Abstract:Trading Pro Review reveals scam alerts, fake offices, and withdrawal issues. Stay cautious with this unregulated broker.

Trading Pro Review: Regulation and Red Flags

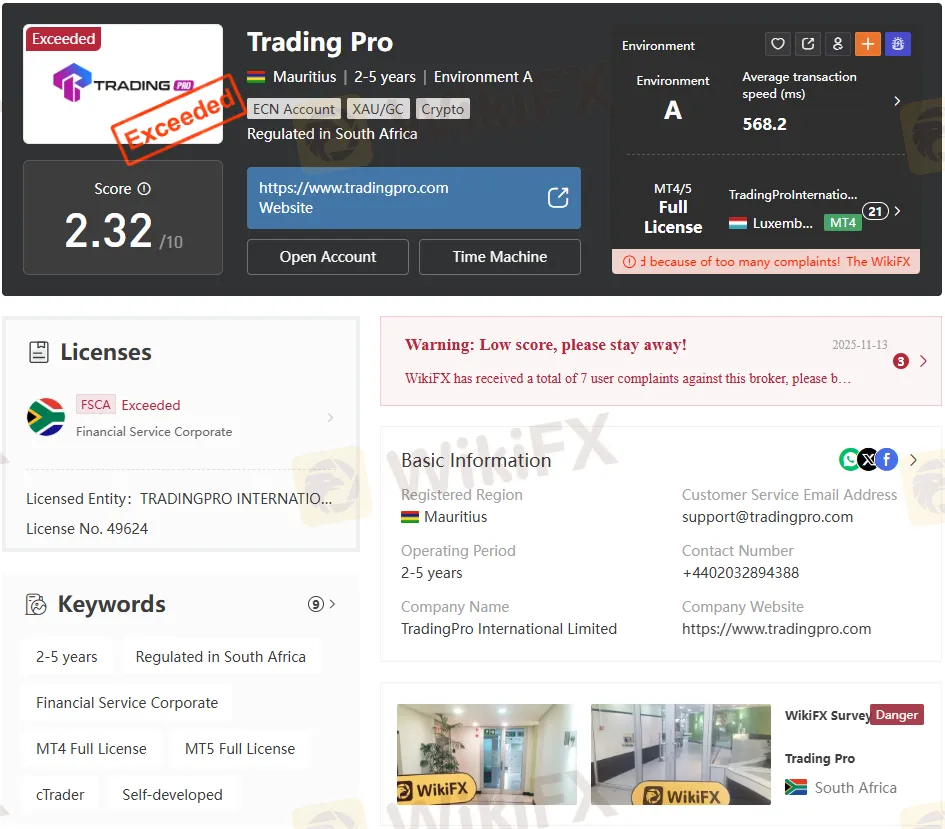

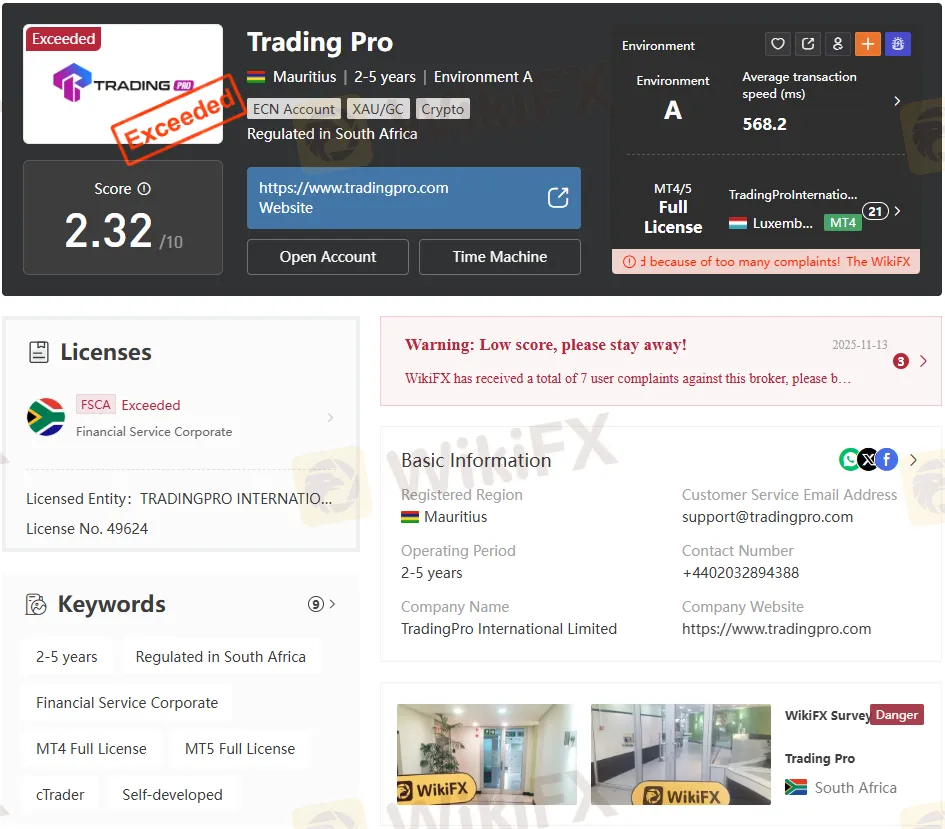

Trading Pro International Limited positions itself as a global forex and CFD broker, but the evidence collected in the attached records paints a troubling picture. The company claims regulation under South Africas Financial Sector Conduct Authority (FSCA), license number 49624, yet the license status is marked “Exceeded”—a designation that signals non‑compliance.

Investigators visiting the listed South African office (Pharos House, Durban) found no physical presence, confirming suspicions that Trading Pro operates without genuine oversight. WikiFX surveys further highlight the absence of verifiable offices and a low trust score of 2.32/10, warning traders to stay away.

Key Regulatory Findings:

- FSCA license exceeded, not valid for current operations

- No verified office in South Africa despite claims

- Registered in Mauritius, operating for 2–5 years

- Multiple complaints filed (7 documented cases)

This regulatory opacity is the first major red flag in the Trading Pro Review.

Trading Pro Exposed: User Complaints and Withdrawals

The brokers credibility collapses when examining user experiences. One trader reported being lured at the Dubai Forex Expo with a 100% deposit bonus. After making profits, the withdrawal request was denied, citing “account violations.” Both profits and bonuses were removed.

Transaction records from 2025 show repeated issues:

- Deposits via crypto wallets are approved but later offset by “credit expired” entries.

- Transfers in/out between wallets and MT5 accounts, often reversed or nullified.

- Withdrawals are blocked, leaving traders unable to access funds.

These records confirm a pattern: deposits are accepted, but withdrawals are systematically obstructed. This aligns with the “Trading Pro Exposed” narrative circulating in trader forums.

Trading Pro Review: Accounts and Trading Conditions

Trading Pro advertises multiple account types—ScalpX, Pro, Rookie, and Micro—with leverage up to 1:2000. Minimum deposits vary from $1 to $50, depending on the account tier.

