简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What Is a Pip in Forex? The Ultimate Guide to Calculating Profit & Loss

Abstract:We started with a simple question: what is a pip in forex? We've journeyed from basic definition to calculation, risk management, and market application. You now see the market not as random fluctuating numbers, but as measurable opportunities and risks, all quantified in pips.

Getting into forex trading can feel overwhelming. You'll encounter unfamiliar terms like leverage, spread, and lot size. But no term is more important than the pip.

New traders often wonder, “what is a pip in forex?” Technical language can be confusing. We'll break it down for you. Simply put, a pip is the smallest standard unit that measures price changes between two currencies.

You need to understand what a pip is and know how to calculate its value. You should learn how it affects your profits and losses. This isn't just helpful knowledge—it's essential. Master this concept first, and you'll trade with greater confidence and accuracy.

The Core Concept

To succeed in forex trading, you need a solid grasp of its most important measurement unit. That's the pip. It forms the foundation for all profit and loss calculations.

Defining the “Pip”

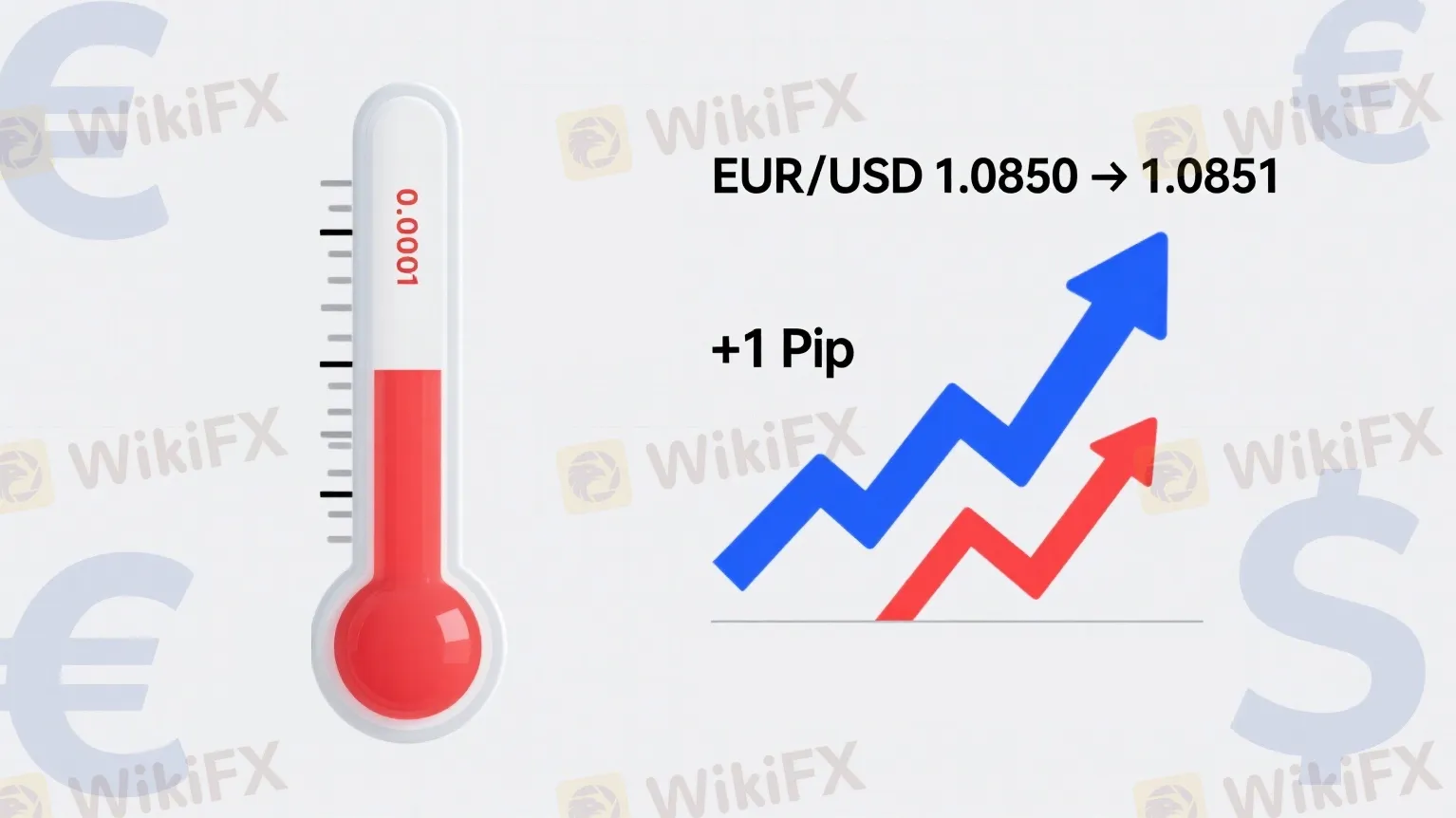

“Pip” stands for “Percentage in Point” or “Price Interest Point.” Think of it like this: a pip relates to currency prices the same way a single degree relates to temperature. It's the standard, smallest change we measure.

For most currency pairs, a pip appears in the fourth decimal place. That's a movement of 0.0001.

Let's look at EUR/USD, the world's most traded pair.

> When EUR/USD moves from 1.0850 to 1.0851, it has risen by one pip. A drop from 1.0850 to 1.0840 equals a 10-pip decline.

This simple unit helps us understand all market movements.

Language of Profit/Loss

Traders speak in pips. You'll hear statements like “I made 50 pips on that trade” or “My stop loss is 30 pips away.” This creates a common language. We can discuss price movements without getting lost in complex currency amounts.

Why should you care about what are pips in forex trading? The answer connects directly to your money. A single pip seems tiny. But its real impact grows with your trade size, known as lot size. A 20-pip profit might mean $2, $20, or $200. It all depends on your position volume. We'll explore this connection in detail later.

Pips vs. Pipettes

