Company Summary

| HIROGIN SECURITIES Review Summary | |

| Founded | 2008 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | ETFs, ETNs, REITs, stocks, IPO/PO, futures, options, investment trusts, bonds |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: +81 0120-523-814 (Weekdays 8:30~17:00, Excluding Saturdays, Sundays, and holidays, as well as December 31 ~ January 3) |

| Address: 〒730-0031 広島県広島市中区紙屋町1丁目3番8号 | |

Founded in 2008 and based in Japan, Hirogin Securities is a brokerage firm regulated by the Financial Services Agency (FSA). The firm offers a diverse range of market instruments, including ETFs, REITs, foreign stocks, IPOs, futures, options, investment trusts, and both domestic and foreign bonds. Moreover, it provides three account types: multi-channel trading (combining online and traditional methods), face-to-face transactions with dedicated asset management support, and internet trading for convenient access via digital devices.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Complex fee structure |

| A wide range of products | No demo accounts |

| Diverse account types | Inconvenient deposit and withdrawal |

Is HIROGIN SECURITIES Legit?

Yes, HIROGIN SECURITIES is currently regulated by FSA, holding a Retail Forex License.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| Financial Services Agency (FSA) | ひろぎん証券株式会社 | Regulated | Retail Forex License | 中国財務局長 (金商) 第20号 |

What Can I Trade on HIROGIN SECURITIES?

