简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TradeFxP Legitimacy Check: Addressing Fears: Is This Fake Broker or Legitimate Trading Partner?

Abstract:This article gives you a direct, fact-based investigation into TradeFxP. We are not here to promote or guess. Our goal is to take a deep look into the broker's regulatory status, company details, and how they operate using information that can be publicly verified. By the end of this analysis, you will have a clear answer based on solid evidence, giving you the power to make an informed decision about your financial safety. We will examine the facts to determine Is TradeFxP legit or a trustworthy trading partner.

Checking if a forex broker is real and trustworthy is one of the most important things a trader can do. The internet is full of companies that look professional but may not have the basic protections needed for safe trading. This brings us to the main question many people are asking: Is TradeFxP legit or is it potential risk to your money? It makes sense to be worried about this. This article gives you a direct, fact-based investigation into TradeFxP. We are not here to promote or guess. Our goal is to take a deep look into the broker's regulatory status, company details, and how they operate using information that can be publicly verified. By the end of this analysis, you will have a clear answer based on solid evidence, giving you the power to make an informed decision about your financial safety. We will examine the facts to determine Is TradeFxP legit or a trustworthy trading partner.

The Verdict at a Glance

For traders who need a quick, clear answer, we have put together the most important findings into a summary table. These points highlight the most serious issues discovered during our 2026 investigation. Each finding is an important piece of the puzzle, and together, they create a worrying picture.

| Metric | Finding |

| Regulatory Status | No Valid Forex Regulation Found. This is the most important red flag. |

| Official Score | An extremely low score of 1.58/10 from independent analysis, accompanied by a warning: “Low score, please stay away!” |

| Key Risk Warnings | Labeled with: `Suspicious Regulatory License`, `Suspicious Scope of Business`, and `High potential risk`. |

| Physical Presence | Registered in the United Kingdom, but the listed business address is in Dubai. Importantly, investigations found “No Physical Presence Found” at the UK registered location. |

| Initial Conclusion | The combination of no regulation and major differences in company information places TradeFxP in the highest risk category for traders. For a full breakdown of these alarming signs, you can view the complete, verified report. [See the full evidence on TradeFxP at WikiFX - https://www.wikifx.com/en/dealer/5631721170.html] |

Breaking Down the Red Flags

The initial findings raise serious concerns and these warnings can give you clear answer to the Is TradeFxP legit or Scam Now, we will break down each red flag step-by-step to explain why these issues are so important from an expert perspective. Understanding these tactics is key to protecting yourself not just from this specific broker, but from similar operations in the future.

Red Flag #1: No Regulation

Trading with an unregulated broker is like navigating a storm without a map or safety equipment. No regulation tells you Is TradeFxP legit or not . It is the single most dangerous risk a trader can take. Financial regulation is not just paperwork; it is a trader's main line of defense.

A regulated broker is legally required to follow strict standards that protect you. These protections include:

• Fund Segregation: This ensures the broker keeps your money in separate accounts from their own business funds. An unregulated broker can, in theory, use your deposit to pay their bills, leaving you with nothing.

• Fair Trading Practices: Regulatory bodies monitor brokers to prevent price manipulation, unfair liquidations, and other deceptive practices.

• Dispute Resolution: If you have a problem with a regulated broker, like a withdrawal issue, you can appeal to a third-party governing body. With an unregulated broker, you have no way to get help.

Our investigation confirms that TradeFxP has no valid forex trading license from any reputable authority. Top-tier regulators like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC) have no record of authorizing TradeFxP. This fact alone is a good enough reason for any careful trader to immediately stop considering opening an account.

Red Flag #2: Misleading Structure

Many new traders fall into a common trap: confusing company registration with financial regulation. Questionable brokers often use this confusion to create a false sense of security and try to show positive image to mislead you to the question Is TradeFxP legit or not. TradeFxP's corporate structure is a classic example of this tactic.

Here is the important difference:

• Company Registration: Anyone TradeFxP Ltd registered in Saint Lucia with Registration Number 2024-001111. This is a simple administrative act that provides zero financial oversight and does not permit the company to legally offer investment services to the public.

• Financial Regulation: This is a tough, expensive, and continuous process with a competent authority like the UK's FCA. It involves strict audits, capital requirements, and following conduct rules. TradeFxP does not hold this license.

The evidence reveals a deliberate disconnect. The company is registered in the UK, but its listed physical address is in Dubai: `#908, 9th Floor, Fifty One Tower, Business Bay, Dubai, United Arab Emirates. To make matters worse, on-the-ground investigations confirmed “No Physical Presence Found” at the UK registered address. This structure is designed to project an image of British legitimacy while operating from a jurisdiction with different, often less strict, oversight, all while having no actual base of operations in the country it claims as its home. This is a massive red flag.

