Abstract:Recently, WikiFX received multiple reports from traders who used to trade with TenX Prime, claiming this broker has defrauded them. According to these traders, the PAMM (Percent Allocation Management Module) system of TenX Prime has completely stopped responding since October, leading to significant financial losses among investors.

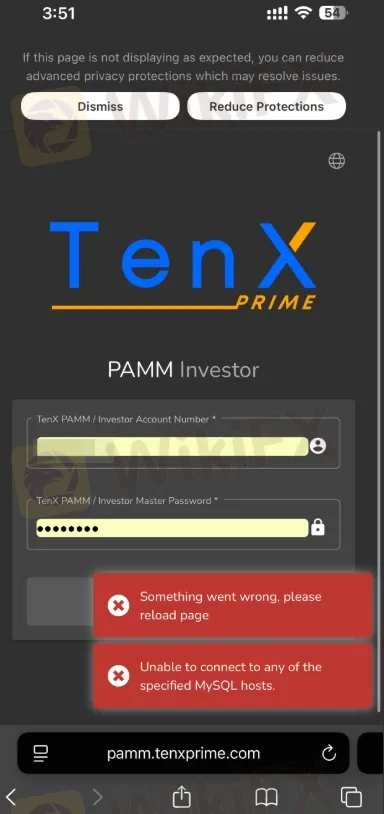

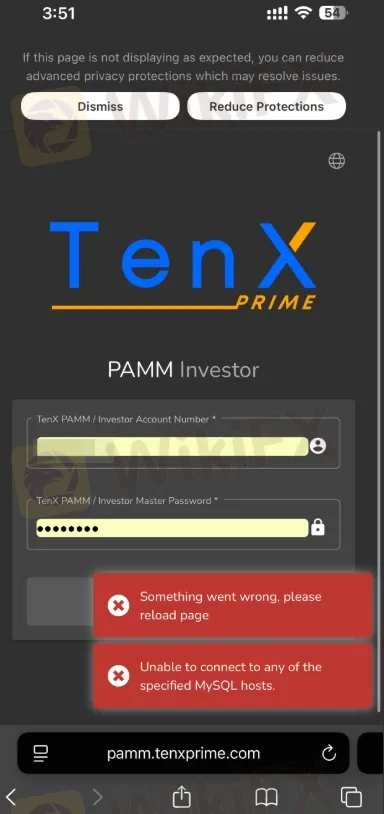

Recently, WikiFX received multiple reports from traders who used to trade with TenX Prime, claiming this broker has defrauded them. According to these traders, the PAMM (Percent Allocation Management Module) system of TenX Prime has completely stopped responding since October, leading to significant financial losses among investors.

Massive Investor Losses Reported

The collapse of the PAMM system has reportedly affected over 1,200 traders, many of whom entrusted their funds to TenX Prime‘s managed accounts with the expectation of stable returns. However, since early October, users have been unable to access their accounts, withdraw profits, or even contact the broker’s support team.

Numerous traders have described the situation as a total blackout — trading dashboards became unresponsive, and the brokers website either stopped updating or failed to display account balances accurately. This has caused widespread panic and confusion within the trading community.

WikiFX has released an article about one case that TenX Prime has scammed investor.

Click here for more story

According to the website of this platform, the operation information and relevant company information are unclear. The lack of transparency raises public concern, which traders should pay attention to this matter.

Besides, the most typical practice of TenX Prime to attract investors is to promise excessive profits. In the short term, claims such as “doubling” and “principal guarantee” have made investors' dreams come true. This kind of behavior of exaggerating profits is a typical deceptive measure and will hinder investors' calm judgment. Investors should pay attention to these “traps” and adopt realistic investment strategies.

Continuous Complaints from Traders

WikiFX continues to receive emails and complaints daily from traders claiming that TenX Prime has withheld their funds and ignored all communication attempts. Some investors reported that the broker initially promised “temporary maintenance” but later shut down all responses entirely.

Such behavior raises serious concerns that TenX Prime may be operating a fraudulent investment scheme, using its PAMM system as a tool to attract deposits before disappearing with client funds.

Red Flags and Unregulated Operations

Investigations indicate that TenX Prime does not hold a valid regulatory license from any recognized financial authority. This lack of oversight means that investor funds are not protected under any financial compensation scheme, leaving victims with little recourse.

Unregulated brokers often exploit investor trust through high-return promises and automated trading systems such as PAMM or copy trading tools. Once they accumulate enough deposits, they may freeze withdrawals or shut down platforms without notice — a pattern that appears consistent with TenX Primes current situation.

Stay Vigilant and Report Suspicious Brokers

Traders are strongly advised to avoid engaging with TenX Prime or any entities claiming affiliation with it. If you have invested with this broker and experienced similar issues, report your case to WikiFX or your local financial regulator immediately.

Before investing, always verify a brokers licence and read reviews from trusted sources. A simple background check can help prevent devastating losses caused by fraudulent platforms.

Comparison Table: TenX Prime VS Regulated Brokers

Conclusion

The situation surrounding TenX Primes PAMM system shutdown underscores the growing risks of investing with unregulated brokers. With over 1,200 traders reportedly affected and ongoing complaints surfacing daily, this case serves as a critical warning to the trading community.

For safe trading:

- Always choose licensed and transparent brokers.

- Confirm regulation via the regulators official register.

- Avoid brokers that suddenly stop responding, delay withdrawals, or claim unrealistic returns.

- Use caution when trading PAMM, copy accounts or high-leverage products with unverified brokers.