Company Summary

| Yuanta Review Summary | |

| Founded | 1992 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Stocks, derivatives, futures & options |

| Demo Account | ❌ |

| Trading Platform | eWinner, YSHK SP Trader |

| Minimum Deposit | / |

| Customer Support | Phone: (852) 3555-7878 |

| Fax: (852) 3555-7889 | |

| Email: HK.services.brk@yuanta.com | |

Yuanta Information

Founded in 1992, Yuanta is governed by the Hong Kong Securities and Futures Commission. The company provides a variety of trading tools including stocks, futures, and derivatives. Though it lacks a demo account, it helps multi-platform trading with in-house created technologies and provides localised support via phone and email.

Pros and Cons

| Pros | Cons |

| Regulated by Hong Kong SFC | No demo accounts |

| Supports multi-market trading through one login | Some service fees (e.g., nominee services) can be high |

| Offers broad product coverage: stocks, futures, options | No clearly stated minimum deposit |

Is Yuanta Legit?

Yes, Yuanta is regulated by Securities and Futures Commission of Hong Kong (SFC).

| Licensed Entity | Regulated by | Regulated License | Current Status | License Type | License No. |

| Yuanta Securities (Hong Kong) Company Limited | Hong Kong, China | SFC | Regulated | Dealing in futures contracts | ABS015 |

| Yuanta Futures (HK) Co., Limited | Hong Kong, China | SFC | Regulated | Dealing in futures contracts | AXQ690 |

| Yuanta Asia Investment (Hong Kong) Limited | Hong Kong, China | SFC | Exceeded | Dealing in securities | ABZ023 |

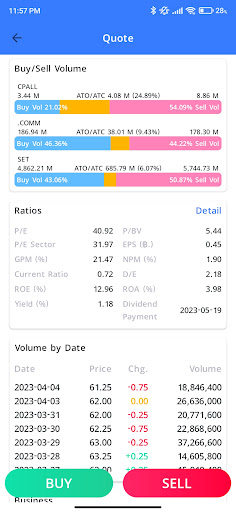

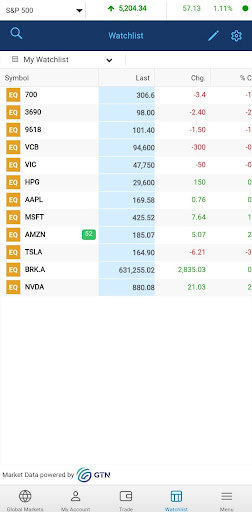

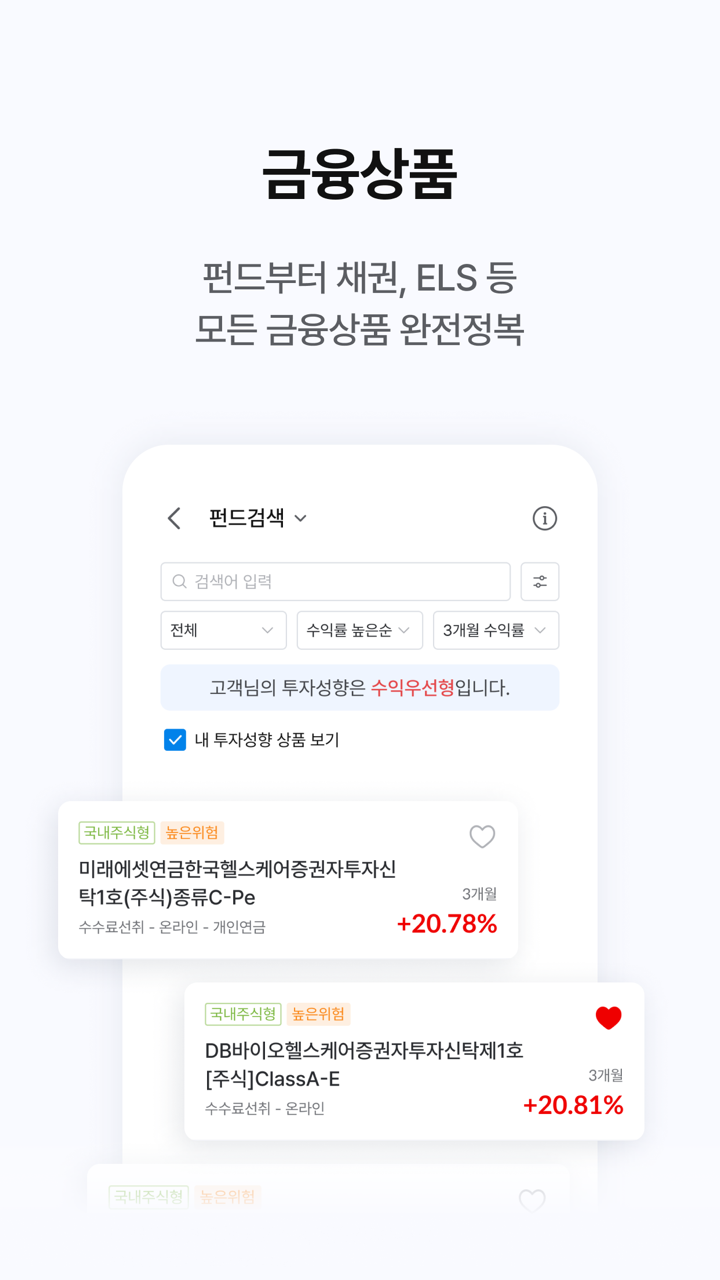

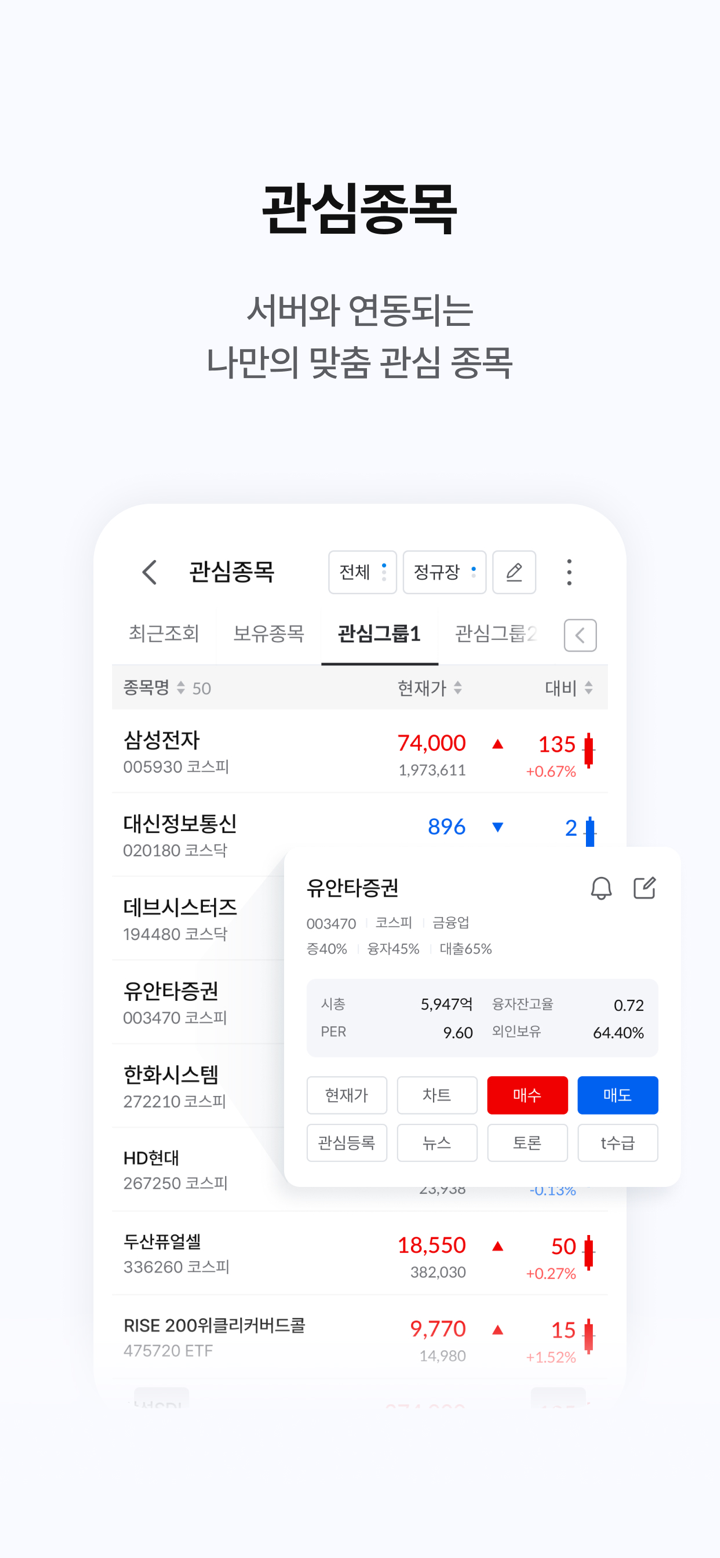

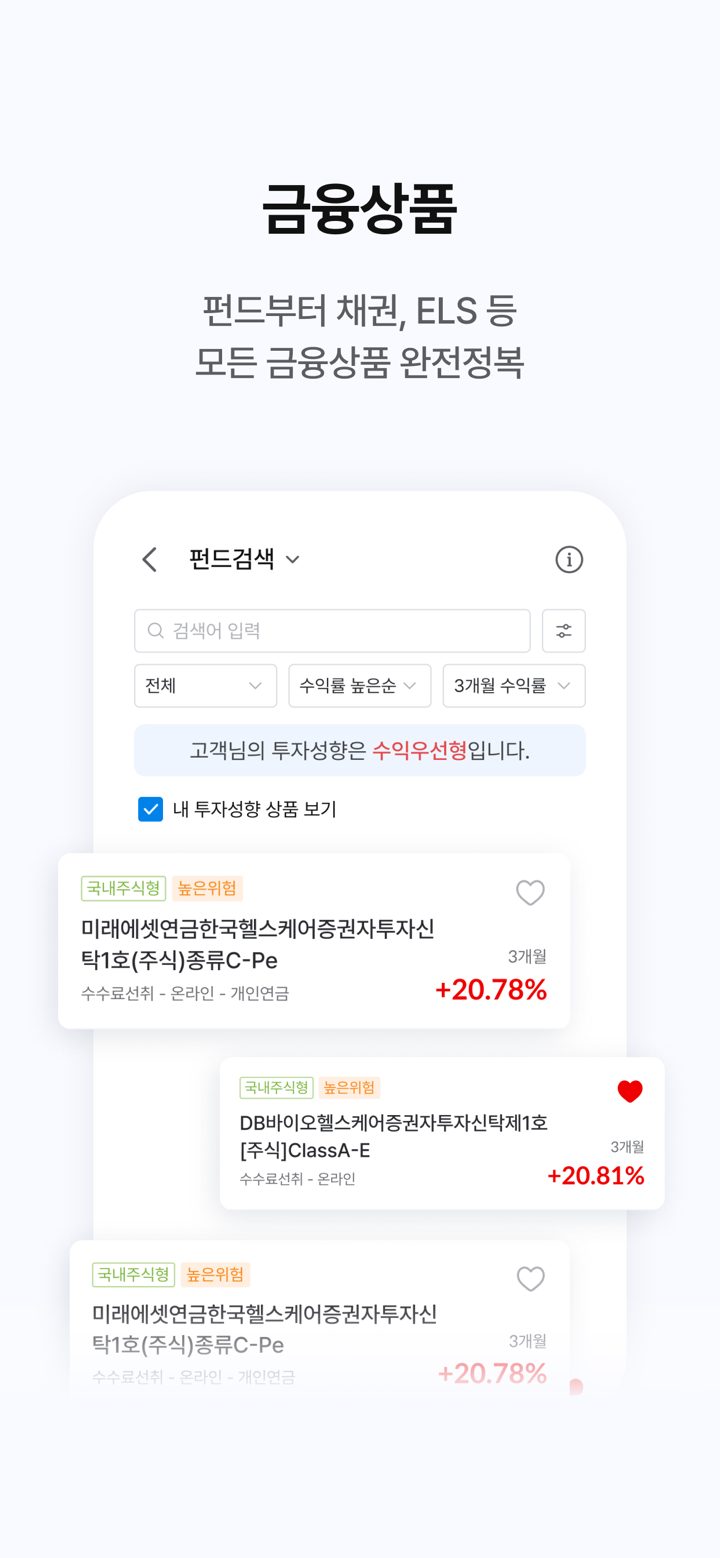

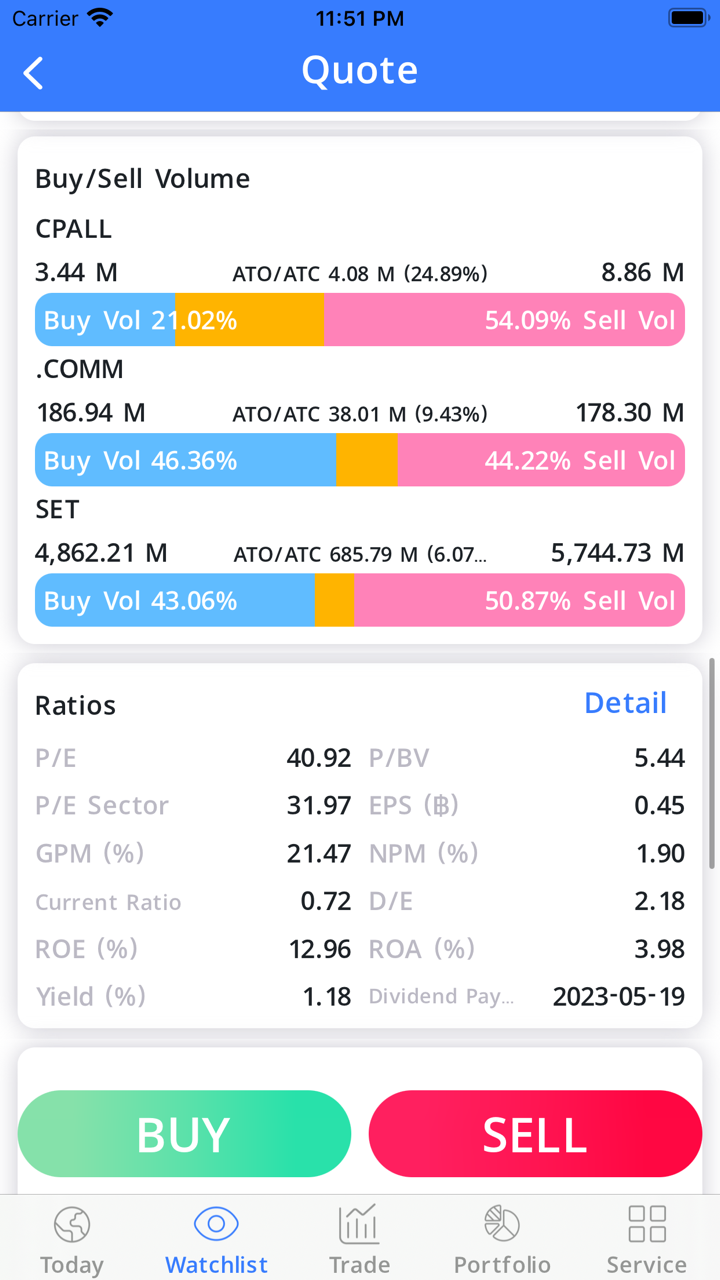

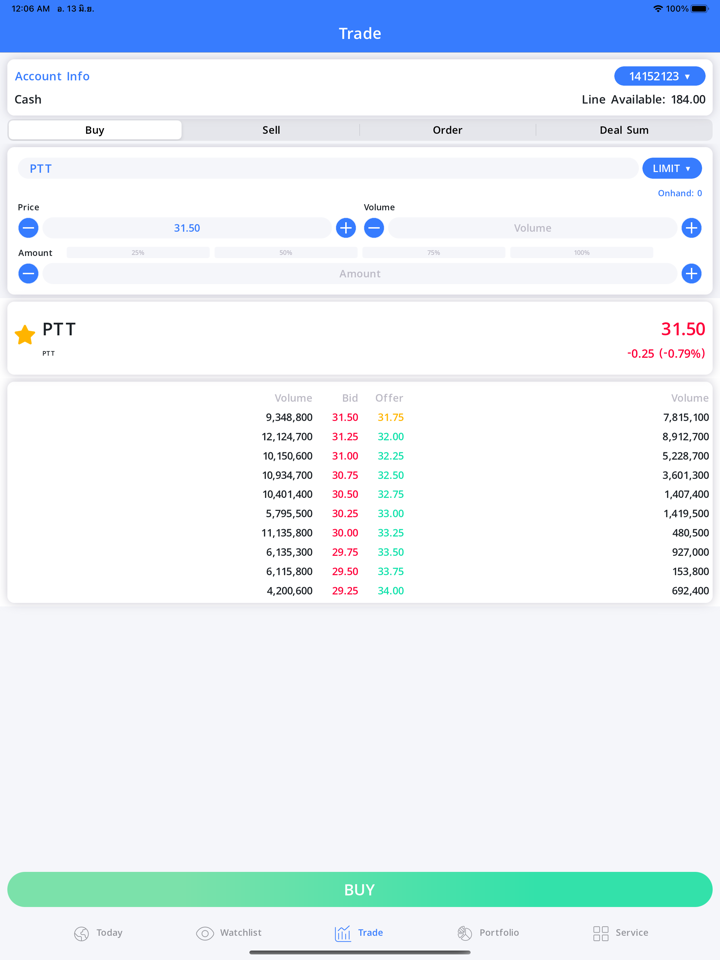

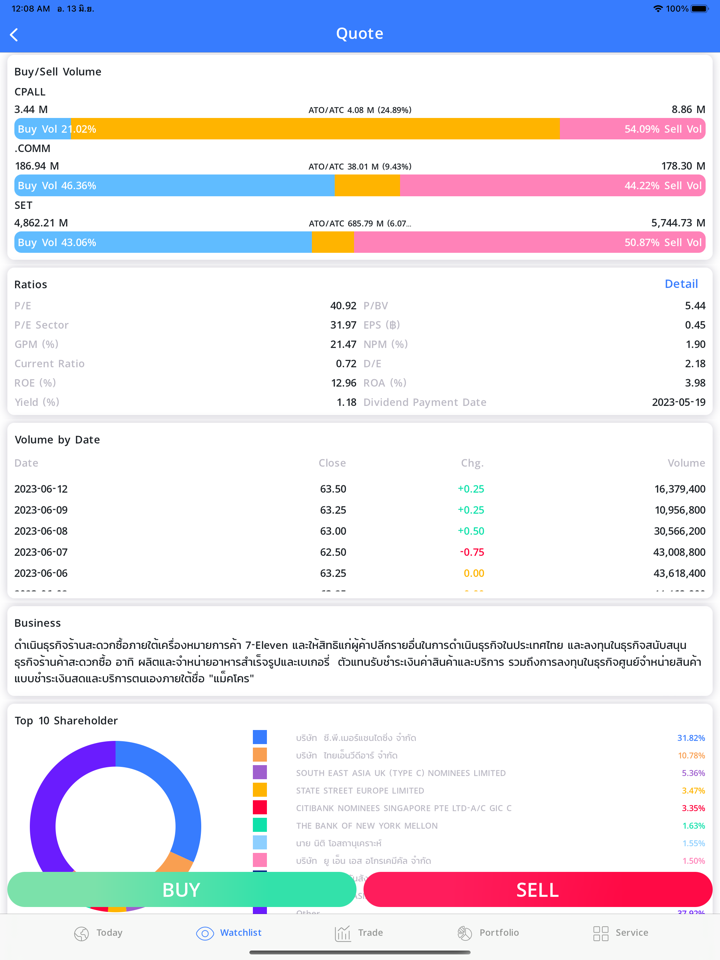

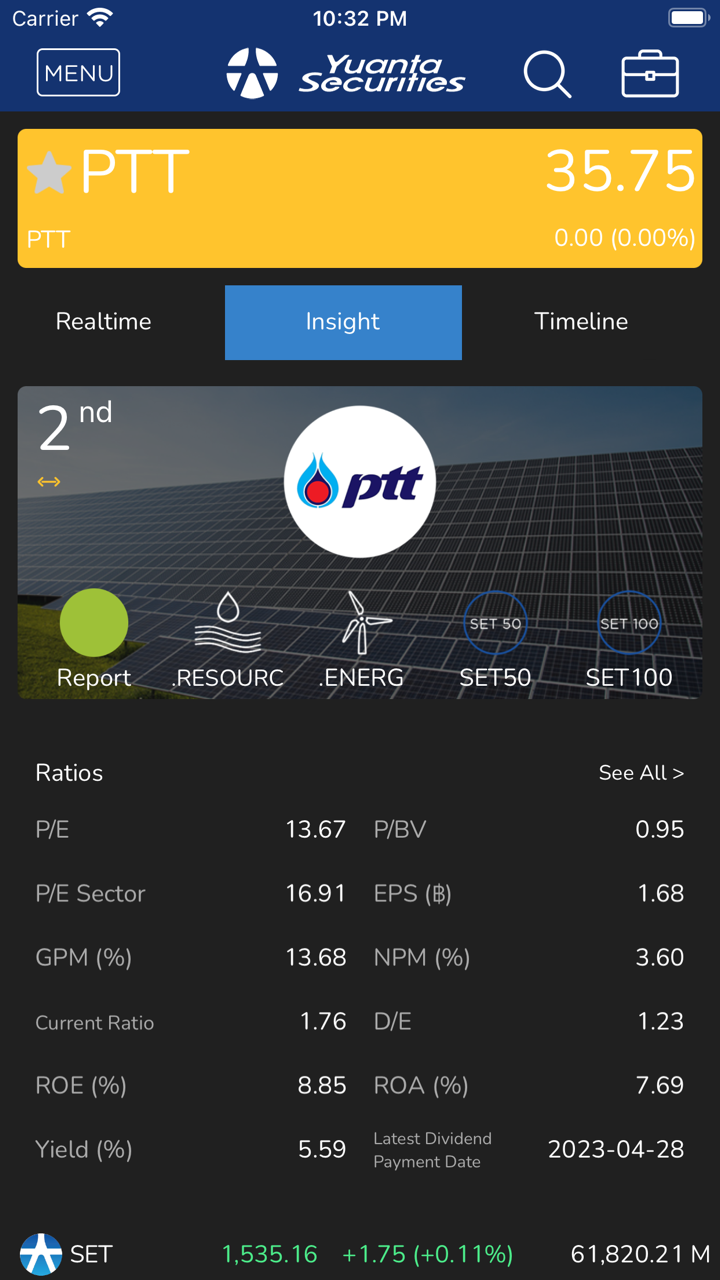

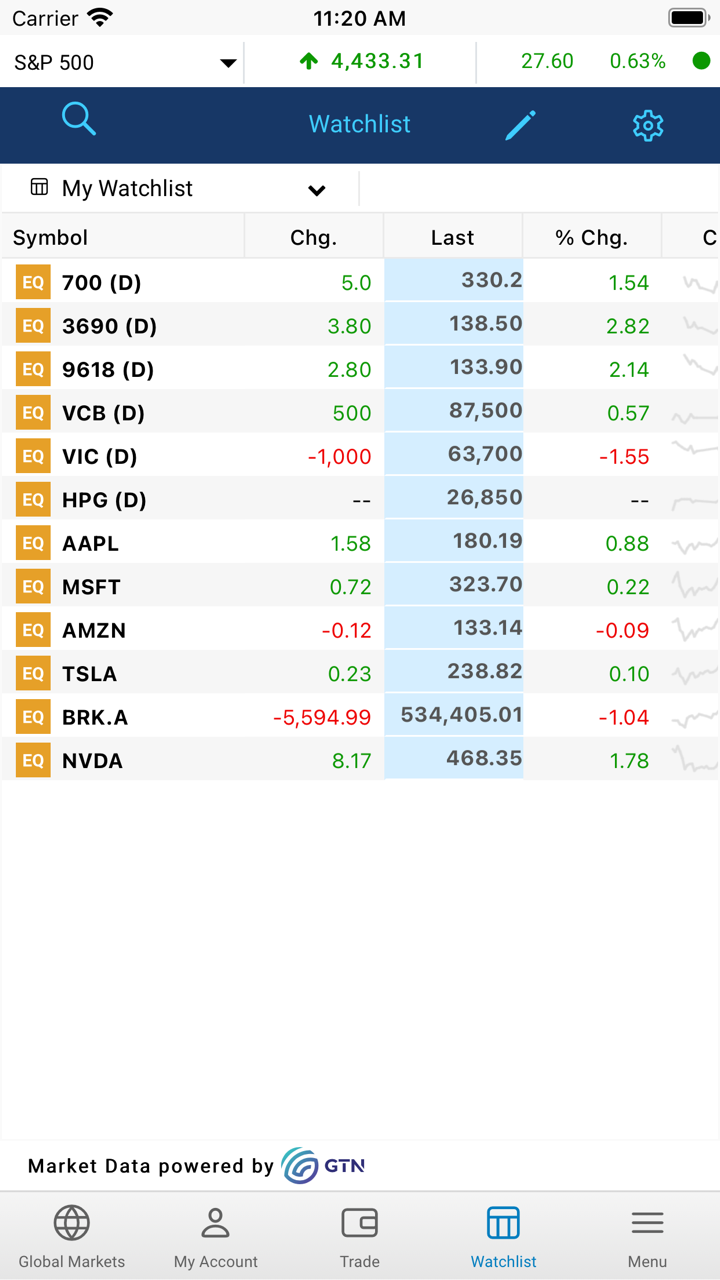

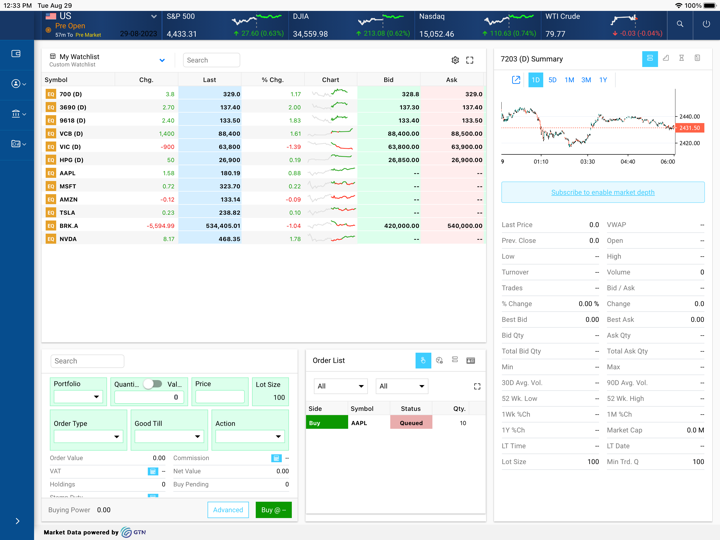

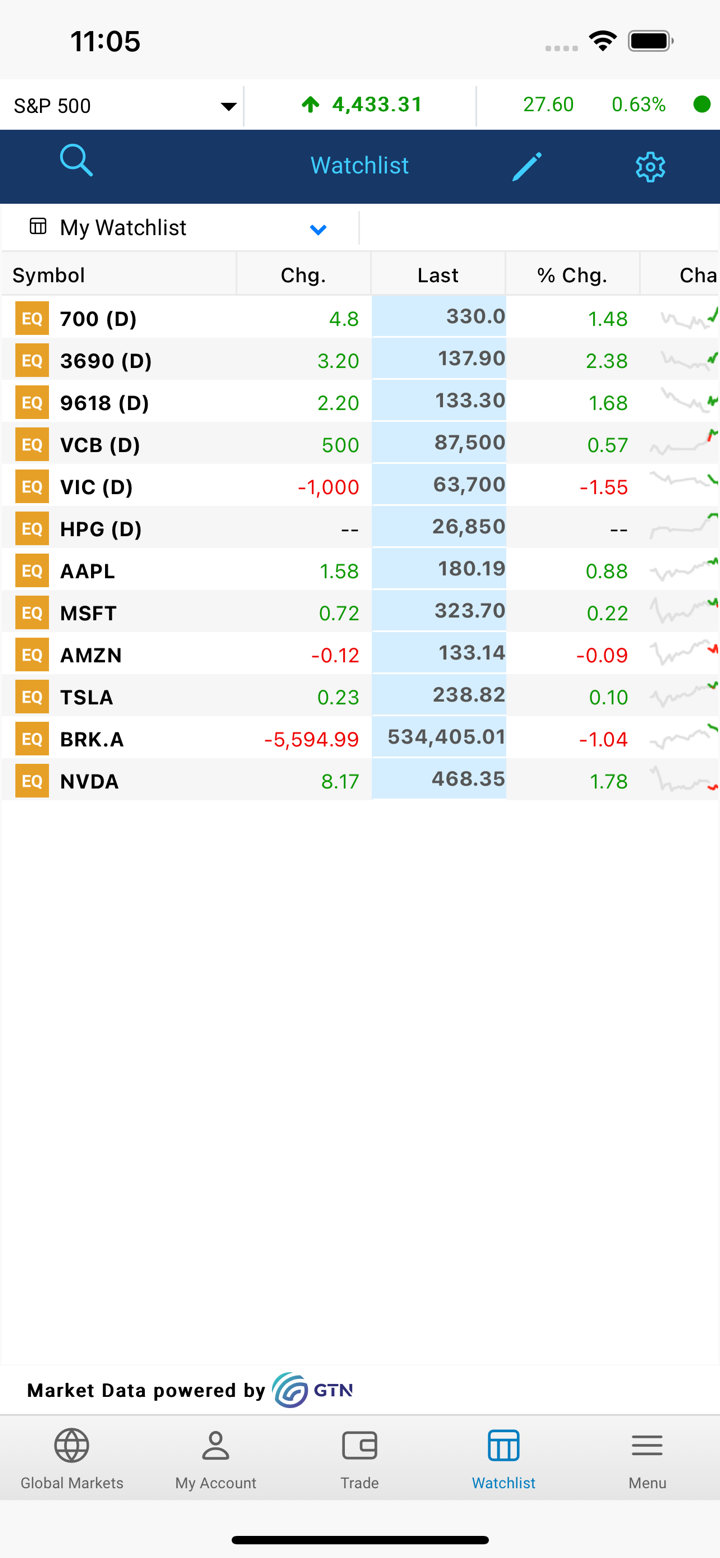

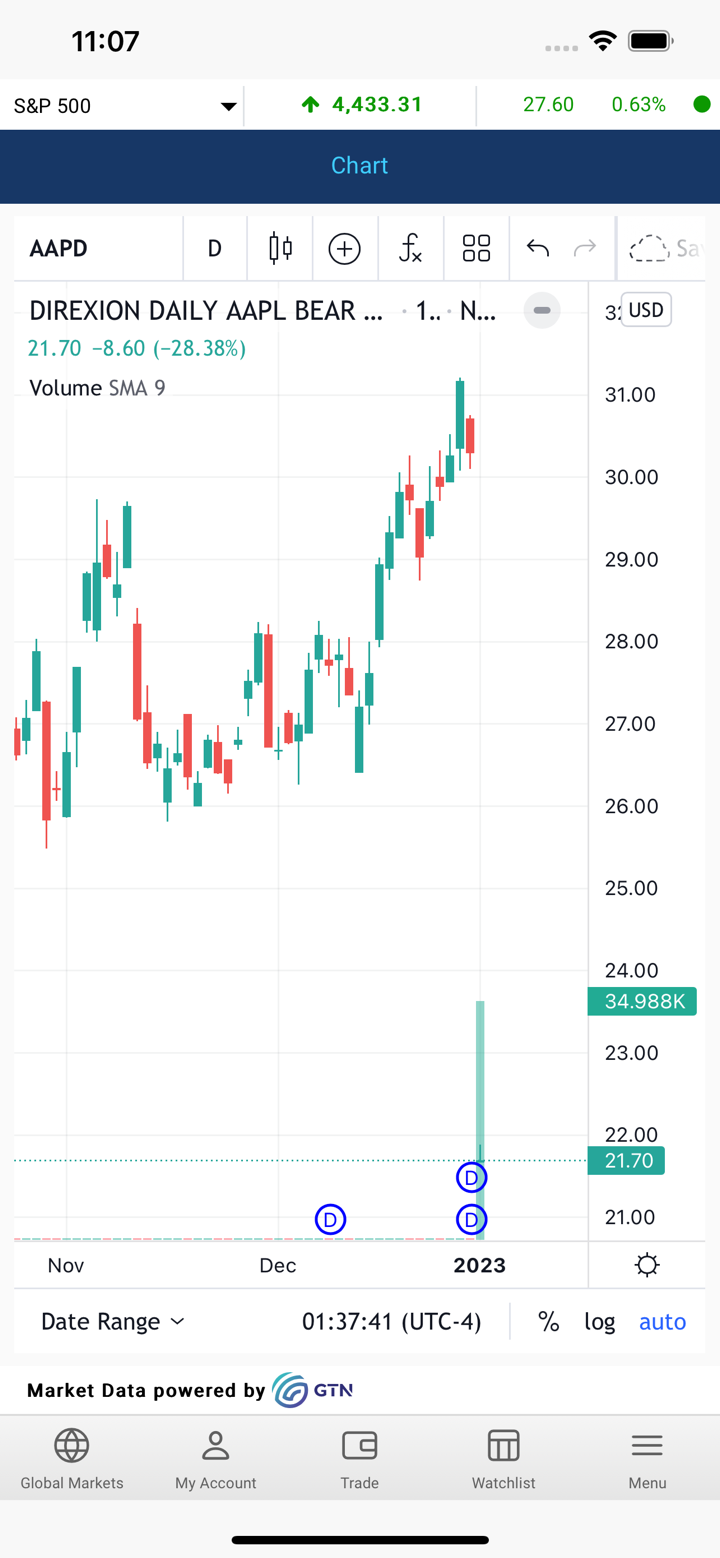

What Can I Trade on Yuanta?

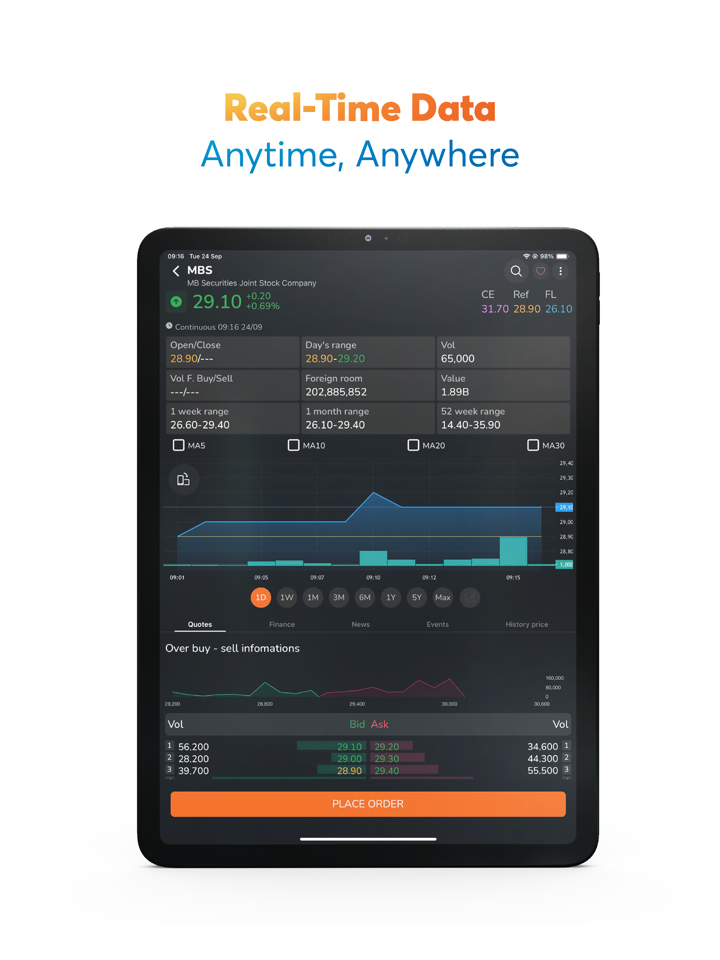

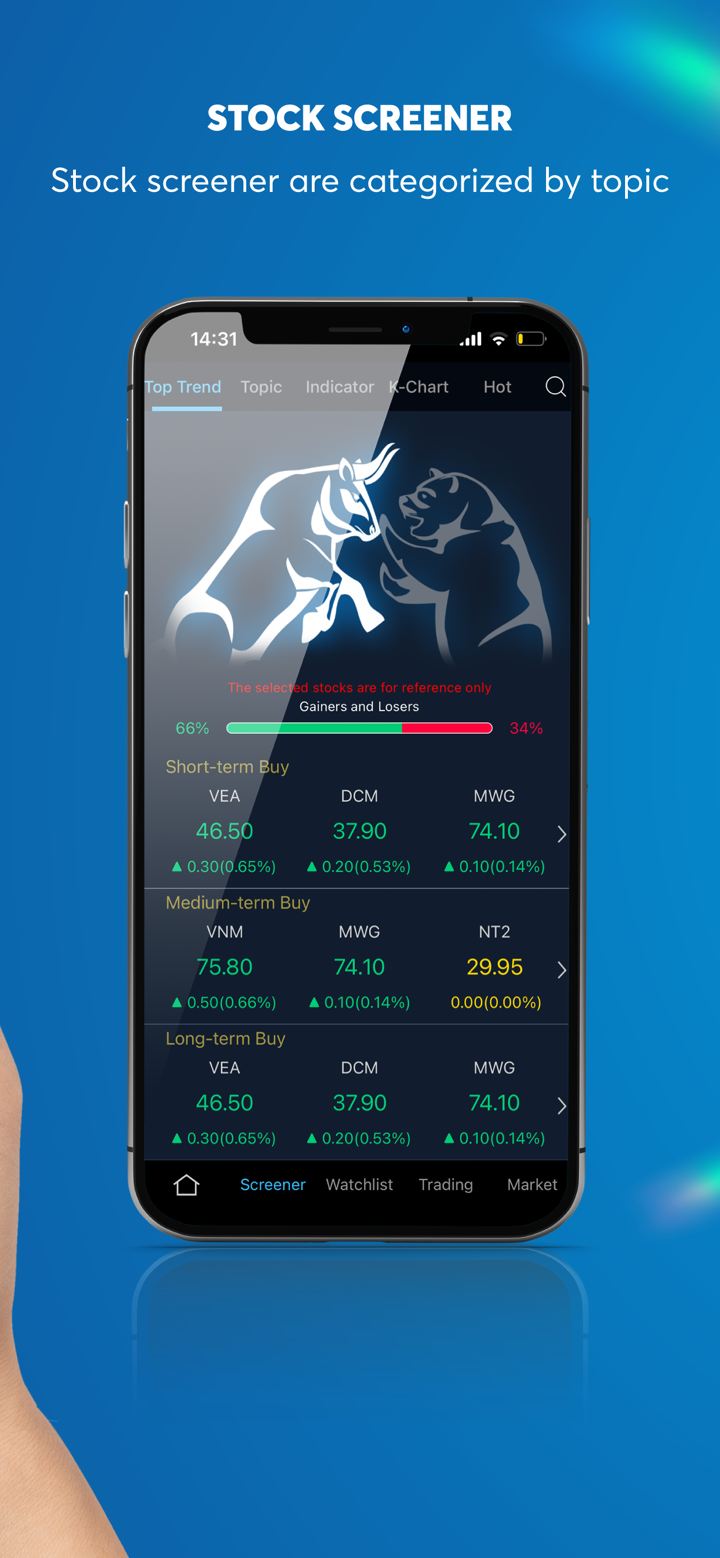

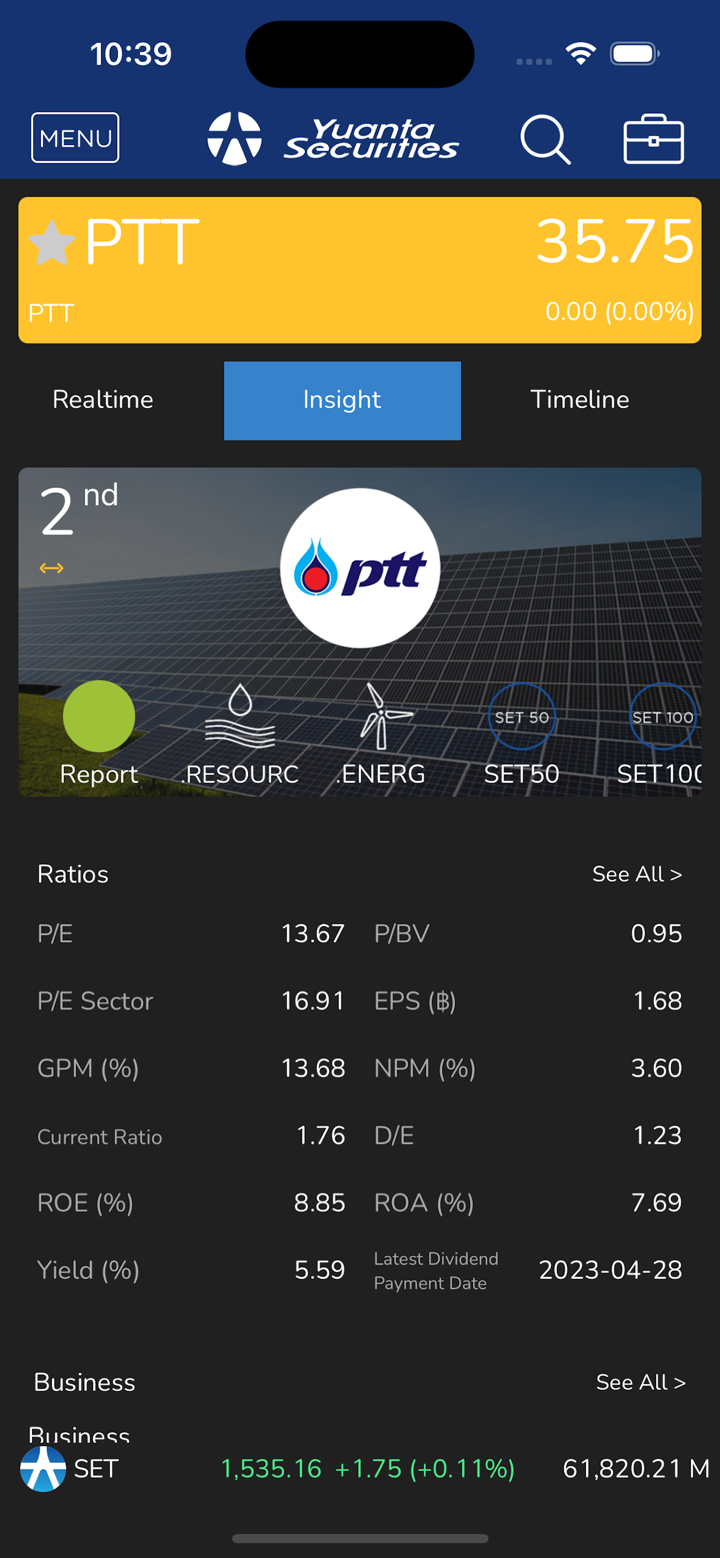

Mainly covering stock trading, derivative products, and futures & options, the organization provides a broad spectrum of financial products and services.

