Company Summary

| ICICI Bank Review Summary | |

| Founded | 1996 |

| Registered Country/Region | India |

| Regulation | Not regulated |

| Market Instruments | Stocks, ETFs, Mutual Funds (SIP), Bonds, IPOs, National Pension System, Sovereign Gold Bonds |

| Demo Account | ❌ |

| Trading Platform | Mobile Banking, Net Banking, WhatsApp Banking |

| Min Deposit | Not mentioned |

| Customer Support | Phone: 1800 1080 |

| Email: Via official helpdesk/contact forms | |

| Address: ICICI Bank Tower, Vadodara & Corporate HQ, Mumbai | |

ICICI Bank Information

ICICI Bank is a Indian financial services company that provides integrated banking and investing products such as 3-in-1 accounts for savings, demat and trading. While it offers a diverse selection of financial goods and platforms, it lacks features like leverage, demo accounts, and regulatory control like a trading brokerage.

Pros and Cons

| Pros | Cons |

| Wide range of banking and investment services | Not regulated |

| User-friendly digital banking platforms | No advanced trading tools like MT4/MT5 |

| Three-in-one accounts with several benefits included | No demo or Islamic accounts offered |

Is ICICI Bank Legit?

Registered in India, ICICI Bank lacks regulatory licensing as a forex or CFD broker. International financial authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus), which are regarded as standard for globally recognized trading platforms, do not supervise it.

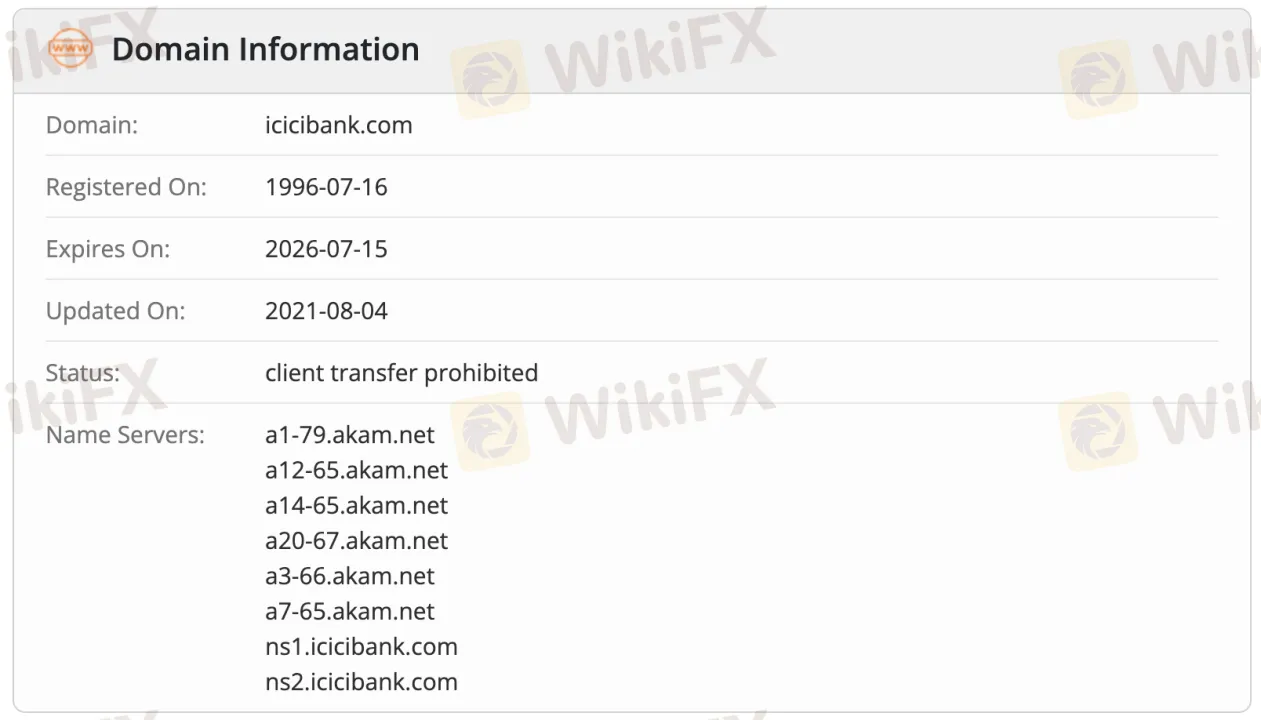

WHOIS records show the domain icicibank.com was registered July 16, 1996 and now active with “client transfer prohibited” status, suggesting defense against illegal domain modifications. Last updated August 4, 2021, the domain is scheduled to expire July 15, 2026.

