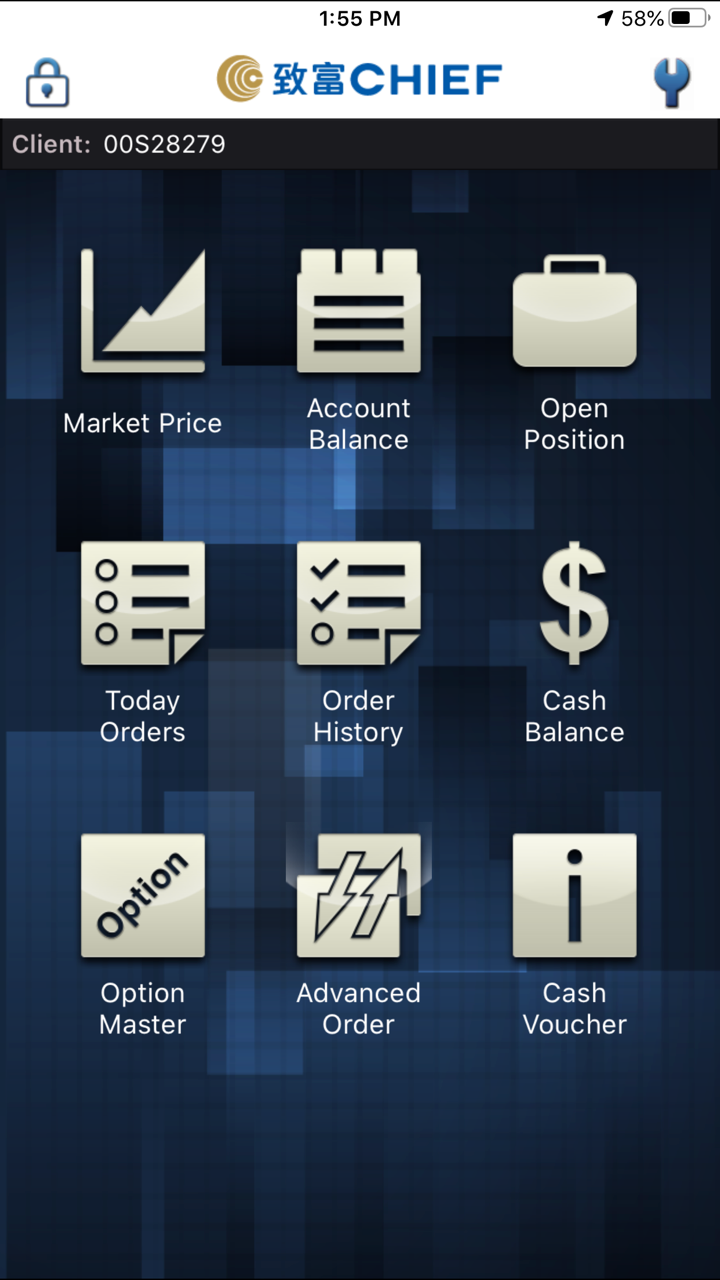

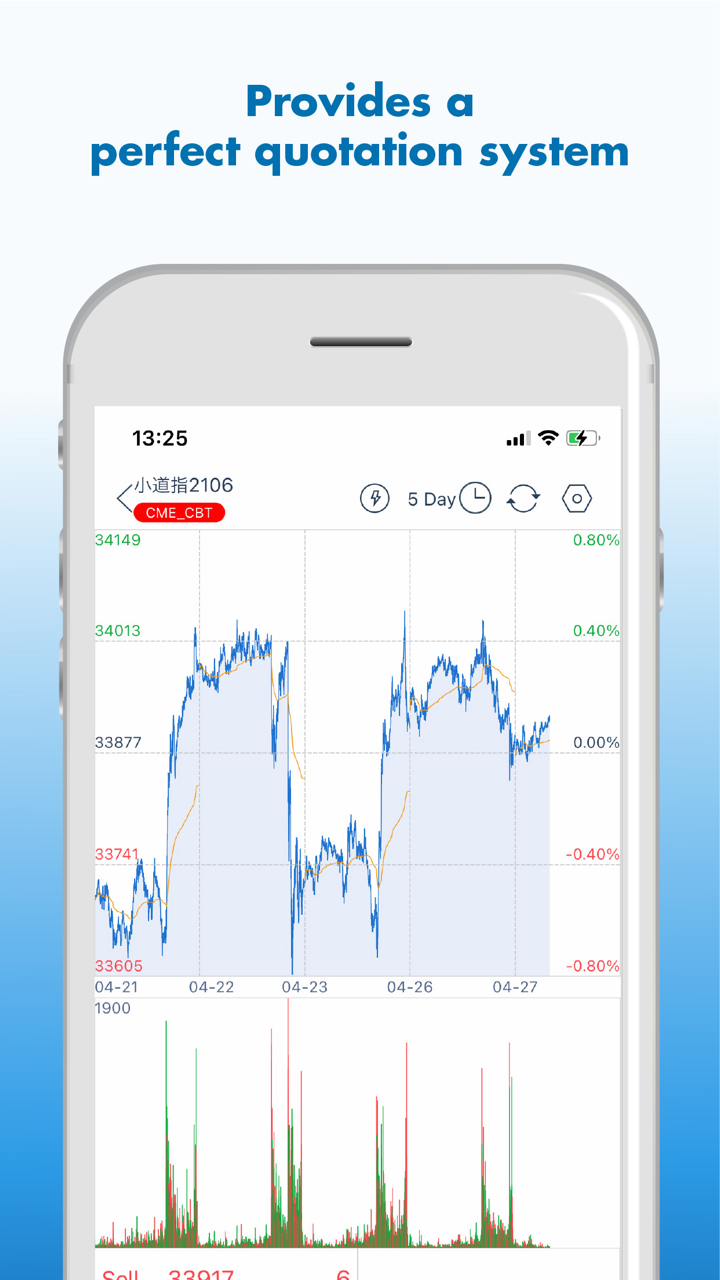

