简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Eight Forex Websites, One Template: Inside a Mass-Produced Scam Network

Abstract:Eight unlicensed forex websites share identical layouts, wording, and short-term domains. WikiFX analysis reveals a mass-produced scam pattern traders should avoid.

Over the past year, a cluster of newly launched online trading platforms has appeared across different regions, each presenting itself as an independent brokerage brand. At first glance, these websites look polished and professional, featuring live market tickers, modern layouts, and familiar slogans promising access to global financial markets.

A closer technical and structural review, however, reveals a far more concerning picture.

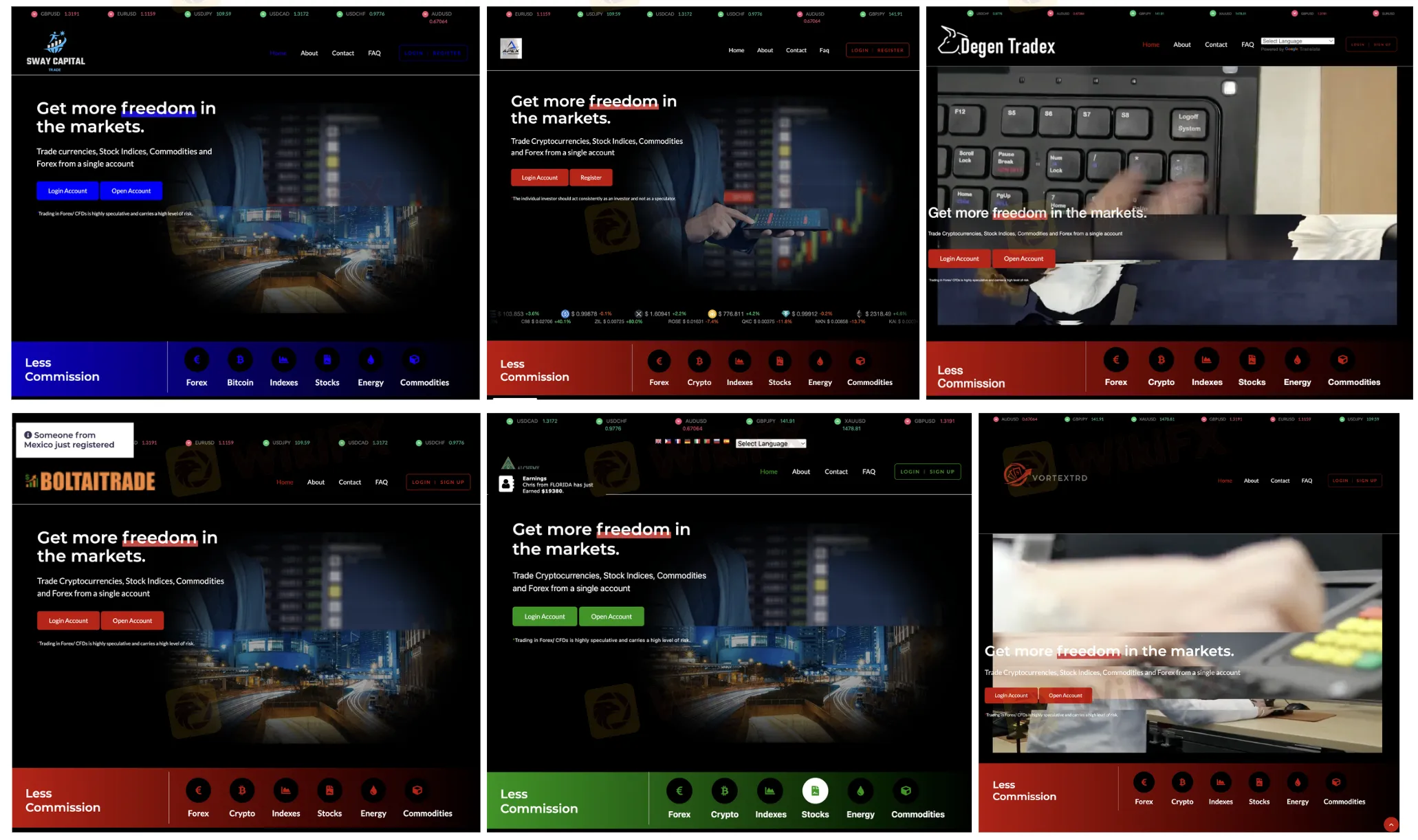

An analysis of eight brokers — Degen Tradex, Sway Capital Trade, Hartman Grey Capital, Bolt AI Trades, Alchemy X Markets, Vortextrd, Global Stocks Market, and Apex FX Trading — shows that these platforms are not merely similar in style, but nearly identical in construction. The evidence strongly suggests coordinated deployment rather than separate, independently operated businesses.

All eight platforms have since been flagged by the UK regulator for operating without authorization, adding regulatory weight to what technical analysis already indicates.

Eight Brokers Flagged, One Design Blueprint

Side-by-side comparison of the eight websites reveals a shared design blueprint that goes far beyond coincidence:

- Identical homepage layouts, including full-width hero banners and centered call-to-action buttons

- The same rotating forex price ticker placed at the top of each page

- Logos positioned in the same screen coordinates, differing only in brand name

- Matching slogans such as “Get more freedom in the markets”

- The same asset categories displayed in the same order, presented over gradient color blocks at the bottom of the page

Even minor interface details — icon styles, spacing, font weights, and navigation structure — align precisely across all eight sites.

This level of uniformity strongly suggests a template-based rollout, where brand names are swapped but the underlying framework remains unchanged.

Regulatory Warnings Across All Eight Platforms

Each of the eight brokers has been formally warned by the UK financial regulator for offering investment services without authorization. While regulatory notices are often issued on a case-by-case basis, the fact that all eight platforms share the same structural footprint raises broader concerns.

Rather than isolated compliance failures, the pattern points to a replicable setup designed for rapid launch, enabling multiple sites to go live in parallel before regulatory intervention occurs.

The Telltale Technical Signs

Beyond visual similarity, technical checks reveal further red flags.

