简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Axi Safe or a Scam? A Data-Driven Risk Analysis for Traders

Abstract:Axi in-depth article provides a risk-focused analysis for experienced traders. Drawing primarily on concrete data from the global broker inquiry platform WikiFX, and supplemented by broader public information, we will perform a comprehensive Axi safety risk and scam check. Our goal is to dissect the broker's operational integrity, regulatory standing, and user-reported experiences to deliver a clear, data-driven verdict.

When evaluating a forex and CFD broker for a long-term trading relationship, the fundamental question is one of trust. For a broker with a global footprint like Axi, this question becomes paramount: “Is Axi safe or a scam?” With over 15 years in the industry, Axi has built a significant reputation, but a closer look reveals a complex picture of top-tier regulation juxtaposed with notable user complaints and historical sanctions.

This in-depth article provides a risk-focused analysis for experienced traders. Drawing primarily on concrete data from the global broker inquiry platform WikiFX, and supplemented by broader public information, we will perform a comprehensive Axi safety risk and scam check. Our goal is to dissect the broker's operational integrity, regulatory standing, and user-reported experiences to deliver a clear, data-driven verdict.

Axi's Regulatory Framework: A Multi-Tiered Reality

A broker's regulatory status is the bedrock of its trustworthiness. For Axi, the framework is robust but layered, a reality that traders must understand to accurately assess their risk exposure.

Top-Tier Licensing and Its Protections

According to data from WikiFX, Axi is regulated by two of the world's most respected financial authorities:

• ASIC (Australian Securities & Investments Commission): As an Australian-registered company, Axi's regulation under ASIC ensures it adheres to strict standards for capital adequacy, client fund handling, and transparent business practices.

• FCA (Financial Conduct Authority): In the United Kingdom, Axi is authorized by the FCA, arguably the gold standard in retail brokerage regulation. For UK-based traders, this provides significant protections, including the Financial Services Compensation Scheme (FSCS), which can protect client deposits up to £85,000 in the event of broker insolvency.

These top-tier licenses are a powerful argument against Axi being a scam. Unregulated or poorly regulated entities are the hallmarks of fraudulent operations, whereas maintaining compliance with ASIC and the FCA requires a substantial, ongoing commitment to legitimate business conduct.

The Offshore Entity and Historical Sanctions

However, the regulatory picture is more nuanced. WikiFX lists Axi's company address in St. Vincent and the Grenadines (SVG), an offshore jurisdiction. Public sources confirm that Axi, like many global brokers, operates an entity registered with the SVGFSA. This entity is often used to onboard international clients who may not fall under FCA or ASIC jurisdiction, typically offering them higher leverage. It is critical for traders to recognize that the SVGFSA provides minimal regulatory oversight and no investor compensation schemes. The level of safety a trader experiences is therefore highly dependent on which Axi entity they are registered with.

Furthermore, a deeper look into Axi's history reveals past regulatory infractions. Public records show that its ASIC license was temporarily suspended in 2020 for failures related to client money reporting rules. Similarly, its FMA (New Zealand) license faced a temporary suspension in 2019. While these licenses were reinstated after Axi demonstrated corrective measures, this history is a significant data point in any risk assessment. It suggests past compliance lapses that, while resolved, should not be ignored by cautious traders.

For any trader, the first step in due diligence should be to verify a broker's current regulatory status and user feedback. Platforms like WikiFX provide a consolidated dashboard showing licenses, complaint history, and on-site verification reports, which is invaluable for an initial safety check.

Operational Integrity and Business Model Scrutiny

Beyond licenses, a broker's operational history and business model provide crucial clues about its reliability.

A Long-Standing Market Presence

WikiFX confirms that Axi has been in operation for 15-20 years. This longevity is a significant factor in its favor. Outright scams rarely survive for nearly two decades while maintaining licenses in premier jurisdictions. A long track record indicates a sustainable business that has navigated numerous market cycles, technological shifts, and regulatory changes.

Market Maker Model and Physical Verification

WikiFX identifies Axi's business model as a Market Maker (MM). In this model, the broker can act as the direct counterparty to its clients' trades. This creates a potential conflict of interest, as the broker may profit from client losses. While this is a standard and legitimate model used by many of the world's largest brokers, experienced traders should be aware of this dynamic.

To counter concerns about being a “virtual” or untraceable entity, Axi has undergone physical verification. WikiFX's on-site survey teams have conducted inspections of Axi's offices in Australia and Hong Kong, returning with a “Good” assessment. This confirms that Axi maintains a tangible, physical presence with real operations, a key differentiator from anonymous, fraudulent websites.

