Company Summary

| Grand Capital Review Summary | |

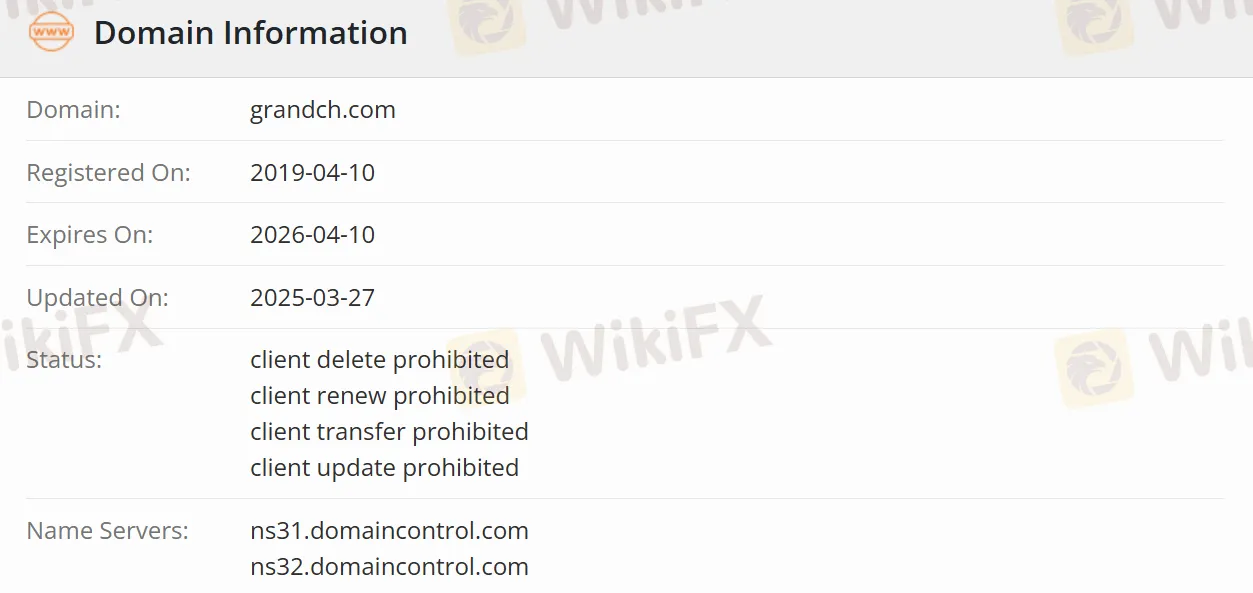

| Founded | 2019-04-10 |

| Registered Country/Region | United Kingdom |

| Regulation | Suspicious Clone |

| Market Instruments | Securities and Fixed-income products |

| Trading Platform | Multiple types of trading platforms (Desktop and Mobile) |

| Customer Support | Tel: +852 3891 9888 |

| Fax: +852 2529 2899 | |

| Email: cs@grandch.com | |

Grand Capital Information

Grand Capital Holdings Limited is a financial services company headquartered in Hong Kong. Its wholly-owned subsidiary, Grand Capital Securities Limited, provides execution and consulting services for individuals, enterprises, and institutions through its brokerage, wealth management, asset management, and institutional business departments. Investors can conveniently access 23 trading markets around the world through its desktop, mobile, and web-based trading platforms.

Pros and Cons

| Pros | Cons |

| Access to global markets | Suspicious Clone |

| Convenience of multi-platform trading | Unclear fee information |

| Diversified business |

Is Grand Capital Legit?

Grand Capital's legitimacy is in question. Although it claims to be regulated by the Hong Kong Regulatory Authority and asserts that it holds relevant licenses issued by the Hong Kong Securities and Futures Commission (SFC), it is suspected of being a cloned firm, and there is no actual proof to support its claims of having legitimate licenses.

What Can I Trade on Grand Capital?

Grand Capital offers securities products, allowing trading of listed stocks in more than 20 countries around the world. It also covers products such as ETFs (Exchange-Traded Funds), REITs (Real Estate Investment Trusts), derivative warrants, and CBBCs (Callable Bull-Bear Contracts). Trading services for fixed-income products, such as various government and corporate bonds, investment-grade and high-yield bonds, as well as multi-currency bonds, can also be realized.

| Tradable Products | Supported |

| Securities | ✔ |

| Fixed-income | ✔ |

Account Type

Classified by the account holder entity, Grand Capital offers individual accounts, joint accounts, and corporate accounts. Classified by business type, Grand Capital's securities accounts are divided into cash accounts and margin accounts. In cash accounts, transactions are conducted using the account holder's funds. Margin accounts, on the other hand, allow for trading with borrowed funds, which increases the investment leverage but also comes with higher risks.

In addition, there are asset management accounts that focus on professional asset management, as well as private banking accounts that provide customized financial services for high-net-worth clients.

Leverage

Grand Capital offers margin trading, which means that investors can trade with leverage. Leverage can magnify investment returns, but at the same time, it will also amplify risks. However, Grand Capital has not specified the details of the leverage.

Trading Platform

The company provides multiple types of trading platforms, including desktop versions, mobile versions (which can be obtained from the Play Store and the App Store), as well as web-based versions. These platforms are equipped with functions such as checking account balances and position information, enabling investors to keep track of their investment status at any time.