Abstract: In the US, several brokers faced complaints in March 2024, raising concerns about their practices and reliability. This article focuses on the most complained brokers during that month, as reported by WikiFX.

In the US, several brokers faced complaints in March 2024, raising concerns about their practices and reliability. This article focuses on the most complained brokers during that month, as reported by WikiFX.

ST5

WikiFX Rating: 1.17/10

Number of Complaints in March: 15

ST5, a China-based brokerage firm, offers a diverse range of market instruments, encompassing Forex, Metals, Oil, CFDs, and Cryptocurrencies. Nevertheless, it's imperative to highlight that the broker currently operates without any valid regulatory oversight, which can understandably raise concerns among traders regarding the safety and security of their investments when trading with ST5.

We have received four exposures against this broker recently.

Turbine Trade LTD

WikiFX Rating: 1.11/10

Number of Complaints in March: 3

Turbine Trade LTD, an unregulated trading company based in China, presents a concerning profile. With a lack of regulatory oversight, the company operates without the safeguards that regulations provide for transparency and accountability. The absence of clear information on minimum deposits, coupled with varying spreads by account type, adds to the uncertainty surrounding this broker.

Vistova

WikiFX Rating: 1.11/10

Number of Complaints in March: 22

Vistova, a newly established trading company founded in 2023 and headquartered in Saint Lucia, offers a range of financial services. However, it's important to note that Vistova operates without regulatory oversight. The minimum deposit requirement to open an individual account with Vistova is $500.

QOINTECH

WikiFX Rating: 1.19/10

Number of Complaints in March: 21

QOINTECH is a broker based in Japan that has been operating for less than a year. However, it is important to note that QOINTECH currently lacks valid regulation, which raises potential risks for investors. The broker's regulatory status with the United States NFA is categorized as unauthorized, and it exceeds the business scope outlined by its license. Additionally, QOINTECH lacks trading software, which may hinder trading activities. As such, caution is advised when considering engagement with this broker, and it is recommended to explore regulated alternatives with established track records for a safer investment experience.

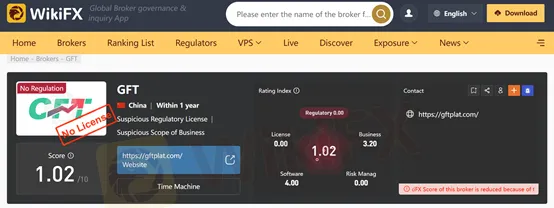

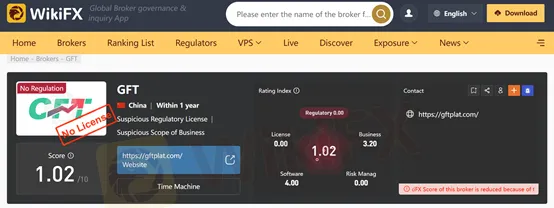

GFT

WikiFX Rating: 1.02/10

Number of Complaints in March: 8

GFT is an unregulated broker registered in China. This broker has a trading experience of less than one year. Moreover, some traders claimed that this platform is a “fraud” scam. There was an alleged freezing of each users money so that no one could make a withdrawal.

Conclusion

Selecting a reputable broker is a critical decision for investors. The brokers mentioned here have garnered varying levels of trust and scrutiny. Individuals need to conduct thorough due diligence and research before choosing a broker to ensure their investments and interests are protected. Regulatory compliance, reputation, and user feedback should all be considered when making this crucial decision. Although some brokers here have relatively high scores, it doesn't mean you can trust them without care.

WikiFX Rating System is updated in real-time, ensuring investors have access to the latest, most accurate, and comprehensive broker information.

The WikiFX score of a broker can be increased or decreased if the broker is constantly running the business in a good or bad direction. If you want to know more information about the reliability of certain brokers, you can open our website or you can download the WikiFX APP to find the most trusted broker for yourself.