The Core of the Axi Safety Risk and Scam Check: User Complaints

While regulation and operational history build a picture of legitimacy, user-reported experiences reveal potential cracks in the facade. This is where the “scam” allegations primarily originate.

WikiFX issues a clear warning on Axi's profile: “The WikiFX Score of this broker is reduced because of too many complaints!” It notes a total of 16 user complaints filed against the broker. These are not trivial issues; they strike at the heart of fund safety and broker integrity.

Let's examine the specific allegations documented by WikiFX:

• Withheld Deposits and Profitable Trading: One user from Brazil claims that after making a profitable withdrawal, a subsequent deposit was never credited to their MT4 account, leading to a negative balance. The user alleges this is a tactic to penalize profitable traders, concluding with the stark warning: “Scam—stay away!”

• Account Security and Stolen Funds: A trader from the Philippines reports that their funds were stolen from their Axi account on two separate occasions. After a three-month investigation, the broker allegedly refused to refund the stolen amount, raising serious questions about platform security and the broker's dispute resolution process.

• Bonus and Rebate Complications: A Japanese trader details an issue where a negative balance was not properly zeroed out before a rebate was applied, effectively nullifying the rebate. This points to potential complexities and a lack of clarity in the terms and conditions of promotional offers.

These complaints are serious and directly feed the “Axi scam” narrative. They highlight risks related to fund handling, account security, and the treatment of profitable clients.

However, it is crucial to balance this with the positive feedback also present on WikiFX. Multiple users from around the world praise Axi for “fast withdrawals, no unnecessary questions,” “lightning-fast execution,” and transparent pricing. This stark contrast suggests that while a significant number of clients have a seamless experience, a non-trivial minority encounters severe and costly problems. The risk, therefore, may not be one of a systematic scam, but of inconsistent service and inadequate problem resolution when things go wrong.

Trading Environment and Execution Performance

For an experienced trader, safety isn't just about fund security; it's also about the reliability of the trading environment. A broker that manipulates its platform can be just as damaging as one that steals funds.

Here, Axi scores remarkably well. WikiFX's in-depth analysis of Axi's trading environment assigns it a top-tier “AA” rating. This is based on several key performance metrics:

• Transaction Speed: An average speed of 256.3 ms is rated as “Great,” indicating fast order processing, which is critical for intraday and news traders.

• Slippage and Costs: Both receive an 'A' rating, suggesting that slippage is generally well-managed and trading costs are competitive.

• Platform Stability: A “Disconnected” rating of 'AA' implies a very stable server connection with minimal downtime.

• Platform License: WikiFX confirms Axi holds a “Full License” for the MT4 platform. This is a significant investment and a sign of a serious, legitimate operation, as scam brokers typically use cheaper, less reliable white-label solutions.

While public sources indicate Axi's platform offering is primarily centered on the popular MetaTrader 4 (enhanced with tools like MT4 NexGen and AutoChartist), some user reviews also mention MT5 availability. This focus on a robust and stable MT4/MT5 environment, backed by strong performance metrics, is a major point in Axi's favor and speaks to its operational competence.

Deposits, Withdrawals, and Fund Security: A Closer Look

The flow of money is the ultimate test of a broker's trustworthiness. While Axi's top-tier regulation mandates the segregation of client funds from company funds—the primary safeguard against misuse—the user complaints paint a worrying picture of the practical experience.

The allegations of uncredited deposits and stolen funds are direct assaults on the concept of fund safety. Another complaint found on public forums mentions a user being forced to withdraw via bank wire, a slow and inconvenient method, despite having deposited via Skrill.

This must be contrasted with the multiple positive reviews on WikiFX and Trustpilot that explicitly praise Axi for “fast withdrawals” and an efficient process. This inconsistency is a risk factor in itself. It suggests that while the system may work smoothly for most, there are edge cases or specific circumstances—perhaps related to jurisdiction, payment method, or profit level—where traders encounter significant friction.

An experienced trader must interpret this not as proof of a scam, but as an indicator of potential operational risk. The withdrawal process may not be as universally seamless as the broker's marketing suggests.

The Verdict: Is Axi Safe or a Scam?

After a thorough, data-driven review, we can now directly address the central question.

