Abstract:Protect your investments in the Philippines with WikiFX, the trusted forex scam checker app that helps traders verify brokers and avoid fraud.

Forex Trading Risks in the Philippines

Forex trading has become increasingly popular among Filipino investors, particularly as accessible mobile trading platforms attract both beginners and experienced traders. Yet beneath the promise of fast profits lies a darker side—scam brokers, fraudulent traders, and fly-by-night operations that prey on uninformed investors.

The need for a reliable forex scam checker Philippines service has never been greater. According to data gathered by the Bangko Sentral ng Pilipinas (BSP), forex-related complaints have risen sharply since 2020, with many cases involving unregistered foreign exchange entities operating through social media or messaging apps.

Amid these risks, platforms like WikiFX App are gaining traction as trusted tools for transparency and verification, helping traders confirm a brokers legitimacy before depositing a single peso.

Why Forex Scams Are Rising in the Philippines

Several factors contribute to the increase in forex-related fraud across the country. First, more Filipinos are venturing into alternative income streams amid economic uncertainty, making them easy targets for get-rich-quick schemes. Second, scam operators are becoming more sophisticated—using fake regulatory licenses, cloned broker websites, and misleading influencer marketing campaigns.

Investigations by the National Bureau of Investigations Cybercrime Division show that many forex scams now operate through localized Telegram groups and Facebook communities. Scammers often impersonate legitimate financial analysts or claim affiliation with reputable foreign institutions.

Without a forex scam checker Philippines tool like WikiFX, many victims realize too late that their “broker” was never licensed in the first place. The need for verifiable data, accurate reviews, and regulator-backed transparency is no longer optional—its essential.

What Makes WikiFX a Trusted Forex Verification Tool

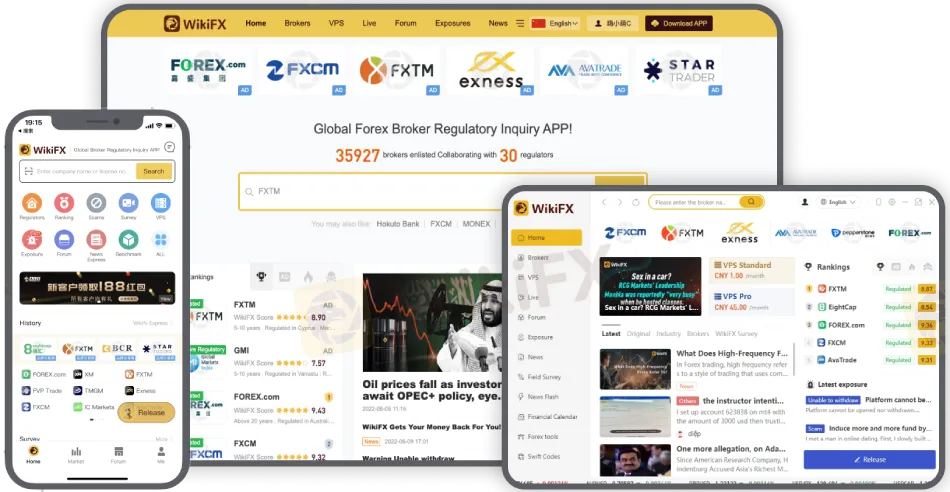

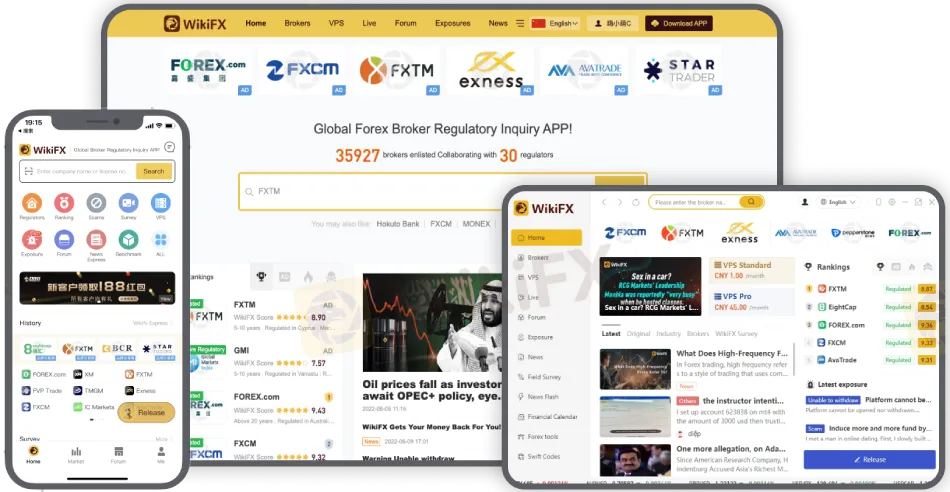

WikiFX, first launched internationally in 2018, has emerged as one of the most comprehensive forex scam checker platforms serving the global trading community. The app evaluates brokers based on multiple verifiable data points:

- Regulatory licenses and geographical jurisdiction

- History of complaints and penalties from financial authorities

- User feedback and detailed company background checks

- Security ratings and operational transparency

For traders in the Philippines, this means you can input a brokers name into the WikiFX App and instantly access its regulatory status, license validity, and disciplinary history. This database-driven approach helps Filipino traders distinguish between reputable global brokers and fraudulent entities posing as licensed financial firms.