| Trading Products | Details |

| Stock Trading | HK Stocks, SH Stocks, SZ Stocks, Taiwan Stocks, US Stocks, China B Shares, Overseas Stocks |

| Derivative Products | Callable Bull / Bear Contracts, Derivative Warrants |

| Futures & Options | Futures, Options, Trading Details, Contract Specifications, Margin Requirements |

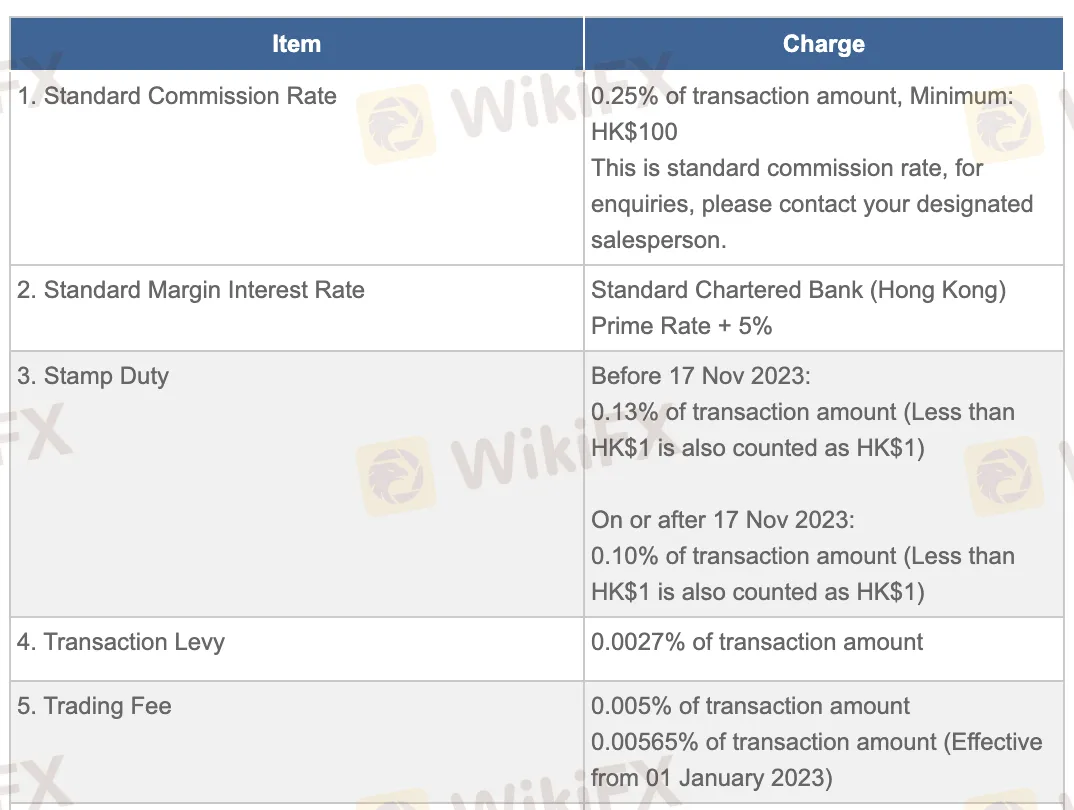

Yuanta Fees

Though some administrative and nominee service fees could be on the higher side, Yuanta's fees are usually in line with industry standards, with standard commission and interest rates similar to major Hong Kong brokers.

