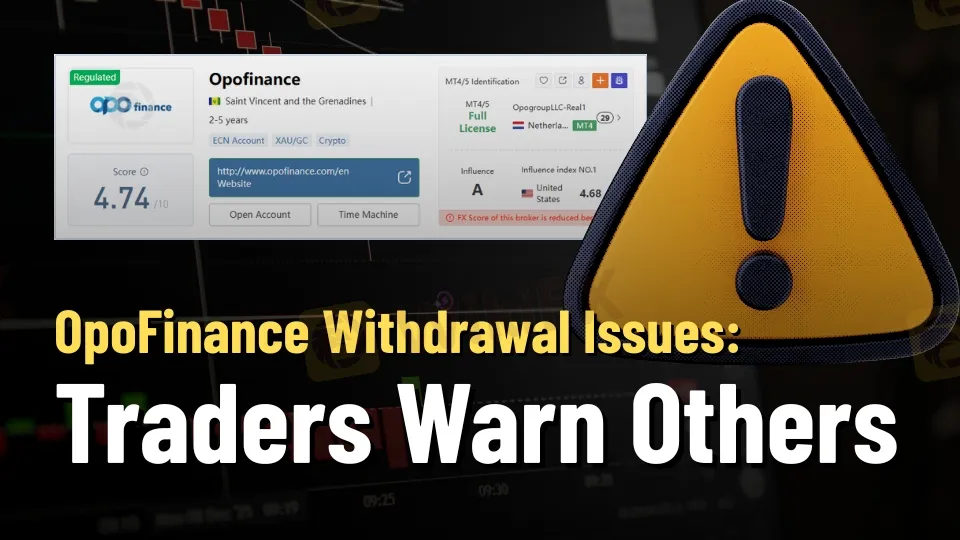

Abstract:OpoFinance scams and exposure reports reveal rising of withdrawal issues. Traders say they can’t withdraw funds—read user stories and warning signs.

OpoFinance has become a name of concern among traders in recent years, especially in 2025 and 2026. The broker initially appeared to offer competitive services, but mounting complaints now reveal a troubling pattern of blocked withdrawals, deleted accounts, and manipulative practices. OpoFinance withdrawal issues are rising. Traders say they can‘t withdraw funds. See user stories and warning signs. These experiences raise serious questions about the broker’s transparency, reliability, and overall safety for retail traders.

Who Is OpoFinance?

OpoFinance is a global trading platform offering forex and CFD services across a wide range of markets. It advertises access to hundreds of instruments, including currency pairs, metals, commodities, indices, stocks, and cryptocurrencies, via popular platforms such as MT4, MT5, cTrader, and its own proprietary terminal. On paper, this combination of choice and technology makes the broker look modern and competitive.

The broker also promotes multiple account types—such as Standard, ECN, and other specialized accounts—along with high leverage and relatively low minimum deposits. This setup is designed to attract both beginners and experienced traders who want flexibility, social trading features, and the ability to start with a small capital base. However, these attractive front‑end features lose their appeal when traders cannot reliably withdraw funds or keep their accounts active.

Beneath the marketing, traders describe a very different reality. Reports of blocked withdrawals, sudden account closures, and unhelpful support suggest that OpoFinances operational practices may not align with its public image. The absence of clear, effective accountability mechanisms only intensifies concerns, especially when users feel their funds are being held hostage.