You might notice a fifth decimal place on your trading platform. This can confuse new traders. But the difference is simple. That extra digit is called a pipette or fractional pip.

What is a Pipette?

A pipette equals one-tenth of a pip. For most pairs, it represents the fifth decimal place (0.00001).

Brokers added pipettes to provide more precise pricing. They also use them to quote tighter spreads. This extra precision reflects today's fast, electronic markets. Understanding this helps you read your trading screen correctly.

How to Tell Them Apart

Your platform might show EUR/USD as `1.0850`⁵. The main numbers (1.0850) show the price down to the pip level. The small “5” at the end is the pipette. A move from `1.0850`⁵ to `1.0850`⁶ equals one pipette. A move from `1.0850`⁵ to `1.0851`⁵ equals one full pip.

Remember this: pipettes exist for precise quoting. But pips remain the standard unit for trade discussions and profit calculations. Most strategies and risk plans use pips, not pipettes.

| Feature | Pip | Pipette (Fractional Pip) |

| Decimal Place | The 4th decimal place (e.g., 0.0001) | The 5th decimal place (e.g., 0.00001) |

| Value | Standard unit of measure | 1/10th of a pip |

| Primary Use | Calculating overall profit/loss | More precise price quotes and spreads |

Calculate Pip Value

Now comes the crucial part: turning pip concepts into real money values. Understanding “what is a pip in forex?” means nothing without knowing what that pip costs or pays you.

Pip value isn't fixed. It changes based on three factors:

1. The currency pair you're trading

2. Your trade size (lot size)

3. Your account currency (USD, EUR, GBP, etc.)

Step 1: Understand Lot Sizes

First, you need to understand trade volume. Forex measures trade size in lots. This knowledge is essential for grasping what is pip in forex from a financial angle.

A Standard Lot contains 100,000 units of the base currency.

A Mini Lot contains 10,000 units of the base currency.

A Micro Lot contains 1,000 units of the base currency.

Your chosen lot size directly multiplies your pip value.

Step 2: The Pip Value Formula

Here's the universal pip value formula:

Pip Value = (Pip in decimal form / Exchange Rate) \* Lot Size

Breaking it down:

- Pip in decimal form: 0.0001 for most pairs (0.01 for JPY pairs)

- Exchange Rate: The current pair price (or conversion rate to your account currency)

- Lot Size: Base units you're trading (100,000, 10,000, or 1,000)

Step 3: Calculation Examples

Let's assume you have a USD account. We'll cover the three most common scenarios.

