Perfil de la compañía

| CHIEFResumen de revisión | |

| Fundado | 1979 |

| País/Región registrado | Hong Kong |

| Regulación | Regulado |

| Instrumentos de mercado | SecuritiesFutures |

| Cuenta demo | ❌ |

| Apalancamiento | / |

| Spread | / |

| Plataforma de trading | Chief Deal |

| Depósito mínimo | / |

| Soporte al cliente | Email: cs@chiefgroup.com.hk |

| Redes sociales: Facebook, Linkedin, Youtube, Whatsapp, Wechat | |

Información de CHIEF

CHIEF, constituida en Hong Kong en 1979. Actualmente está regulada por la SFC, principalmente ofrece operaciones de valores y futuros, y tiene su propia plataforma de trading.

Pros y contras

| Pros | Contras |

| Regulado por la SFC | No se admite MT4/5 |

| No hay cuentas demo disponibles |

¿Es CHIEF legítimo?

| País/Región regulado |  |

| Autoridad reguladora | SFC |

| Entidad regulada | Chief Commodities Limited |

| Tipo de licencia | Operaciones de contratos de futuros |

| Número de licencia | AAZ607 |

| Estado actual | Regulado |

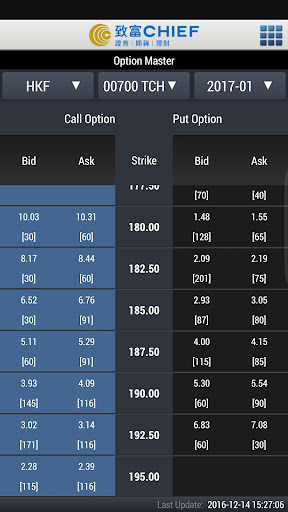

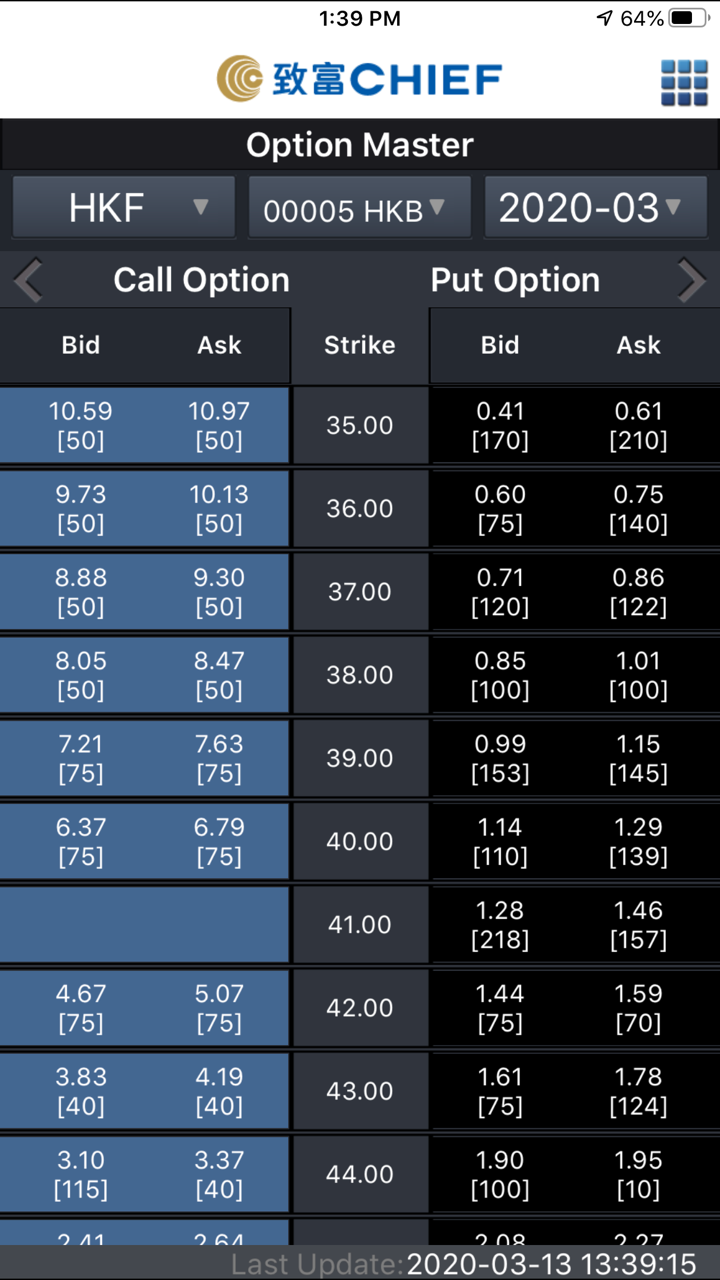

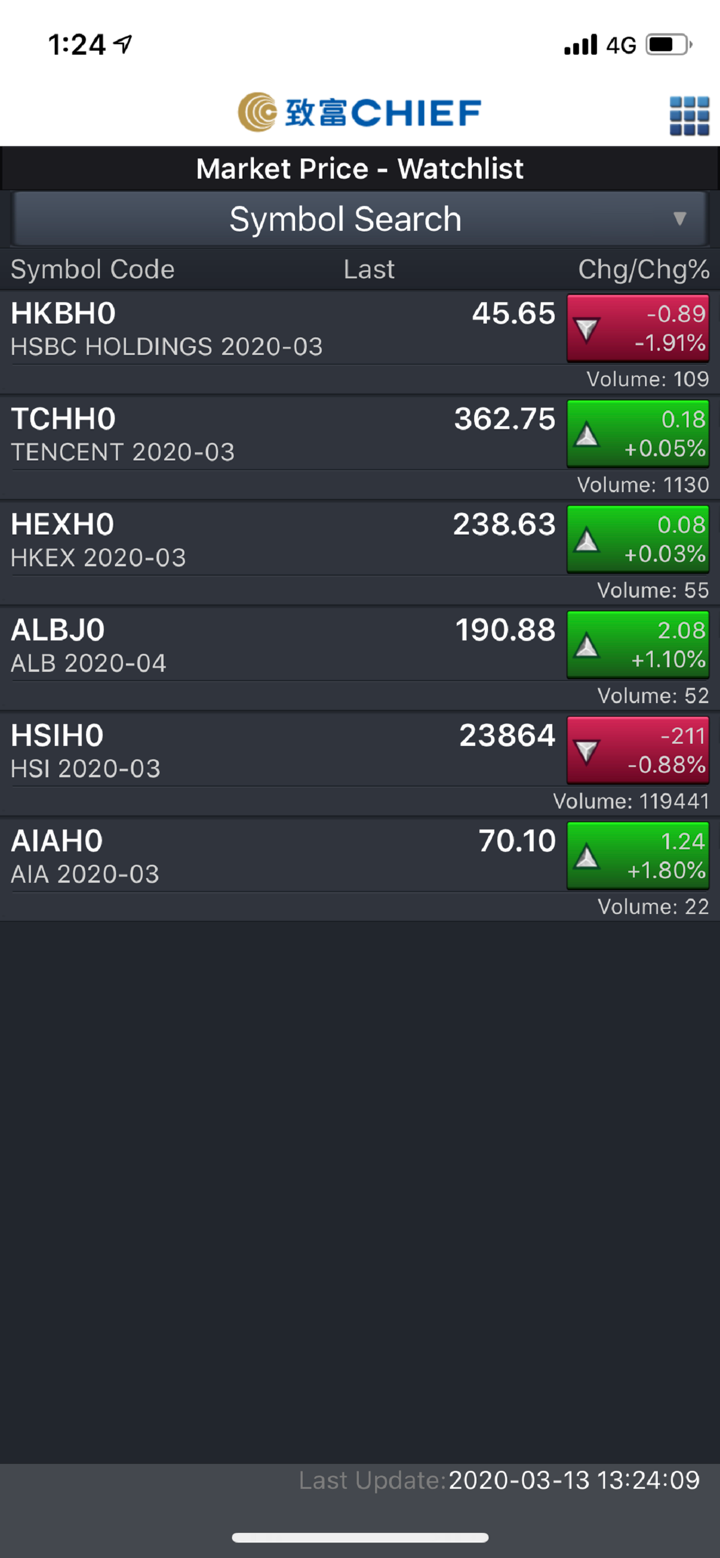

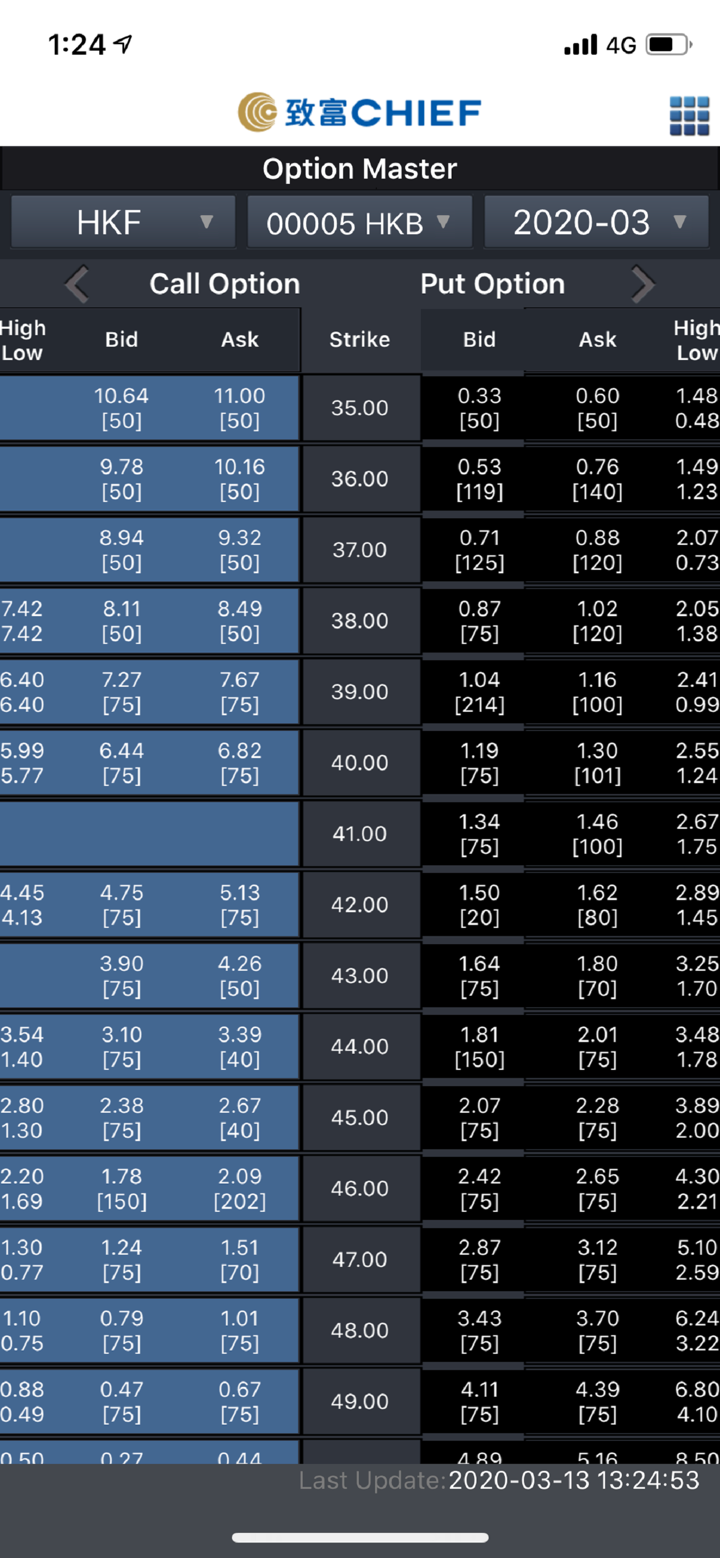

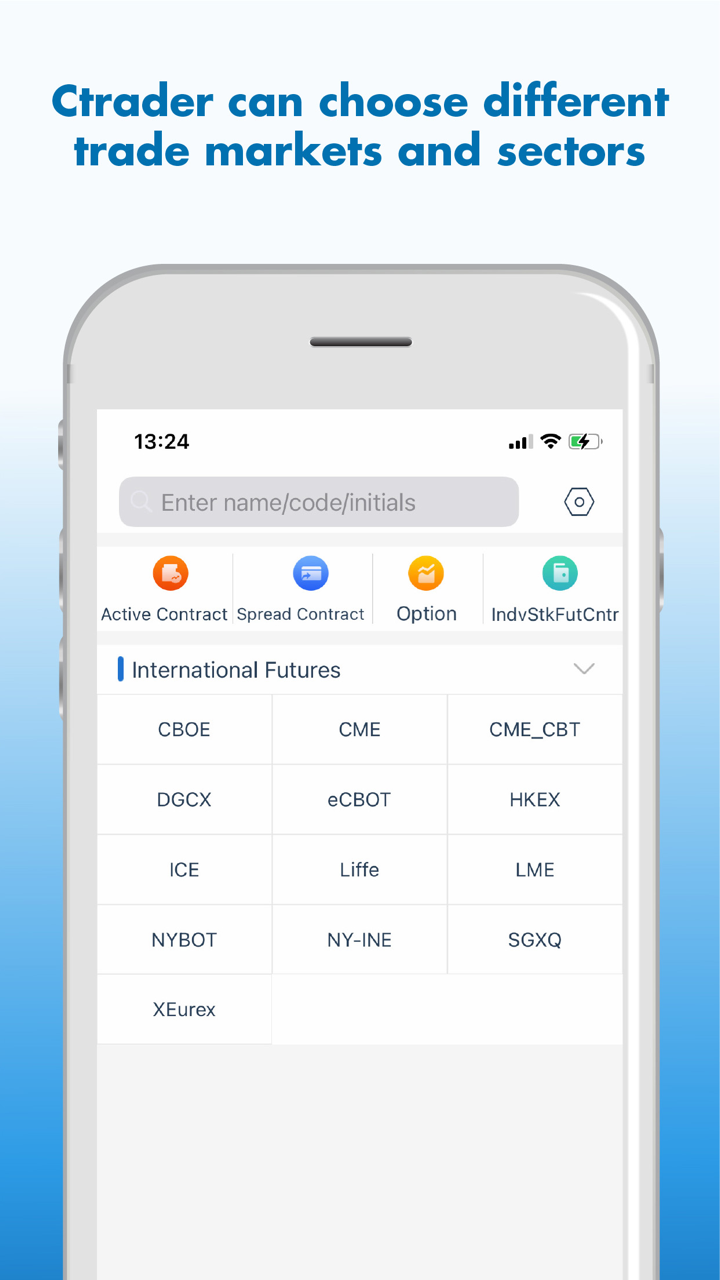

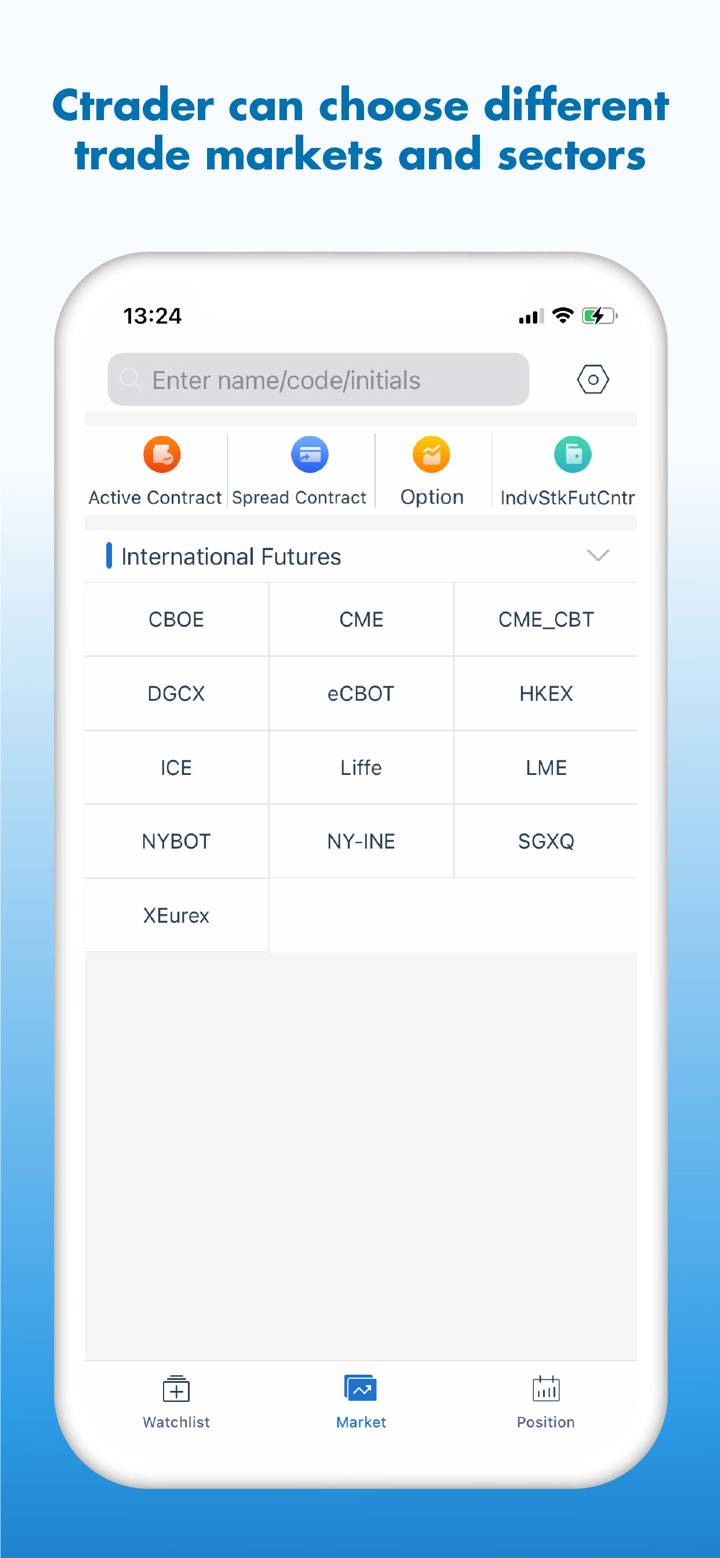

¿Qué puedo operar en CHIEF?

CHIEF te ofrece soporte en operaciones de valores y futuros.

| Instrumentos negociables | Soportados |

| Valores | ✔ |

| Futuros | ✔ |

| Forex | ❌ |

| Metales preciosos y materias primas | ❌ |

| Índices | ❌ |

| Bonos | ❌ |

| ETF | ❌ |

Tipos de cuenta

CHIEF no proporcionó información de la cuenta. Sin embargo, los métodos de apertura de cuenta admitidos son las citas de "apertura de cuenta remota", en persona y por correo. Puede consultar: https://www.chiefgroup.com.hk/hk/account?apply=e-account