Background and Structural Concerns

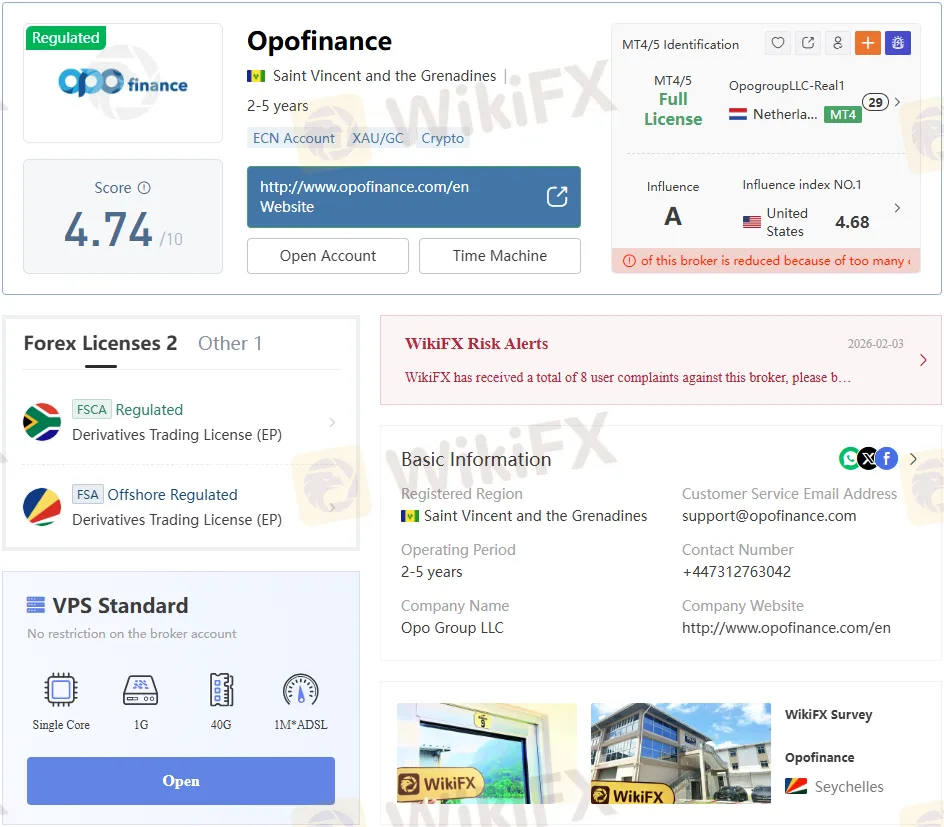

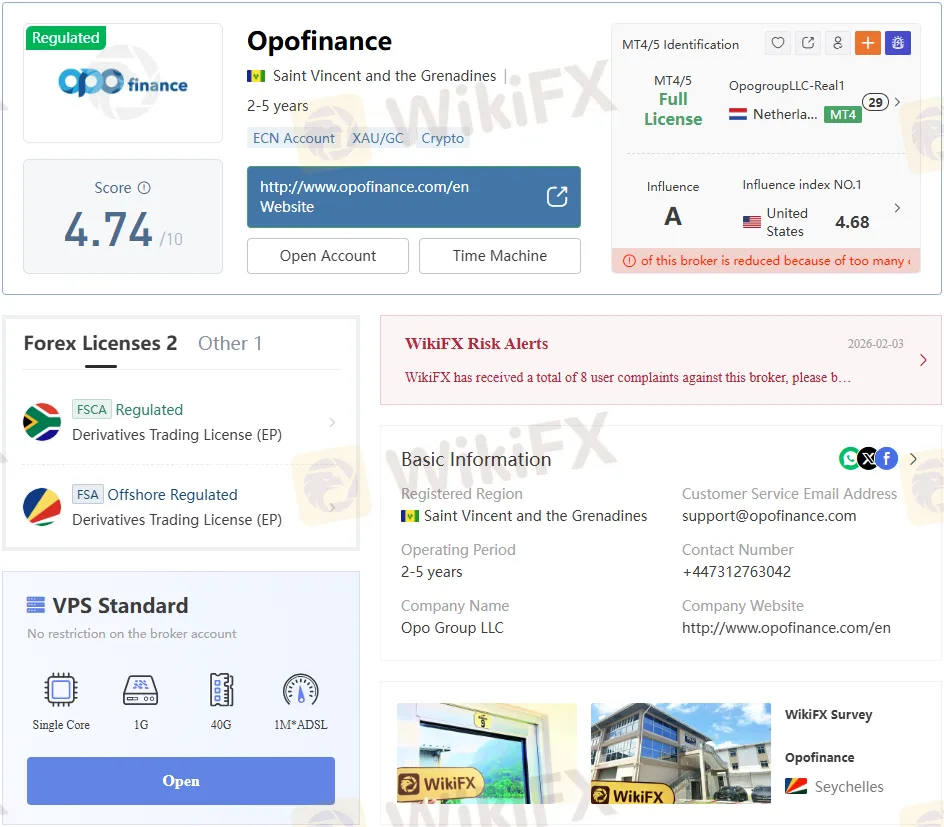

According to its own profile and public information, OpoFinance positions itself as a global broker but exhibits characteristics typical of high‑risk offshore platforms. Traders repeatedly point to unclear or weak regulatory backing and difficulty identifying a transparent, verifiable office presence. When a brokers regulatory status is unclear or tied to jurisdictions with less stringent oversight, clients have fewer practical avenues for dispute resolution.

