Abstract:Deriv is regulated in UAE, Labuan, Malta & offshore jurisdictions. Explore broker's licenses, regulation status, and trading platforms in 2025.

Why Deriv Regulation Matters

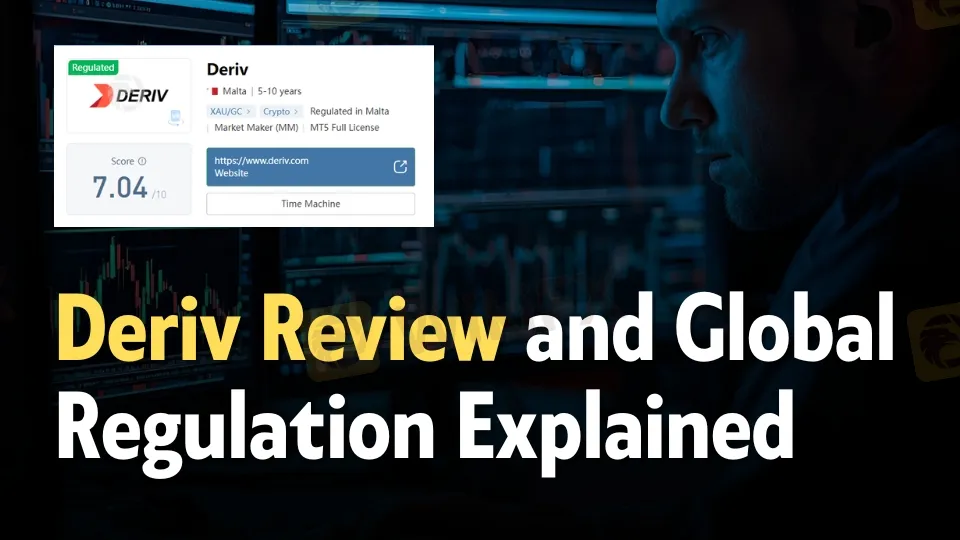

In the crowded forex and CFD brokerage industry, regulatory oversight is the single most important factor separating credible brokers from high-risk operators. This Deriv Review investigates the brokers licensing footprint across multiple jurisdictions, highlighting both its strengths in onshore regulation and the risks tied to offshore registrations. Traders evaluating Deriv must understand how each license impacts credibility, investor protection, and long-term trust.

UAE License – Securities and Commodities Authority

Derivs most notable regulatory achievement is its United Arab Emirates license under the Securities and Commodities Authority (SCA).

- License Type: Retail Forex License

- Licensed Entity: Deriv Capital Contracts & Currencies L

- Effective Date: 2024-04-03

- Jurisdiction: United Arab Emirates

- Status: Fully Regulated

This onshore license is significant. The UAEs SCA is known for strict compliance standards, requiring brokers to maintain transparency, capital adequacy, and client fund segregation. For traders, this represents one of the strongest pillars of Deriv Regulation.

Labuan FSA – Malaysias Offshore Hub

Deriv also holds a license from the Labuan Financial Services Authority (FSA) in Malaysia.

- License Type: Straight Through Processing (STP)

- License No.: MB/18/0024

- Licensed Entity: Deriv (FX) Ltd.

- Jurisdiction: Labuan, Malaysia

- Status: Regulated

While Labuan is technically offshore, its FSA framework is more robust than many other offshore centers. It requires audited reporting and operational transparency. This adds credibility but does not match the investor protection levels of the UAE or EU.

Vanuatu VFSC – Offshore Regulation

Deriv (V) Ltd is registered with the Vanuatu Financial Services Commission (VFSC).

- License Type: Retail Forex License

- License No.: 14556

- Effective Date: 2022-12-23

- Jurisdiction: Vanuatu

- Status: Offshore Regulated

The VFSC is widely considered a light-touch regulator. While it provides legal recognition, it offers limited investor protection. Traders should view this as a weaker layer of Deriv Regulation, suitable for global expansion but not for strong compliance assurance.

British Virgin Islands FSC – Offshore Entity

Deriv (BVI) Ltd operates under the British Virgin Islands Financial Services Commission (FSC).

- License Type: Retail Forex License

- License No.: SIBA/L/18/1114

- Jurisdiction: British Virgin Islands

- Status: Offshore Regulated

The BVI FSC is another offshore regulator. It provides legitimacy but lacks the enforcement rigor of onshore authorities. This license primarily supports Derivs international operations rather than investor protection.

Cayman Islands Monetary Authority – Exceeded License

Deriv Investments (Cayman) Limited is listed under the Cayman Islands Monetary Authority (CIMA).