| Item | Charge |

| Standard Commission Rate | 0.25% of transaction amount, Minimum HK$100 |

| Standard Margin Interest Rate | Prime Rate + 5% |

| Stamp Duty | 0.10% (after 17 Nov 2023), 0.13% (before), min HK$1 |

| Transaction Levy | 0.0027% of transaction amount |

| Trading Fee | 0.00565% of transaction amount (since Jan 2023) |

| CCASS Fee | 0.002%, min HK$2, max HK$100 |

| Italian Financial Transaction Tax | 0.2% of transaction amount |

| FRC Transaction Levy | 0.00015% of transaction amount |

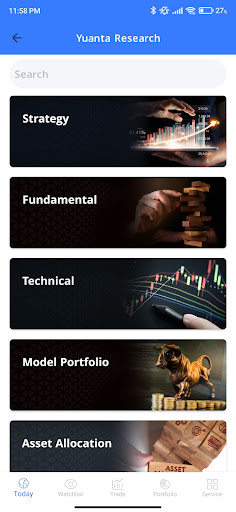

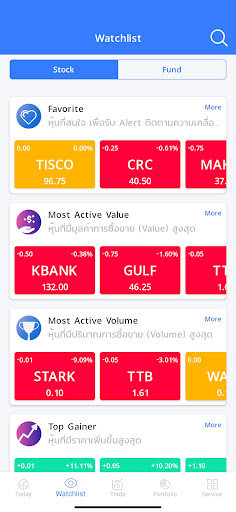

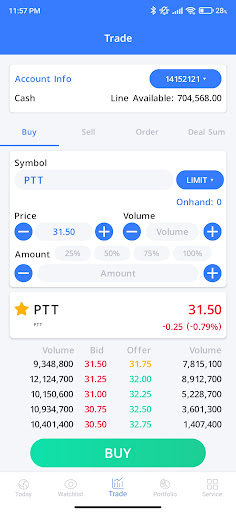

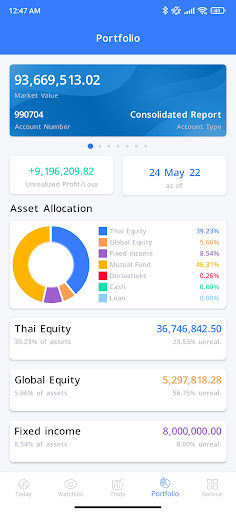

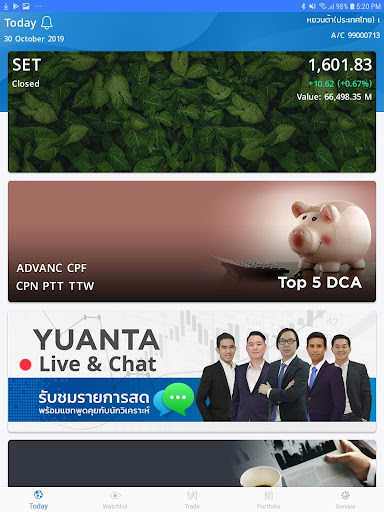

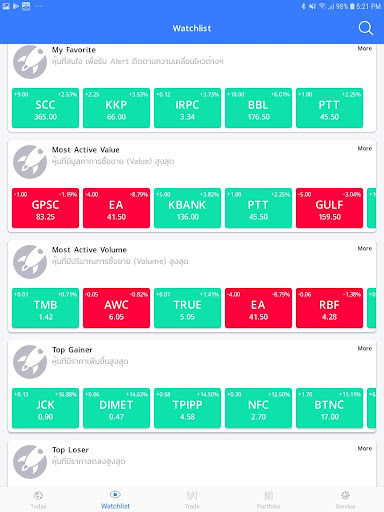

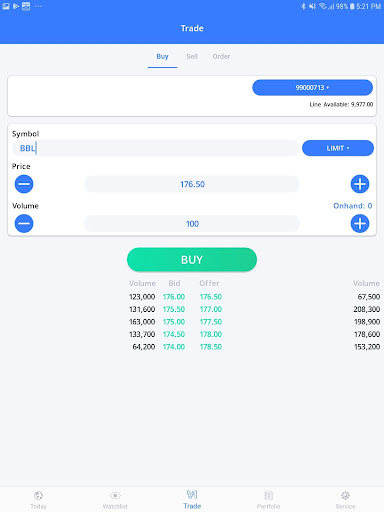

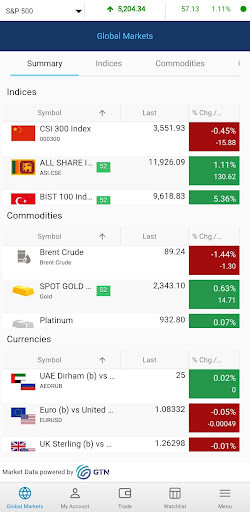

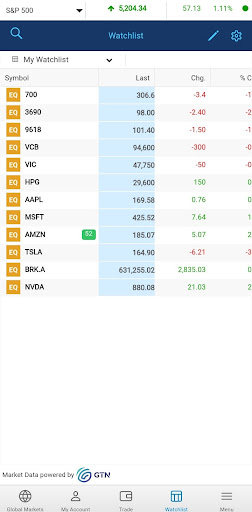

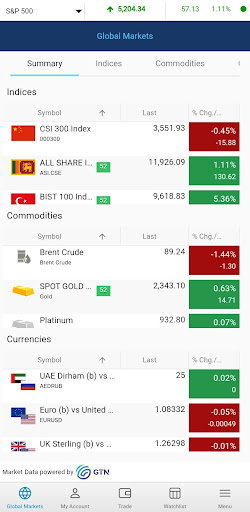

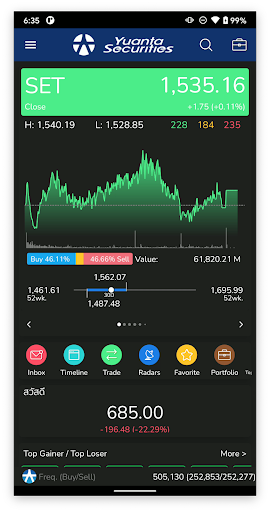

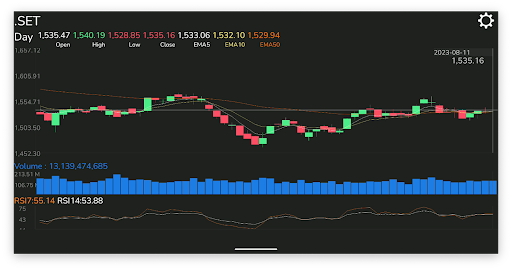

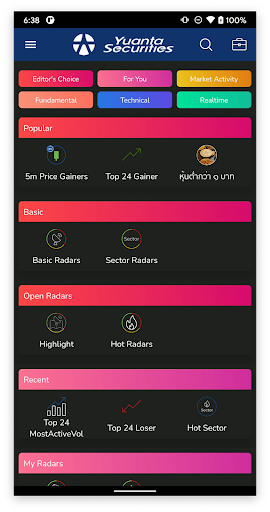