Red Flag #3: Misleading History

TradeFxP claims an operating history of “5-10 years,” with its UK company established in 2018. On the surface, this might suggest a stable and experienced broker. However, this is a dangerous assumption.

In our experience analyzing hundreds of brokers, longevity without regulation is a major warning, not a sign of trustworthiness. It simply means an unregulated entity has managed to operate for several years without being shut down. But that does mean that TradeFxP is legit . The answer for Is TradeFxP legit will be same . This can often be achieved by changing domain names, rebranding, or moving between jurisdictions, all while potentially leaving a trail of unsatisfied clients who have no legal path to recover their funds.

An establishment date means nothing without the backing of a top-tier regulator. A five-year history of operating outside the law is arguably worse than a one-year history. It demonstrates a consistent and long-term business model built on avoiding oversight, which directly translates to a higher risk for you, the trader.

Red Flag #4: Suspicious Reviews

Customer feedback is a valuable tool for research, which reveals Is TradeFxP legit or not. A legitimate broker with a 5-10year history would naturally accumulate hundreds, if not thousands, of reviews across various independent platforms.

Our investigation found only a single “positive” review for TradeFxP on the verification platform. The lack of feedback is immediately suspicious. Furthermore, the details of this lone review are highly unusual. For those unfamiliar, the last two characters, are the Chinese term for “defending one's rights” or “rights protection.” This is a term used by people seeking to resolve a dispute or claim damages, not a name a happy customer would use.

This suggests the review may be fake, automated, or part of a more complex and misleading campaign. The key lesson here is to be wary of brokers with very few reviews. A lack of a digital footprint is just as telling as a negative one.

A Closer Look at Offerings

Even with the overwhelming red flags, which reveals Is TradeFxP legit or scam. Some traders might be tempted by a broker's advertised trading conditions. It is important to analyze these offerings through the lens of the broker being unregulated. Attractive features can easily become traps when there is no foundation of trust or safety.

Accounts, Spreads, and Leverage

TradeFxP presents a range of account options, spreads, and leverage that might appear competitive at first glance. Let's break them down with the necessary critical context.

• Account Offerings: The broker offers various accounts, including Premium, ECN, Islamic and Classic with a stated minimum deposit starting from $100. However, the ECN account, often preferred by experienced traders for its tighter spreads, requires a high minimum deposit of $3,000.

• Our Analysis: Offering multiple account types is standard practice. However, entrusting an unregulated broker with a $3,000 deposit for an ECN account is an enormous and unjustifiable risk. Without regulatory protection, there is absolutely no guarantee that those funds will be secure or that you will be able to withdraw them.

• Leverage Up to 1:100:

• Our Analysis: This level of leverage is a significant warning sign. Top-tier regulators in major markets like Europe, the UK, and Australia have capped leverage for retail clients, typically at 1:30 for major forex pairs. They do this to protect traders from catastrophic losses. Unregulated brokers often offer high leverage (1:100 or more) as a marketing tool to attract clients. In reality, it amplifies both gains and losses, dramatically increasing the speed at which a trader can lose their entire deposit.

• Trading Platform (MT5):

• Our Analysis: TradeFxP provides the MetaTrader 5 (MT5) platform. MT5 is a legitimate, powerful, and widely respected trading platform. However, the platform is merely a tool. The security of your funds and the fairness of your trades are not controlled by the platform provider; they are controlled by the broker. A fraudulent broker can easily use a great platform like MT5 to project a false sense of security and lure in unsuspecting traders. The quality of the software does not guarantee the integrity of the broker using it.

Comparing these trading conditions against a regulated broker is essential. You can use a verification tool to see the full, unfiltered data on TradeFxP's offerings and how they stack up. See the complete trading conditions for TradeFxP on WikiFX - https://www.wikifx.com/en/dealer/5631721170.html

The Final Answer

After a thorough examination of the evidence, we must return to the central question: Is TradeFxP legit? Based on the facts, the answer is clearly no.

Let's recap the evidence:

• There is zero top-tier financial regulation.

• The corporate structure is misleading, with mismatched and unverified addresses.

• Independent analysis has assigned it the lowest possible score and multiple high-risk warnings.

• The user review history is practically non-existent and highly suspicious.

• Attractive offerings like high leverage are used as bait, posing a danger to retail traders.

This leads to the question of whether TradeFxP is a scam. While “TradeFxP scam” is a legal term that requires a court's judgment, the operational profile of TradeFxP aligns perfectly with the characteristics of untrustworthy and potentially fraudulent online trading schemes. The complete lack of regulatory oversight means that if you deposit funds, you have no protection, no legal recourse, and a high probability of being unable to withdraw them.