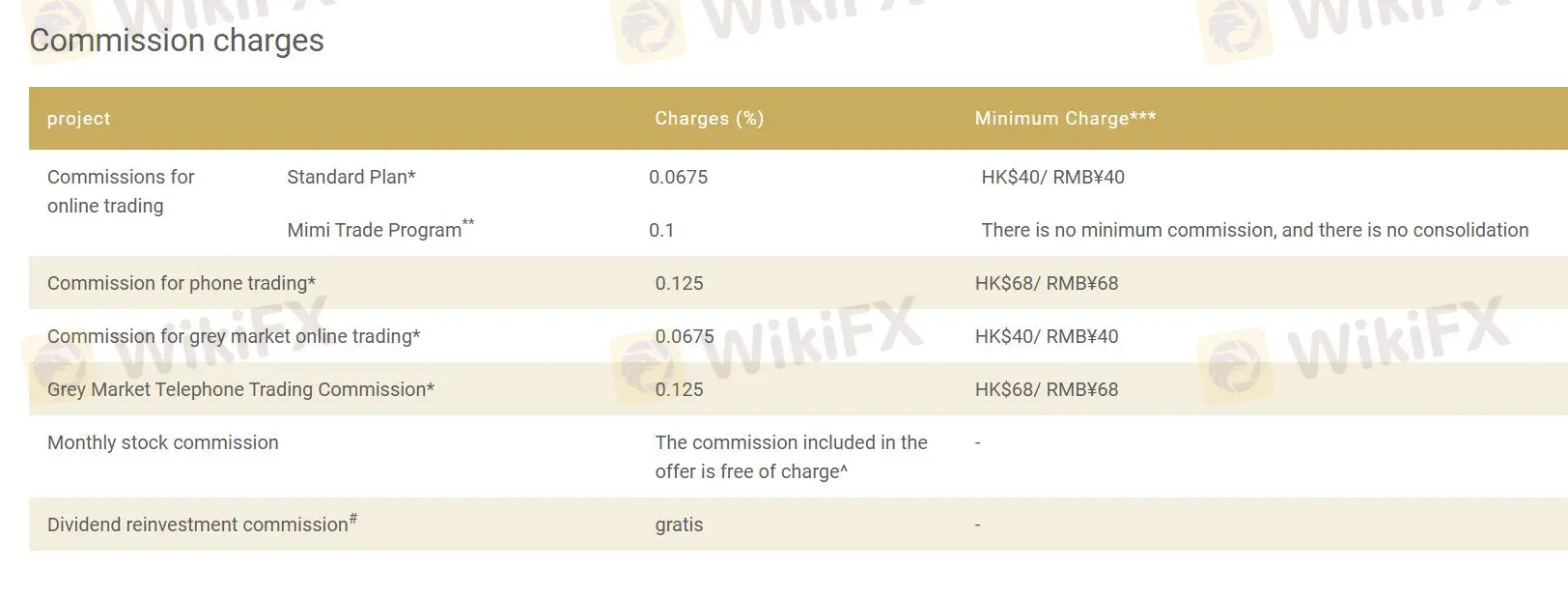

Tarifas de CHIEF

CHIEF admite algunos proyectos sin comisión, y la tasa de comisión del proyecto no supera el 0.2%. La tarifa mínima oscila entre HK $40 y HK $68 y RMB ¥40 a RMB ¥68.

| Proyecto | Cargos (%) | Cargo Mínimo**** |

| Comisiones para operaciones en línea | ||

| Plan Estándar* | 0.0675 | HK$40 / RMB¥40 |

| Programa de Operaciones Mimi** | 0.1 | Sin comisión mínima, sin consolidación |

| Comisión para operaciones telefónicas* | 0.125 | HK$68 / RMB¥68 |

| Comisión para operaciones en línea en el mercado gris* | 0.0675 | HK$40 / RMB¥40 |

| Comisión para operaciones telefónicas en el mercado gris* | 0.125 | HK$68 / RMB¥68 |

| Comisión mensual de acciones | La comisión incluida en la oferta es gratuita* | - |

