Company Summary

| CITIC SECURITTIES Review Summary | |

| Founded | 1995 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Products | Securities, IPO Subscriptions, Grey Market, Stock Options, Algorithmic Trading |

| Demo Account | ❌ |

| Trading Platform | XeT International APP, iTrade |

| Customer Support | Tel: 852 2237 6899 |

| Fax: 852 2104 6862 | |

| Email: csi-callcentre@citics.com.hk | |

| Address: 26/F, CITIC TOWER, 1 TIM MEI AVE, CENTRAL, HONG KONG | |

| Social Media: Facebook, Instagram, LinkedIn | |

| Promotion | ✅ |

CITIC SECURITTIES Information

CITIC SECURITTIES is a regulated service provider of premier brokerage and financial services, which was founded in Hong Kong in 1995. It offers products in Securities, IPO Subscriptions, Grey Market, Stock Options and Algorithmic Trading.

Pros and Cons

| Pros | Cons |

| Long operation time | No demo accounts |

| Various products | Commission fees charged |

| Regulated well | Limited types of payment options |

| Various contact channels | |

| Promotions offered |

Is CITIC SECURITTIES Legit?

Yes. CITIC SECURITTIES is licensed by Securities and Futures Commission of Hong Kong (SFC) to offer services. Its license number is AHR752. The Securities and Futures Commission (SFC) is an independent statutory body set up in 1989 to regulate Hong Kong's securities and futures markets.

| Regulated Region | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | CITIC Securities Futures (HK) Limited | Dealing in futures contracts | AHR752 |

CITIC SECURITIES Products

CITIC SECURITIES provides a number of products, including Securities, IPO Subscriptions, Grey Market, Stock Options, and Algorithmic Trading.

| Products | Supported |

| Securities | ✔ |

| IPO Subscriptions | ✔ |

| Grey Market | ✔ |

| Stock Options | ✔ |

| Algorithmic Trading | ✔ |

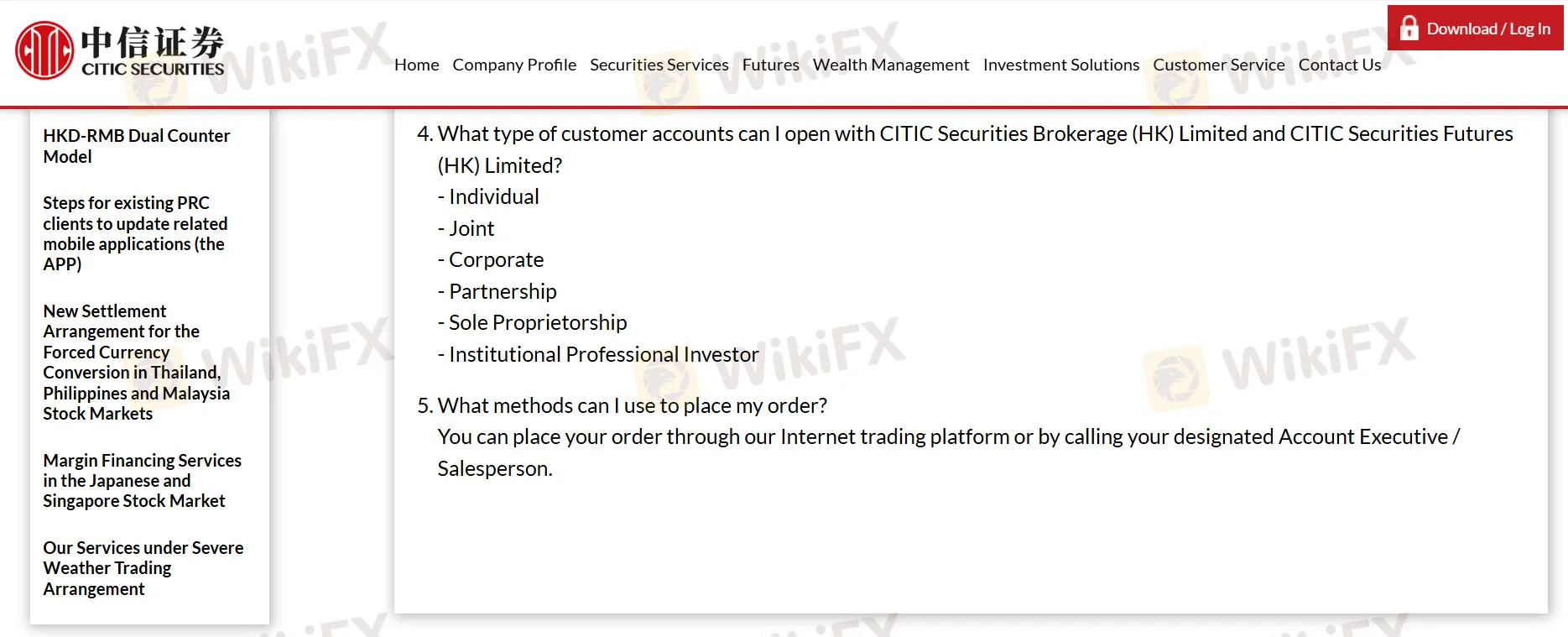

Account Type

CITIC SECURITIES provides various customer account types, such as Corporate Account, Partnership Account, etc. But the broker does not provide any information about the minimum deposit of accounts.

