Abstract:Do you find mBank services too slow or unresponsive? Do you find your account getting blocked? Failing to access your account online due to several systemic glitches? Can’t perform the transactions on the mBank app? Do you also witness inappropriate stop-level trade execution by the financial services provider? You are not alone! Frustrated by these unfortunate circumstances, many of its clients have shared negative mBank reviews online. In this article, we have shared some of the reviews. Read on!

Do you find mBank services too slow or unresponsive? Do you find your account getting blocked? Failing to access your account online due to several systemic glitches? Cant perform the transactions on the mBank app? Do you also witness inappropriate stop-level trade execution by the financial services provider? You are not alone! Frustrated by these unfortunate circumstances, many of its clients have shared negative mBank reviews online. In this article, we have shared some of the reviews. Read on!

Top Complaints Against mBank

Account Block and the Problems That Followed for the Client

An mBank client recently reported that he lost access to his account and tried to unlock it online. However, the client could not do it successfully. The client further added that mBank issued him a card a year later and kept charging for four years despite it remained inactive during the period. Expressing disappointment over how the bank changed from good to bad, the client said these while sharing the mBank review online.

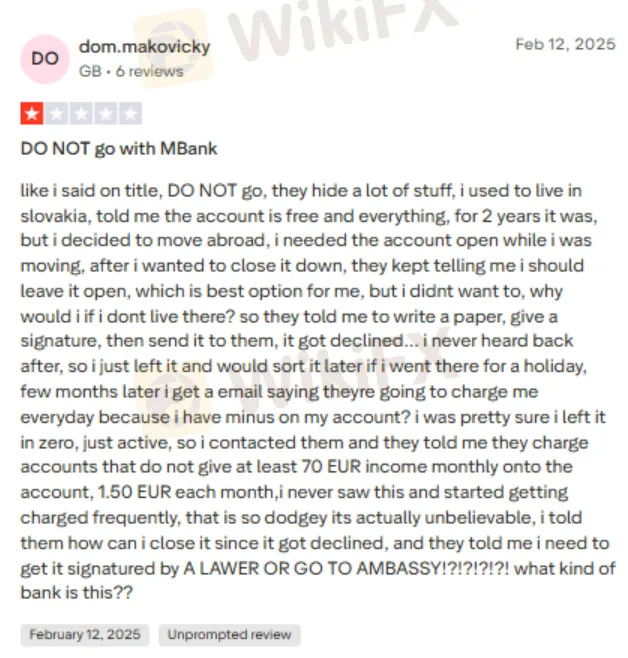

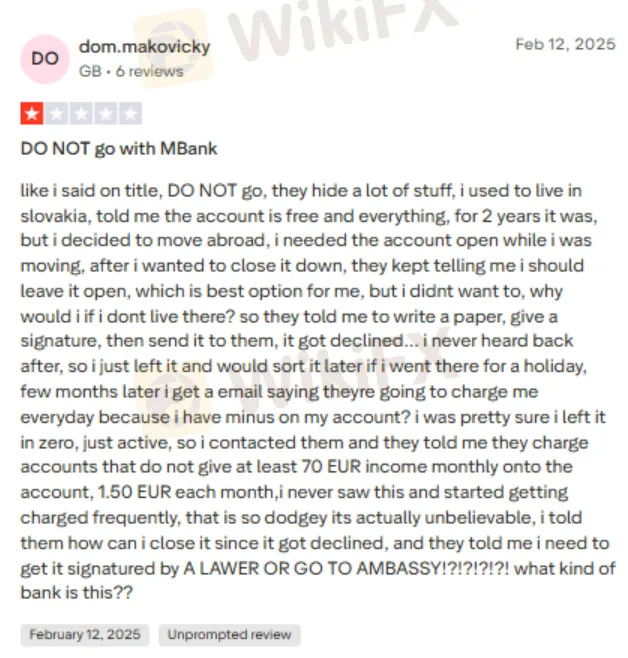

Account Closure Request Rejection Along with Illegitimate Fees Deduction

The client imposed severe allegations on mBank by saying that the latter hid vital information. As per his admission, the client wanted to close his Slovakian account. However, mBank constantly rejected the request. Whats worse is that the bank debited daily fees as the account did not receive the required monthly income of €70. The client conceded that this was never disclosed to him. Check the screenshot below to know the entire matter.

The Perennial Online Account Access Loss

An mBank client recently reported having lost online account access. Although, as per her admission, the mobile app works. However, the client cannot perform transactions through the app. The client tried to resolve the issue by even visiting the bank with his ID, computer and phone. The bank did offer him two activation letters. However, despite these, the client could not regain online bank account access. This made the client share this mBank review.