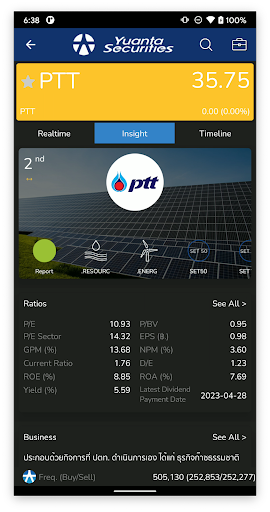

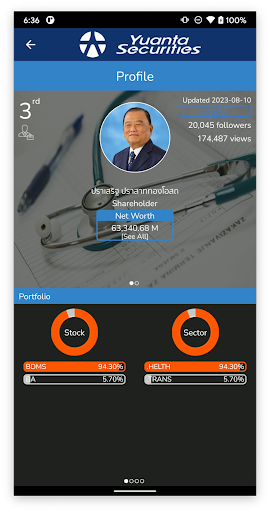

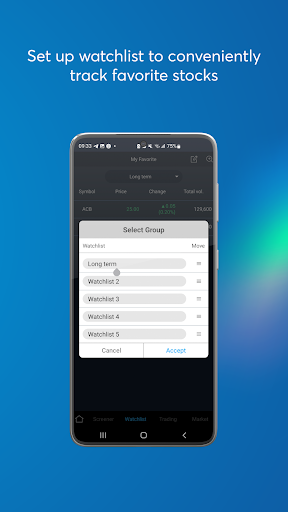

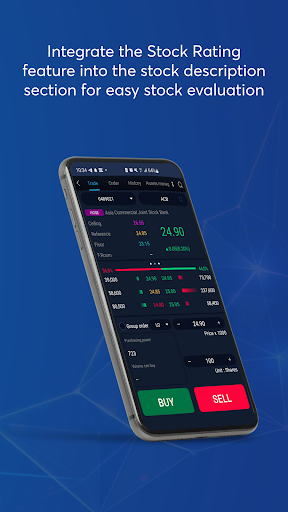

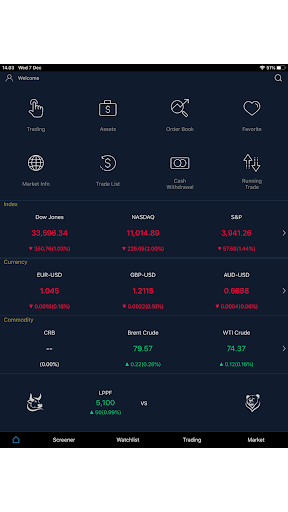

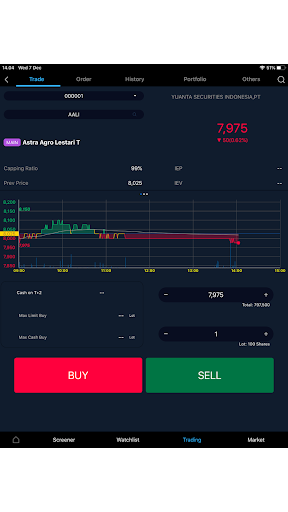

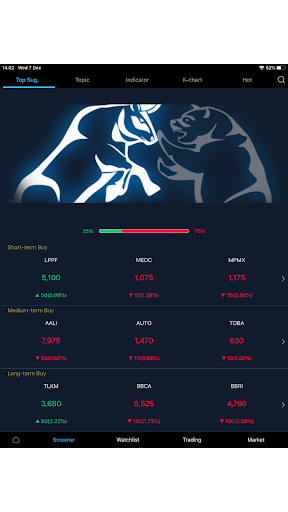

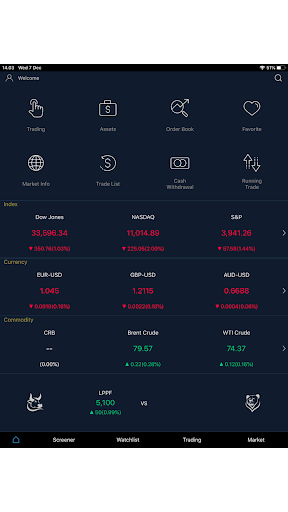

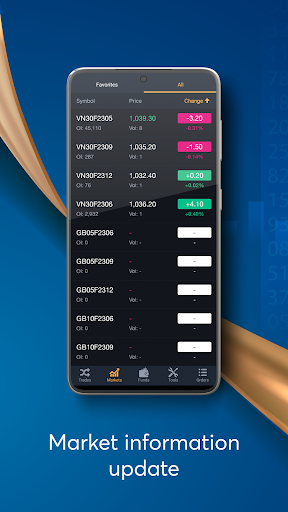

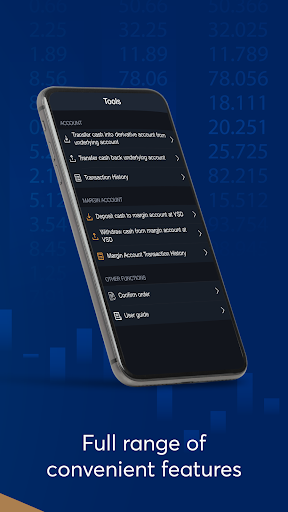

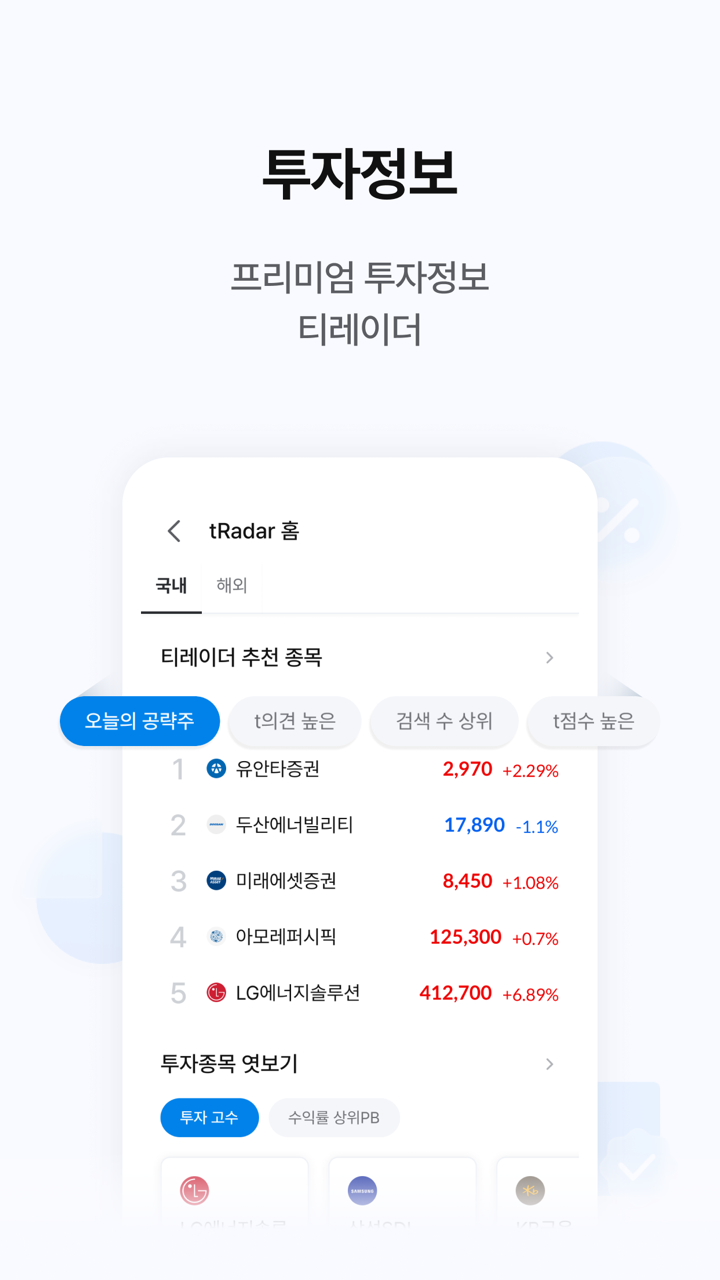

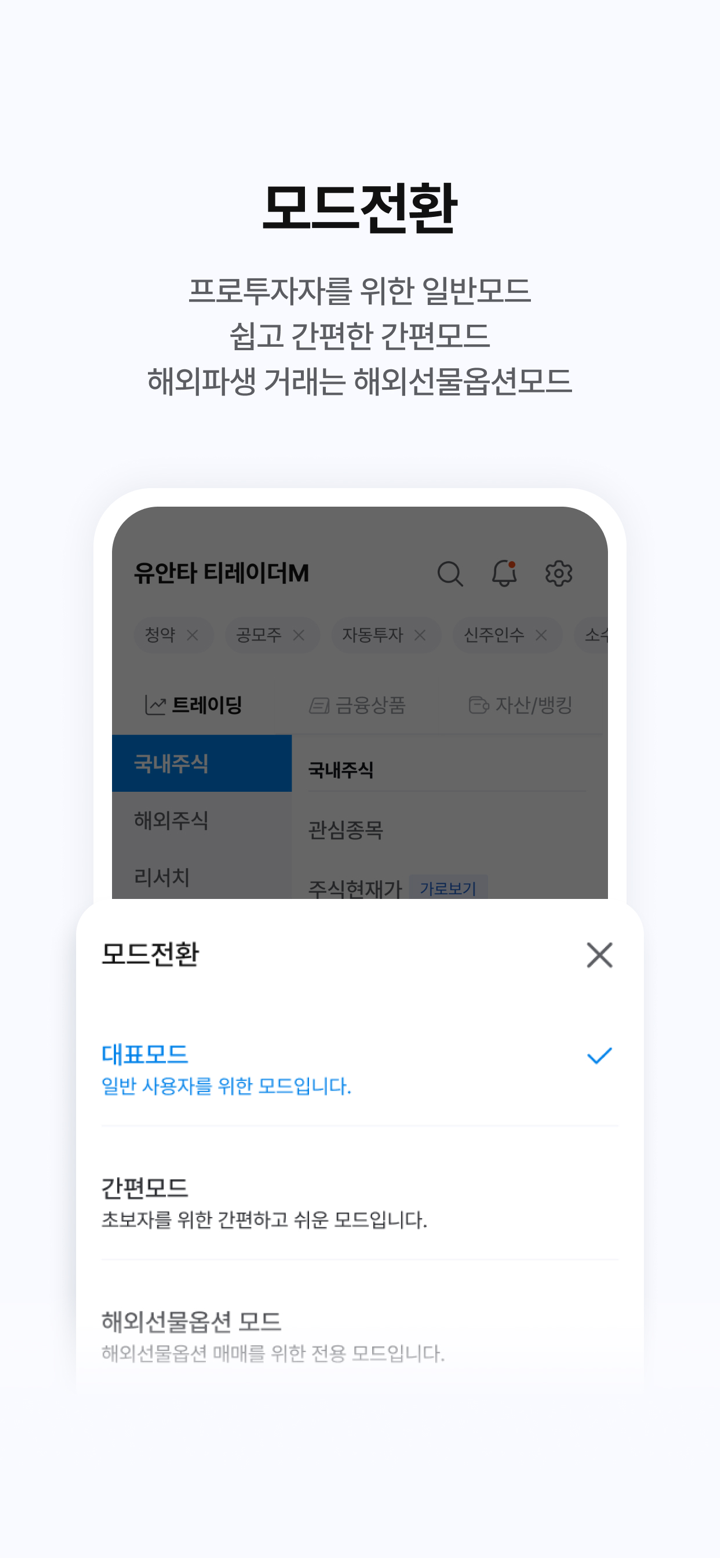

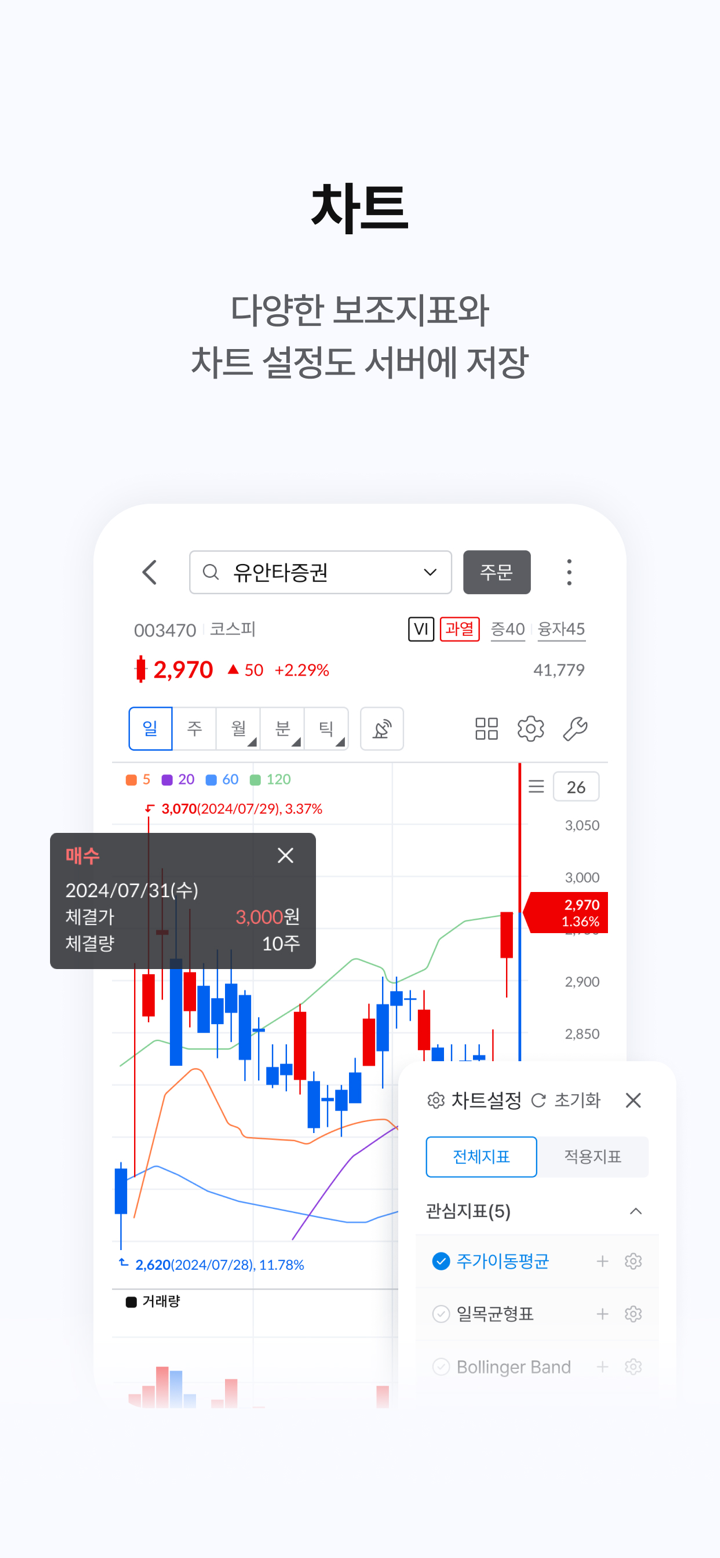

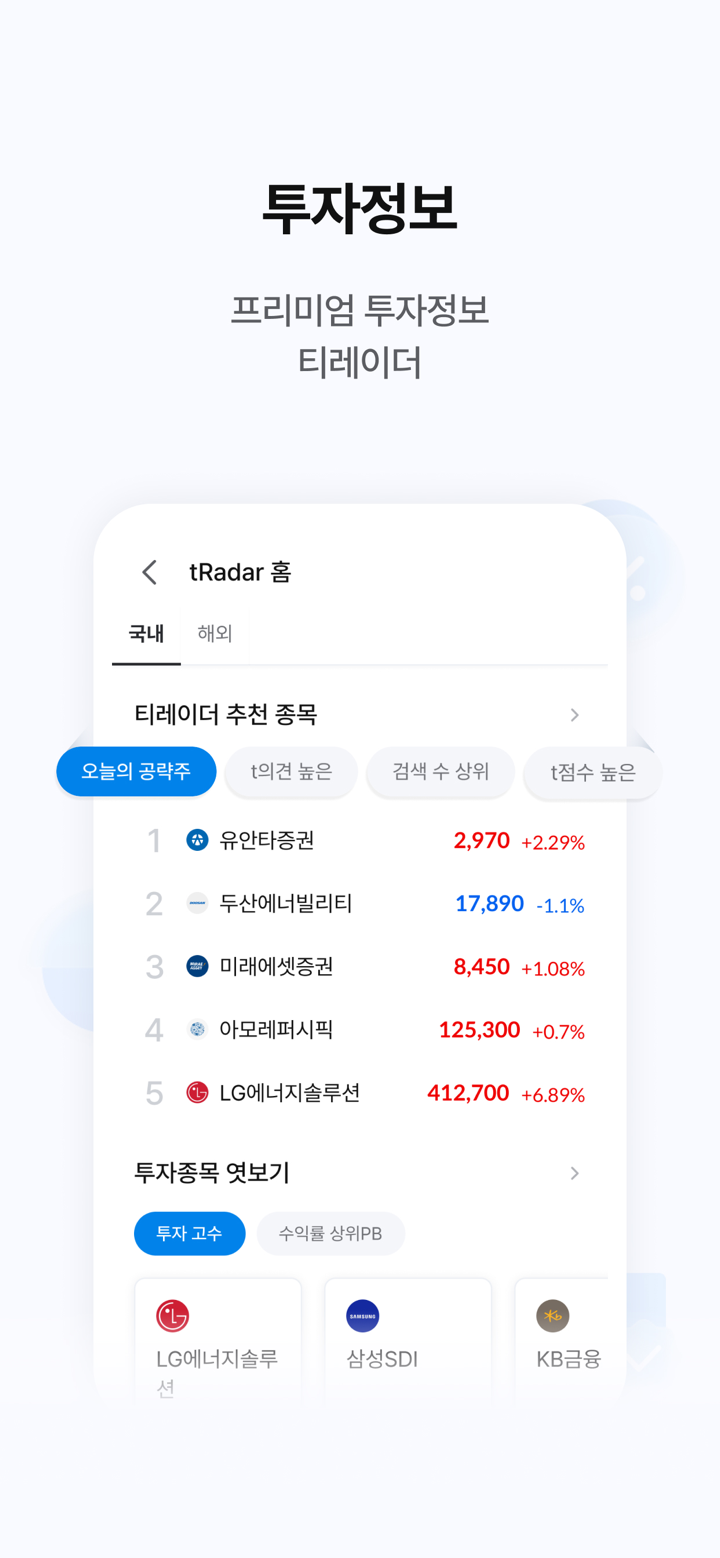

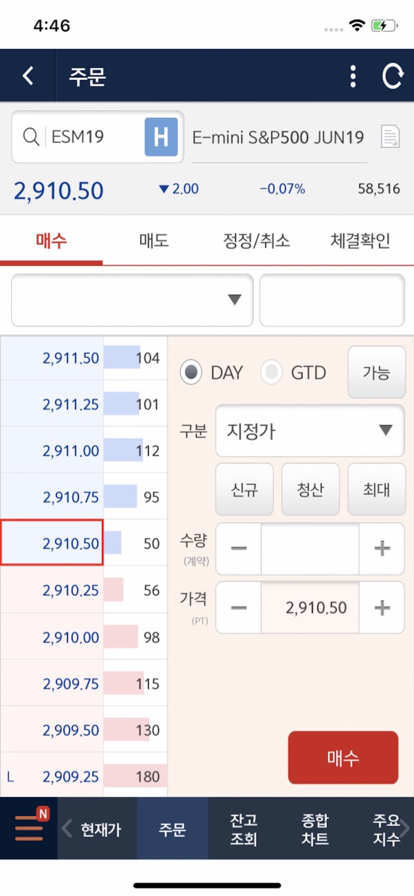

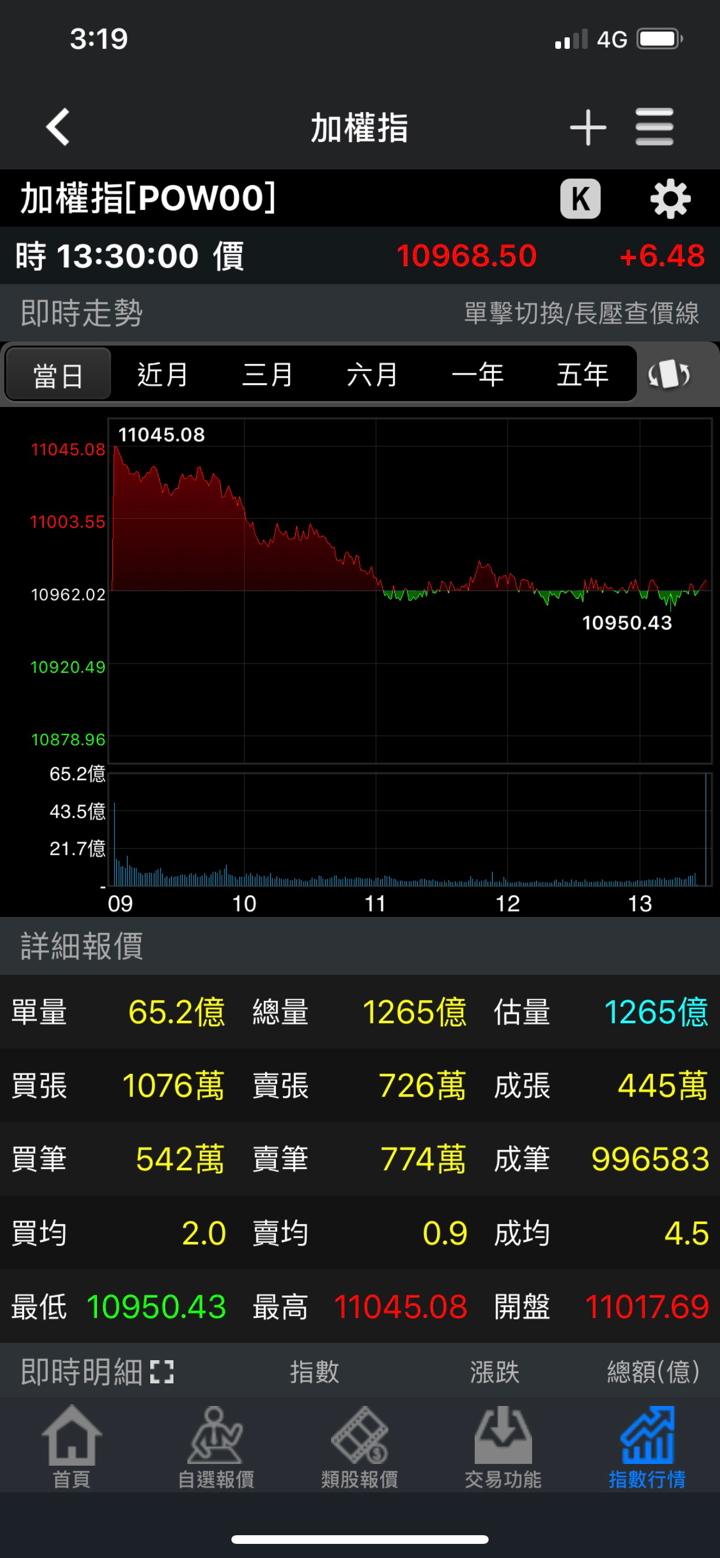

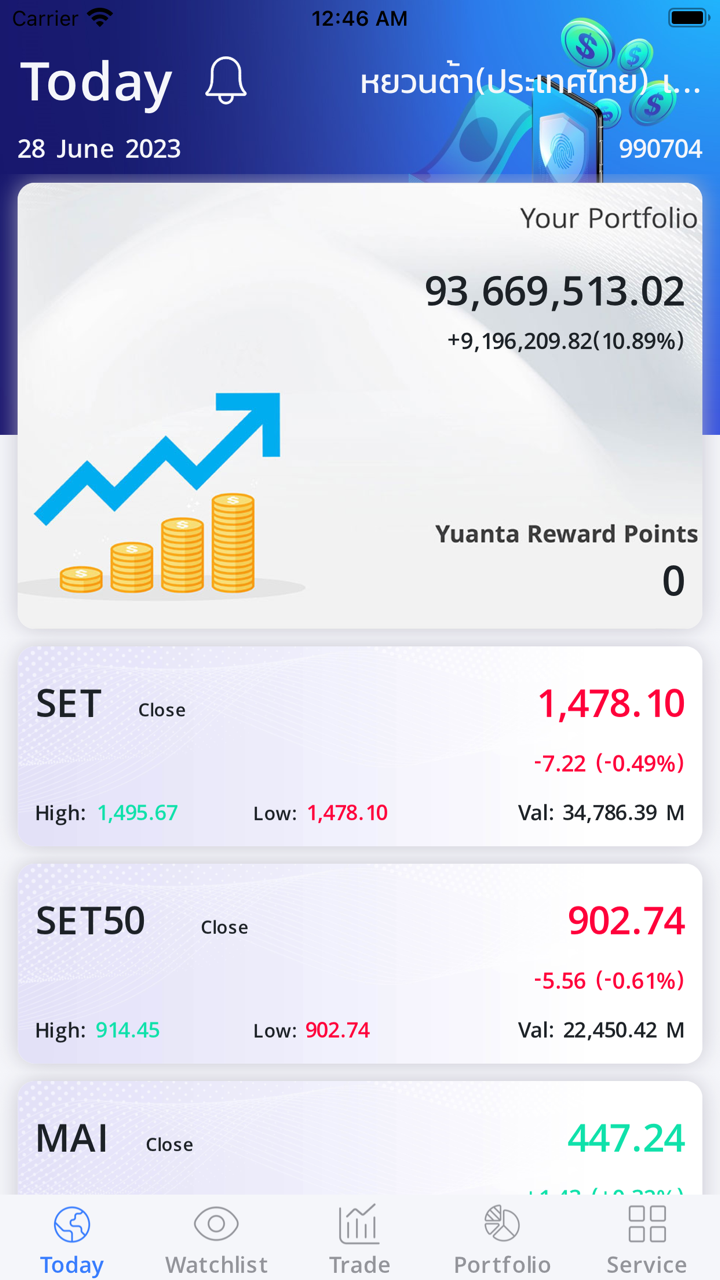

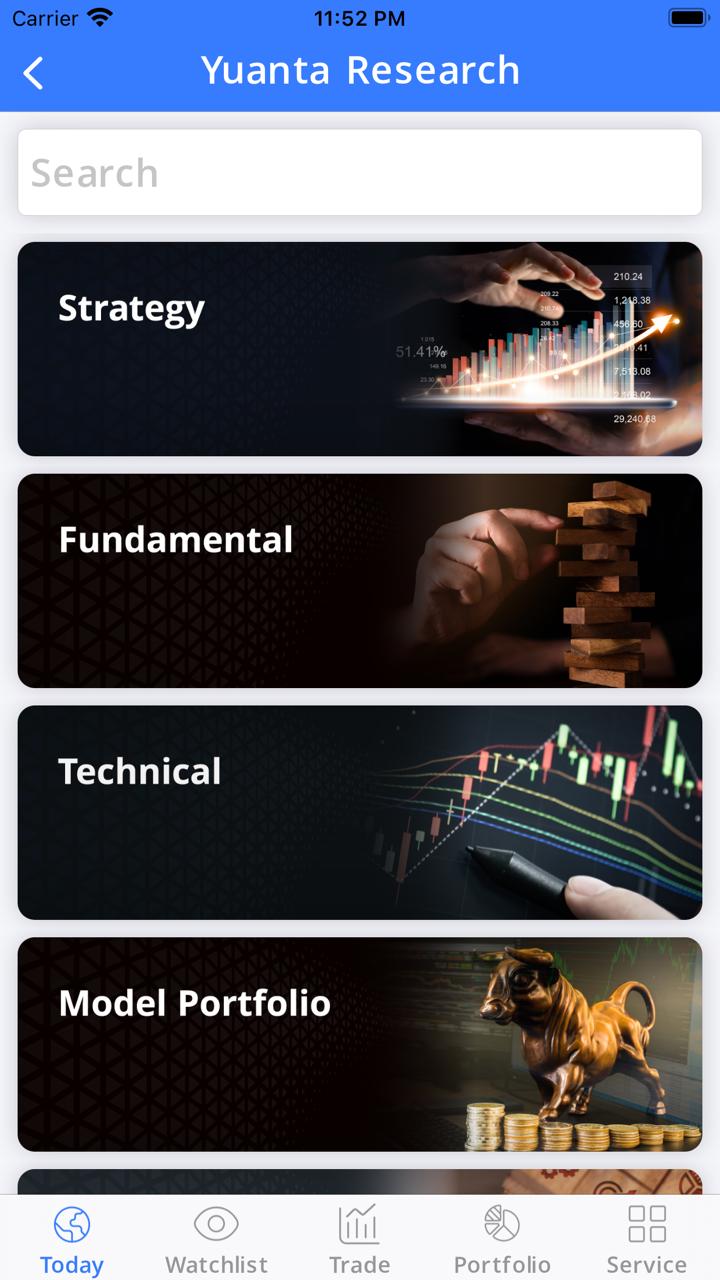

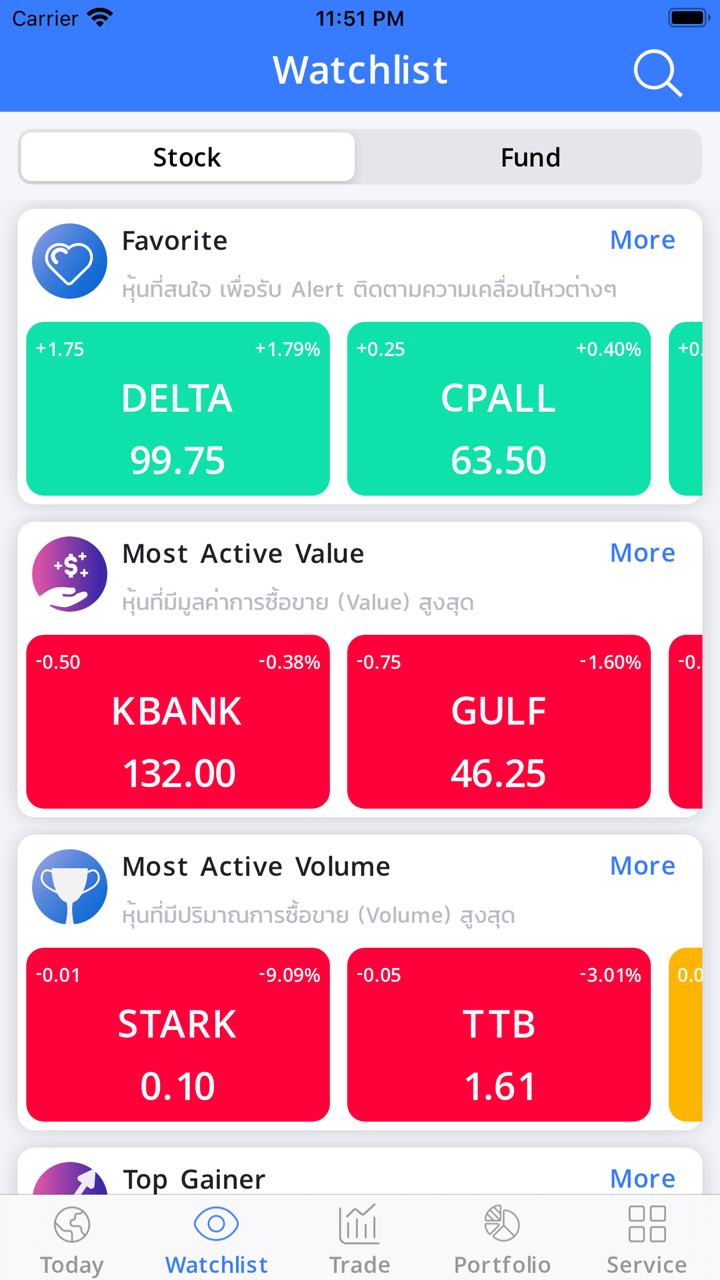

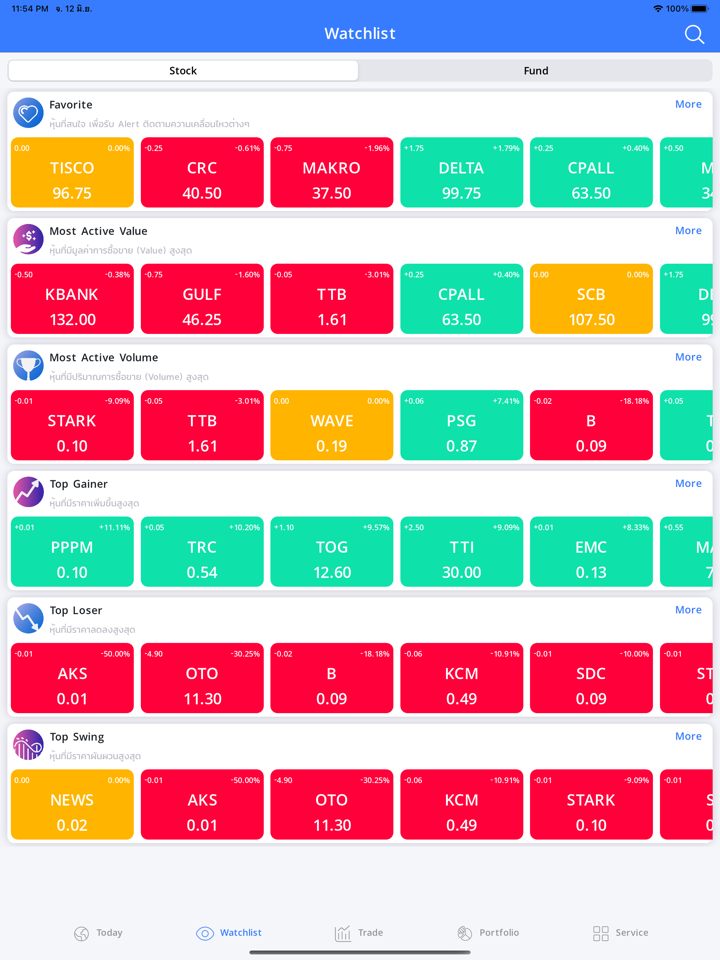

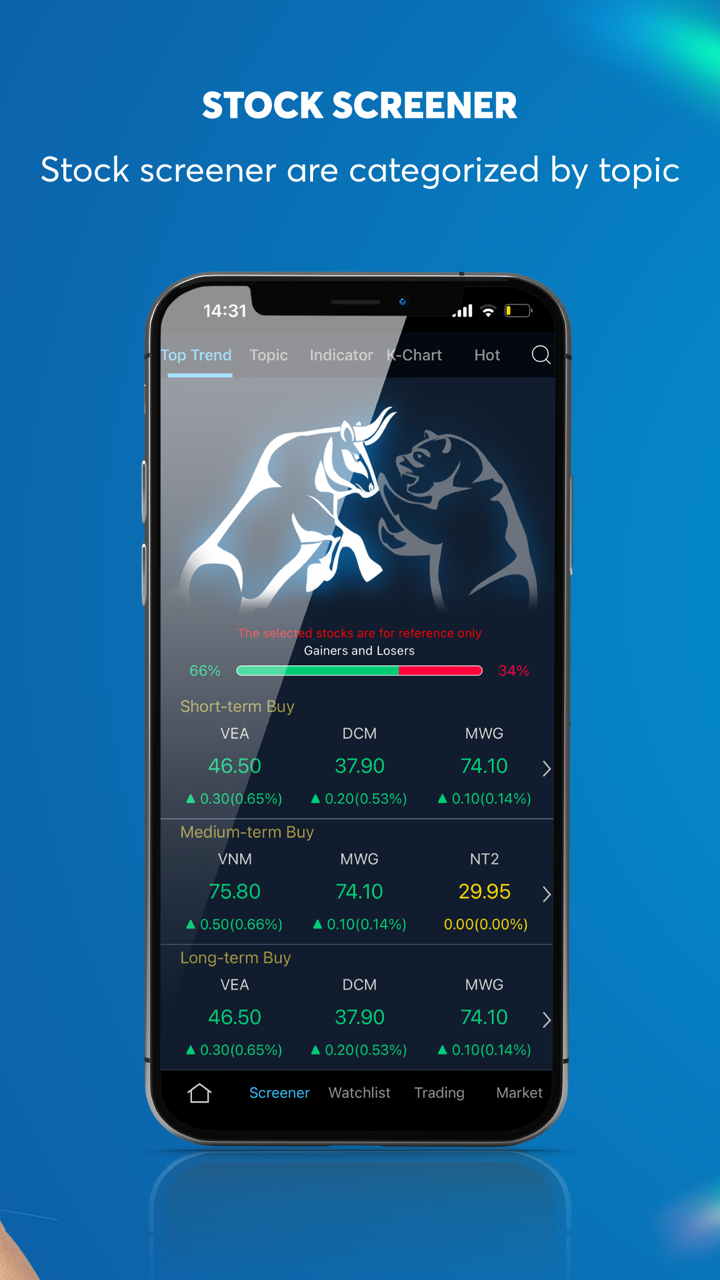

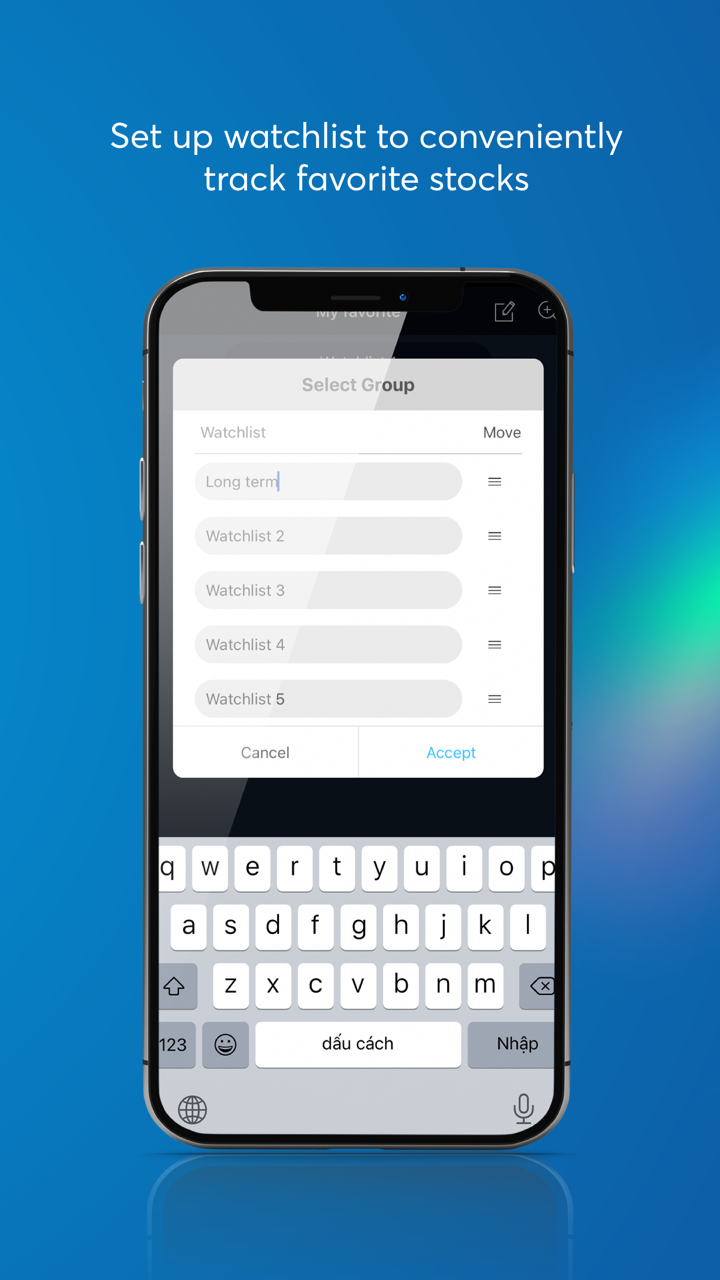

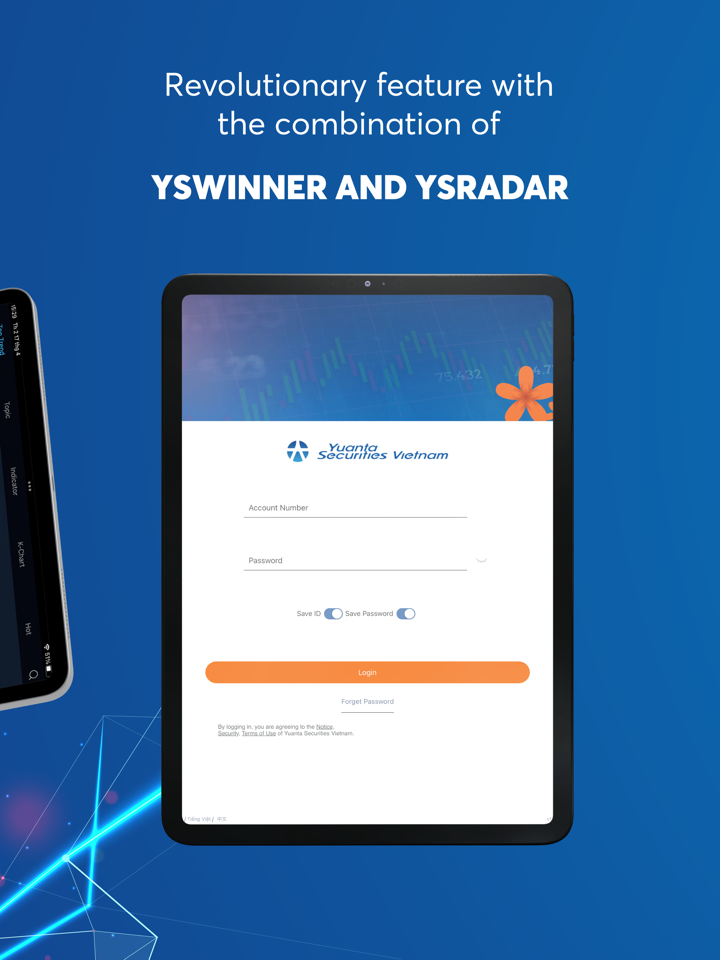

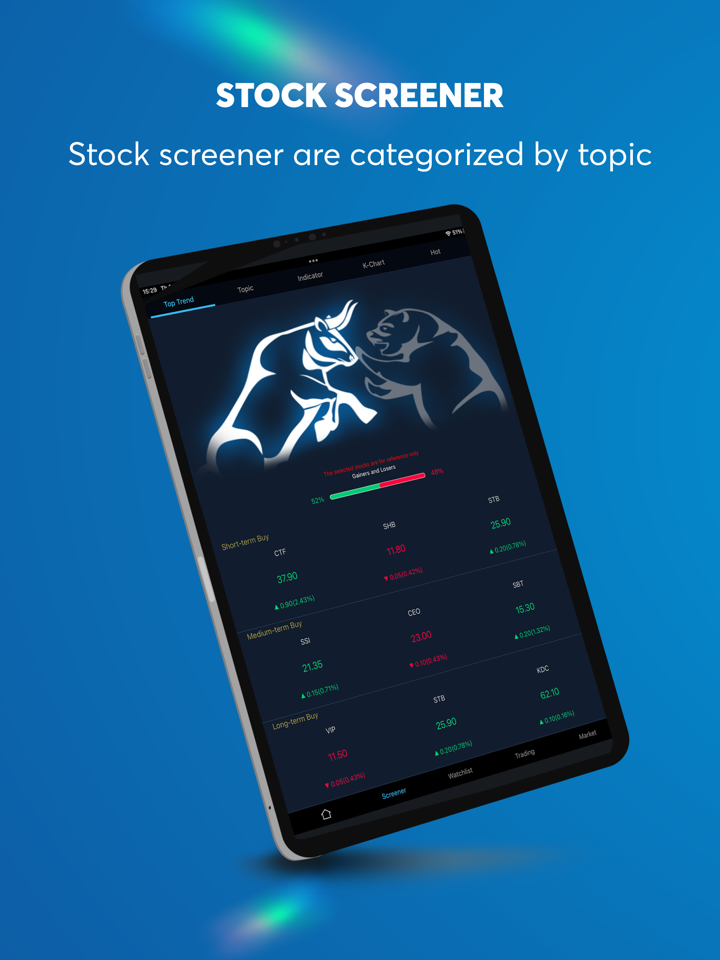

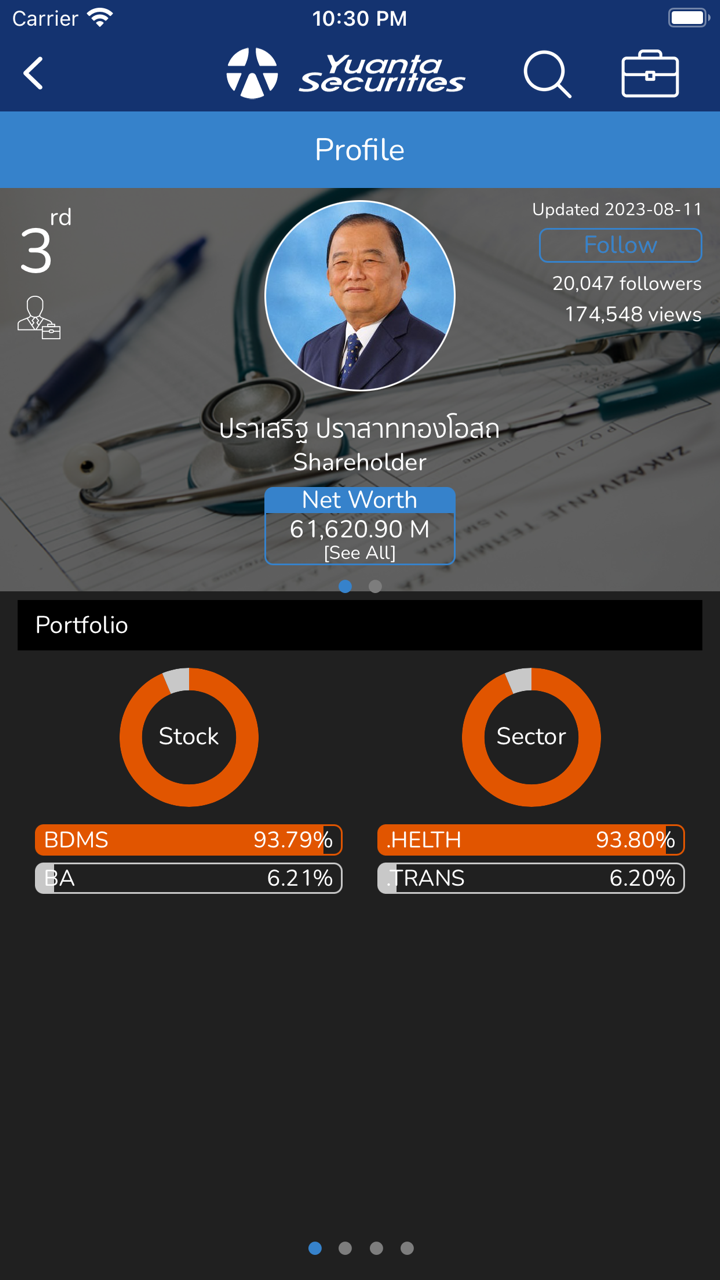