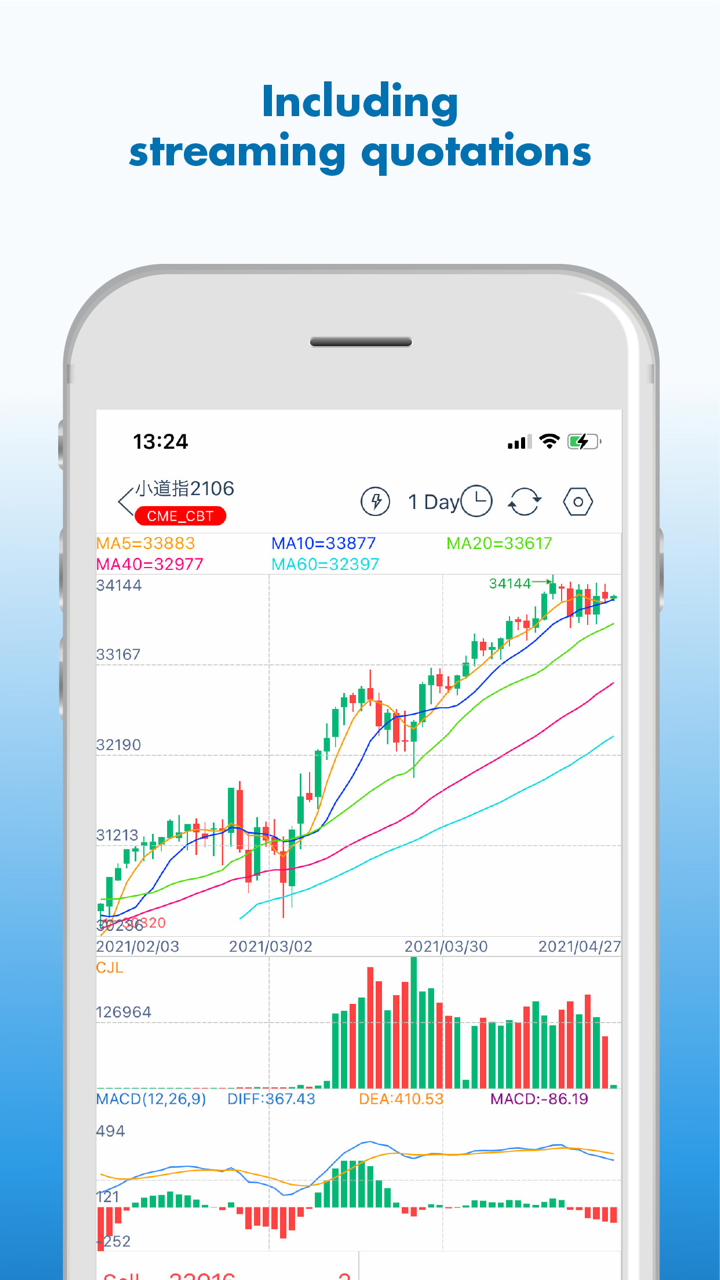

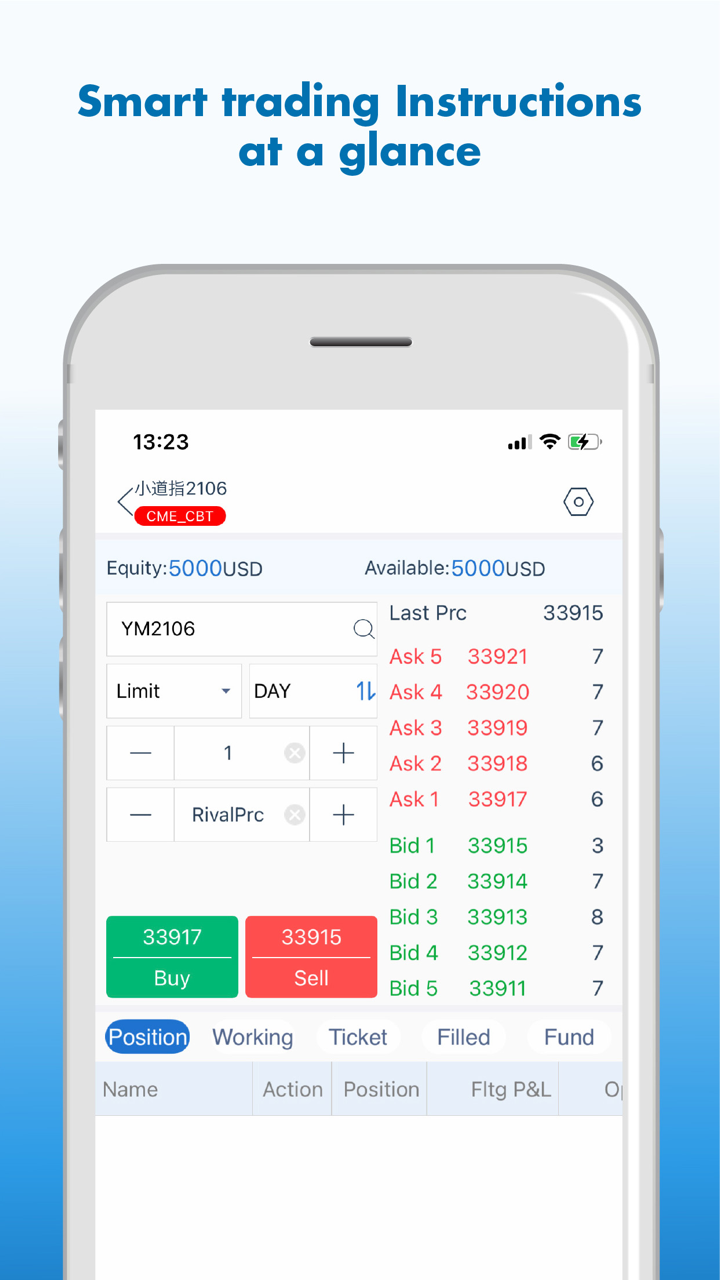

