Company Summary

| QCG Review Summary | |

| Founded | 2021 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | NFA (Exceeded) |

| Market Instruments | 200+, forex pairs, precious metals, indices, shares, cryptocurrencies, oil and energy |

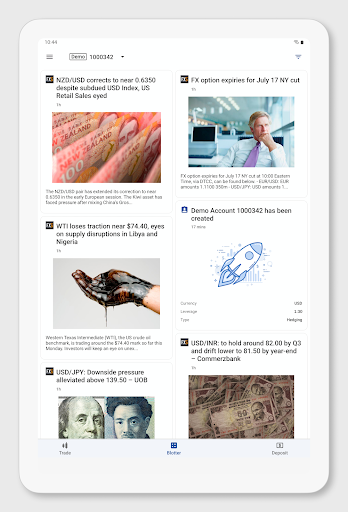

| Demo Account | ✅ |

| Leverage | 1:30-1:500 |

| Spread | From 1.6 pips (Standard account) |

| Trading Platform | cTrader, Quantum capital global trader |

| Copy Trading | ✅ |

| Min Deposit | / |

| Customer Support | 24/7 support |

| Contact form | |

| Tel: +84906712961 | |

| Email: support@qcgbroker.com | |

| Address: 63d Võ Văn Tần Phường 6, Quận 3, Thành phố Hồ Chí Minh, 700000 Vietnam | |

Overview of QCG

Founded in 2021, QCG is a forex broker registered in Saint Vincent and the Grenadines, offering 200+ trading instruments, including forex pairs, precious metals, indices, shares, cryptocurrencies, oil and energy, with flexible leverage ratios ranging from 1:30 to 1:500 and spread from 1.6 pips on the Standard account via cTrader and Quantum capital global trader platforms. However, their NFA license is exceeded.

Pros and Cons

| Pros | Cons |

| Diverse range of tradable assets | Exceeded NFA license |

| Multiple account types | No MT4/5 |

| Availability of demo accounts | Unknown minimum deposit |

| Flexible leverage ratios | No info on payment options |

| Copy trading | |

| 24/7 customer support |

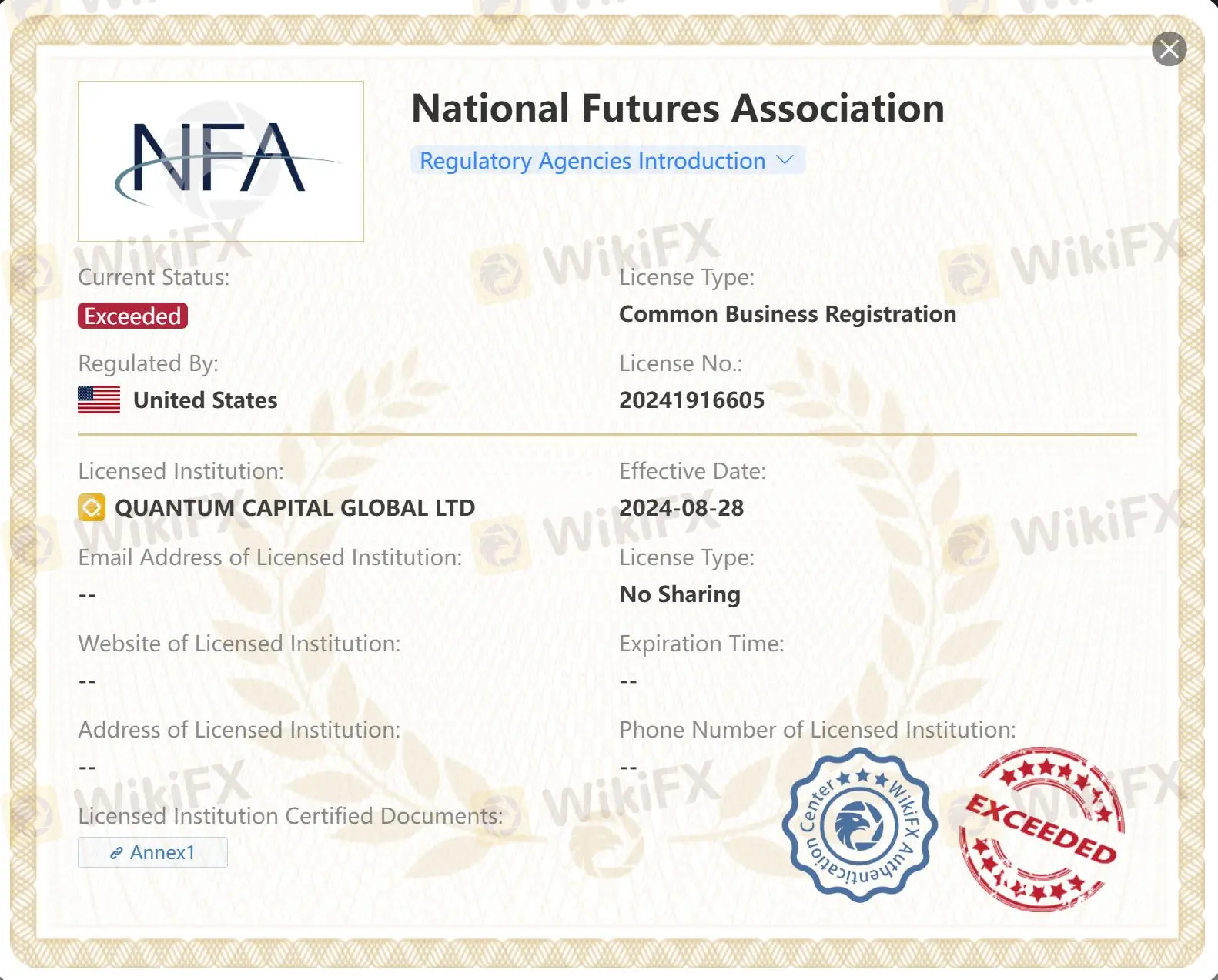

Is QCG legit?

