Abstract:Start the week of April 18, 2022 with our Forex forecast focusing on major currency pairs here.

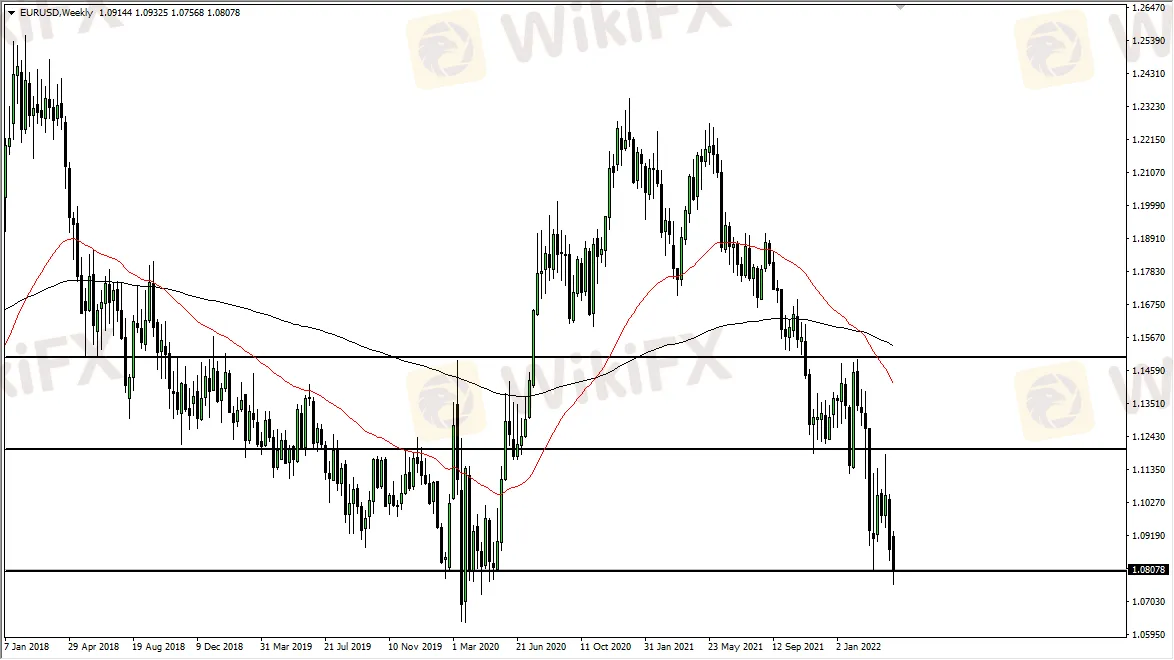

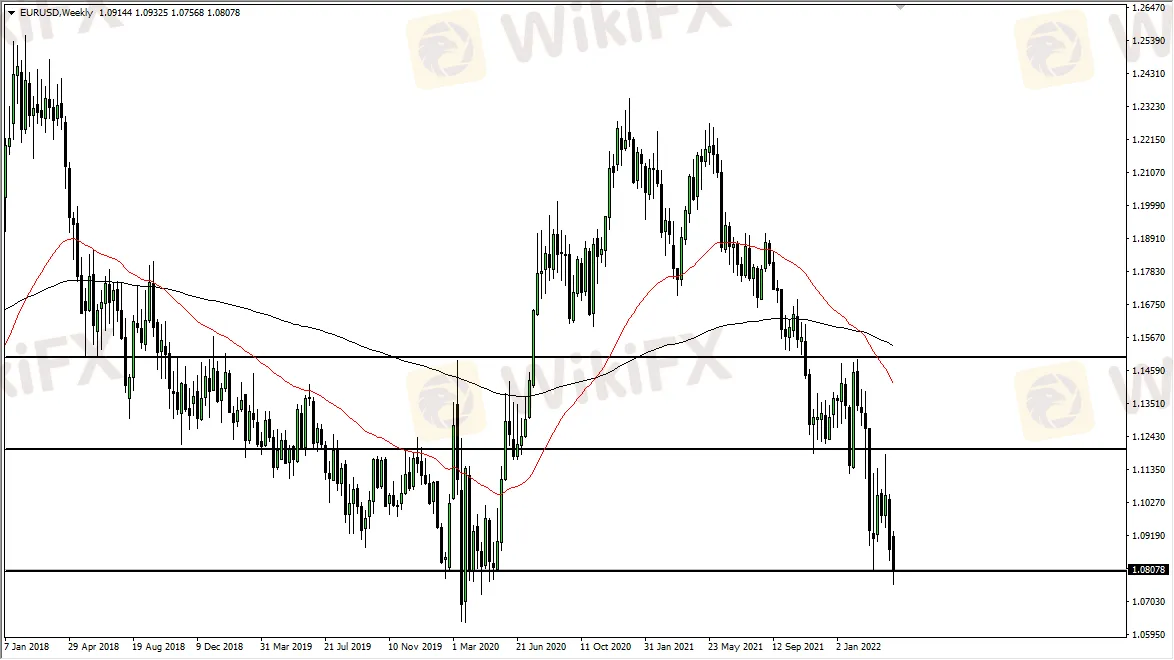

EUR/USD

The euro continues to get punished, and I think at this point we are getting ready to attempt to break down below the 1.08 level. Having said that, there is a significant amount of support here, so a short-term rally is almost certain to happen. Nonetheless, this should end up being a nice shorting opportunity and at this point, I have no interest in trying to buy this market. Keep in mind that the area below 1.08 is very noisy, so the drive down to the 1.06 level will more than likely be more of a grind than any type of freefall unless headline shocks cross the wires

GBP/JPY

The British pound has rallied again against the Japanese yen, breaking through a major barrier in the form of the ¥165 level. That being said, we are overstretched, so I think this is a situation where you may look for a short-term pullback in order to get involved again. The ¥162.50 level should be supported, just as the ¥160 level will be. That being said, I do not expect that deep of a correction, but it is certainly within the realm of possibility. Keep in mind that as long as the Bank of Japan is looking to find interest rates rising, they will have to continue to keep quantitative easing in play, the main driver of this move.

AUD/USD

The Australian dollar fell during the trading week, breaking below the 0.74 level. This was preceded by a massive shooting star at the 0.75 handle, so it all ties together quite nicely. I suspect at this point in time that any short-term rally that you get is more than likely going to be an opportunity to short this market again. That being said, a breakdown below the are where we are closing more than likely will send fresh sellers into the market.

EUR/GBP

The euro is approaching a very important region on the longer-term charts as far as support is concerned. The 0.82 level being tested is a big deal, and if we were to break down below that level, the bottom will follow out of this pair. More likely than not, we will get a short-term bounce, but I would be a seller of that move because without a doubt the euro is one of the weakest currencies that we currently deal with. If we do get that breakdown, it will become a longer-term position.