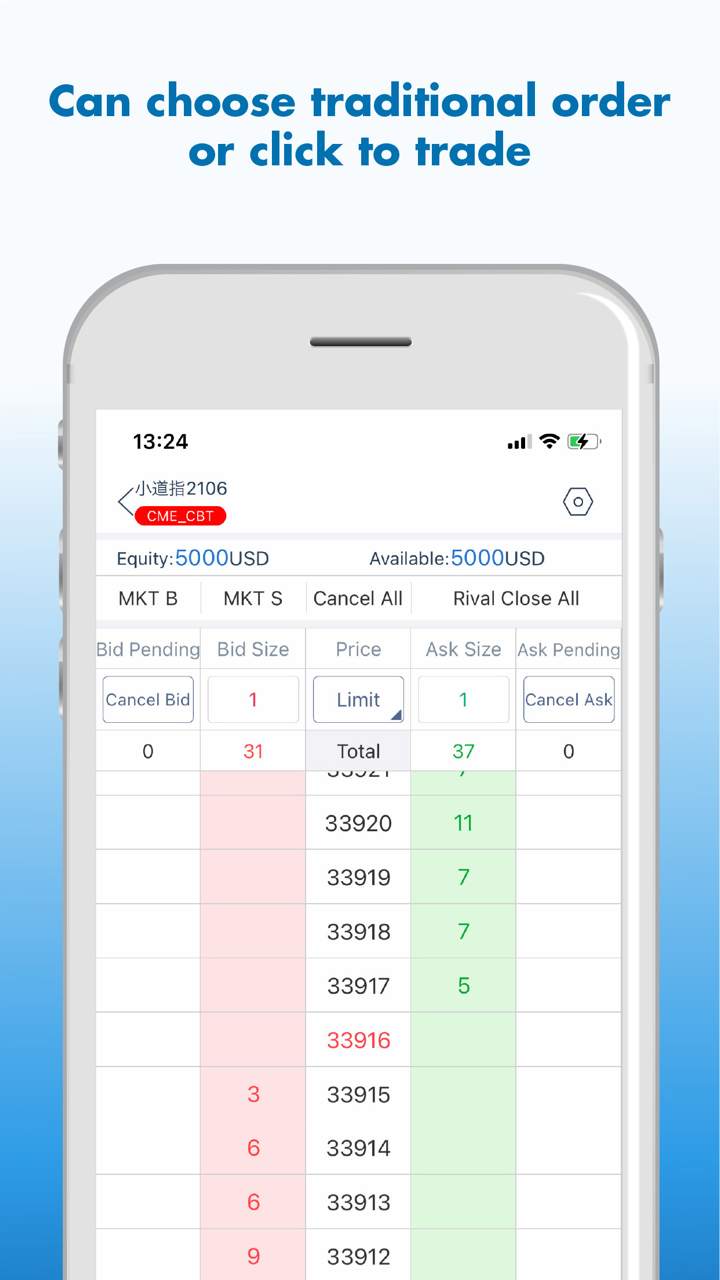

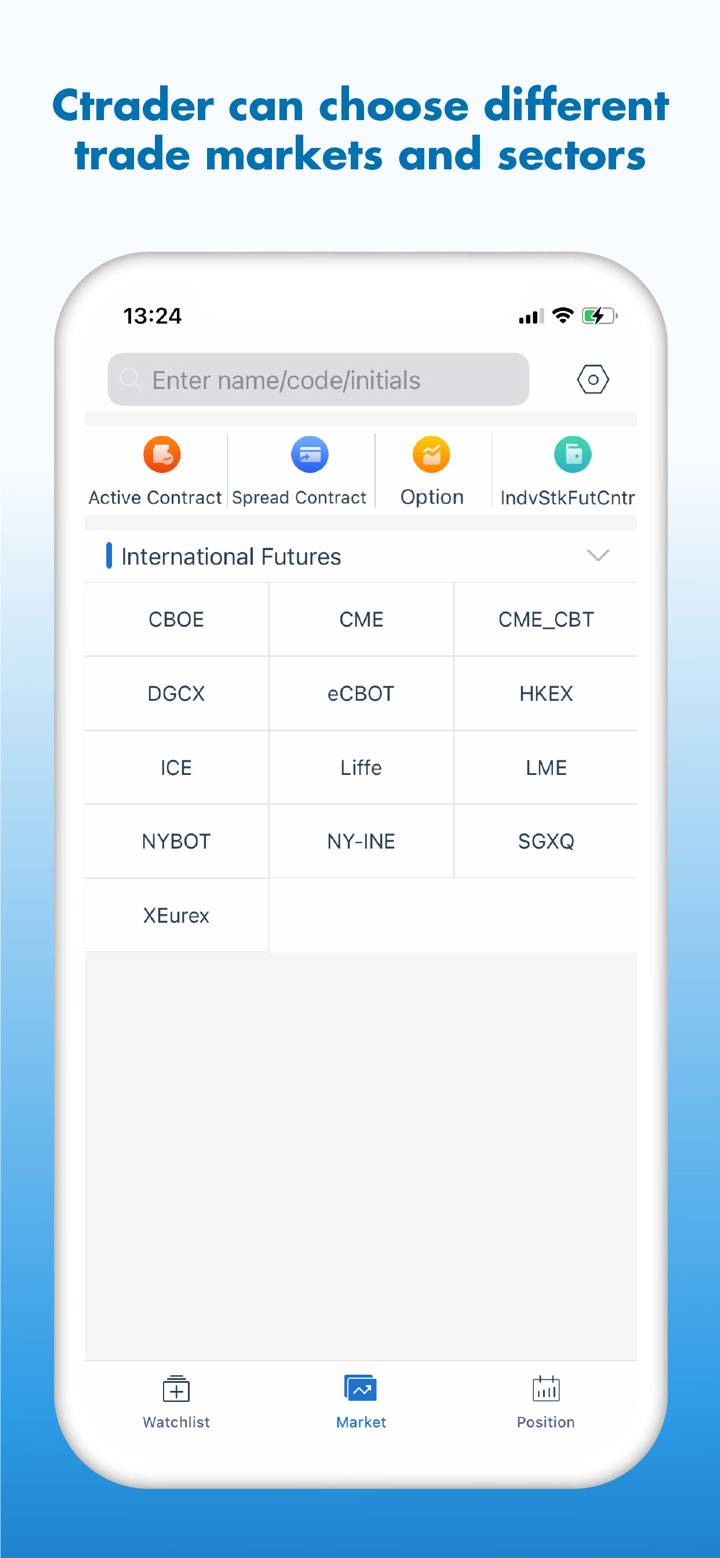