| Account Type | Minimum Deposit |

| Individual/Joint Name Account | / |

| Corporate Account | / |

| Partnership Account | / |

| Sole Proprietorship Account | / |

| Institutional Professional Investor Account | / |

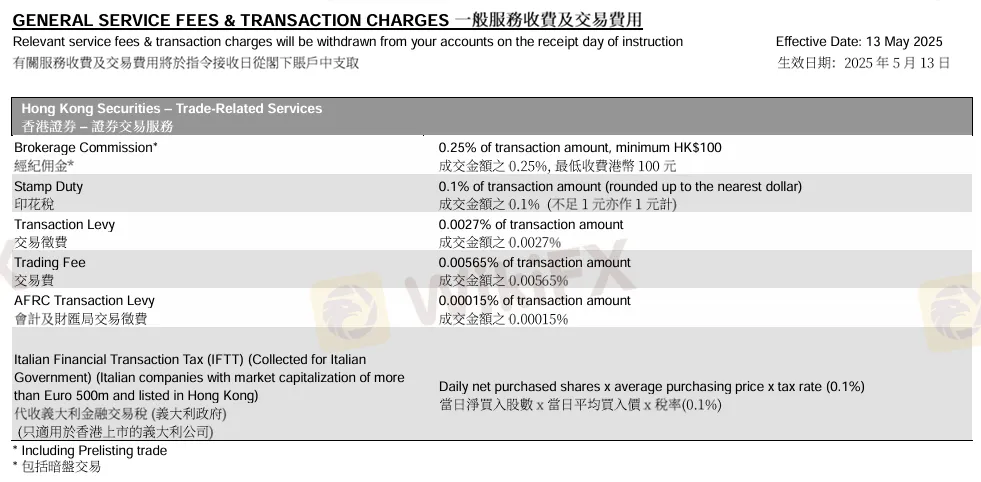

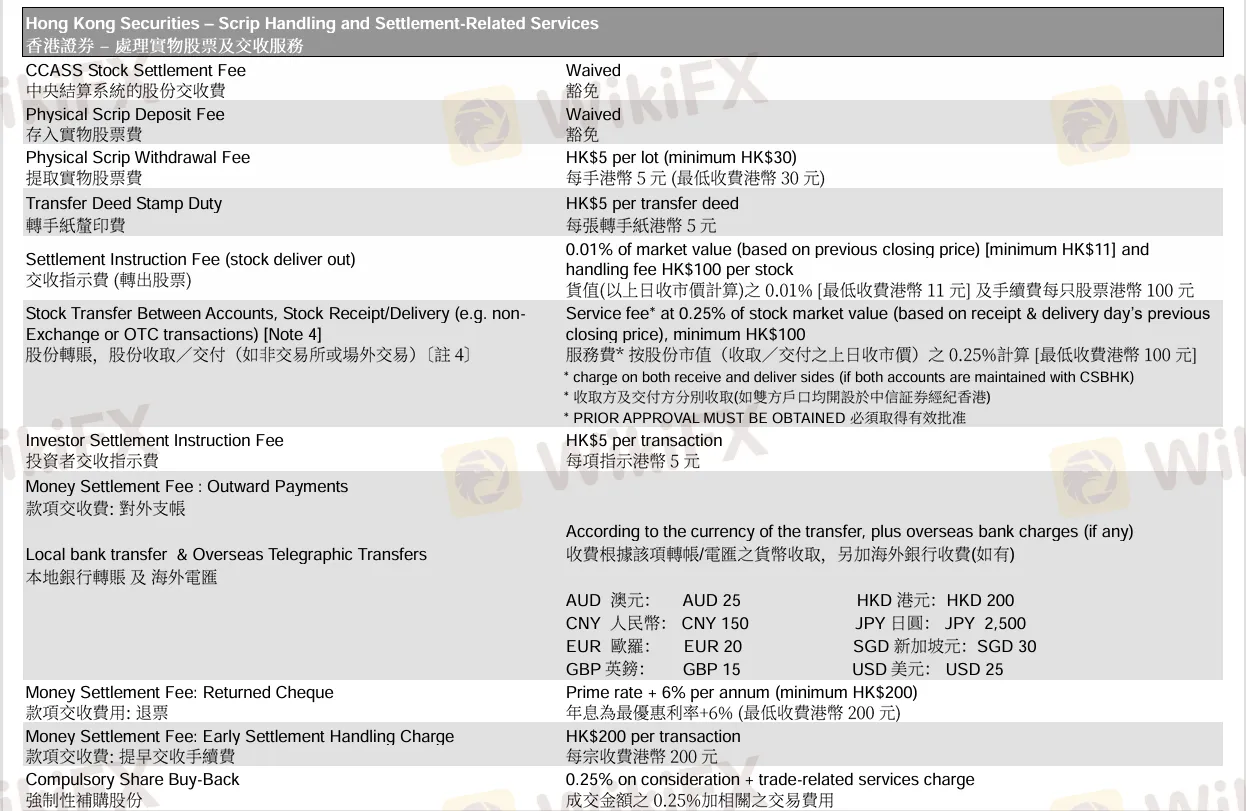

CITIC SECURITTIES Fees

Fees vary for different transactions. Please refer to the fee schedule provided on the official website for details.

Trading Platform

CITIC SECURITIES offers XeT International APP and iTrade online trading platform for mobile and web respectively.

| Trading Platform | Supported | Available Devices |

| XeT International APP | ✔ | Mobile |

| iTrade | ✔ | PC, web |

Deposit and Withdrawal

CITIC SECURITIES does not accept third party deposits and withdrawals. Cash deposits and withdrawals are also not acceptable. Clients should transfer funds through their own bank accounts or use cheque deposit.

Bank Transfer Service and Faster System (FPS): If the deposit is made through E-banking, Bank Counter, ATM, Cheque or FPS, please submit the deposit instruction on Xet International app, iTrade or TDX, or you can inform your designated Account Executive / Salesperson for acknowledgement.

Bill Payment: Fund deposits can also be made through the electronic bill payment services of HSBC or Hang Seng Bank.

