简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MultiBank Group Launches MBG Token: Future of Finance or Another Trap?

Abstract:MultiBank Group launches MBG token with bold claims, but concentrated holdings, unlock risks, and regulatory doubts raise red flags.

In 2025, the blockchain industry has increasingly attracted the attention of traditional financial institutions. MultiBank Group, a broker that claims to hold 17 global regulatory licenses and processes $35 billion in daily trading volume, recently launched its own token, MBG, accompanied by an aggressive global marketing campaign. Official narratives highlight MBG as a tool to “revolutionize finance” through tokenized real-world assets (RWA). Yet behind this polished story, risks and doubts loom large.

From Forex Giant to Blockchain Player

Founded in 2005, MultiBank Group built its business around forex and CFD trading. Despite its claims of multi-jurisdictional oversight, its reputation is far from spotless. WikiFX has long collected user complaints against the group, citing withdrawal delays and unresponsive support, with the platform assigning the broker an average score of just 2.5 out of 10.

According to WikiFX data, MultiBank Group does hold licenses from regulators including Australia‘s ASIC, Germany’s BaFin, Cyprus‘ CySEC, Singapore’s MAS, the UAE‘s SCA, and Poland’s KNF. At first glance, this suggests a broad compliance footprint. However, a closer look reveals gaps: licenses from the UAE‘s DFSA, the UK’s FCA, and Spain‘s CNMV have been revoked, while the Cayman Islands’ CIMA license is marked as “exceeded scope.” Registrations in Seychelles and Vanuatu remain unverified. This mixed record undermines the groups narrative of unquestionable global compliance.

MBG Amid a Global Marketing Blitz

In July 2025, MultiBank Group announced the launch of MBG, its first utility token, and quickly rolled out an extensive promotional campaign. Across its official website, social media platforms, and industry events, MBG was portrayed as the bridge between TradFi and Web3. The tokens “deflationary model” and “RWA empowerment” became the cornerstone of its marketing pitch, with promises of tokenized real estate and other major assets reshaping finance. Meanwhile, the group plastered purchase links and subscription portals across channels, attempting to capitalize on hype and accelerate inflows.