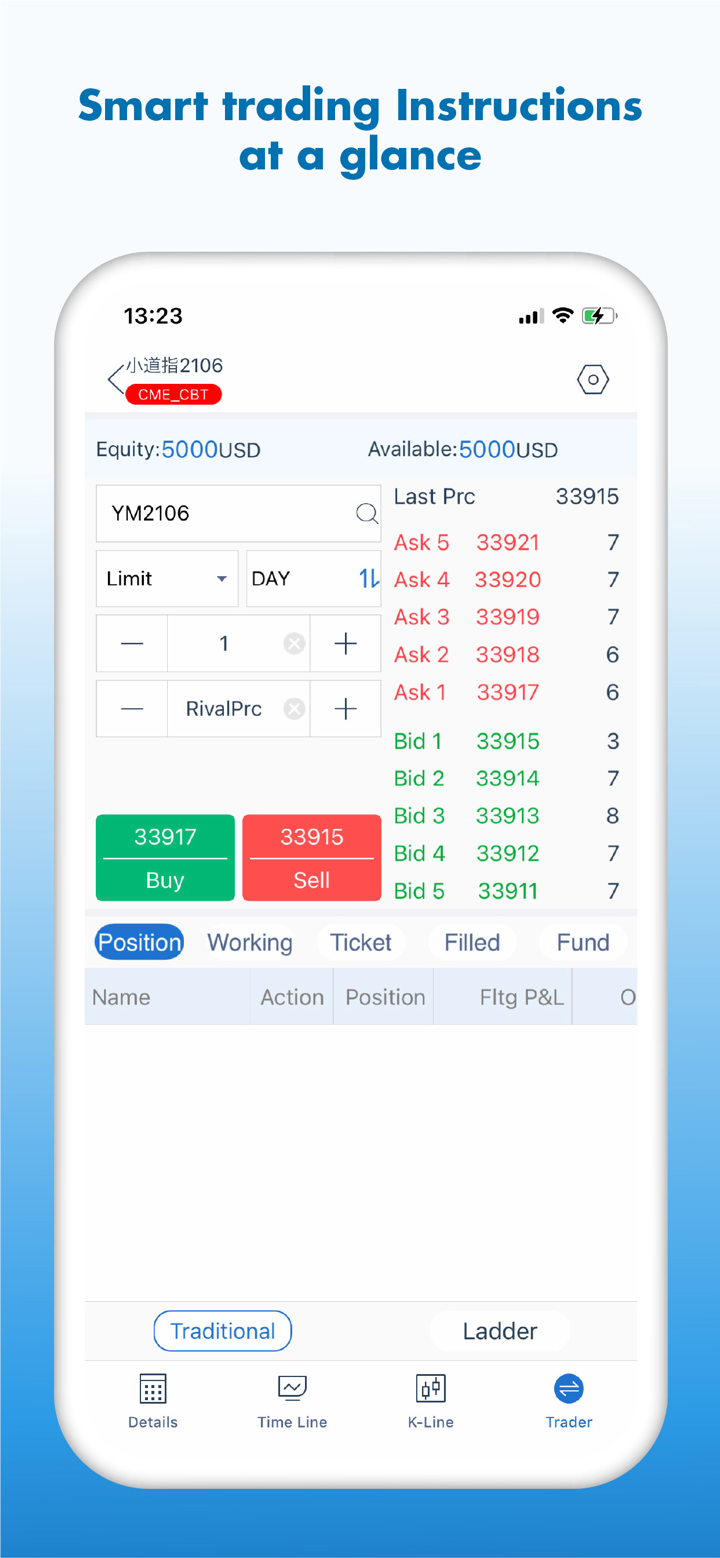

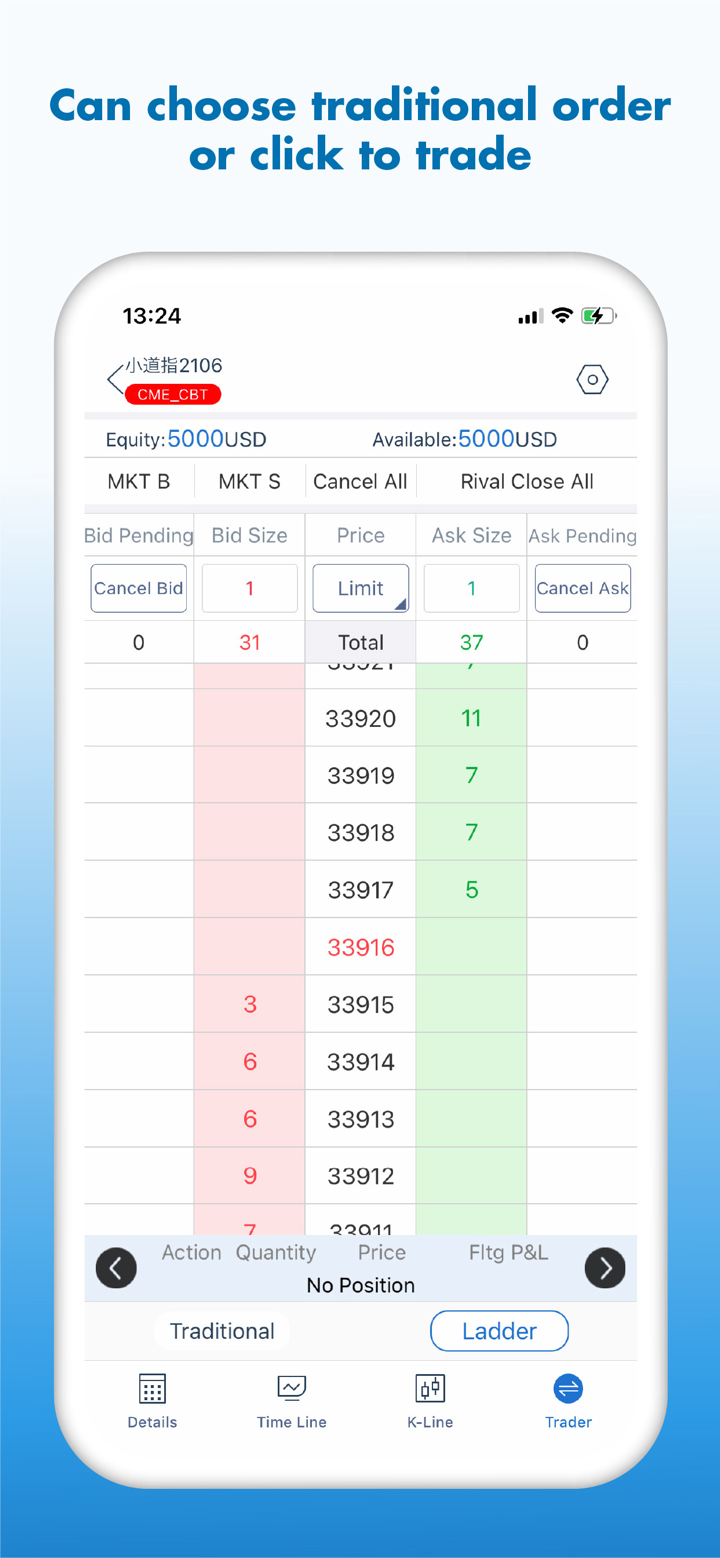

CHIEF propose sa propre plateforme Chief Deal, qui peut être utilisée sur mobile.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient à |

