Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Acting as an intermediary between traders and brokerage firms, Introducing Brokers (IBs) can be both a company and an individual. They do not have a role in trade execution or account management. Their role is to offer advice and let clients open trading accounts and trade on the platform. In this article, we have discussed the meaning of the term 'introducing broker,' its role, payment structure, and other related aspects. Read on!

Imagine how simple yet insightful tips can help traders elevate their forex trading game. As the market continues to fluctuate based on news developments and technical factors, implementing these tips can help traders maximize gains or minimize losses. The best part is that such support is available to forex traders through an Introducing Broker (IB).

Acting as an intermediary between traders and brokerage firms, IBs can be both a company and an individual. They do not have a role in trade execution or account management. Their role is to offer advice and let clients open trading accounts and trade on the platform. In this article, we have discussed the meaning of the term 'introducing broker,' its role, payment structure, and other related aspects. Read on!

The primary function of IBs is to refer new clients to a forex brokerage house and help them with market insights, financial information, trading strategies, account setups, and choosing the appropriate trading platforms. Offering language-specific or localized support, IBs let clients navigate the global forex market.

The role of introducing brokers is solely focused on helping traders navigate the forex market, whereas a full-service broker does everything - whether it is about acquiring clients, executing trades, offering customer support, or managing portfolios.

IBs receive a portion of the spread charged by the brokerage firm as commission. For the unversed, a spread remains the difference between bid and ask prices for each trade made by the trader. Based on the trading volume and frequency, the IBs may receive a rebate. Some brokers may offer IBs a fee for every successful client referral, irrespective of the trading volume. This is called Cost Per Acquisition (CPA). Depending on the IB-brokerage agreement, the exact earnings may differ.

The path to becoming a successful introducing broker lies in complying with the steps shown below.

Becoming a successful and reliable introducing broker requires mastering the art of forex trading. As a prospective IB, you need to understand how different trading platforms work and gain in-depth knowledge of several brokerage structures.

Choosing a reputable broker offering an IB program comes next. Make sure to review the commission structures, client services and platform support of several forex brokers. This will help you figure out the right alternative.

To gain more trust from brokers and their traders, you need to register and comply with investor-friendly regulations of the forex market regulator in your region. For instance, in India, forex market regulations are governed by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). As clients prefer investment safety, having registration and compliance with the necessary regulations makes them feel confident about the introducing broker.

Do you want to work as an individual or a corporate IB? This has to be made clear to the trading community. After that, you can create a website with marketing materials and client support tools.

Reach out to traders using educational content, webinars and social media tools. This helps ensure you carve an empathetic image of yourself in traders minds.

Summing Up

Introducing Brokers play a crucial role in the forex trading ecosystem by bridging the gap between traders and brokerage firms. While they do not execute trades or manage accounts, their guidance, market insights, and localized support help traders make informed decisions. For aspiring IBs, success depends on strong market knowledge, choosing the right broker partner, regulatory compliance, and building trust through consistent client support. When approached ethically and transparently, the IB model can be mutually beneficial for traders, brokers, and the introducing brokers themselves.

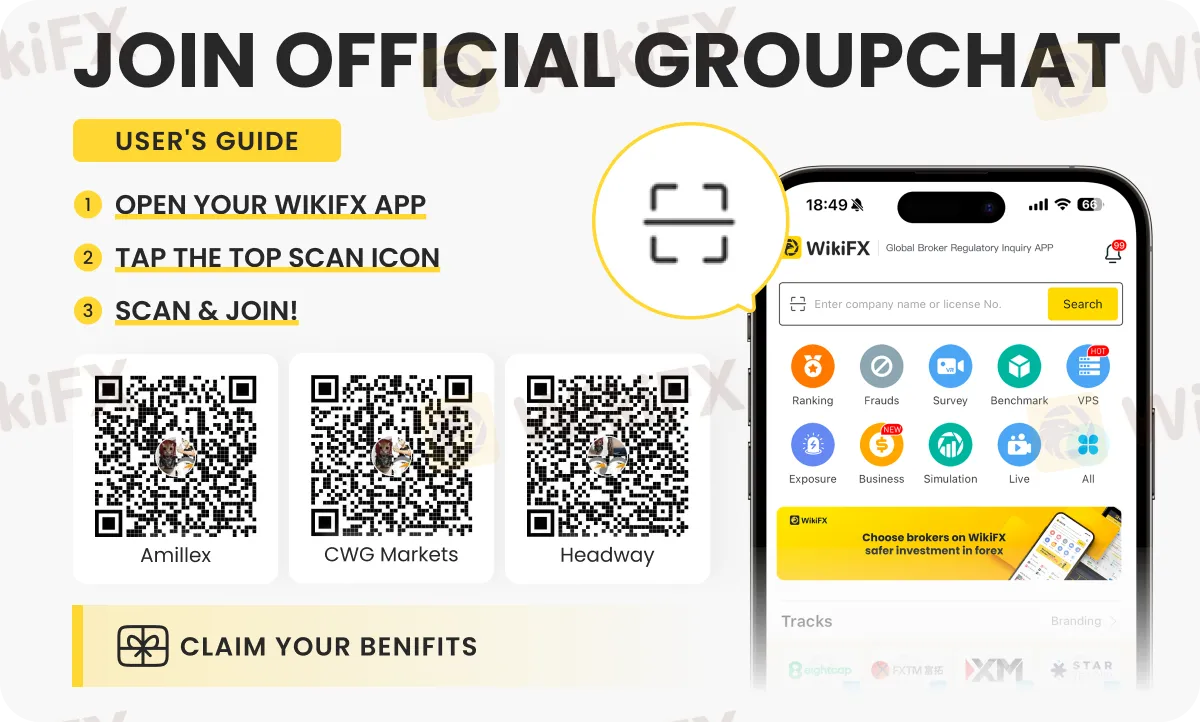

To know more about the IB and other forex trading aspects, join our special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.