Abstract:Get hands‑on with the best forex demo accounts from top brokers, designed to help beginners and pros practice trading securely.

Best Brokers Offering Trade Demo Accounts

Demo accounts serve as a vital bridge for forex traders, letting you test strategies and platforms without risking real capital. These virtual trading platforms mimic live market conditions, offering a risk-free way to build skills and confidence. Whether youre a beginner dipping into forex or a seasoned pro refining tactics, the best demo accounts from top brokers deliver realistic spreads, tools, and features to prepare you for live trading.

What Is a Demo Account?

A trade demo account, often called a forex demo or practice trading account, provides virtual funds to simulate real trading. Brokers like IG and eToro fund these accounts with $10,000 to $100,000 in fake money, allowing access to live market data, charts, and order types. Unlike live accounts, no real losses occur, making it ideal for exploring currency pairs without financial pressure.

These accounts replicate broker platforms exactly, from spreads on EUR/USD to execution speeds. Top demo forex brokers ensure no time limits on most accounts, so you can practice indefinitely. This setup helps traders understand leverage, margin calls, and volatility in a controlled environment.

Why Demo Accounts Matter

Demo accounts matter because they eliminate the steep learning curve of forex trading. New traders often lose money early due to poor risk management or unfamiliar platforms; demos prevent that by offering hands-on experience. Regulated brokers provide these as standard, building trust and compliance.

For the forex markets 24/5 nature, demos let you trade majors like GBP/USD during off-hours without commitment. They also showcase broker reliability—tight spreads and fast execution in demos signal quality live performance. Ultimately, they boost win rates by fostering discipline before real stakes hit.

Benefits for Beginners

Beginners gain a safe space to learn basics like pips, lots, and order types. Platforms from XM or Forex.com include tutorials alongside demos, speeding mastery. Practice reveals common pitfalls, such as overtrading, without blowing accounts.

Demos build pattern recognition through backtesting historical data. Start with simple strategies like trend following on EUR/USD, then scale up. This risk-free trading experience turns theory into instinct, with many brokers offering $100,000 virtual balances for realistic position sizing.

Benefits for Pros

Professionals use demos to test new strategies or Expert Advisors (EAs) on MT4/MT5. Switch to cTrader demos at IC Markets for algo trading tweaks without live disruptions. Pros also benchmark brokers—compare XTBs xStation spreads to live conditions.

Market pros simulate high-volume scenarios, like news events, to refine entries. Unlimited demos from eToro allow copying pro traders virtually first. This keeps edges sharp amid evolving markets, ensuring seamless live transitions.

Choosing Top Demo Accounts

Select demo accounts by regulation (FCA, ASIC), platform variety (MT4, MT5, proprietary), and realism. Look for real-time quotes, no requotes, and spreads matching live averages—e.g., 0.6 pips on EUR/USD. Virtual funds should scale to your planned live deposit.

Ease of signup matters; instant demos like Plus500s beat lengthy verifications. Check expiry—unlimited is best—and extras like education or signals. Mobile app demos ensure on-the-go practice.

Prioritize brokers with seamless demo-to-live switches, preserving history. Test leverage up to 1:500 and instruments beyond forex, like indices.

IG Demo Account Overview

IG leads with its award-winning demo, offering £10,000 virtual funds across 17,000+ markets. No expiry means endless practice on L2 Dealer or MT4, with spreads averaging 0.91 pips on EUR/USD standard accounts.

Access news, signals, and research mirrors live trading. Pros love spread betting vs. CFD options in one demo. Signup takes minutes; ideal for UK/EU traders under FCA oversight.

IGs app shines for mobile demos, with alerts and one-click trading. Drawback: no balance reset without a new email.

eToro Demo Breakdown

eToros unlimited $100,000 demo excels for social trading fans. Copy top traders or practice 47+ forex pairs with 1-pip spreads. The proprietary platform feels intuitive, perfect for beginners.

No slippage differences from live, but psychology lacks—still, great for strategy testing. Includes stocks, crypto; min live deposit $100. CySEC/FCA regulated.

Switch to live effortlessly; webinars enhance learning.

Forex.com Key Features

Forex.com delivers MT4/MT5 demos with 0.0-pip RAW spreads (commission-based). $100 min deposit live; demo unlimited. Diverse pairs, technical tools abound.

Excellent for scalpers; fast execution. CFTC/NFA is regulated for the US, globally elsewhere. Education via videos/webinars.