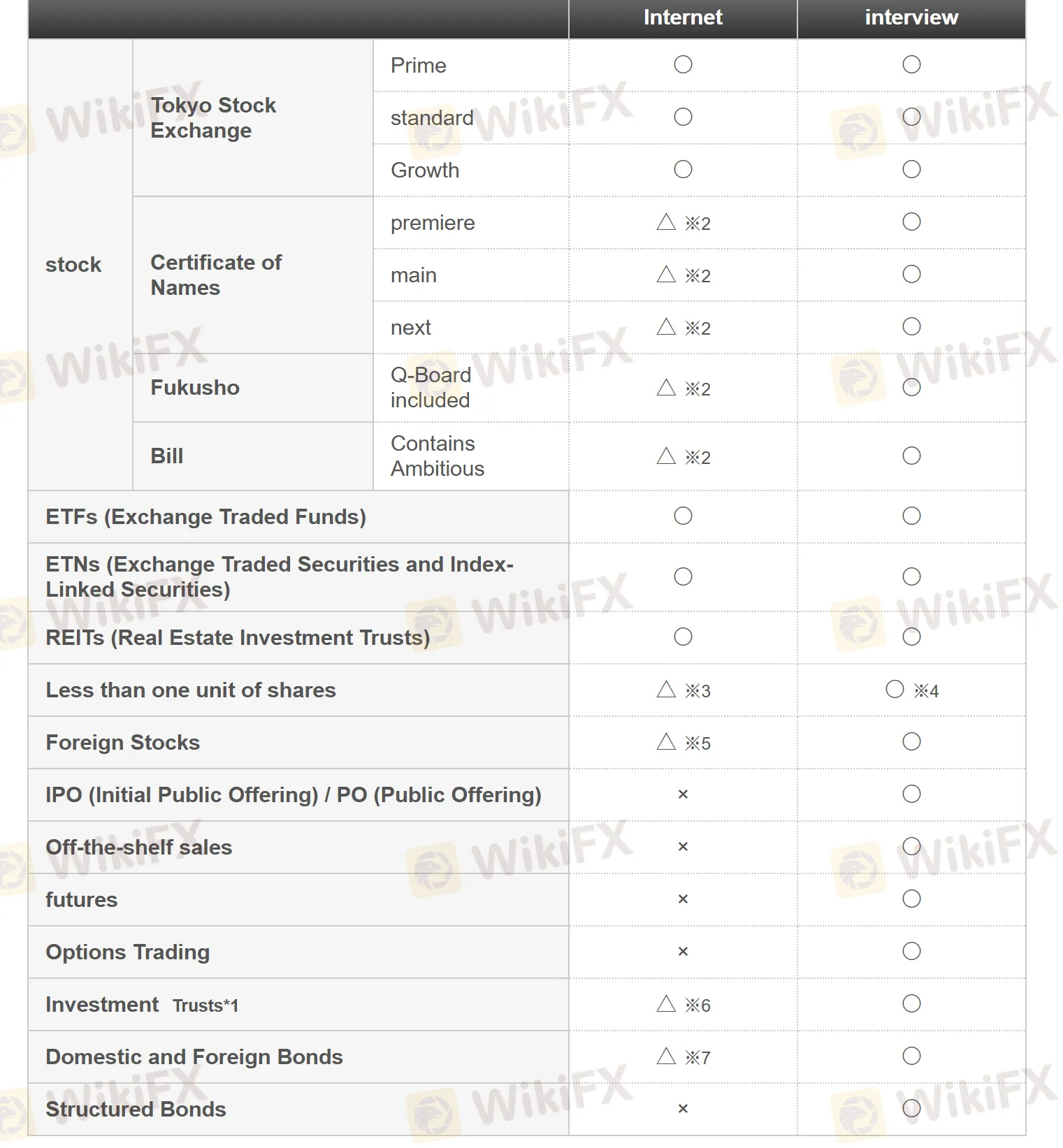

On HIROGIN SECURITIES, you can trade with ETFs (Exchange Traded Funds), ETNs (Exchange Traded, Securities and Index-Linked Securities), REITs (Real Estate Investment Trusts),less than one unit of shares, foreign stocks, IPO (Initial Public Offering)/PO (Public Offering),futures, options, investment trusts, domestic and foreign bonds, and structured bonds.