Key structural concerns include:

- Limited or unclear regulatory protection for retail clients.

- Offshore‑style operations, where local authorities may offer minimal recourse.

- Marketing that stresses features and bonuses but says little about conflict‑of‑interest management.

- A support structure that appears quick to onboard deposits but slow or obstructive when handling withdrawals or complaints.

These underlying issues matter because they set the stage for the problems traders report. When a broker has broad control over accounts and little effective oversight, the risk of abuse—such as freezing withdrawals or deleting accounts—rises sharply.

The Red Flags Traders Are Reporting

As complaints accumulate, a consistent set of red flags emerges around OpoFinance. Traders are not describing isolated technical glitches; they are highlighting patterns that closely resemble common scam indicators in the forex and CFD industry.

Reported warning signs include:

- Blocked withdrawals even after traders meet stated trading conditions.

- Deleted or blocked accounts following periods of profitable trading.

- Manipulated or unclear reports showing equity erosion without transparent justification.

- Unexplained margin calls that appear to benefit the broker at the traders expense.

- Customer support that responds with vague excuses, such as “account under review,” rather than clear answers.

- Lack of a transparent office presence or a straightforward complaint channel.

When such behaviors recur across multiple cases, it suggests systemic issues rather than isolated errors. For traders evaluating where to place their capital, these patterns make OpoFinance a high‑risk choice.