Our final verdict is clear: TradeFxP is not a legitimate or safe trading partner. The overwhelming evidence points to an extremely high-risk operation that should be avoided by all traders.

How to Protect Yourself

The case of TradeFxP is a powerful lesson in research. To avoid similar risks in the future, it is essential to have a clear, repeatable process for checking any broker. We recommend a simple, four-step checklist to protect your capital.

1. Prioritize Regulation Above All

Before you look at spreads, bonuses, or account types, your first and only question should be: Is this broker regulated by a top-tier authority? This includes bodies like the FCA (UK), ASIC (Australia), CySEC (Cyprus), or FINMA (Switzerland). If the answer is no, or if they are only regulated by a weak offshore authority, stop your research and move on.

2. Use an Independent Verification Tool

Never trust a broker's website as the sole source of information. They can claim anything. You must use a comprehensive, third-party verification platform to cross-reference their claims.

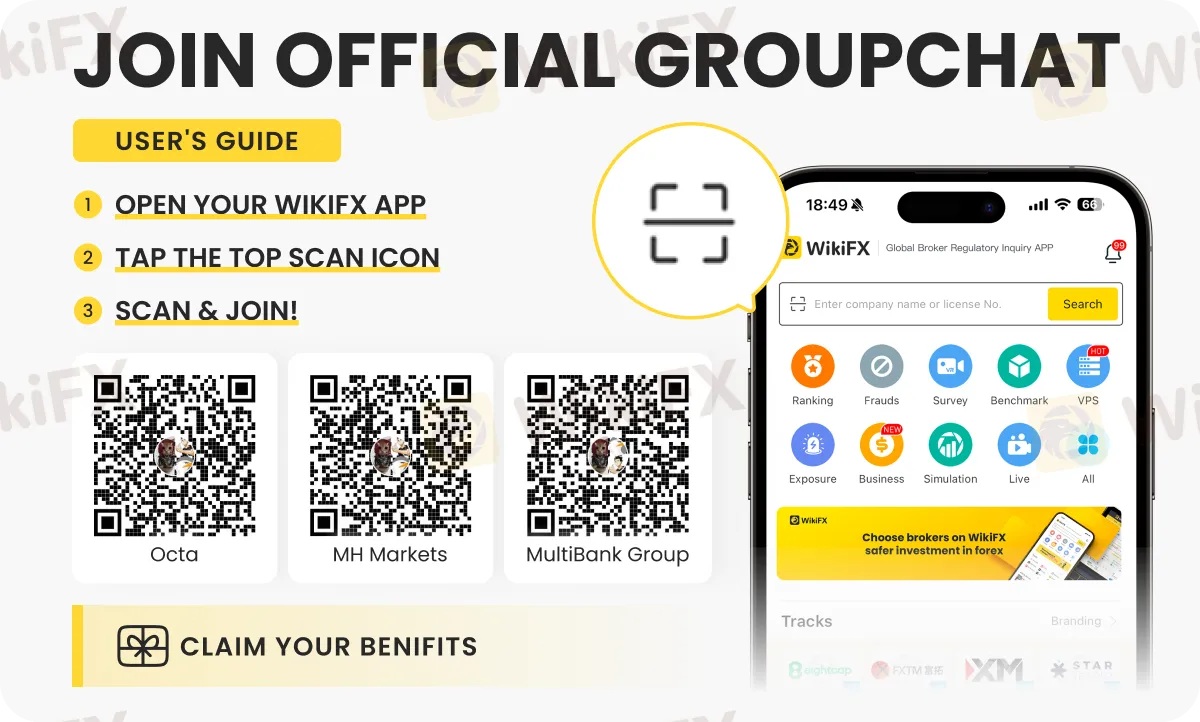

• Our Recommendation: A tool like WikiFX is designed for this exact purpose. It gathers regulatory data directly from official sources, conducts on-site surveys (which is how the “No Physical Presence” for TradeFxP was discovered), and consolidates user reviews and complaints. Its scoring system provides an instant, data-driven assessment that can prevent a costly mistake.

3. Examine Every Detail

Pay attention to the details. Does the broker's physical address match its regulatory jurisdiction? Is their communication professional and transparent? Are their fees and terms clearly stated? A single red flag, like a mismatched address or vague terms of service, is enough to warrant extreme suspicion.

4. Seek Real User Feedback

Look for a large volume of reviews across multiple independent sites, such as Trustpilot, Forex Peace Army, and the dedicated review sections on verification platforms like WikiFX. A single positive review, or even a handful, means nothing. You need to see a broad consensus from a large number of real users over time to check Is TradeFxP legit.

Your first step in checking any broker should be a visit to a verification platform. You can see the type of detailed report that is essential for research by viewing TradeFxP's profile https://www.wikifx.com/en/dealer/5631721170.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Currency Calculator