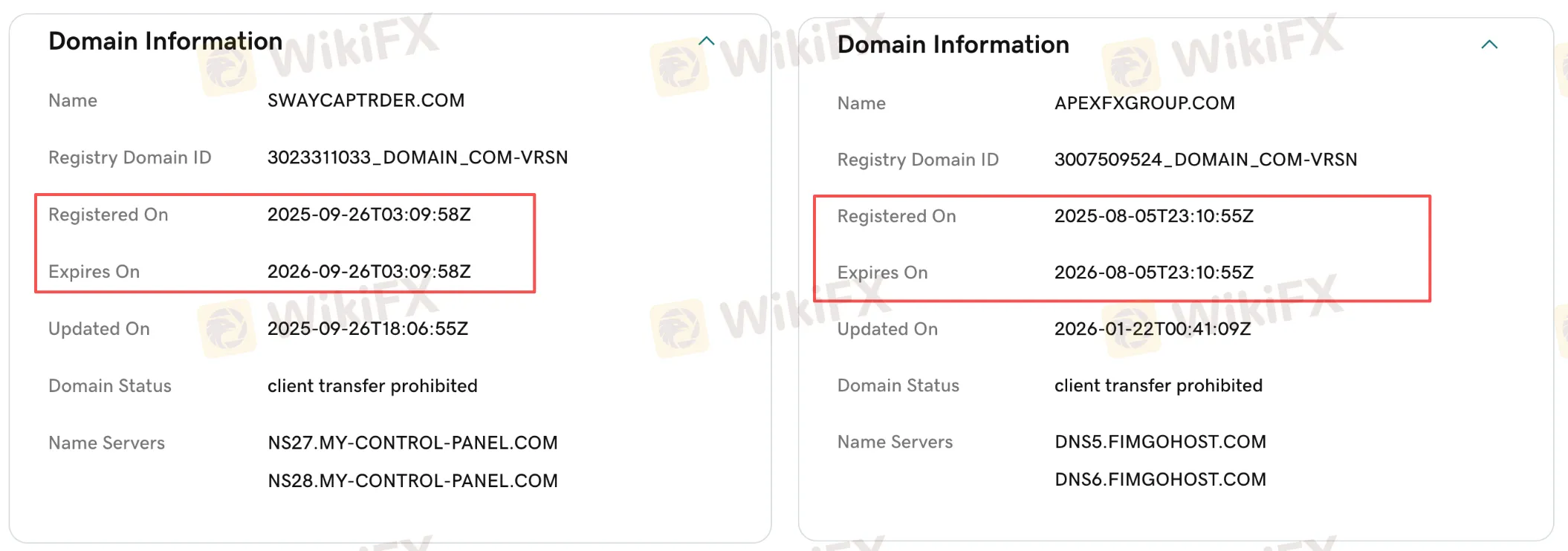

Short Domain Lifespans

Domain registration records show that all eight websites were registered less than one year ago, with most domains set to expire after just twelve months. This short operational window is inconsistent with legitimate brokerage operations, which typically maintain long-term digital infrastructure.

