简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

PINAKINE Broker India Review 2025: A Complete Guide to Safety and Services

Abstract:As online trading grows in popularity, Indian traders are always looking for brokers that offer good deals and fair conditions. PINAKINE has become one of these companies, getting attention by promising high leverage and many different account options. This broker, officially called Pinakine Liquidity Limited, has been operating for about one to two years and has made many people curious. Traders want to know the most important question: Is PINAKINE a real and safe place to invest money, or are there hidden dangers behind its attractive offers?

What is PINAKINE?

As online trading grows in popularity, Indian traders are always looking for brokers that offer good deals and fair conditions. PINAKINE has become one of these companies, getting attention by promising high leverage and many different account options. This broker, officially called Pinakine Liquidity Limited, has been operating for about one to two years and has made many people curious. Traders want to know the most important question: Is PINAKINE a real and safe place to invest money, or are there hidden dangers behind its attractive offers?

This review will answer that question. We will carefully examine PINAKINE using facts and evidence, looking past the marketing promises to focus on what really matters for a trader's financial safety and chances of success. We will look at whether it's properly regulated, what trading platforms it offers, account requirements, fees, and real feedback from Indian traders. Our goal is to give you a clear and honest picture so you can make a smart decision about whether this broker fits your comfort level with risk and trading goals.

Regulation and Safety Analysis

The most important thing to consider when choosing a broker is whether it's properly regulated. This decides how well your money is protected and what legal help you can get if something goes wrong. In this section, we directly look at how safe and trustworthy PINAKINE is.

Company Information

First, we need to know who the broker is and where it operates. This basic information helps us understand what rules and protections might apply.

· Company Name: Pinakine Liquidity Limited

· Registered Location: Saint Lucia

· How Long Operating: 1-2 years

· Contact Information: Phone (+44 74 54630174), Email (support@pinakineliquidity.com)

· Registered Address: Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia

The Problem: No Regulation

Our research shows that PINAKINE currently has no valid regulation from any major, well-known financial authority. The company is registered in Saint Lucia, which is an offshore location. While being registered means the company legally exists, this is not the same as being regulated by financial authorities.

Offshore locations like Saint Lucia often have much weaker financial oversight compared to top-level regulatory bodies like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

The main job of a financial regulator is to protect consumers. They do this by making strict rules that brokers must follow, including:

1. Keeping Client Money Safe: This means the broker must keep trader funds in separate bank accounts from the company's own money. If the broker goes out of business, your money is protected and cannot be used to pay the company's debts.

2. Fair Trading: Regulators watch brokers to make sure they provide fair prices and don't manipulate trades against their clients.

3. Solving Problems: Regulated brokers must have a clear and fair way to handle client complaints. If a problem can't be solved, traders can often go to an independent service for help.

Without these regulatory protections, traders using PINAKINE are basically without a safety net. The protection of your money depends only on the broker's own policies and good intentions, with no outside authority to hold them responsible.

Understanding Official Warnings

The lack of regulation is a major warning sign, and this shows up in how the broker is rated within the industry. PINAKINE has received a very low trust score and comes with clear warnings telling traders to “please stay away.” This is a direct result of its high-risk profile, which comes mainly from not being regulated.

Additionally, the broker is marked with a “Suspicious Regulatory License” note. This suggests there may be problems or concerns about any regulatory claims the broker might make, confirming that it operates outside the control of any credible financial authority. The broker's regulatory status is a main concern for any trader. You can view the latest verification of PINAKINE's license status and detailed risk warnings on its comprehensive profile page.

Do not miss this article-

Stonefort Securities Review — MT5 Broker Overview, Regulation, and Trader Experience- www.wikifx.com/en/newsdetail/202511108124917725.html

Trading Accounts and Platform

Beyond safety, a trader's daily experience depends on the tools and conditions the broker provides. Here, we look at the trading platform, account types, and investment options offered by PINAKINE.

The MT5 Platform

PINAKINE gives its clients the MetaTrader 5 (MT5) platform. MT5 is a globally recognized and powerful trading program, liked by many for its advanced charting tools, extensive technical indicators, and support for automated trading through Expert Advisors (EAs).

Importantly, the broker uses a Full License MT5. This is an important technical detail. A full license generally means a more direct relationship with MetaQuotes, the platform's developer, suggesting more stable system services and reliable technical support. This is often better than a “white-label” solution, where a broker simply rebrands another company's platform. The server details for their MT5 platform are:

· Server Name: PinakineLiquidity-Server

· Server Location: Germany

This information can be useful for traders concerned with delays and execution speed, as server location can affect how fast trades are processed.

