Abstract:When you look for information about a forex broker, you often find a confusing mix of great reviews and serious warnings. This is especially true for Pemaxx, where traders have one main question: Is Pemaxx Safe or Scam? The internet has many different user experiences, making it hard to know what's true.

This article won't give you a simple yes or no answer. Instead, we'll do an objective, fact-based study to help you make a smart choice. We'll look at the available information, focusing on real user reviews, common Pemaxx Complaints, and whether it follows proper regulations. By looking at patterns in both good and bad reports, we want to give you a clear picture of the risks and warning signs with this broker, helping you protect your capital.

A Fact-Based Introduction

When you look for information about a forex broker, you often find a confusing mix of great reviews and serious warnings. This is especially true for Pemaxx, where traders have one main question: Is Pemaxx Safe or Scam? The internet has many different user experiences, making it hard to know what's true.

This article won't give you a simple yes or no answer. Instead, we'll do an objective, fact-based study to help you make a smart choice. We'll look at the available information, focusing on real user reviews, common Pemaxx Complaints, and whether it follows proper regulations. By looking at patterns in both good and bad reports, we want to give you a clear picture of the risks and warning signs with this broker, helping you protect your capital.

The Problems with Pemaxx

A Close Look at Complaints

Any thorough investigation of a broker must start with the most serious accusations. For potential traders, the main worry is whether their capital is safe. The evidence about Pemaxx shows many user complaints and several serious warning signs that need careful attention. This section comes directly from user reports and warnings collected by third-party checking platforms, giving a clear view of the possible risks.

Low Score and Official Warnings

The first thing to consider is a broker's safety score from an independent checker. According to WikiFX, a global broker research platform, Pemaxx has an extremely low score of 2.16 out of 10. This score isn't random; the platform clearly states the score is low “because of too many complaints.”

Along with this low score are several direct warnings given to investors:

· High potential risk

· Suspicious Regulatory License

· Warning: Low score, please stay away!

These warnings are the strongest form of alert a checking service can give. They suggest that the broker's operations have raised serious concerns about reliability and investor safety. The “Suspicious Regulatory License” tag, in particular, questions whether the broker's claimed oversight is valid or good enough, which is a critical part of trust.

A Pattern of Problem Reports

Beyond the summary warnings, a detailed look at individual user complaints, often called “Exposure” reports, shows repeating themes. These first-hand accounts give specific details about the negative experiences traders have reportedly faced.

The most common and serious complaints form a worrying pattern:

· Can't Withdraw Money: This is the most frequent and alarming accusation. Multiple users report being unable to withdraw their profits or even their original money. One user from Hong Kong detailed making a $7,000 profit, only to have their withdrawal request ignored for over five days before their entire trading account was deleted. Another report from February 2024 describes a user's funds being blocked for over 10 days with no response from support.

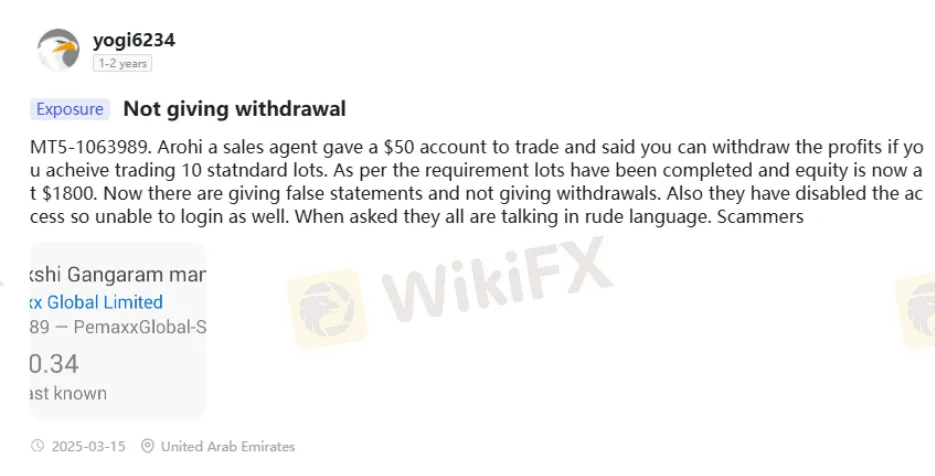

· Account Blocking and Shutting Down: A consistent theme is the sudden loss of account access, particularly after a withdrawal is requested. A user from the UAE reported that after meeting a 10-lot trading requirement to withdraw a profit of $1,800, their MT5 account access was disabled. This tactic effectively locks the user out from their funds and trading history.