No, QCG currently has no valid regulations. The claimed Common Business Registration license from the National Futures Association (NFA) is exceeded.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| National Futures Association (NFA) | Exceeded | QUANTUM CAPITAL GLOBAL LTD | Common Business Registration | 20241916605 |

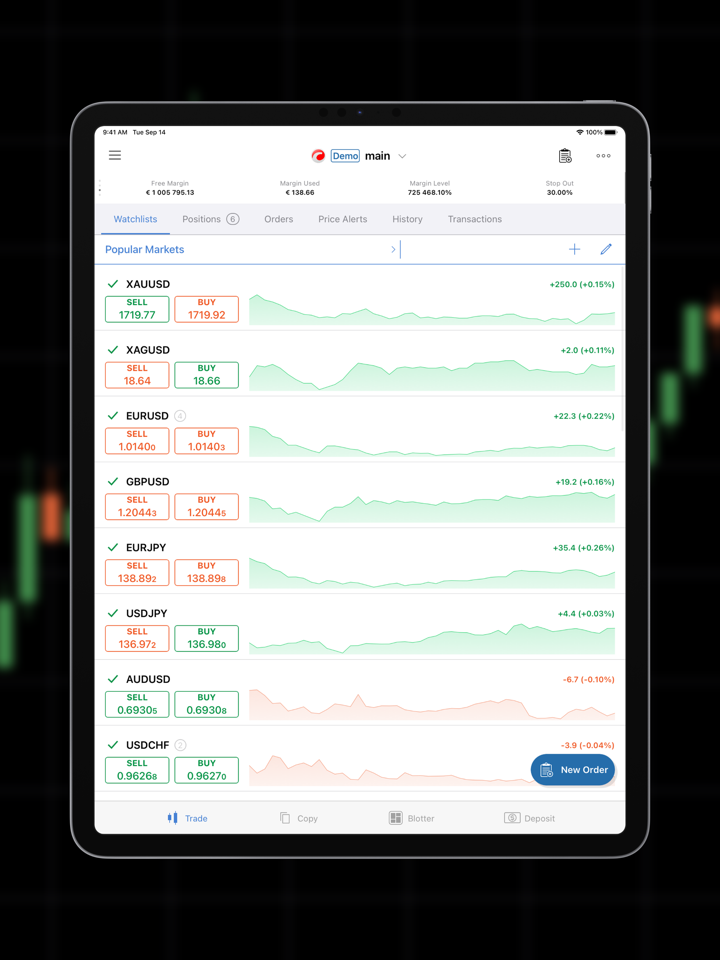

Market Instruments

| Tradable Instruments | Supported |

| Forex pairs | ✔ |

| Precious metals | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ✔ |

| Oil & energy | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