How the WikiFX App Works in the Philippines

The WikiFX App simplifies the process of broker validation by combining advanced data modeling with real-time regulatory monitoring. Using both local and international data sources, the app cross-references broker details with official records from global authorities such as:

- U.S. Commodity Futures Trading Commission (CFTC)

- UK Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Philippine Securities and Exchange Commission (SEC)

Once a user enters a broker‘s name or website domain, WikiFX assigns a score that reflects the broker’s regulatory trustworthiness, risk profile, and operational credibility.

With the Philippines experiencing a rapid surge in online forex participation, this verification process is not only useful but increasingly necessary for traders aiming to reduce risk exposure.

Real Stories: Filipino Traders Share Their Experiences

Local trading forums and Facebook groups have become the heart of forex community discussions, but theyve also been breeding grounds for misinformation. Dozens of Filipino traders who fell victim to fraudulent brokers have turned to WikiFX to warn others.

For instance, a trader from Cebu shared in an interview that after verifying her broker through WikiFX, she learned that its claimed license from the “European Financial Market Authority” was fabricated. Another from Davao discovered that the broker he had invested with was blacklisted in multiple countries—a red flag only visible through the apps regulatory database.

These experiences highlight why the forex scam checker Philippines keyword is trending in local search results—Filipinos are increasingly vigilant and seeking dependable verification tools.

The Role of Regulation and Government Oversight

The Philippine Securities and Exchange Commission (SEC) continues to issue warnings against unregistered online investment platforms, especially forex-related schemes. In recent advisories, the SEC listed dozens of entities suspected of engaging in unauthorized financial activities targeting local investors.

However, government enforcement can only go so far. With the cross-border nature of online forex trading, Filipino traders often deal with offshore entities outside the SECs jurisdiction. This gap underscores the importance of platforms like WikiFX App, which maintain a global database of brokers regulated (or banned) in multiple jurisdictions.

By bridging this regulatory gap, WikiFX offers Filipino traders the tools to apply due diligence before investing—something that manual checks or traditional research methods often fail to deliver.

How to Protect Yourself from Forex Scams

Every Filipino trader should follow a systematic approach when entering the forex market to minimize risk. Here are key steps that align with the best practices promoted within the WikiFX community:

- Always verify a brokers regulatory license using a trusted forex scam checker Philippines app.

- Review the brokers operating history, company records, and compliance score.

- Avoid platforms that promise “guaranteed” profits or fixed returns—no legitimate forex broker can lawfully do that.

- Double-check payment channels: reputable brokers typically use bank wires or authorized payment gateways, not crypto transfers or peer-to-peer deposits.

- Seek peer reviews on forums, but rely only on verifiable sources.

Ultimately, the best protection is informed awareness. Apps like WikiFX equip Filipino traders with the information they need to make smart, data-driven decisions before committing capital.

Why WikiFX Should Be Your First Line of Defense

In an environment flooded with online trading promises, verified data remains your strongest protection. WikiFX offers that layer of transparency that separates speculation from security. By leveraging its database of more than 40,000 global brokers and public regulatory reports, it empowers Filipino traders to avoid scams before they happen.

As forex trading continues to grow in the Philippines, using the WikiFX Forex Scam Checker isn‘t just about verifying licenses—it’s about building a culture of financial literacy and discipline in a decentralized, digital market. For Filipino traders seeking safer ways to grow their forex journey, WikiFX may well be the first essential download.

FAQ: Forex Scam Checker Philippines

1. What is the forex scam checker Philippines feature in WikiFX?

It is a real-time verification tool that helps Filipino traders confirm whether a forex broker holds a valid regulatory license and whether any fraud warnings have been issued.

2. Is WikiFX recognized by official regulators?

WikiFX collaborates with major global regulators like the SEC, ASIC, and FCA to maintain verified, cross-border data access but operates independently as an information provider.

3. How reliable are the WikiFX broker ratings?

Each score is based on multiple performance indicators such as licensing, legal disputes, and transparency levels, making it a reliable reference for evaluating broker legitimacy.

4. Can WikiFX help recover funds from scam brokers?

While WikiFX cannot facilitate recovery directly, it assists by documenting verified broker information that can support official complaint filings with local authorities.

5. How can Filipino users report suspicious forex brokers on WikiFX?

Users can submit reports directly in-app through the “Exposure” section, where credible complaints contribute to platform audits and public scam alerts.