| Tradable Instruments | Supported |

| Shares/Stocks | ✔ |

| Bonds | ✔ |

| Futures | ✔ |

| Investment Trusts | ✔ |

| ETFs | ✔ |

| ETNs | ✔ |

| REITs | ✔ |

| IPO/PO | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

Account Type

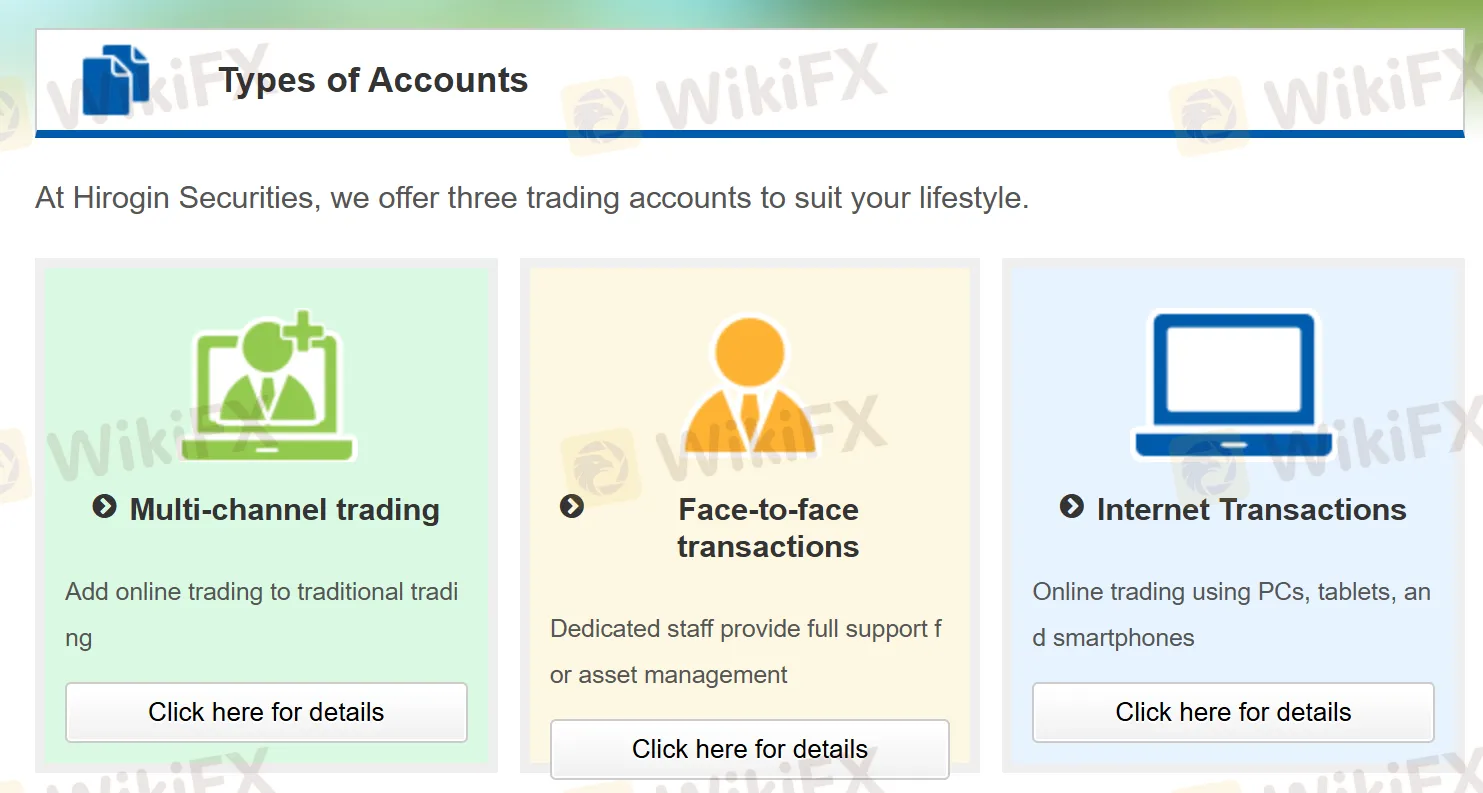

Hirogin Securities offers three types of accounts:

- Multi-channel trading: combines online and traditional trading methods.

- Face-to-face transactions: provides full support for asset management with dedicated staff.