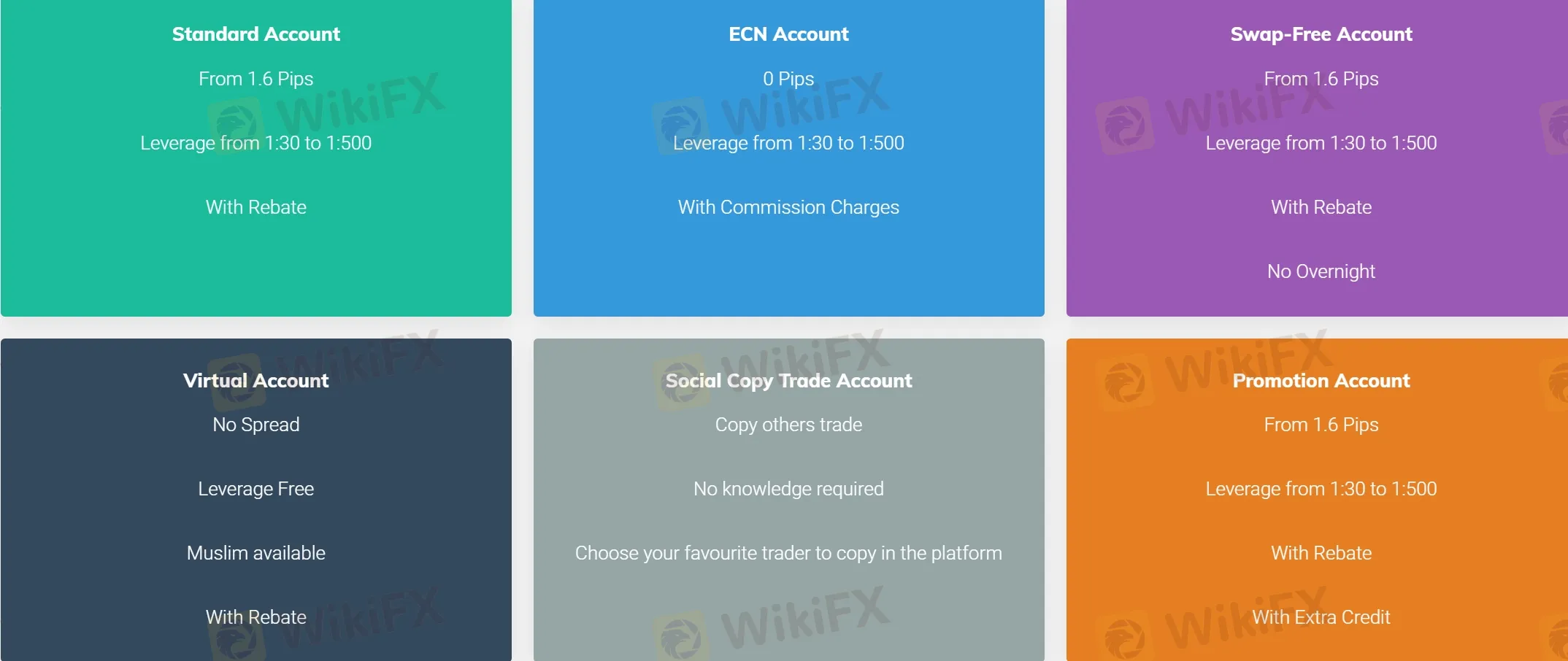

Account Types

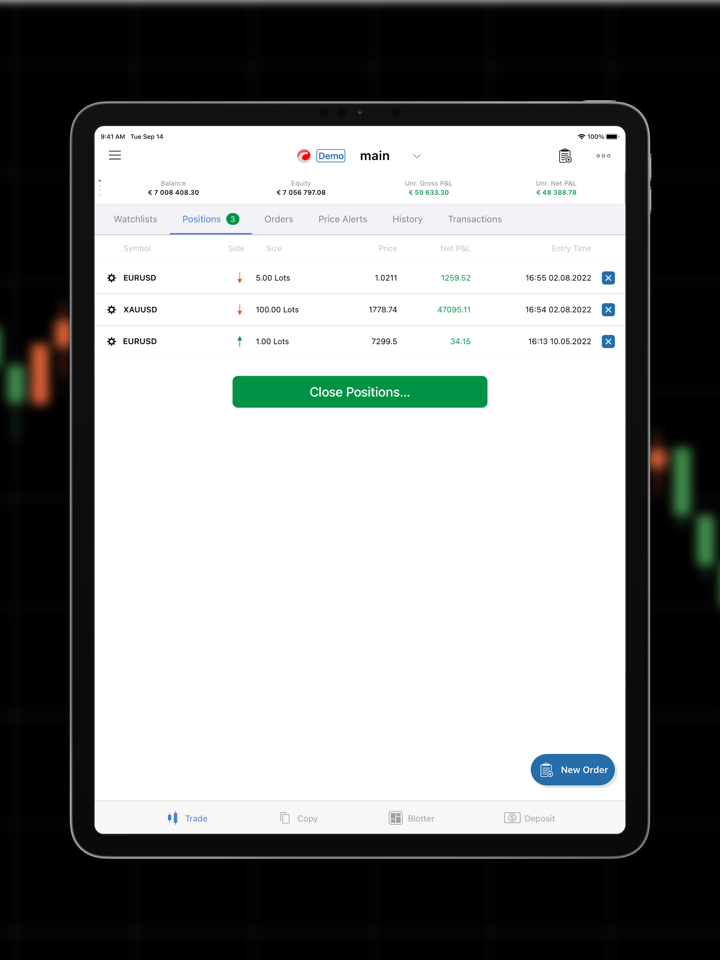

QCG provides 6 account types, including Standard Account, ECN Account, Swap-Free Account, Virtual Account, Social Copy Trade Account, Promotion Account.

Leverage

QCG provides leverage ranging from 1:30 to 1:500. However, it's important to note that while high leverage can enhance potential gains, it also significantly increases the level of risk. Trading with such a high leverage ratio requires careful risk management and a thorough understanding of the market dynamics.

