1x Trade Review Exposed: Withdrawal and Bonus Tricks

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:For experienced traders, the cost of execution is a critical factor in broker selection. Low spreads, fair commissions, and transparent pricing can be the difference between a profitable and a losing strategy over the long term. This has led many to scrutinize the offerings of brokers like Uniglobe Markets, which presents a tiered account structure promising competitive conditions. However, a professional evaluation demands more than a surface-level look at marketing claims. It requires a deep, data-driven analysis of the real trading costs, set against the backdrop of the broker's operational integrity and safety. This comprehensive Uniglobe Markets commission fees and spreads analysis will deconstruct the broker's pricing model, examining its account types, typical spreads, commission policies, and potential ancillary costs. Using data primarily sourced from the global broker inquiry platform WikiFX, we will provide a clear-eyed view of the Uniglobe Markets spreads commissions prici

For experienced traders, the cost of execution is a critical factor in broker selection. Low spreads, fair commissions, and transparent pricing can be the difference between a profitable and a losing strategy over the long term. This has led many to scrutinize the offerings of brokers like Uniglobe Markets, which presents a tiered account structure promising competitive conditions. However, a professional evaluation demands more than a surface-level look at marketing claims. It requires a deep, data-driven analysis of the real trading costs, set against the backdrop of the broker's operational integrity and safety.

This comprehensive Uniglobe Markets commission fees and spreads analysis will deconstruct the broker's pricing model, examining its account types, typical spreads, commission policies, and potential ancillary costs. Using data primarily sourced from the global broker inquiry platform WikiFX, we will provide a clear-eyed view of the Uniglobe Markets spreads commissions pricing structure to help seasoned traders determine if its costs are truly competitive and whether the associated risks are justifiable for a long-term trading relationship.

Before dissecting spreads and commissions to the tenth of a pip, it is imperative to address the foundational issue of broker safety. The most attractive pricing structure becomes meaningless if a trader's capital and profits are at risk. In the case of Uniglobe Markets, the data presents a concerning picture that must be the starting point of any serious evaluation.

According to WikiFX, Uniglobe Markets operates with “No valid regulatory information.” The platform assigns the broker a very low score and issues a stark warning: “Low score, please stay away!” This lack of oversight from a reputable financial authority is not merely a procedural gap; it is a fundamental flaw that exposes clients to significant counterparty risk. Without regulation, there is no mandated segregation of client funds, no access to investor compensation schemes, and no formal, impartial body to mediate disputes over trade execution, pricing or withdrawals.

This concern is amplified by multiple official warnings from European regulators. Public records show that financial watchdogs in Cyprus (CySEC), France (AMF), and Spain (CNMV) have all issued alerts or placed Uniglobe Markets on their blacklists of unauthorized entities. These are not suggestions but explicit directives from national authorities warning their citizens against engaging with the firm.

Furthermore, WikiFX data highlights a connection to a UK-registered entity, UNI SMART SOLUTIONS LTD, which is now listed as “Deregistered.” The dissolution of an associated company adds another layer of uncertainty about the broker's corporate stability and legitimacy. This structural ambiguity, combined with a physical address listed in Saint Lucia—a well-known offshore jurisdiction—paints a portrait of a broker operating outside the framework of robust financial supervision.

Finally, the “Exposure” section on WikiFX contains numerous user complaints, with recurring themes of being unable to withdraw funds and receiving no response from customer service. While a single positive review from an Introducing Broker (IB) exists, it is vastly outnumbered by serious allegations. For any experienced trader, these regulatory gaps and user-reported issues are critical concerns. It is advisable to visit the WikiFX platform to independently verify Uniglobe Markets' current regulatory status, review the detailed exposure reports from other users, and check its updated score.

With the essential risk context established, we can now analyze the broker's pricing model. Uniglobe Markets employs a tiered account system, a common industry practice designed to offer progressively better trading conditions to clients who deposit larger amounts of capital.