· Broken Promises and Agreements: The same complaint contained promises made by sales agents that aren't kept. The previously mentioned user who made an $1,800 profit was initially told by an agent that they could withdraw profits after trading 10 standard lots. When this condition was met, the withdrawal was denied, and the agreement was broken.

· Poor or Rude Customer Service: When users confront the support team about these issues, the response is often unhelpful or downright hostile. The trader whose account was disabled after requesting an $1,800 withdrawal noted that when they questioned the situation, the staff spoke to them in a “rude language.”

Summary of Negative Feedback

To provide a clear, easy-to-read overview of these serious accusations, the key complaints are summarized below. These examples are taken directly from user-submitted reports.

These reports represent serious accusations of fundamental failures in a broker's duties. We advise every potential trader to double-check this information and view the latest user reports and the broker's current status before making any decisions. You can view the latest user complaints and the full regulatory details for Pemaxx on its WikiFX page here.

The Other Side of the Story

Positive Reviews and Benefits

To keep an objective perspective, it's important to acknowledge that not all feedback about Pemaxx is negative. A review of user-submitted comments reveals a number of positive experiences. While these should be weighed carefully against the severe complaints detailed earlier, they represent the other side of the story and help explain what might attract traders to the platform in the first place.

A Summary of Positive Reviews

Several users have praised Pemaxx for its service and platform. The positive feedback generally centers on a few key areas:

· Good Customer Support: Multiple reviews describe the support team in glowing terms, with phrases like “Excellent and always helpful” and “It has the best support team.”

· Smooth Transactions: In direct contrast to the exposure reports, some users claim that “Withdrawal and deposit are very smooth” and that the broker offers the “Best paying and payout.”

· User-Friendly for Beginners: One user review from late 2024 notes that the platform is “Perfect for beginners—very user-friendly platform” and mentions receiving free training.

· Profitability: At least one user has shared a significant success story, claiming to have turned a $2,000 deposit into over $7,000.

It's worth noting that a significant portion of these positive reviews appear to come from specific regions, such as India and the UAE. They also tend to be more general in nature (“Great Broker,” “Good service”) compared to the highly specific and detailed negative reports concerning fund withdrawals.

Pemaxx's Advertised Features

Beyond user reviews, the features that Pemaxx advertises are a key part of its appeal. The broker presents itself as a modern, full-featured platform, which can be attractive for both new and experienced traders. Its stated offerings include:

· Trading Platform: A full license for MetaTrader 5 (MT5), a popular and powerful platform favored by many traders.

· Tradable Instruments: A wide range of markets, including Forex, Commodities, Cryptocurrencies, Indices, and Stocks.

· Account Variety: Seven different account tiers, from a “Titanium” account with a $10 minimum deposit to a professional “ECN” account, catering to various levels of traders.

· Leverage: High leverage of up to 1:500 is available, which can attract traders looking to maximize their market exposure.

· Regulation: The company states it is regulated by the Financial Services Commission (FSC) of Mauritius.

These features, combined with the positive reviews, create an attractive package. However, the critical task for any careful trader is to weigh these advertised benefits against the documented risks.

Understanding the Contradictions

Making Sense of Opposite Reviews

How can a single broker receive reviews claiming it offers the “best payout” while others claim their accounts were deleted after requesting a withdrawal? This polarization is common in the world of online brokers, and learning how to interpret it is a crucial skill for any trader. This section goes beyond listing pros and cons to provide an expert framework for evaluating a broker's true reputation.