What Can I Trade on ICICI Bank?

Especially for Indian retail consumers, CICI Bank provides a range of investment and financial products. Although not a conventional trading platform for worldwide financial assets, it does provide stock-related accounts, NPS, IPOs, bonds, mutual fund investments, and Demat services.

| Tradable Instruments | Supported |

| Forex | ❌ |

| Commodities | ❌ |

| Crypto | ❌ |

| CFDs | ❌ |

| Indexes | ❌ |

| Stocks | ✅ |

| ETFs | ✅ |

| Mutual Funds (SIP) | ✅ |

| Bonds | ✅ |

| IPOs | ✅ |

| National Pension System | ✅ |

| Sovereign Gold Bonds | ✅ |

Account Types

ICICI Bank offers two main accounts for distinct uses. The 3-in-1 Account (Savings + Demat + Trading) is for individual investors who want seamless savings and investing. The 3-in-1 Account (Salary + Demat + Trading) gives salaried professionals superior loan and exchange rates and exclusive credit card offers. However, ICICI Bank does not offer demo or Islamic (swap-free) accounts.

| Account Type | Key Features | Suitable for |

| 3-in-1 Account (Savings + Demat + Trading) | Combines savings, demat, and trading features for seamless investment access | Individual investors, long-term savers |

| 3-in-1 Account (Salary + Demat + Trading) | Salary integration, credit card offers, discounts on loans/forex, digital banking | Working professionals, convenience-focused users |

