Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

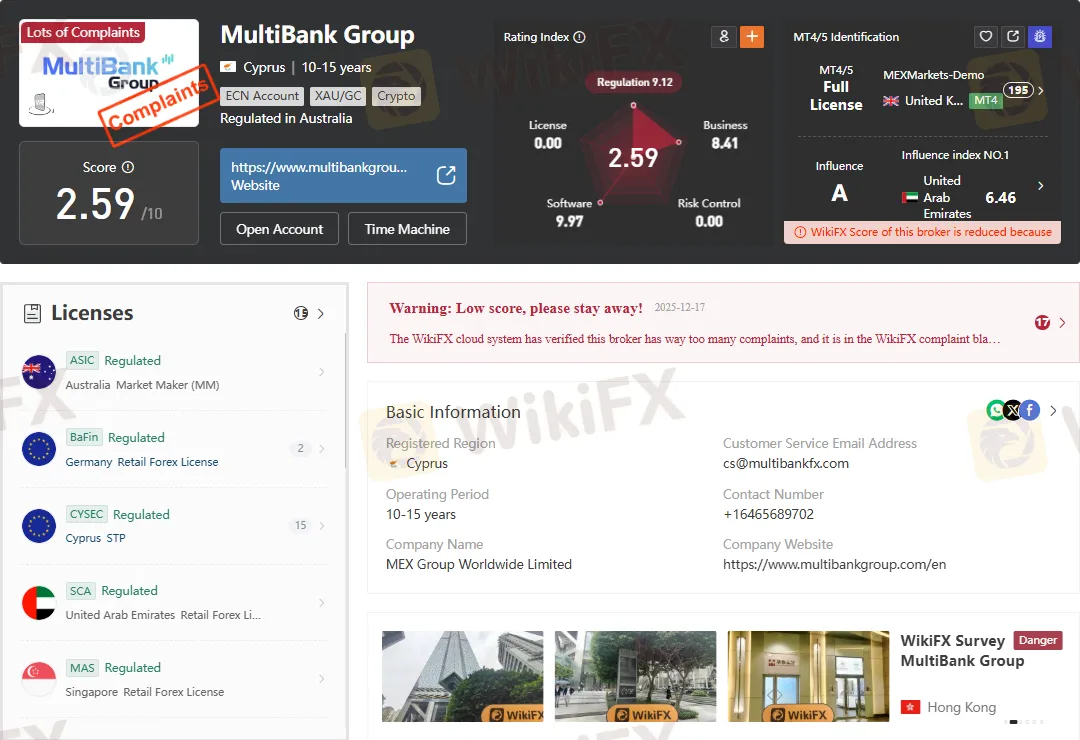

Abstract:Multibank Group broker review: regulated in Cyprus, Australia, and Germany, but facing revoked licenses and severe complaints.

Multibank Group presents itself as a multinational broker with a wide regulatory footprint. The attached regulatory records confirm licenses across several jurisdictions, including Cyprus (CySEC, License No. 430/23), Australia (ASIC, License No. 416279), and Germany (BaFin, License No. 10119375). These licenses provide the broker with legitimacy in key financial markets.

However, the same records reveal a troubling pattern: revoked authorizations in the United Kingdom (FCA, License No. 843796), Dubai (DFSA, License No. F004403), and the Cayman Islands (CIMA, License No. 1425303). This duality—regulated in some regions, stripped of licenses in others—raises questions about the brokers compliance consistency and long-term credibility.

Investigations into physical office presence show mixed results.

This inconsistency in office verification undermines transparency, a critical factor when evaluating any broker‘s legitimacy. Competitors such as IG Group and Saxo Bank maintain clear, verifiable headquarters, contrasting sharply with Multibank’s fragmented presence.