Specific vs General Feedback

The first principle in evaluating user feedback is to understand the difference in importance between specific and general claims. In broker evaluation, specific, detailed complaints carry significantly more weight than general praise.

A complaint that details a specific event—“My withdrawal request for $1,800 was denied after I completed the 10-lot trading requirement, and then my account was disabled”—is a factual, verifiable claim of a critical operational failure. It contains amounts, conditions, and consequences. In contrast, a review that simply states “good service” or “great broker” is subjective, lacks concrete evidence, and is easy to fake.

Consider the relative importance:

· High Importance: A detailed, documented account of a failed withdrawal or a blocked account.

· Low Importance: A brief, positive comment without any specific supporting details.

When the high-importance evidence points consistently to failures in fund safety, it should be a primary focus of your research.

The Importance of Fund Safety

The main function of a broker is to act as a guardian for your funds and execute your trades. Above all else, a broker must provide a secure environment where you can deposit, trade, and—most importantly—withdraw your capital and profits.

Claims of withdrawal failures, account blocking, and fund deletion strike at the very heart of a broker's trustworthiness. While issues like occasional platform freezes or wide spreads are inconvenient, the inability to access your own capital is a catastrophic failure. Therefore, official warnings from a third-party checker like WikiFX (“High potential risk”) and multiple, specific user complaints about fund withdrawals should be considered major red flags that often outweigh any amount of positive, general reviews or advertised platform features.

Understanding Offshore Regulation

Pemaxx states on its website that it is regulated by the Financial Services Commission (FSC) of Mauritius. While this may sound reassuring, it's critical to understand what this means for a trader's safety. The Mauritius FSC is considered an offshore regulator.

Offshore regulators typically operate with less strict oversight and offer weaker investor protection mechanisms compared to top-tier regulatory bodies like the FCA in the UK, ASIC in Australia, or the CFTC in the United States. While holding an offshore license is better than having no regulation at all, it doesn't provide the same level of security, separated fund requirements, or compensation schemes that traders in top-tier jurisdictions enjoy. This is why platforms, such as WikiFX, may still flag a license from an offshore jurisdiction as “Suspicious,” as it doesn't meet the highest standards of investor protection.

Understanding a broker's regulatory environment is essential. To protect your capital, always verify a broker's license and regulatory status. You can check the verified (or unverified) status of Pemaxx's license on WikiFX.

Final Decision: Checking Trustworthiness

Summarizing the Evidence

After a thorough analysis of the available data, a clear picture of high risk emerges. On one hand, Pemaxx advertises a range of attractive features like MT5, high leverage, and multiple account types. It has also received some positive, though general, user reviews praising its service and platform.

However, this positive side is heavily overshadowed by a collection of significant red flags:

· A critically low safety score of 2.16/10 from WikiFX.

· Multiple, specific, and severe user complaints detailing failed withdrawals, blocked accounts, and broken agreements.

· Official warnings about “high potential risk” and a “suspicious” regulatory license.

· Its status as an entity regulated in an offshore jurisdiction, which provides a lower level of investor protection.

Making Fund Safety the Priority

When faced with such a volume of evidence pointing to fundamental issues with fund safety, the conclusion must be one of extreme caution. The most essential function of any financial broker is the safeguarding and return of client funds. The numerous claims that Pemaxx fails in this primary duty present an exceptionally high risk.

The potential benefits advertised by such a broker, such as low spreads or high leverage, become meaningless if a trader cannot reliably withdraw their initial capital and profits. The documented risk of losing your entire investment appears to far outweigh any potential trading advantages.

The Most Important Research Step

The insights gained from this analysis of Pemaxx lead to a universal piece of advice for all traders. Before depositing funds with any broker, performing independent verification through a trusted third-party platform is the single most important step you can take to protect yourself. Don't rely solely on a broker's own website or the promises of a sales agent.

Protect yourself from potential scams and high-risk brokers. Always use a trusted verification platform to check a broker's regulatory status, user reviews, and safety score before you invest. We strongly advise checking the complete and up-to-date profile of Pemaxx on WikiFX.