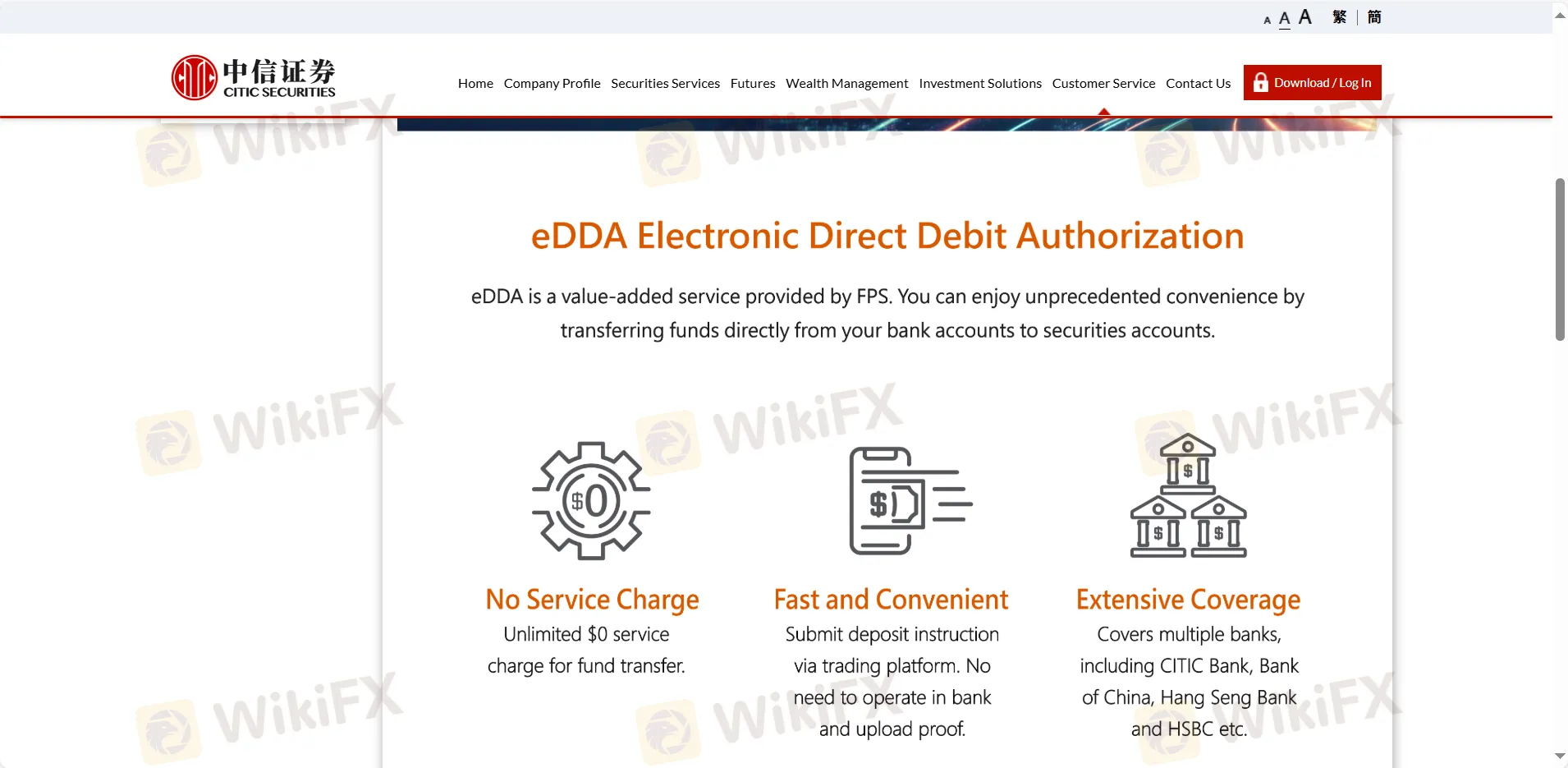

eDDA Electronic Direct Debit Authorization (For Securities account and HKD deposit only): After successful authorization, you can directly initiate an electronic direct debit instruction (eDDI) via our mobile app XeT International, online trading platform iTrade or mobile app (general version).

Except for the eDDA electronic direct debit service, the brokers deposit cutoff time is 5:00 p.m. on each business day. Deposit instructions submitted after 5:00 p.m. will be processed on the next business day. And no minimum deposit/withdrawal amount defined and no fees or charges specified.

Promotions

Promoting activities are available. Customers can participate in different types of activities and gain bonuses.

