Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Looking for the best MetaTrader forex brokers in the Philippines for 2025? See top MT4/MT5 brokers, fees, platforms, and PH-specific tips to trade smarter.

For Filipino traders, MetaTrader remains the go-to standard for forex thanks to its speed, algorithmic trading (EAs), and vast indicator ecosystem—now fully available again on iOS after a brief 2022 removal and subsequent reinstatement in 2023. In 2025, the top MetaTrader forex brokers combine strong global regulation, tight pricing, and reliable execution with convenient funding for Philippine-based clients. This guide spotlights the best MT4/MT5 brokers for traders in the Philippines right now, plus regulatory context and practical selection tips tailored to local needs.

Forex trading is legal for individuals, but there‘s no large domestic industry of licensed online retail brokers—Filipino traders typically use reputable overseas brokers instead. The Bangko Sentral ng Pilipinas (BSP) regulates FX flows and authorized agent banks, while the SEC polices securities offerings; neither bans individuals from using foreign brokers, but both caution against scams and unlicensed solicitations. In April 2025, the BSP updated FX derivatives rules via Circular No.1212 to curb speculation and emphasize legitimate hedging, reinforcing the regulator’s intent to keep currency markets disciplined and transparent.

These brokers accept Filipino clients and offer compelling MT4/MT5 experiences, based on 2025 industry testing and awards.

1) IG — Best Overall MT4 Experience for 2025

IG topped major global rankings for overall forex in 2025 thanks to superb execution, breadth of markets, and education; it supports MetaTrader with robust add‑ons and tight pricing. For Filipino traders, IGs MT4 setup pairs strong reliability with pro‑grade research and risk tools—ideal for both discretionary and EA‑driven strategies.

2) OANDA — User-Friendly with Solid MT4 Support

OANDA is known for transparent pricing, reliable execution, and extensive educational content, and remains a go‑to for MT4 traders who value straightforward conditions and robust analytics. While often paired with its proprietary platform, OANDAs MT4 implementation remains polished and beginner‑friendly.

3) Pepperstone — Excellent for EAs, Copy Trading, and MT4/MT5 Tooling

Pepperstone offers MT4/MT5 plus cTrader and TradingView, catering to algo traders and system testers with raw spreads from 0.0 pips plus commission, Smart Trader Tools, Autochartist, and multiple copy‑trading options. Its execution quality and platform breadth make it a favorite for strategy diversification.

4) Interactive Brokers (IBKR) — Low Costs and Institutional-Grade Access

IBKR is frequently recognized for ultra‑low costs, massive market access, and professional infrastructure; while many use its proprietary stack, IBKRs low-fee ethos and execution quality appeal to sophisticated forex traders in 2025. Pair with MT‑compatible bridges where applicable or mix workflows across platforms for strategy execution.

5) Admirals (Admiral Markets) — MT4/MT5 Supreme Edition and Deep Research

Admirals supports MT4/MT5 with a “Supreme Edition” suite that adds custom indicators and plugins, backed by multi‑jurisdiction regulation and rich market analysis—useful for PH traders who want enhanced technicals on MetaTrader. Its research, economic calendars, and education complement systematic trading on MT4/MT5.

6) MultiBank Group — Accessible Minimums and Strong Global Oversight

MultiBank Group offers MT4/MT5 with low minimums (from $50), widespread regulation, and conditions suited to CFD and high‑volume traders, coupled with negative balance protection. Filipino clients gain access to flexible account types and broad instrument coverage on MetaTrader.

7) Eightcap / FP Markets / IC Markets / Tickmill — Competitive MT4/MT5 Specialists

Independent 2025 roundups for the Philippines highlight these brokers for tight spreads, fast execution, and strong MetaTrader support, with each offering different strengths in pricing, tooling, and funding. These options are well‑suited to active MT4/MT5 traders seeking low costs.

8) AvaTrade — MT4/MT5 With Risk Tools and Simple Pricing

AvaTrade offers commission‑free accounts with competitive spreads, wide asset coverage, and platforms including MT4/MT5 and AvaTradeGO, appealing to Filipino traders who value simplicity plus options like AvaProtect for defined‑risk trading.

In 2025, MetaTrader remains a powerhouse for Filipino forex traders—now fully accessible across devices—with a deep broker lineup led by IG, OANDA, Pepperstone, IBKR, Admirals, MultiBank, and other MT4/MT5 specialists. The best choice hinges on priorities: award‑winning trust and research (IG), user‑friendly stability (OANDA), EA/copy trading power and raw pricing (Pepperstone), ultra‑low costs (IBKR), or enhanced MT tooling and insights (Admirals). Pair a reputable, well‑priced MetaTrader broker with disciplined risk management and awareness of the Philippine regulatory context to trade smarter in 2025.

Trade only with well‑regulated brokers, maintain strict risk controls, and stay current on BSP/SEC guidance to keep forex trading safe and sustainable in the Philippines.

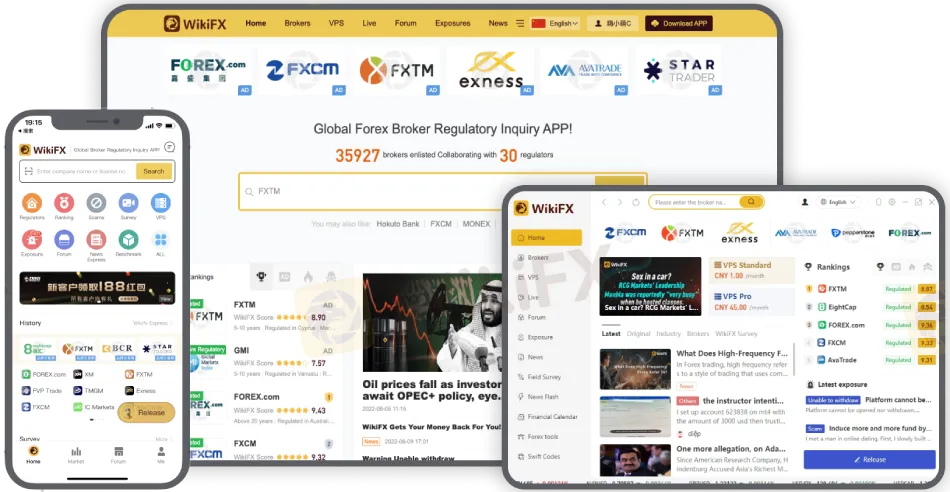

Note: Don't get lured easily by cloned and unregulated brokers in the market. Scan the QR code below to download and install the WikiFX app on your smartphone for quick verification.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Mastering forex broker regulation ensures you avoid pitfalls and select trustworthy platforms. We’ll cover regulator types, license details, the distinction between licensed and registered, and practical steps.

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!