Spread

| Account Type | Spread |

| Standard | From 1.6 pips |

| ECN | 0 pips |

| Swap-Free | From 1.6 pips |

| Virtual | No spread |

| Social Copy Trade | / |

| Promotion | From 1.6 pips |

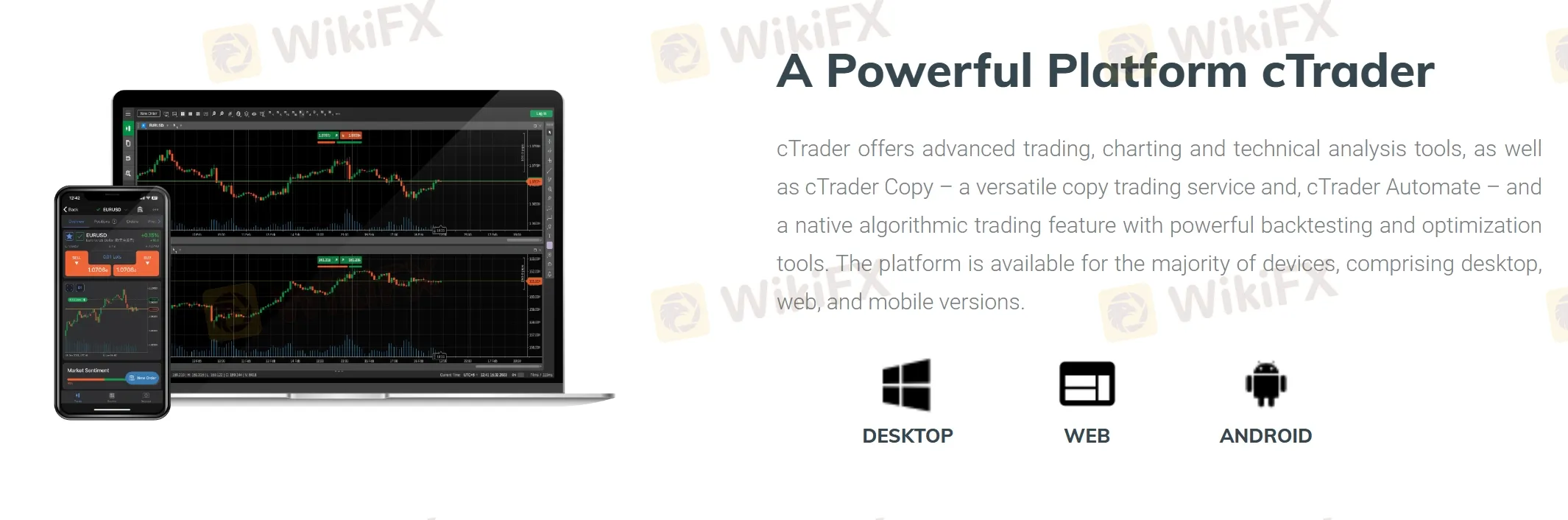

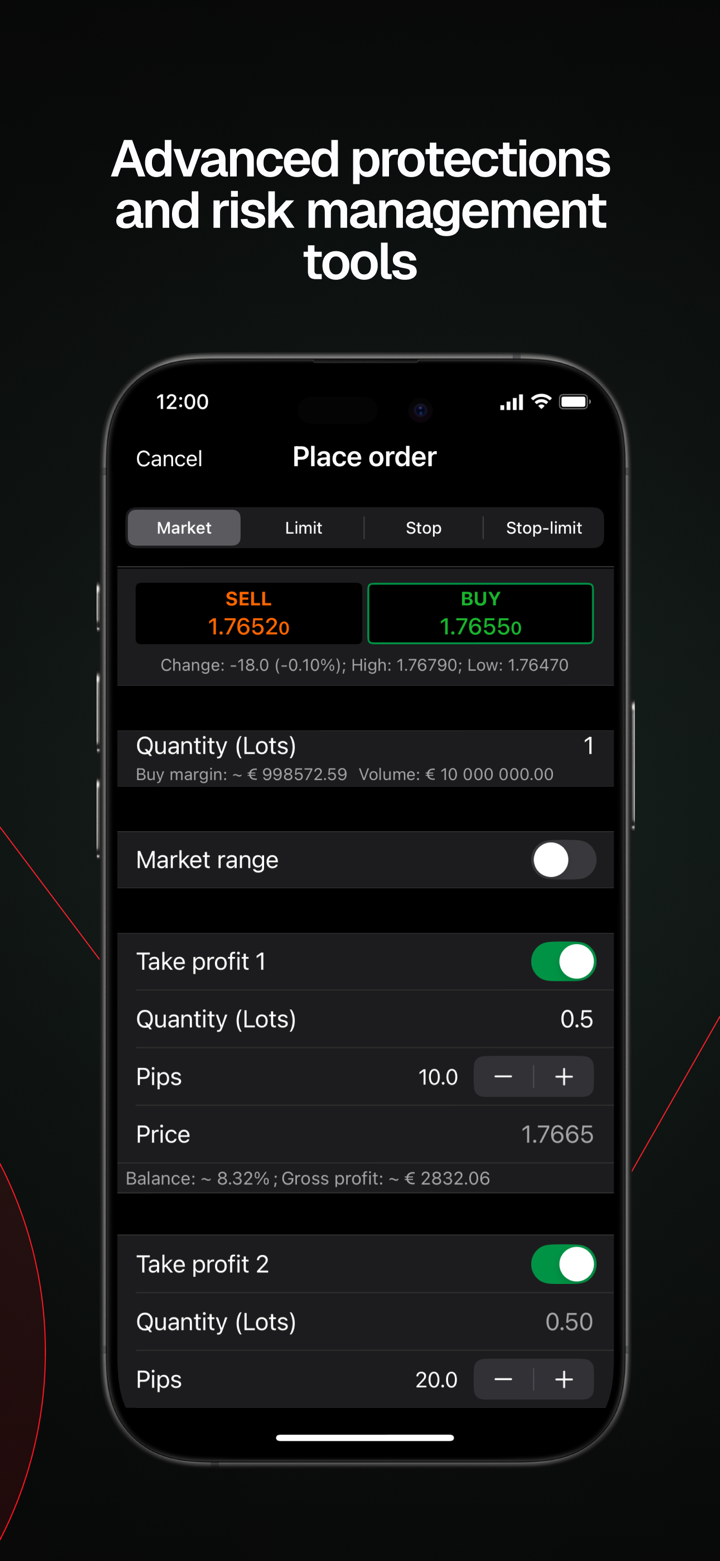

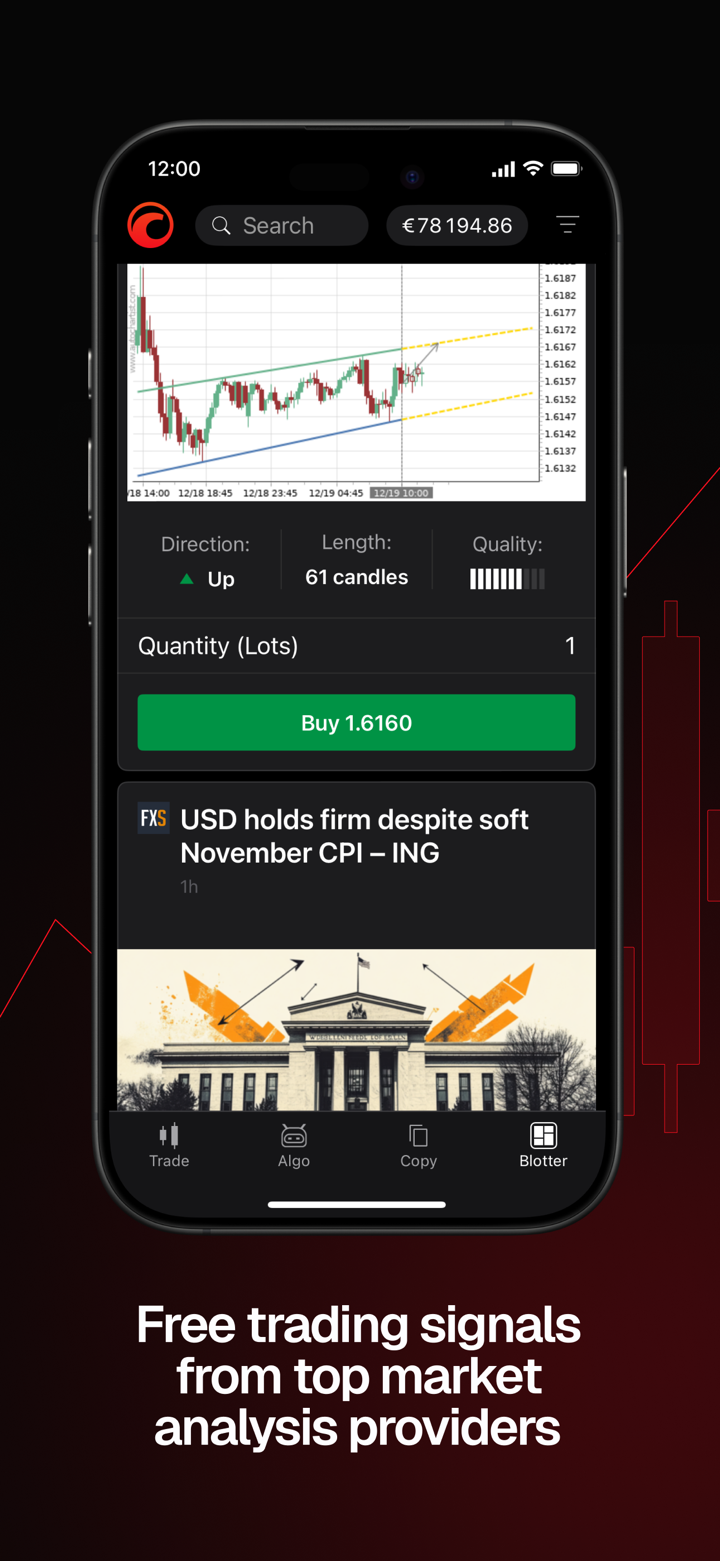

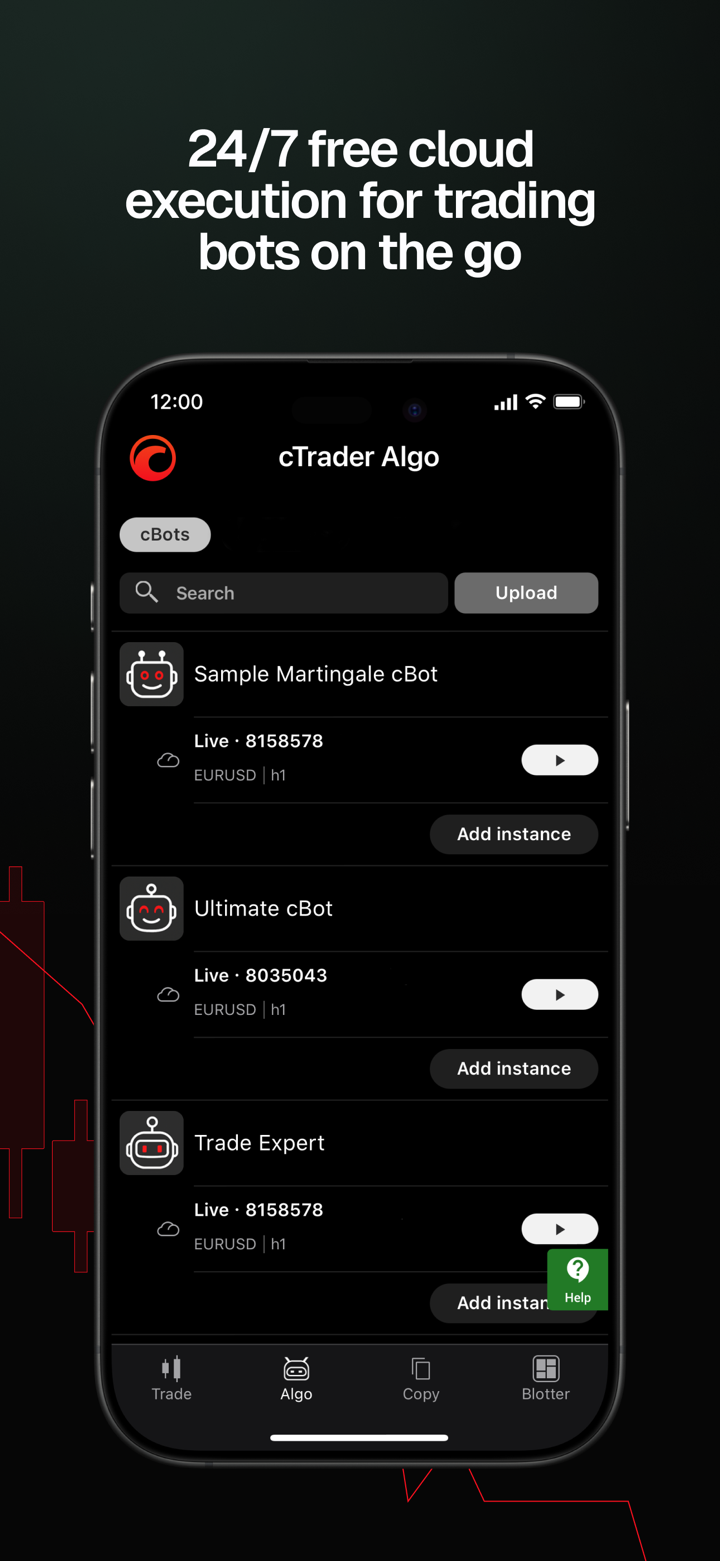

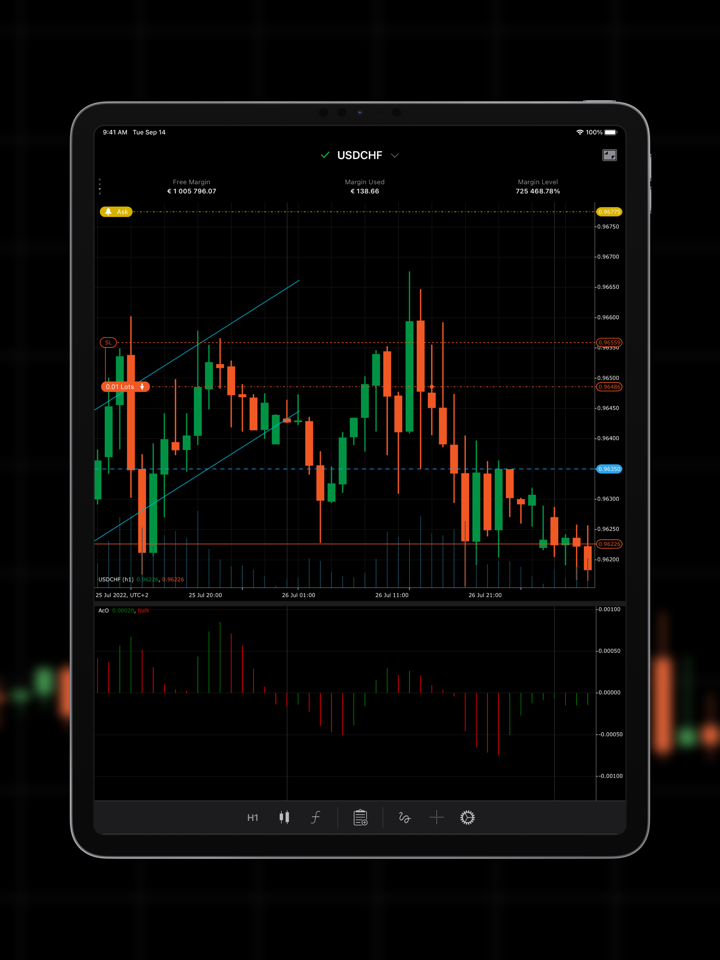

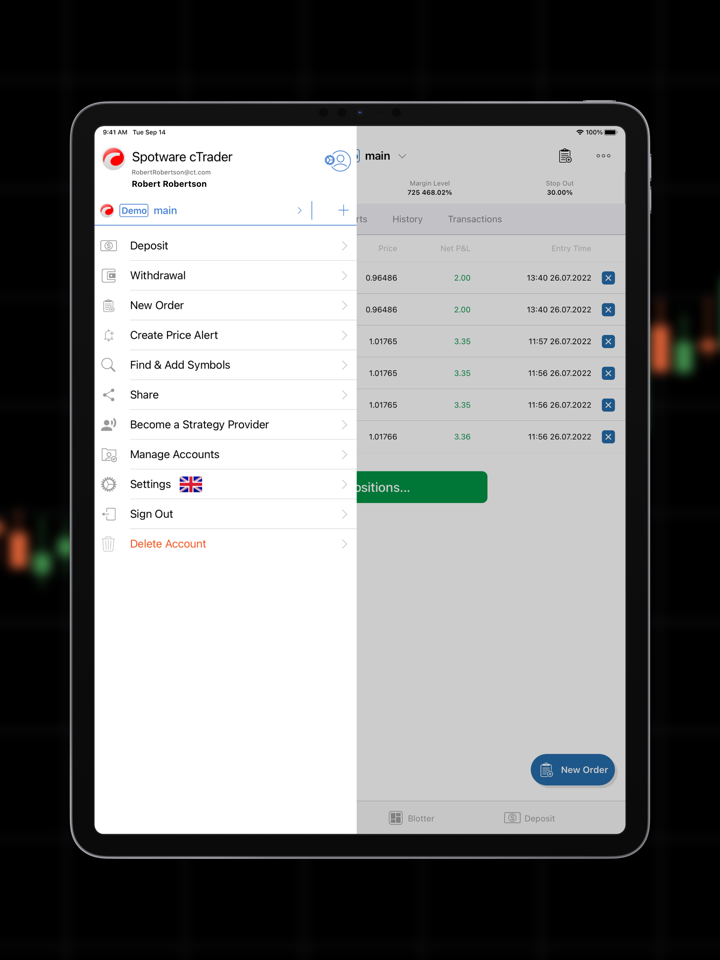

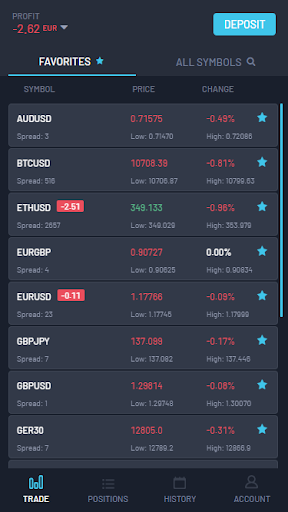

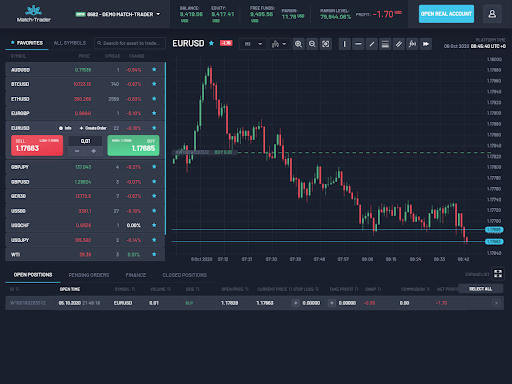

Trading Platform

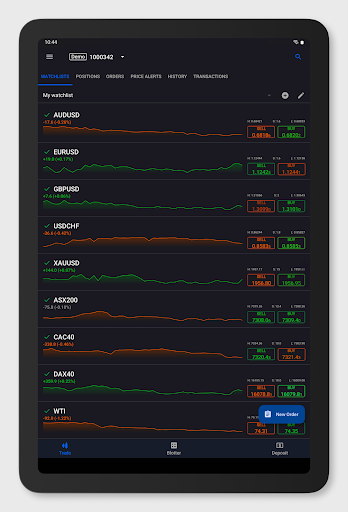

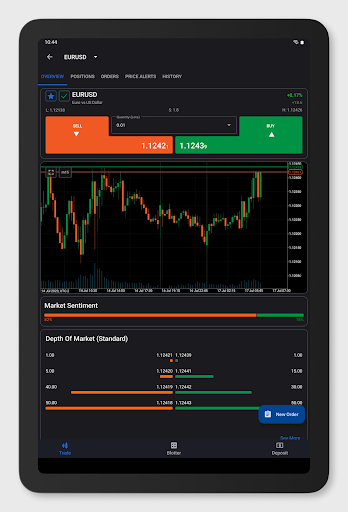

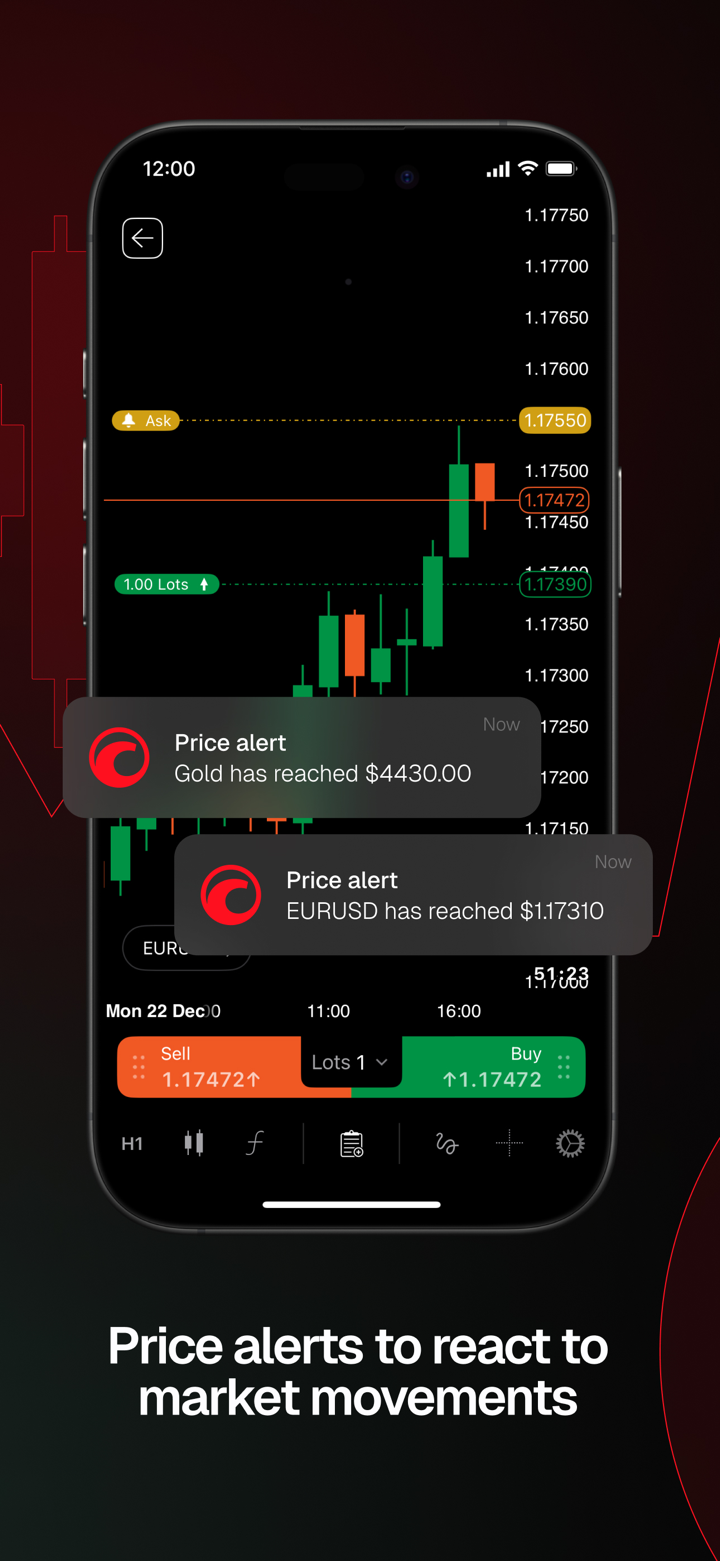

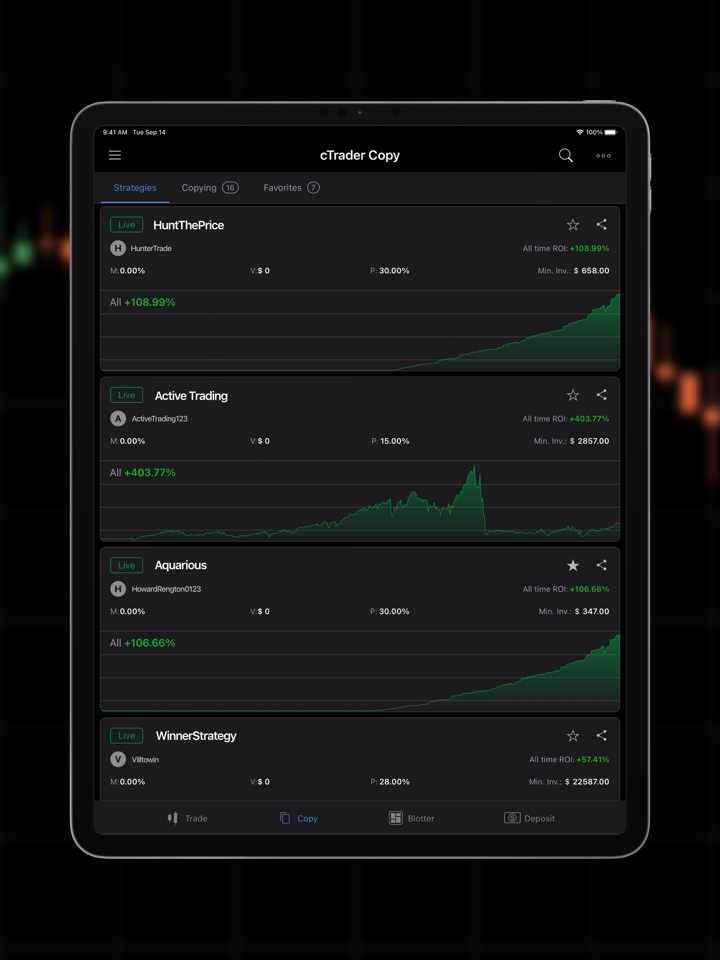

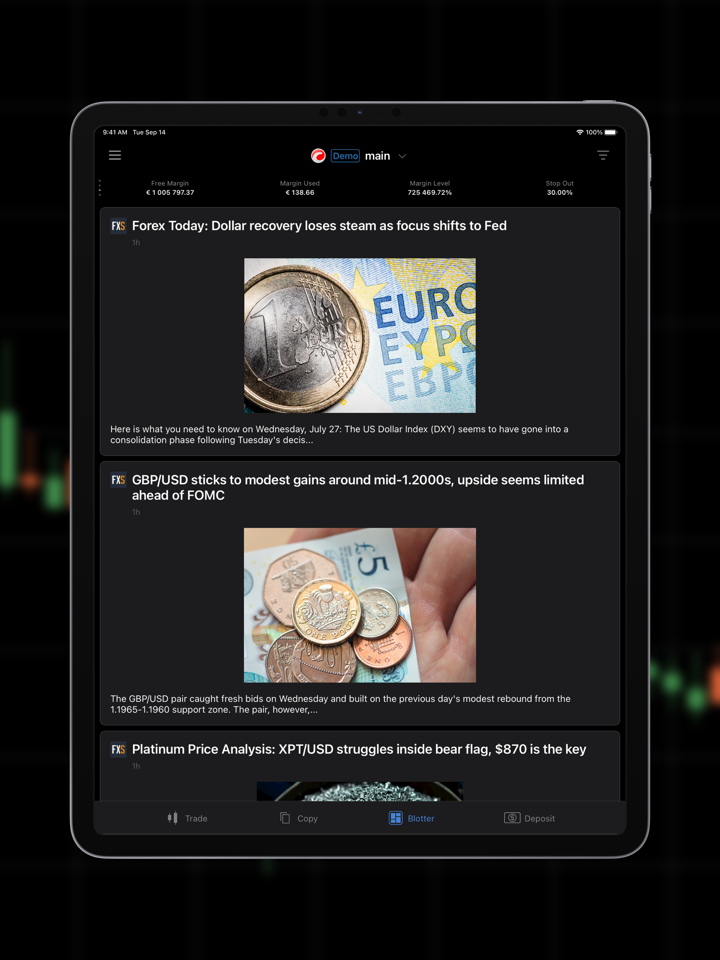

CG offers two trading platforms, cTrader and Quantum capital global trader, each with its own distinct features and advantages.