weng1959

Taiwan

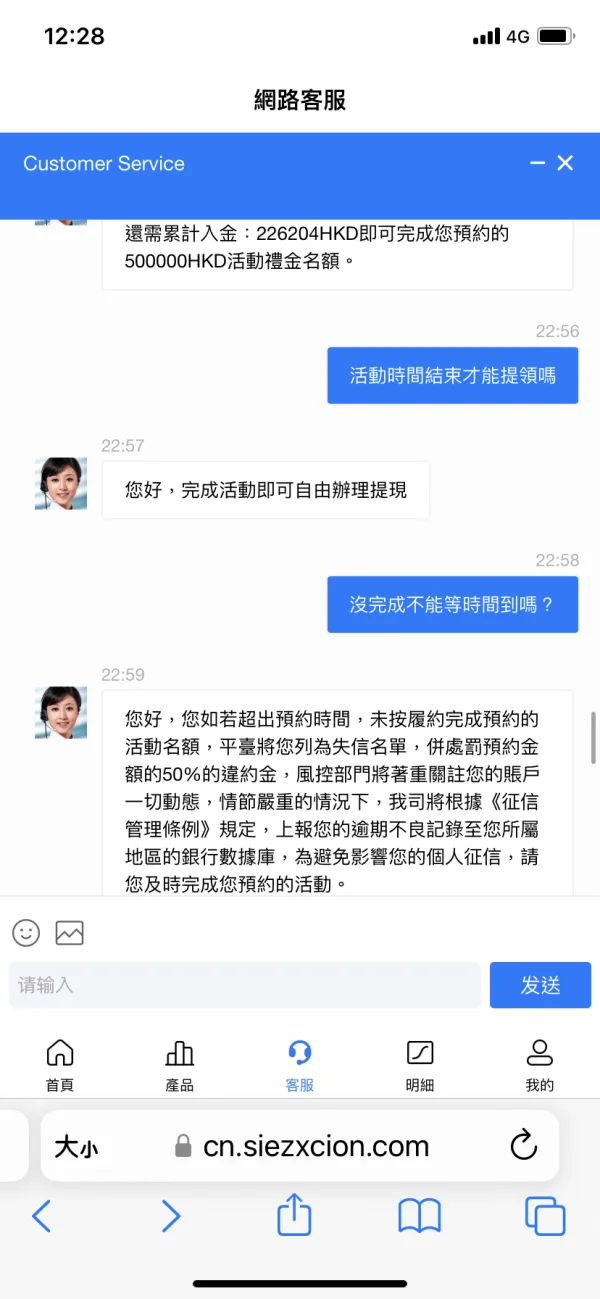

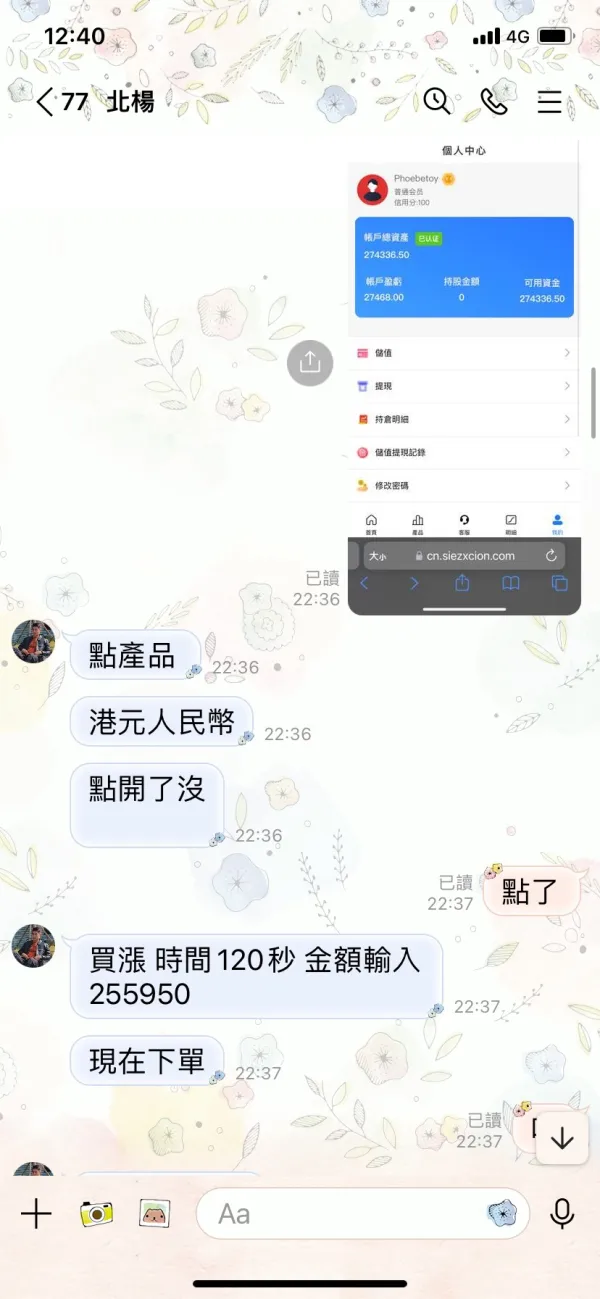

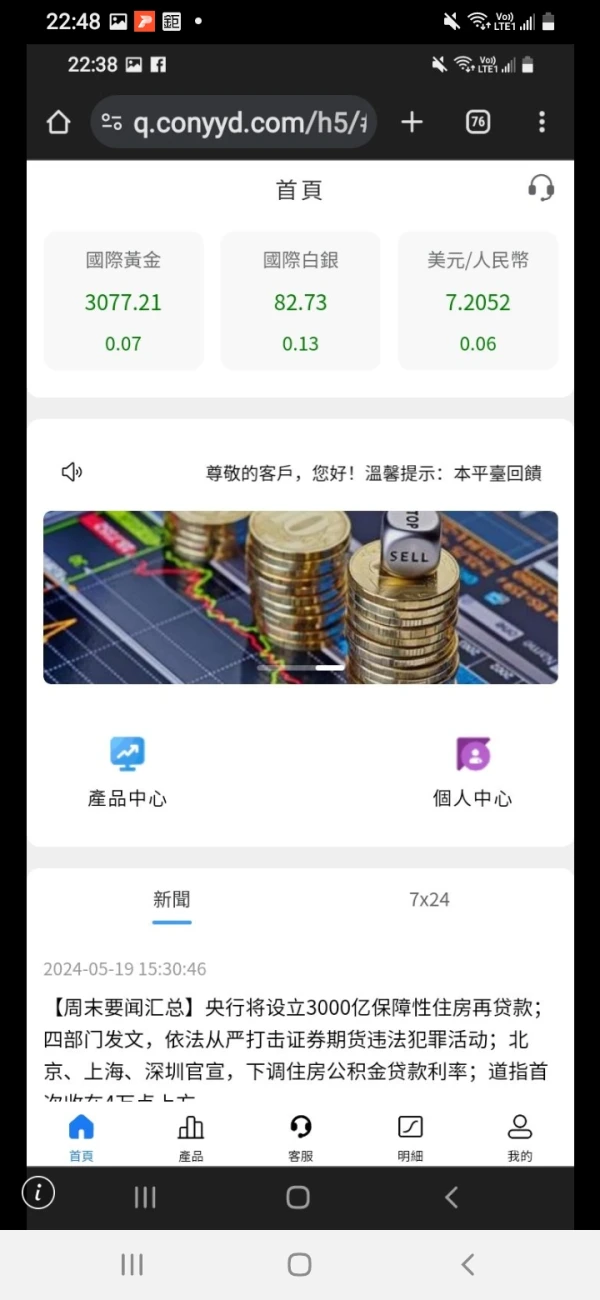

On IG, I met someone who claimed to be Taiwanese but stayed in Hong Kong. The person cultivated a relationship with you first, and then told you about investment channels. The person asked you to download some apps and let you start with small amounts of money. After a large amount of money is deposited, they refuse to allow withdrawals, claiming that the new user tasks have not been completed. If the tasks are not completed within the deadline, they will require payment of risk control fees and report credit defaults.