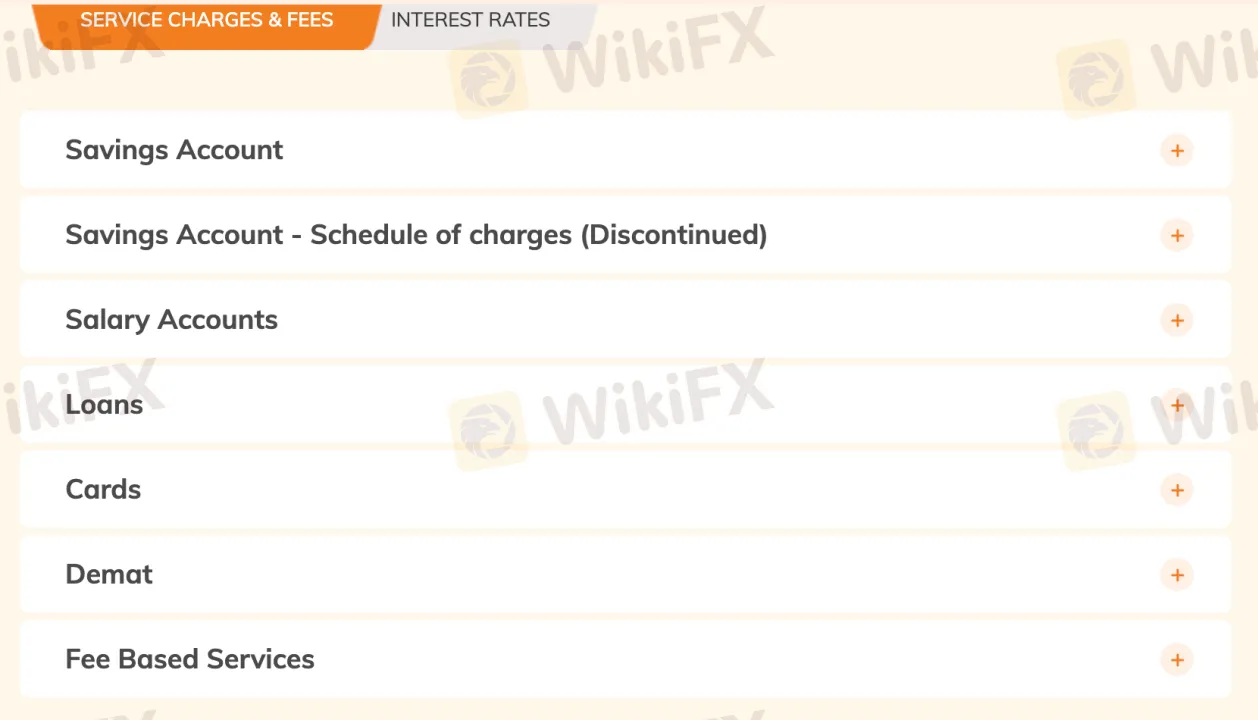

ICICI Bank Fees

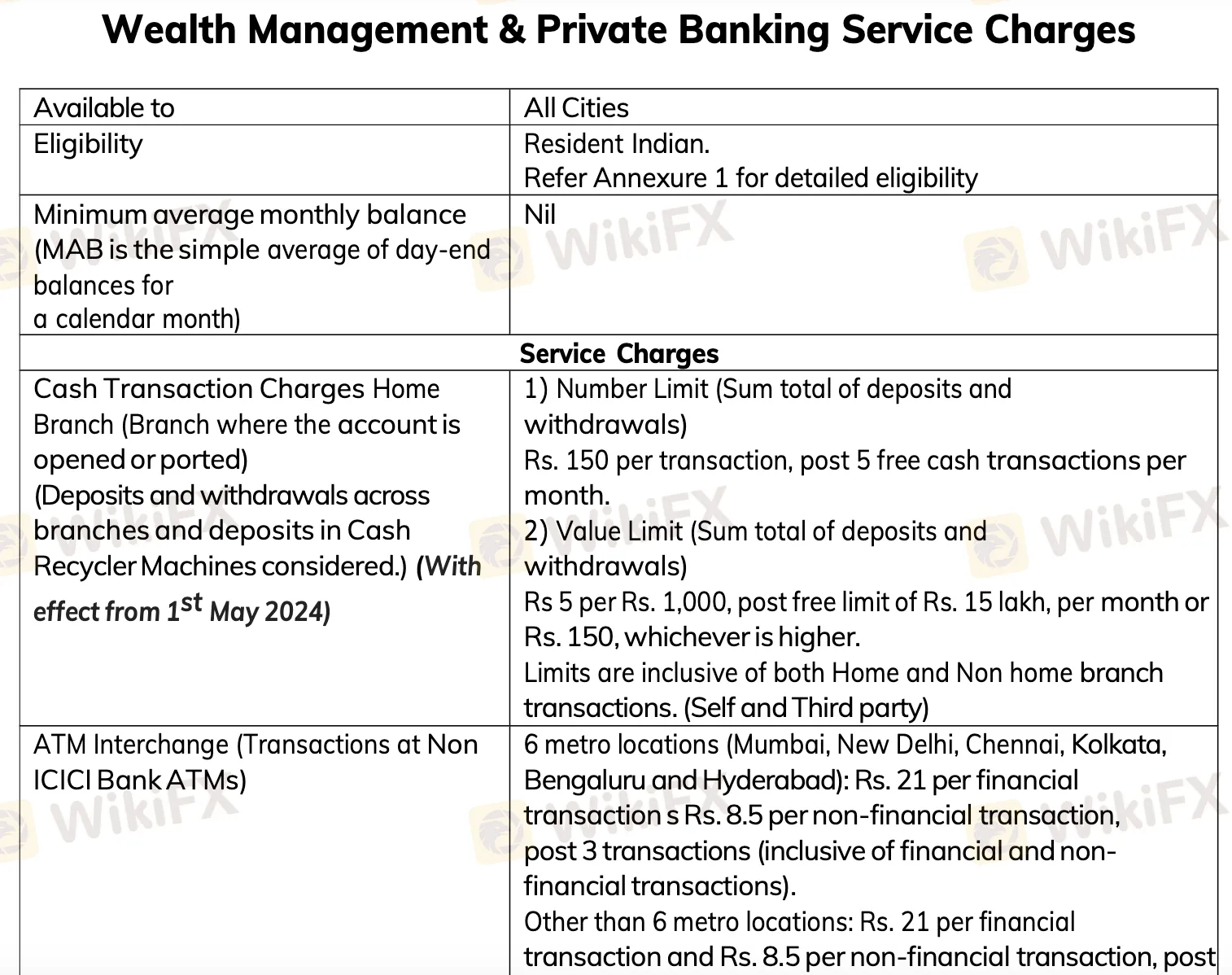

ICICI Bank categorizes its fees and service charges into several sections including Savings Accounts, Salary Accounts, Loans, Cards, Demat services, and Fee-Based Services. Each section contains specific fee structures related to that account type or service. For example, under Wealth Management & Private Banking, cash transactions at the home branch (including Cash Recycler Machines) incur a fee of ₹150 per transaction after the first five free cash transactions each month.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| Mobile Banking | ✔ | iOS, Android | Retail traders who prefer trading on the go |

| Net Banking | ✔ | Desktop, Web Browser | Investors managing finances via web interface |

| WhatsApp Banking | ✔ | WhatsApp-enabled devices | Users seeking simple, conversational banking tools |

| MetaTrader / cTrader | ❌ | – | Not supported |

