简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GGCC Bonus and Promotions: A Data-Driven Analysis for Experienced Traders

Abstract:In the competitive landscape of forex and CFD trading, brokers often use bonuses and promotions as a primary tool to attract new clients. For experienced traders, these offers can seem like an opportunity to enhance trading capital or offset costs. However, the true value of any promotion lies not in its headline figure, but in the integrity of the broker offering it and the fairness of its terms. This review provides an in-depth, data-driven analysis of GGCC bonus and promotions, aiming to cut through the noise and reveal what traders truly need to know.

In the competitive landscape of forex and CFD trading, brokers often use bonuses and promotions as a primary tool to attract new clients. For experienced traders, these offers can seem like an opportunity to enhance trading capital or offset costs. However, the true value of any promotion lies not in its headline figure, but in the integrity of the broker offering it and the fairness of its terms. This review provides an in-depth, data-driven analysis of GGCC bonus and promotions, aiming to cut through the noise and reveal what traders truly need to know.

Our investigation hinges on a critical examination of Global Gold & Currency Corporation (GGCC), scrutinizing its promotional landscape—or lack thereof—against its operational and regulatory framework. Using verified data as our foundation, primarily from the global broker regulatory inquiry platform WikiFX, we will explore the broker's safety, trading environment, and the significant risks that may lurk behind the promise of a bonus.

The Critical Distinction: GGCC vs. GGPoker

A preliminary search for “GGCC bonus” often leads to a significant point of confusion that must be addressed immediately. Many online results prominently feature “GGPoker,” an online poker and gambling website known for its large-scale promotions, welcome bonuses, and tournament giveaways, such as its “$14M November Giveaway” and “100% matched deposit bonus up to $600.”

It is imperative for traders to understand that GGPoker is an entirely separate entity from the forex broker Global Gold & Currency Corporation (GGCC). GGCC, which operates the domain ggccfx.com, is a forex and CFD broker. The lavish, well-documented promotions associated with GGPoker have no connection to the trading services or offers provided by GGCC. Traders evaluating the forex broker must disregard any information related to the poker site to avoid falling into a marketing trap based on a simple name similarity. Our analysis from this point forward will focus exclusively on the forex broker, GGCC.

GGCCs Regulatory Status: A Foundation of Sand

For any experienced trader, the first and most crucial due diligence step is verifying a broker's regulatory credentials. Regulation is the bedrock of trust, ensuring client fund segregation, fair dealing practices, and a legal avenue for dispute resolution. An analysis of GGCC's regulatory standing reveals a deeply concerning picture.

According to its profile on WikiFX, Global Gold & Currency Corporation is a broker registered in Saint Lucia and has been in operation for 2-5 years. The platform assigns GGCC a staggeringly low score of 0.90 out of 10. More alarmingly, the regulatory status is explicitly flagged with the following warnings:

• “No valid regulatory information, please be aware of the risk!”

• “Suspicious Regulatory License”

• “Warning: Low score, please stay away!”

This lack of valid regulation is the single most important factor in this review. Operating without oversight from a reputable financial authority (like the FCA in the UK, ASIC in Australia, or CySEC in Cyprus) means that GGCC is not legally bound to adhere to the strict standards that protect traders. There are no guarantees of:

• Segregated Accounts: Client funds may be co-mingled with the company's operational funds, putting them at extreme risk in the event of broker insolvency or malpractice.

• Negative Balance Protection: Traders could potentially lose more than their deposited capital.

• Fair Execution: The broker is not monitored for practices like price manipulation or excessive slippage.

• Recourse: If a trader encounters issues, such as withdrawal denials, there is no regulatory body to appeal to for assistance.

The registration in Saint Lucia further compounds these concerns. While a legitimate business location, it is also known as an offshore jurisdiction with notoriously light-touch financial regulation, making it a popular choice for brokers wishing to avoid stringent oversight. For traders considering this broker, it is highly advisable to visit WikiFX to independently verify the current regulatory status and see the detailed breakdown of the broker's low score.

A Deep Dive into GGCC Bonus and Promotions

Given the severe regulatory red flags, the conversation about GGCC bonus and promotions shifts from “Are they good?” to “Do they even exist, and what is their true purpose?”

A thorough review of the WikiFX data and the broker's listed website reveals a conspicuous absence of specific, publicly advertised bonus schemes. There are no mentions of deposit bonuses, no-deposit bonuses, rebates, or loyalty programs. This lack of transparency is, in itself, a significant warning sign. Reputable brokers are typically clear and upfront about their promotional offers, with dedicated pages outlining the terms and conditions.

The absence of information leads to two likely possibilities:

1. GGCC offers no promotions: The broker may not use bonuses as part of its acquisition strategy.

2. Promotions are offered privately and strategically: This is a far more concerning scenario and a common tactic among unregulated brokers. In this model, bonuses are not a standardized offer but a discretionary tool used by account managers to entice larger deposits or to placate clients who are having issues.