Exposure

FX2163534972

Taiwan

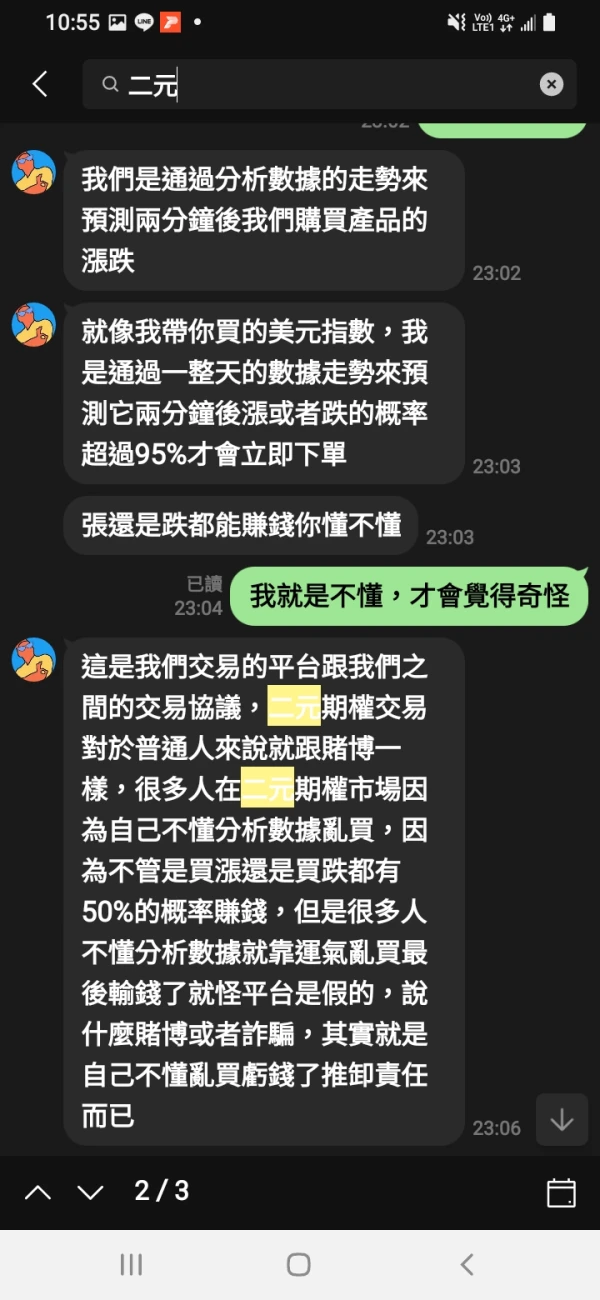

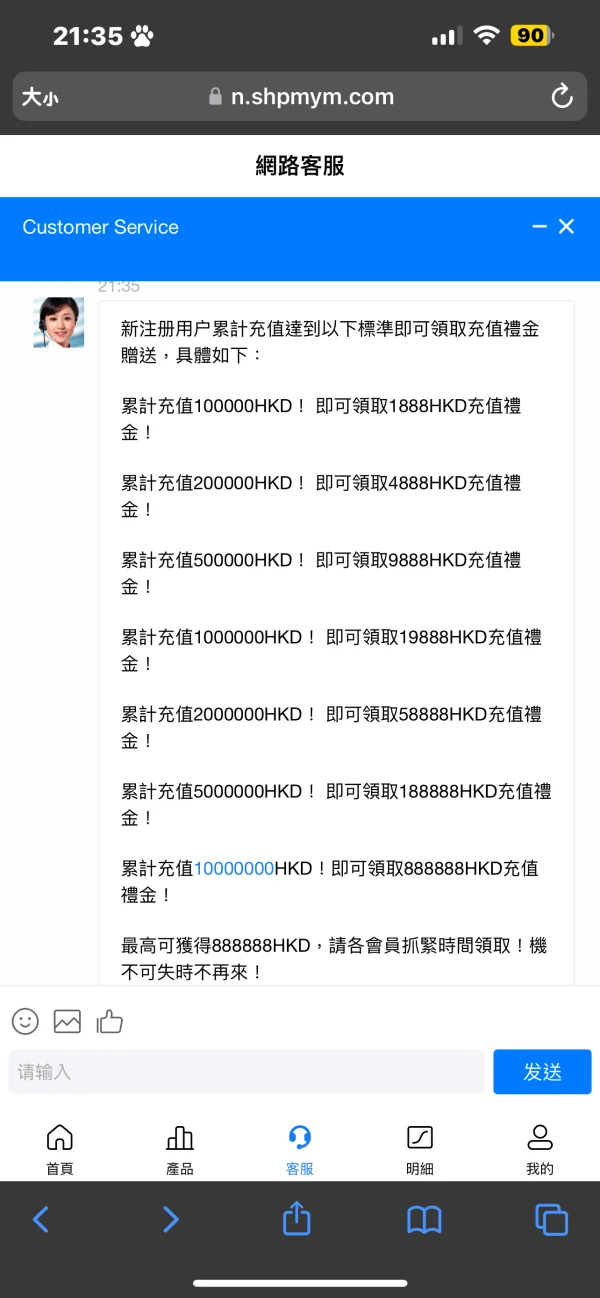

I met a man on IG who runs a decoration company in Hong Kong. He claims to be Taiwanese but has stayed in Hong Kong since he was a child. He first added my friend on IG, making me think that I was a friend of a friend, so I agreed to his invitation to be friends! After chatting online for a while, he started to mention the topic of investment! First it was stocks and then it was foreign exchange. He said that he had insider information in the bank and his professional judgment, and he could make 95% profit. At first, I was dubious and only made a small deposit and followed the order. After a few operations, I made a small withdrawal of 500u. The next day he asked me to ask customer service if there was any new activity, and it turned out that there was indeed an activity for new customers. He asked me to make an appointment with a gold member (if you deposit 50,000u, you will receive a gift of 5,888u). At first, I refused and said that I didn’t have that much spare money to spare. But he said he would help me and immediately put 10,000u in. I thought he had already put it in, so it should be fine! Later, he suggested that I borrow a loan to store value... and told me that he also had a loan, and he could withdraw it and pay it back after the activity was completed. After that, he helped me save another 10,000u. After the event was completed, there was indeed a gift. The man immediately asked me to withdraw 2000u, and I could actually withdraw it! But a few days later, I wanted to withdraw it myself but was blocked for a whole day. When I asked customer service, they said they wanted me to wait because there were so many people withdrawing! Now that I think about it, they should be operating behind the scenes...

