VORBIX MARKETS Review: No License, Withdrawal Risk

Is VORBIX MARKETS safe? Read this WikiFX review on no license status, withdrawal issues, and trader complaints before you deposit. Download now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Many Forex traders may believe that a larger broker is superior to a smaller broker due to advantages such as economies of scale, a stronger position in liquidity, and increased scrutiny from the public and regulatory entities. Traders' trading needs and objectives vary, so it is critical for traders to compare and evaluate brokers to find the one that best meets their needs. That said, let’s look at some advantages that stand out for large forex brokers.

1) More capital, better R&D

Large forex brokers tend to be more reputable, have a bigger customer base, competent employees, better channels and abundant capital. Therefore, they are mostly superior in platform development and cooperation. Usually, they operate globally and offer a large number of products to their clients through in-house research and development, extensive partnerships and acquisitions.

Smaller brokers, on the other hand, have limited market share and thus insufficient investment in research and development. They also usually offer lesser platforms and have relatively rudimentary product ranges. They do not offer as much currency pairs or instruments like the bigger forex brokers, which limits the choices of traders. There is also no headcount advantage, which causes the lack of customer service, resulting in longer processing times for withdrawals and deposits – this is one of the biggest concerns for traders. Smaller brokers also have much lower brand awareness and reputation which could be a factor of distrust among traders.

2) Lower spreads

Large brokers have better credit, which facilitates them to get better forex quotes from the interbank market. For example, FFX has a strong relationship with Deutsche Bank, which provides FFX with preferential quotes in the interbank market. Deutsche Bank will then provide the discounted interbank quotes to FFX, and FFX will add a small spread to the discounted quotes and provide them to the average individual trader.

The better the broker's credit and the more influence it has, the more preferential quotes it will receive from banks on exchange rate quotes, and the more benefits individual traders will get.

3) One-stop solution

In addition to operating their official websites, large brokers also provide value-added services around their platforms to promote customer loyalty. Traders can get access to trading e-books, courses, seminars, webinars, intelligent trading systems (also known as expert advisors), participate in simulation competitions, etc. Some brokers also have their trading forums to allow traders to socialize and exchange ideas with one another.

Knowing all this, the next question will be “how do you select the right broker”?

WikiFX is a global forex broker regulatory inquiry app that holds information of over 35,000 forex brokers worldwide with a tight knit collaboration with 30 national regulators. At WikiFX, we help you filter out unqualified brokers.

For mobile applications, download the free WikiFX app from Google Play/App Store. Click on “Ranking”.

In the ranking page, you can see a list of top-ranking brokers that were meticulously reviewed and ranked by the WikiFX team in terms of license, business, risk management, software, and regulatory.

On the top row of page tabs, click on “frauds” which is a very useful tool that was designed to pinpoint the high risk brokers so traders can be aware of them and not fall prey into the brokers traps.

In addition, as mentioned in point 2 above, spread levels offered by forex brokerage firms are another factor to consider by traders when choosing brokers. For this, click on “Spread” on the homepage of the WikiFX mobile app as demonstrated in the image above.

On this page, you can see the spreads offered by each forex broker on the main currency pair (EUR/USD), and commodities (gold and crude oil).

This information is particularly useful for short term traders, especially for scalpers (traders who trade many times a day, collecting a few pips at a time).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Is VORBIX MARKETS safe? Read this WikiFX review on no license status, withdrawal issues, and trader complaints before you deposit. Download now.

CySEC has told Cyprus brokers to prepare for on-site inspections and desk reviews focused on conflicts of interest and retail product sales.

Read this amana review covering broker regulation, user complaints, and withdrawal risk signals on WikiFX before you deposit. Check the facts now.

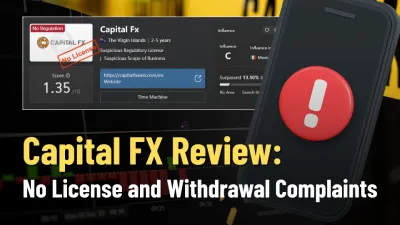

Capital Fx shows no valid regulation on WikiFX, and reviews cite withdrawal problems and steep fees. Read the warning signs on the WikiFX App.