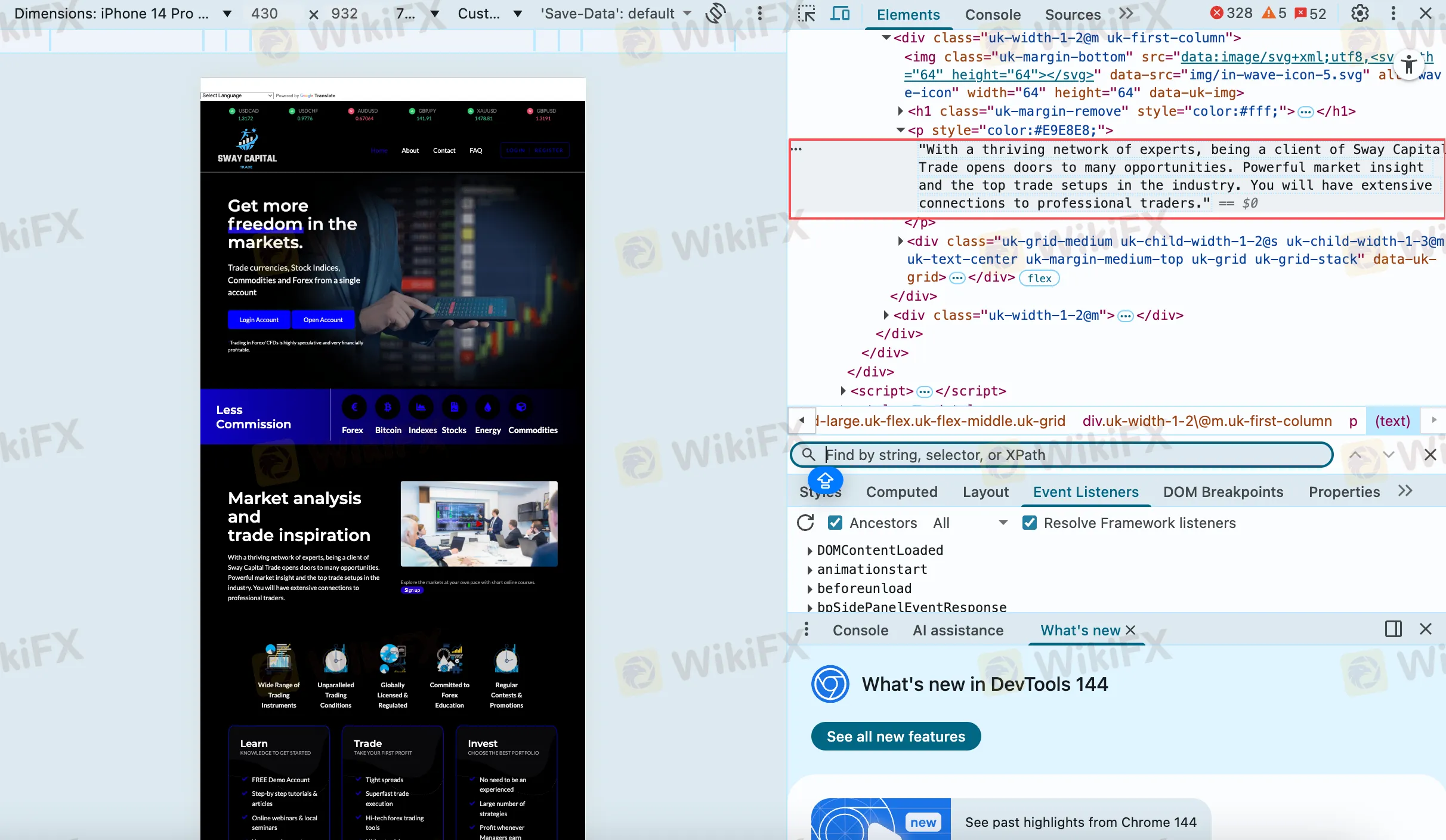

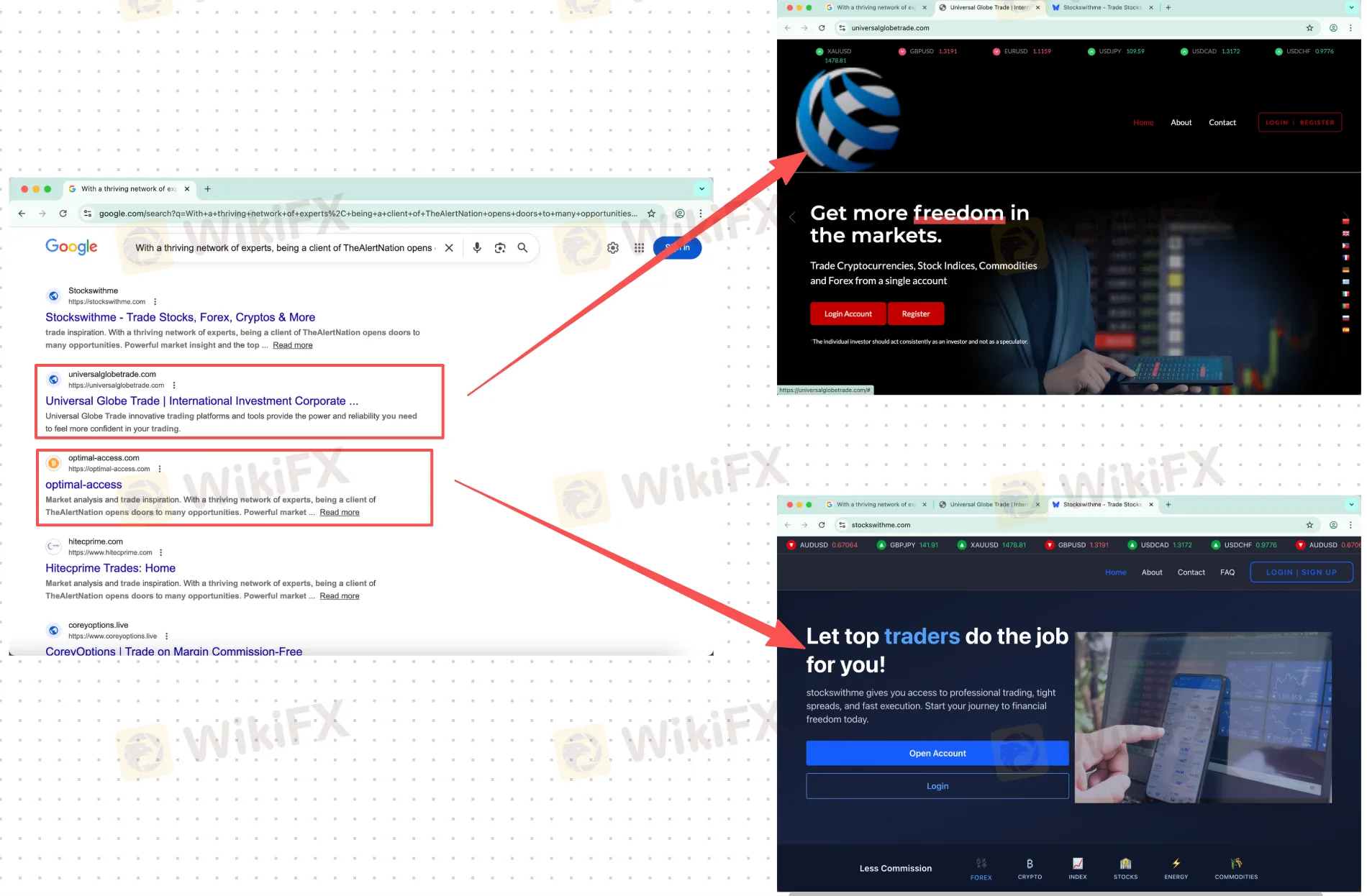

Identical Marketing Language at Scale

One of the most striking findings comes from front-end text analysis. A key promotional paragraph found on Sway Capital Trade reads:

“With a thriving network of experts, being a client of Sway Capital Trade opens doors to many opportunities. Powerful market insight and the top trade setups in the industry. You will have extensive connections to professional traders.”

Using browser-based reverse search tools, this exact wording appears on dozens — and in some cases hundreds — of unrelated websites, differing only by brand name. Many of those sites follow the same visual and structural template.

This level of duplication strongly indicates mass production, not individualized branding or legitimate business development.

Why This Pattern Matters

Individually, a new domain, a generic website template, or a regulatory warning might not appear unusual. Taken together, however, these elements form a clear operational pattern:

- Multiple broker brands launched within a short timeframe