Exposure

FX4224431316

Taiwan

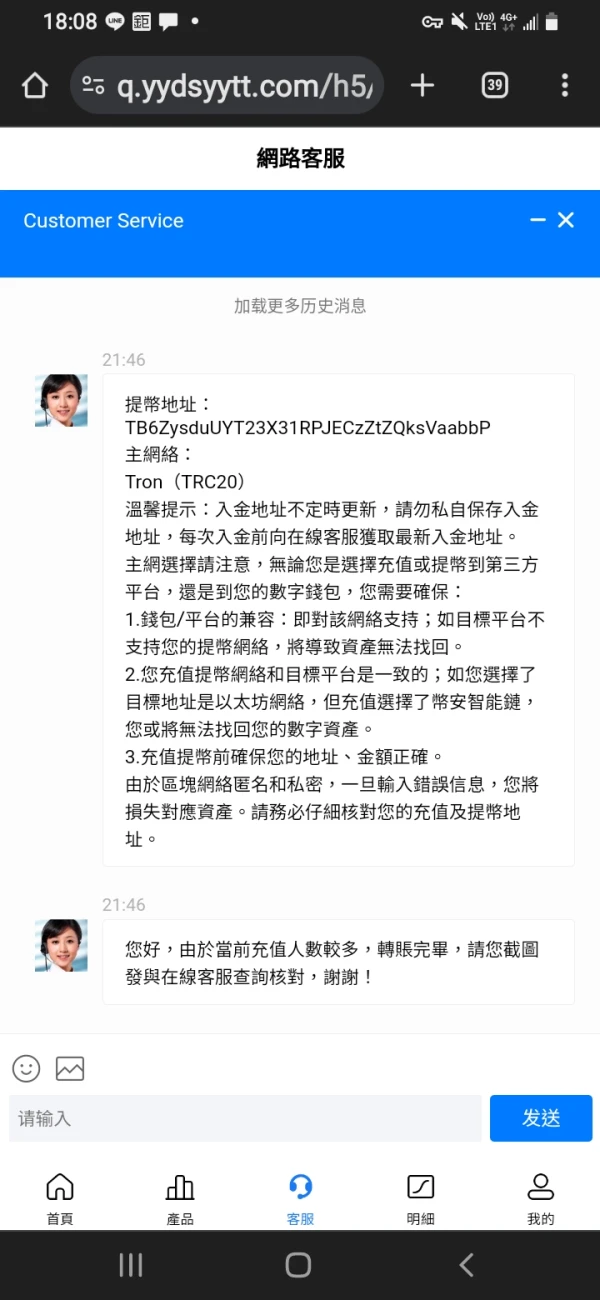

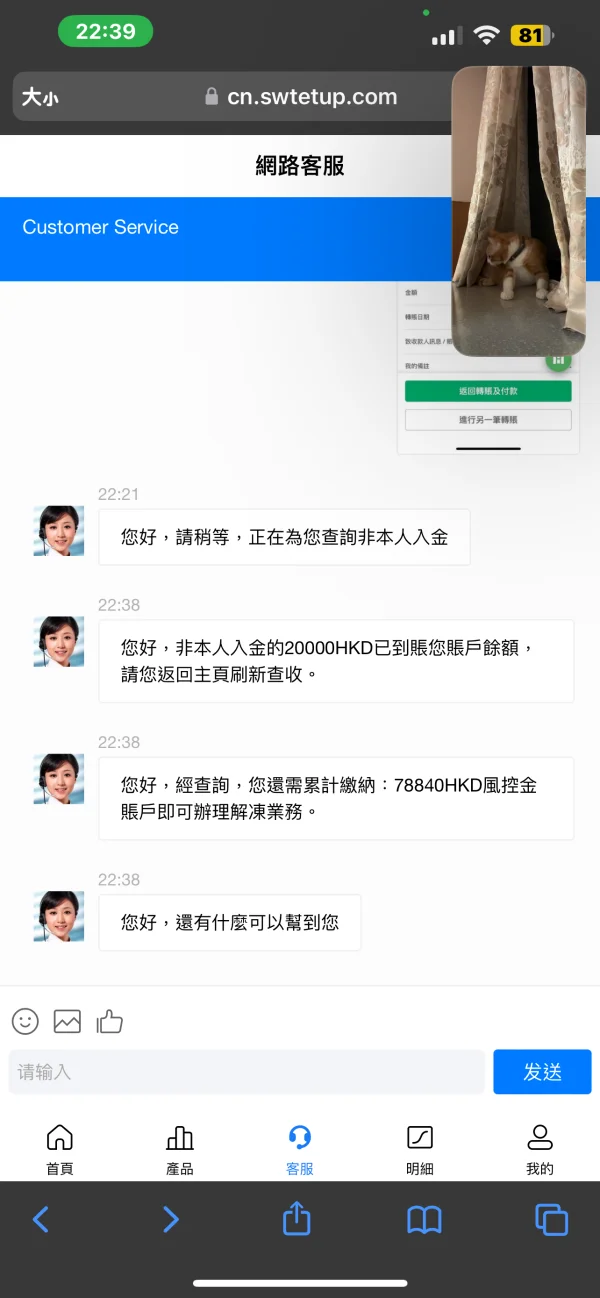

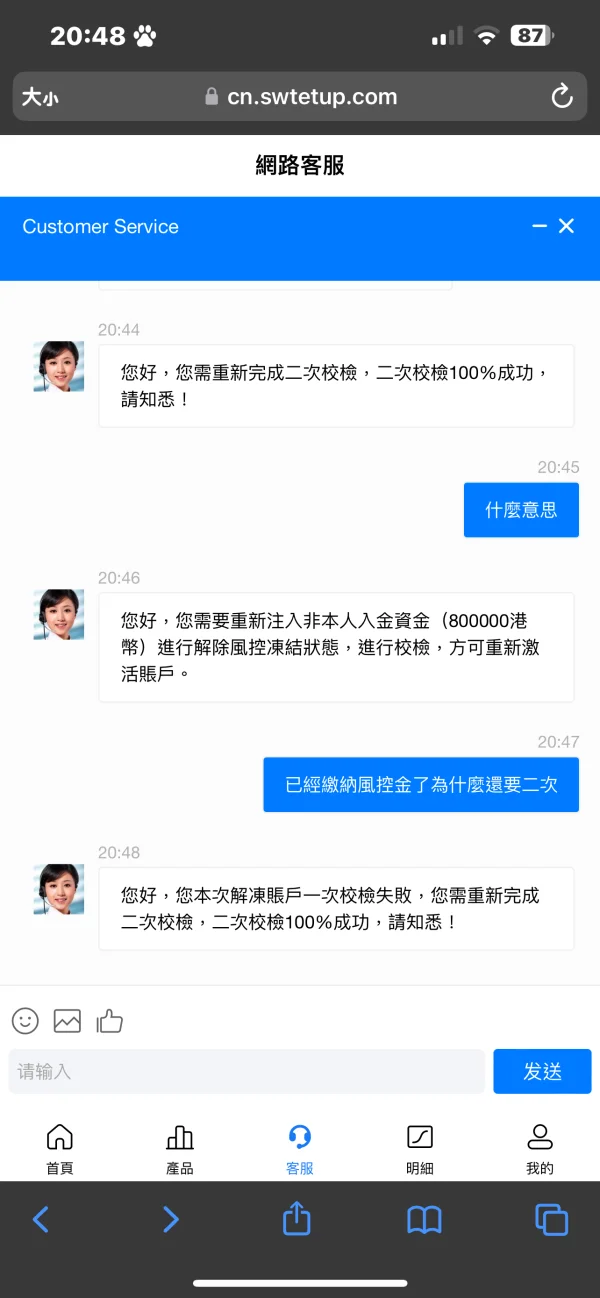

I met a businessman on the Internet who said he lived in Hong Kong. He expressed his affection for me at first and started teaching me how to make money and invest with him. He asked me to download the OKX, MAX app and then gave me a URL https:// cn.swtetup.com/h5/#/ After asking me to register an account, it said it was a foreign exchange account. At first, he asked me to swipe my card to recharge money to operate the foreign exchange difference, and I successfully withdraw cash into the account. Later, he thought that my principal was not large enough and the profit was too small, so he remitted NT$1 million and put it into my foreign exchange account and told me to make more money. Later, he asked me to collect the 1 million recharge gift from the customer service (after remitting the money, he asked me to ask the customer service for all the recharge gift at once). The next day, I felt something was wrong and I wanted to withdraw the money from my account and return it to him. At that time, I found that I couldn't withdraw the cash and I couldn't pay him back. The customer service explained that I had to complete the recharge bonus activity before I could cash it out successfully, which meant that I had to put in more funds to complete the activity before I could withdraw the cash. Later, inexplicably, my account was said to be frozen. The Hong Kong man also said that he would help me solve the problem together and put money into this foreign exchange account. Indeed, he also gave me his transfer information, and the money he transferred was also displayed in the foreign exchange account. I also transferred money into it just to complete the recharge activity successfully. withdraw! However, after completing the activity, withdrawals were still not allowed due to various reasons...