| Comisión de reinversión de dividendos# | gratis | - |

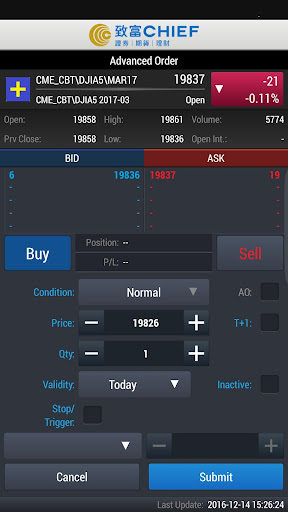

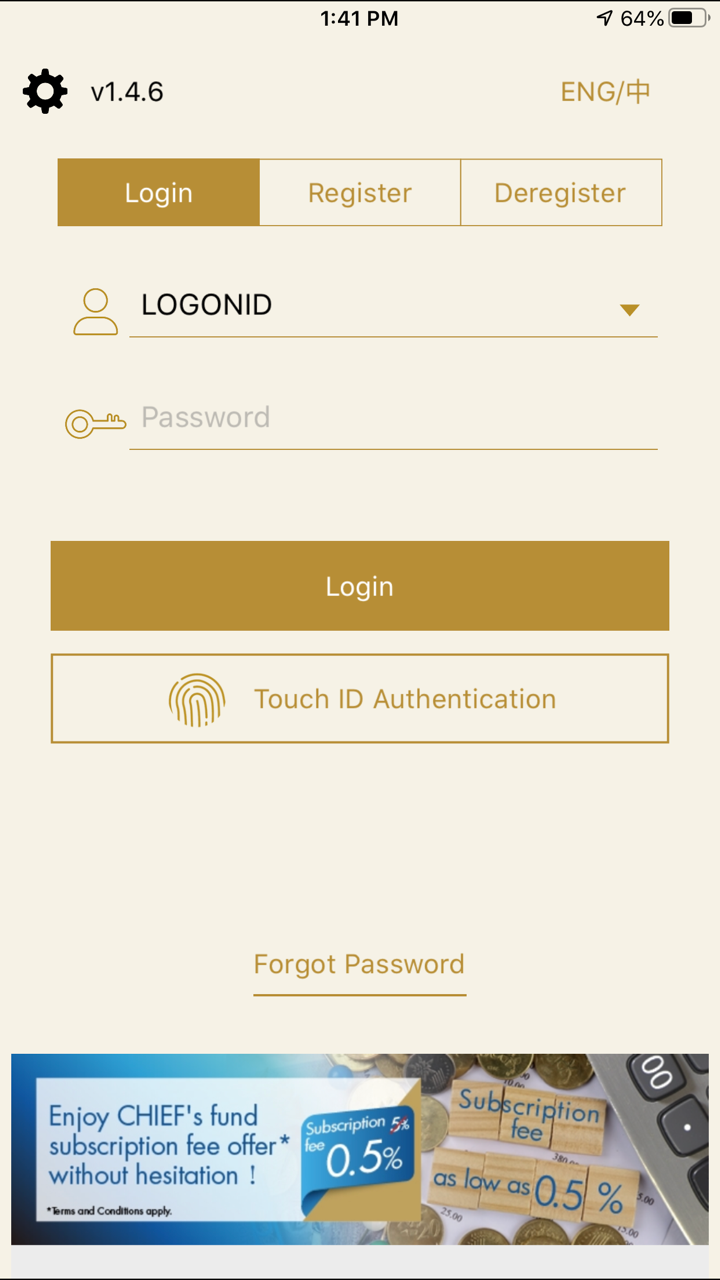

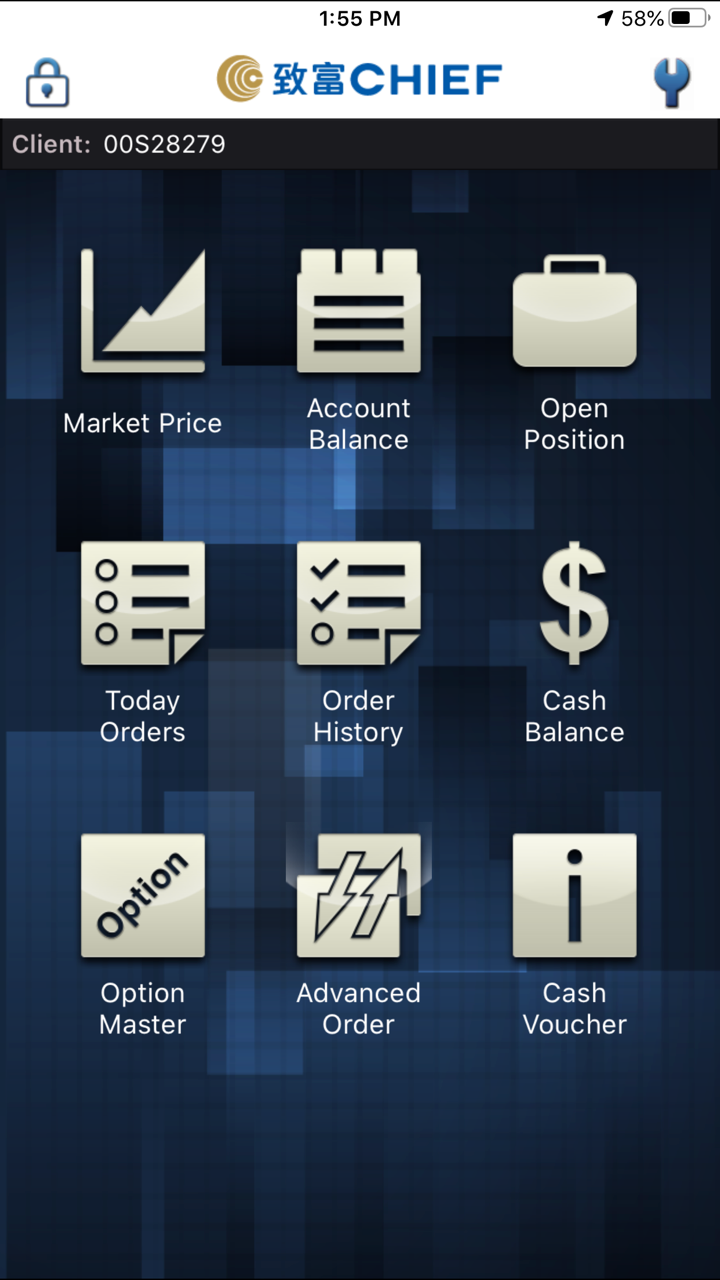

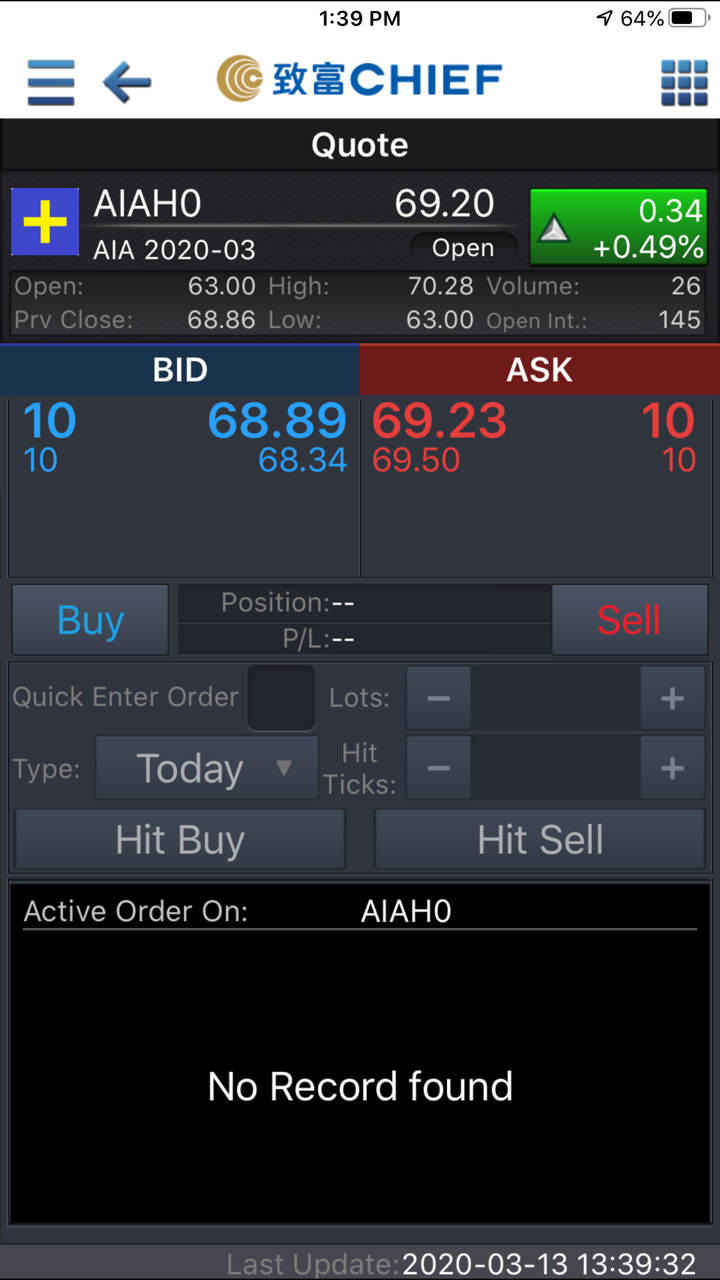