Case 1: USD is the Quote Currency (e.g., EUR/USD)

This is the easiest calculation. When USD is the second currency, pip value stays fixed regardless of exchange rate changes.

- Pair: EUR/USD

- Lot Size: 1 Standard Lot (100,000 units)

- Pip in decimal form: 0.0001

Pip Value = 0.0001 \* 100,000 = $10.00

For any USD quote pair (GBP/USD, AUD/USD), pip values are always:

- Standard Lot: $10 per pip

- Mini Lot: $1 per pip

- Micro Lot: $0.10 per pip

Case 2: USD is the Base Currency (e.g., USD/JPY)

When USD comes first, pip value changes with the exchange rate. You need the full formula here.

- Pair: USD/JPY

- Lot Size: 1 Mini Lot (10,000 units)

- Pip in decimal form: 0.01 (JPY pairs are different)

- Current Rate (example): 157.50

For USD base pairs, use this simplified formula:

Pip Value = (Pip in decimal form \* Lot Size) / Exchange Rate

For USD/JPY: (0.01 * 10,000) / 157.50 = 100 / 157.50 = ~$0.63 per pip.

As USD/JPY rises, each pip's USD value falls.

Case 3: Cross-Currency Pairs (e.g., EUR/GBP)

When your pair doesn't include your account currency, it's a two-step process.

- Pair: EUR/GBP

- Lot Size: 1 Standard Lot (100,000 units)

- Pip in decimal form: 0.0001

- Current EUR/GBP Rate (example): 0.8450

Step 1: Calculate pip value in the quote currency (GBP).

Pip Value = 0.0001 \* 100,000 = 10 GBP

Step 2: Convert to your account currency (USD).

Assume GBP/USD = 1.2500.

Pip Value in USD = 10 GBP \* 1.2500 = $12.50

One standard lot of EUR/GBP equals $12.50 per pip in your USD account at these rates.

Pips to Profit & Loss

Theory matters, but practical application is everything. Let's connect pips, lot sizes, and pip values in a real trading scenario. This shows how understanding what are pips forex trading translates into managing actual money.

We'll walk through a complete trade. After market analysis, we believe EUR/USD will rise. Our account uses USD.

The Trade Setup

Here's our hypothetical trade plan. Having a clear plan before entering marks professional trading.

- Trade: Buy EUR/USD

- Lot Size: 1 Mini Lot (10,000 units)

- Entry Price: 1.0850

- Stop Loss: 1.0820 (exit point if trade goes wrong)

- Take Profit: 1.0910 (target exit price)

Calculating Potential Risk/Reward

Before clicking “buy,” we must know our potential loss and gain. This is risk management at its core.

Step 1: Calculate Pip Differences.

We measure risk and reward distances in pips.

- Risk (Stop Loss): 1.0850 - 1.0820 = 0.0030 = 30 pips

- Reward (Take Profit): 1.0910 - 1.0850 = 0.0060 = 60 pips

Our trade risks 30 pips for a potential 60-pip reward. That's a 1:2 risk-to-reward ratio.

Step 2: Determine Pip Value.

For EUR/USD in a USD account, pip values are fixed.

- Lot Size: 1 Mini Lot

- Pip Value: $1.00 per pip

Step 3: Calculate Monetary Risk & Reward.

Combine pip distance with pip value for real dollar amounts.

- Monetary Risk: 30 pips \* $1.00/pip = $30.00

- Monetary Reward: 60 pips \* $1.00/pip = $60.00

We're risking $30 to potentially make $60. This clarity comes from understanding pips.

The Trade Outcome

Imagine the trade works perfectly. The market rallies. EUR/USD climbs to our take-profit target of 1.0910. Our broker automatically closes the trade.

Final calculation:

- Price Move: 1.0910 - 1.0850 = 60 pips

- Total Profit: 60 pips \* $1.00/pip = $60.00

Our account increased by $60 from this single trade. This example connects “what is a forex pip?” to actual money earned or lost.

Pips in Action

As you gain experience, you'll notice that currency pairs behave differently. The pip definition can change. Daily pip movements vary dramatically between pairs. This is where expert knowledge becomes valuable.