The pricing you receive is directly tied to the account you open. Based on information from WikiFX and other public sources, the account hierarchy is as follows:

• Micro Account: Minimum deposit of $100

• ECN Classic Account: Minimum deposit of $1000

• Uniglobe Premium Account: Minimum deposit often cited around $500

• ECN Lite Account: Minimum deposit reported to be $10,000

• Uniglobe VIP Account: Minimum deposit of $50,000

An Islamic (swap-free) account option is also available, typically starting from a $100 deposit. This structure clearly segments traders, with baseline access starting at a relatively low threshold but requiring substantial capital for the most preferential terms.

The spread—the difference between the bid and ask price—is a primary cost for forex traders. Uniglobe Markets' spread offering varies significantly across its account types.

For its standard, non-ECN accounts like the Micro, traders should expect wider, all-inclusive spreads with no separate commission. These accounts are designed for simplicity but often carry a higher effective cost per trade. The ECN Classic Account features a minimum spread starting from 0.0-0.3 pips.

ECN accounts are defined by a two-part cost structure: a tight raw spread plus a fixed commission per lot traded. This model is favored by scalpers and high-frequency traders for its transparency.

However, a critical piece of information is missing from the primary WikiFX data, which lists the commission for the ECN Classic account as “--” (not specified). This lack of transparency is a significant drawback. Without knowing the commission, it is impossible to calculate the total “all-in” cost of trading.

Some public sources suggest a commission starting from “$2,” but it is unclear if this is per side ($4 round-turn) or round-turn, and for which account type it applies. If we assume a hypothetical $5 round-turn commission per standard lot, a trader on the ECN Classic account would face a total cost of:

Total Cost = Spread + Commission Total Cost = 1.3 pips ($13) + $5 = $18 per standard lot on EUR/USD

This “all-in” cost is substantially higher than the sub-$10 costs available at many top-tier, regulated ECN brokers. The lack of a clearly stated, verifiable commission structure makes it difficult for traders to perform accurate cost comparisons and is a red flag in itself.

Beyond spreads and commissions, several other factors contribute to the total cost and risk of trading with Uniglobe Markets.

For swing and position traders who hold trades overnight, swap fees are a major consideration. Uniglobe Markets offers an Islamic account, which is swap-free to comply with Sharia law. These accounts typically substitute swaps with a fixed daily or weekly administration fee on open positions. For all other account types, standard swap rates will apply, adding a credit or debit to a trader's account each day a position is held open past the market close. The exact rates are instrument-specific and can be found within the MT5 platform.

Uniglobe Markets offers high maximum leverage of up to 1:500. While this can amplify potential profits, it equally magnifies losses, making it an extremely high-risk tool. The provision of such high leverage by an unregulated broker is particularly concerning, as it lacks the protective guardrails—such as mandatory negative balance protection—enforced by regulators in jurisdictions like the EU, UK, and Australia. This high leverage can quickly lead to the total loss of a trader's capital.

The transparency of non-trading fees is another area of concern. While the broker's website may claim zero fees on deposits and withdrawals, the user complaints on WikiFX regarding withdrawal difficulties suggest this process is a significant point of friction. One user report specifically mentions using USDT-TRC20 (a cryptocurrency method) for deposits and withdrawals, a channel often favored by offshore entities for its speed and lower regulatory scrutiny, but which can also come with its own network fees and risks. Traders should be vigilant about potential inactivity fees, which are common in the industry, and clarify the exact terms for all withdrawal methods before funding an account.

On a more positive note, Uniglobe Markets provides its clients with the globally recognized MetaTrader 5 (MT5) platform. WikiFX confirms that the broker holds a “Full License” for MT5, which suggests a degree of technical maturity and a stable trading infrastructure.

The MT5 platform offers:

• Advanced charting tools and a wide array of technical indicators.

• Support for algorithmic trading through Expert Advisors (EAs).

• A familiar and powerful interface for both desktop and mobile trading.

• Access to a range of instruments, including forex, commodities, metals, energies, and CFDs on indices and stocks.

WikiFX data also provides some technical details, noting MT5 servers located in Germany with ping times in the 150-190 ms range. While not lightning-fast, this provides a tangible metric for traders concerned with latency.

This Uniglobe Markets commission fees and spreads analysis reveals a broker with a multi-tiered pricing model that, on the surface, appears to cater to different trader profiles. However, a closer, data-driven inspection raises serious questions about its cost-competitiveness and overall viability for serious, long-term traders.