- License Type: Common Financial Service License

- License No.: 2108455

- Effective Date: 2025-04-10

- Jurisdiction: Cayman Islands

- Status: Exceeded

The “Exceeded” status raises questions. While Cayman is a respected offshore hub, the unclear status of this license suggests compliance challenges. Traders should monitor updates closely.

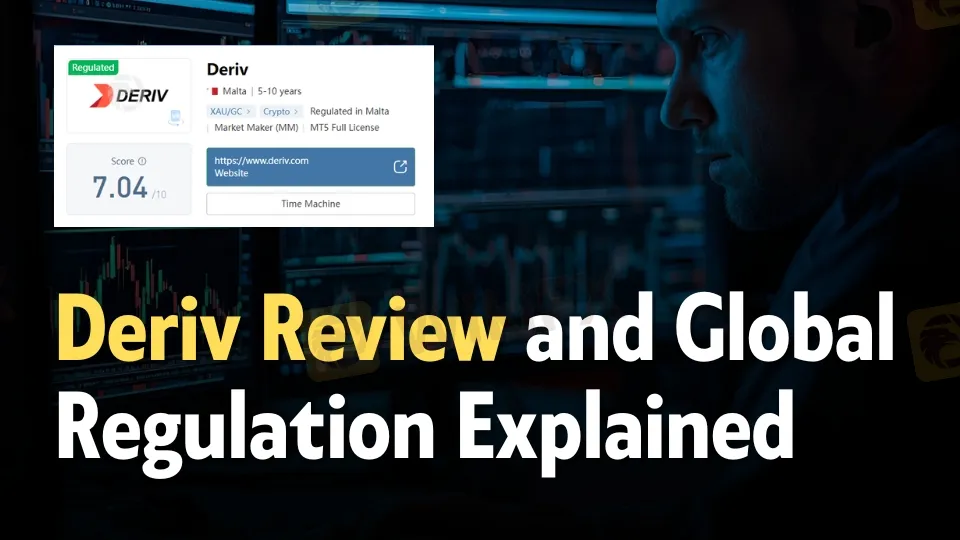

Malta MFSA – European Regulation

Deriv (Europe) Ltd is registered in Malta under the Malta Financial Services Authority (MFSA).

- Jurisdiction: Malta

- Operating Period: 5–10 years

- Status: Regulated

- Market Role: Market Maker (MM)

- Platforms Licensed: MT5 Full License

Malta‘s MFSA is an EU-recognized regulator, offering strong investor protection. However, investigative reports note inconsistencies in Deriv’s Malta office presence, raising transparency concerns.

Onshore vs Offshore Regulation

Onshore Regulation (UAE, Malta): Strong compliance, investor protection, strict audits.

- Offshore Regulation (Vanuatu, BVI, Cayman, Labuan): Easier licensing, global expansion, but weaker investor safeguards.

For traders, the distinction is critical. Onshore licenses provide confidence in dispute resolution and fund safety. Offshore licenses, while legitimate, should be treated with caution.

Trading Platforms and Instruments

Deriv offers a wide range of platforms and instruments:

- Platforms: Deriv MT5, Deriv X, Deriv cTrader, Deriv Trader, Deriv Bot, Deriv GO, SmartTrader

- Instruments: Forex, indices, stocks, commodities, cryptocurrencies, ETFs

- Leverage: Up to 1:1000 (forex)

- Spreads: From 0.1 pips (standard account)

- Minimum Deposit: $5

- Copy Trading: Available

This breadth of platforms and instruments enhances accessibility but must be weighed against regulatory credibility.

Pros and Cons of Deriv Regulation

Pros

- Strong UAE SCA license (2024)

- Malta MFSA oversight with EU recognition

- Multiple platforms including MT5 and cTrader

- Low minimum deposit ($5)

- Demo accounts available

Cons

- Heavy reliance on offshore licenses (VFSC, BVI, Cayman)

- “Exceeded” Cayman license status raises compliance questions

- Transparency issues in Malta office verification

- Offshore regulation offers limited investor protection

Regulatory Snapshot Table

Bottom Line: Is Deriv Legitimate?

This Deriv Review shows a broker with a complex regulatory footprint. Onshore licenses in the UAE and Malta provide strong credibility, while offshore registrations in Vanuatu, BVI, Labuan, and Cayman expand reach but dilute investor protection.

For traders, the takeaway is clear: Deriv Regulation offers both strengths and weaknesses. The UAE and Malta licenses inspire confidence, but offshore reliance requires caution. Deriv remains a legitimate broker, yet traders should prioritize accounts under its onshore entities for maximum safety.

Final Verdict: Deriv is a regulated broker with credible onshore licenses but notable offshore exposure. Its value proposition lies in platform diversity and low entry barriers, balanced against the need for careful jurisdictional selection.