Deposit and Withdrawal

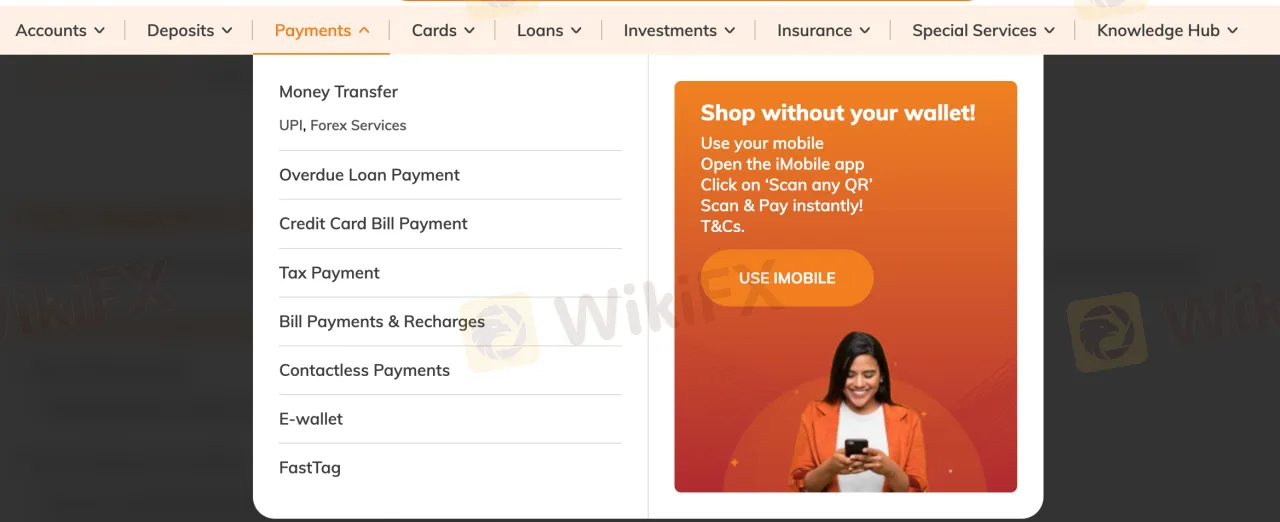

ICICI Bank offers multiple deposit and withdrawal methods including UPI, bank transfers (IMPS/NEFT/RTGS), iMobile app, and ATMs.

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Bank Transfer (IMPS/NEFT/RTGS) | Not mentioned | Varies by method | Instant to 1 working day |

| UPI Transfer | Not mentioned | Usually free | Instant |

| iMobile App Transfer | Not mentioned | Usually free | Instant |

| E-wallet | Not mentioned | May apply | Instant |

| Cash Deposit at Branch/ATM | Not mentioned | May apply | Instant to few hours |

Withdrawal Options

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| Bank Transfer (NEFT/RTGS/IMPS) | Not mentioned | Varies by method | Instant to 1 working day |

| ATM Withdrawal | Depends on card type | Possible fee after limit | Instant |

| iMobile / Net Banking Transfer | Not mentioned | Usually free | Instant |