Exposure

无言的结局523

Hong Kong

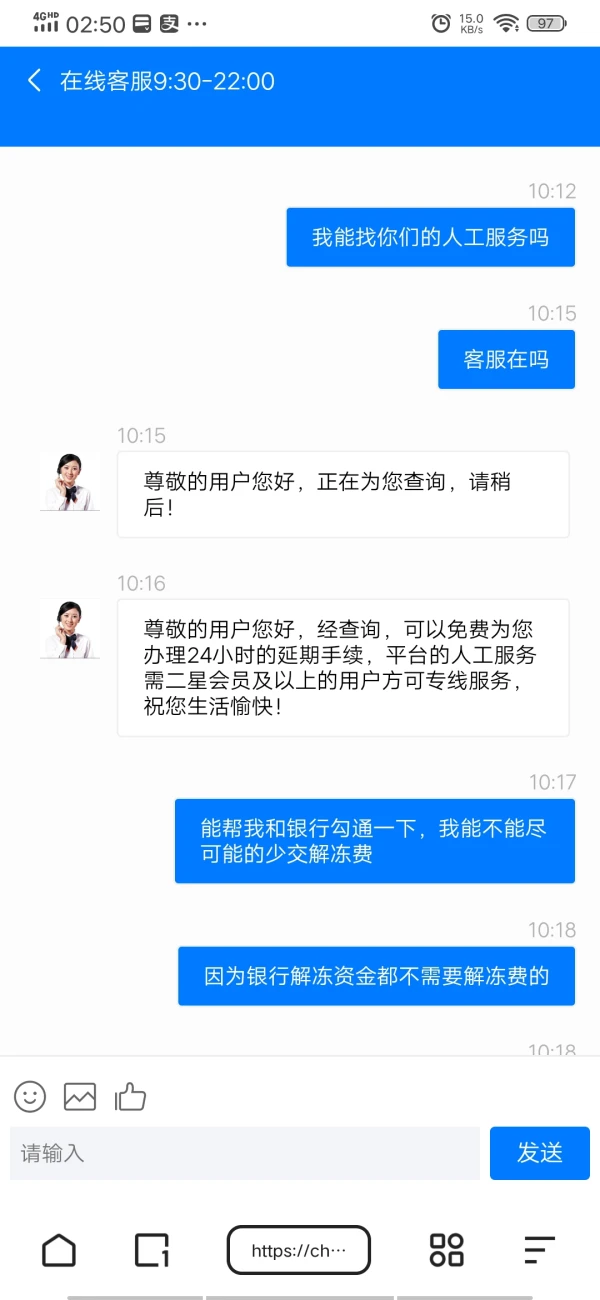

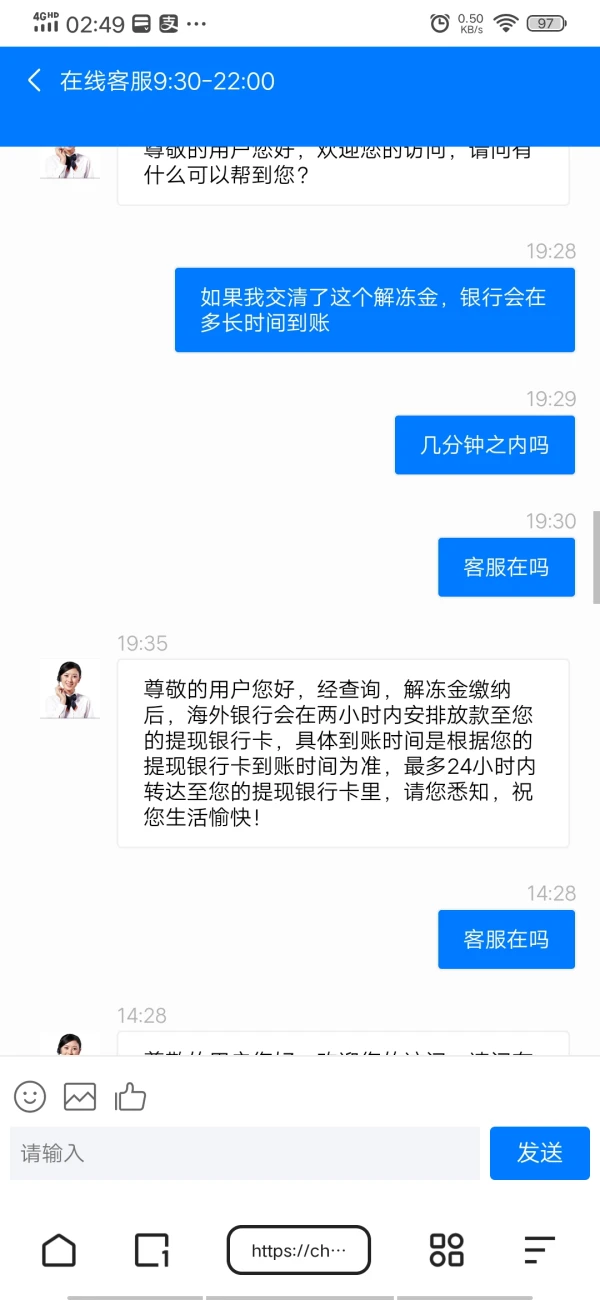

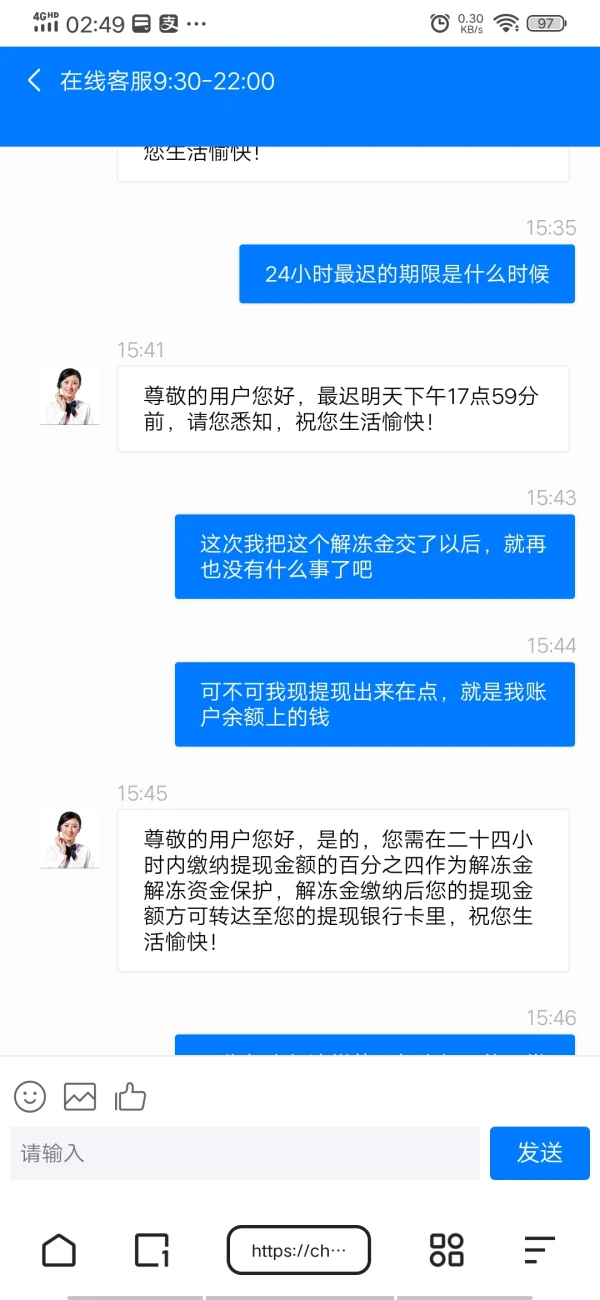

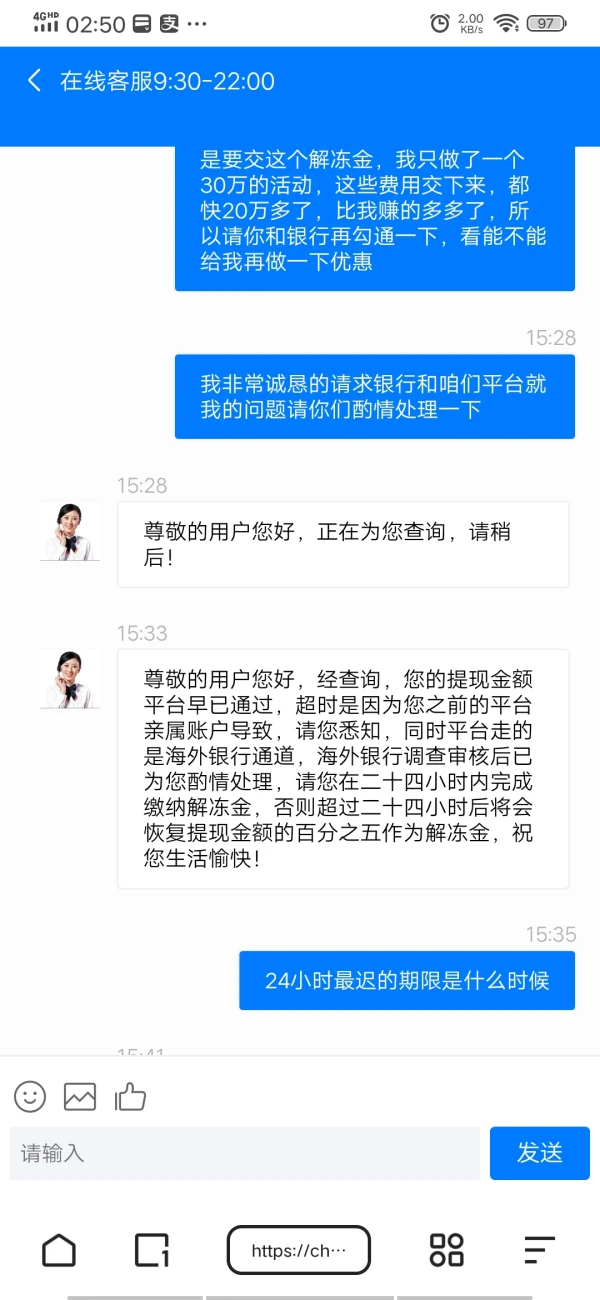

The BYFX platform under CITIC Securities uses various reasons to ask customers to pay fees, and the reason is that the funds are frozen in the bank and the unfrozen funds are handed over. Just do not withdraw money to customers. This is a scam.

Exposure

z@qqcom

Hong Kong

Hope to help me to solve the problem that fund does not arrive. It is a lesson. Do not trust others easily.