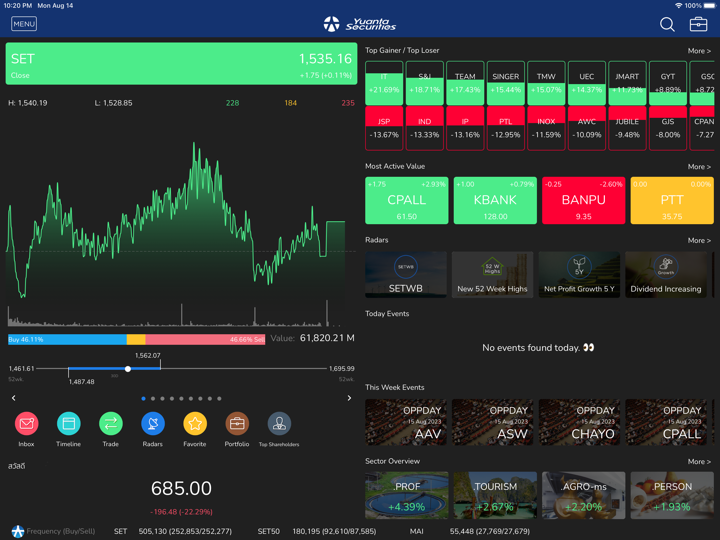

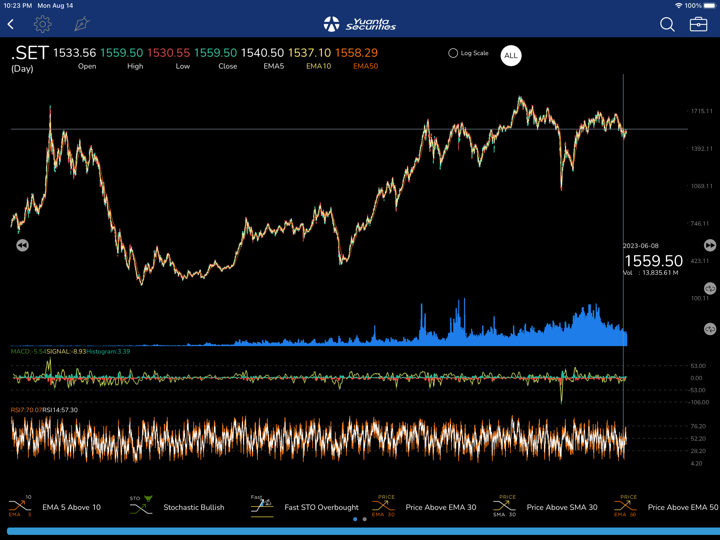

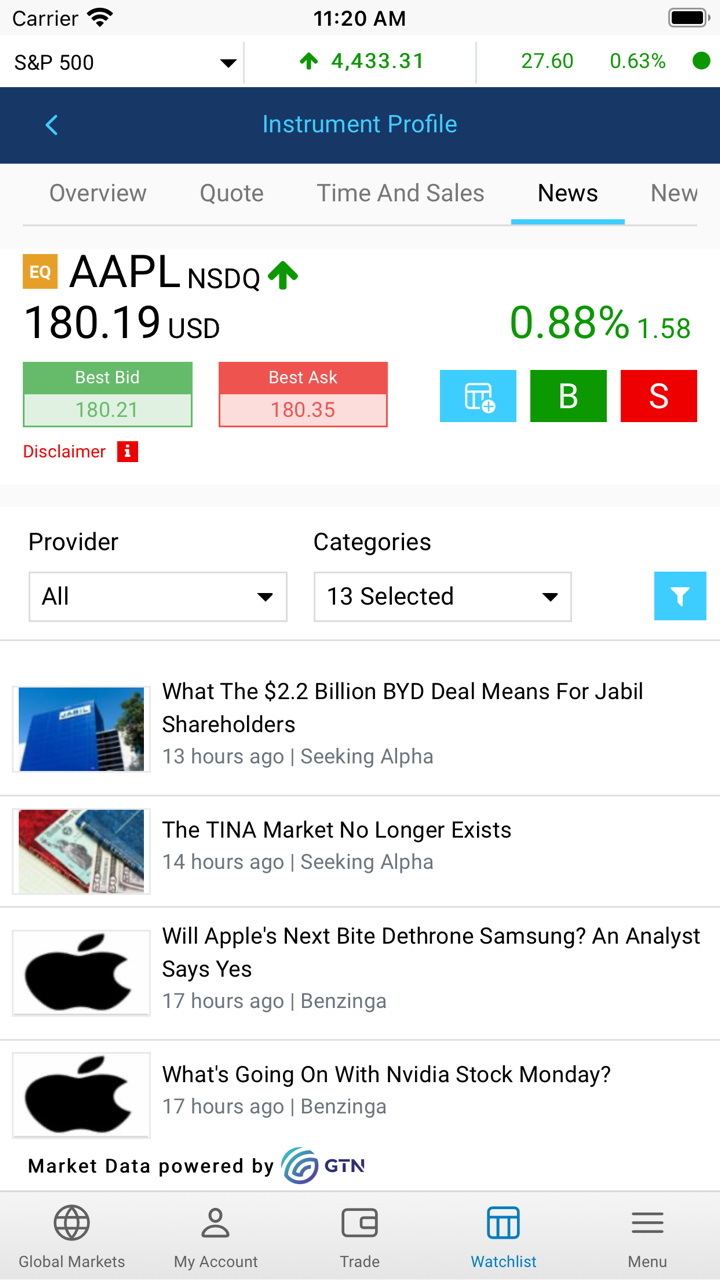

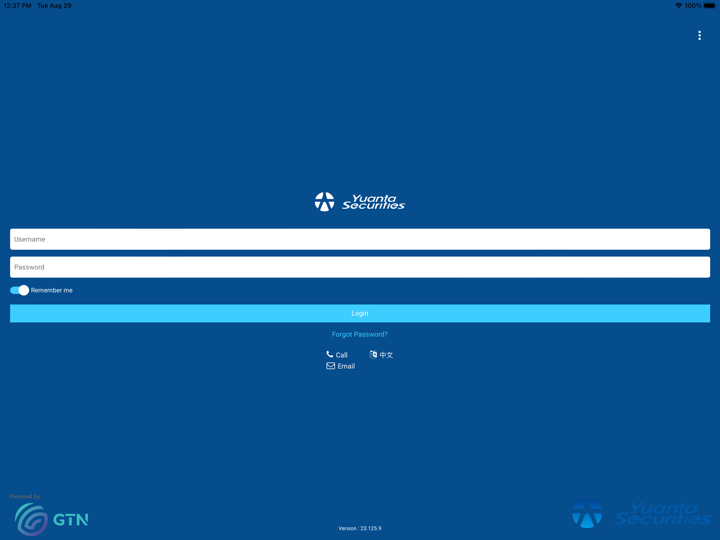

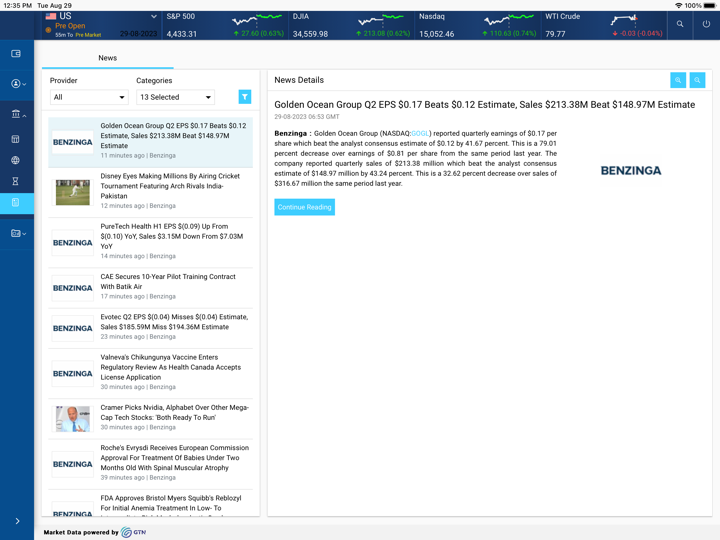

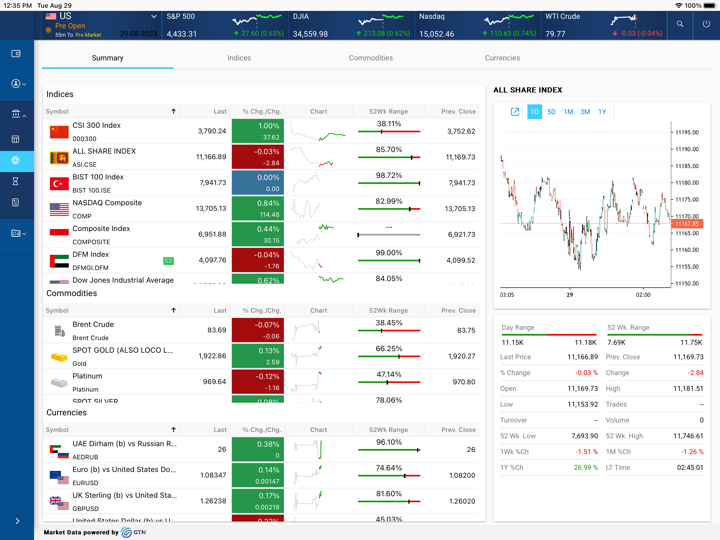

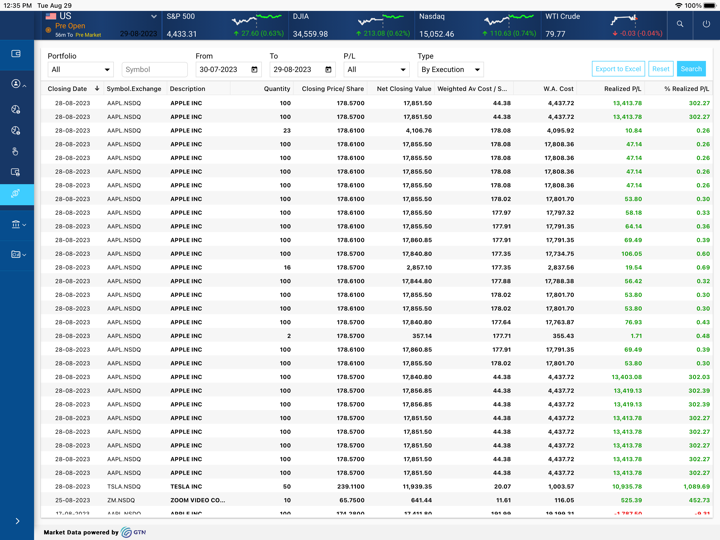

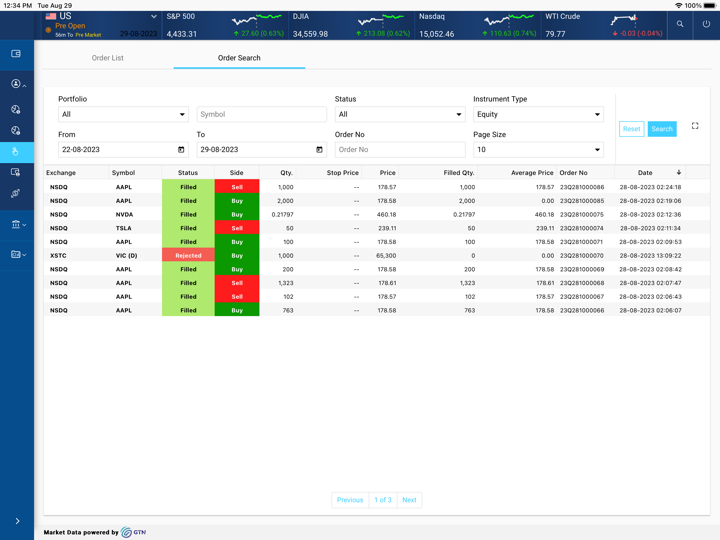

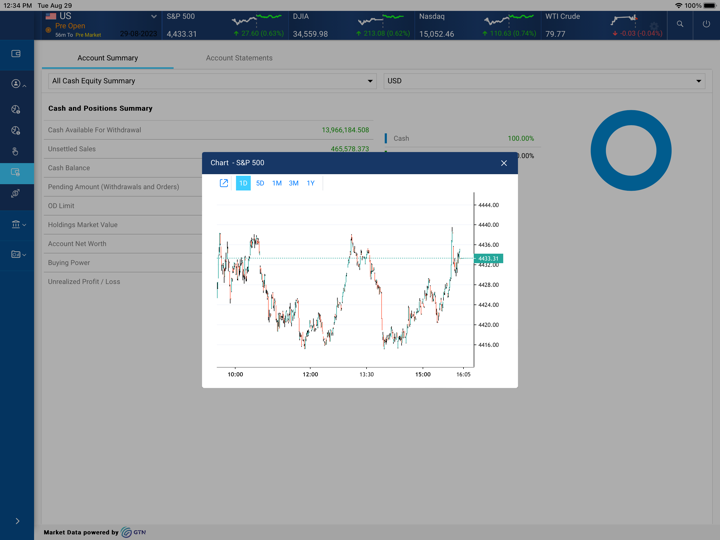

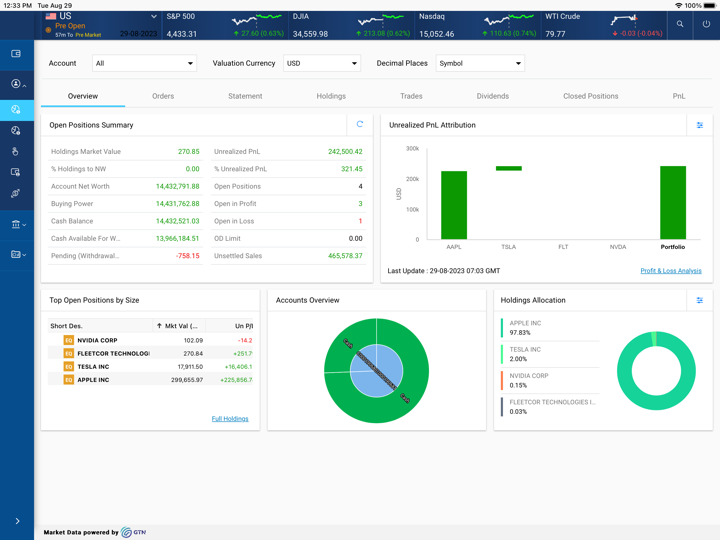

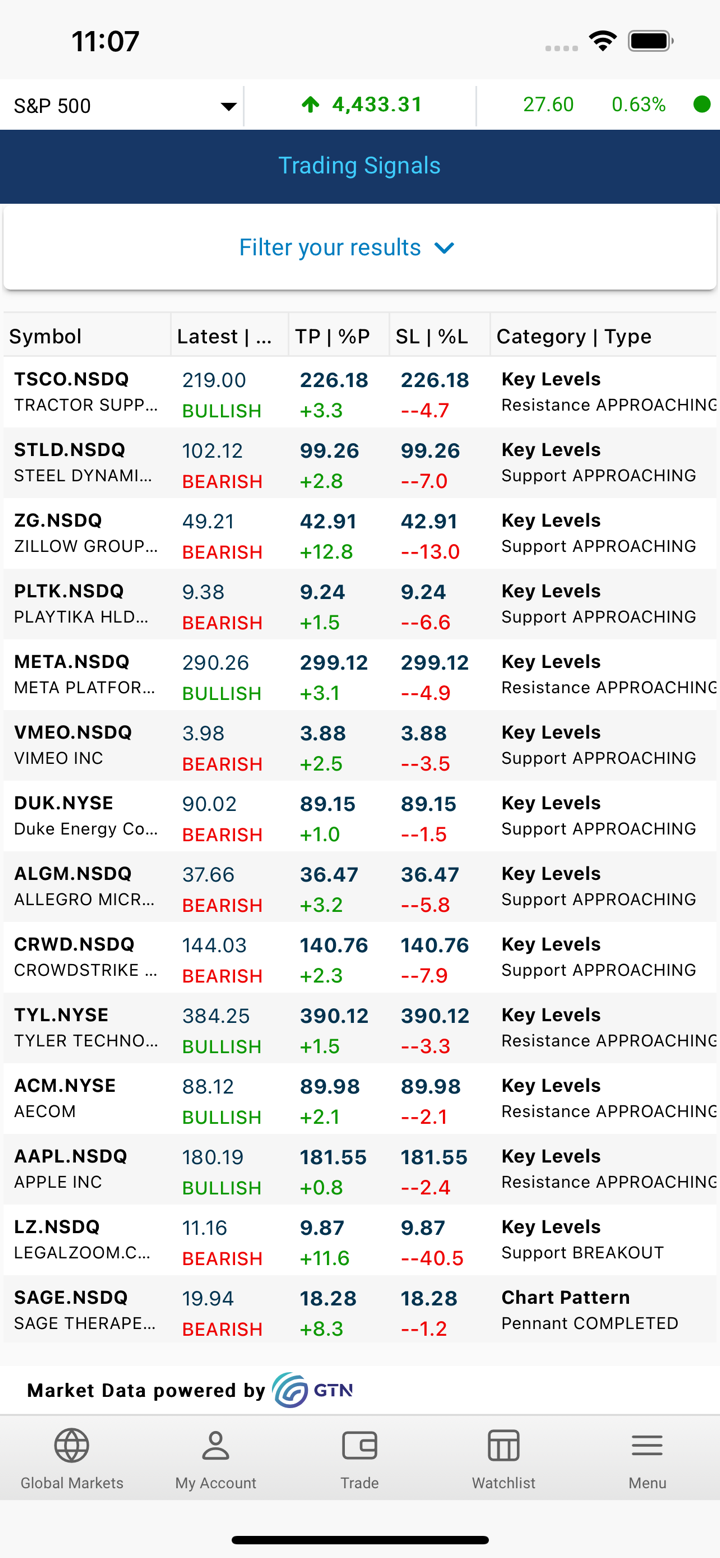

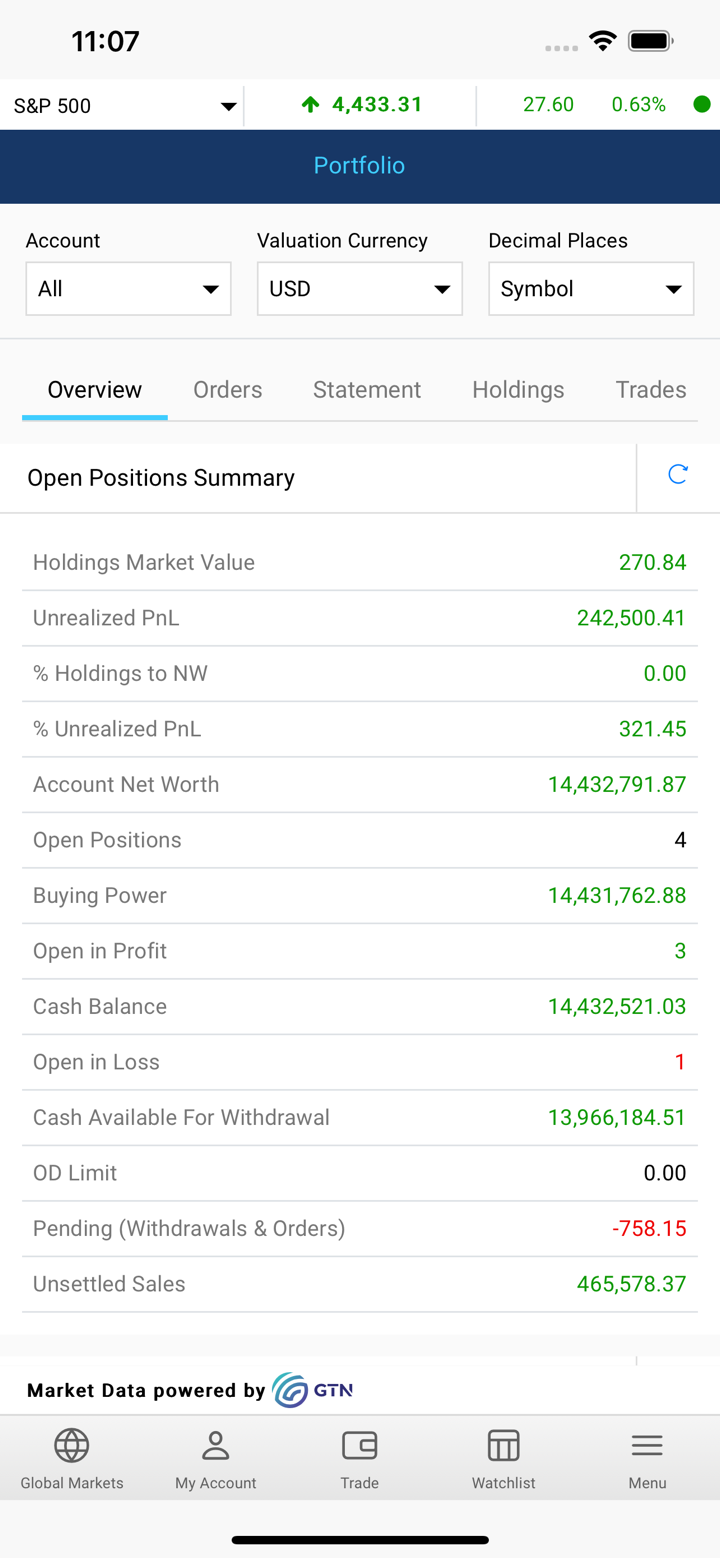

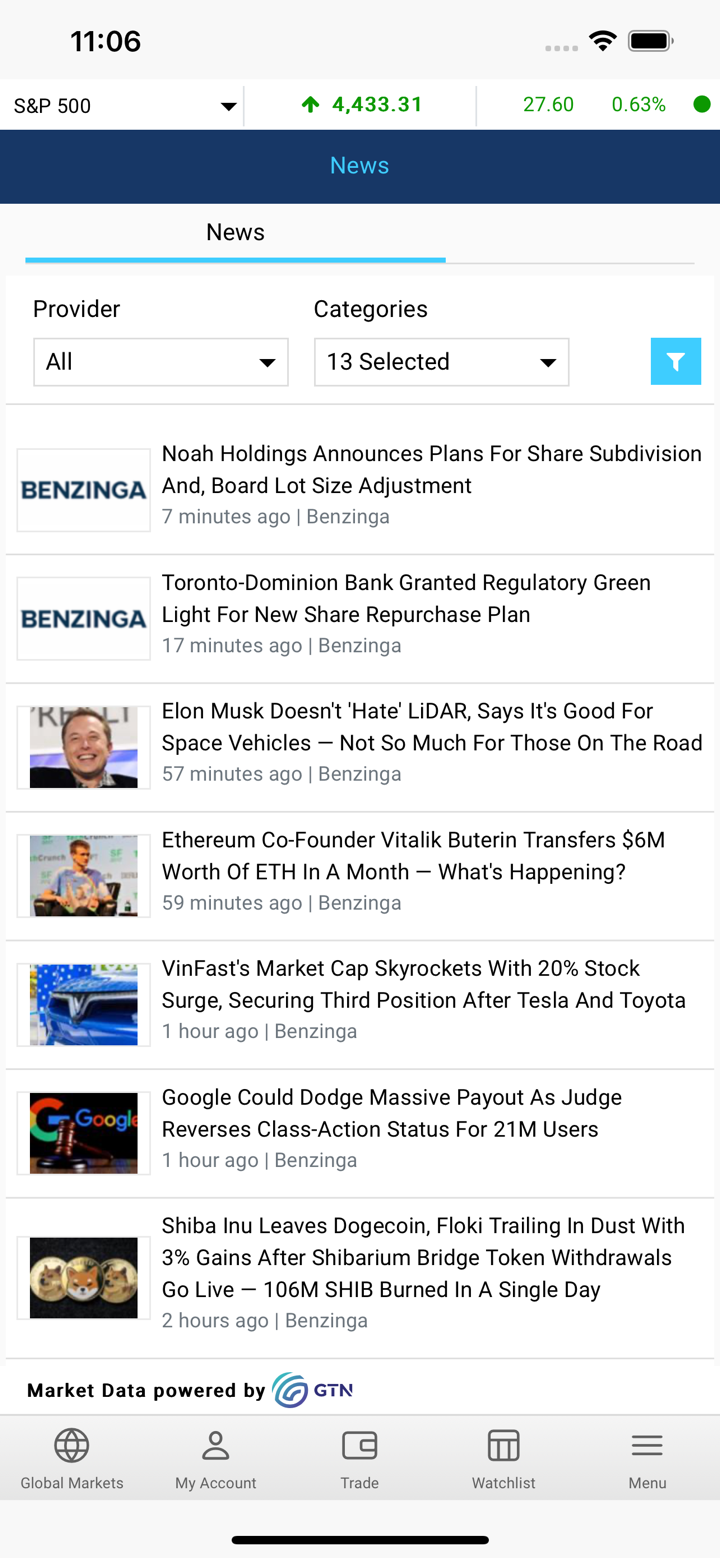

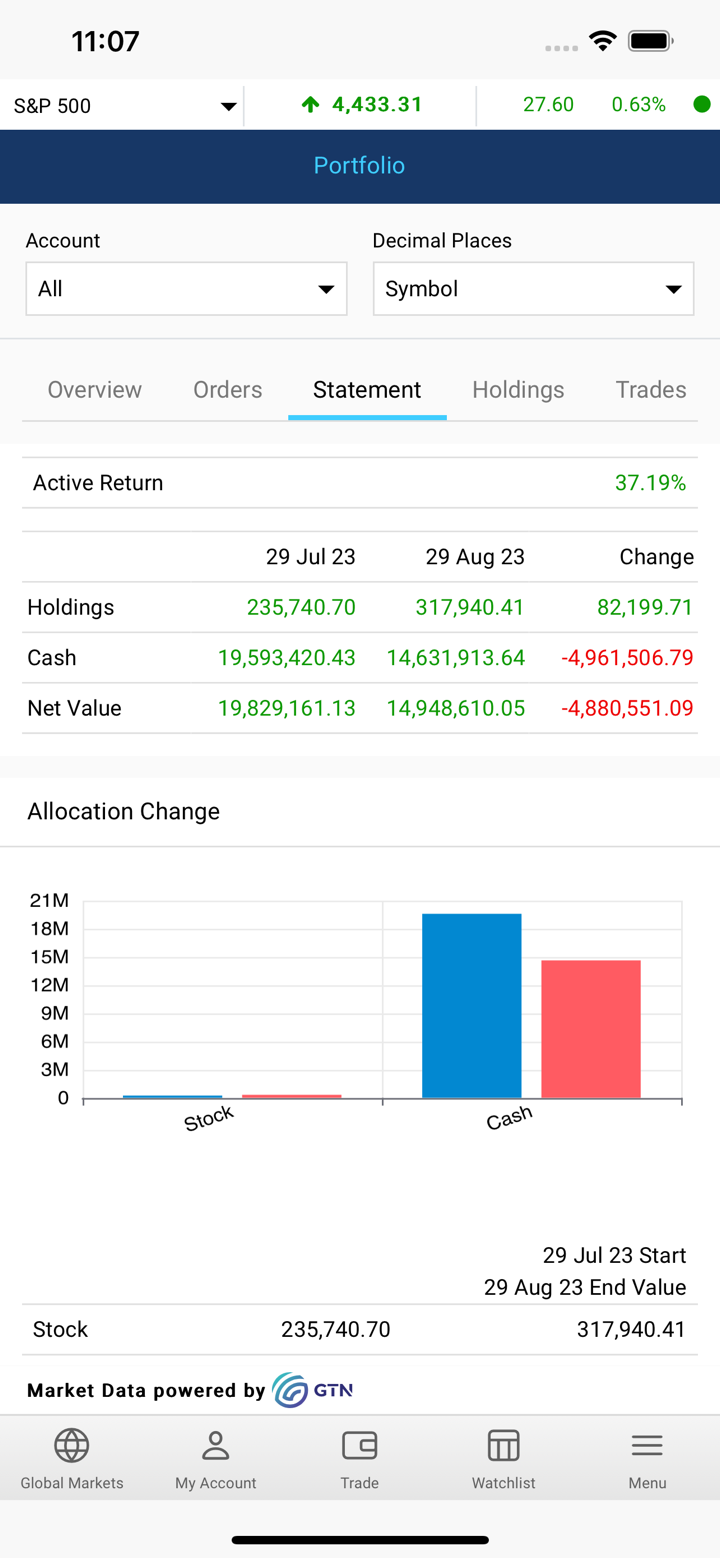

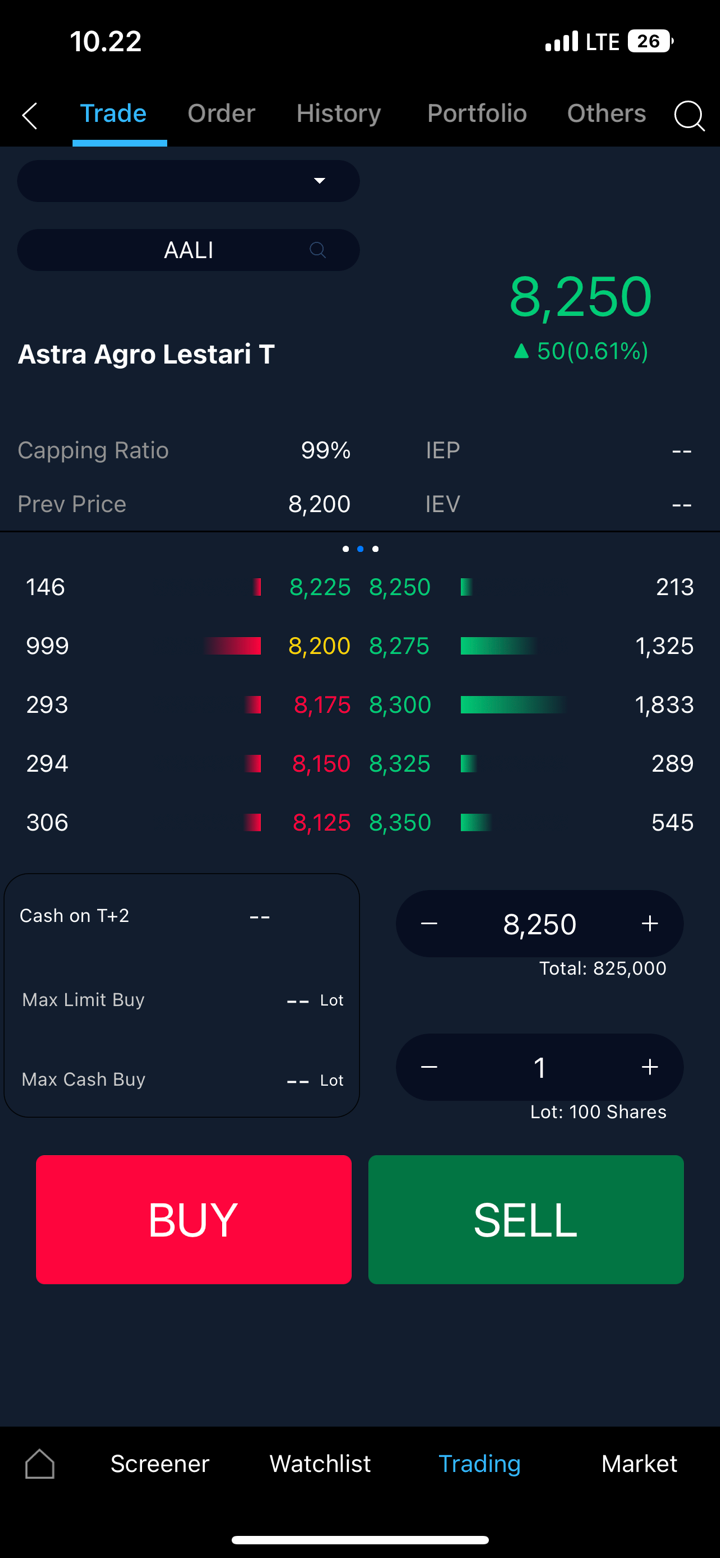

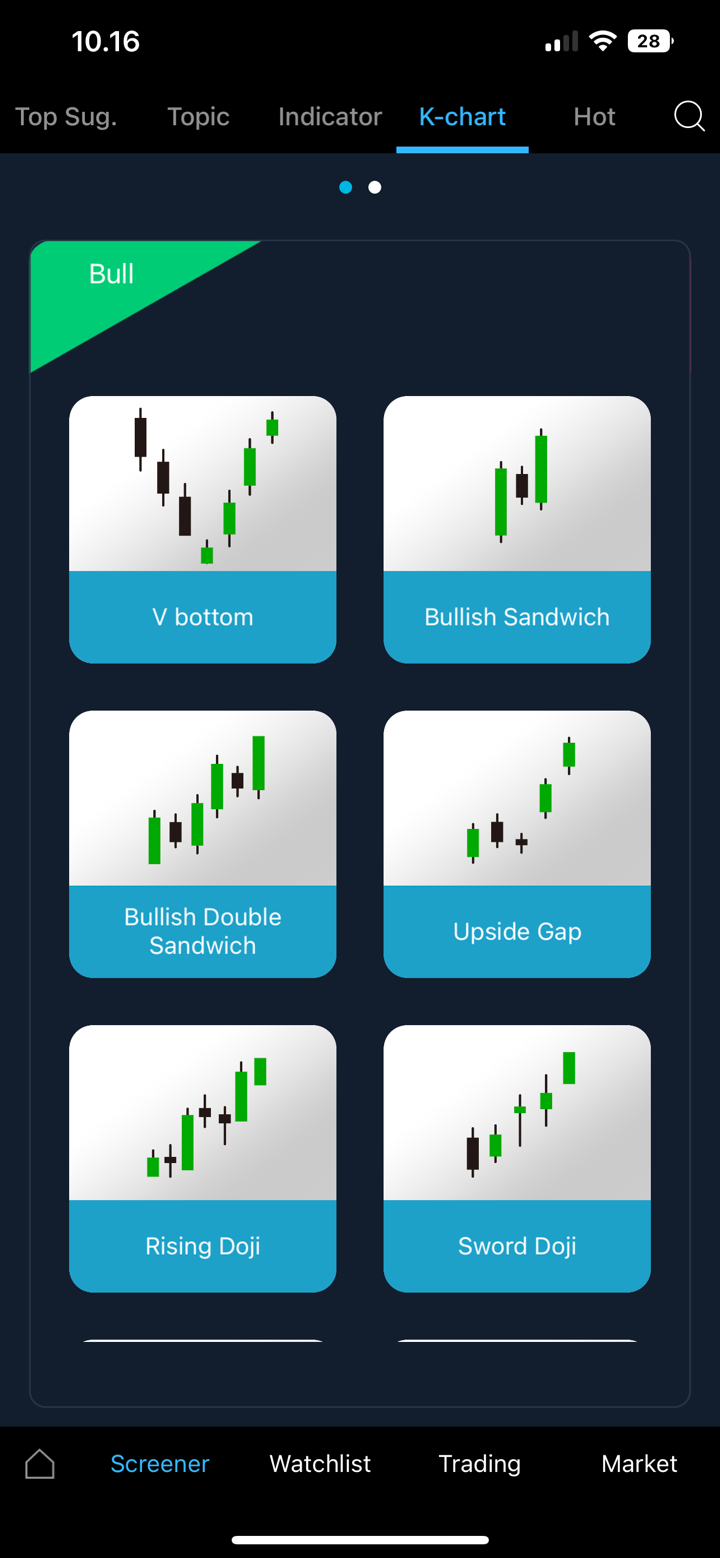

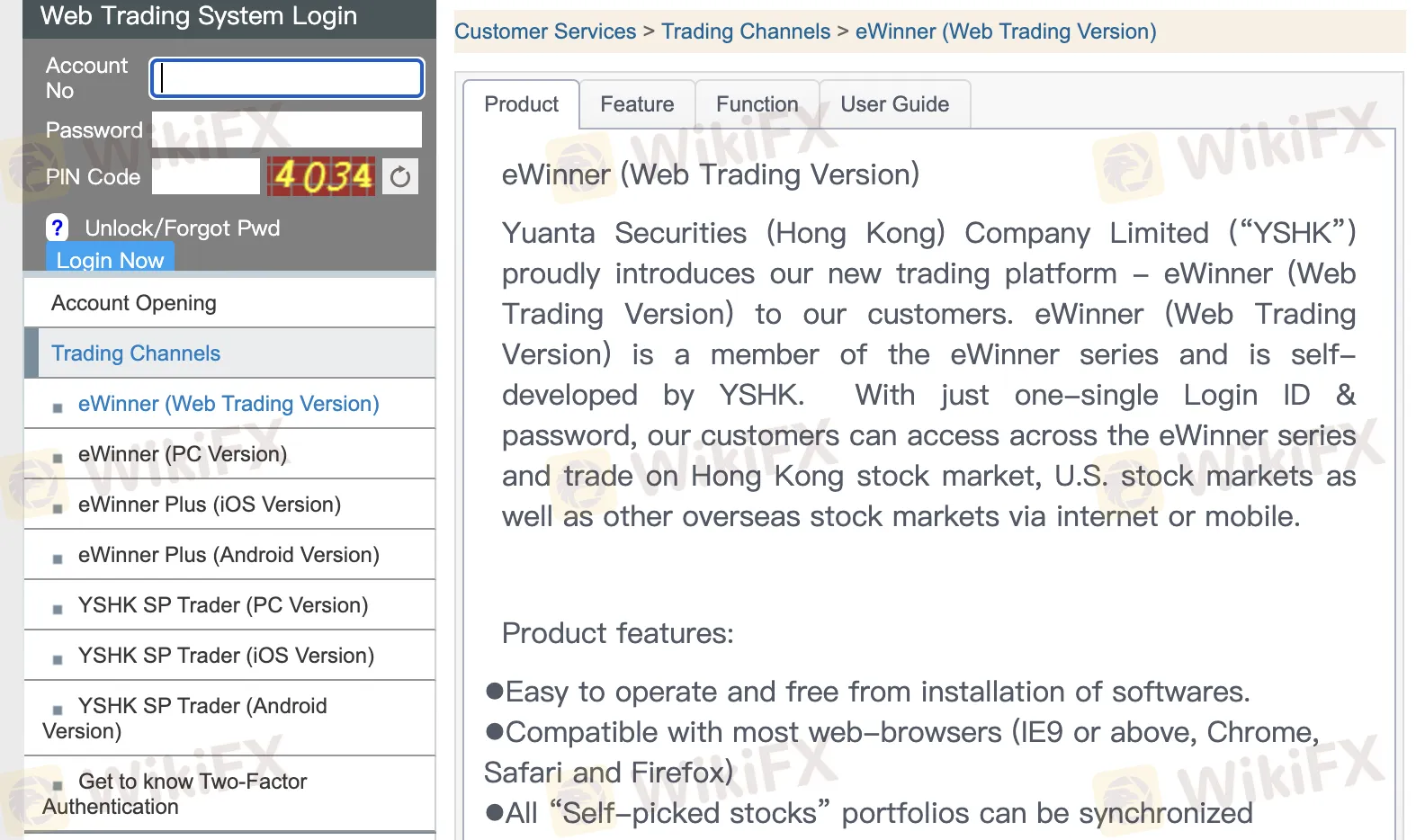

Trading Platform

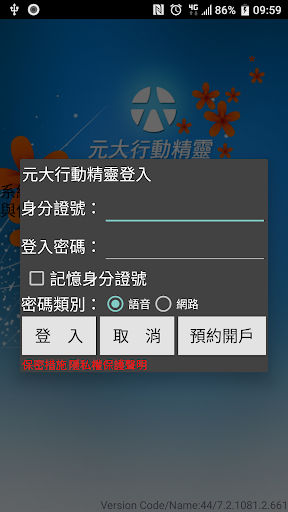

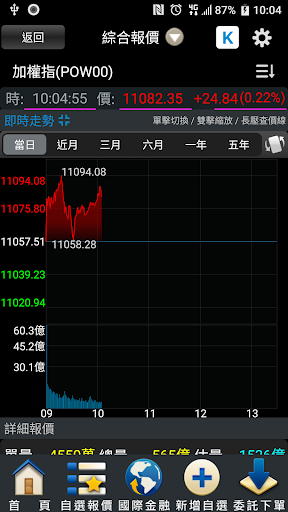

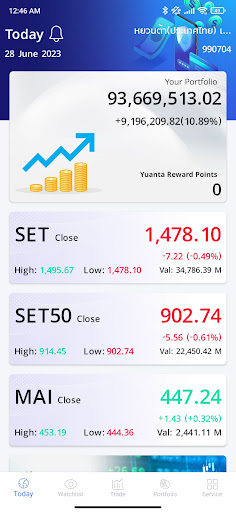

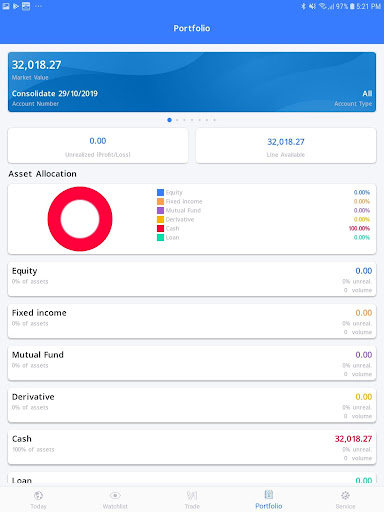

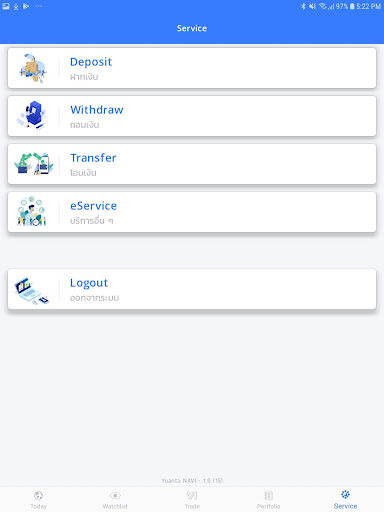

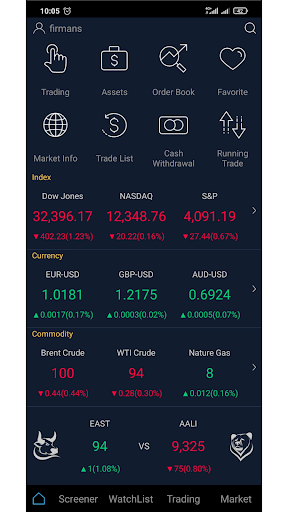

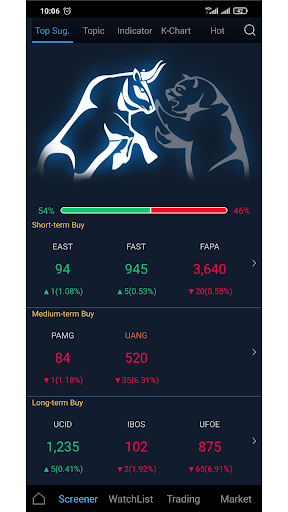