- Near-identical website design, structure, and messaging

- Short-lived domain registrations

- Recycled marketing language reused at scale

- Regulatory warnings issued across the entire group

This combination points to a networked operation rather than standalone brokerage firms.

A Repeated Risk Model Already Documented

Patterns like this are not new. WikiFX has previously published multiple risk alerts documenting similar schemes, where operators deploy batches of cloned trading websites under different brand names, rotate domains, and rely on rapid user acquisition before complaints and regulatory action accumulate.

In many documented cases, platforms disappear or rebrand shortly after warnings are issued, while new websites using the same framework quietly replace them.

Rather than being detected through a single red flag, these operations are often exposed through pattern recognition — comparing structure, timelines, licensing status, and user exposure across platforms.

Read more: https://www.wikifx.com/en/newsdetail/202601096754204565.html

The Role of Independent Risk Mapping

Platforms such as WikiFX aggregate regulatory notices, licensing records, technical data, and user-submitted exposure reports in one place. This makes it possible to identify networks of cloned or high-risk brokers early — before engagement, deposits, or losses occur.

When unfamiliar platforms appear professional but share technical fingerprints with already-flagged entities, independent cross-checking becomes a critical step in understanding actual risk.

Final Observations

The eight brokers examined in this analysis do not merely raise individual compliance concerns. Together, they illustrate how template-driven website networks can be used to rapidly introduce unlicensed trading platforms into the market under different brand identities.

As regulators continue issuing warnings, the underlying lesson remains consistent: surface-level professionalism is no longer a reliable indicator of legitimacy. Structural patterns, domain behavior, and regulatory history provide far clearer signals than design alone.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Currency Calculator