| Chief Deal | ✔ | Mobile | Tous les traders |

| MT4 | ❌ | ||

| MT5 | ❌ |

Dépôt et retrait

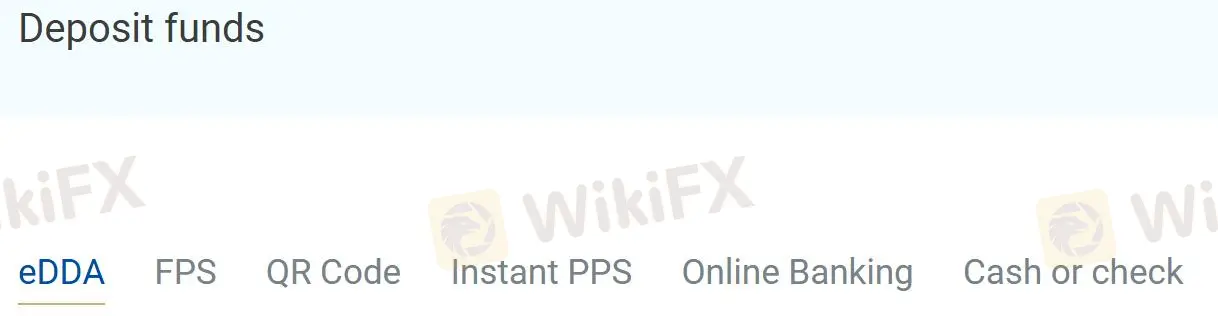

CHIEF propose 6 méthodes de dépôt: eDDA, FPS, QR Code, Instant PPS, Online Banking, Cash or check.

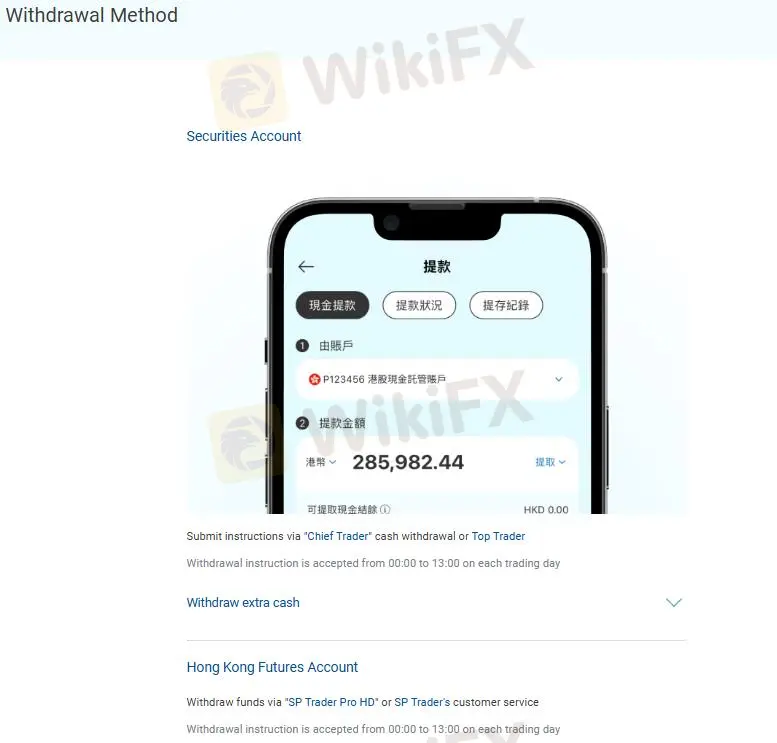

Les retraits doivent être effectués en soumettant des instructions via le retrait d'espèces "Chief Trader" ou Top Trader, ou en retirant des fonds via "SP Trader Pro HD" ou le service client de SP Trader.