The JPY Exception

Here's the biggest exception to standard pip rules: Japanese Yen pairs. For JPY pairs like USD/JPY, EUR/JPY, or GBP/JPY, a pip is the second decimal place (0.01), not the fourth. When USD/JPY moves from 157.20 to 157.21, that's one pip. A move from 157.20 to 158.20 equals 100 pips. This exists because the Yen has historically low value compared to Dollars or Euros. Quoting to the fourth decimal would be impractical. Understanding this distinction is crucial for trading JPY crosses.

Pip Volatility

Volatility measures how many pips a pair typically moves in a given time. Some pairs are calm and stable. Others swing wildly, moving hundreds of pips daily. Understanding what is forex trading pips includes knowing these characteristics.

The Average True Range (ATR) indicator measures historical volatility. It might show that EUR/USD averages 70 pips per day, while GBP/JPY might move 150 pips. This data helps set realistic targets and appropriate stop-loss levels.

Let's compare different pair types:

| Pair Type | Example Pair | Pip Decimal Place | Typical Daily Volatility | Trader Consideration |

| Major Pair | EUR/USD | 4th (0.0001) | Moderate | High liquidity, lower spreads. Great for beginners. |

| Yen Cross | USD/JPY | 2nd (0.01) | Moderate to High | Different pip calculation. Sensitive to risk sentiment. |

| Exotic Pair | USD/ZAR | 4th (0.0001) | Very High | Wider spreads, large pip swings. Requires careful risk management. |

Choose pairs that match your risk tolerance and trading style. Start by understanding their pip behavior.

