Company Summary

| UCO Bank Review Summary | |

| Founded | 1943 |

| Registered Country/Region | India |

| Regulation | Not regulated |

| Products and Services | Corporate Banking, International Banking, Government Business, Rural Banking, Digital Banking |

| Trading Platform | Internet Banking, WhatsApp Banking, mBanking Plus, UCO Pay+, UCO mPassbook, UCO Secure, Online Services, Instant Digital Loan, UCO Smart Pay |

| Customer Support | Address: UCO Bank Head Office, 10, B T M Sarani, Kolkata - 700001, West Bengal, India |

| Toll Free Number: 1800 103 0123 | |

UCO Bank Information

Founded in 1943 and based in Kolkata, UCO Bank is among India's major public sector banks providing a wide spectrum of financial services to people, businesses, NRIs, and government agencies. The bank offers branch-based services like forex, treasury, retail loans, and specialized business banking as well as integrated digital platforms.

Pros and Cons

| Pros | Cons |

| Wide service coverage: rural, government, corporate | Not regulated |

| Modern digital platforms | No access to global trading platforms like MT4 or MT5 |

| Fee concessions for MSMEs and agriculture | Relatively complex fee structure for larger or high-risk borrowers |

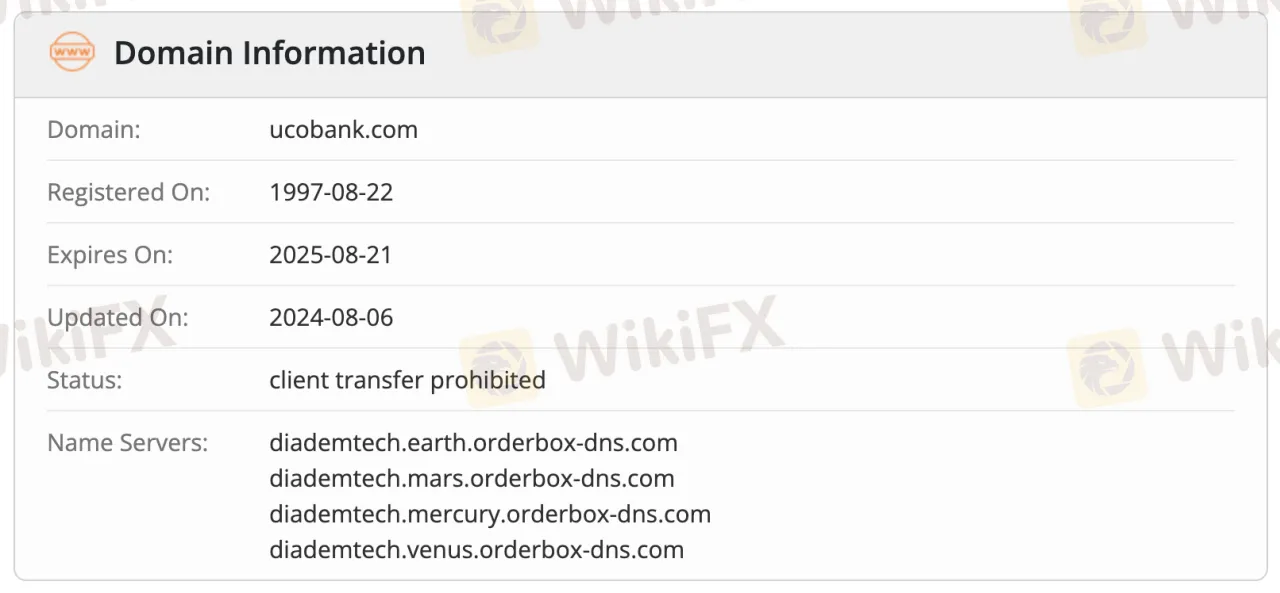

Is UCO Bank Legit?

UCO Bank is not governed as a forex or CFD broker in its registered nation, India. It also lacks trading-related licenses from major international regulatory authorities including the FCA (UK), ASIC (Australia), or CySEC (Cyprus), which are usually considered industry standards for trader protection and regulatory control.

The domain ucobank.com was registered on August 22, 1997, and it is set to expire on August 21, 2025. It was last updated on August 6, 2024. The domain status is marked as client transfer prohibited, which means it is protected against unauthorized domain transfers.

What Can I Trade on UCO Bank?

Spanning corporate, international, government, rural, and retail banking, UCO Bank offers all-encompassing banking solutions. From deposits, loans, remittances, foreign exchange, and treasury to digital banking tools including WhatsApp and internet banking, the services cover all aspects.

| Category | Products/Services Offered |

| Corporate Banking | Loans/Advances, Deposits, Value Added Services, Credit Growth |

| International Banking | Products and Services, Remittances, Forex & Treasury Services, Authorized Forex Branches |

| NRI Services | NRI Corner, Remittance, Services |

| Government Business | Govt. Deposit Schemes/Bonds, Tax Collection, Pension Payment, Policy Info, Valuation, Others |

| Rural Banking | Microfinance Loans, Agriculture Credit, Personal Loans, Financial Inclusion, Deposits, SLBC |

| Digital Banking | Internet Banking, WhatsApp Banking, UCO Rewardz, Social Media Access, Loan Tools |

