Abstract:The regulatory status of Pemaxx is a major concern for traders. When you search online, you can find the broker claiming to be regulated, but financial watchdog sites show serious warnings and user complaints. This creates a confusing and potentially risky situation for anyone considering an investment. The goal of this analysis is to clear up the confusion. We will examine the available information, explain the facts about the Pemaxx License status, and look at the risks for traders.

Introduction: The Important Question

The regulatory status of Pemaxx is a major concern for traders. When you search online, you can find the broker claiming to be regulated, but financial watchdog sites show serious warnings and user complaints. This creates a confusing and potentially risky situation for anyone considering an investment. The goal of this analysis is to clear up the confusion. We will examine the available information, explain the facts about the Pemaxx License status, and look at the risks for traders.

This article provides a fact-based investigation. You will learn:

· Pemaxx's official regulatory score and verified status.

· A comparison of their claimed license versus what is actually documented.

· A detailed look at real user experiences and complaints.

· A final, evidence-based conclusion about the broker's safety and trustworthiness.

The Official Decision on Pemaxx

When researching any broker, the first step is to check independent, third-party verification tools. According to data from regulatory inquiry platforms, such as WikiFX, Pemaxx is clearly marked as having “No Regulation.” This is the most important information for any potential investor.

This lack of valid regulation shows up in the broker's extremely low safety score of 2.16 out of 10, with a clear warning: “Low score, please stay away!” This score is not random; it is calculated based on the broker's license, business practices, risk management, and software. The low score gets worse because of a notice stating, “The WikiFX Score of this broker is reduced because of too many complaints!”

For clarity, here are the key facts from the broker's profile:

· Regulatory Status: No Valid Regulation

· Warning Level: High potential risk

· License Status: Suspicious Regulatory License

· Key Reason for Low Score: Many users complain about being unable to withdraw funds.

These facts are the foundation of any trader's risk assessment. A “No Regulation” status combined with a “High potential risk” warning should be an immediate red flag. For the most current information and to review the evidence directly, we strongly recommend checking Pemaxx's detailed profile on WikiFX.

Breaking Down the License Claim

A common point of confusion comes from Pemaxx's own marketing materials, where it claims to be a regulated company. This section will break down that claim by comparing it against verified, third-party data to show the significant difference.

What is a Mauritius FSC License?

Pemaxx claims a license from the Financial Services Commission (FSC) of Mauritius. It is important to understand that the FSC is an offshore regulator. While it provides a framework for financial services, offshore regulation is generally considered less strict and offers weaker investor protection compared to top-tier regulators like the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). Brokers often seek offshore licenses because of lower capital requirements and less strict oversight, which can mean higher risk for their clients.

Pemaxx's Claim vs The Evidence

The main issue is the conflict between what Pemaxx claims and what verification tools have found. The broker's summary states it holds FSC License No. C24209694. However, this claim does not stand up when checked.

Let's compare the information side-by-side:

The meaning of this table is serious. A “Suspicious Regulatory License” status means that even if a license was once held, it is no longer considered valid, trustworthy, or active by the verification platform. This is supported by a news report from December 4, 2025, which clearly mentions a “License Revoked” status in its headline about Pemaxx. This means that, for all practical purposes, the broker is operating without the regulatory oversight it claims to have. Relying on a revoked or suspicious license is like driving a car with a suspended license—the original registration doesn't matter if it is no longer valid.

Trader Experiences and Withdrawal Problems

Beyond regulatory data, the most convincing evidence of a broker's true nature often comes from the experiences of its users. In the case of Pemaxx, there is a clear and alarming pattern of serious complaints that directly support the high-risk warnings from regulatory databases.

The Concerning Exposure Reports

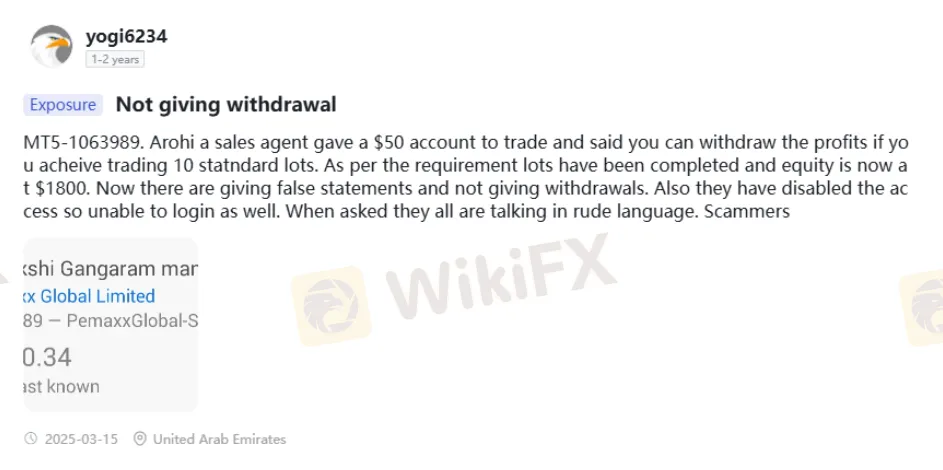

The “Exposure” section on Pemaxx's WikiFX profile shows a disturbing picture. These are not isolated incidents but a repeated theme of traders being unable to access their funds, especially after making a profit. The pattern strongly suggests systematic problems rather than random customer service failures.

