WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Gold reached its latest record high during quiet trade on Monday. The question for traders now is whether it can sustain momentum into the year end with depleting volumes.

Gold prices have moved back into the spotlight after breaking above the previous October high, a move that has caught the attention of many market watchers as the year draws to a close. Spot gold was the first to push past the record level on Monday, with futures following shortly after. There was no single headline or major event driving the breakout, but in this case, one may not have been necessary. Gold has been on a steady uptrend since its October low, and seasonal patterns, combined with thinner trading volumes heading into Christmas and year-end, have helped keep the bullish momentum intact.

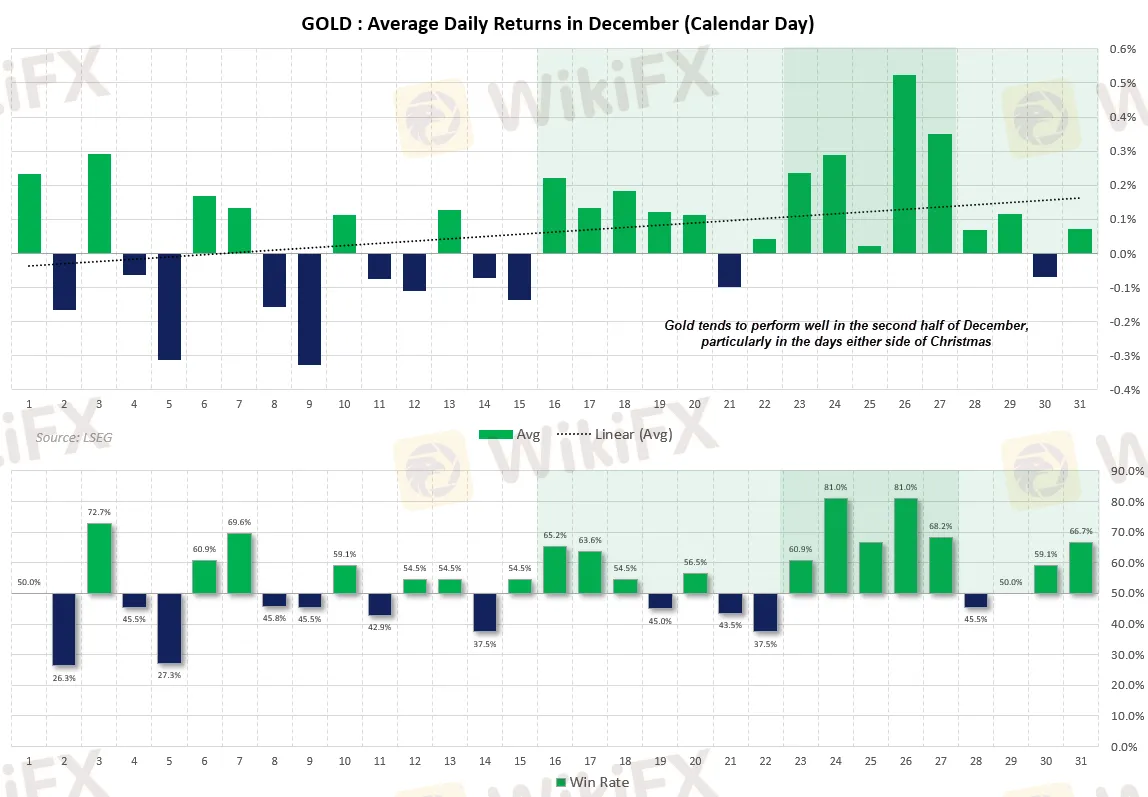

December has historically been a supportive month for gold, although the results are not always straightforward. Looking back over the past 50 years, gold has posted average and median gains of about 1.1% during the month, suggesting a generally positive bias. That said, the win rate sits at around 52%, which means gains are far from guaranteed every year. Still, when December is a winning month, the upside can be meaningful, with average returns close to 4.8%. In contrast, losing Decembers tend to see smaller declines, averaging around 2.9%. This uneven pattern reflects why traders often remain optimistic but cautious during this period.

With only about a week of real trading left before the year ends, some caution is still warranted. Gold has already climbed roughly 4.3% so far this December, and lower liquidity during the holiday period can sometimes lead to consolidation or short-term profit-taking. That said, there are no clear technical signs pointing to an immediate top. The 14-day RSI has only just moved into overbought territory, which is typical during a healthy uptrend rather than a warning signal on its own.

Seasonal trends also continue to favour the bulls. Historically, gold tends to perform well in the sessions around Christmas, with average daily returns leaning positive and win rates relatively high. This keeps the door open for another push higher before any end-of-year profit-taking comes into play. Looking beyond the holidays, the broader outlook for gold remains constructive, with any pullbacks likely to attract buyers looking to add on dips rather than exit the market altogether.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.