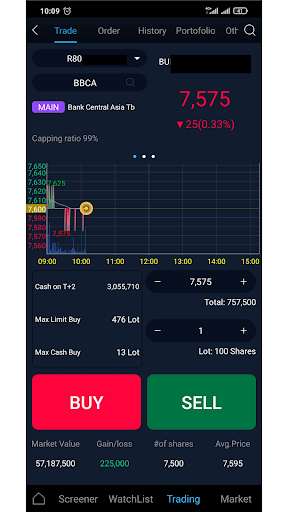

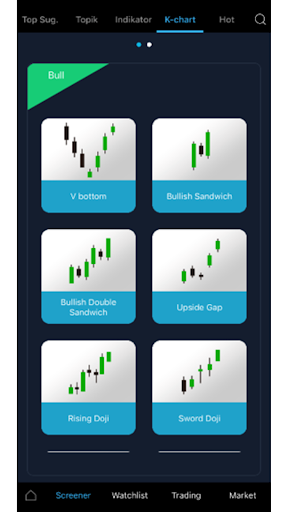

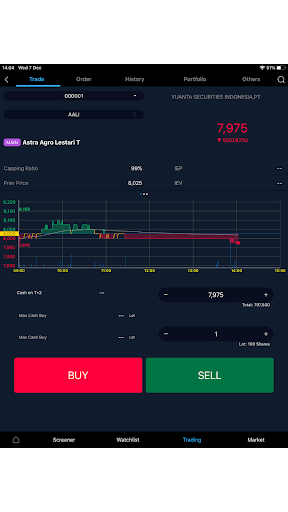

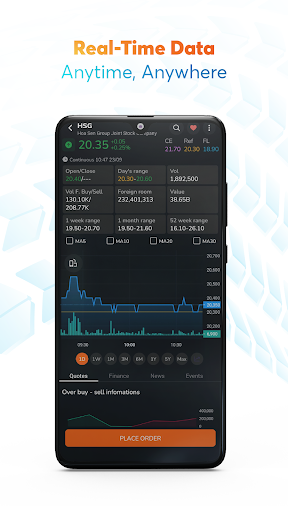

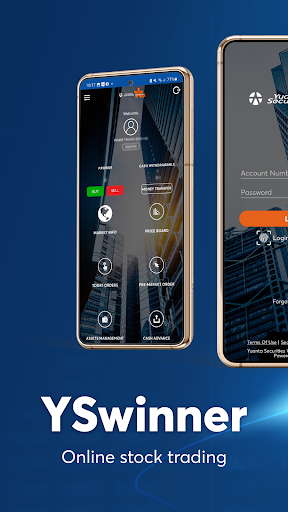

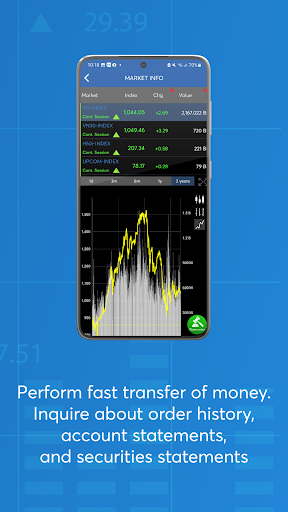

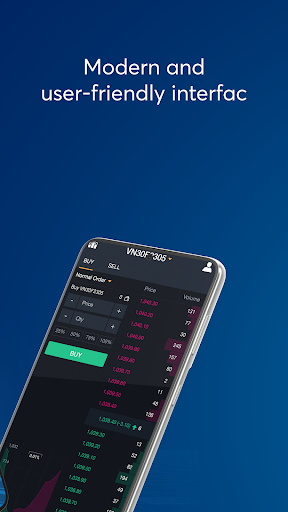

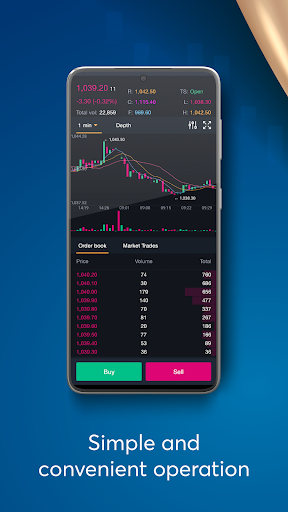

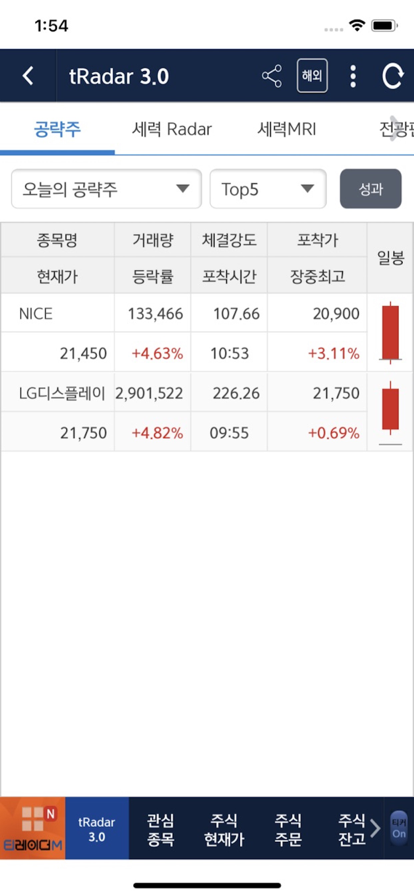

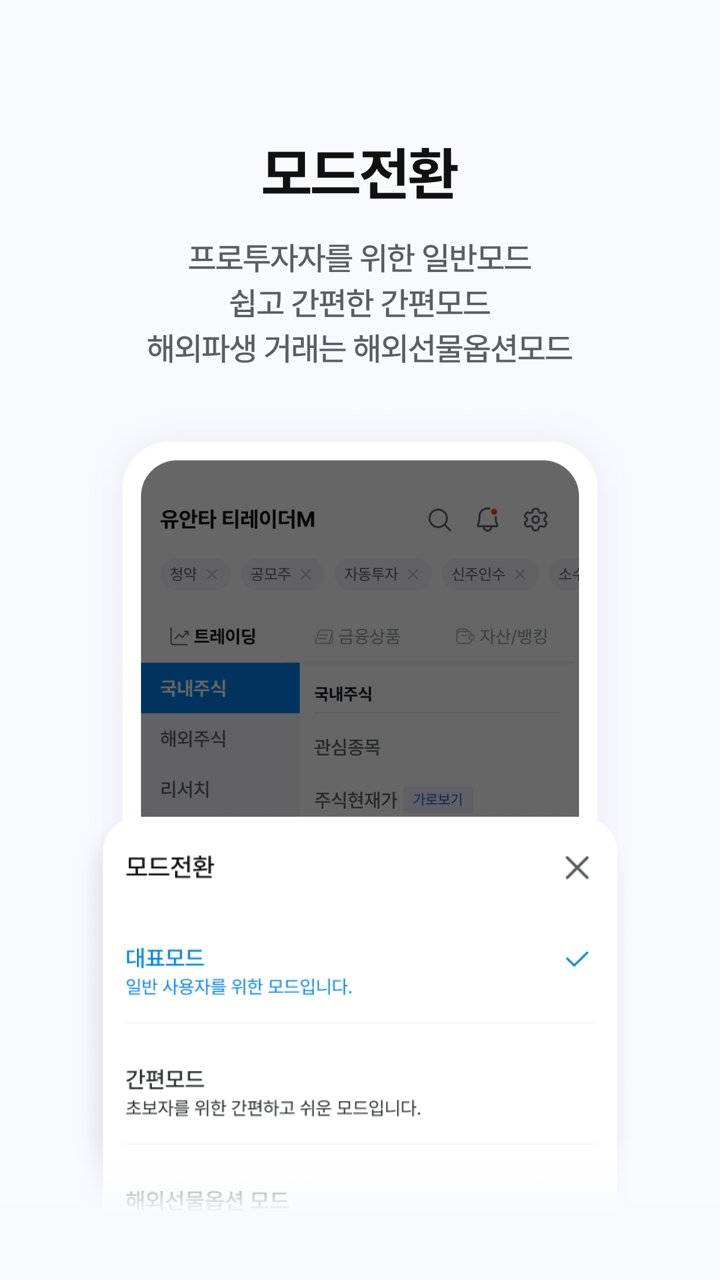

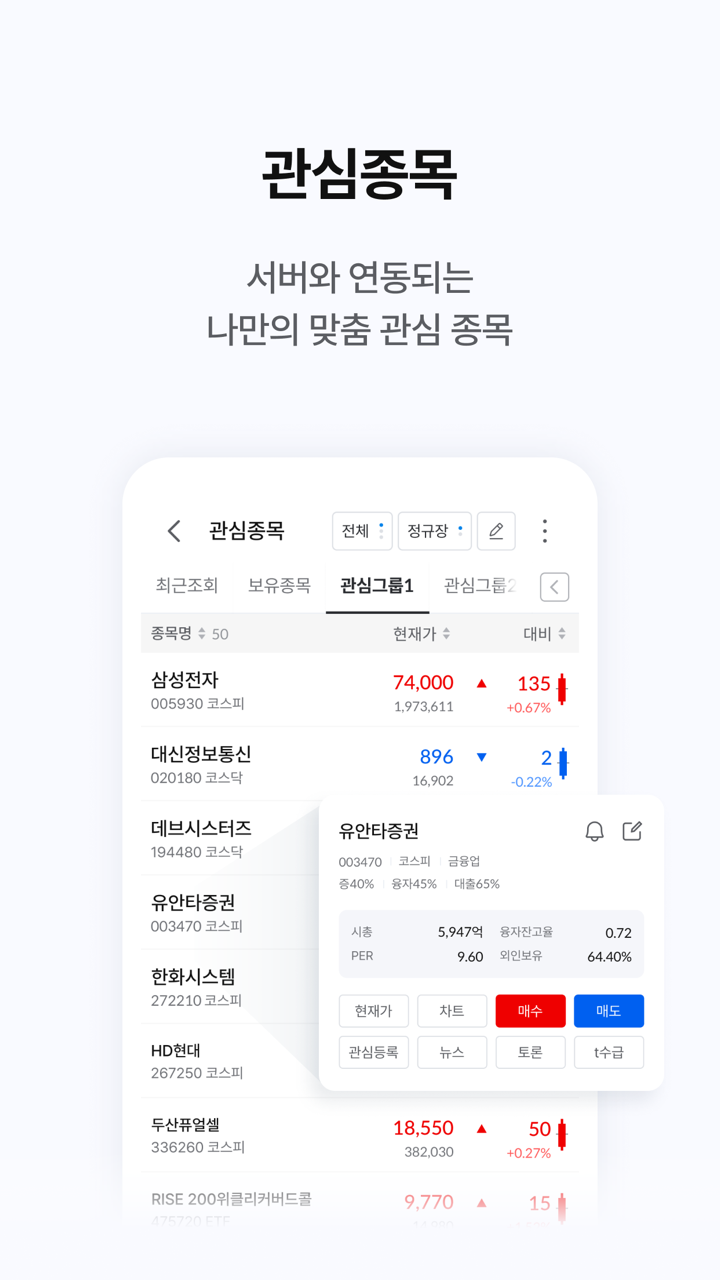

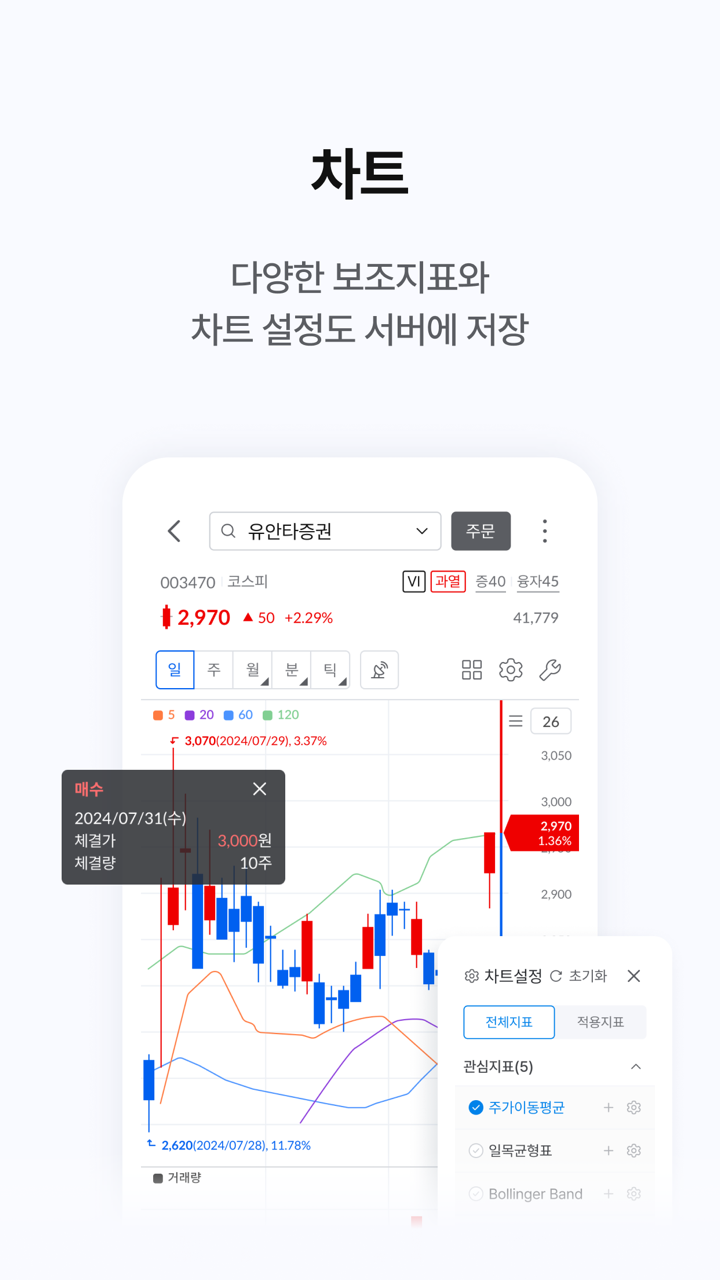

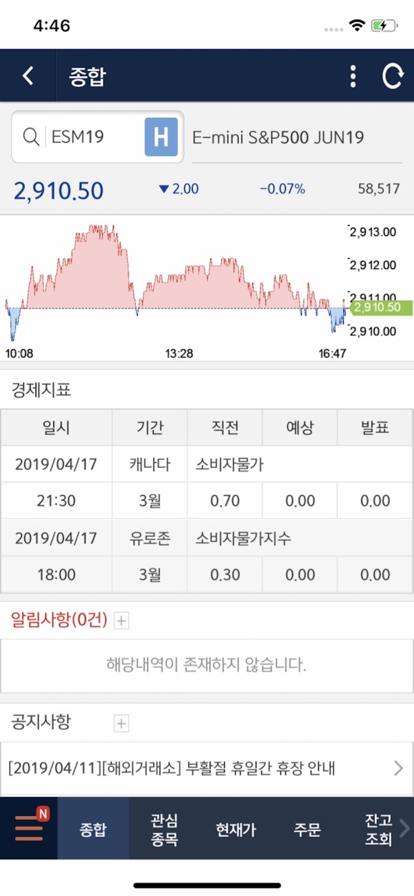

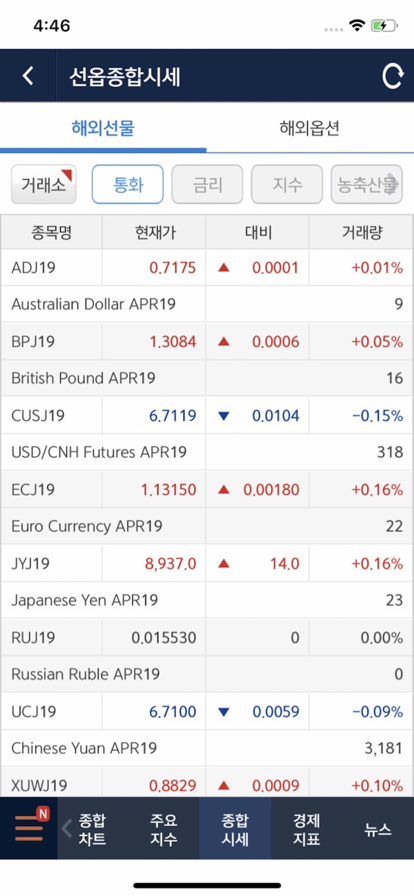

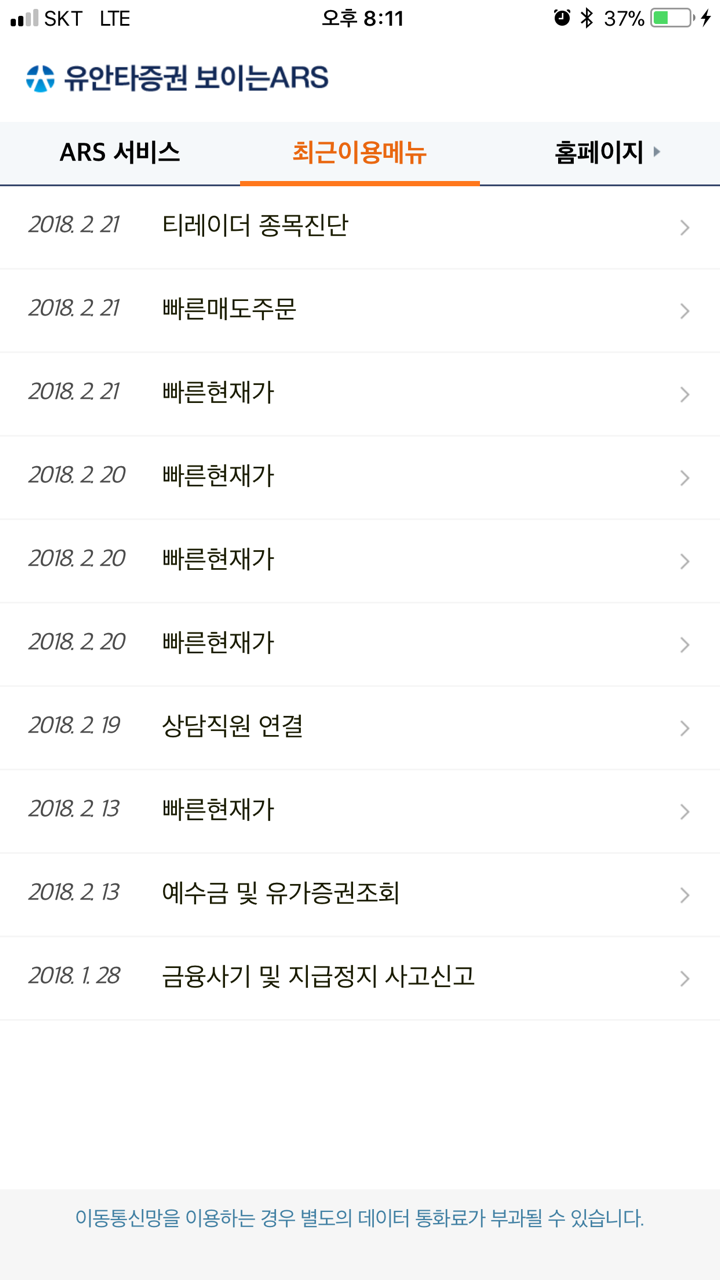

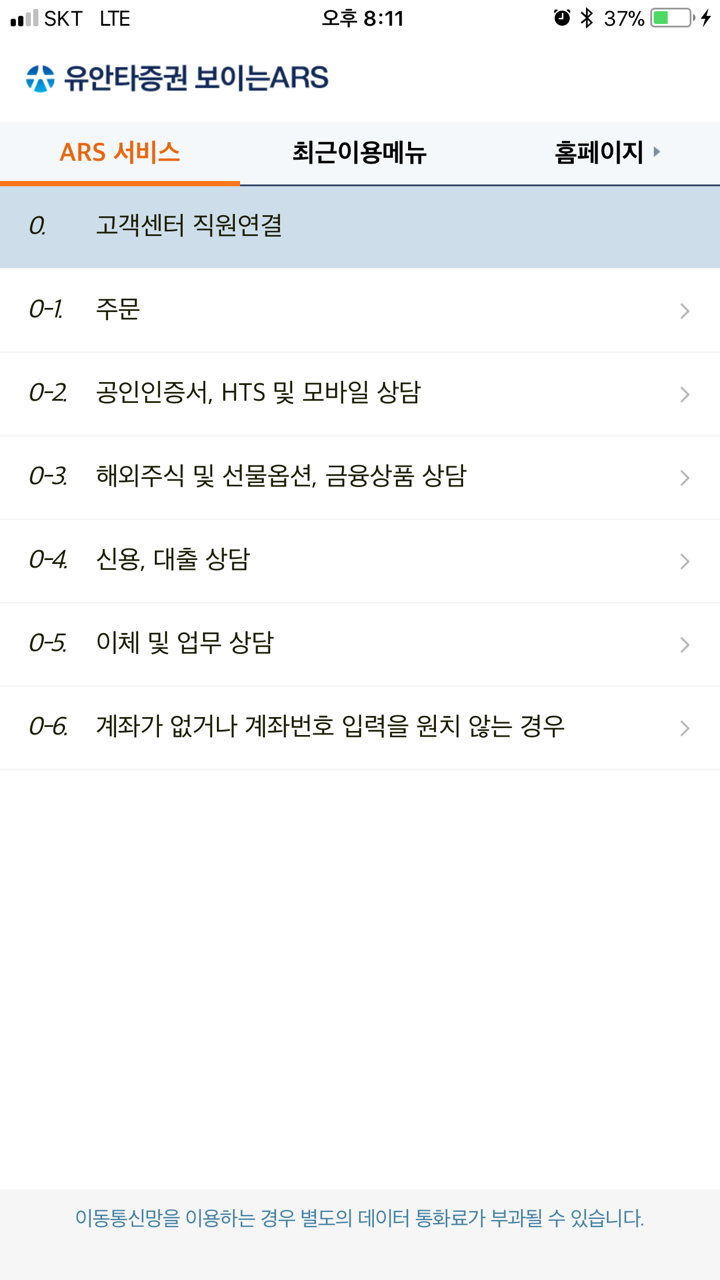

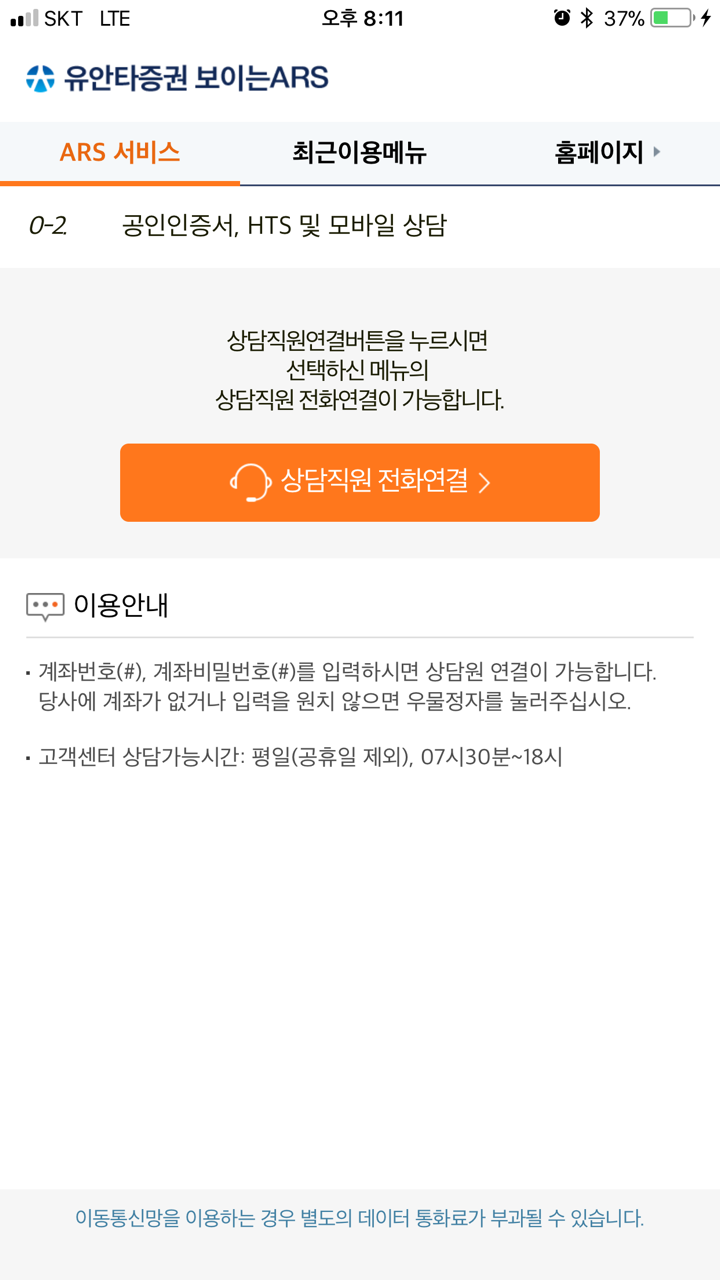

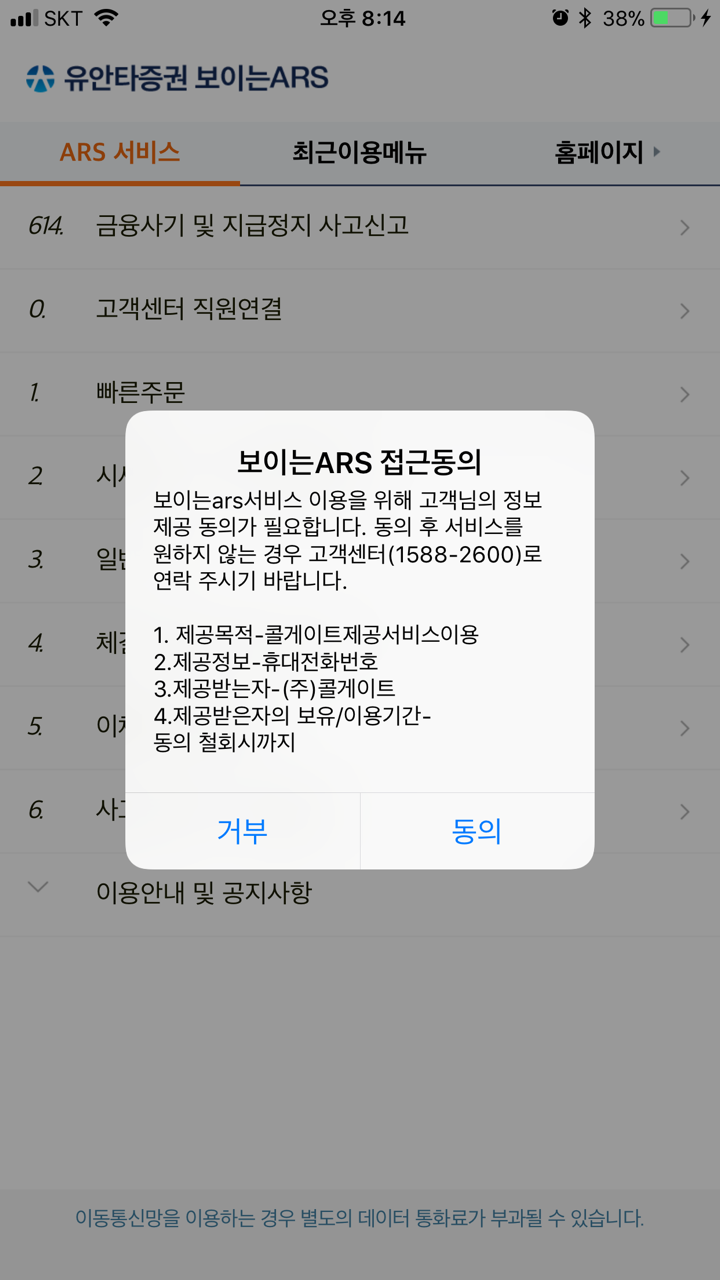

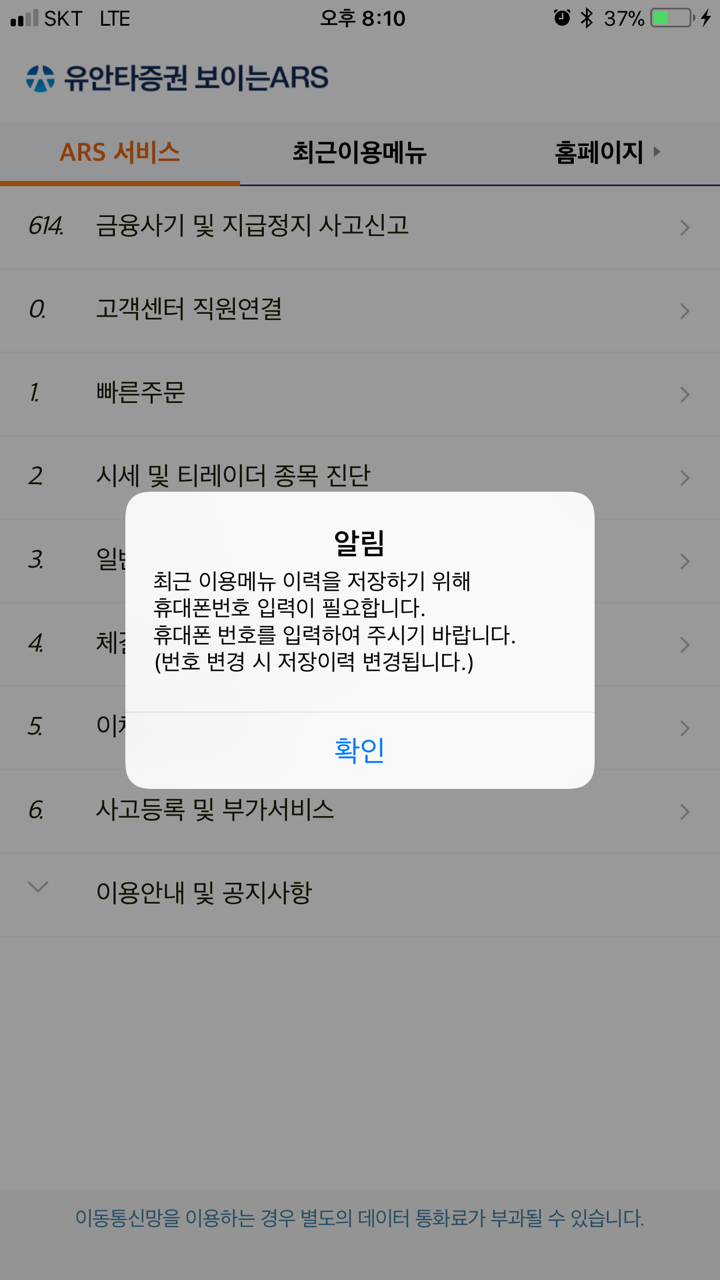

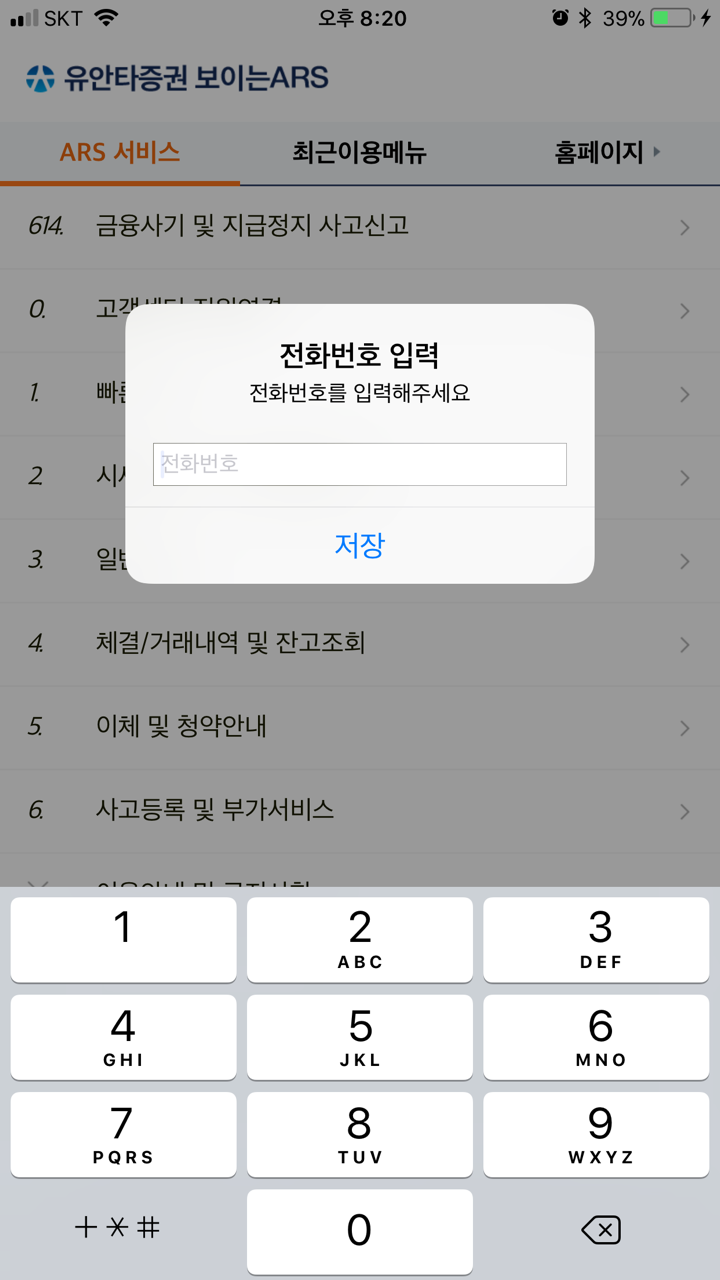

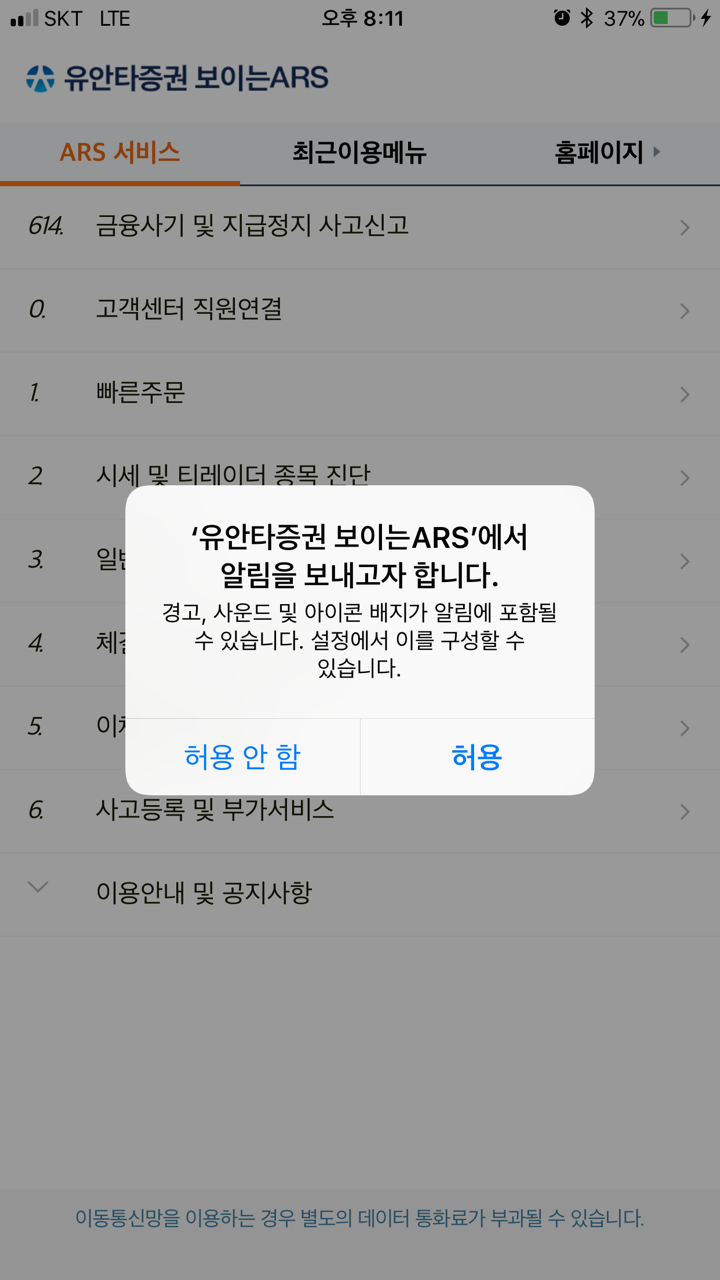

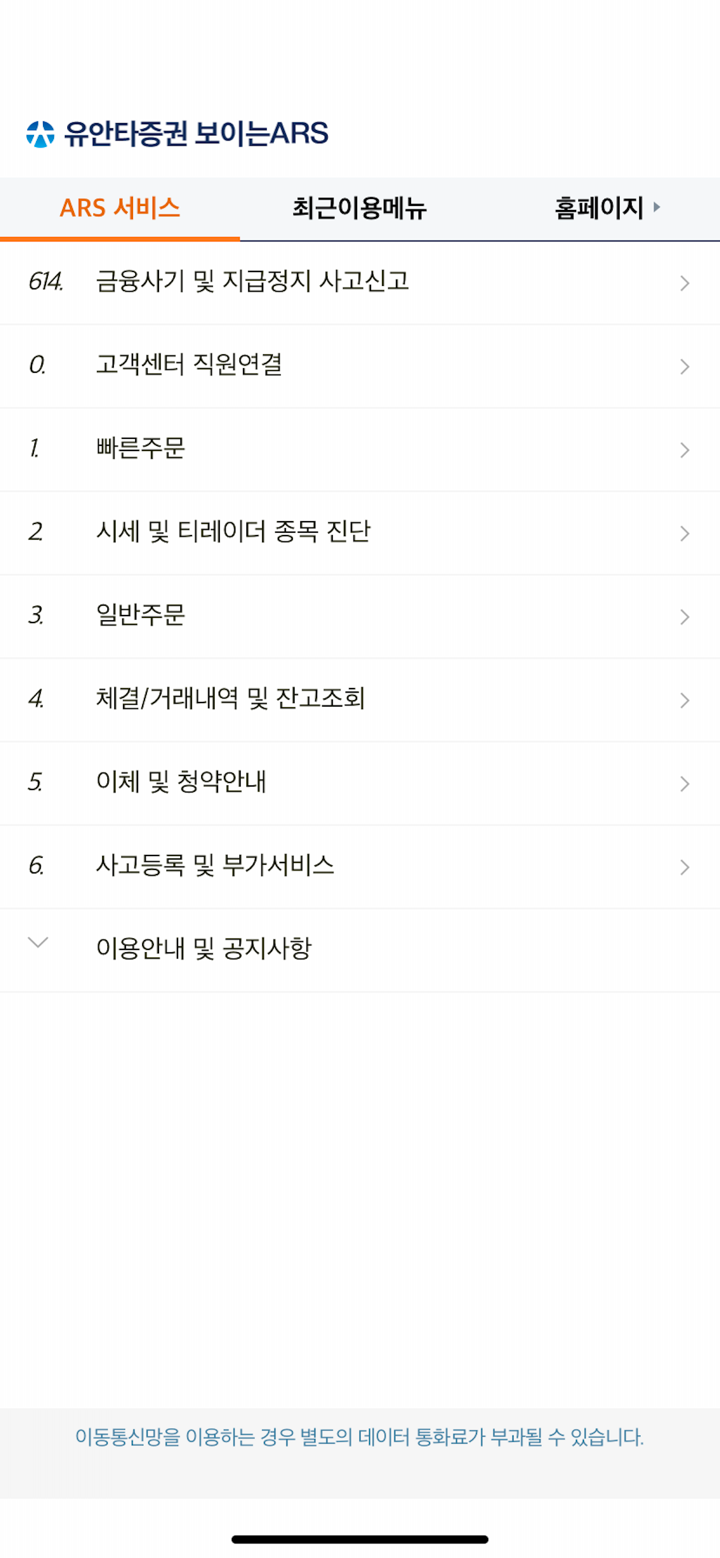

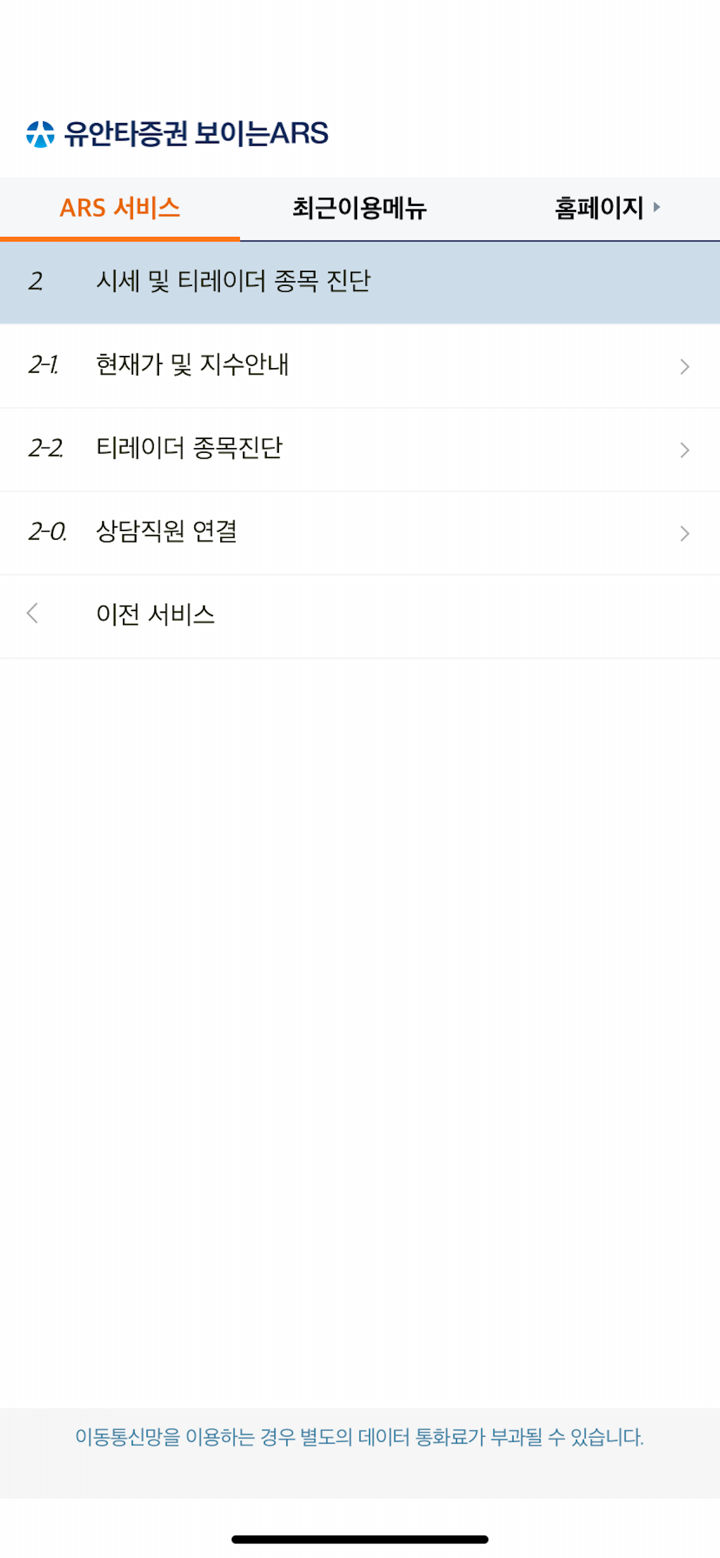

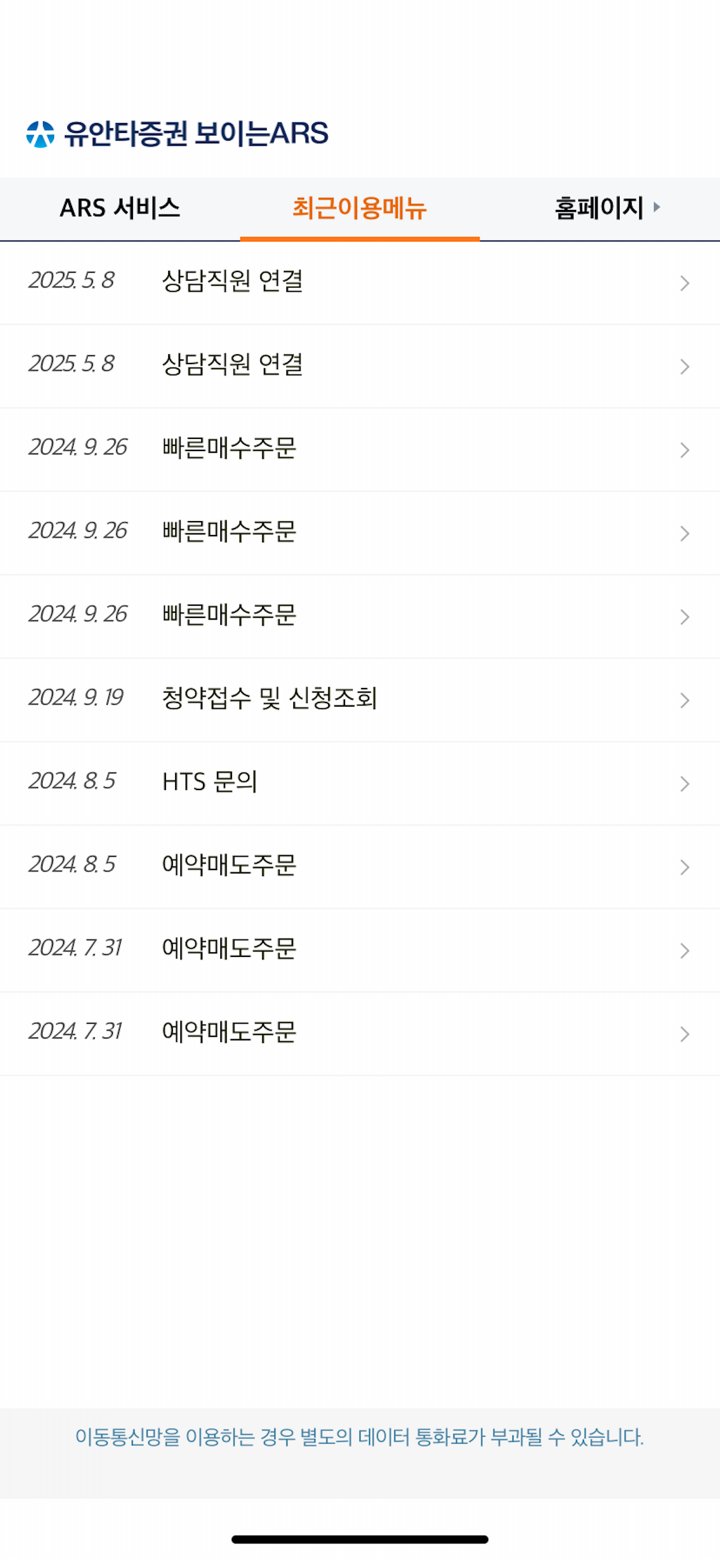

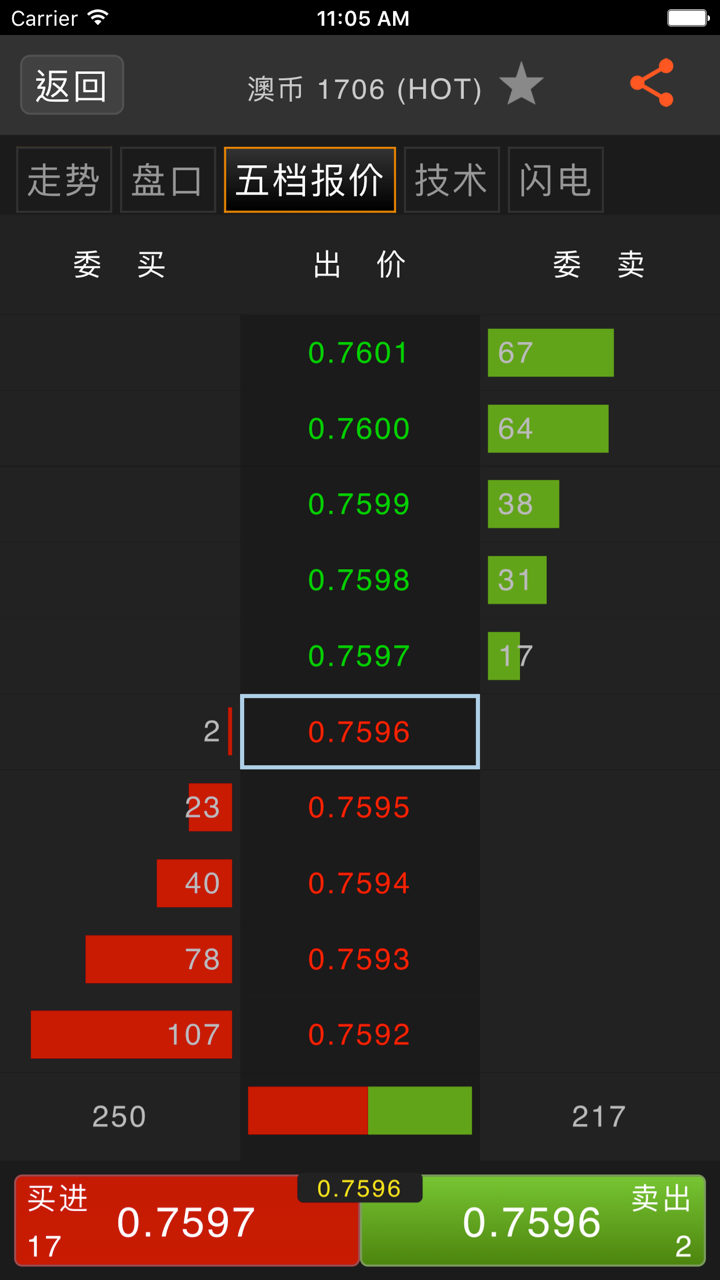