cTrader is a widely recognized and robust trading platform. It provides advanced charting tools, ultrafast order execution, access to Level II pricing, and a user-friendly interface. Traders can analyze the markets, customize their charts, and automate their trading strategies using cAlgo.

Quantum capital global trader, on the other hand, is a professional trading platform designed for brokers. It offers proprietary technology, a full server setup for complete control, advanced in-house technology, and white label solutions. Traders using Quantum capital global trader can benefit from a user-friendly interface, advanced charting tools, multiple order types, and automated trading capabilities with Expert Advisors (EAs).

Both platforms provide traders with a comprehensive and efficient trading experience, but cTrader is more geared towards individual traders, while Quantum capital global trader is tailored for brokers looking to offer a robust trading solution to their clients.

| Trading Platform | Supported | Available Devices | Suitable for |

| cTrader | ✔ | Desktop, Web, Android | / |

| Quantum capital global trader | ✔ | Windows, iPhone, Tablet, Android | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experience traders |

Hendrik G

Netherlands

Solid, but not spectacular. Does the job, but might not exceed expectations.

Neutral

Mohd Ali bin Abdullah

Malaysia

IQCG cTrader 's functionality is solid, and the user experience is smooth, the range of charts, indicators, and tools quite comprehensive. 💯

Positive

Lorelei St. James

Malaysia

Operating without regulatory oversight is a red flag for me, especially when dealing with a brokerage like QCG. The potential risks associated with trading in such an environment could be significant, and that worries me. That being said, their multiple account offerings and powerful trading platforms deserve a nod in their favor.

