Abstract:If you don’t find any review about broker. Does it make you suspicious about that particular broker? Qorva Markets is one such broker you can’t find any reviews about it. And it’s not just that — there are other red flags too that put this broker under the radar. Discover 7 legit reasons to stay away from it.

If you don‘t find any reviews about a broker, does it make you suspicious about that broker? Qorva Markets is one such broker you can’t find any reviews about it. And its not just that — there are other red flags too that put this broker under the radar. Discover 7 legit reasons to stay away from it.

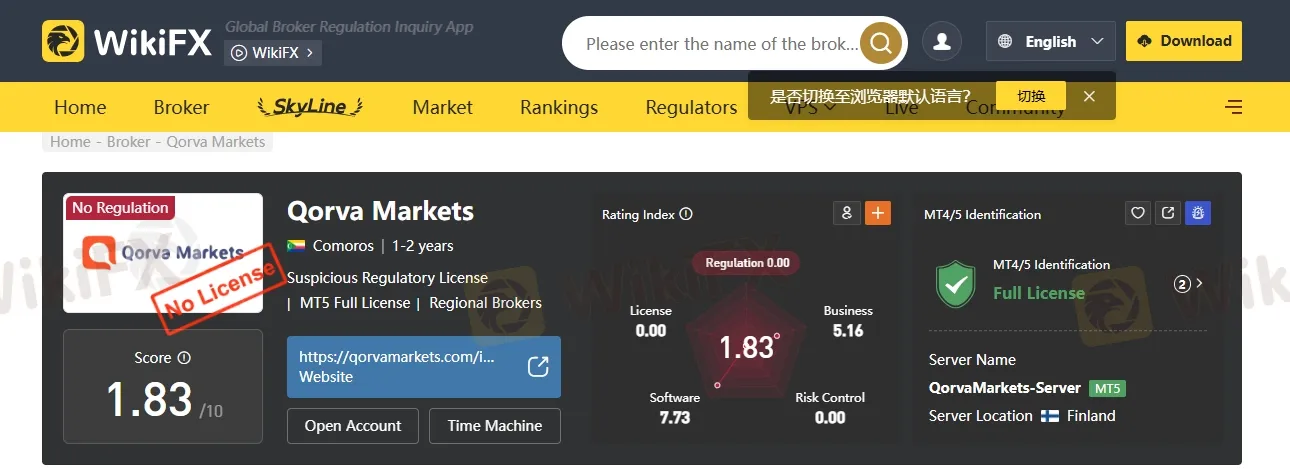

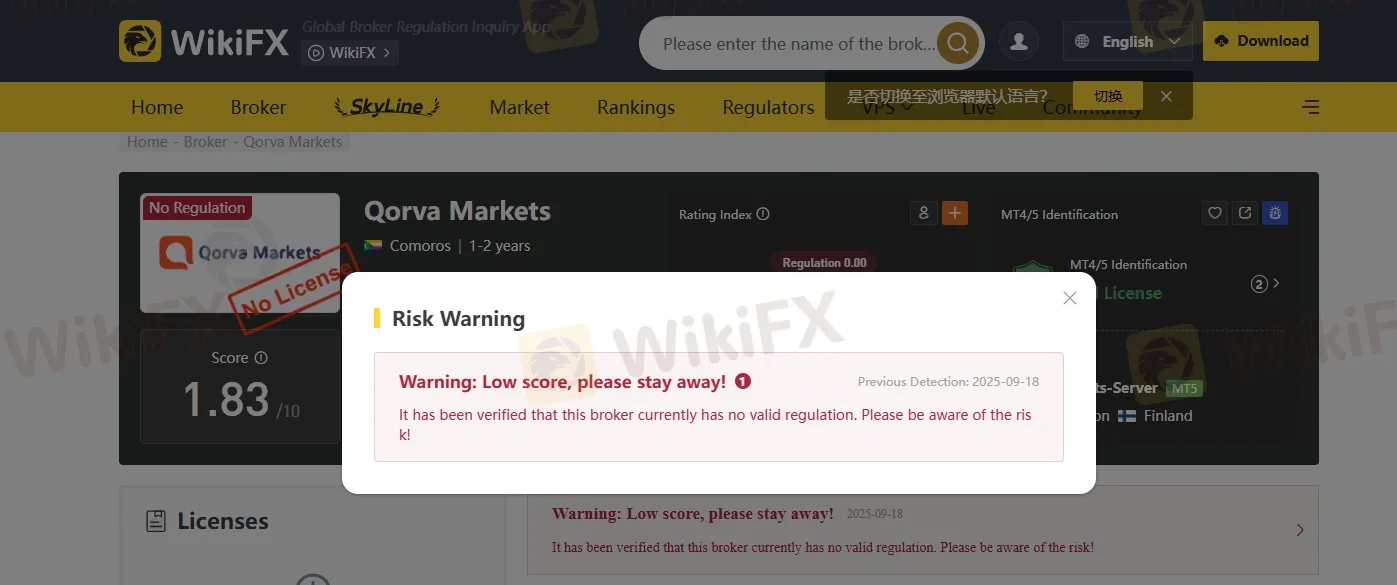

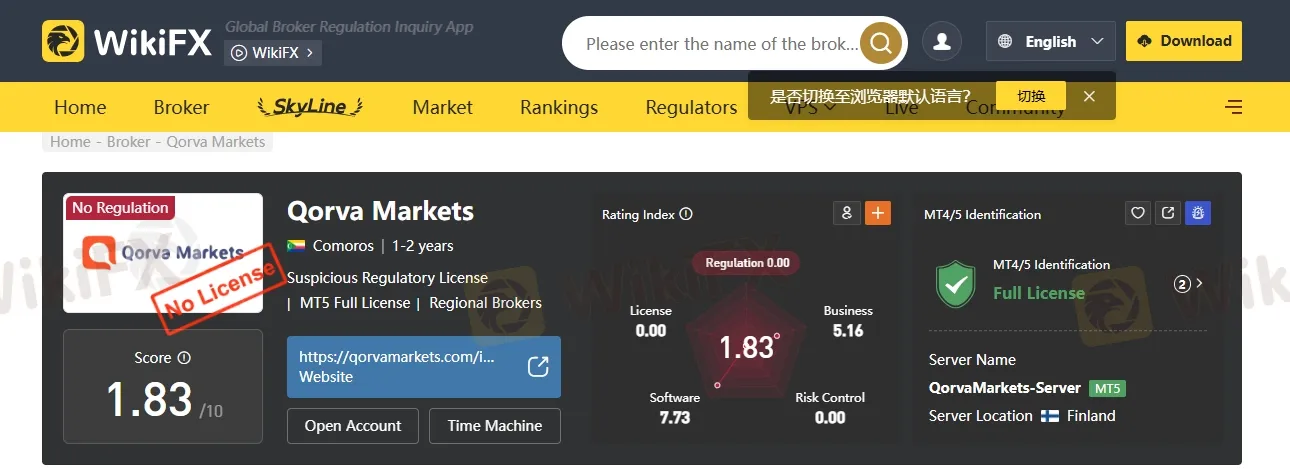

1. Extremely Low Score on WikiFX

One of the first things any smart trader should check before choosing a broker is its trust score. According to WikiFX, Qorva Markets receives an alarmingly low score of 1.83 out of 10, which is far below the minimum threshold for reliability. A score this low raise immediate concerns about the brokers legitimacy, transparency, and overall quality of service. Such a poor rating suggests high level of risk for traders and investors who are considering opening an account with them.

