Company Summary

| ZHONGYANG Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC (Exceeded, Suspicious clone) |

| Market Instruments | Securities and futures |

| Demo Account | ❌ |

| Trading Platform | Yisheng Polestar 9.5.7 system |

| Min Deposit | / |

| Customer Support | Online consultation |

| Phone: +852 31070731 | |

| Fax: (852) 2836 3825 | |

| Email: CS@zyzq.com.hk | |

| Address: Room 1101, 118 Connaught Road West, Hong Kong | |

ZHONGYANG provides securities and futures brokerage services, offering trading options in various markets, including the Hong Kong Stock Exchange (HKEX), American stock exchanges (NYSE, NASDAQ), and the Shanghai and Shenzhen Stock Connect.

They offer a range of financial products, including securities and futures contracts, each with its associated trading fees.

However, their regulatory licenses of SFC are exceeded and suspicious clone.

Pros and Cons

| Pros | Cons |

| Access to global securities and futures | Exceeded and suspicious clone SFC licenses |

| Online consultation available | Limited funding methods |

| No info on minimum deposit |

Is ZHONGYANG Legit?

ZHONGYANG holds two license types of SFC: Advising on securities and Dealing in futures contracts. However, these two licenses are reported as exceeded or suspicious clones.

| Regulatory Status | Exceeded |

| Regulated by | Securities and Futures Commission of Hong Kong (SFC) |

| Licensed Institution | Zhong Yang Capital Limited |

| Licensed Type | Advising on securities |

| Licensed Number | BLG119 |

| Regulatory Status | Suspicious Clone |

| Regulated by | Securities and Futures Commission of Hong Kong (SFC) |

| Licensed Institution | Zhong Yang Capital Limited |

| Licensed Type | Dealing in futures contracts |

| Licensed Number | BGT529 |

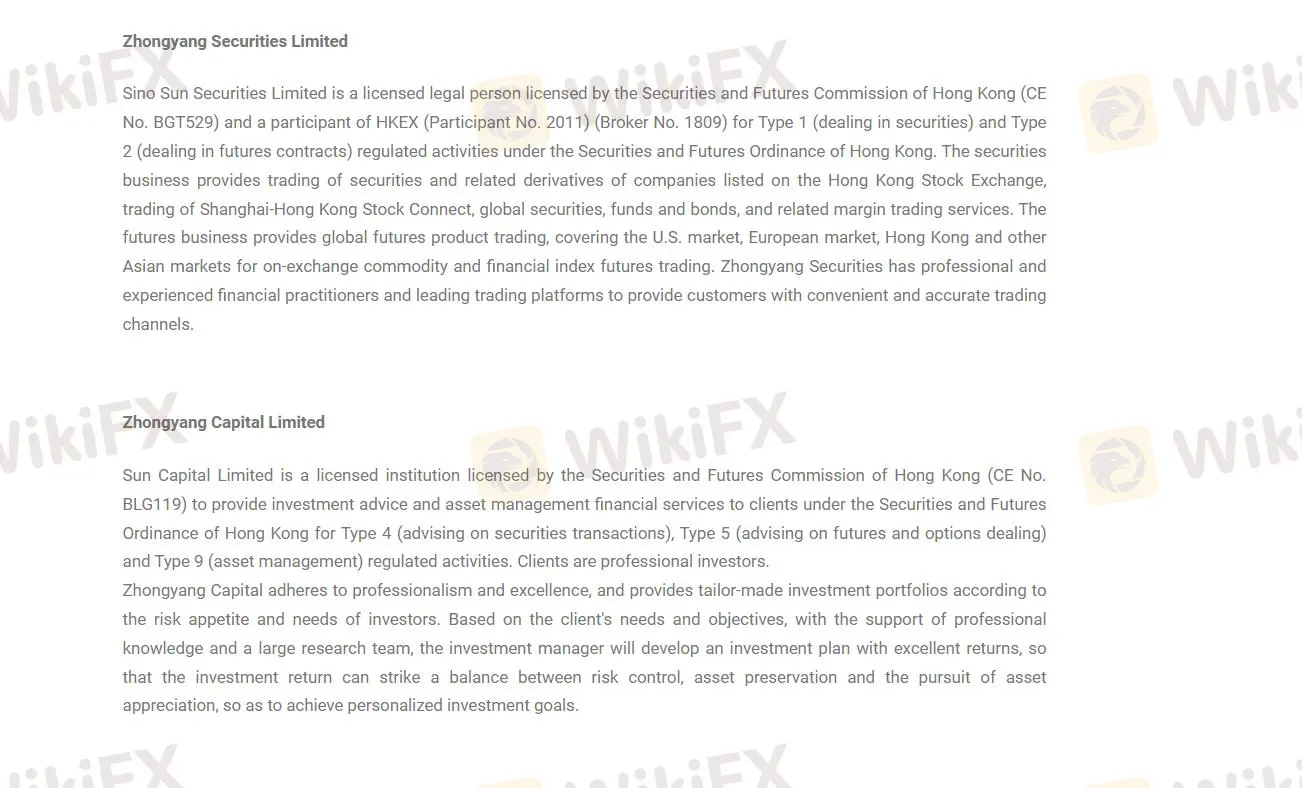

Products and Services

ZHONGYANGs securities business provides trading of securities and related derivatives of companies listed on the Hong Kong Stock Exchange, trading of Shanghai-Hong Kong Stock Connect, global securities, funds and bonds, and related margin trading services.