The Narrative of MBGs Utility

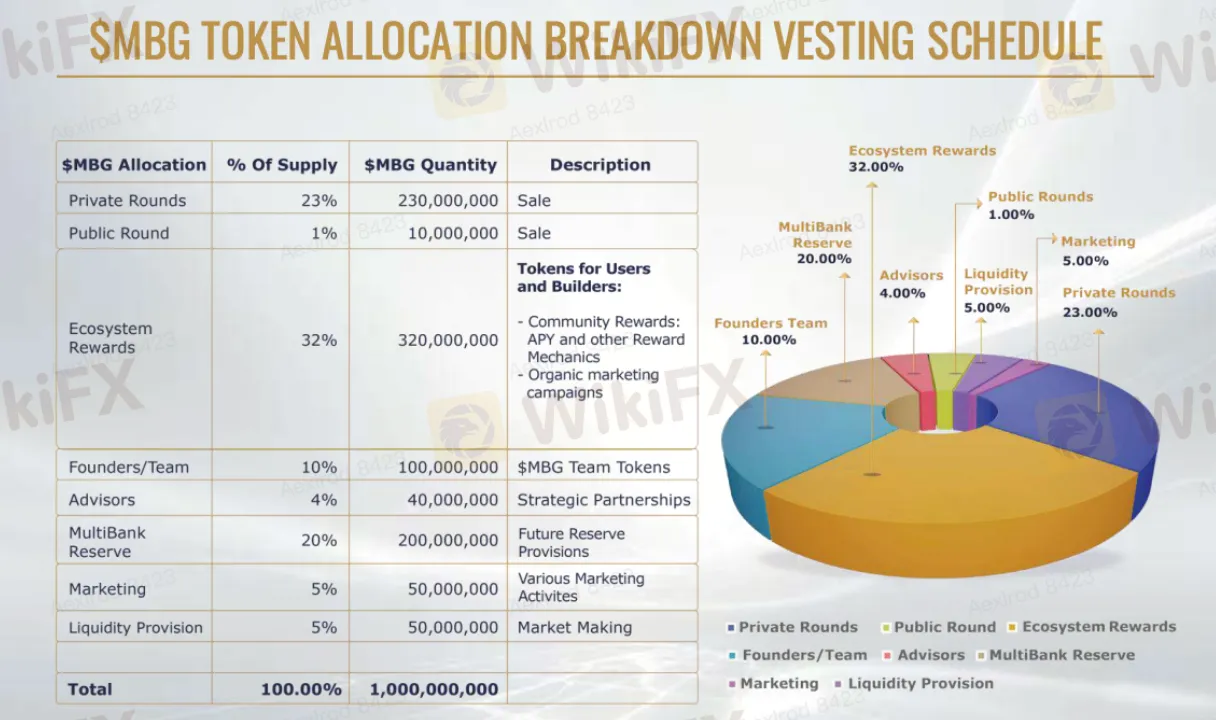

According to its whitepaper, MBG has a fixed total supply of one billion tokens. Within the MultiBank ecosystem, MBG is positioned as a utility asset, designed for paying fees, earning discounts, and participating in reward programs. The group has also promised RWA integration, including tokenized real estate, as a means to enhance long-term value and expand its narrative space.

In official packaging, MBG is portrayed as the groups “universal key”: a token that pays fees, offers discounts, and promises a gateway into future RWA projects. The marketing language revolves around two buzzwords—“deflation” and “utility.” The team has pledged ongoing buybacks and token burns to manufacture scarcity, while simultaneously promoting MBG as the bridge between traditional finance and blockchain.

Yet the reality has already contradicted this story. On August 27, MultiBank announced its first buyback and burn, removing approximately 4.86 million MBG (worth around $10 million) from circulation. In theory, such a move should have boosted the price. Instead, MBG collapsed the very next day, dropping from $2.42 to $1.76—a fall of more than 20% in a single week.

Against this backdrop, MBGs risks stand out even more clearly. Three areas in particular demand investor scrutiny.