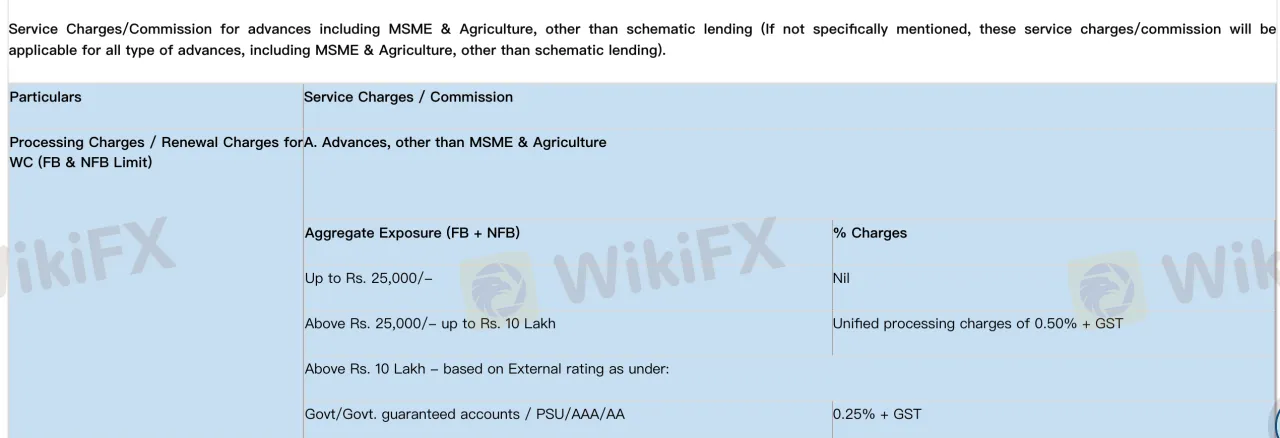

UCO Bank Fees

From corporate to international to government to rural to retail banking, UCO Bank offers thorough banking solutions. From deposits, loans, remittances, foreign exchange, and treasury to digital banking tools including WhatsApp and internet banking, the services cover everything.

| Category | Fee / Commission | Remarks |

| Processing Charges | 0.25% – 0.50% + GST | Nil for small MSME/Agriculture loans; based on credit rating |

| Upfront Fees (Term Loan/DPG) | 0.75% – 1.50% + GST | Based on external rating; Nil for < ₹25,000 |

| Documentation Charges | ₹250 – ₹50,000 + GST | Based on limit size; waived for small borrowers |

| Mortgage Charges | ₹10,000 – ₹35,000 + GST | Based on limit; Nil for loans < ₹10 Lakh |

| Inspection Charges | ₹800 – ₹50,000 + GST | Based on limit; annual charge |

| Prepayment Charges | 2.00% + GST | Waived for MSEs and agriculture loans |

| Supervision Charges | ₹3,100 + GST per half year | For accounts ≥ ₹1 crore |

| Modification of Sanction Terms | ₹1,500 – ₹5 Lakh + GST | Based on limit; applicable only for customer-initiated changes |

| Issuance of NOC | ₹2,500 – ₹1.5 Lakh + GST | Based on loan limit |

| LC Opening Charges | Usance: 2.40% p.a.; Commitment: 1.20% p.a. + GST | Discounts for AAA/A borrowers; additional ₹250 SFMS fee |

| Bank Guarantee Commission | 1.25% – 3.60% p.a. + GST | Based on rating & tenure; higher for unrated or SPV/JV guarantees |

| Amendments (LC/BG) | ₹1,000 + GST per amendment + SFMS fee | Additional ₹250 per SFMS message |

| Project Appraisal Charges | 0.20% + GST (max ₹5 Lakh) | If appraisal shared with others in consortium |

| Pre-Processing Charges | Nil | Actual third-party verification charges (CIBIL, CRIF, etc.) recovered separately |

| Revalidation Charges | 25% – 50% of original fees | Based on size; subject to minimum ₹15,000 + GST |

| Withdrawal of Concessions | Full recovery of discounts + 2% prepayment | On takeover by another bank |

| LC Negotiation Charges | ₹500 – ₹3,000 + GST | Based on bill size + SFMS fee |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| Internet Banking | ✔ | Desktop, Web | Retail users preferring full-service online access |

| WhatsApp Banking | ✔ | Mobile (WhatsApp enabled) | Users seeking quick, chat-based banking services |

| mBanking Plus | ✔ | Android, iOS | Retail users for comprehensive mobile banking |

| UCO Pay+ | ✔ | Android, iOS | UPI users for quick, seamless digital payments |

| UCO mPassbook | ✔ | Android, iOS | Customers tracking transaction history digitally |

| UCO Secure | ✔ | Android, iOS | Security-focused users for transaction verification |

| Online Services | ✔ | Desktop, Web | General users accessing banking tools and utilities |

| Instant Digital Loan | ✔ | Web, Mobile | Users needing quick, automated loan approvals |

| Cardless Transaction | ✔ | ATM, Mobile | Users preferring cash withdrawals without physical cards |

| UCO Corporate Mbanking | ✔ | Web, Mobile | Businesses managing accounts and transactions |

| Payment Gateway | ✔ | Web | Online merchants integrating payment collections |

| POS | ✔ | POS Devices | Retail merchants accepting card payments |

| Merchant QR & Sound Box | ✔ | QR Device, Mobile App | Small businesses using UPI QR-based transactions |

| Bhim UCO UPI | ✔ | Mobile App | Any users making UPI payments |

| UCO Smart Pay | ✔ | Mobile App | Retailers offering integrated digital payment experience |