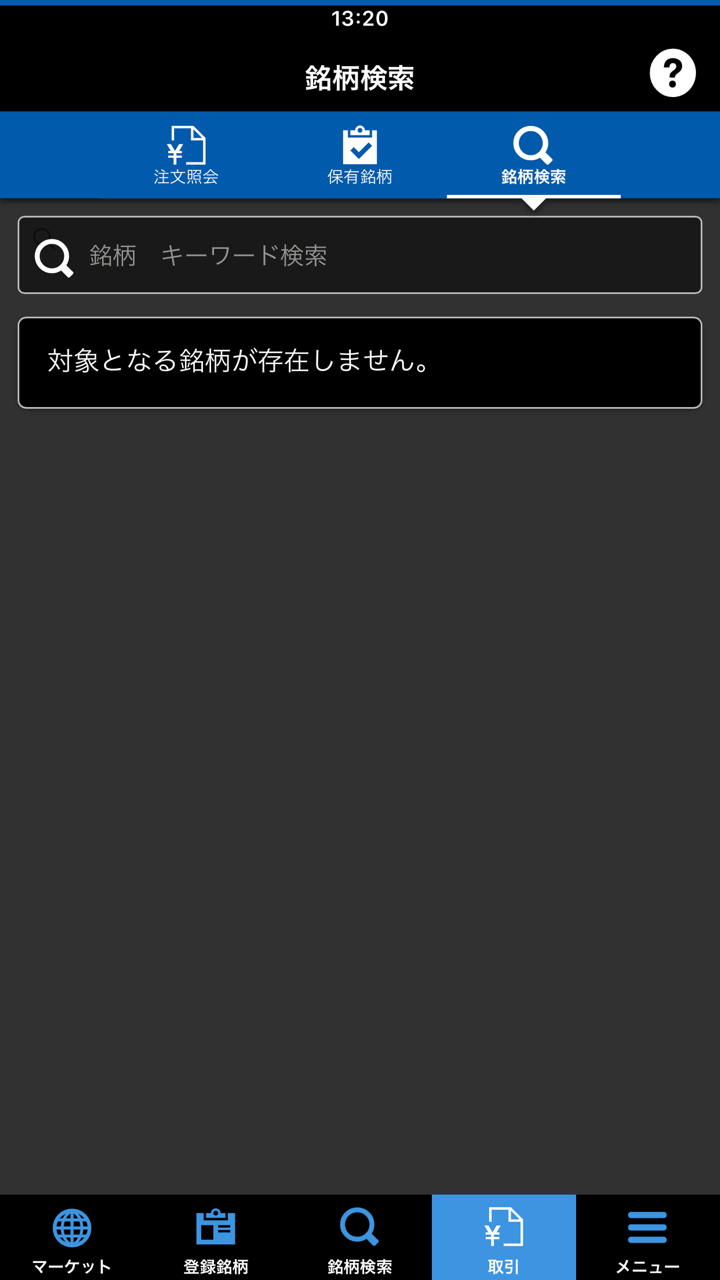

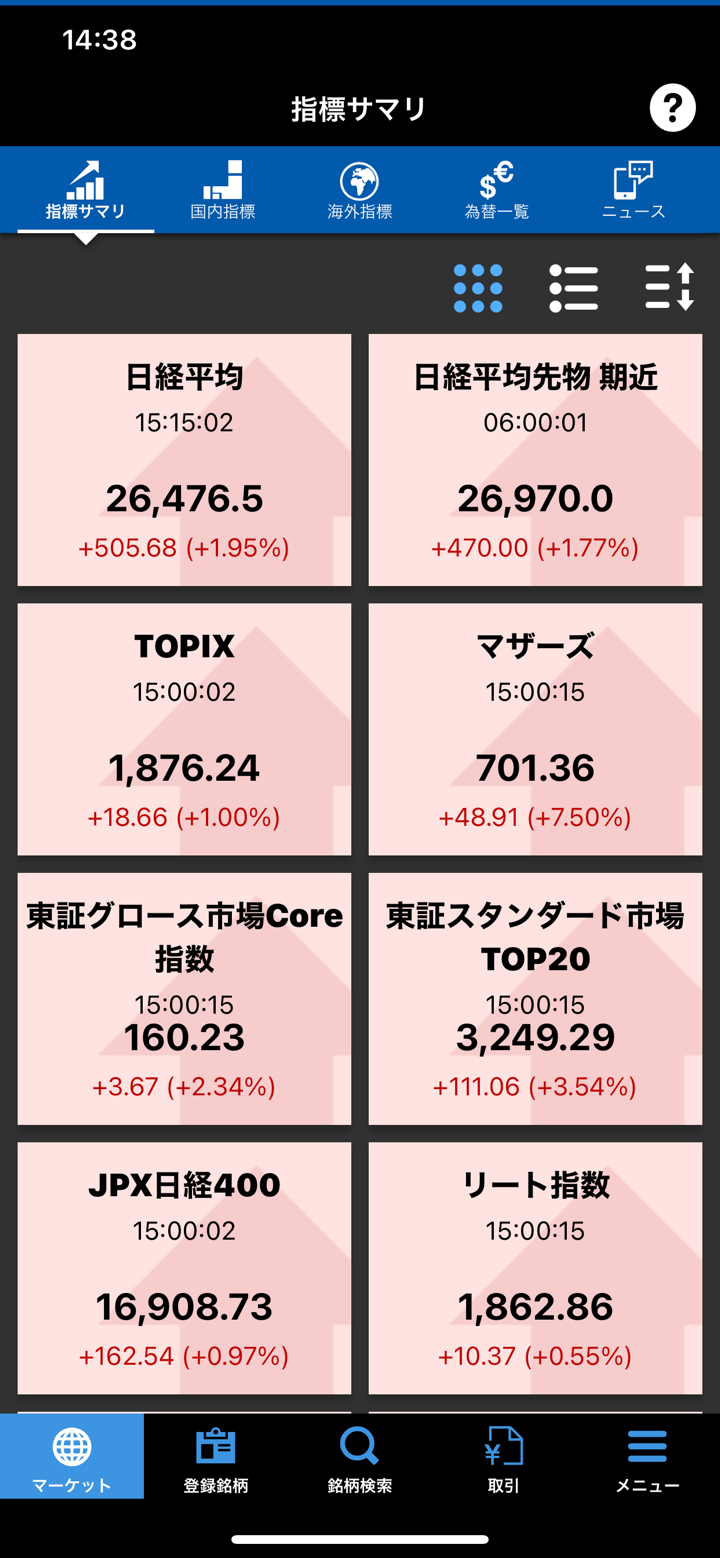

- Internet Transactions: allows online trading using PCs, tablets, and smartphones.