These “private” bonuses are often designed as traps. They come with predatory terms and conditions that are not disclosed until after a deposit is made, effectively locking the trader's capital.

GGCC Bonus Conditions and Promotion Analysis: The Unseen Traps

While we cannot analyze specific GGCC bonus terms that are not published, we can perform a GGCC bonus conditions and promotion analysis based on the typical predatory clauses used by brokers with this risk profile. Experienced traders should be on high alert for the following potential traps:

• Impossible Trading Volume Requirements: A broker might offer a $500 bonus on a $2,000 deposit but require the trader to execute 200 or 500 standard lots to “unlock” the bonus for withdrawal. For most retail traders, this volume is unattainable and serves only to encourage over-trading and risk-taking.

• Capital Lock-In: The most dangerous clause is one that prevents the withdrawal of not just the bonus, but the trader's own deposited capital until the volume requirements are met. This effectively holds the client's funds hostage.

• Profit Forfeiture: Some terms state that any profits made while the bonus is active are considered “bonus-derived profits” and can be voided at the broker's discretion, especially if a withdrawal is requested before meeting the turnover target.

• Ambiguous and Subjective Clauses: Unregulated brokers often use vague language like “trading activity must be deemed legitimate by the company” or “abuse of the bonus policy will lead to cancellation.” This gives the broker unilateral power to cancel profits or block withdrawals without a clear, objective reason.

Given GGCC's regulatory status and the user complaints documented on WikiFX, it is highly probable that any bonus offered would be a tool for client retention through coercion rather than a genuine value-add.

Real Trader Experiences: A Pattern of Problems

Theoretical risks become concrete when backed by user-generated data. The “Exposure” section on GGCC's WikiFX profile paints a damning picture, with numerous verified complaints from traders, primarily from India. These firsthand accounts directly contradict the idea of a trustworthy trading partner and align perfectly with the dangers of unregulated brokers.

Key themes from trader complaints include:

• Withdrawal Obstruction: This is the most common and severe complaint. Users report:

– “My withdrawal has been delayed and Pending for long I havent received it...”

– “...my dashboard isnt showing the balance of my funds…. this broker is really Scammers”

– “I made withdrawal but since its has been pending... the CS is no longer responding”

– One user described being drowned in “endless verification” requests—selfies, utility bills, bank statements, notarized letters—as a deliberate stalling tactic to prevent a withdrawal.

• Poor Trading Conditions and Platform Manipulation: Beyond fund access, the trading environment itself is heavily criticized.

– Extreme Slippage: Multiple traders complain of “severe slippage,” with one stating, “All my stoploss were hit because of negative balances caused by the slippage.” Another notes, “This slippage issue could turn your trading experience into a frustrating ordeal.”

– Unmanageable Spreads: One user mentions battling “criminal spreads.”

– Account Deactivation: A trader reported their account was deactivated after incurring losses, preventing any attempt to withdraw remaining funds.

These reports of withdrawal blockages, excessive slippage, and unresponsive customer service are classic hallmarks of a fraudulent operation. The promise of any bonus is rendered completely meaningless if a trader cannot access their initial deposit, let alone any profits.

It is worth noting that there are two “Unverified” positive reviews. However, their generic praise (“withdrawals happen at the speed of light,” “I feel safe and secured”) lacks the specific detail of the negative complaints and should be viewed with extreme skepticism, as such reviews are easily fabricated.

A Look at GGCC's Trading Infrastructure

To complete our analysis, we examine the trading infrastructure and account details provided by WikiFX.

• Trading Platform: GGCC offers the MetaTrader 5 (MT5) platform and holds a “Full License.” It is crucial to understand that an MT5 Full License is a software license purchased from MetaQuotes. It is not a financial regulatory license. Unregulated brokers often leverage the “Full License” terminology to create a false sense of security. While it means they have a legitimate version of the platform, it says nothing about their business ethics or financial stability.

• Account Types: The broker lists several account tiers (Micro, Standard, Premium, etc.), with the “Master” account requiring a minimum deposit of $2000. Entrusting such a sum to an entity with a 0.90/10 score and no valid regulation is an exceptionally high-risk proposition.

• Leverage: The maximum leverage is listed as 1:300. While moderate by offshore standards, high leverage combined with an unregulated environment is a recipe for disaster. It amplifies the risk of rapid losses, which can be exacerbated by the reported slippage issues.

• Tradable Instruments: GGCC claims to offer Forex, Commodities, Crypto, Stocks, and Indices. This wide selection is irrelevant if the underlying execution is faulty and withdrawals are systematically blocked.