Neutral

Constantine Alistair Fitzroy

Australia

QCG's trading platforms, cTrader and Match-Trader, have impressed me with their advanced features and user-friendly interfaces. This, coupled with their wide variety of assets and high leverage of 1:500, gives me fantastic opportunities to diversify and expand my trading strategies. However, I'm concerned about their lack of regulatory oversight which leaves me unsure about the safety of my funds.

Neutral

FX1501701504

Tunisia

I had a mixed experience with QCG. While their trading platforms and asset selection are decent, the lack of regulation is a significant concern. It's unsettling to trade with an unregulated broker, as it raises questions about the safety of funds and the transparency of operations. I also found their educational resources to be limited, which made it challenging to enhance my trading skills. Additionally, their customer support, although available via email, lacks other channels like live chat or phone support, which could have been more convenient. If they address these issues and prioritize regulation and customer support, it would significantly improve the overall user experience.

Neutral

FX1501697579

Russia

I've been trading with QCG for a few months now, and I must say I'm impressed with their trading platforms and the range of assets they offer. The cTrader platform is powerful and user-friendly, making it easy to analyze the markets and execute trades. I particularly enjoy trading forex pairs and cryptocurrencies, and QCG provides competitive spreads and quick order execution. The copy trading feature is also a great addition, as it allows me to follow the trades of experienced traders and learn from their strategies. Overall, QCG has provided me with a satisfying trading experience.

Positive