Account Types & Conditions

PINAKINE offers many different account types, seemingly to serve a wide range of traders, from beginners to experienced professionals. However, the trading conditions, especially the high leverage and minimum deposit, need careful consideration.

| Feature | Details | Notes for Traders |

| Account Types | ECN, Islamic, Gold, Diamond, Standard, Cent | This variety offers flexibility but requires careful review of each account's specific terms. |

| Maximum Leverage | 1:500 | This is extremely high. While it can increase profits, it equally increases losses and can empty an account quickly. |

| Minimum Deposit | $500 | This is a relatively high entry requirement, especially for an unregulated broker. |

| Commissions | $0 | An attractive feature, but traders should always check the spreads to understand the total cost of trading. |

| Minimum Position | 0.01 lots | This is a standard micro-lot size, allowing for precise position sizing. |

| EA Support | Yes | The MT5 platform fully supports the use of Expert Advisors for automated trading strategies. |

The combination of a $500 minimum deposit and 1:500 leverage is a high-risk situation. A high minimum deposit means trusting a significant amount of money to an unregulated company, while high leverage can lead to fast and large losses if not managed with extreme discipline.

Available Trading Instruments

The broker appears to offer a standard range of asset classes for trading. The available products mentioned include:

• Forex

• CFDs

• Metals

• Cryptocurrencies

*Disclaimer: This list may not be complete. Traders should always verify the full range of available instruments, including specific currency pairs, indices, and commodities, directly with the broker or on its platform before putting money in.*

---

Deposits, Withdrawals, and Fees

How easy and expensive it is to move money are practical concerns for every trader. This section analyzes PINAKINE's policies regarding financial transactions.

Account Funding Methods

PINAKINE supports several common payment methods for adding money to and taking money out of a trading account. These include:

• Credit/Debit Cards

• Bank Transfers

• Potentially Cryptocurrencies

While the deposit process is described by some as relatively straightforward, the broker's website lacks a detailed breakdown of all available payment processors, processing times, and any regional restrictions that might apply to Indian traders. Having various payment options is good as it provides flexibility, but transparency is key.

The 'Zero Fee' Policy

One of PINAKINE's most advertised features is its policy of free deposits and withdrawals. The broker states it does not charge any internal fees for transactions. This is a significant advantage, as many competitors charge fees, particularly for withdrawals or certain payment methods, which can reduce a trader's profits over time.

Warning on Third-Party Fees

This is where expert experience becomes important. While PINAKINE may not charge fees, it does not mean every transaction will be completely free. It is essential to understand that other institutions involved in the transfer may charge their own fees.

For example, when you make a bank wire transfer, your bank and any other banks involved may take out a fee. Similarly, e-wallet providers or credit card companies might have their own transaction or currency conversion fees. These are third-party costs outside of the broker's control. Before starting a large deposit or withdrawal, we advise traders to clarify this point directly with PINAKINE's customer support and their chosen payment provider to avoid any unexpected charges to their money.

---

Community User Experiences

While technical details are important, the experiences of other traders provide valuable insight into a broker's day-to-day operations and service quality.

Positive Service Reports

We have seen some positive feedback specifically from traders based in India. These reviews praise the broker's service and support system.

• Trader 1 (Ravi): This user reported trading with PINAKINE for over a year with money exceeding $4,000. Their feedback highlights “really quick” service and expresses total satisfaction with a “friendly supporting team.”

• Trader 2 (Mr. Ajay Sahu): Having traded with the broker for 1 year and 2 months, this user describes the services as “superb” and the support system as “very fast & clear.” They clearly state their happiness with PINAKINE.

These first-hand accounts suggest that, on an operational level, the broker's customer support is responsive and helpful, and the daily user experience for some has been positive.

A Critical Perspective

How should a potential trader balance these positive service reviews against the fundamental risk of no regulation? This is an important question.

While good customer service and smooth daily operations are valuable, they exist on the surface. They do not, and cannot, replace the basic security that financial regulation provides. A quick response from a support agent is helpful for minor issues, but it offers no protection if the broker becomes insolvent or if a major financial dispute arises, such as a refusal to process a large withdrawal.

The structural protection of separated funds and access to a legal framework for solving disputes are safeguards that only a regulated broker can offer. Positive day-to-day experiences do not guarantee the long-term safety of your entire money. Therefore, it is important for traders to learn a critical skill: do not be influenced by surface-level positives when core safety issues, like a lack of regulation, are present. While some users report positive experiences, it's important to see the full picture. For a broader perspective, we encourage you to explore more unfiltered user reviews and see how the broker's score has changed over time on PINAKINE's detailed profile.

---

Final Verdict for Traders

After a thorough analysis of its regulatory status, trading conditions, and user feedback, we can now combine our findings into a final verdict for Indian traders considering PINAKINE.

Pros vs. Cons Summary

To make an informed decision, it is helpful to see the potential benefits and significant risks side-by-side.

Potential Advantages:

• Full License MT5 Platform: Access to a strong, professional-grade trading program.