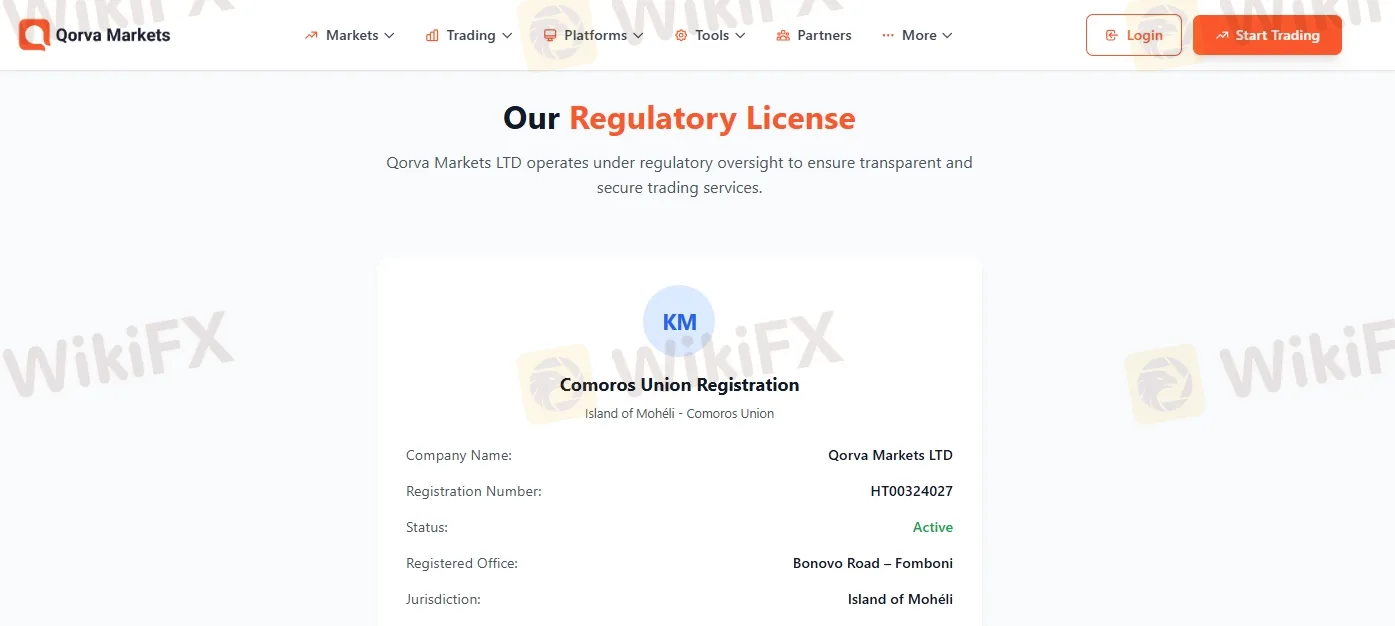

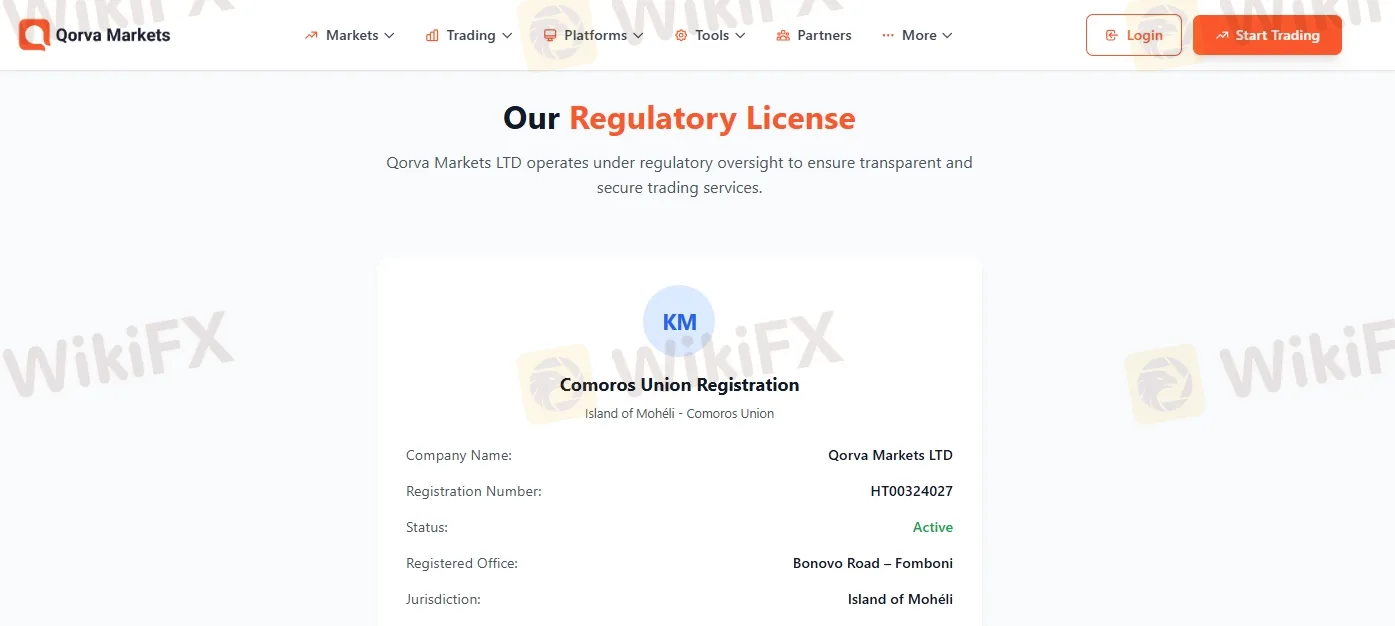

2. Weak Regulation

Qorva Markets claims to be regulated by the Comoros Union specifically, the Island of Mohéli. This jurisdiction is widely known for offering offshore registrations with minimal oversight, making it a preferred destination for brokers looking to avoid strict regulatory scrutiny. Regulation from such entities does little to protect traders, especially when it comes to issues like fund security, dispute resolution, and compliance. While, top-tier regulators such as FCA (UK), ASIC (Australia), or CySEC (Cyprus), the Comoros Union lacks transparency and enforcement power making this regulatory claim highly questionable.

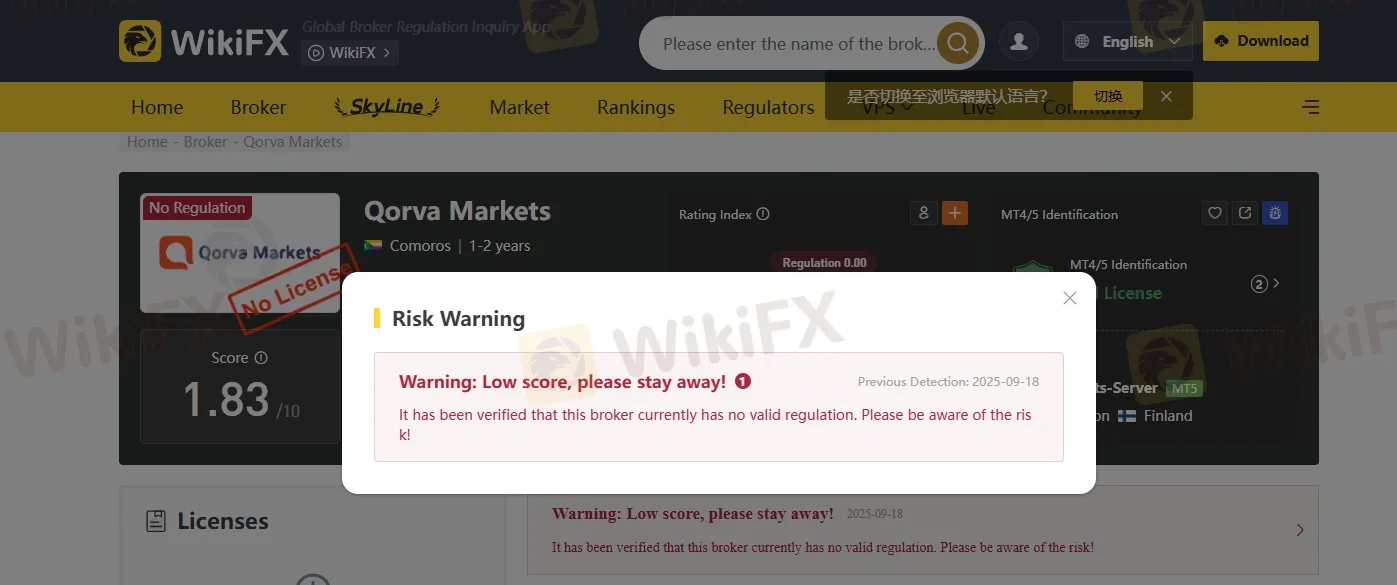

3. Official Warning Issued by WikiFX

Another major red flag is that WikiFX has officially issued a warning against Qorva Markets. The platform alerts traders & investors by Loudly stating:

“⚠️ WARNING: LOW SCORE! STAY AWAY!”

When a trusted watchdog platform like WikiFX issues such a direct warning, it‘s not something to ignore. These warnings are typically based on extensive research, user reports, and regulatory findings. Ignoring such alerts could put your funds and personal data at serious risk. The presence of this warning adds to the growing list of concerns surrounding Qorva Markets and further confirms that caution is not just recommended it’s essential.

4. No User Reviews Available

Perhaps one of the most telling signs of an unreliable broker is the complete absence of verified user reviews. When we searched for genuine customer feedback on Qorva Markets, we found absolutely nothing —no ratings, no testimonials, no experiences shared by real users. In todays digital age, a lack of online presence or customer reviews is a major red flag. A legitimate broker typically has some level of community engagement or user feedback available.

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!