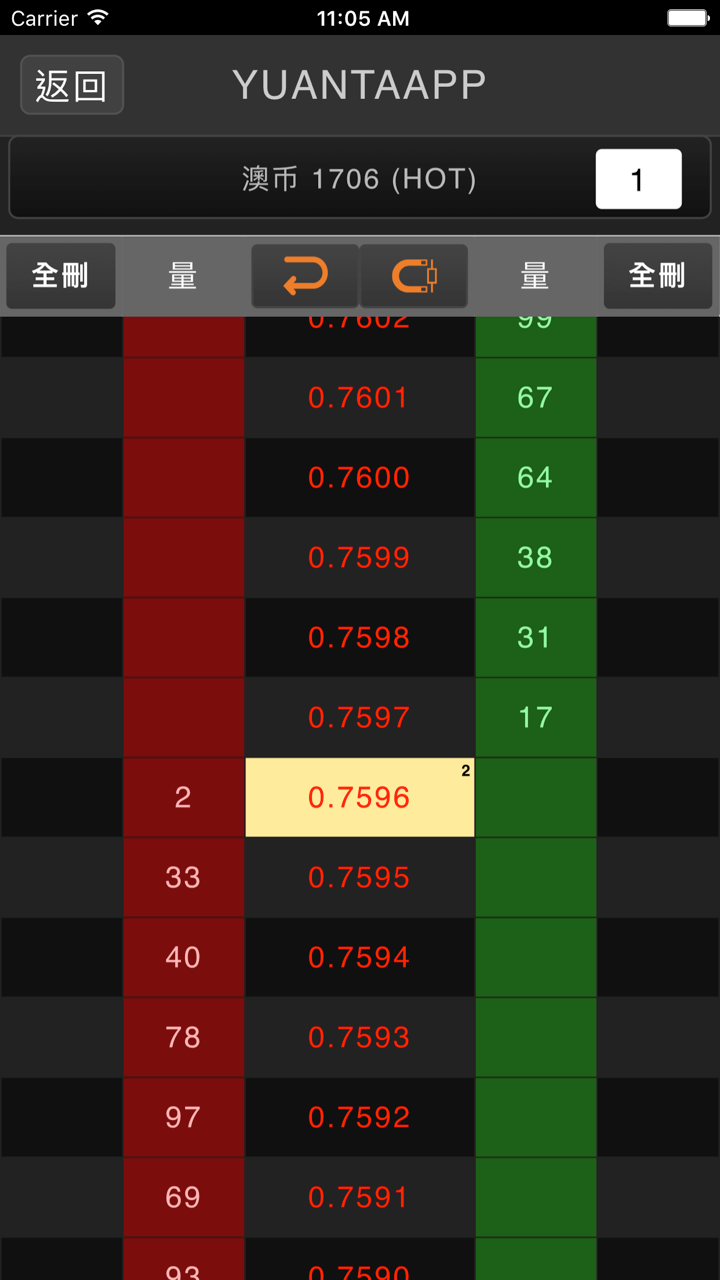

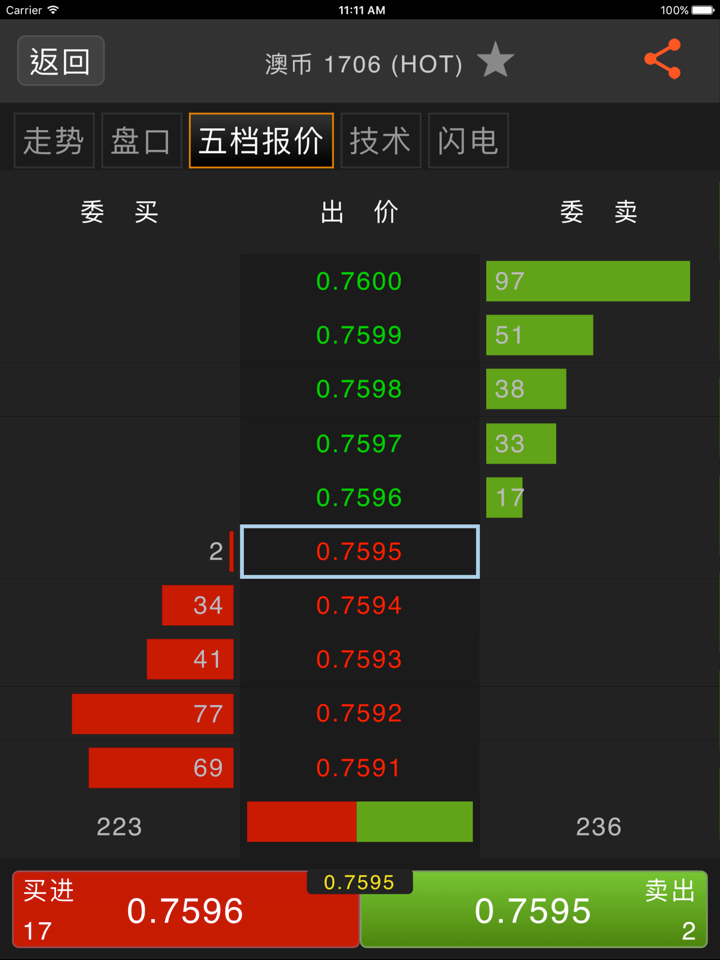

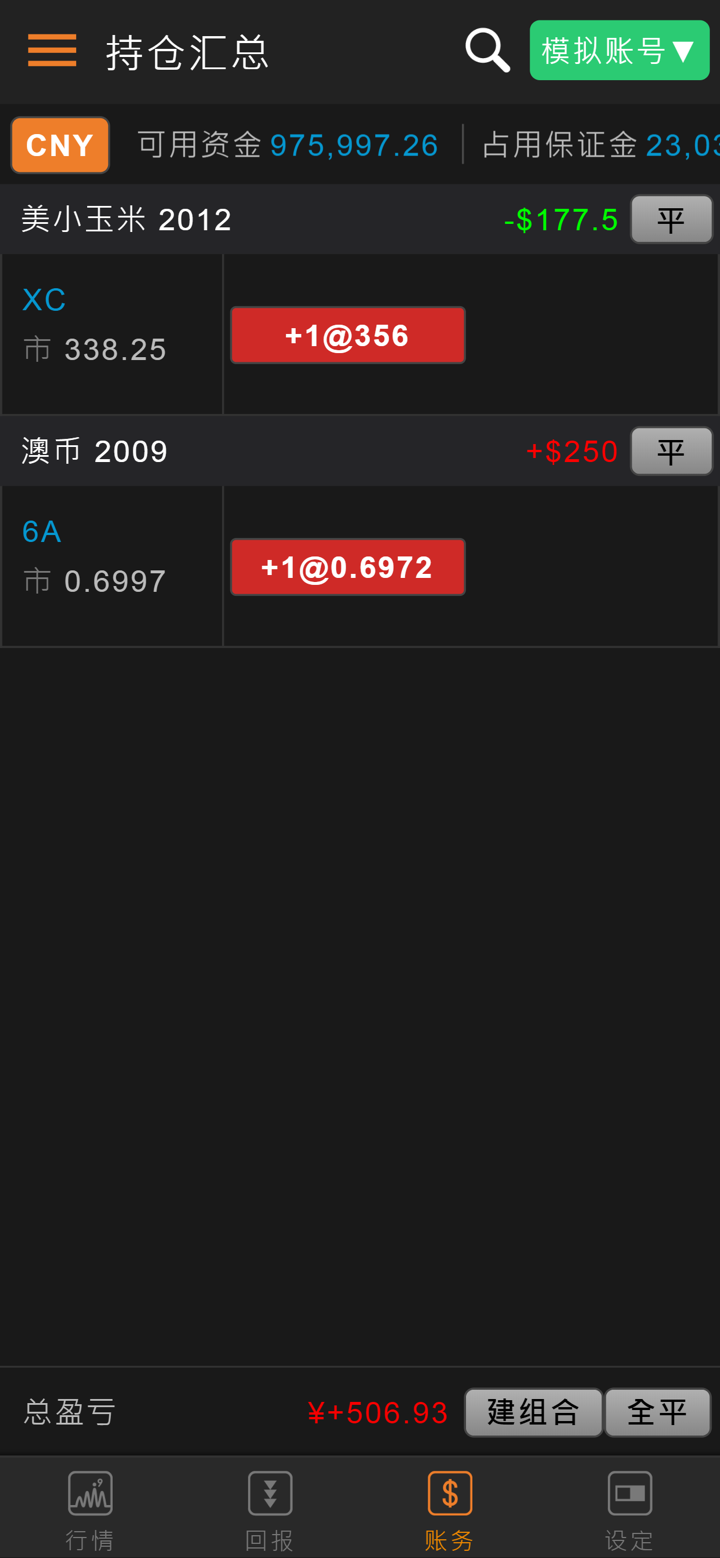

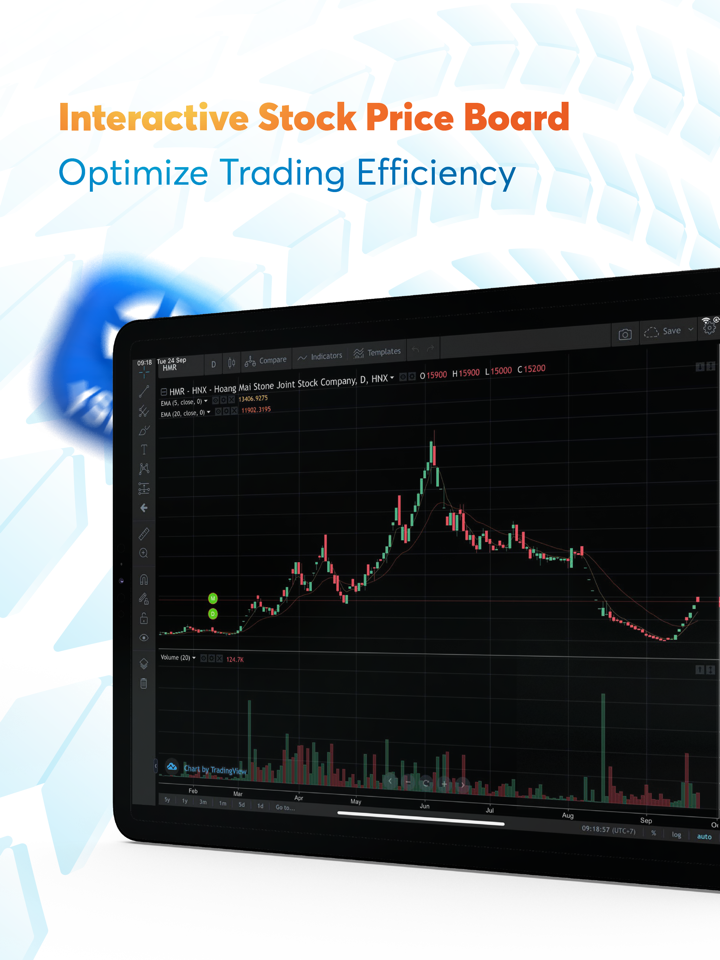

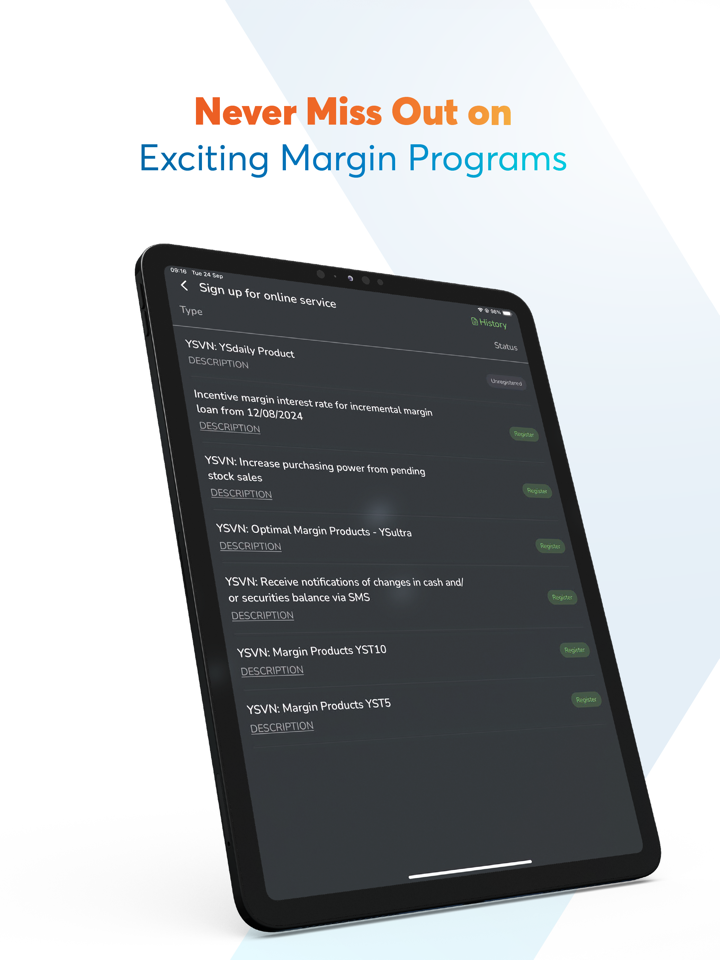

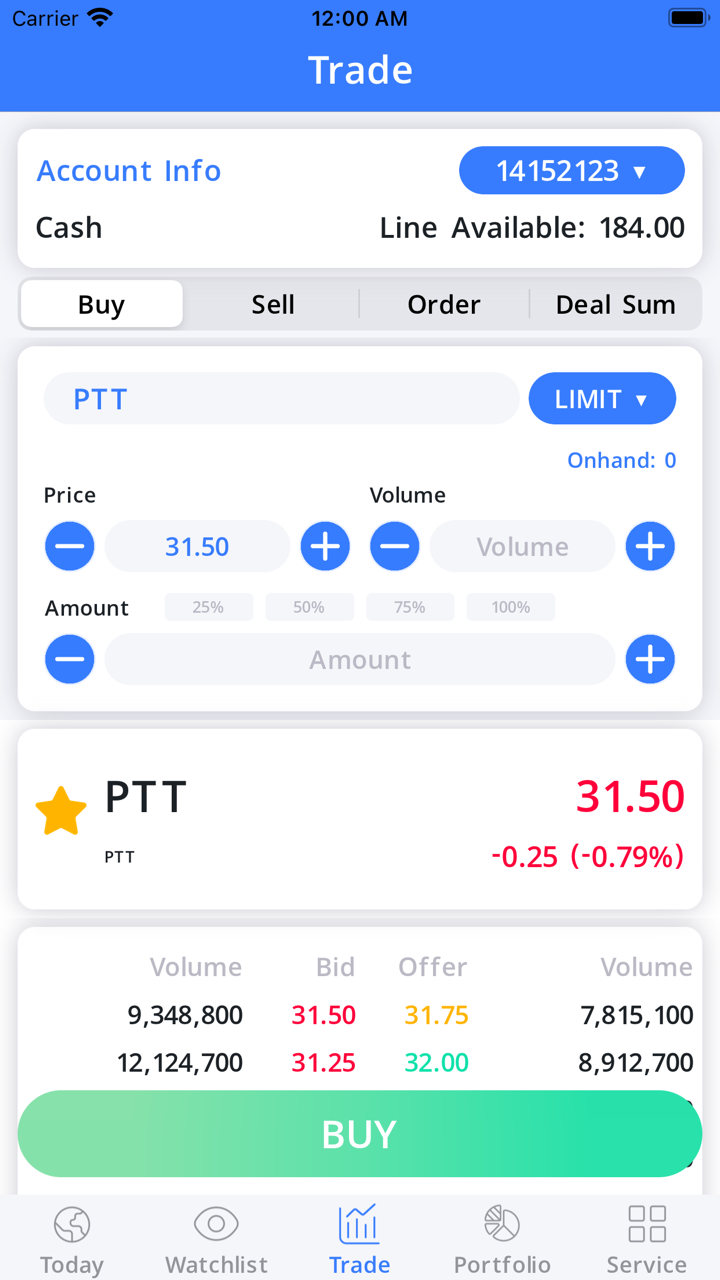

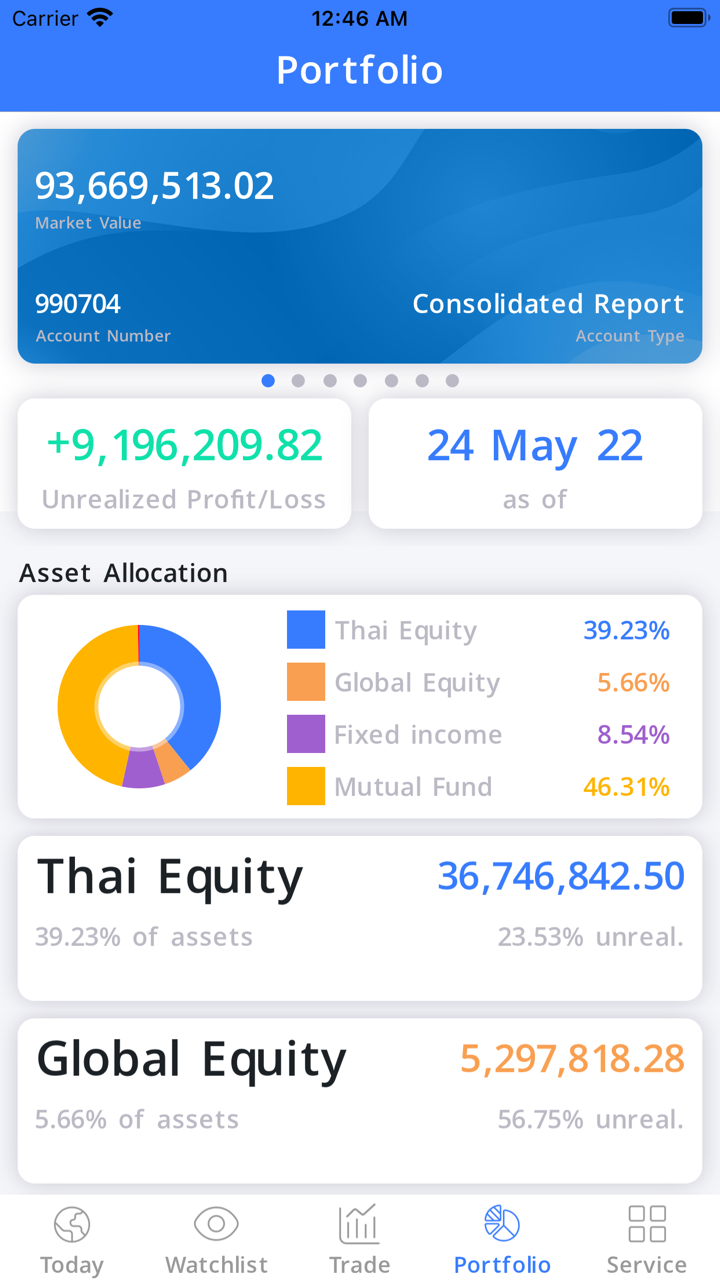

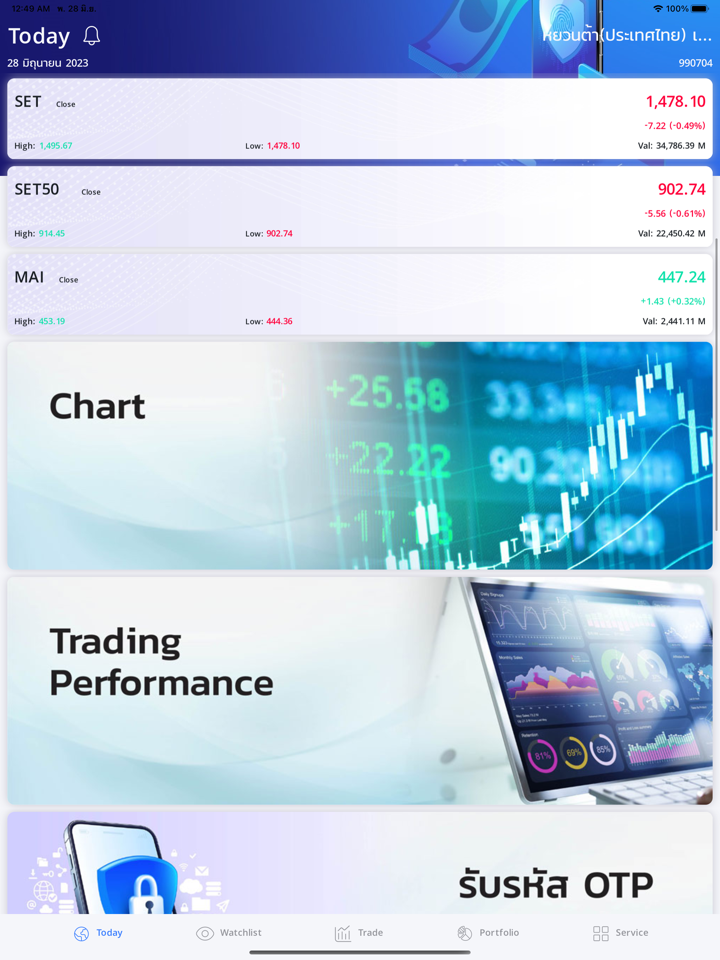

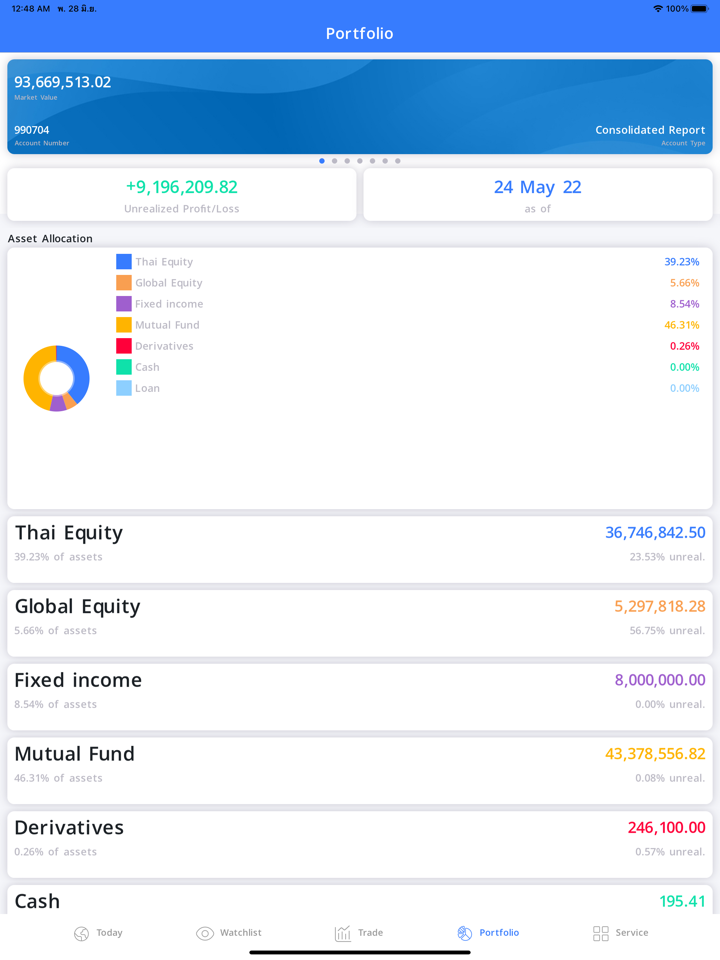

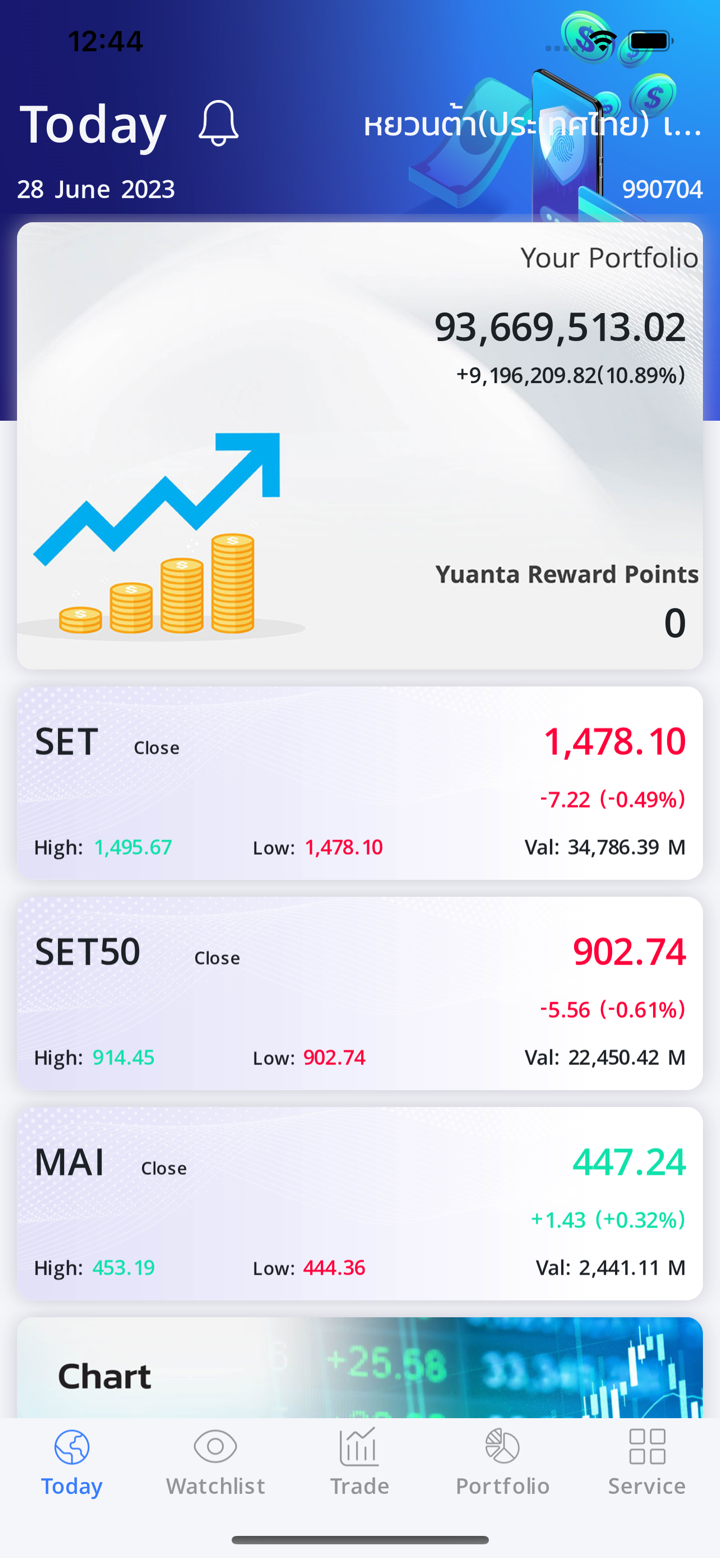

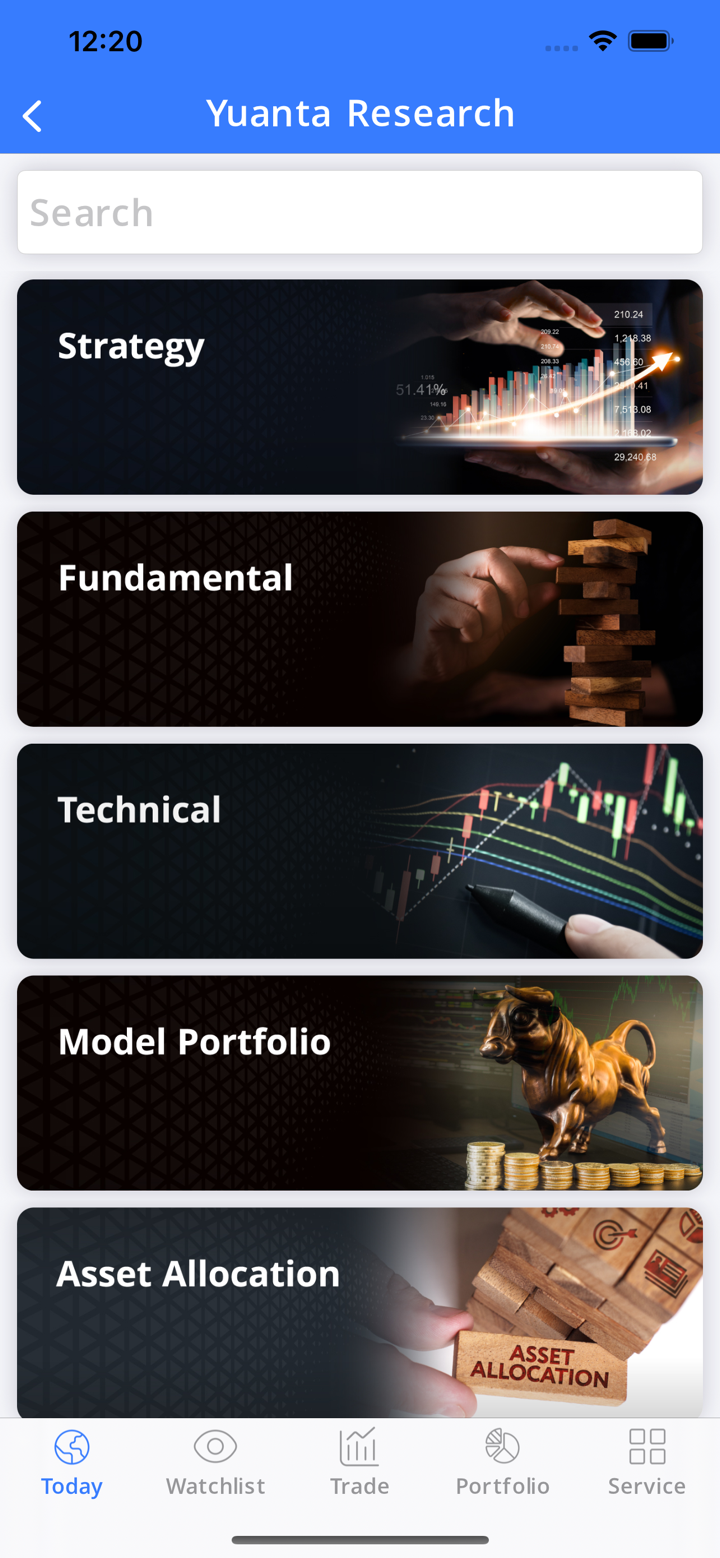

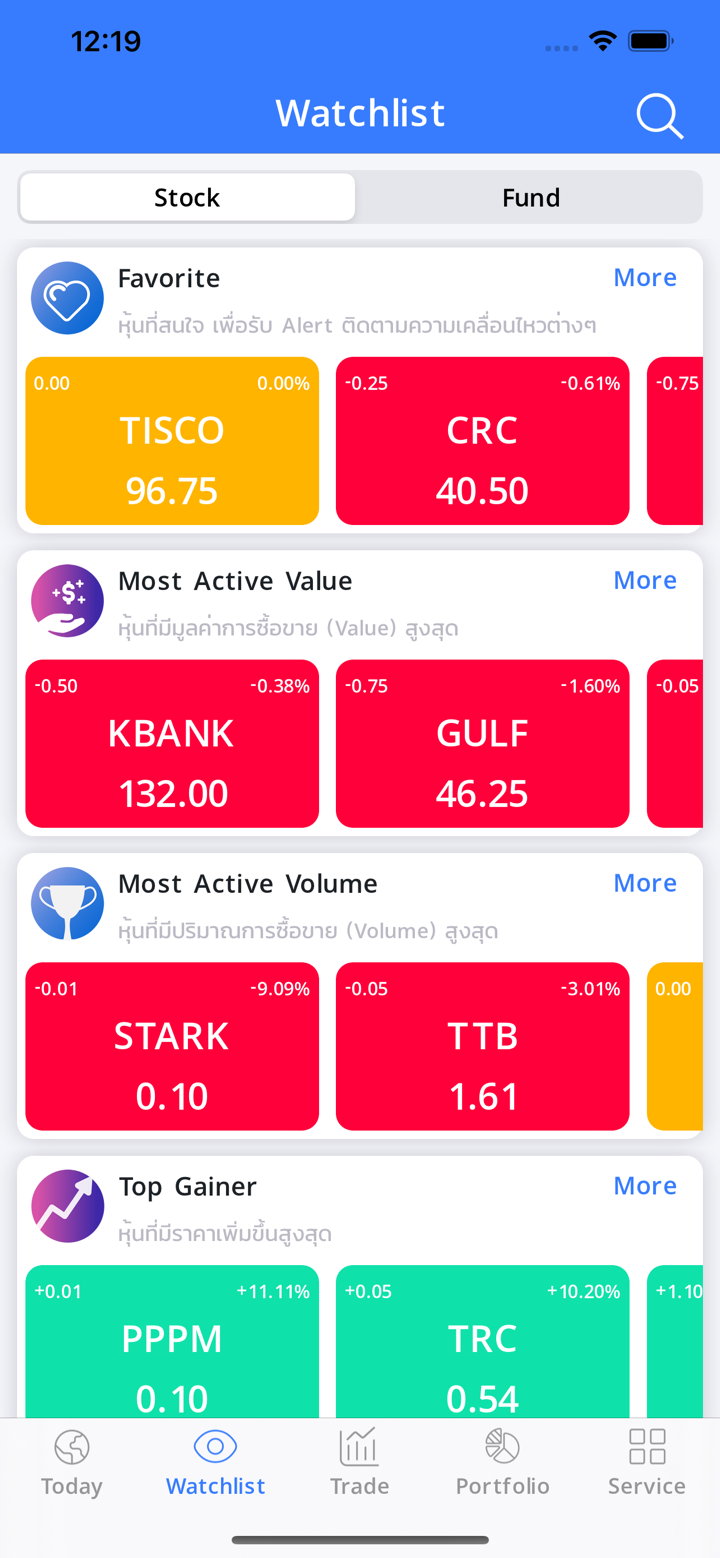

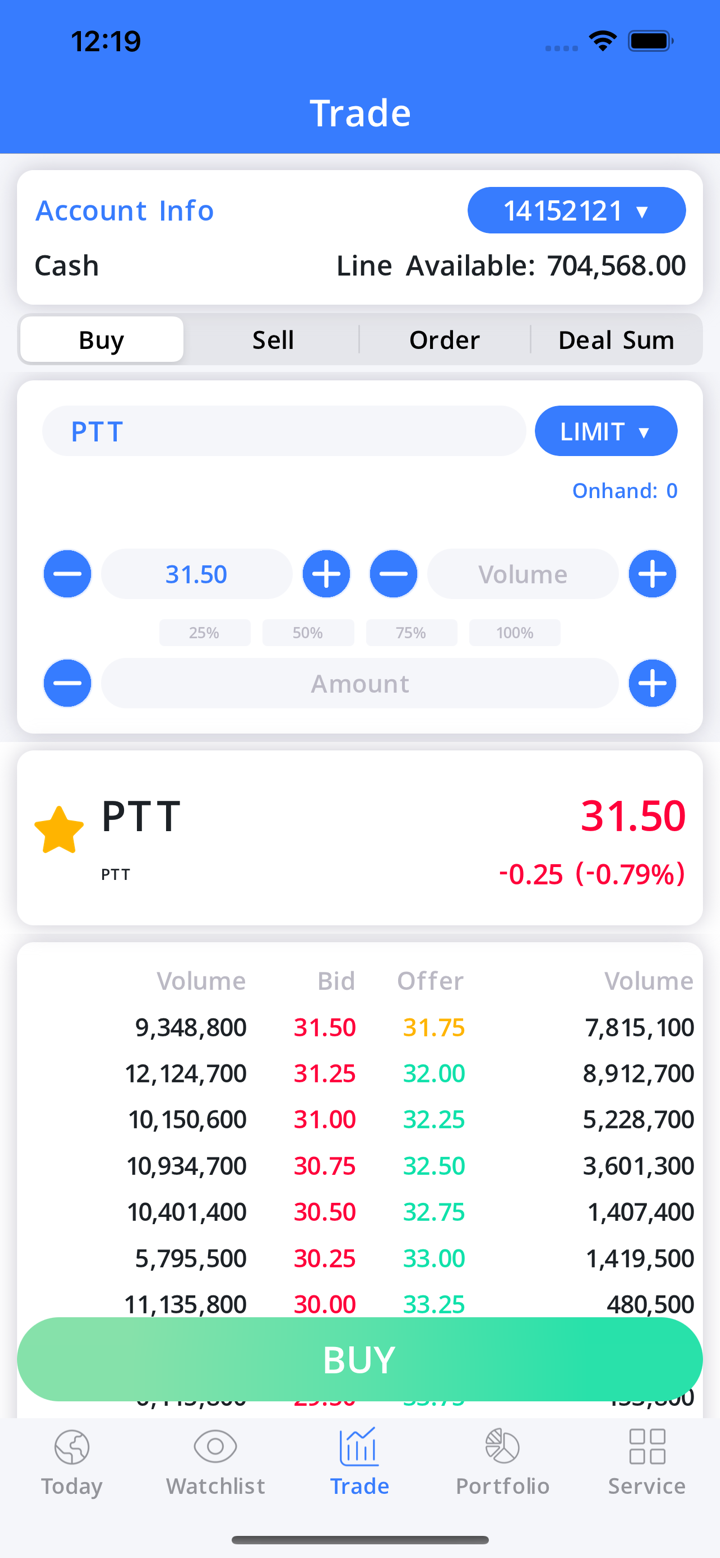

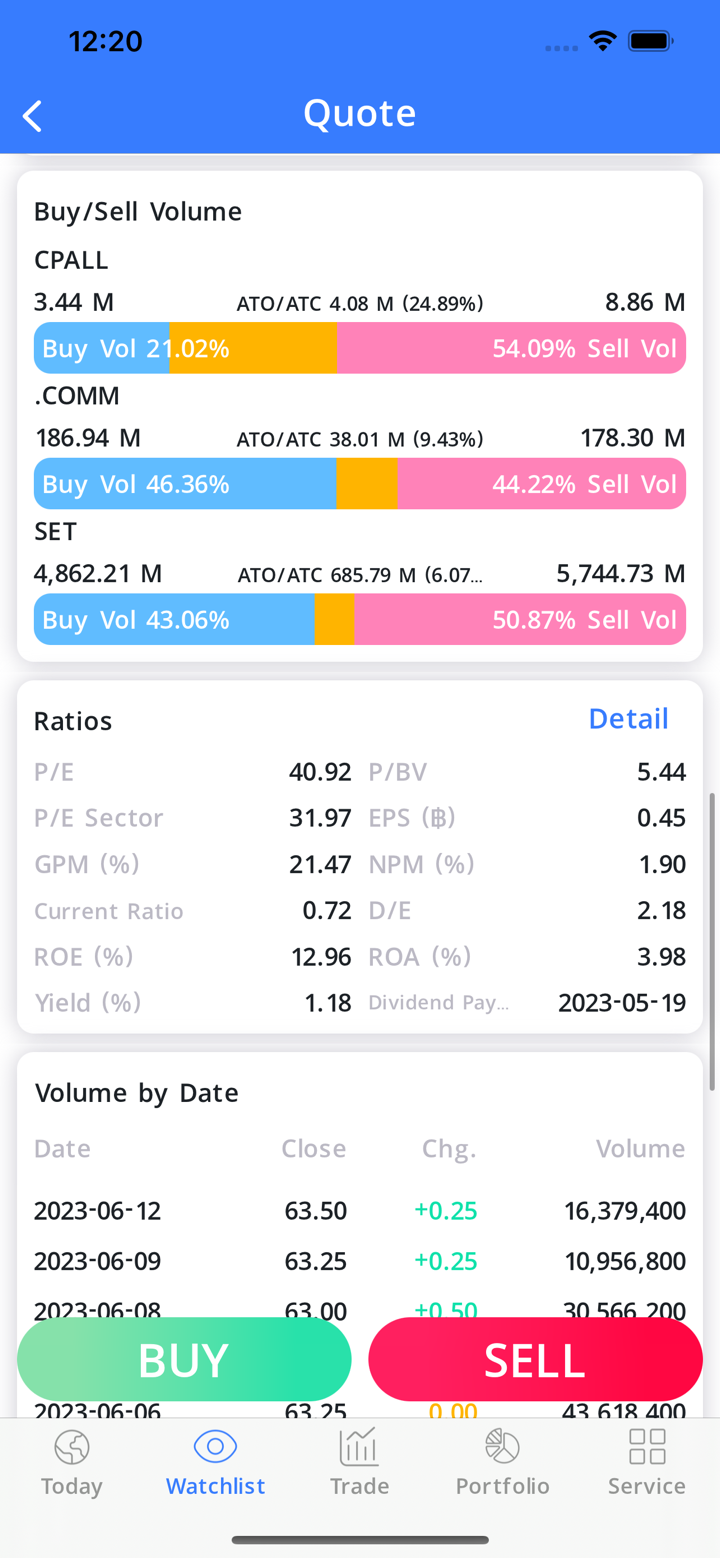

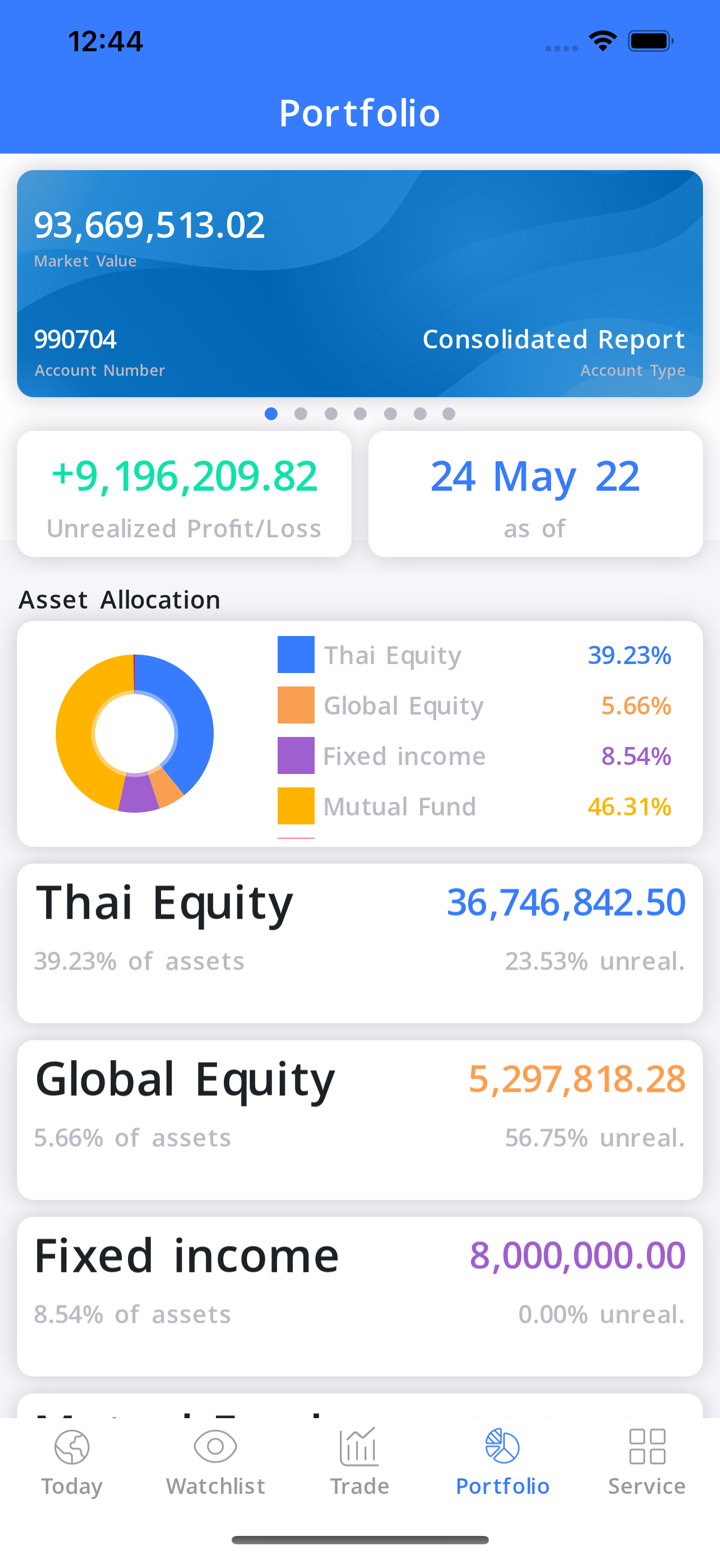

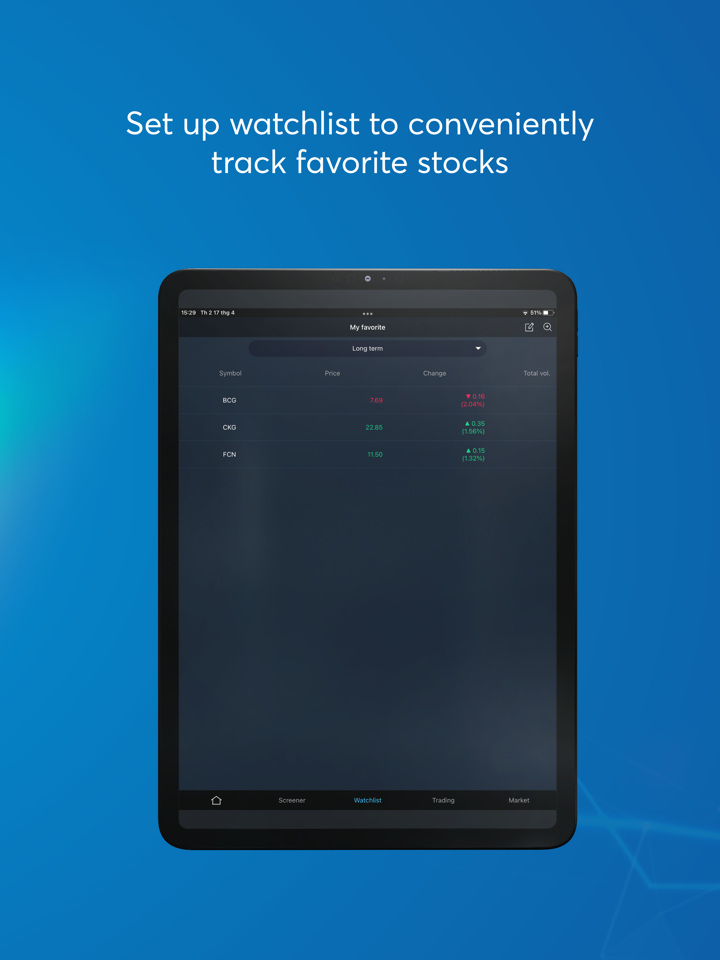

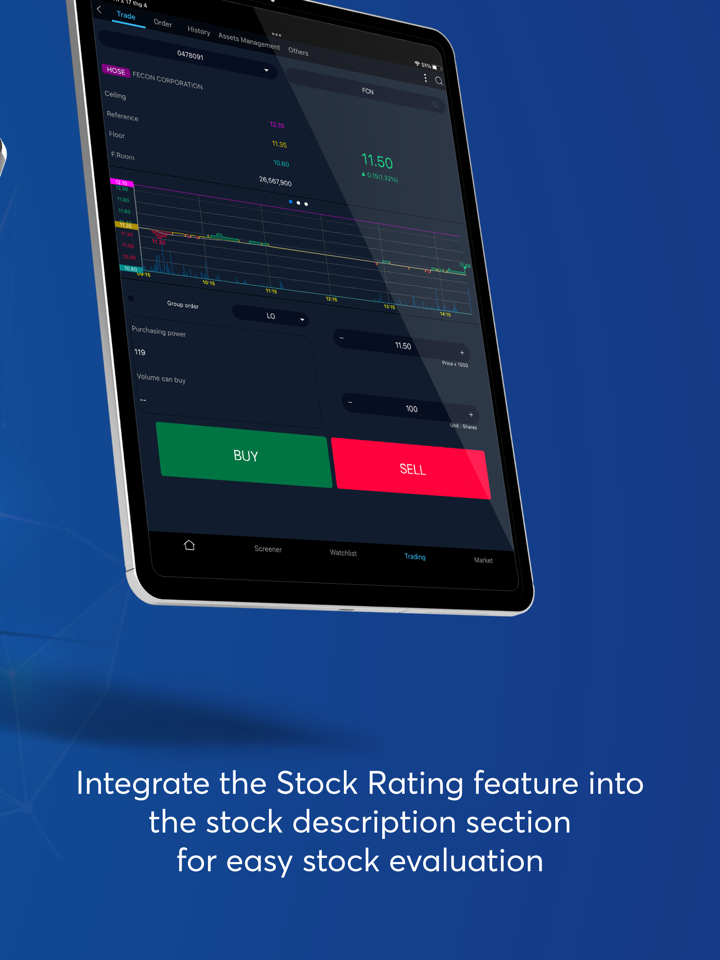

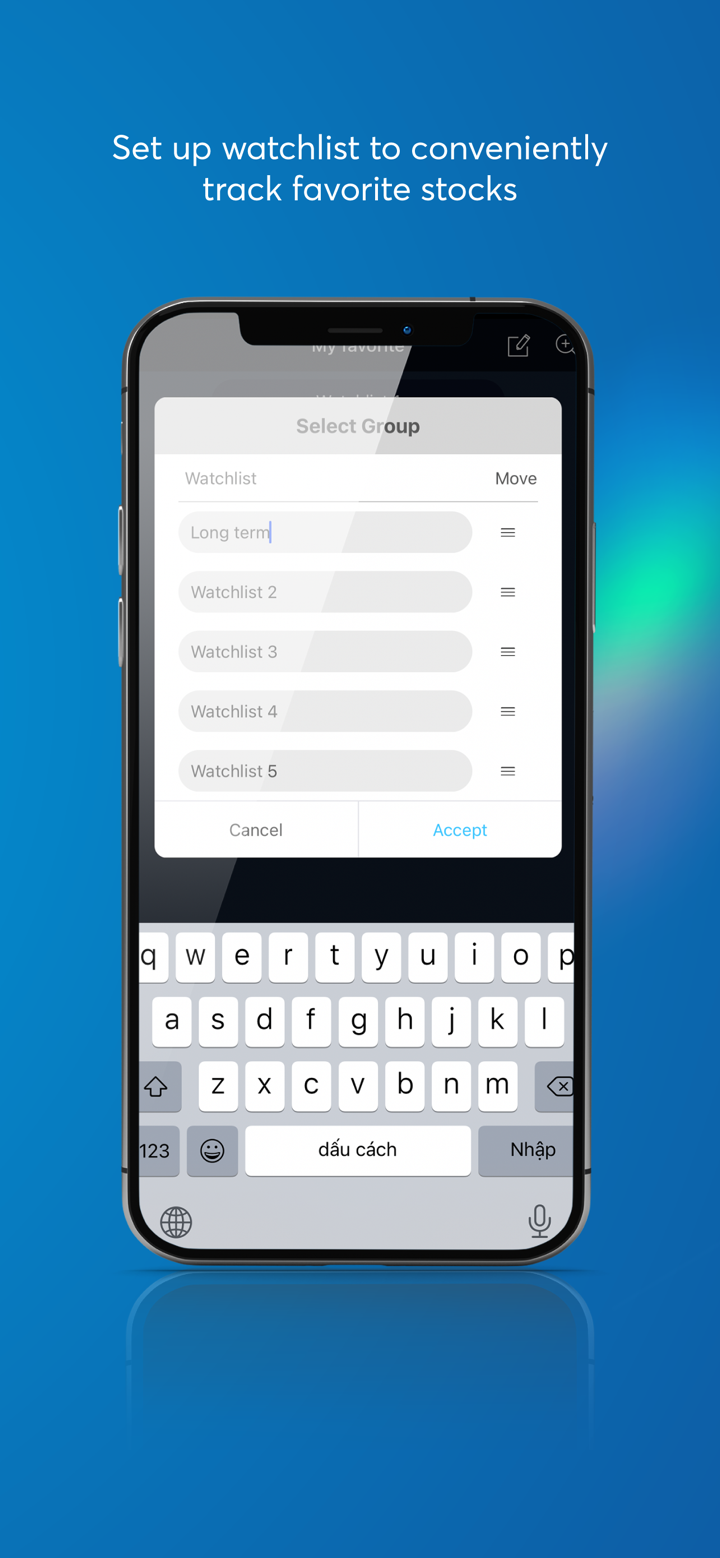

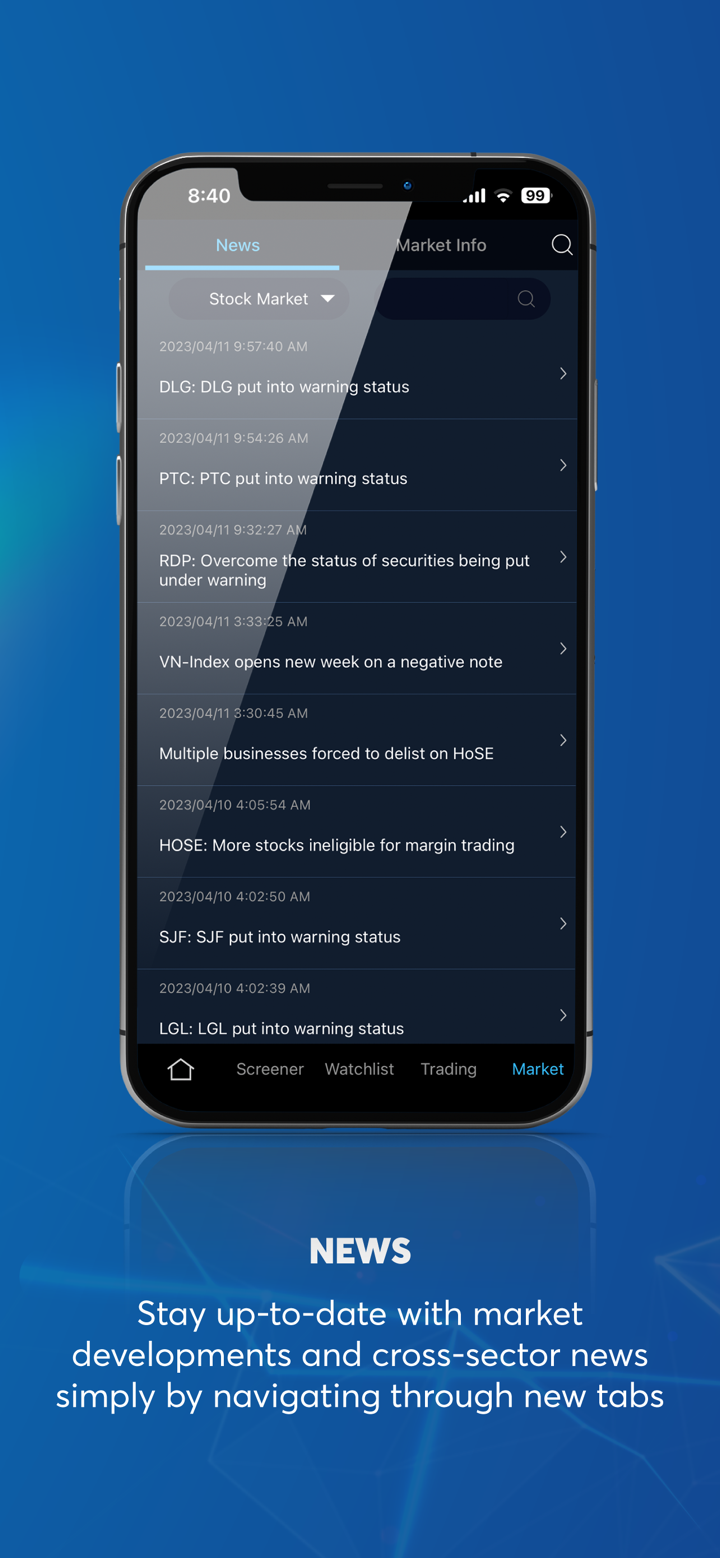

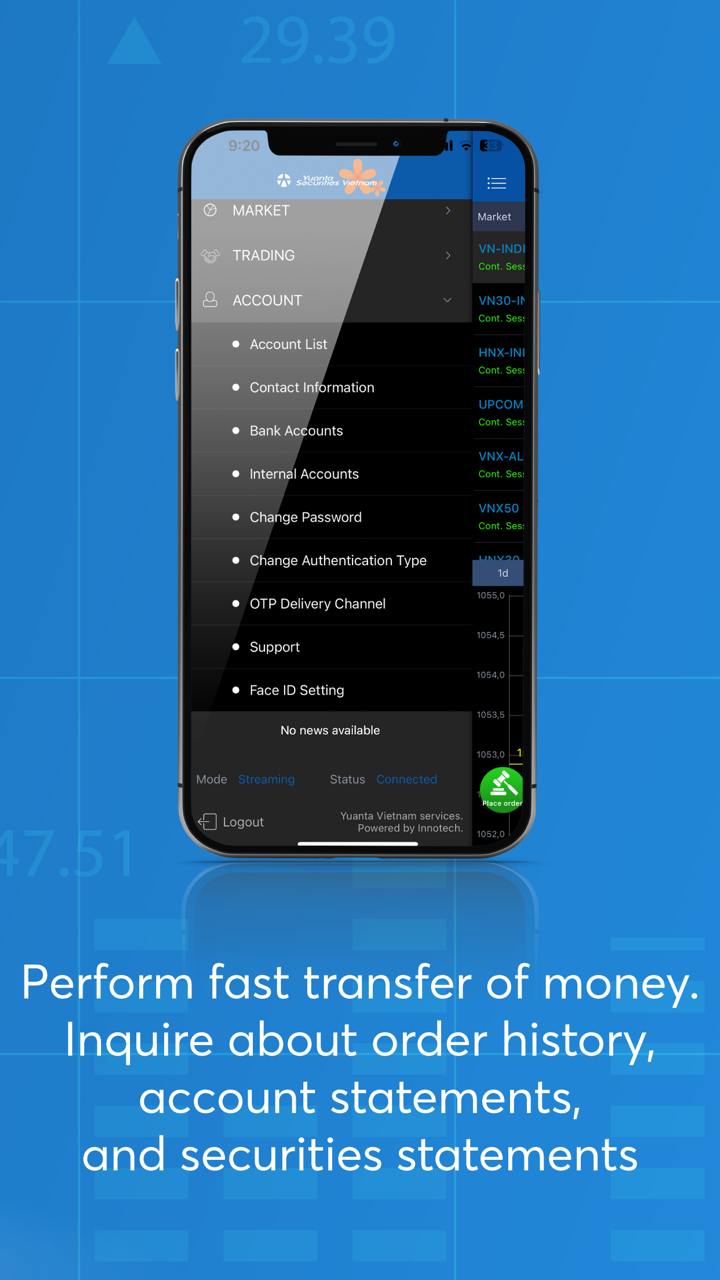

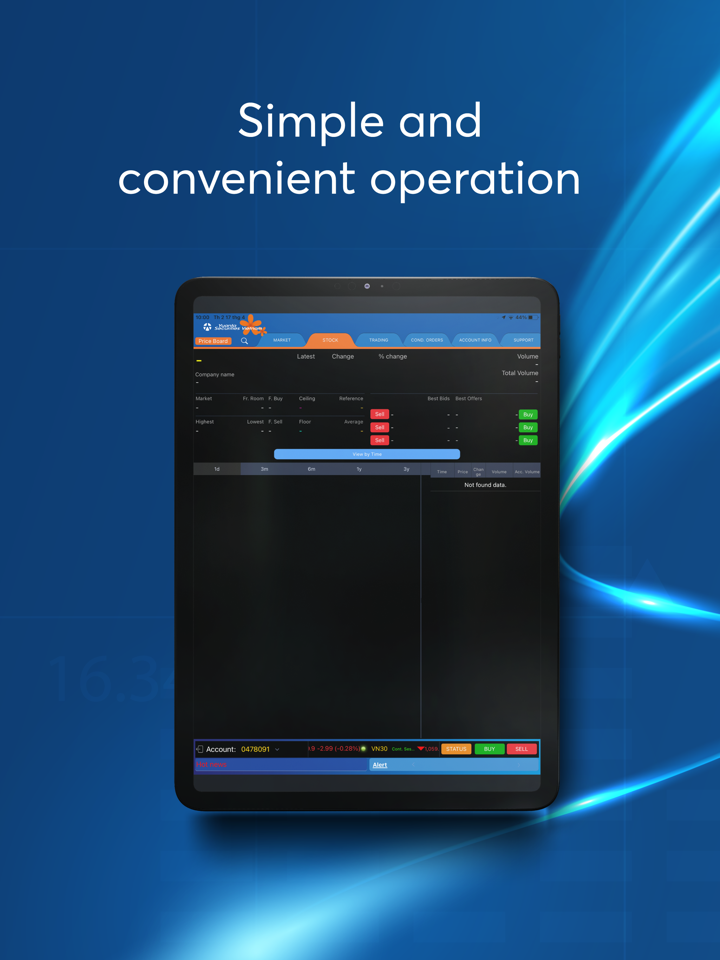

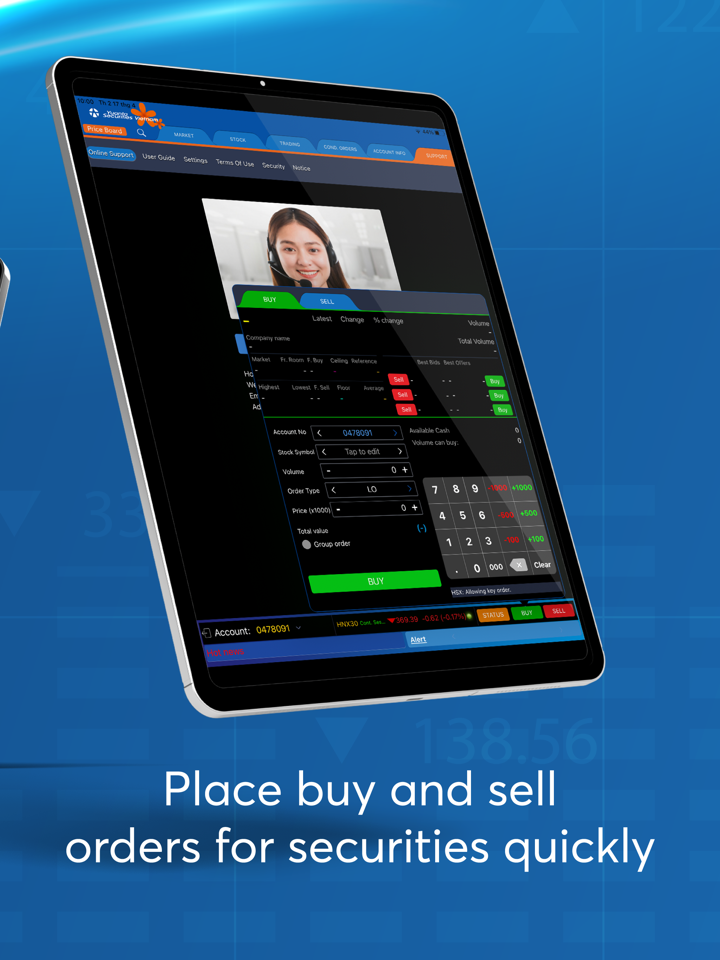

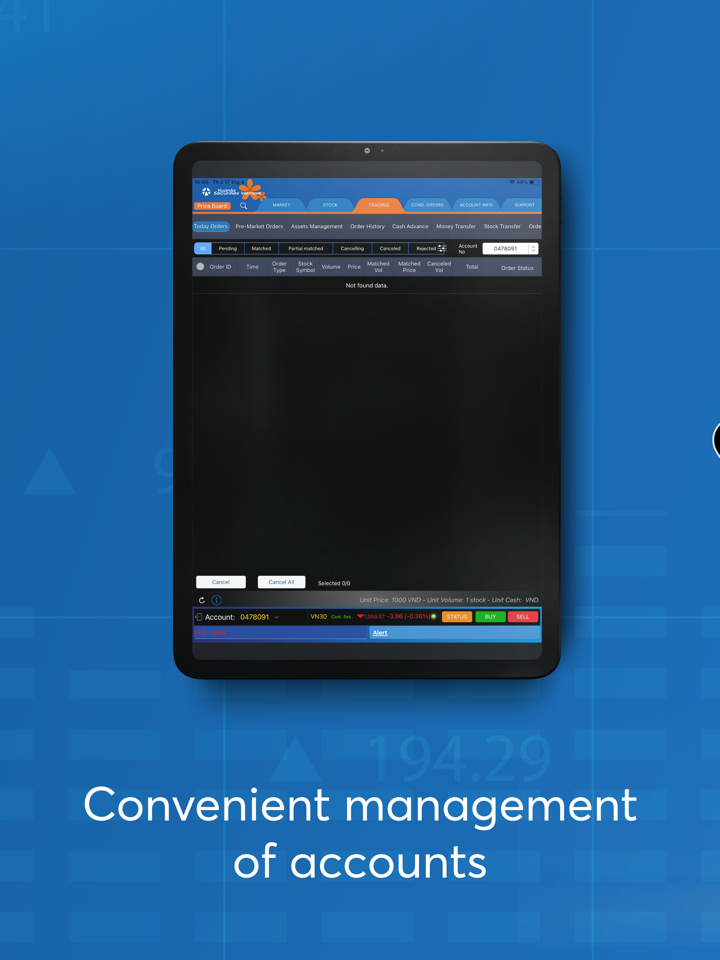

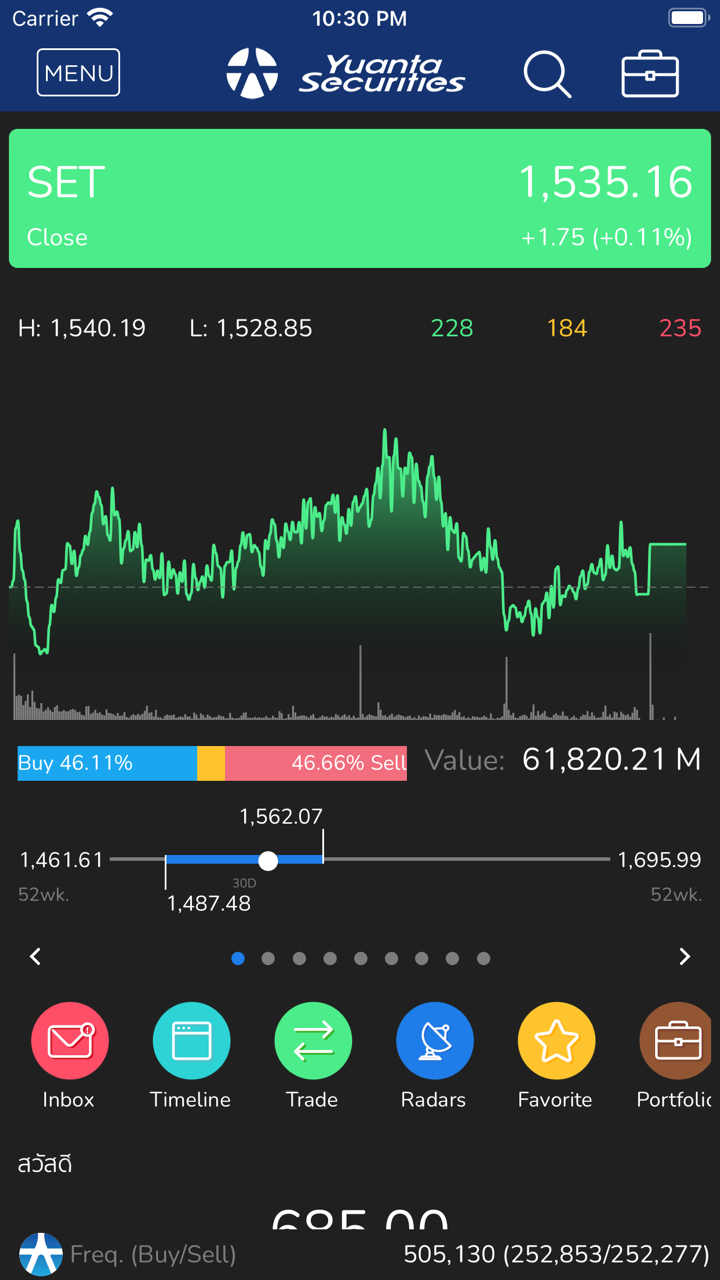

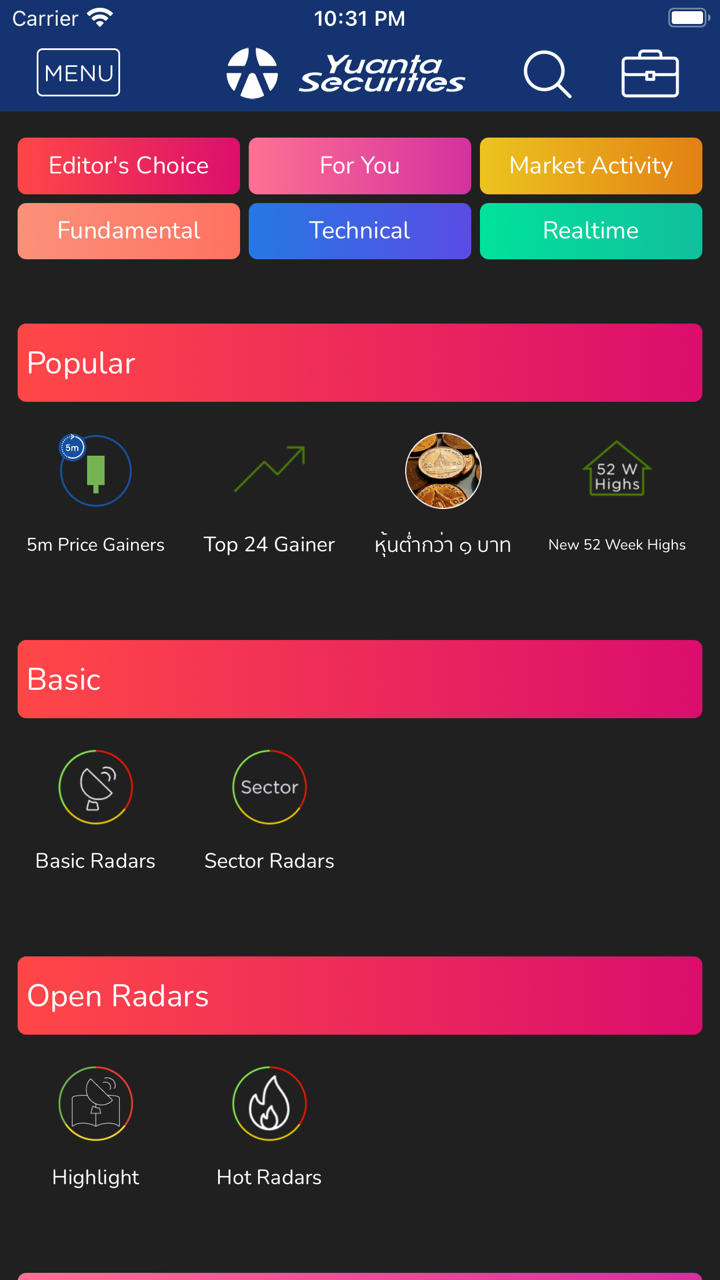