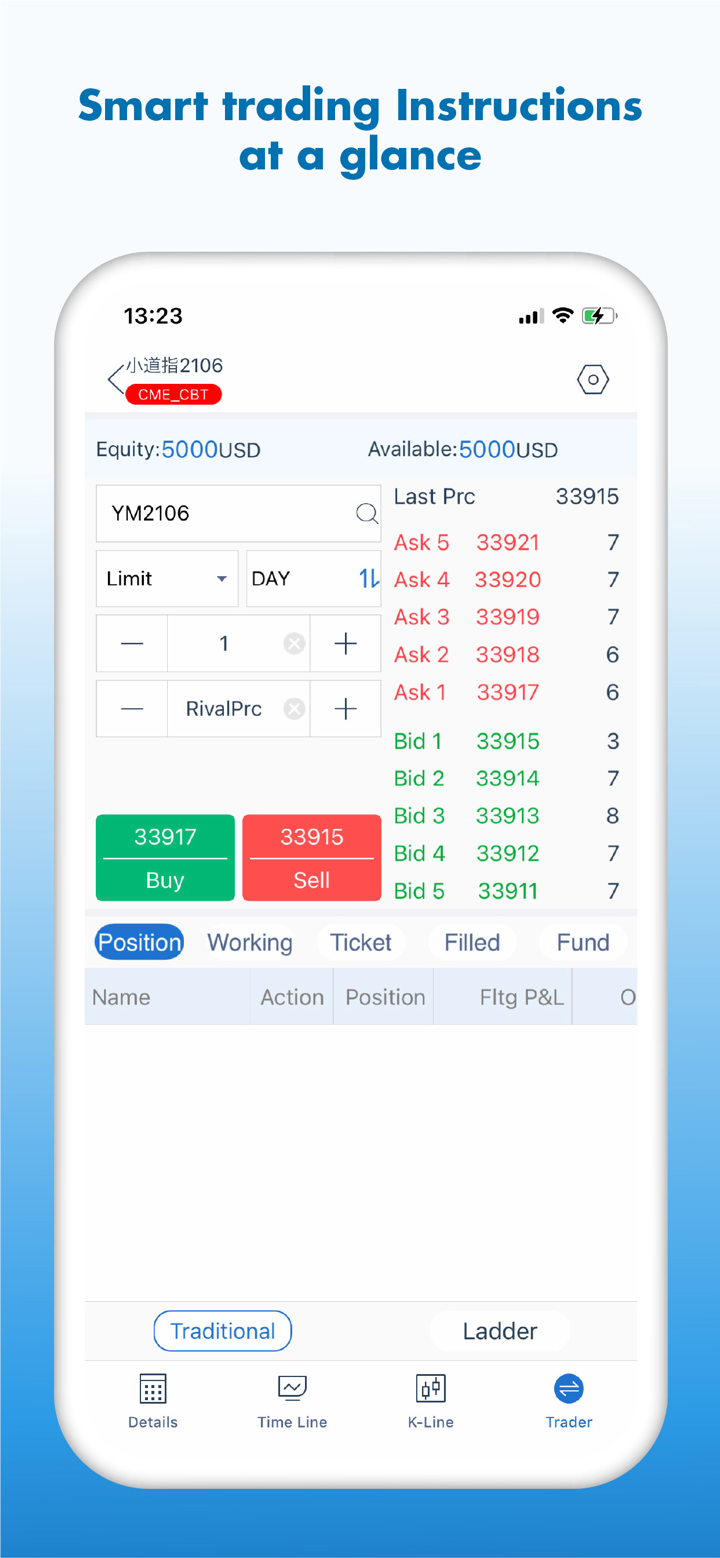

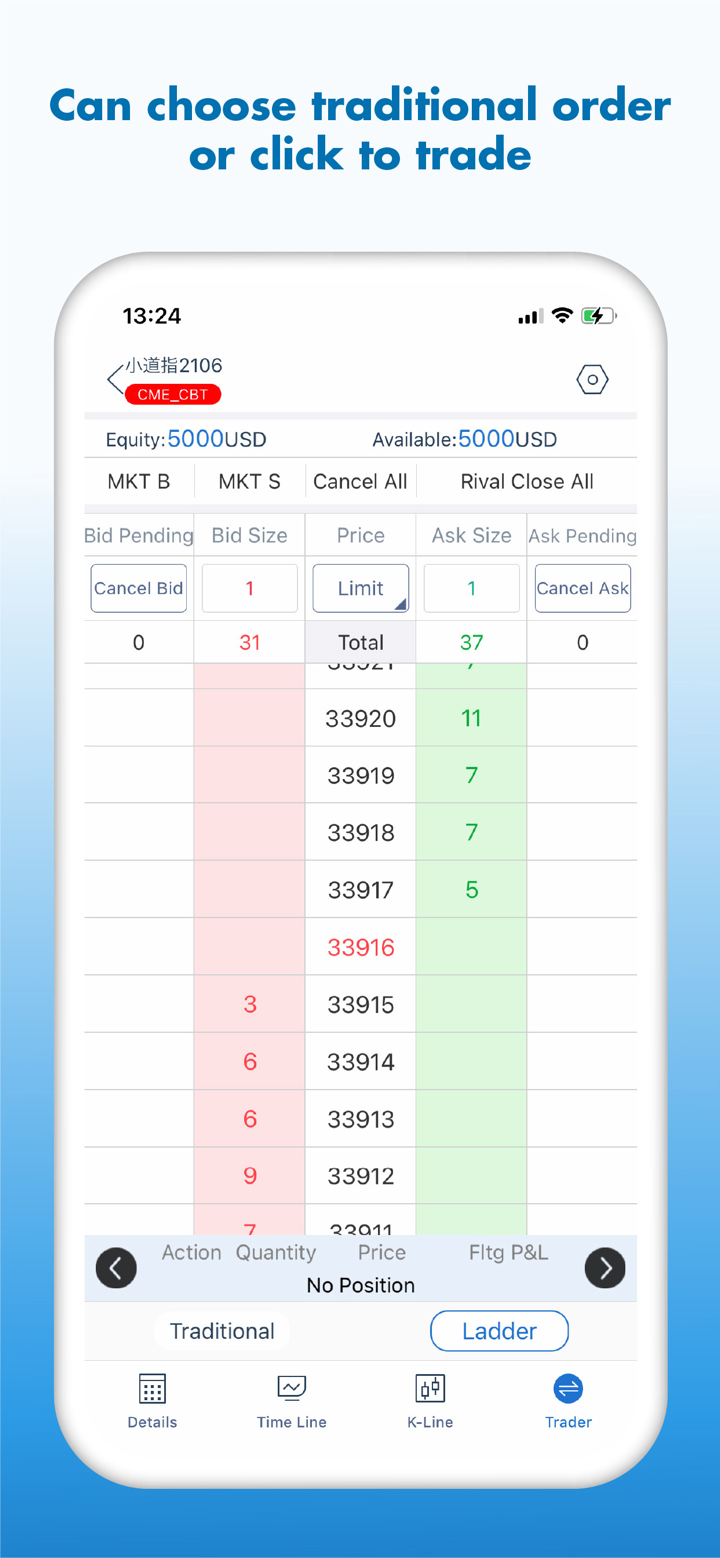

Plataforma de Trading

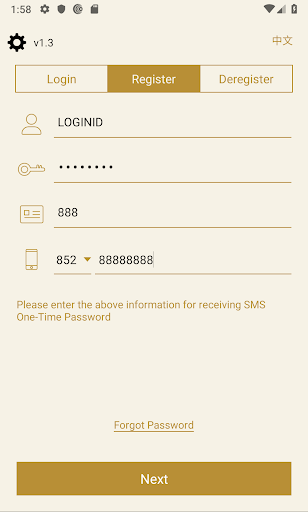

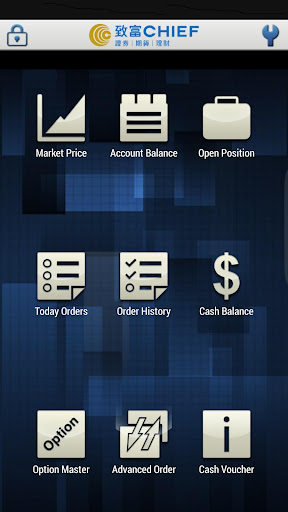

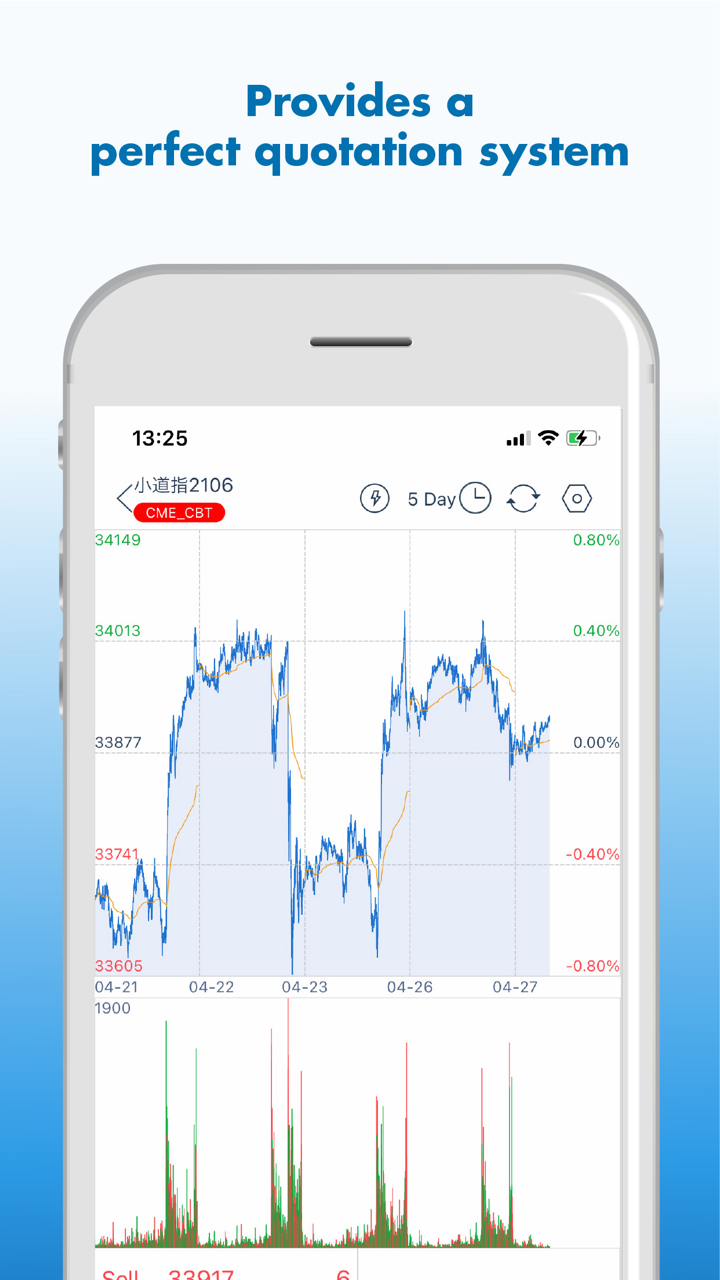

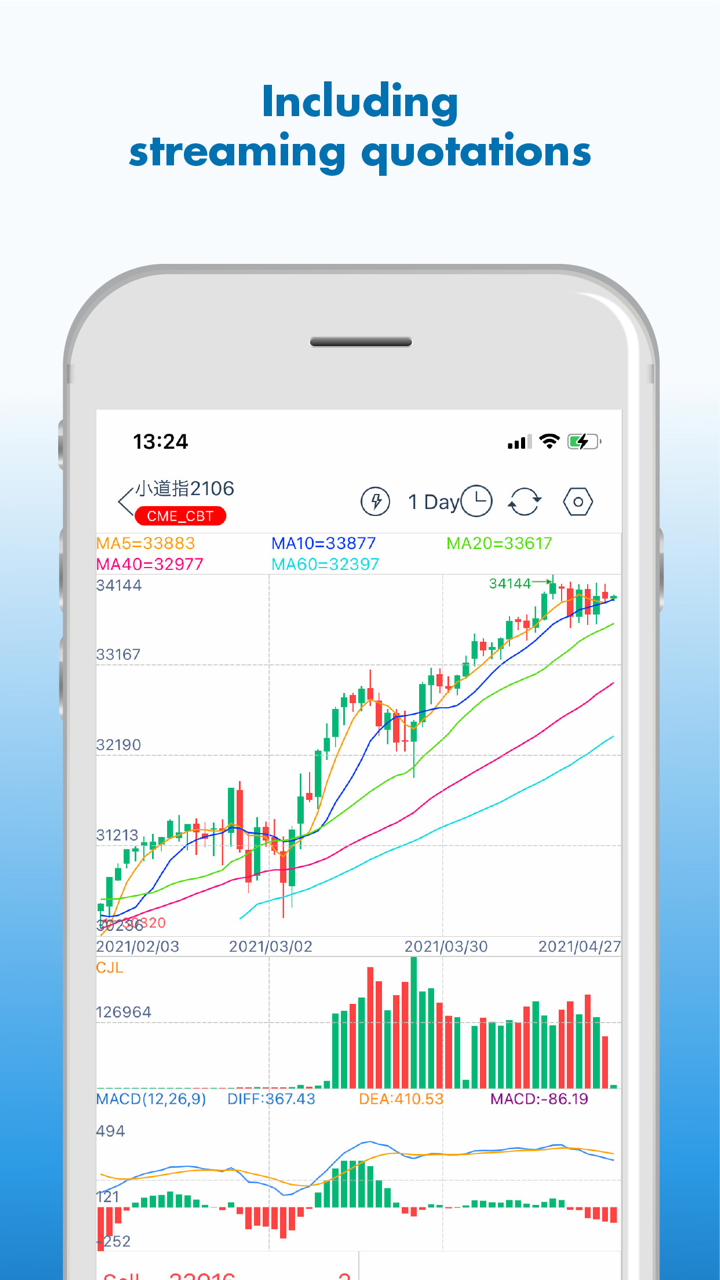