Conclusion: A Clear Verdict on GGCC and its Promotions

The search for GGCC bonus and promotions ultimately leads to a far more important discovery: Global Gold & Currency Corporation is an unregulated, offshore broker with a rock-bottom trust score and a long list of serious user complaints related to withdrawal failures and platform manipulation.

There is no public evidence of any legitimate, structured bonus program. Any promotional offer a trader might receive from GGCC should be viewed not as an opportunity, but as a baited hook designed to secure a deposit that may never be seen again. The analysis of potential bonus conditions reveals a high probability of predatory terms designed to lock in client funds.

The overwhelming evidence points to a single, unavoidable conclusion: GGCC is an extremely high-risk broker that experienced traders should avoid at all costs. The fundamental requirements of safety, reliability, and fund security are entirely absent. The allure of a potential bonus is insignificant when faced with the near-certainty of encountering severe operational problems and the potential loss of one's entire investment.

Before making a final decision on any broker, especially one with as many red flags as GGCC, prudent traders should always consult WikiFX to get a comprehensive and structured overview of its regulatory data, user feedback, and overall risk profile. In the case of GGCC, the verdict is already clear: the risk is not worth any reward.

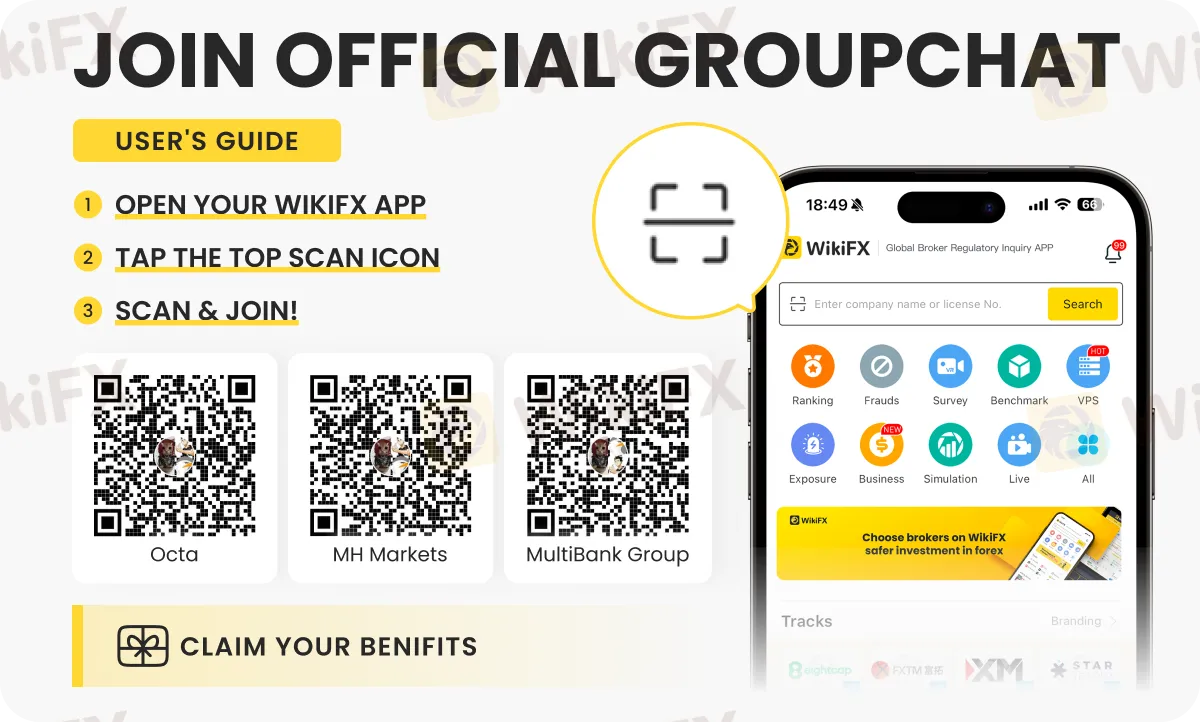

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC Withdraws CIF License of OBR Investments Ltd (OBRInvest)

RM115 Million Lost in a Month: Are Malaysians Underestimating Investment Scams?

Invest RM300, Make RM10,000? Police Say It’s a Scam

XBTFX Review: Beware of Offshore Regulated Forex Traps

FX Markets: King Dollar Reigns Amid Chaos; BoJ Eyes "Neutral" Rates

War in the Middle East: Oil Spikes and Stocks Tumble as Conflict Enters "Uncharted Territory"

Geopolitical Conflict Drives Gold Rally as Insurers Cut Gulf Coverage

Middle East Tensions Rattle Risk Sentiment: Airspace Closures Signal Supply Fears

Oil Markets Rally as Escalating Middle East Conflict Threatens Supply Lines

Investment Scams That Could Be Targeting Malaysians Right Now

Currency Calculator