The Uniglobe Markets spreads commissions pricing structure is characterized by a lack of transparency, particularly regarding its ECN commission fees. The benchmark minimum spread of 1.3 pips on its ECN Classic account is significantly higher than industry-leading regulated brokers. When combined with a hypothetical commission, the all-in cost appears uncompetitive.

More importantly, any discussion of pricing is fundamentally overshadowed by the broker's high-risk profile. The complete absence of credible regulation, multiple warnings from financial authorities, a history of user complaints about withdrawals, and an opaque corporate structure are overwhelming red flags. For an experienced trader whose primary goal is capital preservation and long-term growth, these risks are likely too great to bear, regardless of the advertised spreads. The potential for losing one's entire deposit to operational failure or malfeasance far outweighs any marginal savings on trading costs.

Ultimately, while a detailed pricing analysis is crucial, it's only one piece of the puzzle. Before committing any capital, cautious traders should consult WikiFX to get a comprehensive overview, including the latest user feedback and any new regulatory warnings concerning Uniglobe Markets.

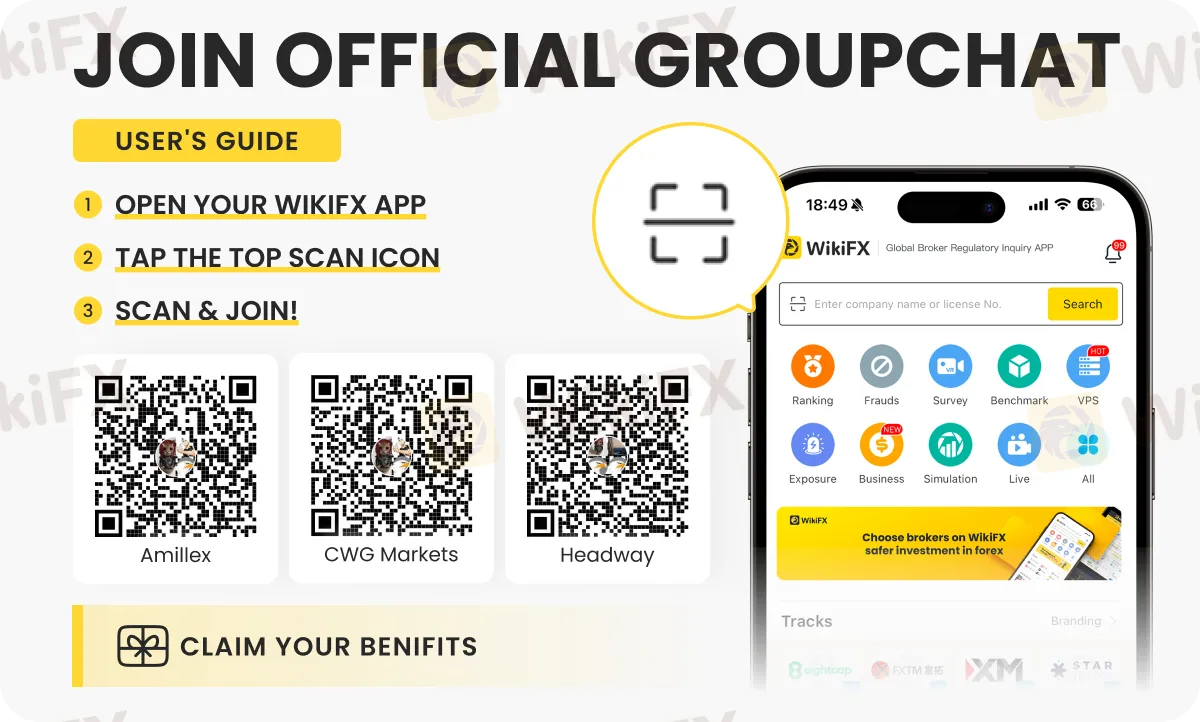

Stay updated about the latest forex news by following us on any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Join the group/s by following the instructions shown below.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.

Exclusive Markets review highlights weak offshore regulation and rising scams, including unpaid withdrawals. Multiple exposures demand caution—verify before trading.