Common complaints include:

· Refusal to Process Withdrawals: A user from Hong Kong reported in January 2023 that after making a profit of $7,000, their withdrawal request went unfulfilled for five days. Another user in February 2024 stated they had been facing withdrawal problems for over 10 days with no reply from the broker.

· Account Deletion and Disabling: The same Hong Kong trader reported that after their withdrawal was denied, their MT5 trading account was simply deleted. Another user, in a report from March 15, 2025, detailed how their trading access was disabled after they met the profit and volume requirements for a withdrawal.

· Unfulfilled Promises and Scams: The March 2025 report details a particularly concerning case where a sales agent offered a promotional account. The trader successfully grew the account to $1,800 after meeting the required 10 standard lots trading volume. When they requested the promised withdrawal, the broker allegedly responded with “false statements” and “rude language” before disabling the account. The user directly calls them “Scammers.”

· Direct Accusations of Fraud: The language used by traders is direct and serious. Reports are filled with phrases like “fake broker,” “fraud platform,” and “they have eaten my money.” One user, whose account was allegedly manipulated when they made profits, called it the “Worse broker in history.”

A Note on Positive Reviews

In fairness, Pemaxx's profile also contains a number of positive reviews. These often feature general praise such as “Great Broker,” “best support team,” and “Withdrawal and deposit are very smooth.”

However, these positive comments must be viewed with critical thinking. They stand in stark contrast to the highly specific, detailed, and serious nature of the negative “Exposure” reports. Furthermore, a significant red flag appears in one positive review from January 30, 2025, where a user claims, “I have been working with Pemaxx for the last 5 years.” According to Pemaxx's own company summary, the firm was founded in 2023. This obvious contradiction seriously undermines the credibility of the positive feedback and suggests that not all reviews may be genuine.

These first-hand accounts are invaluable. We encourage all traders to read through the full list of user reviews and 'Exposures' on the Pemaxx page on WikiFX before making any decisions.

Trading Platform and Company Details

To provide a complete overview, it is useful to examine the broker's stated offerings and company structure, while keeping the previously established risks in mind.

Company Footprint

Pemaxx's operating entity is listed as `Pemaxx Global Limited`, with a registered region of `Mauritius`. It is important for traders to understand a key distinction: company registration is not the same as financial regulation. Registering a company in a specific location is a simple administrative process. Being financially regulated, however, means the company is subject to oversight from a financial authority that enforces rules designed to protect client funds, ensure fair dealing, and maintain market integrity. As established, Pemaxx lacks this credible financial regulation.

Trading Conditions and Offerings

On the surface, Pemaxx presents an attractive package of trading features. These include:

· Platform: MetaTrader 5 (MT5)

· Leverage: Up to 1:500

· Instruments: A wide range including Forex, Cryptocurrencies, Commodities, and Indices.

· Account Types: Multiple tiers from a $10 minimum deposit “Titanium” account to a professional “ECN” account.

However, these features must be viewed through the lens of the fundamental safety issue. While high leverage, a low minimum deposit, and the powerful MT5 platform may seem appealing, they are rendered meaningless if the broker is not trustworthy. Without the foundation of a valid Pemaxx Regulation status and the assurance that client funds are safe, these features can become tools that expose traders to even greater and faster losses, especially if withdrawals are systematically blocked.

Conclusion: An Evidence-Based Decision

Our detailed investigation into the Pemaxx Regulation and Pemaxx License status reveals a consistent and high-risk profile that should be of extreme concern to any potential investor. The evidence, drawn from independent verification platforms and direct user testimony, points to a single, clear conclusion.

To summarize the key findings:

· No Verified Regulation: The broker is officially marked with “No Regulation” and operates under a “Suspicious License,” meaning its claims of oversight are not currently valid or trustworthy.

· Significant User Complaints: There is a clear, documented pattern of serious complaints from traders, with the most common and alarming theme being the inability to withdraw funds, especially after achieving profits.

· Contradictory and Misleading Information: The broker's own claims of being regulated are directly contradicted by third-party verification data. Furthermore, inconsistencies within its own positive reviews cast serious doubt on its authenticity.

Based on the overwhelming weight of this evidence, we must conclude that trading with Pemaxx carries a significant and unacceptable risk to capital. The patterns of behavior reported by users are classic signs of an untrustworthy operation. Therefore, we cannot recommend this broker. We strongly advise traders to exercise extreme caution and prioritize their financial safety by seeking out brokers with a long track record and regulation from reputable, top-tier authorities.

Before engaging with any broker, always perform your own research. You can start by verifying their latest regulatory status and reading user reviews on independent platforms, such as WikiFX, to ensure you are making a safe investment choice.