• $0 Commissions & Free Transfers: An attractive fee structure that can reduce trading costs.

• Wide Range of Account Types: Flexibility to choose an account that may suit different money levels and trading styles.

• Positive User Feedback: Some Indian traders report good customer service and a satisfactory experience.

Significant Disadvantages & Risks:

• NO VALID REGULATION: This is the most critical and non-negotiable risk, leaving client funds entirely unprotected by any financial authority.

• Offshore Registration (Saint Lucia): The broker operates from a location with weak financial oversight and limited legal help for traders.

• High Minimum Deposit ($500): A substantial amount of money to risk with an unregulated company.

• High Leverage (1:500): This dramatically increases the risk of rapid and total loss of investment, especially for newer traders.

• Low Trust Score & Official Warnings: Industry evaluators have marked the broker as high-risk.

An Unsuitable Risk

Based on the evidence, our verdict is clear: the overwhelming risk posed by the complete lack of regulation far outweighs any of the potential benefits offered by PINAKINE.

While an advanced platform and a zero-fee policy are appealing, they are secondary to the fundamental safety of your money. Without regulatory oversight, there is no guarantee of fund separation, fair practices, or a path for help in the event of a serious dispute. In contrast, top-tier brokers widely available to Indian traders, such as IC Markets, XM, or TMGM, are regulated by strict authorities in locations like Australia, providing a much higher and verifiable level of security for their clients. The peace of mind that comes with regulation is invaluable.

Your Next Step

Our final recommendation for Indian traders is to exercise extreme caution. Making safety the top priority should be the main consideration in your search for a broker. The risk of losing your entire investment to issues beyond market movements is significantly higher with an unregulated company.

Before making any decision, it is vital to have the most current information. The financial industry is dynamic, and a broker's status can change. We strongly recommend you review the complete and up-to-date profile of PINAKINE to assess all the latest findings, user reviews, and official alerts for yourself.

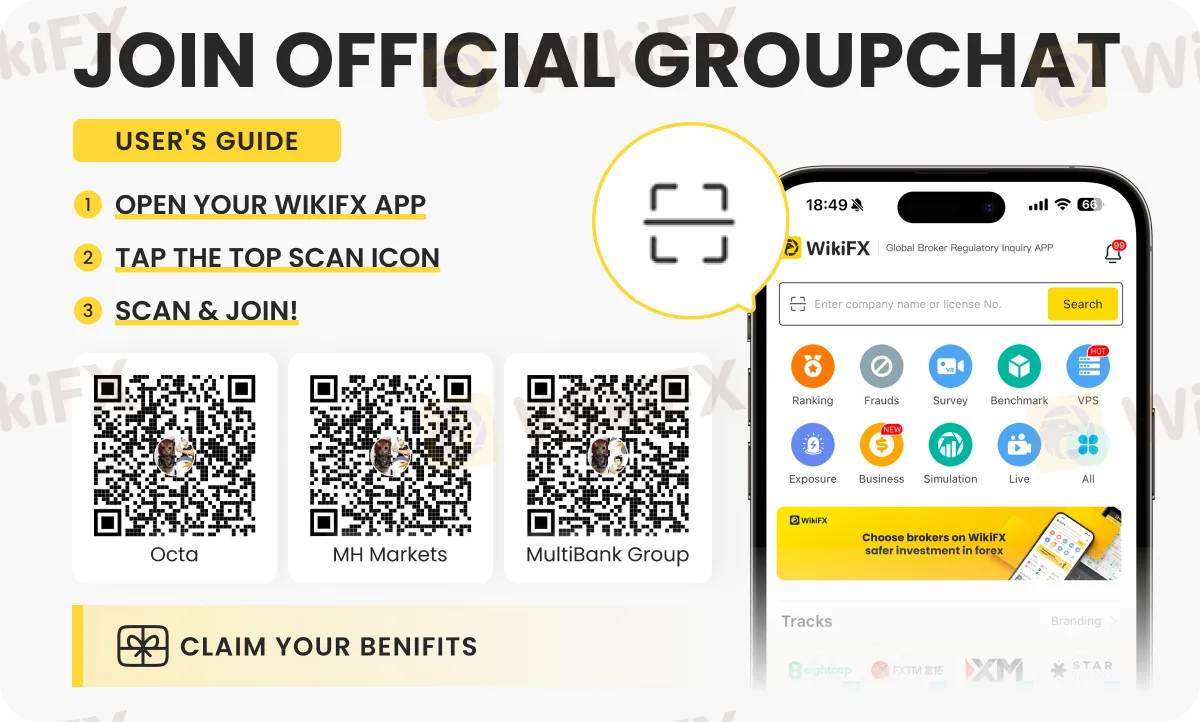

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

Currency Calculator