Besides, they also provide investment advice and asset management financial services to clients.

ZHONGYANG Fees

ZHONGYANG charges turnover fees and commission:

| Hong Kong Stock | Shanghai/Shenzhen-Hong Kong Stock Connect | U.S. | |

| Fee | 0.1% turnover fee | 0.1% hand-on fee | $0.05/share ($0.01/share for more than 2,000 shares per day) running fee |

| Minimum consumption rate | 80 Hong Kong dollars | 100 yuan | $1.99 |

| Financing interest rate | 8% annual | 8% annual | 8% annual |

Besides, they also charge commissions for different futures products, for example:

| Breed Number | Breed Name | Contract Units | Minimum Price Change | Commission (USD) | |

| COMEX | GC | U.S. Gold | 100 ounces | 0.1 | 20 |

| COMEX | HG | CMX Copper | 25000 pounds | 0.0005 | |

| COMEX | SI | U.S. Silver | 5000 ounces | 0.005 | |

| COMEX | MGC | Micro Gold Futures | 10 ounces | 1 | |

| NYMEX | CL | U.S. crude oil | 1000 barrels | 0.01 |

More details can be learned through clicking: https://www.zyfgl.com/index.php?m=content&c=index&a=lists&catid=19

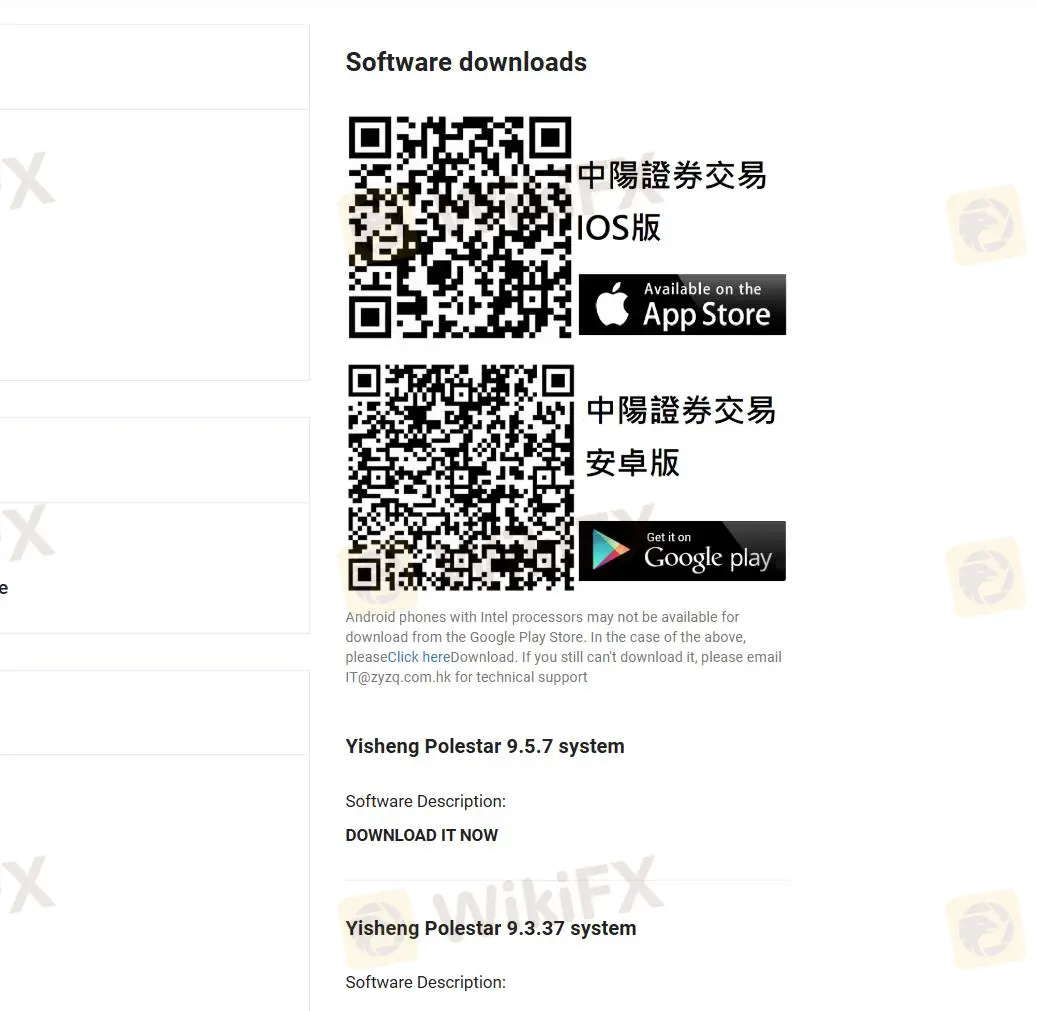

Trading Platform

ZHONGYANG offers Yisheng Polestar 9.5.7 system, which can be downloaded via App Store and Google Play.

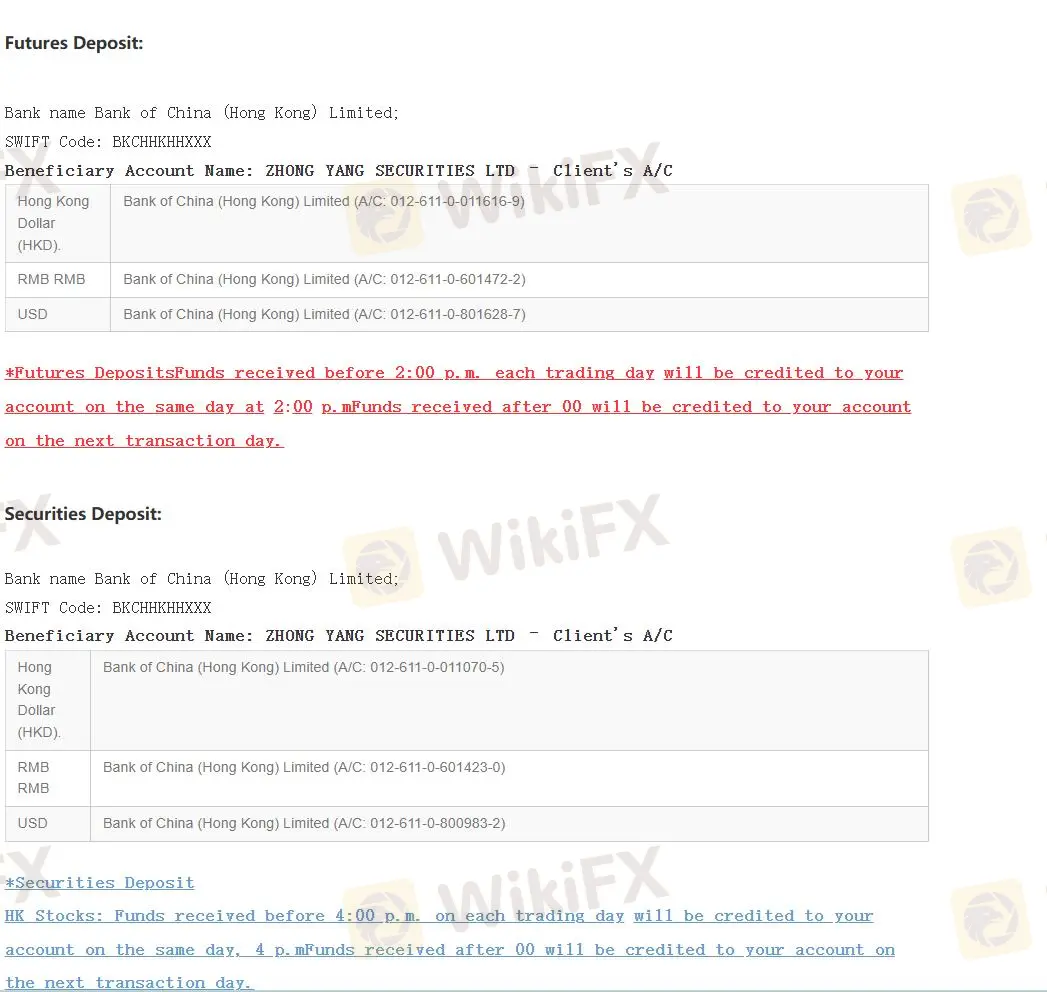

Deposit and Withdrawal

Deposit:

ZHONGYANG offers bank transfer to make a deposit. After the account transfer is completed, the customer needs to provide Zhong Yang Securities with a complete deposit certificate. The company will then call the customer to verify and confirm the fund deposit operation.