The Bigger Picture

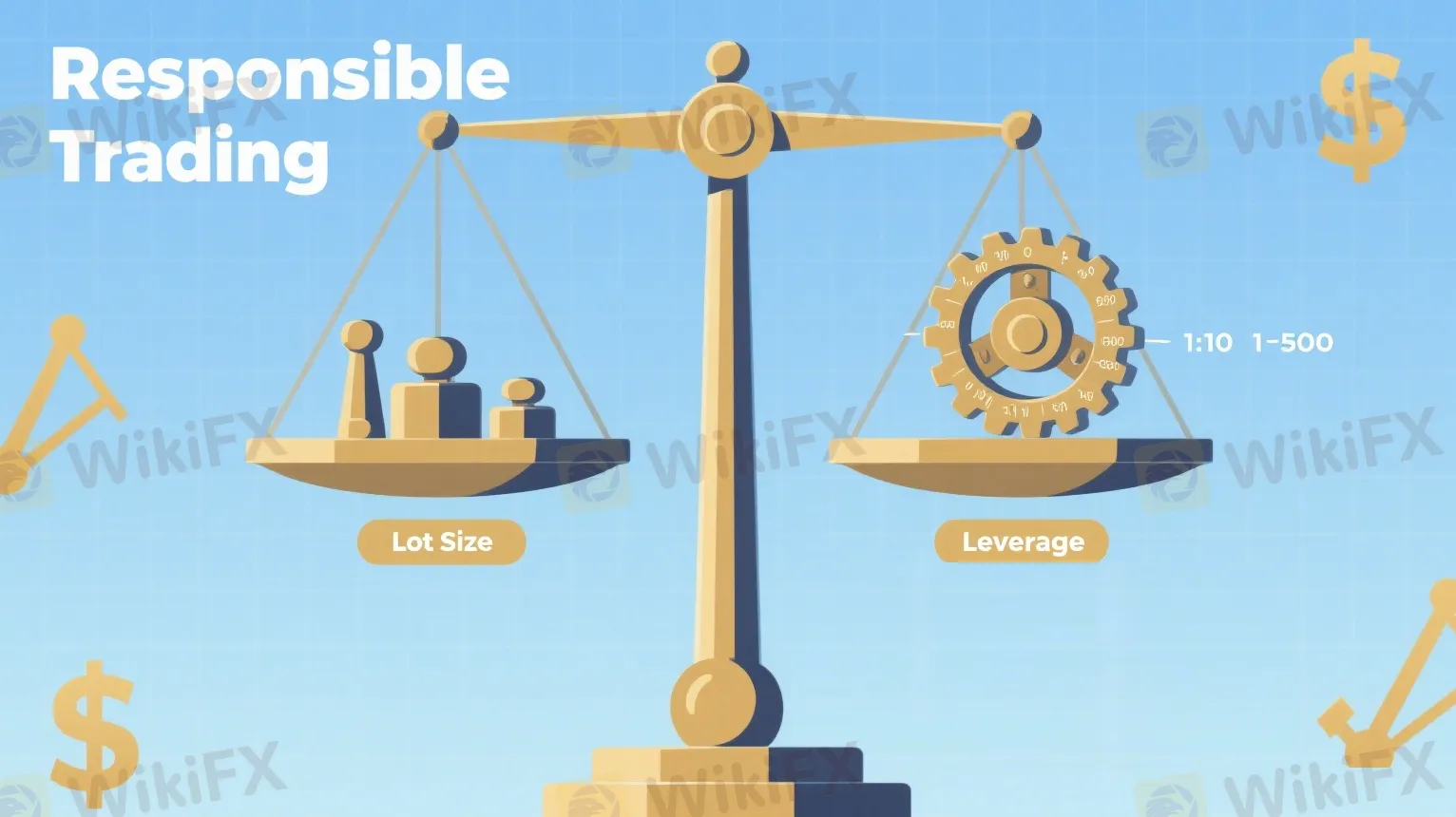

Knowing what pips are in forex trading is foundational. But lot size and leverage determine the ultimate impact of every pip movement. Understanding their role is essential for responsible trading.

Lot Size: Volume Dial

We've covered this, but it's worth repeating: lot size controls your trading volume. It directly affects each pip's monetary value. A pip has no power alone—you give it power through your trade size choice.

EUR/USD in a USD account:

- Micro Lot (1,000 units): Each pip = $0.10. A 50-pip move = $5

- Mini Lot (10,000 units): Each pip = $1.00. A 50-pip move = $50

- Standard Lot (100,000 units): Each pip = $10.00. A 50-pip move = $500

Scaling from micro to standard lots increases each pip's impact by 100 times. This makes position sizing one of the most critical risk management skills.

Leverage: Double-Edged Sword

Leverage lets you control large market positions with relatively small capital. With 100:1 leverage, you can control a $100,000 position (one standard lot) with just $1,000 of your money.

Here's a crucial point many new traders miss: leverage doesn't change pip value itself. A standard EUR/USD lot always has a $10 pip value, regardless of leverage.

However, leverage enables you to trade that standard lot with a smaller account. It lets you increase your volume dial higher than otherwise possible. This amplifies both potential profits and losses relative to your account equity. High leverage plus large lot sizes means even small pip moves against you can devastate your account.

Always respect leverage. It magnifies every pip's consequences.

Conclusion: Make Pips Work

We started with a simple question: what is a pip in forex? We've journeyed from basic definition to calculation, risk management, and market application.

You now see the market not as random fluctuating numbers, but as measurable opportunities and risks, all quantified in pips.

Key takeaways:

- A pip is the standard, smallest price change unit for currency pairs

- Its monetary value depends on the currency pair, lot size, and account currency

- Calculating pip value before trading is key to effective risk management and position sizing

- Mastering pip concepts—from definition to calculation—is fundamental to becoming a consistent, confident trader

The goal isn't just counting pips. It's building a robust strategy that lets you capture them methodically and consistently. You now have the foundational knowledge to do exactly that.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

China Reportedly Scraps Three Red Lines Reporting, Signaling Property Sector Pivot

Grand Capital Review: The Anatomy of a Regulatory Fugitive

Emerging Currencies and Gold Rally as US Dollar Stumbles

Fortrade Review 2026: Is this Forex Broker Legit or a Scam?

SARB Defies Easing Expectations with Hawkish Hold on Rates

Geopolitical Risk Ignites Commodities: Gold Eyes $5,600, Oil Rallies on Iran Fears

Resource Sector Insight: Mining Community Stability Flashed as Key Risk to EM Capital Flows

Understanding Broker Regulation and Licenses

Fed Signals 'Dovish Pause' as Political Pressure Mounts on Powell

Melaka police bust fake investment scam run by Chinese nationals

Currency Calculator