UniPrime Broker Exposed: Blocked Account Alert

Unicorn Prime Liquidity (UniPrime) exposed: user reports a blocked account and unresponsive support. Protect your funds and file a complaint.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Discover how Equiti Trading Broker is revolutionizing the market with zero fees and regulatory compliance. Your guide to profitable, secure trading.

You may have heard some talk about Equiti Trading Broker if you've been following the trading industry recently. What's the problem, then? Let's dissect it.

Let's start by discussing fees—or rather, the absence of them. Equiti is causing a stir with their $0 fees. You read correctly: there are no costs. Zero platform costs, little to no commission, and very narrow spreads. It is revolutionary for traders looking to optimize their earnings while avoiding needless expenses.

What about Equiti itself, though? As for the trade world, well, it's no stranger. Trade broker Equiti has a solid reputation for offering cheap prices and an easy-to-use web platform. Serving traders worldwide, it provides a broad variety of financial goods and services.

Equiti is unique in that it is dedicated to adhering to regulations. This is not just lip service; credible financial authorities from several states oversee Equiti. The Financial Conduct Authority (FCA) of the United Kingdom, the Securities Commission of the Bahamas (SCB), and the Dubai Financial Services Authority (DFSA) of the United Arab Emirates are the primary actors in this respect. These regulatory certifications demonstrate Equiti's commitment to openness, security, and ethical trading methods and are no minor accomplishment.

Dealers now have a piece of mind as a result. Your money is kept in separate accounts, and there's a dependable mechanism in place in case of disagreement. In our industry, credibility is everything, and Equiti's regulatory compliance helps them win over customers.

Is there an issue with Equiti Trading Broker right now? In brief, it is transforming the trading environment because of its zero expenses and commitment to regulatory compliance. Whatever your level of trading expertise, Equiti is a name to remember.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Unicorn Prime Liquidity (UniPrime) exposed: user reports a blocked account and unresponsive support. Protect your funds and file a complaint.

Have you witnessed the automatic disappearance of forex trading positions on the Binary.com platform? Did you fail to receive withdrawals despite paying a fee as asked by the broker official? Were you denied fund withdrawals the moment you earned profits? Did you face a sudden fund loss on the Binary.com login? Many traders have reported these trading issues on review platforms such as WikiFX, a trusted app for forex regulation inquiries. We have investigated these complaints in this Binary.com article. Read on as we share details.

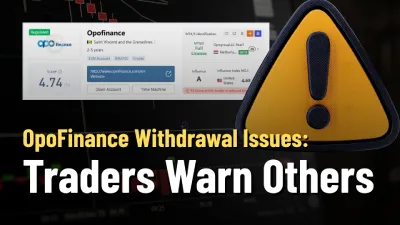

OpoFinance scams and exposure reports reveal rising of withdrawal issues. Traders say they can’t withdraw funds—read user stories and warning signs.

Did the 4T broker deny you withdrawals after you made profits following a spell of losses? Were your funds suspiciously deleted from the broker’s trading platform? Does the forex broker tell you to deposit more once you lose capital? Have you witnessed fund misappropriation by the 4T officials? You are not alone! Many traders have expressed these concerns online. We have investigated some of the complaints in this 4T review article. Have a look!