Company Summary

| OpenMarkets Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Australia |

| Regulation | ASIC (exceeded) |

| Services | Enterprise APIs, Execution, Managed Accounts, Onboarding, Order Manager, Risk Management |

| Customer Support | Contact form |

| Phone: +61 381997700, +61 1300 769 433 | |

| Email: support@openmarkets.com.au | |

| Address: Level 15, 388 George Street, Sydney NSW 2000, Australia | |

OpenMarkets, founded in 2004 and based in Australia, is a financial services firm formerly regulated by the Australian Securities and Investments Commission (ASIC) under an Investment Advisory License, which is now listed as “exceeded”. The company offers various services such as Enterprise APIs, Execution, Managed Accounts, Onboarding, Order and Risk Management.

Pros and Cons

| Pros | Cons |

| A wide range of services | Exceeded ASIC license |

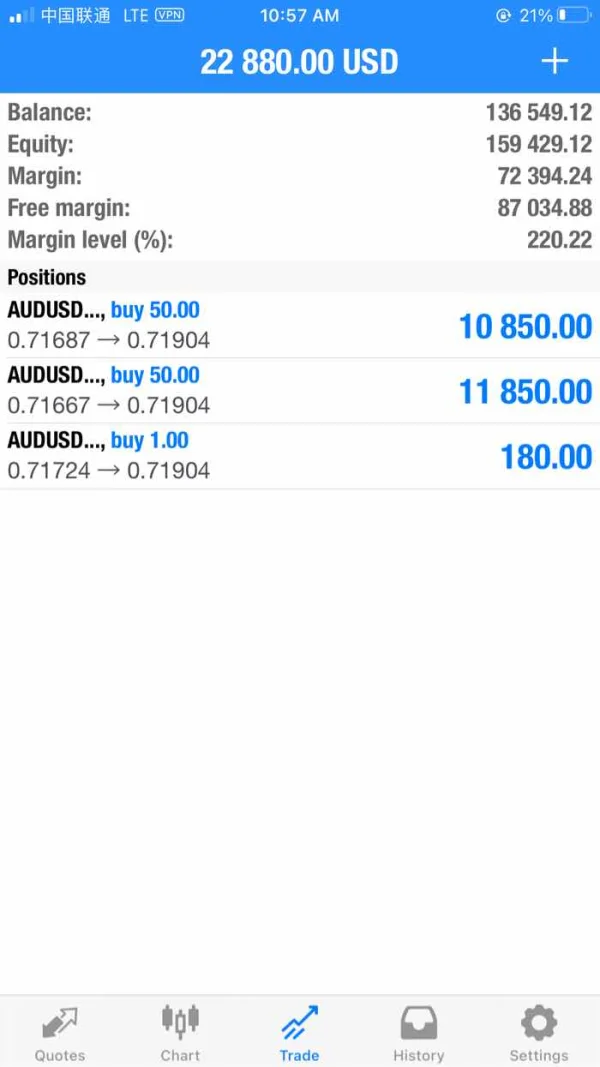

| Diverse customer support channels | Lack of info on trading platforms |

| No demo accounts | |

| Limited info on accounts | |

| Limited info on trading fees |

Is OpenMarkets Legit?

No, at present, OpenMarkets' Investment Advisory License under ASIC has been exceeded.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| Australian Securities and Investments Commission (ASIC) | OpenMarkets Australia Limited | Exceeded | Investment Advisory License | 246705 |

Services

OpenMarkets offers diverse services including Enterprise APIs, Execution, Managed Accounts, Onboarding, Order Manager, and Risk Management.