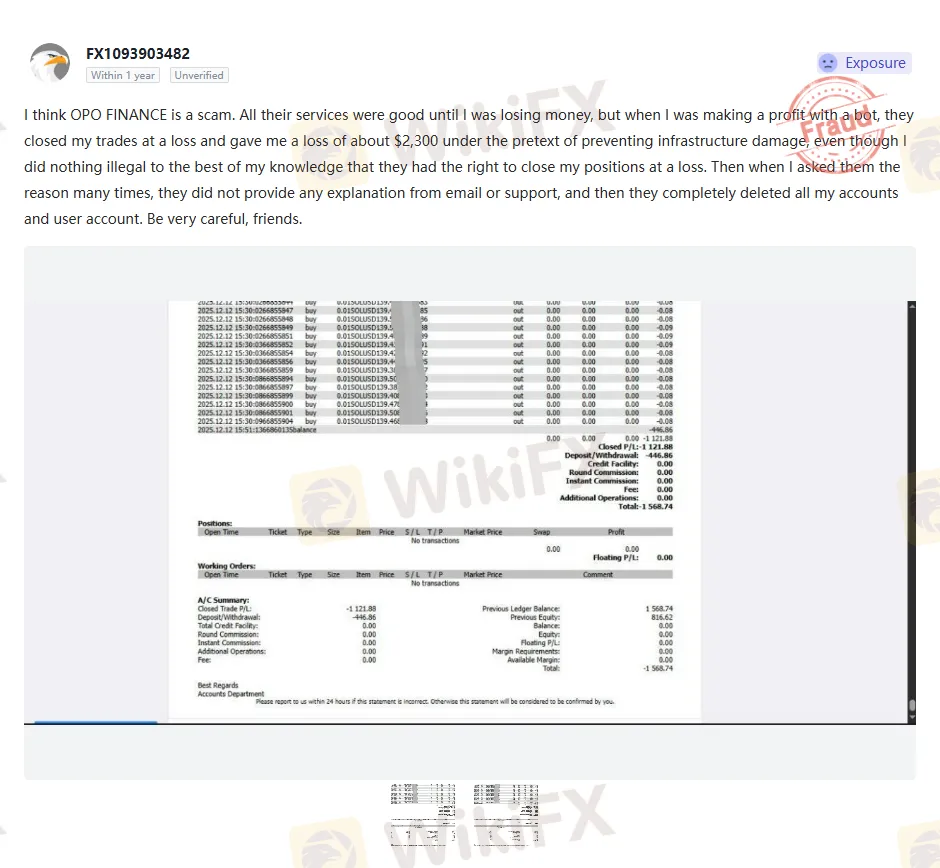

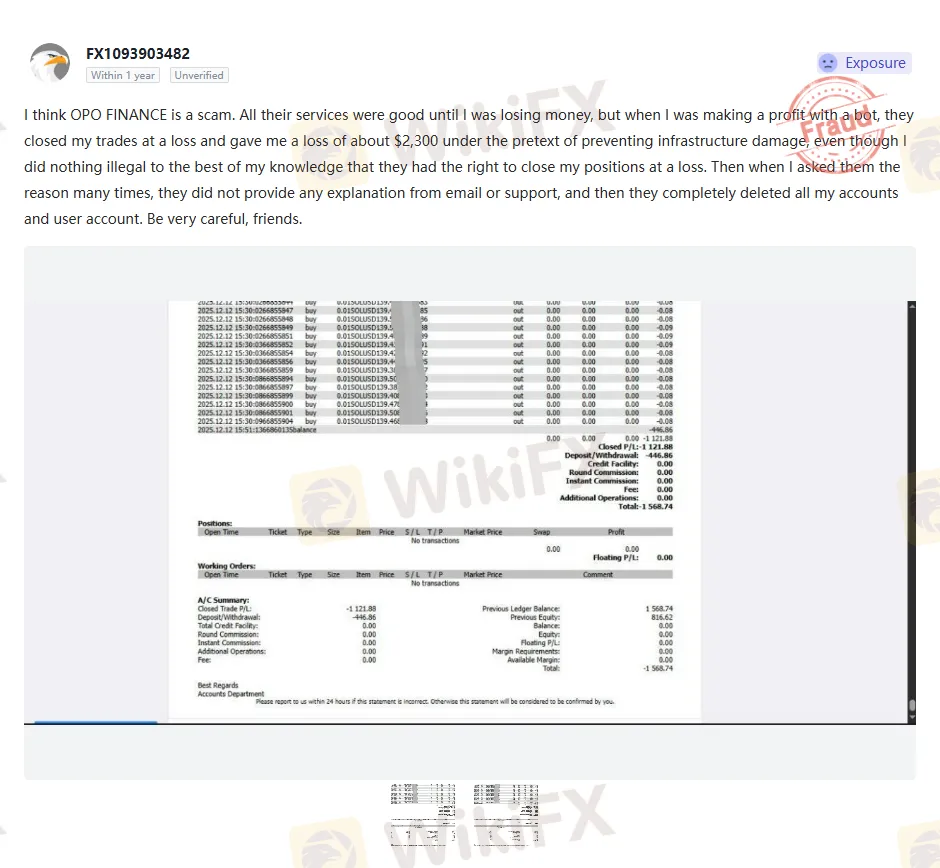

Case 1: Deleted Accounts After Profitable Bot Trading

In the first case, a trader describes initially smooth service while their account was losing money. The relationship changed sharply once they started making a profit using a trading bot. After the strategy became profitable, OpoFinance allegedly closed its open positions at a loss of about USD 2,300, citing “preventing infrastructure damage” as the reason.

The trader insists they did nothing illegal or in violation of the broker‘s rules and has repeatedly asked for a detailed explanation. Instead of receiving a transparent response, they report getting no meaningful answers from either email support or live assistance. Eventually, OpoFinance is said to have deleted all of the traders’ accounts and user profiles.

This sequence—profit with an automated strategy, forced closure of trades at a loss, refusal to clarify, and then full account deletion—strongly suggests an attempt to erase evidence and silence complaints. It raises fundamental questions: if a broker can close profitable trades under vague technical pretexts and then remove clients access entirely, what protection do traders really have?

Case 2: Deposits Trapped, Withdrawals Blocked

The second case comes with a blunt warning: “Do NOT use this broker.” Here, the trader reports that after depositing funds into their OpoFinance account, they were unable to withdraw them. Each withdrawal attempt triggered new excuses and delays, with no concrete resolution offered.

The trader describes OpoFinance as dishonest and manipulative, saying that once funds were deposited, the broker treated the money as their own rather than the clients. Attempts to resolve the issue through support went nowhere; responses remained vague, and no clear technical or compliance reason for the blockage was documented.