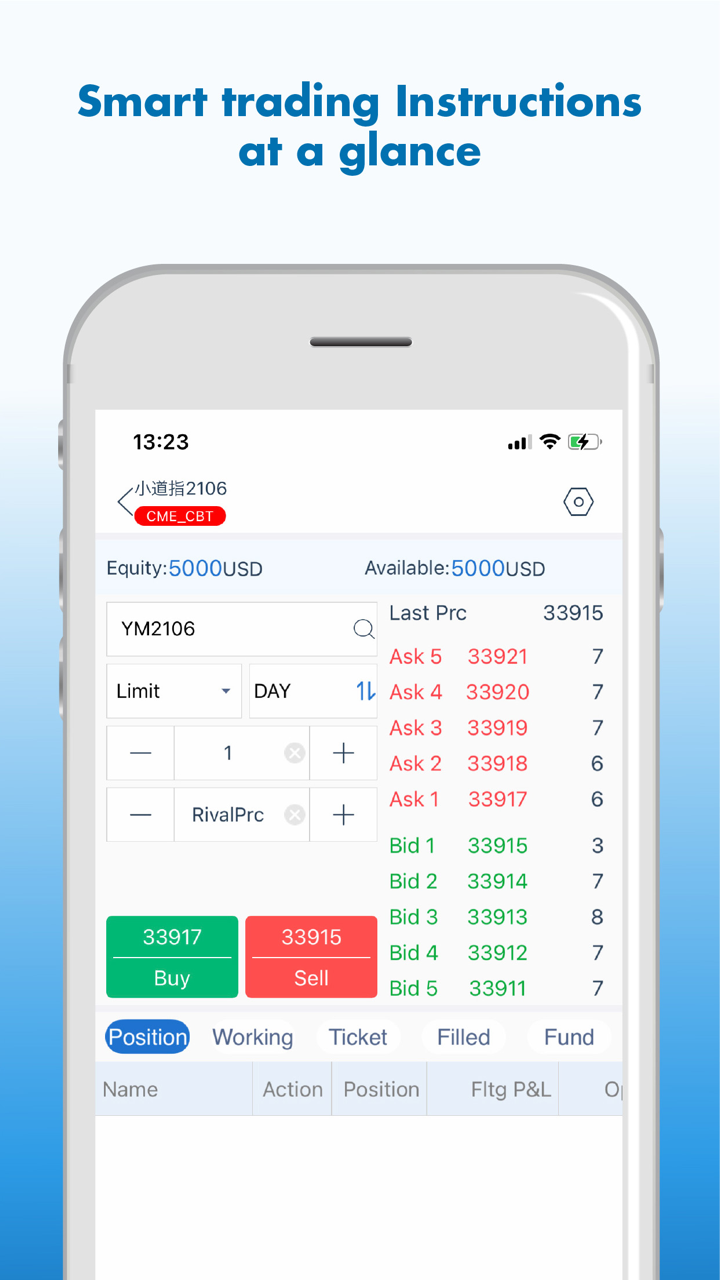

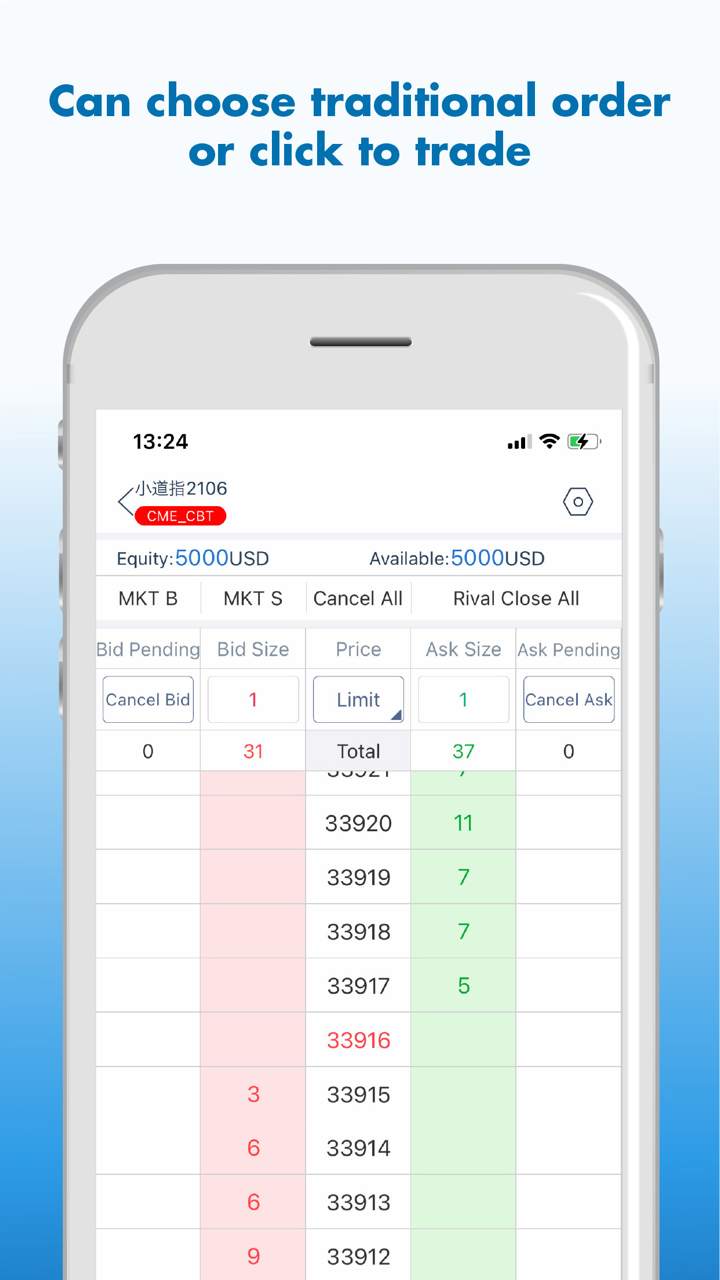

CHIEF ofrece su propia plataforma Chief Deal, que se puede utilizar en dispositivos móviles.

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| Chief