Account Features:

- Minimum spreads: from 0.0 (ScalpX) to 1.6 (Rookie)

- Supported platforms: MT4, MT5, cTrader, proprietary app

- Deposit/withdrawal methods: Visa, MasterCard, Neteller, crypto

- Minimum position size: 0.01 lots

While these conditions appear attractive, they mask deeper risks. High leverage combined with unregulated oversight exposes traders to extreme volatility and broker manipulation.

Trading Pro Exposed: Platforms and Performance

Trading Pro promotes full licenses for MT4 and MT5, with claims of multiple servers and average execution speeds of 79.82 ms. However, independent testing shows inconsistencies:

- Demo servers in Mauritius with latency exceeding 169 ms

- Reports of slippage and delayed order execution

- The cTrader platform is available but with limited adoption (217 downloads)

The brokers proprietary app boasts over 1,200 downloads, yet reviews highlight poor functionality and frequent login issues.

Platform Snapshot:

- MT4: 4 servers, advertised as “perfect”

- MT5: 3 servers, mixed latency results

- cTrader: minimal user base

- Mobile app: unstable, low trust

These findings reinforce the “Trading Pro Exposed” theme—marketing promises rarely match operational reality.

Trading Pro Review: Pros, Cons, and Bottom Line

Pros:

- Multiple account types with low minimum deposits

- Access to MT4, MT5, and cTrader platforms

- Wide range of instruments (forex, gold, crypto)

Cons:

- Regulatory license exceeded, no valid oversight

- Fake offices and unverifiable addresses

- Documented withdrawal failures and credit reversals

- Low trust score (2.32/10) and multiple complaints

- Aggressive bonus schemes tied to blocked withdrawals

Bottom Line

This Trading Pro Review demonstrates why traders should exercise extreme caution. Despite offering attractive spreads, leverage, and platform diversity, the brokers regulatory failures, withdrawal obstructions, and fake office listings outweigh any potential benefits.

Verdict: Trading Pro Exposed as a high‑risk, unregulated broker. Traders are advised to avoid engagement and seek regulated alternatives with transparent operations.