Risk One: Concentrated Holdings and Unlock Pressure

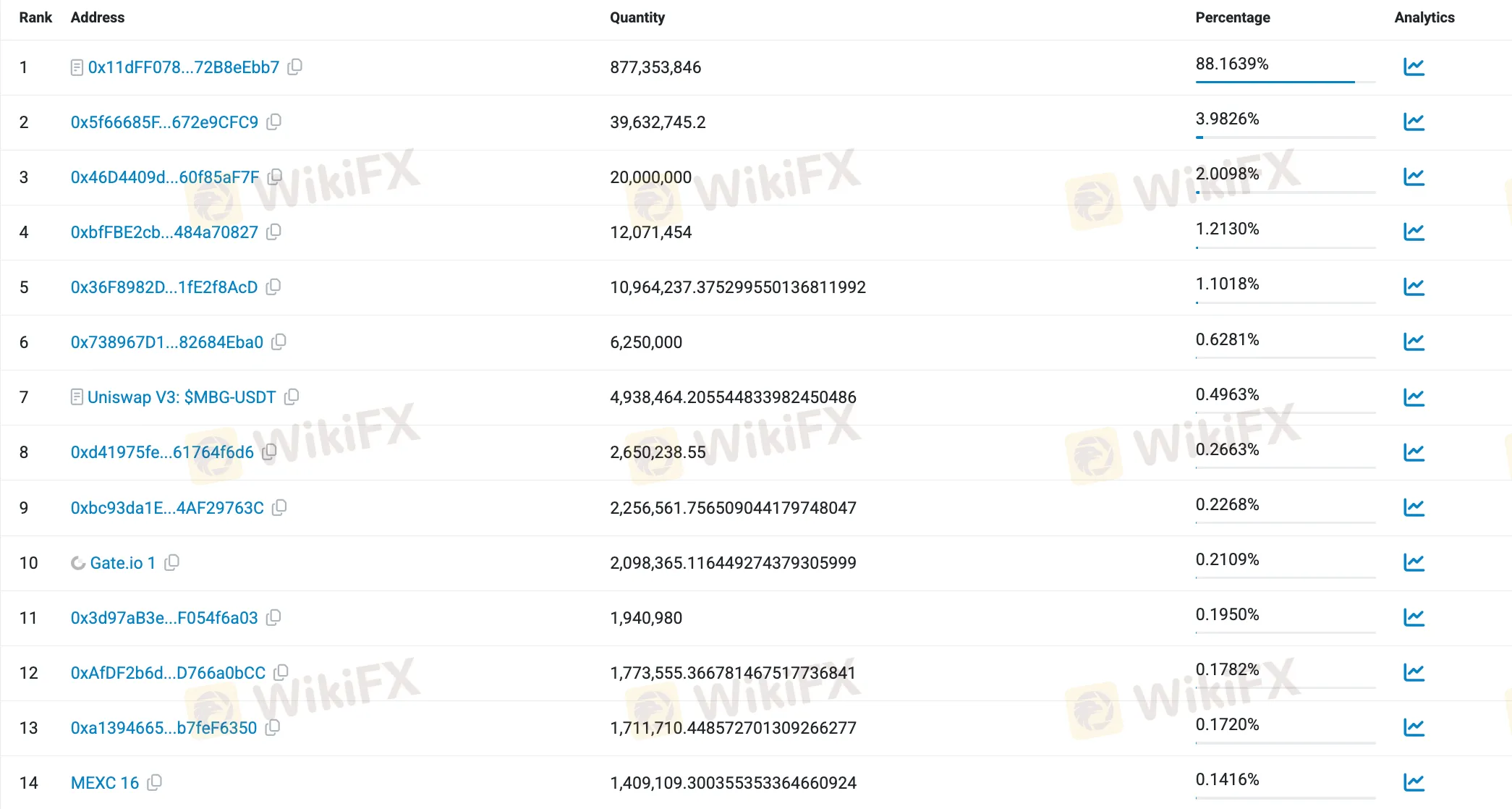

MBGs current market cap stands at roughly $200 million, which may not seem excessive. But the fully diluted valuation reaches $1.7 billion—a figure based on just 117 million tokens in circulation, while over 880 million remain locked. This imbalance means that future unlocks could unleash selling pressure far greater than the market can absorb.

On-chain data highlights the unhealthy concentration of holdings: one contract address controls 88.16% of the supply, and the top 10 wallets collectively account for more than 96%. Liquidity pools hold less than 0.5%, leaving the token highly vulnerable to manipulation.

Vesting schedules only intensify the concern. Private rounds are set to unlock across five tranches within 12 months, while team and reserve allocations each begin releasing after a six-month cliff, stretching over three years. Though this appears structured, every stage of unlock represents additional selling pressure. Given the already fragile balance between circulation and total supply, such releases could destabilize the market.

Risk Two: Opaque Private Rounds and Token Distribution

The whitepaper allots 23% of MBG—230 million tokens—to private rounds. However, none of the critical details have been disclosed. There is no transparency on investor identities, purchase prices, discount rates, or allocation terms. Instead, the market is left with a vague statement: “five tranches over 12 months.” In practice, this means investors have no visibility into when tens of millions of tokens might suddenly hit the market.

Meanwhile, team (10%) and reserve (20%) allocations will begin unlocking from month seven onward, coinciding with private round releases. This overlap creates compounded selling pressure. With circulation still under 120 million tokens, even a moderate tranche unlock could send shockwaves through secondary markets.

Risk Three: Compliance and Issuance Uncertainty

MultiBanks regulatory standing has long been controversial. While the group holds some valid licenses (ASIC, BaFin, CySEC), it also has a history of revoked or unverified registrations, including those flagged by DFSA, FCA, and CNMV. Against this backdrop, critical questions remain unanswered: Which legal entity is actually issuing MBG? Under which jurisdiction? And on what regulatory basis?

The narrative built around MBG—buybacks, burns, utility promises, and potential returns—bears striking resemblance to the hallmarks regulators often associate with unregistered securities. Should MBG be deemed an unlicensed securities offering, the issuer could face scrutiny or enforcement action, while holders would be exposed to legal and financial uncertainty. The absence of clarity in itself is a risk investors cannot ignore.

Conclusion

From forex broker to blockchain issuer, MultiBank Group seeks to use MBG as the centerpiece of a “TradFi + blockchain” narrative. On paper, the tokenomics look polished: deflationary design, ecosystem utility, and RWA integration. But in practice, the gaps are glaring—extreme concentration of holdings, opaque private rounds, overlapping unlock schedules, and unresolved regulatory questions.

These factors do not guarantee MBGs failure, but they undeniably raise risks far beyond what most retail investors can reasonably bear. For the market, MBG might be an experiment. For token holders, however, every unlock and every regulatory headline could act as the spark for sharp price swings. Beneath the polished marketing, what investors may need most is not enthusiasm, but caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Currency Calculator