Deal | ✔ | Móvil | Todos los traders |

| MT4 | ❌ | ||

| MT5 | ❌ |

Depósito y Retiro

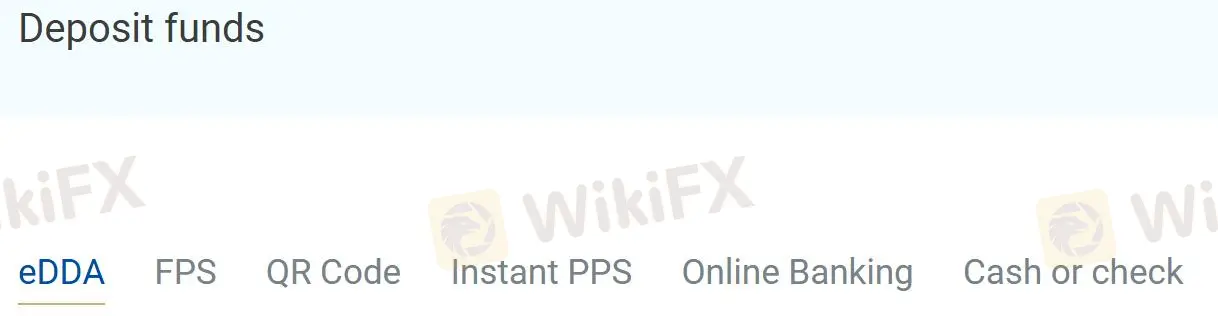

CHIEF ofrece 6 métodos de depósito: eDDA, FPS, Código QR, PPS Instantáneo, Banca en Línea, Efectivo o Cheque.

