Company Summary

| Carlyle Review Summary | |

| Founded | 1987 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Products and Services | Global Private Equity, Global Credit, Investment Solutions |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: +1 212 813 4504 |

| Email: media@carlyle.com | |

| Social Media: X, YouTube, LinkedIn, Instagram | |

| Address: 799 9th Street, NW, Suite 200, Washington, DC 20001 | |

Carlyle Information

Carlyle is a worldwide investment firm headquartered in the United States and was founded in 1987. It is not regulated as a retail broker and does not offer trading accounts. The company specializes in institutional asset management for private equity, credit, and investment solutions, handling approximately $453 billion in assets.

Pros and Cons

| Pros | Cons |

| Long-established global investment firm | Not regulated |

| Various contact channels | No info on trading conditions |

| A number of global branches |

Is Carlyle Legit?

Carlyle is based in the US, although no financial body there keeps an eye on it. It also doesn't have licenses from any of the major international regulatory authorities, like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

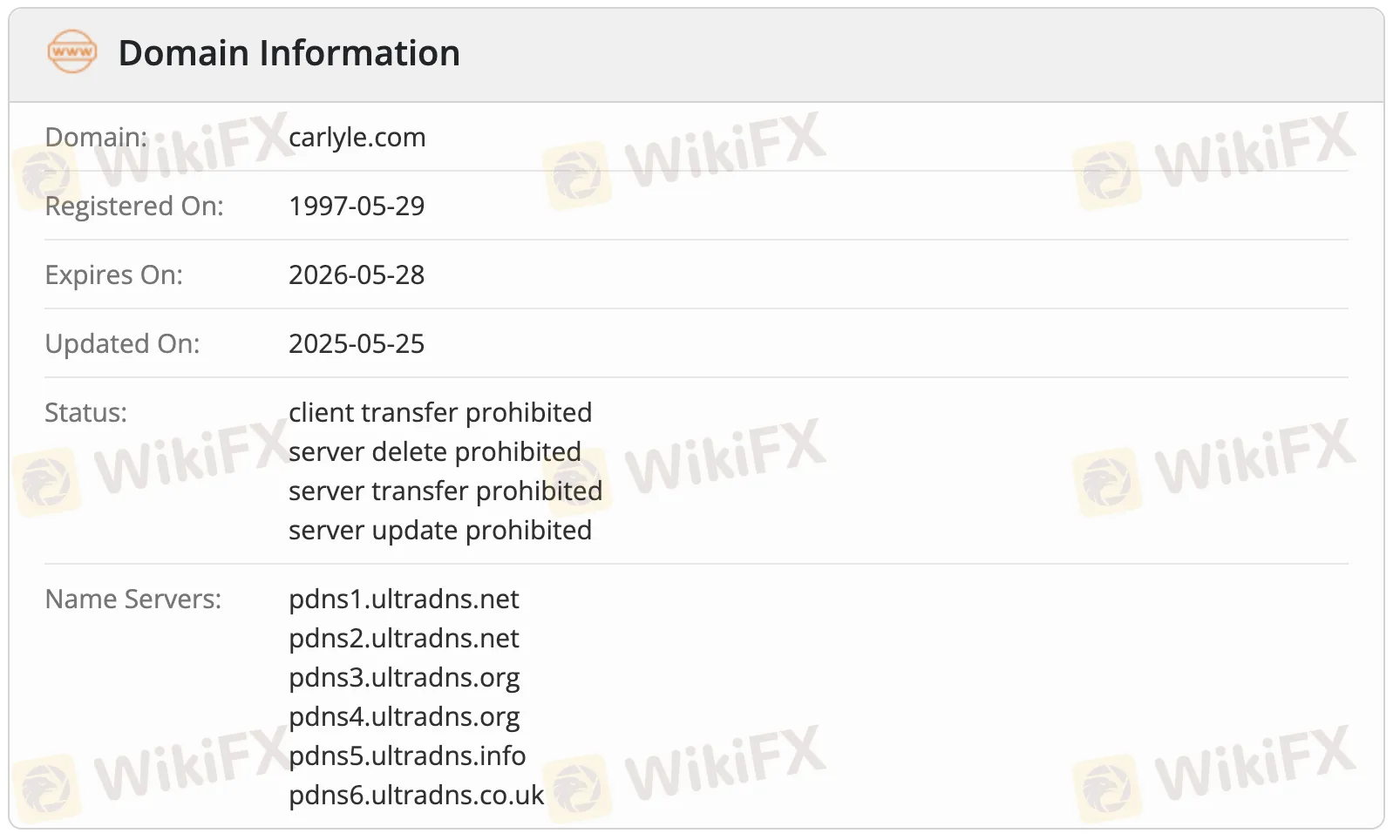

A WHOIS search for the domain carlyle.com shows that it was first registered on May 29, 1997. The domain is still live, and its registration is good until May 28, 2026. The last time it was changed was on May 25, 2025. There are some rules in place for the domain, such as not allowing clients to move, edit, remove, or transfer servers.

Products and Services

Carlyle provides global investment management services, especially in private equity, credit, and investment solutions. It handles more than $453 billion in assets across different segments and vehicles worldwide.

| Products & Service | Supported |

| Global Private Equity | ✔ |

| Global Credit | ✔ |

| Investment Solutions | ✔ |