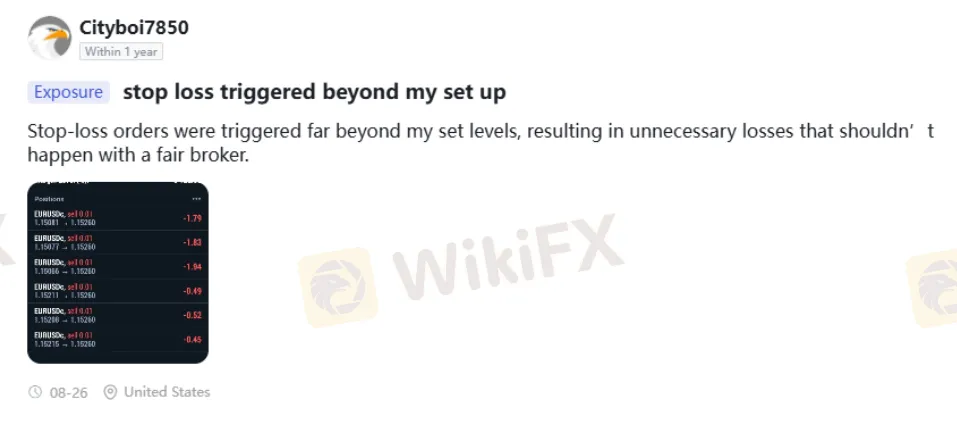

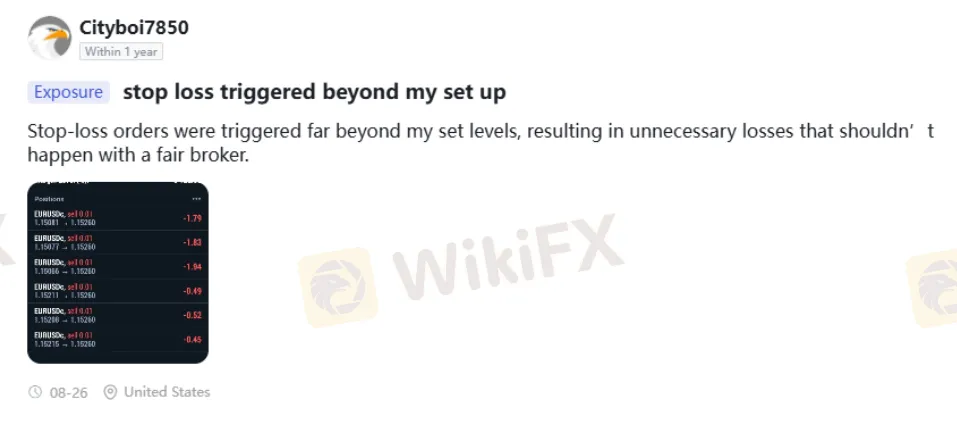

Stop-loss Triggered Way Before the Preset Level

A forex complaint was also raised, with the trader accusing mBank of closing the trade well before the stop-loss level. This caused losses for the trader. As a result, the trader shared this mBank review.

WikiFX Shares mBank Review: A Close Look at Score & Regulatory Status

The WikiFX team took notice of the complaints against mBank and found that it is unlicensed. This sounds alarming for anyone wishing to open accounts with this bank. In view of the elevated risks, the team gave mBank a score of 2.32 out of 10.

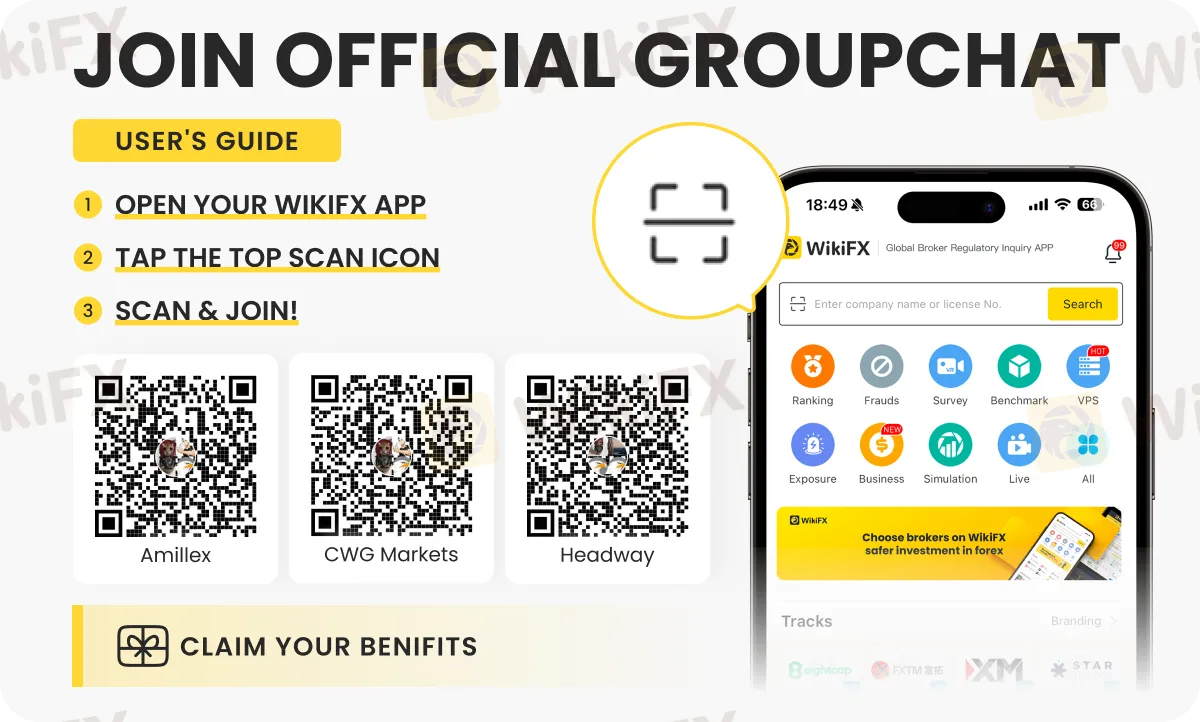

For the latest information about the forex landscape, join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.