This scenario is one of the most direct and serious red flags in retail trading. When a broker systematically blocks access to deposited funds, it undermines the core trust required for any financial relationship. Without reliable withdrawals, features like tight spreads, bonuses, or advanced platforms become irrelevant. The traders' message is straightforward: they felt their money was effectively confiscated, and they do not want others to experience the same fate.

Case 3: Manipulated Reports and Margin Calls

In the third case, a trader warns others to be extremely careful with their capital at OpoFinance and describes the broker as operating on a B‑book model. In a B‑book setup, the broker often profits when clients lose, creating an inherent conflict of interest if not managed transparently and fairly.

The trader reports several troubling practices:

- Incorrect or misleading daily reports.

- Equity is being deducted every day despite hedged positions and no apparent negative swaps.

- The broker is allegedly opening trades themselves and exercising manual control over positions.

- The ability to manually limit withdrawals and “withdraw money whenever they want.”

Despite contacting both customer support and an account manager, the trader says no one could explain why equity was disappearing or why the account ultimately faced a margin call. Compounding the problem, they note that there is no clear office where users can lodge formal complaints, leaving them effectively powerless.

While B‑booking is not inherently illegal, the combination of opaque reporting, unexplained equity changes, and margin calls that seem to favor the broker creates a situation in which traders feel systemically exploited. In such an environment, even carefully managed strategies can be undermined by internal practices that clients cannot verify or challenge.

Cases 4 and 5: No‑Deposit Bonus, No Real Withdrawal

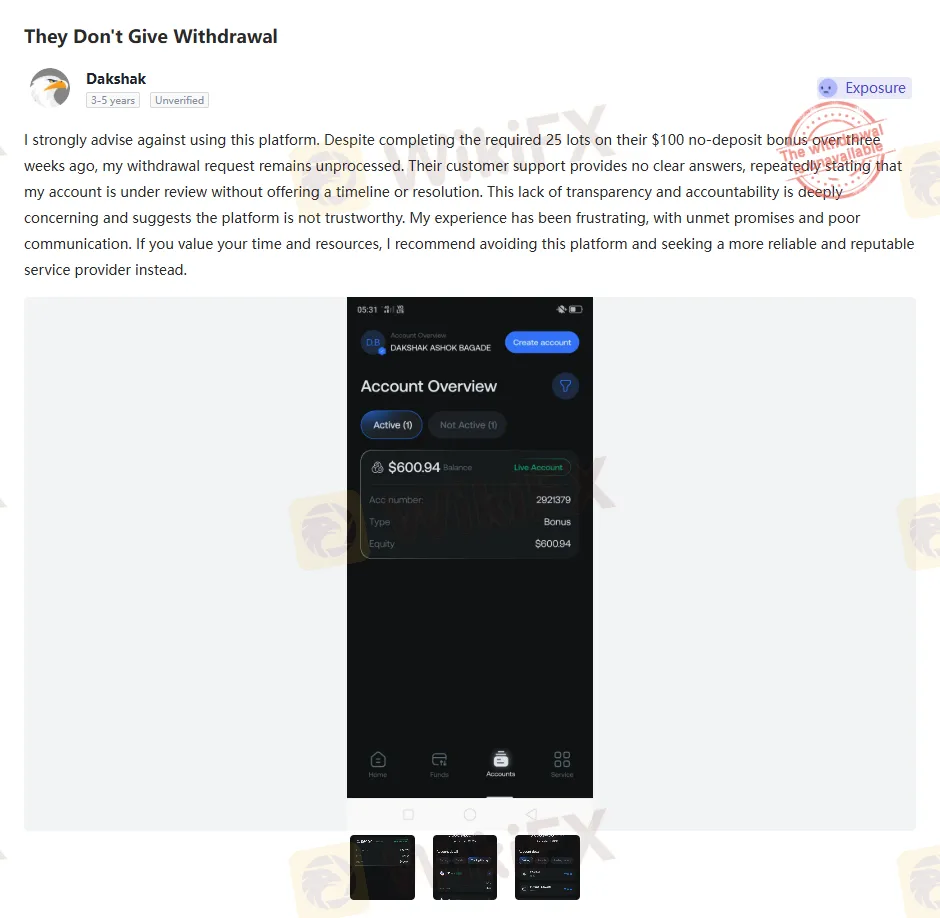

Cases four and five focus on OpoFinance's 100 USD no‑deposit bonus (NDB) promotion, which is marketed as a way for traders to start without risking their own capital. In both cases, traders report meeting the stated requirement of trading 25 lots but were unable to withdraw the promised profits.

