Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

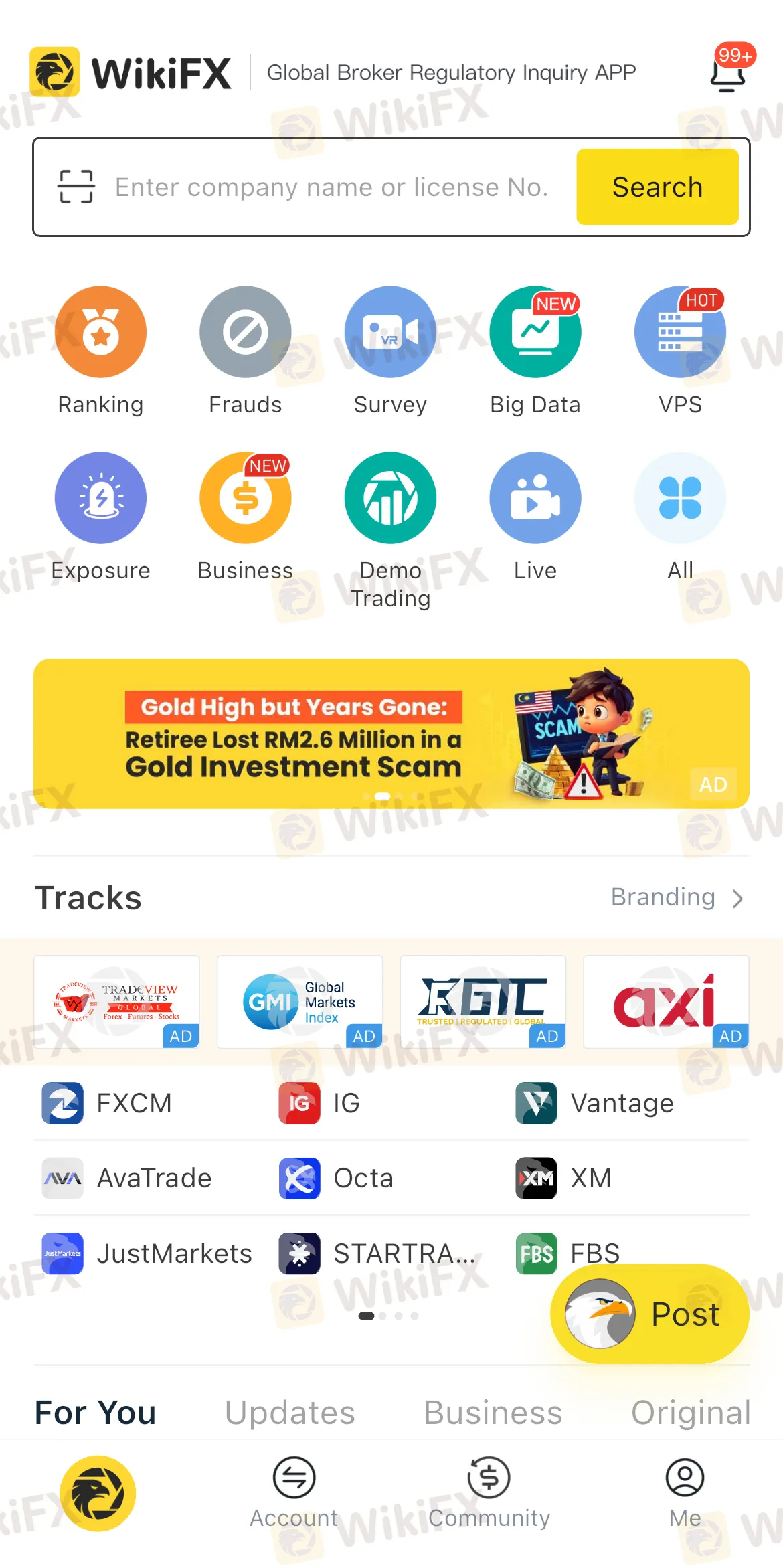

Abstract:Malaysian police are investigating a gold investment scam that has cheated 37 people out of more than RM8.4 million, with a businessman holding the honorific title ‘Datuk Seri’ believed to be the mastermind.

Malaysian police are investigating a gold investment scam that has cheated 37 people out of more than RM8.4 million, with a businessman holding the honorific title ‘Datuk Seri’ believed to be the mastermind.

According to Bukit Aman Commercial Crime Investigation Department (JSJK) director Datuk Rusdi Mohd Isa, police have recorded 40 statements so far, including from three witnesses. The case came to light after the Malaysian International Humanitarian Organisation (MHO) highlighted it, following 43 police reports made nationwide since 2023.

The company behind the scheme claimed to control billions of ringgit in gold and cash held overseas. Investors were told their funds would cover management and activation fees before the gold was sold and high returns paid out.

However, checks showed the company was not registered with the Companies Commission of Malaysia (SSM). Police say the Datuk Seri convinced victims by claiming he was managing the inheritance of a wealthy foreign national. To appear credible, the suspects allegedly produced fake documents carrying forged logos, stamps, and signatures from Bank Negara Malaysia (BNM). These were shown to investors as “proof” of the investments legitimacy.

No investor has received any returns, despite repeated promises. Instead, they were given excuses such as overseas technical problems or missing paperwork.

Police have opened 15 investigation papers under Section 420 of the Penal Code, which deals with cheating and dishonestly inducing the delivery of property. No arrests have been made yet, and the investigation is still ongoing.

Authorities are urging the public to be cautious of investment offers that promise unusually high returns, especially when the companies involved are unregistered and make unverifiable claims about foreign assets.

To prevent falling victim to fraudulent schemes like this one, using tools like WikiFX can be a game-changer. WikiFX provides detailed information on brokers, including regulatory status, customer reviews, and safety ratings, allowing users to verify the legitimacy of any investment platform before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the resources to make informed decisions and avoid unauthorised or unlicensed entities. By checking with WikiFX, users can confidently protect their savings and avoid the costly traps set by unscrupulous investment syndicates.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

Ho Chi Minh City, Vietnam – The WikiFX Elite Club recently concluded a successful offline pickleball networking event, “Elite Gathering Day · Vietnam: Rally for Connection, Rally for Healthy Development.” The event drew over 50 local industry participants, including prominent Introducing Brokers (IBs), Key Opinion Leaders (KOLs), and representatives from multiple trading firms. This unique gathering seamlessly blended sporting energy with high-value professional networking.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!