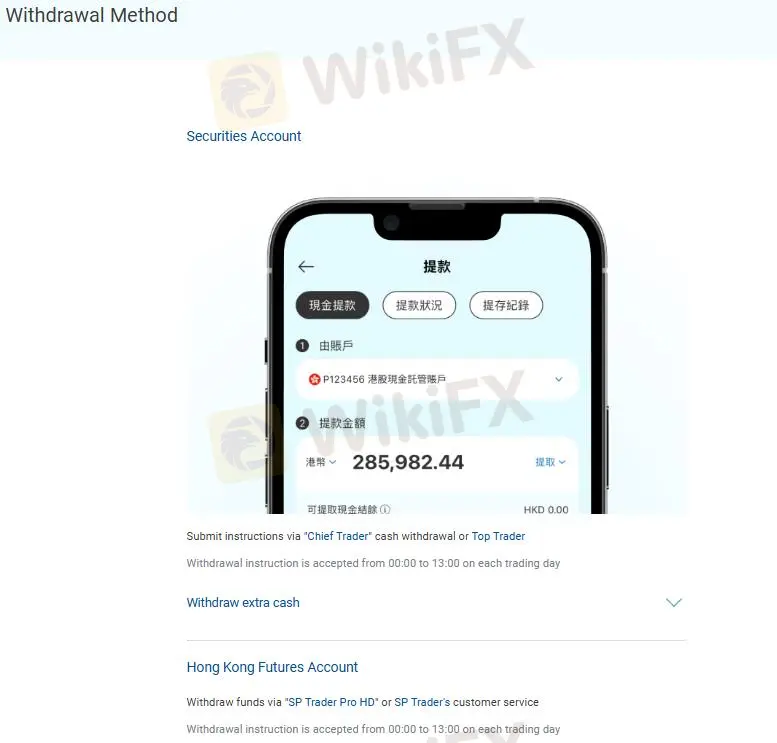

Las retiradas deben enviarse mediante instrucciones a través de "Chief Trader" retiro de efectivo o Top Trader, o retirar fondos a través de "SP Trader Pro HD" o servicio al cliente de SP Trader.