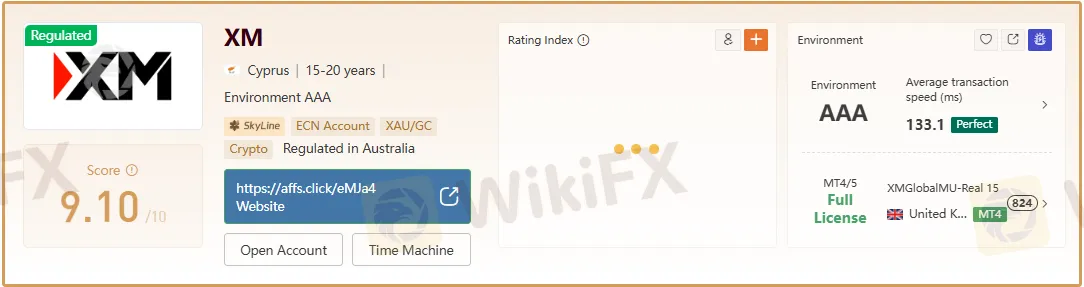

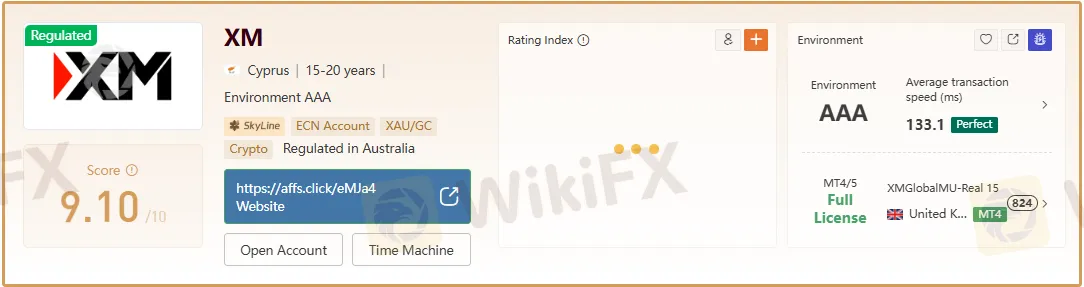

XM Practice Platform

XMs $100,000 demo spans MT4/MT5, Zero account from 0.0 pips + commission. 1,000+ instruments; 1:888 leverage. Ultra-low min deposit $5 live.

Ideal for high-frequency; 99.35% orders <1s. ASIC/CySEC regulated; multilingual support.

XTB Virtual Trading

XTBs xStation5 demo starts at $10,000 virtual, 0.92-pip EUR/USD average. 5,200+ CFDs; no expiry, renewable. Low min deposit $0.

Active trader rebates up to 30%; superb analysis. FCA/FCA regulated.

Saxo Advanced Demo

SaxoTraderGO/PRO demos offer 40,000+ assets, 1.0-pip EUR/USD. $0 min; elite research. Suits pros: multi-asset focus.

Volume discounts; tight indices spreads 0.4 points.

OANDA Simulator

OANDAs demo mirrors live with competitive spreads (1.69 avg, rebates possible). TradingView integration; elite tiers cut costs.

Great research; fast account opening.

IC Markets Raw Demo

IC Markets cTrader/MT demos feature 0.0-pip RAW + $3.50 commission. Unlimited, customizable; scalping/hedging allowed.

ASIC-regulated; ideal EAs.

Pepperstone Test Drive

Pepperstone demos on MT4/5/cTrader, 1.12-pip standard or 0.0 Razor. No expiry; low fees.

Scalping-friendly; multiple platforms.

Plus500 Risk-Free Mode

Plus500s $40,000 demo auto-renews >$200. Web-based; no time limit. Simple for beginners.

FCA regulated; alerts included.

Feature Comparison Table

Maximizing Demo Value

Treat demos like live: risk 1-2% per trade, journal every session. Test multiple strategies—scalping on IC Markets, copying on eToro.

Use real-time data for news trading; customize leverage. Review weekly: win rate, drawdown. Pair with broker education.

Backtest EAs; simulate drawdowns. Track emotions in journals.

Demo Trading Pitfalls

Traders chase wins recklessly on demos, ignoring risk—which leads to live blowups. Overlook slippage; demos rarely match volatile live fills.

No journal means unlearned lessons. Overtrade due to “free” money; skip plans. Treat it as a game, not a business.

Demo to Live Shift

Achieve 2-3 months of consistent demo profits first. Start live small—match demo sizing. Expect slippage, emotions; cut sizes 50% initially.

Preserve demo history; use the same platform. Scale up post-1 month positive. Journal live deviations.

Final Thoughts

The best demo accounts from IG, eToro, and others equip you for forex success through realistic practice. Pick based on your style—scalpers love IC Markets, social traders eToro. Sign up today, journal rigorously, and transition confidently to live trading for real gains. Start risk-free now.