In Case 4, the trader explains that more than three weeks passed after the required volume was completed. Their withdrawal request remained unprocessed throughout. Customer support repeatedly claimed that the account was “under review” but never provided a clear reason or timeframe for resolution. The trader concluded that this lack of transparency made the platform untrustworthy and advised others to avoid it.

Case 5 describes a scenario almost identical to the one described. After meeting the 25‑lot requirement, the trader waited more than two weeks for their withdrawal, only to hear the same “account under review” explanation. Support was described as unresponsive and unhelpful, offering no concrete solution. The trader calls the platform fraudulent and urges others not to waste their time.

Promotional offers like no‑deposit bonuses can be legitimate marketing tools, but when conditions are met, and withdrawals are still blocked, they start to look more like bait. These cases suggest that OpoFinance may be using bonus programs to attract and engage traders while making it extremely difficult to access any resulting profits.

Consolidated Scam Indicators and Patterns

When all of these cases are viewed together, a consistent and alarming pattern emerges around OpoFinance behavior:

- Blocked withdrawals: Traders report being unable to withdraw deposits or profits even after meeting the stated conditions.

- Deleted accounts after profits: Profitable activity, especially with automated strategies, is followed by forced loss‑making trade closures and account deletion.

- Manipulated or unclear reporting: Equity deductions, unexplained margin calls, and confusing daily reports undermine trust in theplatformss fairness.

- Unresponsive or evasive support: Customer service repeatedly cites vague reasons, such as “account under review,” instead of providing clear, documented explanations.

- Lack of transparent presence: Traders have difficulty identifying a concrete office location or an effective complaint channel.

These behaviors closely align with known scam patterns in the forex industry, especially among brokers operating under weak or offshore-style regulatory oversight. Even if some issues could be explained individually, the repetition across unrelated traders suggests structural problems rather than isolated mistakes.

Impact on Traders

The impact of OpoFinances alleged practices extends beyond financial losses. Traders not only lose capital but also experience deep frustration, stress, and a loss of confidence in online trading. Time spent building strategies, meeting bonus conditions, or communicating with support is effectively wasted when withdrawals are blocked or accounts are deleted.

For many, these experiences become a turning point. They realize that attractive trading conditions and promotional offers mean little without a trustworthy framework around withdrawals, reporting, and dispute resolution. The emotional and psychological toll—feeling deceived, ignored, or powerless—can be as damaging as the financial hit itself.

How Traders Can Protect Themselves

Given these reports, traders considering OpoFinance—or any similar broker—should take several protective steps:

- Prioritize regulation and transparency. Choose brokers under strong, well‑known regulators with clear complaint processes and compensation schemes.

- Research withdrawal histories. Look for consistent, verifiable feedback on how quickly and reliably the broker processes withdrawals.

- Be cautious with bonuses. Treat no‑deposit and high‑bonus offers with skepticism, and read all conditions carefully before trading.

- Document everything. Keep detailed records of trades, communications, and account changes in case disputes arise.

- Limit initial exposure. Start with small amounts and test the withdrawal process before committing larger sums.

By following these steps, traders can reduce the risk of encountering the same issues reported by OpoFinance clients.

Conclusion

The combined evidence from 2025 to 2026 paints a clear and consistent picture: OpoFinance is associated with blocked withdrawals, deleted accounts after profitable trading, manipulated reports, and unresponsive support. From trapped deposits to denied no‑deposit bonus payouts, the risks described by multiple traders are too significant to dismiss.

While OpoFinance may advertise attractive platforms, leverage, and bonuses, these features cannot compensate for systemic behaviors that put client funds and trust at risk. To protect your capital, avoid OpoFinance and instead choose brokers that are transparently regulated, accountable, and known for honoring withdrawals. In an industry where your money is only as safe as the broker handling it, putting funds into untrustworthy platforms is a risk no trader should take.