Exposure

伤心了

Hong Kong

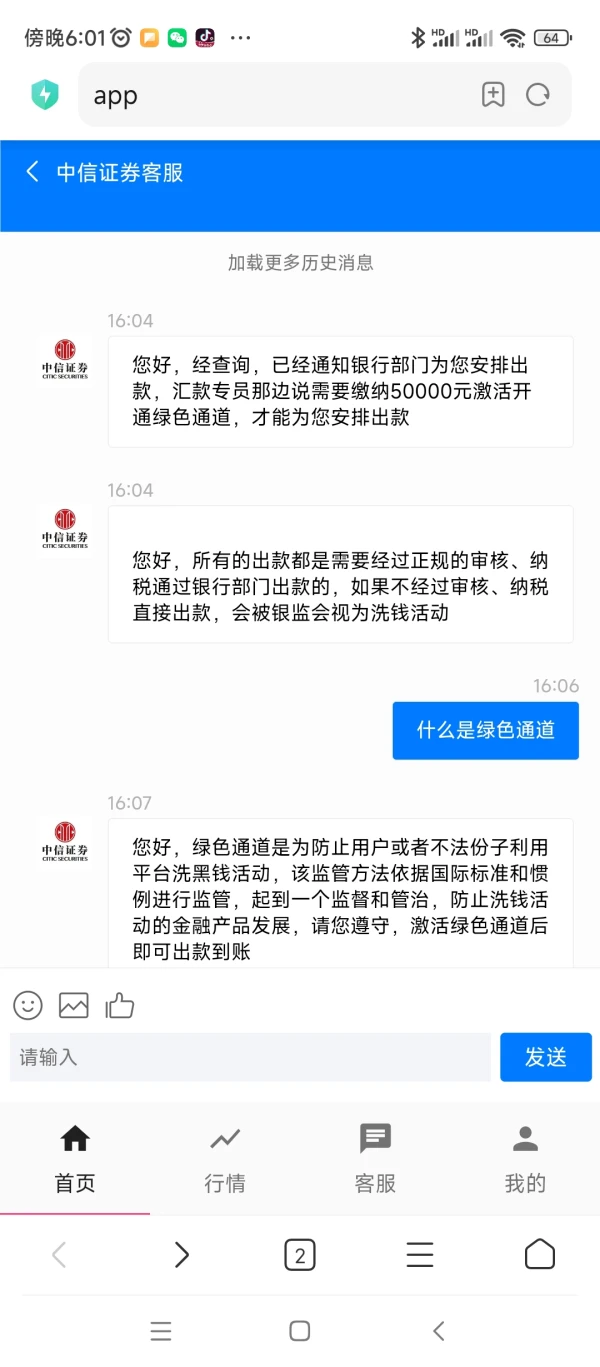

For the first time I was asked to pay the deposit, and then again, i was asked to pay the money for Green Channel. Not sure whether they were cheating on me.

Exposure

FX4024750467

Hong Kong

They said the system was under maintenance.

Exposure

安好28837

Hong Kong

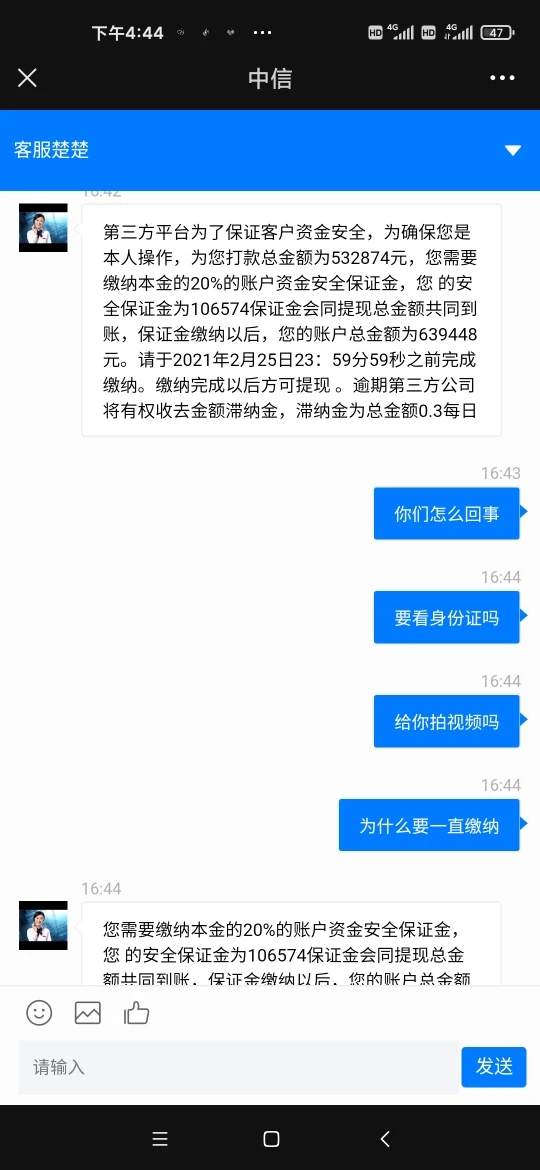

Unable to withdraw. Ask for money with various reasons

Exposure

@快乐每一天@

Hong Kong

CITIC SECURITTIES is deceptive and cannot withdraw funds

Exposure