Axi is definitively not an outright scam. The evidence supporting its legitimacy is overwhelming: a 15-20 year operating history, regulation by the world's top financial authorities (FCA and ASIC), physically verified offices, a high overall WikiFX score of 8.27/10, and a technically proficient trading environment. Scam operations do not possess these characteristics.

However, the question of whether Axi is completely safe is more complex. The broker carries specific, meaningful risks that experienced traders must weigh carefully:

• User Complaint Profile: The volume and severity of user complaints reported on WikiFX, particularly those concerning fund handling, are a major red flag. WikiFX's decision to lower Axi's score based on these complaints is a clear warning.

• Historical Regulatory Issues: The past license suspensions from ASIC and the FMA, while resolved, indicate a history of compliance failures that cannot be disregarded.

• Offshore Risk: Traders onboarded through the St. Vincent and the Grenadines entity face significantly lower regulatory protection, a critical risk factor for anyone trading outside the UK or Australia.

• Inconsistent User Experience: The chasm between users praising fast withdrawals and those alleging stolen funds points to a high degree of variability in service quality and problem resolution.

In conclusion, Axi operates as a legitimate, long-standing broker, but it is not without its flaws. The risks appear to be less about a premeditated scam and more about potential operational weaknesses, inconsistent customer support, and the stark difference in protection between its onshore and offshore entities.

Given the mixed feedback and historical issues, prospective clients should remain cautious. Before committing significant capital, it is prudent to consult an independent broker inquiry platform like WikiFX to review the latest user exposure reports and any updated regulatory alerts for Axi. For traders considering Axi, starting with a small deposit to test the entire process—from deposit and trading to a full withdrawal—is a highly recommended risk management strategy before scaling up capital commitment.

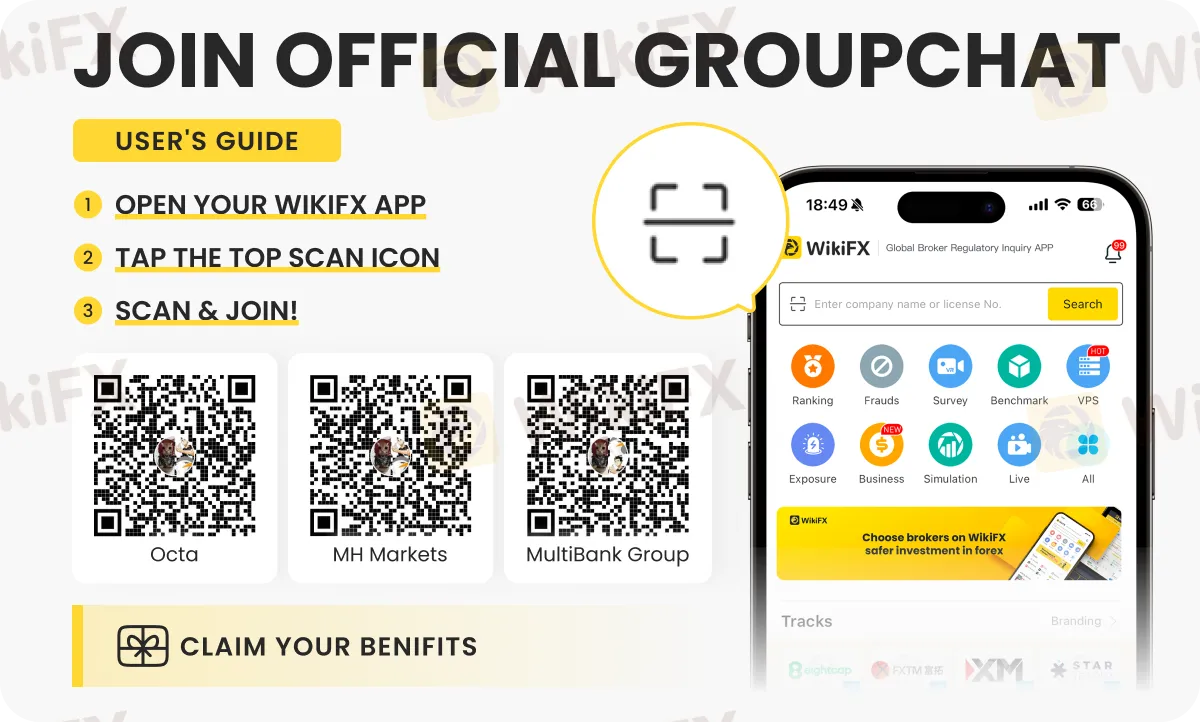

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Currency Calculator