The Head and Shoulders Pattern and How to Trade It

A reversal pattern, the head and shoulders chart pattern is most commonly observed in uptrends. "Head and shoulders" is well-known not only for trend reversals, but also for dandruff reversals.

A reversal pattern, the head and shoulders chart pattern is most commonly observed in uptrends. "Head and shoulders" is well-known not only for trend reversals, but also for dandruff reversals.

A trend reversal has begun when a double top or double bottom chart pattern develops. Let's look at how to recognize and trade these chart patterns.

Consider chart patterns to be a land mine detector; once you've completed this lesson, you'll be able to notice "explosions" on the charts before they happen, potentially making you a lot of money.

We've gone over the two types of technical indicators based on when the signals are generated. Leading and lagging indicators are the two sorts of indicators.

MACD and moving averages have already been established as indicators that can do so. At the cost of delayed input, these indicators will identify patterns once they have been formed.

Any object or data that oscillates between two points is called an oscillator. To put it another way, it's something that will always fall someplace between point A and point B.

We want you to know everything there is to know about each tool so you can figure out which ones work for you and which ones don't. Let's start with the fundamentals. Leading and lagging indicators are the two sorts of indicators.

When you employ the correct tool at the right moment, you'll have a greater chance of making effective trading judgments.

After all, forex traders don't add technical indicators to their charts only to make them seem nicer. Traders are in the money-making industry!

In a real world, we could take just one of these indicators and trade strictly by what that indicator told us.

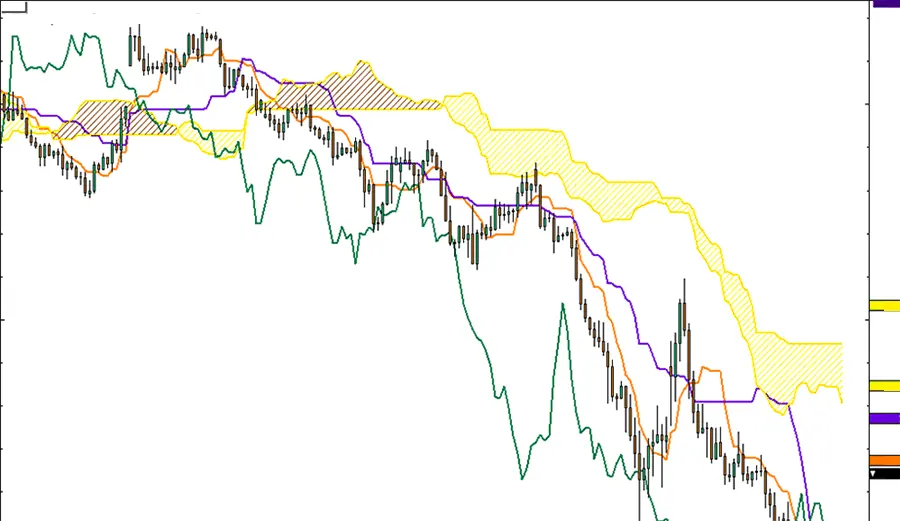

The Ichimoku Kinko Hyo, or equilibrium chart, isolates higher probability trades in the forex market. It is new to the mainstream but has been rising in popularity among novice and experienced traders.

The Average Directional Index, or ADX, is a tool for determining the comprehensive strength of a trend. It is based on the idea that trading, when the market is moving in the direction of a strong trend, increases the chances of profit and lowers the risk by a considerable margin.

Williams %R, also known as the Williams Percent Range, is a type of momentum indicator that moves between 0 and -100 and measures overbought and oversold levels. The Williams %R may be used to find entry and exit points in the market. It shows where the last closing price is relative to the highest and lowest prices of a given time period.

The Relative Strength Index (RSI) describes a momentum indicator that measures the magnitude of recent price changes in order to evaluate overbought or oversold conditions in the price of a stock or other asset.

The price momentum is measured by stochastics. If you imagine a rocket in the air, it must first slow down before it can turn down. Momentum always moves in the opposite direction of price.

It is critical to be able to recognize new trends, but it is also critical to be able to recognize when a trend has reached its end.

MACD is an acronym for Moving Average Convergence Divergence. This technical indicator is a tool for identifying moving averages that indicate a new trend, whether bullish or negative.

Keltner Channels is a volatility indicator created by Chester Keltner, a grain trader, in his 1960 book How To Make Money in Commodities.

As a result, the more tools you have, the more you'll be able to ADAPT to the always altering market environment. It's also fine if you want to concentrate on a few specialized trading settings or tools.

The main purpose of the moving average is to eliminate short-term fluctuations in the market. Because moving averages represent an average closing price over a selected period of time, the moving average allows traders to identify the overall trend of the market in a simple way.