Bank Name: Bank of China (Hong Kong) Limited

SWIFT Code: BKCHHKHHXXX

Beneficiary Account Name: ZHONG YANG SECURITIES LTD – Clients A/C

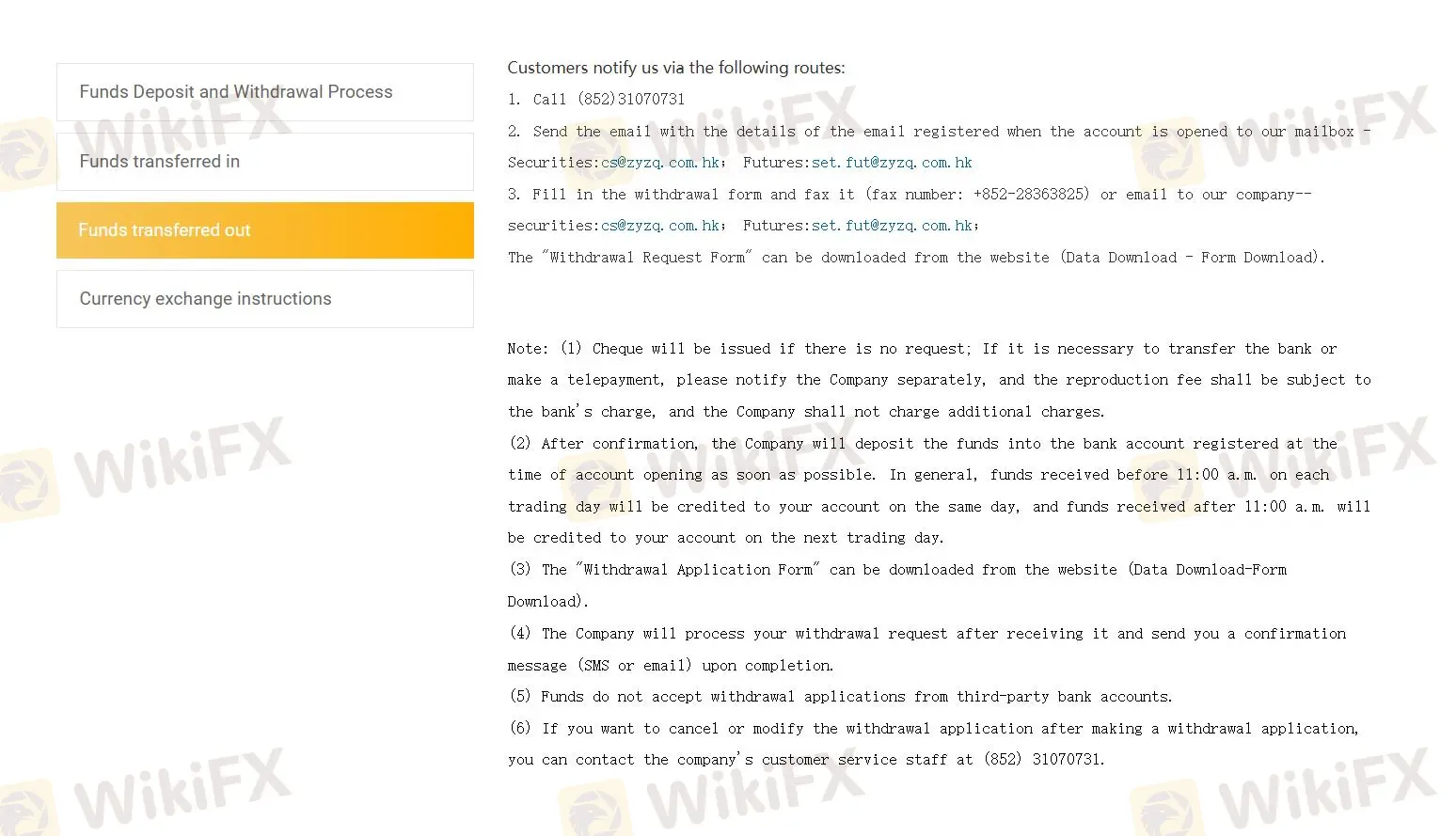

Withdrawal:

Customers can notify Zhong Yang Securities for withdrawals through the following routes:

Call: Dial (852) 31070731

Email: Send an email with the details to cs@zyzq.com.hk for securities and set.fut@zyzq.com.hk for futures, using the email registered when the account was opened.

Fax or Email: Fill out the withdrawal form and fax it to +852-28363825 or email it to cs@zyzq.com.hk for securities and set.fut@zyzq.com.hk for futures.

Notes:

- If no request is made, a cheque will be issued. For bank transfers or telegraphic payments, notify the company separately. Any handling fees are subject to the banks charges.

- Funds received before 11:00 a.m. on a trading day will be credited the same day, and funds received after 11:00 a.m. will be credited on the next trading day.

- The company does not process withdrawal requests from third-party bank accounts.