How to apply for an account?

- For multi-channel trading, click the “Click here to apply for multi-channel services” button.

- For face-to-face transactions, complete the application process at a store near you.

Fees

Here is the summary of the core fee structure across channels and instruments. Please consult the official website for the latest details.

Domestic Listed Stocks & New Share Warrants Fees (Multi-Channel Trading)

| Transaction Amount | Fee Structure (Tax-Included) | Minimum Fee |

| ≤ 1,000,000 JPY | 0.924% of transaction value | 2,200 JPY |

| 1,000,001–5,000,000 JPY | 0.704% + 2,200 JPY | |

| 5,000,001–10,000,000 JPY | 0.528% + 11,000 JPY | |

| 10,000,001–30,000,000 JPY | 0.44% + 19,800 JPY | |

| 30,000,001–40,000,000 JPY | 151,800 JPY (fixed) | |

| 40,000,001–50,000,000 JPY | 165,000 JPY (fixed) | |

| 50,000,001–100,000,000 JPY | 178,200 JPY (fixed) | |

| > 100,000,000 JPY | +17,600 JPY per additional 500,000,000 JPY |

Foreign Stocks Fees (Face-to-Face Trading)

| Yen-Converted Transaction Amount | Fee Structure (Tax-Included) | Minimum Fee |

| ≤ 1,000,000 JPY | 0.88% of transaction value | 2,750 JPY |

| 1,000,001–3,000,000 JPY | 0.77% + 1,100 JPY | |

| 3,000,001–5,000,000 JPY | 0.66% + 4,400 JPY | |

| 5,000,001–10,000,000 JPY | 0.55% + 9,900 JPY | |

| 10,000,001–30,000,000 JPY | 0.44% + 20,900 JPY | |

| > 30,000,000 JPY | 0.275% + 119,900 JPY |

Domestic Stocks Fees (Internet Trading)

| Transaction Amount | Fee Structure (Tax-Included) |

| ≤ 30,000 JPY | 110 JPY |

| 30,001–100,000 JPY | 330–2,200 JPY (tiered fixed) |

| 100,001–200,000 JPY | 3,300 JPY |

| 200,001–300,000 JPY | 4,400 JPY |

| 300,001–500,000 JPY | 5,500 JPY |

| 500,001–1,000,000 JPY | 6,600–7,700 JPY |

| > 1,000,000 JPY | 0.077% of transaction value |

Account Management & Miscellaneous Fees

| Fee Type | Details |

| Account Management | Free for domestic/foreign securities accounts |

| Deposit/Withdrawal | - Deposits to Hirogin banks: ❌ |

| - Withdrawals to external banks: 880 JPY (yen), 2,200–5,500 JPY (foreign currency) | |

| Securities Transfer | - Stocks: 1,100 JPY per security (1 unit), +550 JPY per additional unit (max 11,000 JPY) |

| - Bonds/ETFs: 1,100 JPY per security | |

| Credit Trading Fees | - Management fee: 11 JPY/share (min 110 JPY, max 1,100 JPY) |

| - Nominal transfer: 55 JPY/share (adjusted for splits) | |

| Shareholder Materials | 715 JPY per security request |

Derivatives Fees (Face-to-Face Trading)

| Instrument | Fee Structure (Tax-Included) |

| Nikkei 225 Mini Futures | 1,320 JPY per contract |

| Other Futures | 8,800 JPY per contract |

| Options (≤ 1,000,000 JPY) | 3.52% of transaction value |

| Options (> 1,000,000 JPY) | Tiered: 2.64% + 8,800 JPY to 0.528% + 294,800 JPY |

Deposit and Withdrawal

Each Hirogin Securities' store has its own dedicated financial institution account. If you want to deposit money into your account at Hirogin Securities, you need to contact the store that handles it. In addition, the financial institution account of the customer who uses the Multi-Channel Service will be the account of the store that handles it.