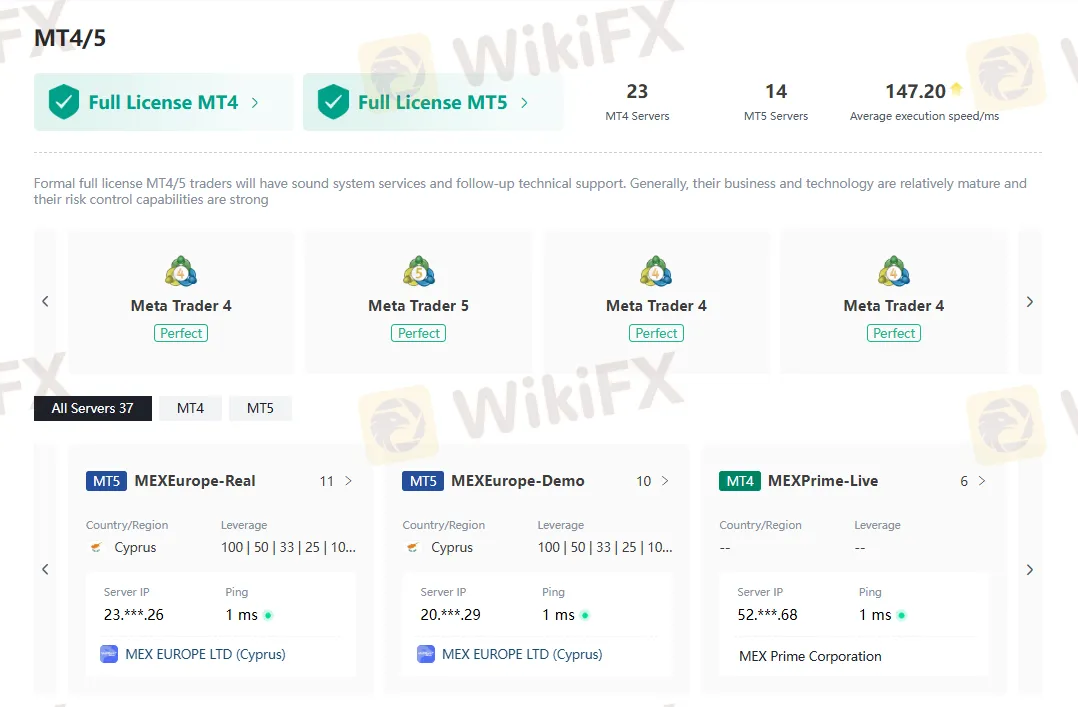

Multibank Group offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) under full licenses, with 23 MT4 servers and 14 MT5 servers. Execution speed averages 147 ms, which is competitive compared to industry standards.

Leverage offerings vary by jurisdiction, with Cyprus accounts showing ratios of 1:100, 1:50, 1:33, 1:25, and 1:10. While these options provide flexibility, they also raise risk concerns, particularly for retail traders.

Competitor brokers such as Pepperstone and IC Markets offer similar MT4/MT5 access but emphasize tighter spreads and faster execution, positioning themselves as more reliable alternatives for high-frequency traders.

The broker operates multiple domains, including multibankgroup.com, mexeurope.com, and mexmarkets.com. Several domains are hosted in Hong Kong and the United States, with additional registrations under obscure names such as dtjrjt.com and mexjituan.com.

This fragmented domain strategy may confuse clients and complicate due diligence. By contrast, established brokers like OANDA or Interactive Brokers consolidate their digital presence under a single, transparent domain structure.

The attached records document 742 user reviews, with 736 classified as exposure cases. Complaints include:

These complaints are severe and consistent, suggesting systemic issues rather than isolated incidents. In comparison, regulated competitors such as CMC Markets or FXCM face far fewer exposure cases, reinforcing the perception that Multibank struggles with client trust.

Pros:

Cons:

When compared to brokers like IG Group, Saxo Bank, and Pepperstone, Multibank Group falls short in regulatory stability and client trust. While competitors emphasize transparency, consolidated branding, and consistent compliance, Multibanks revoked licenses and exposure cases highlight vulnerabilities.

Multibank Groups regulatory footprint is broad but inconsistent. While licenses in Cyprus, Australia, Germany, and Singapore provide legitimacy, revoked authorizations in the UK, Dubai, and Cayman Islands cast a shadow over its credibility.

The brokers technology stack is competitive, offering full MT4/MT5 access, yet persistent complaints about withdrawals and account manipulation undermine its value proposition. Traders seeking reliability may find stronger safeguards with competitors that maintain consistent regulatory compliance and transparent operations.

Multibank Group remains a broker with notable reach but questionable reliability. Its regulatory standing is mixed, and its reputation is marred by severe client complaints. For traders prioritizing trust and transparency, caution is advised when considering this broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.