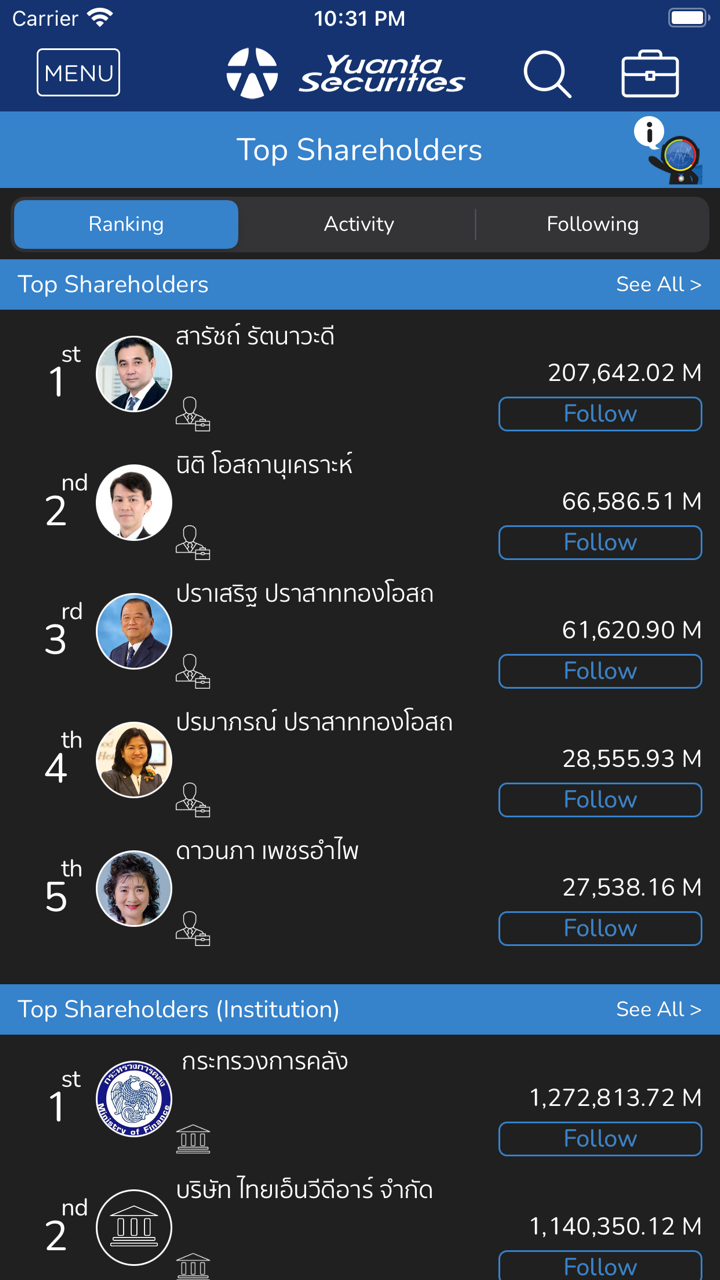

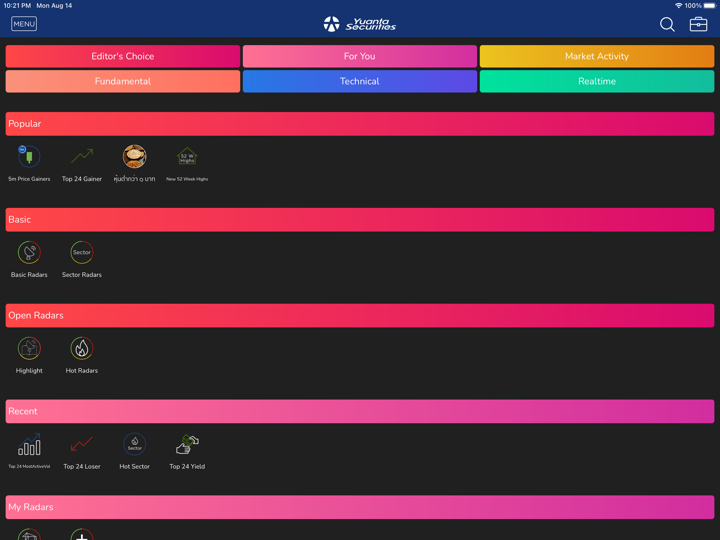

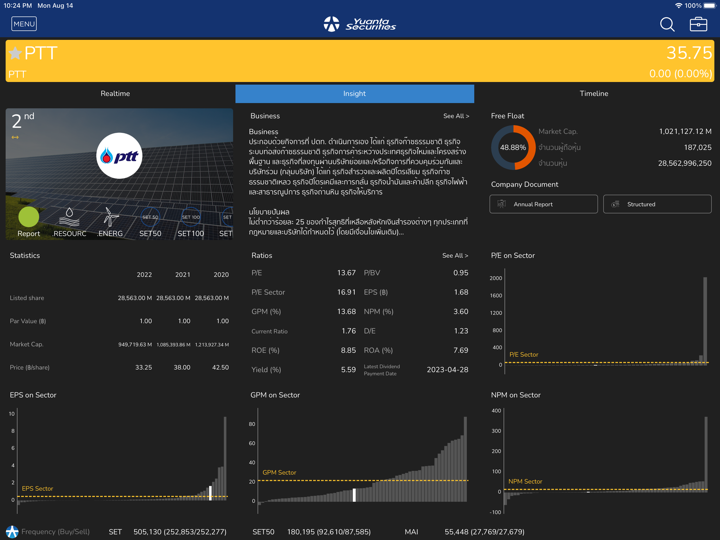

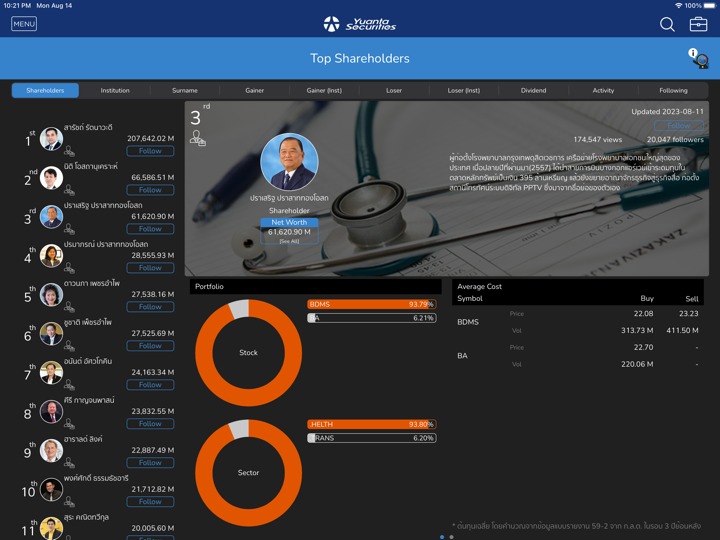

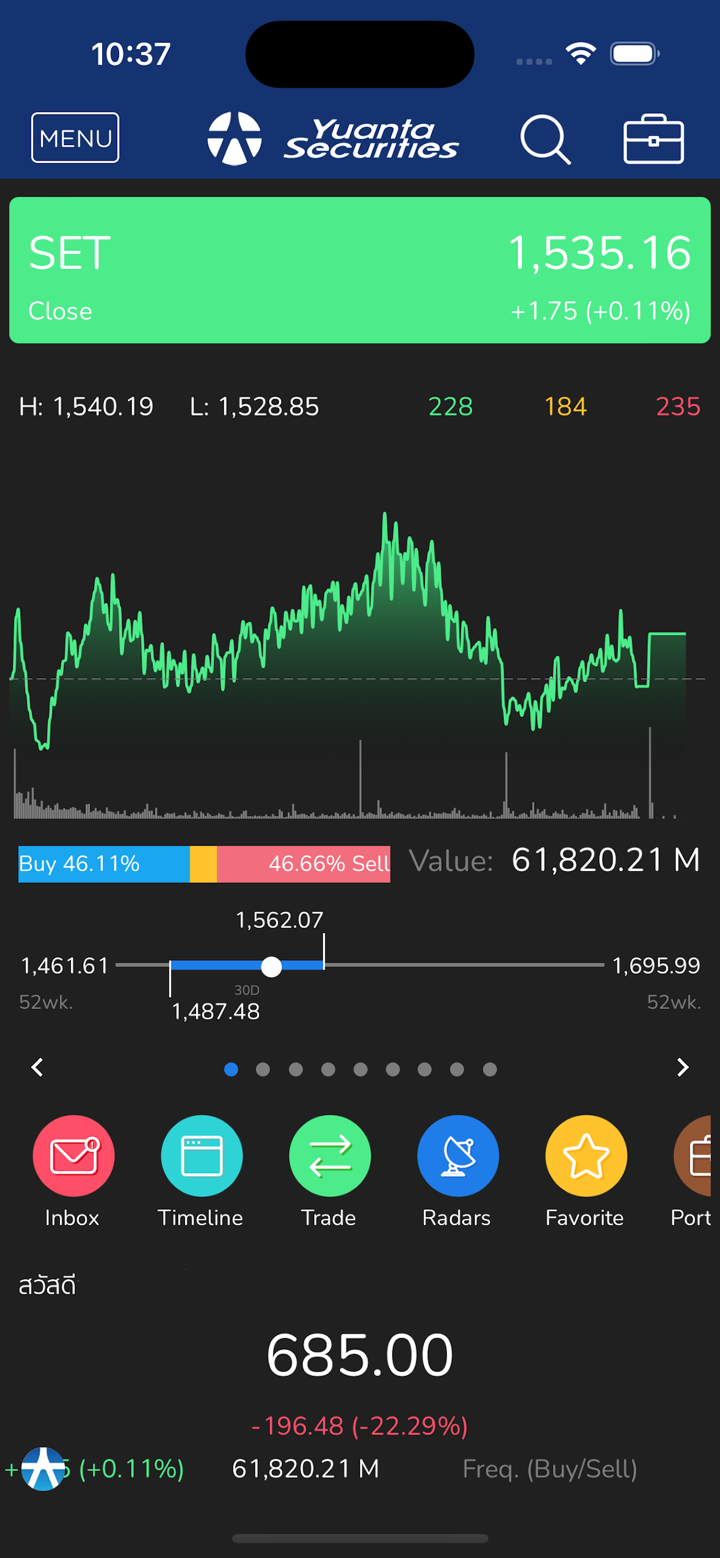

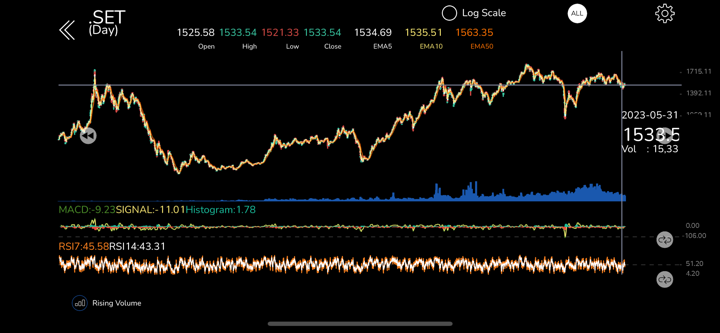

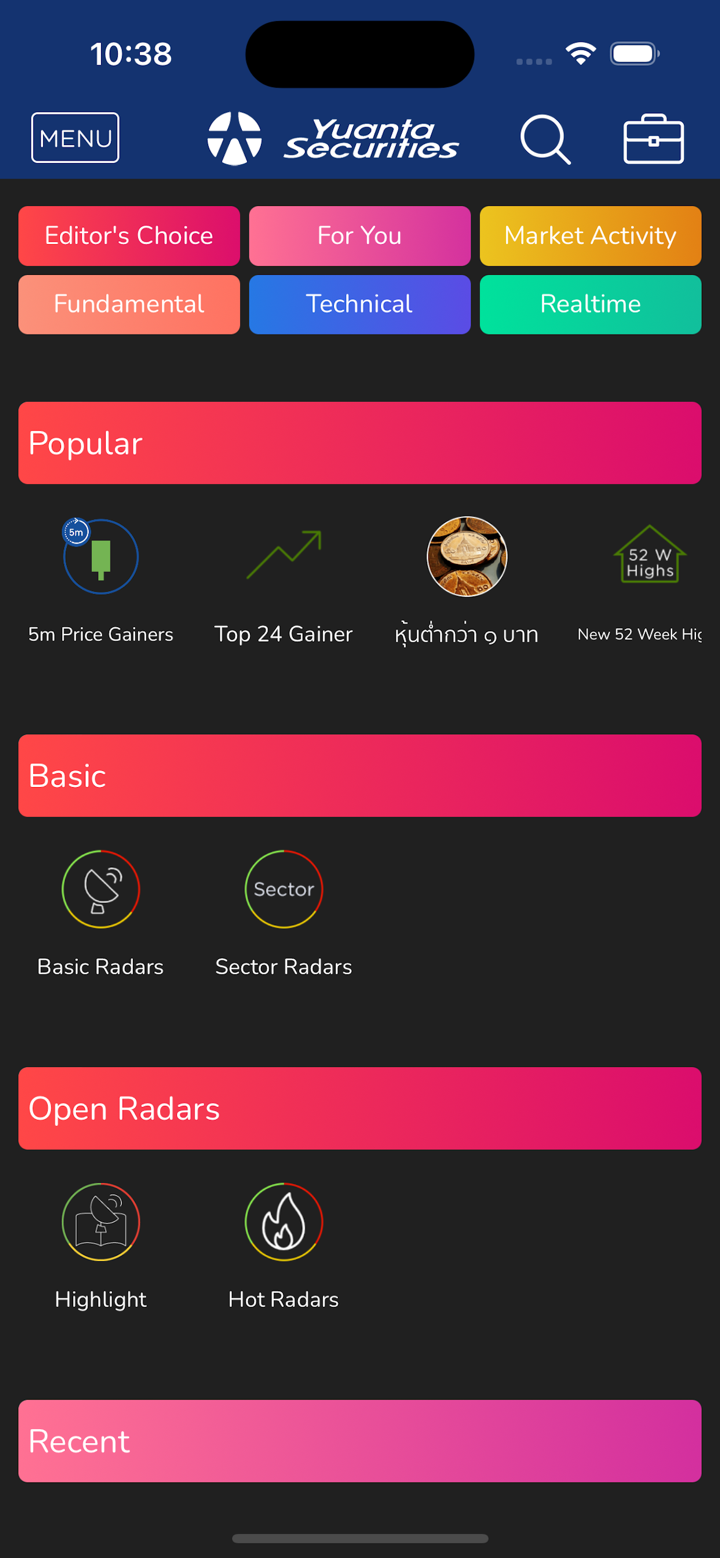

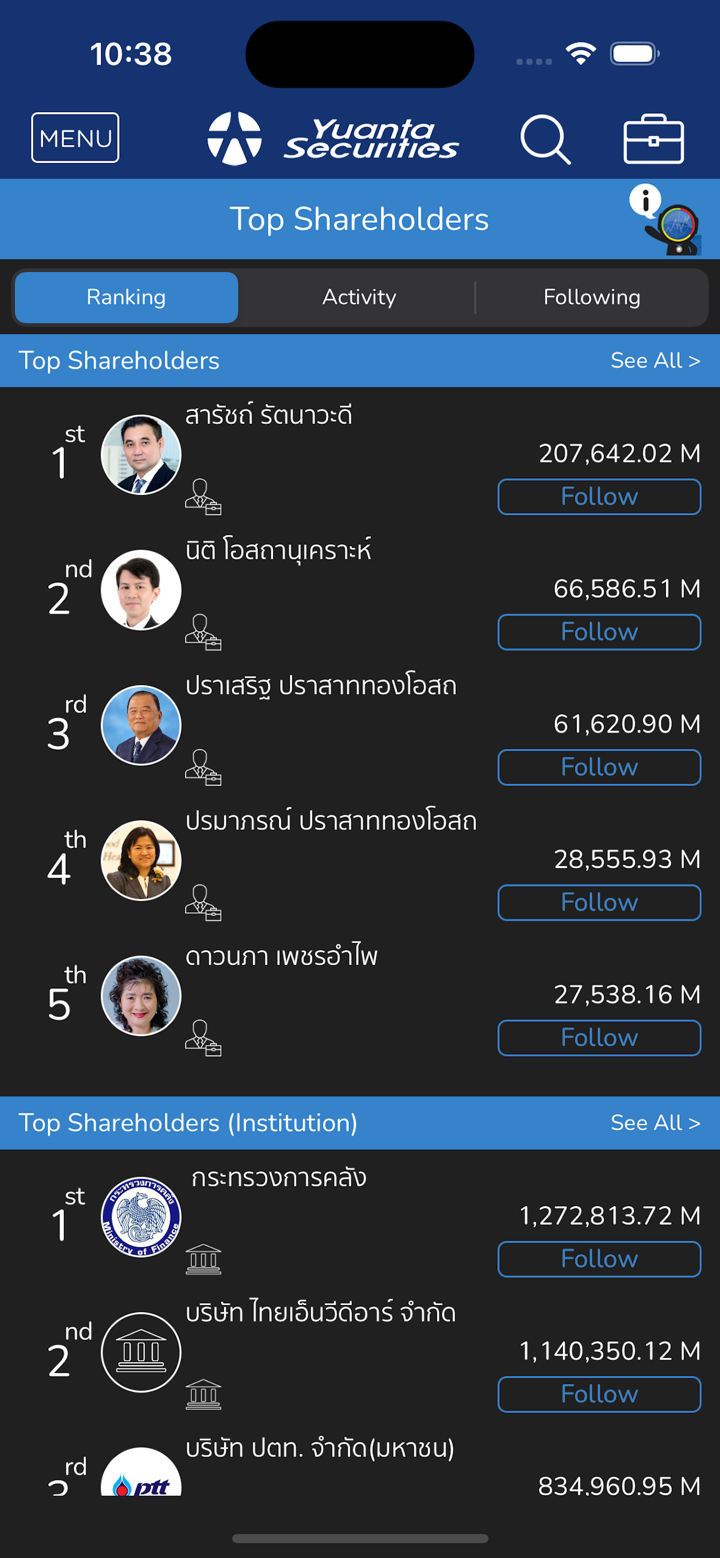

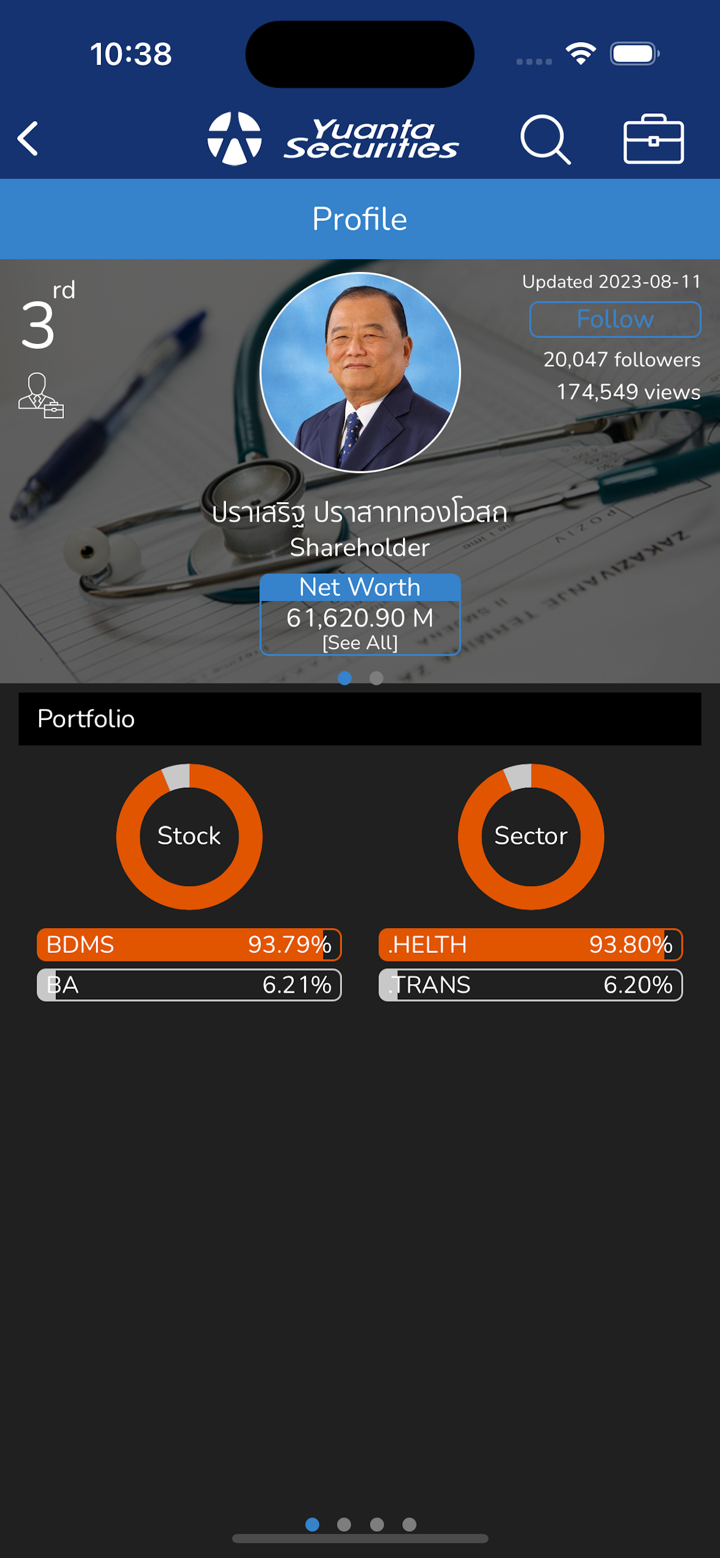

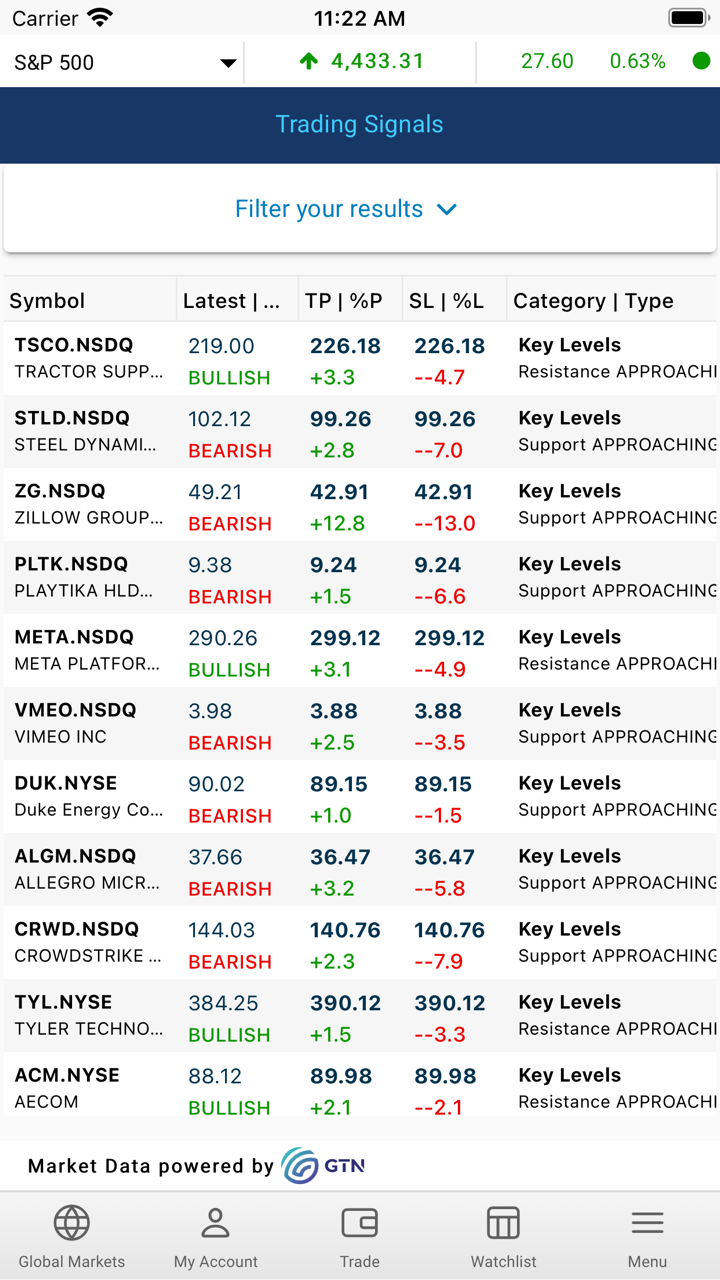

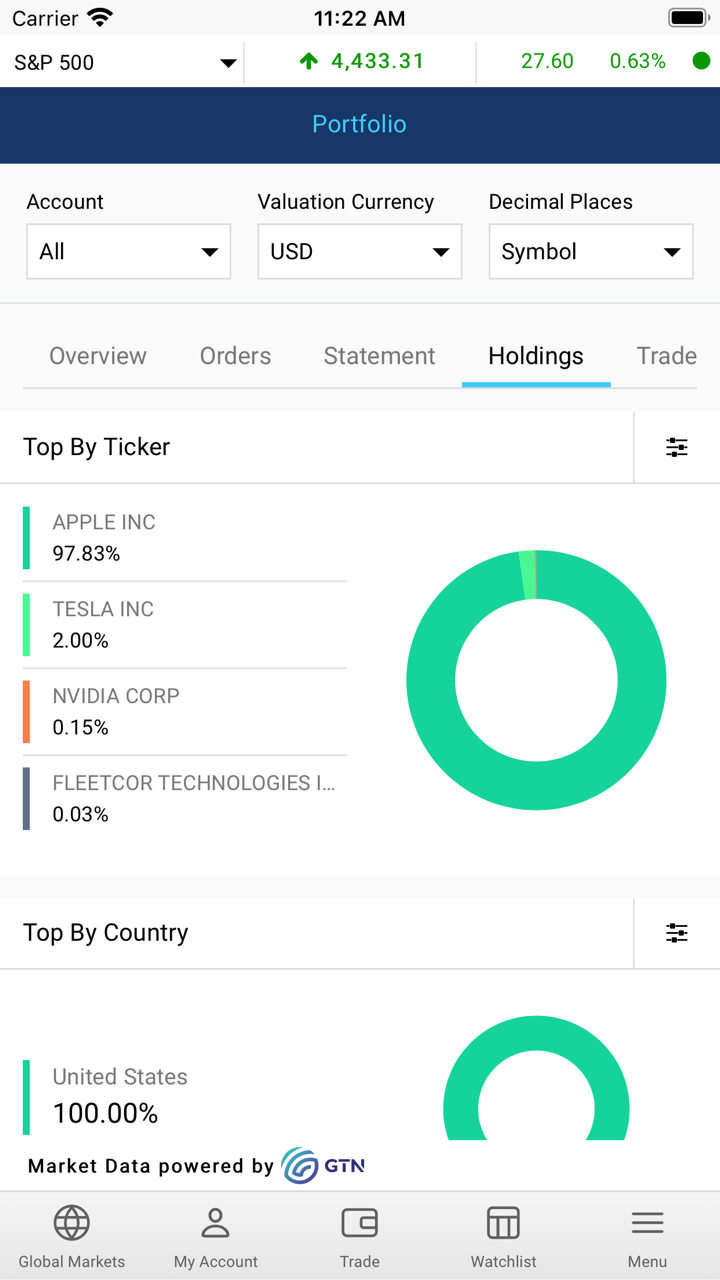

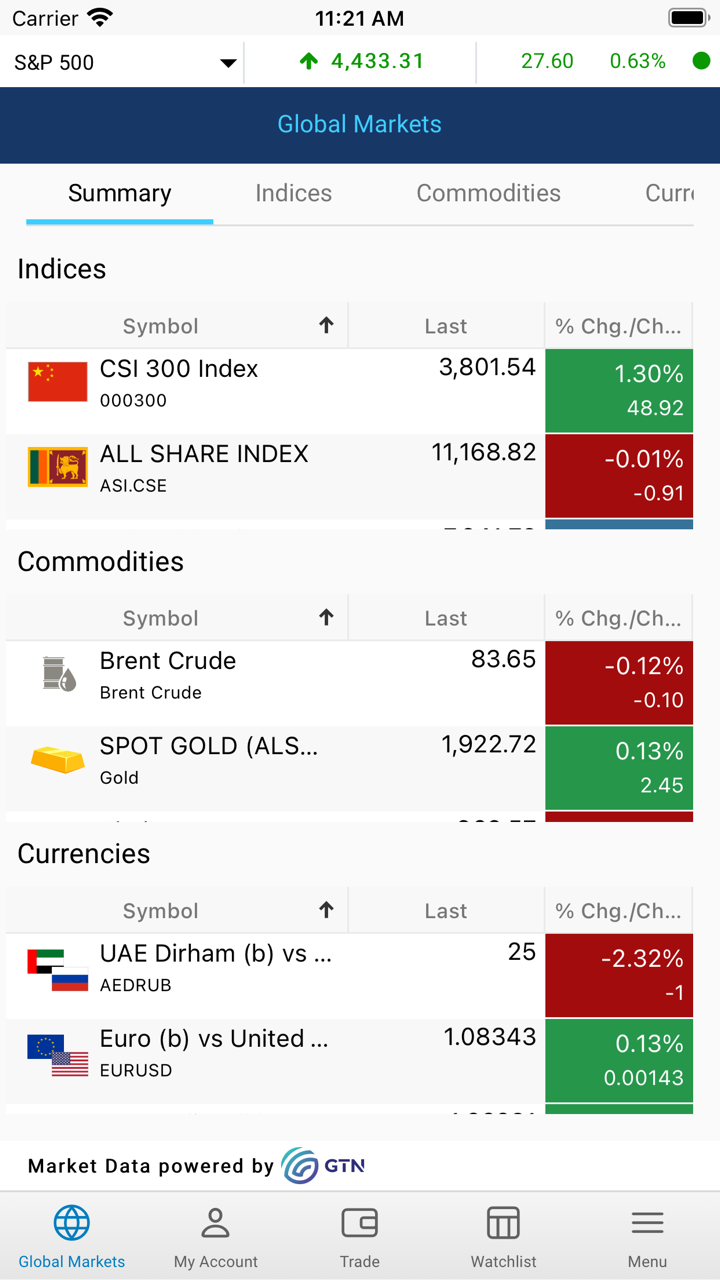

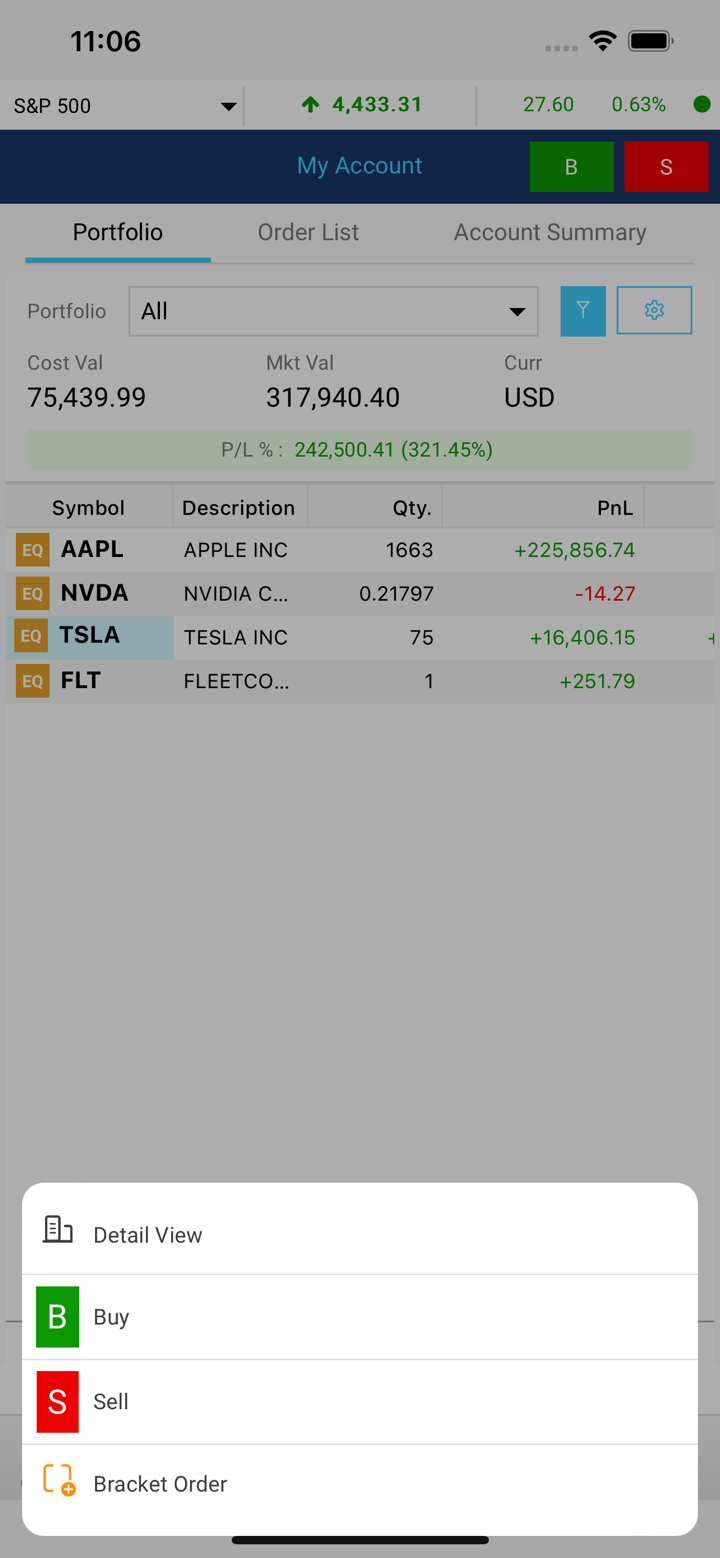

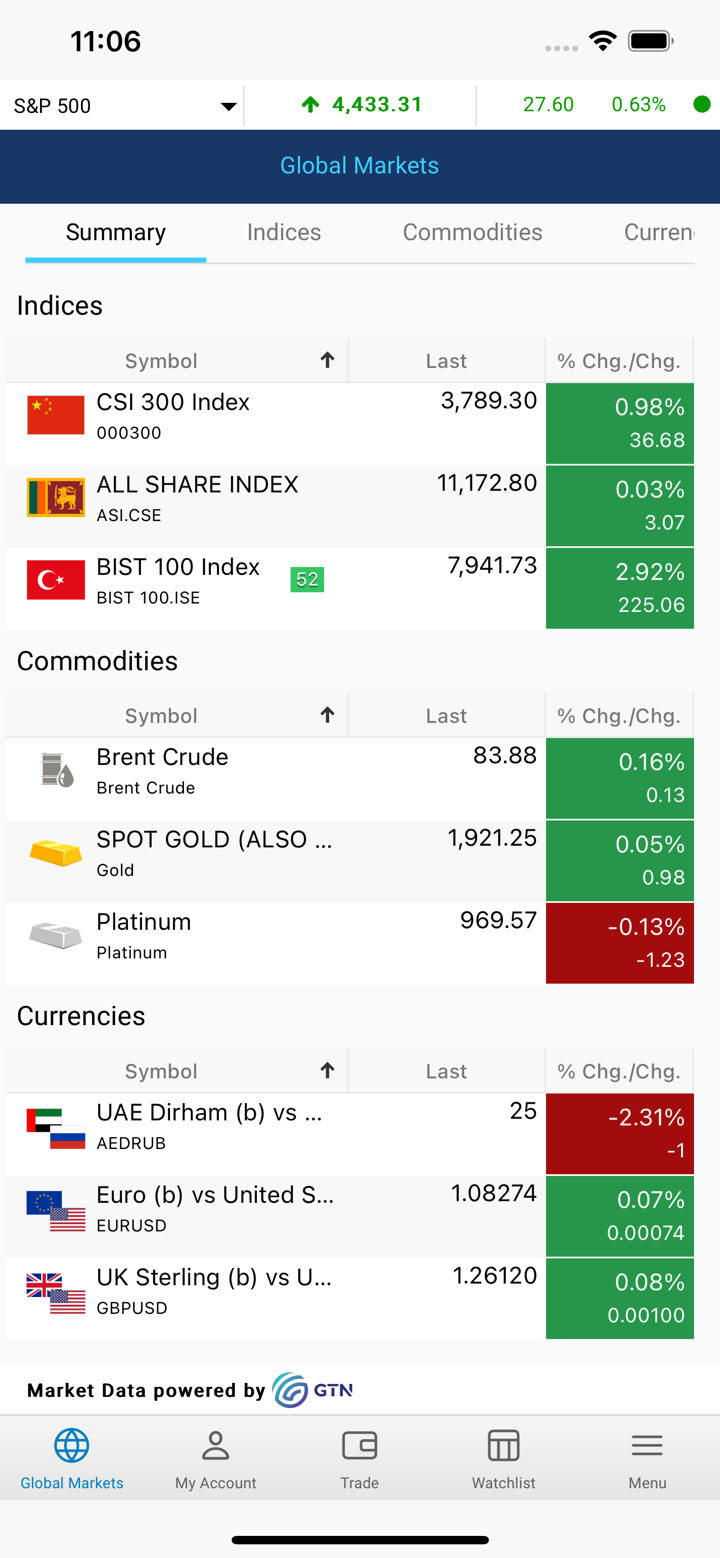

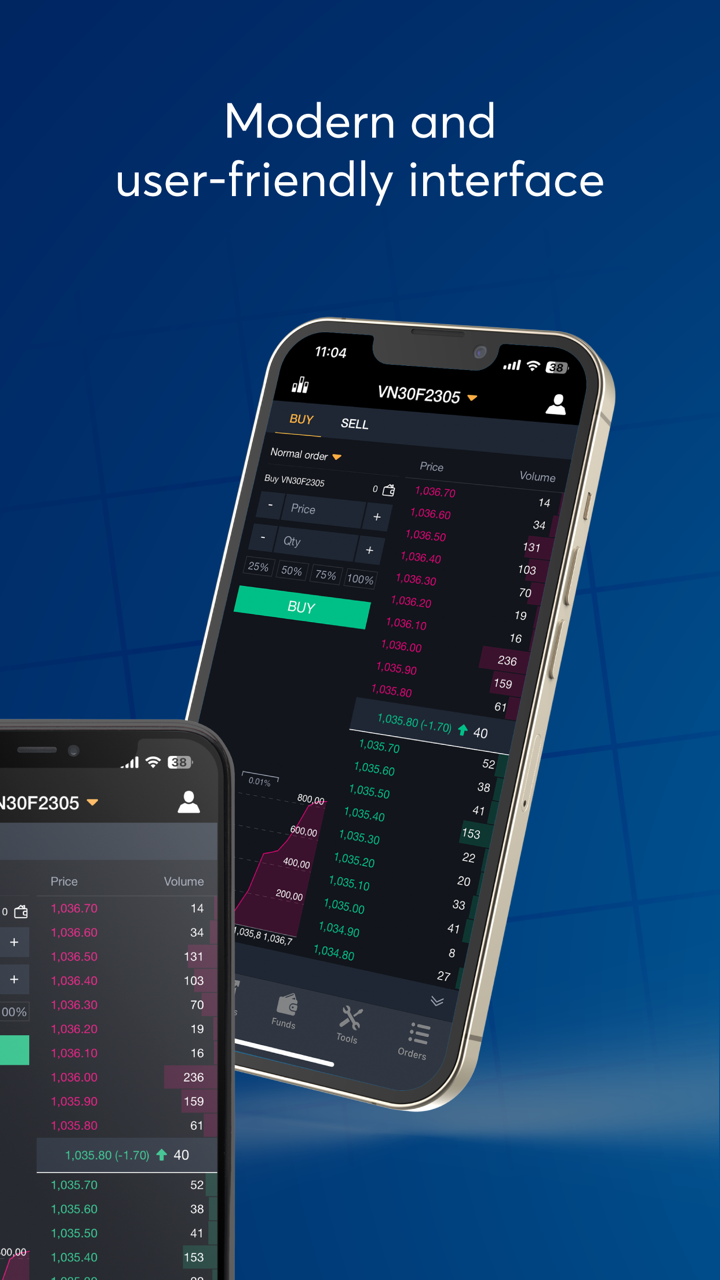

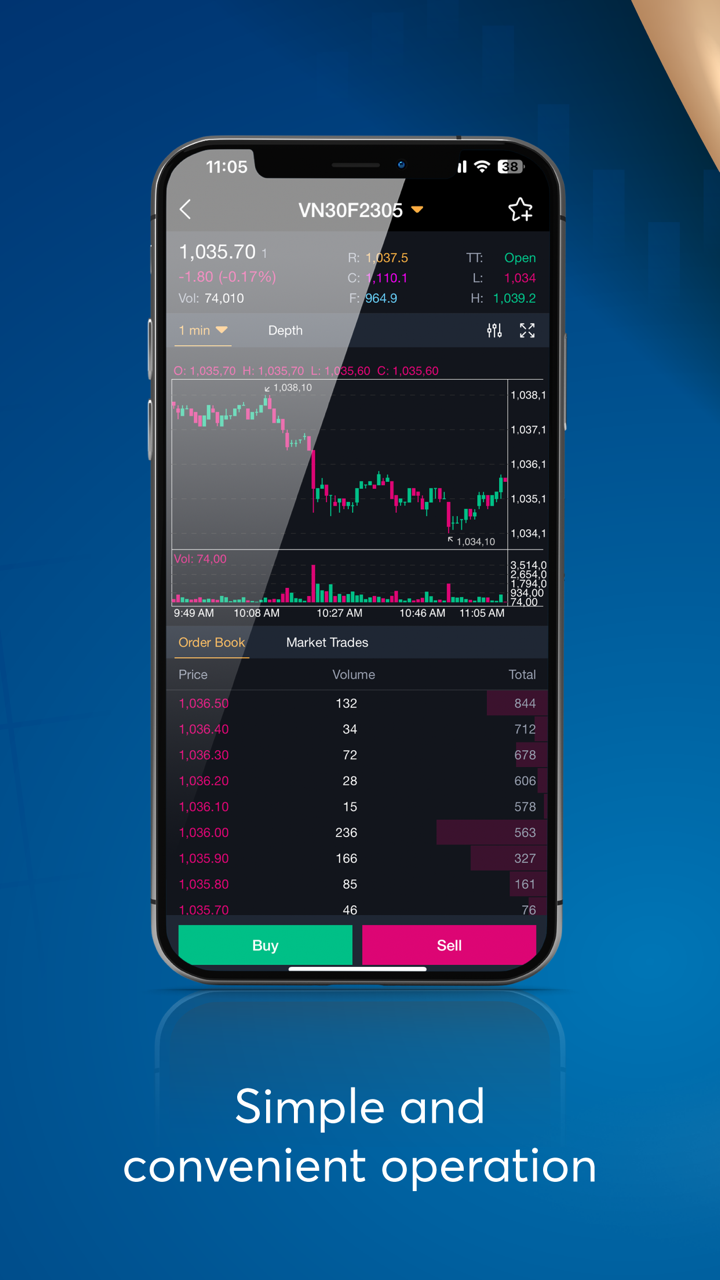

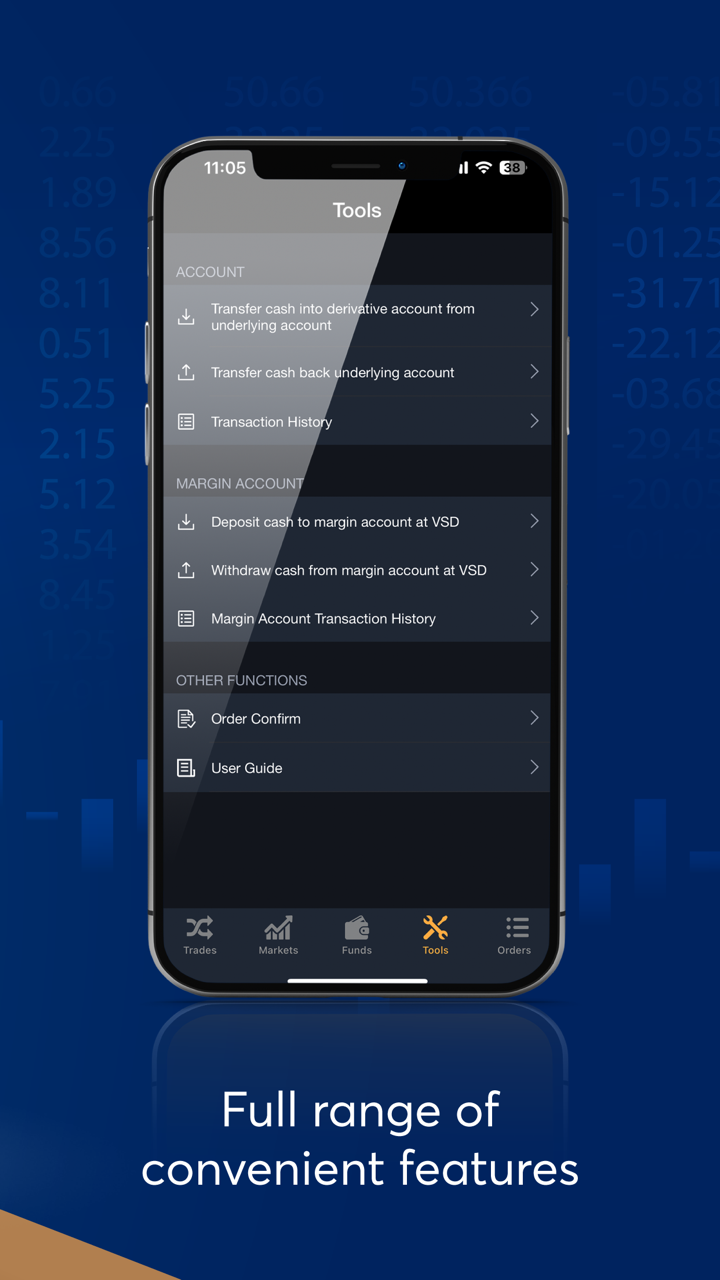

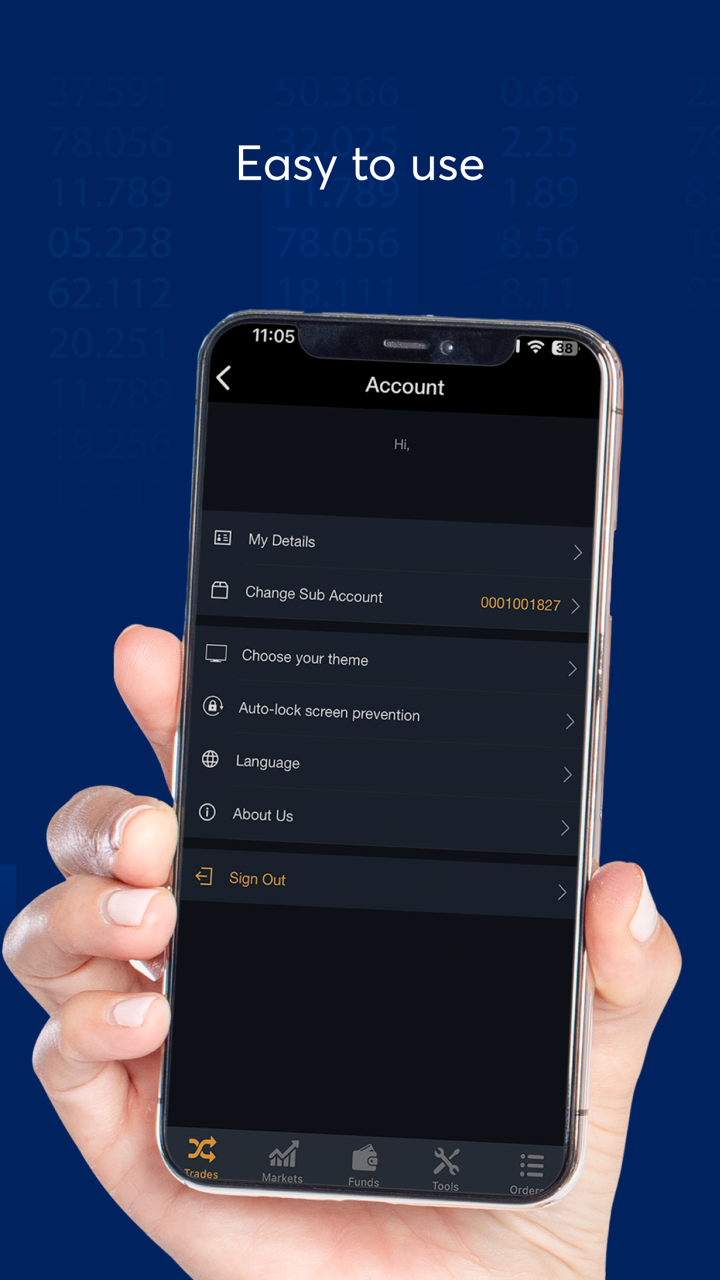

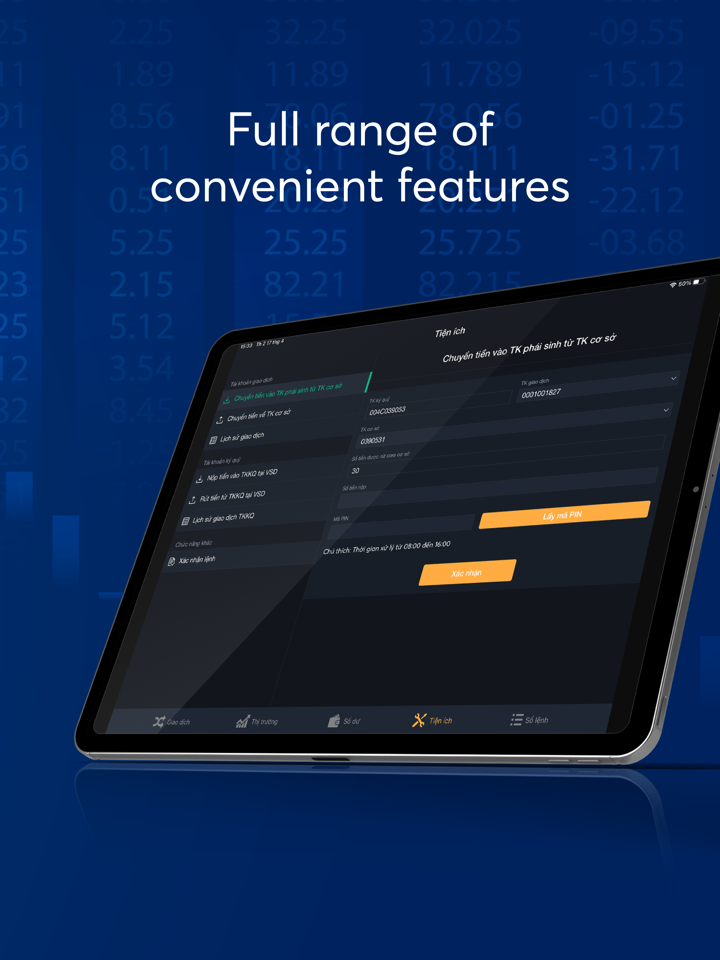

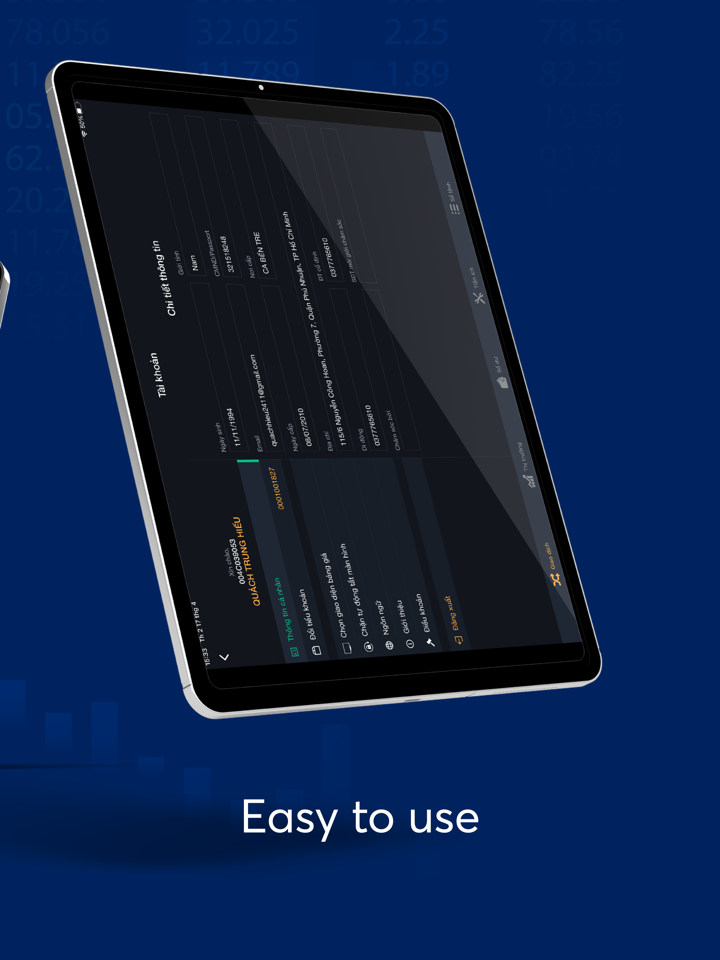

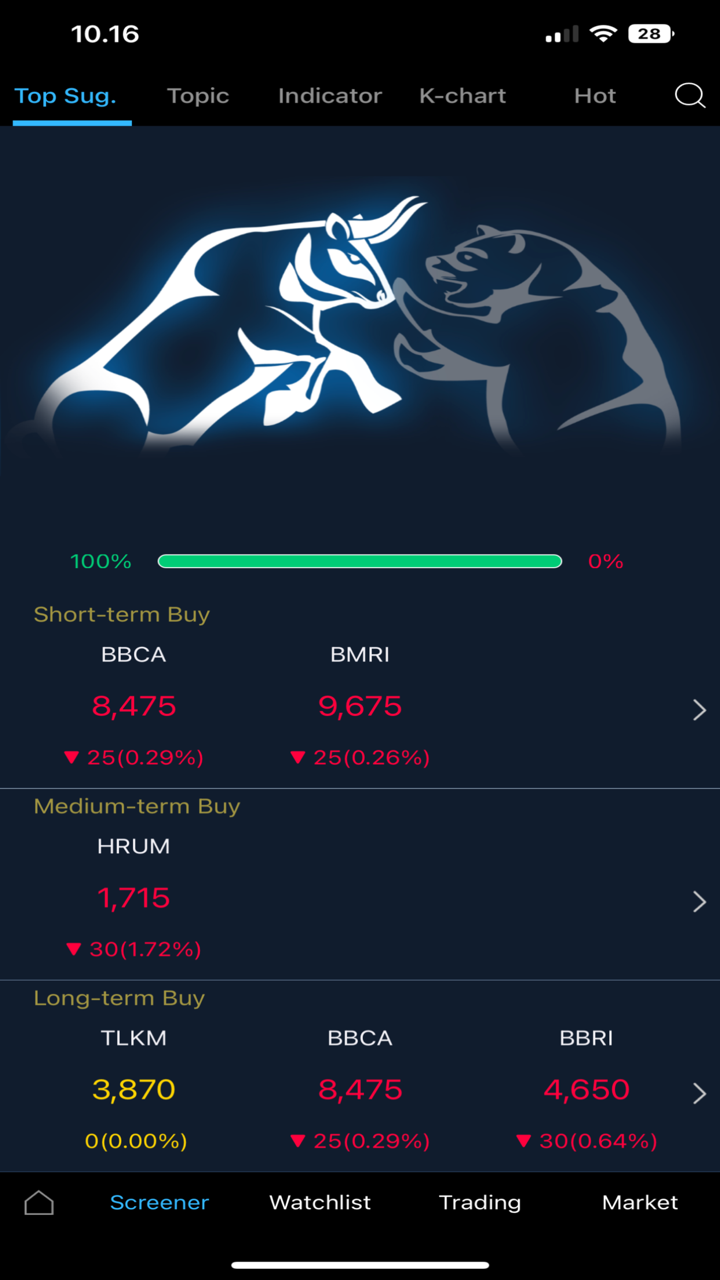

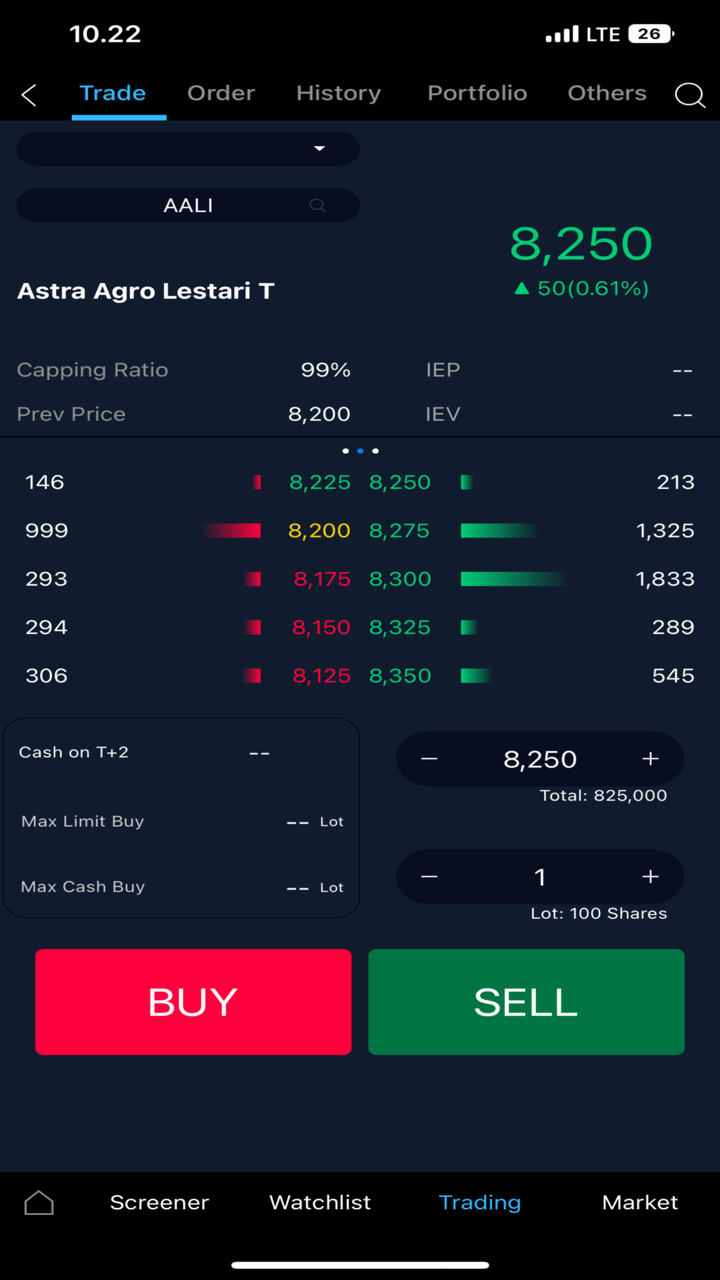

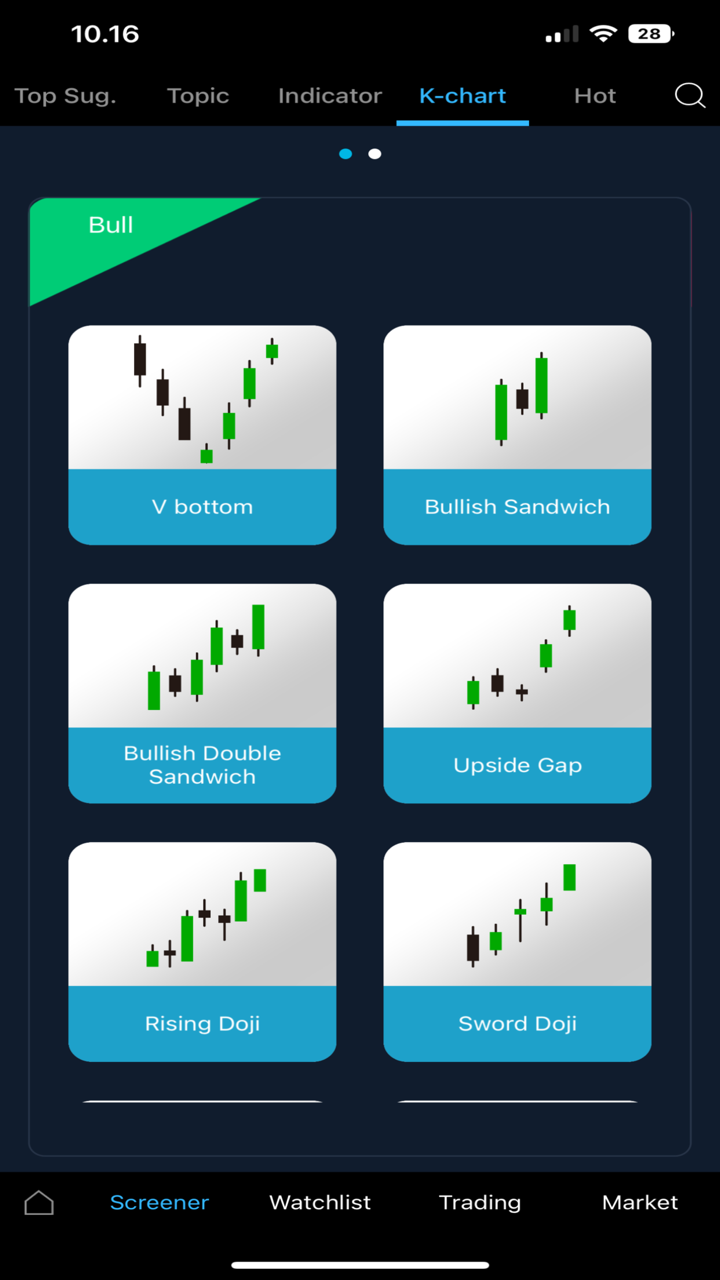

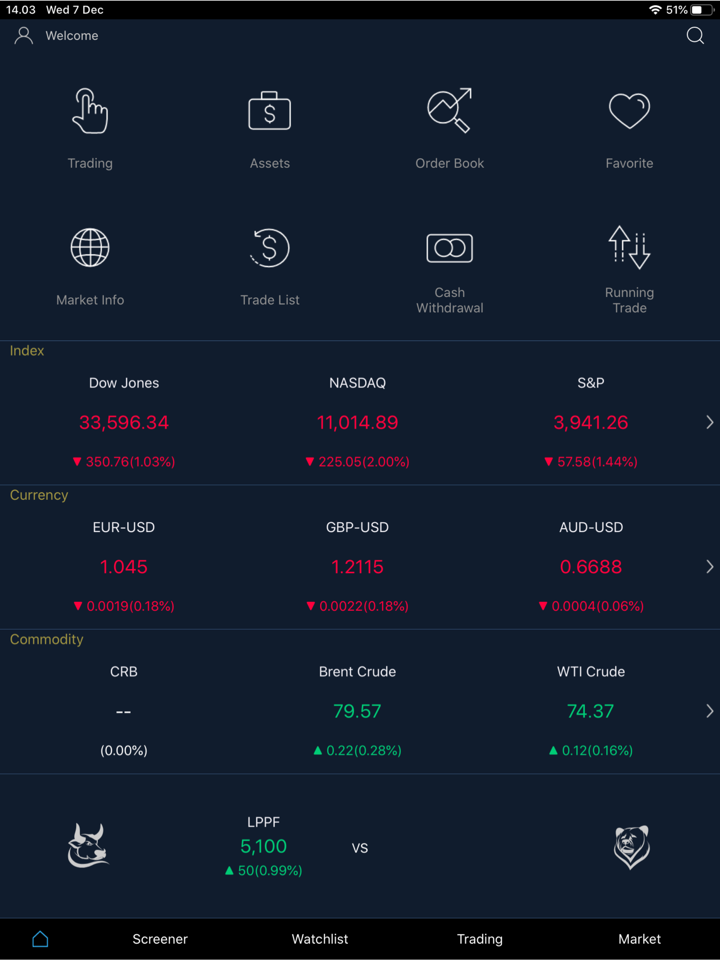

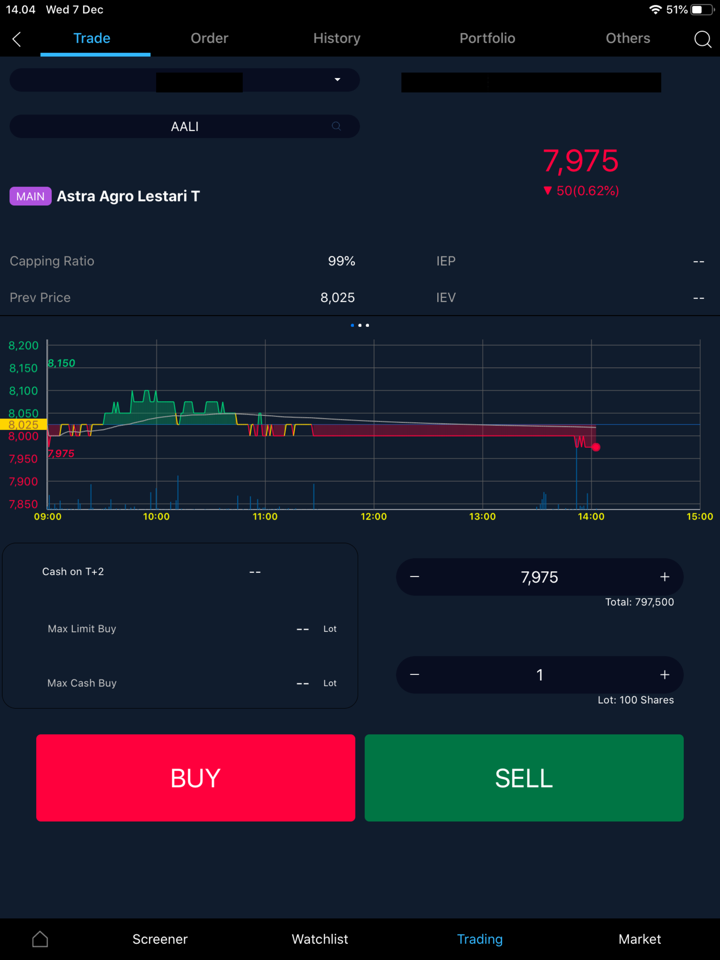

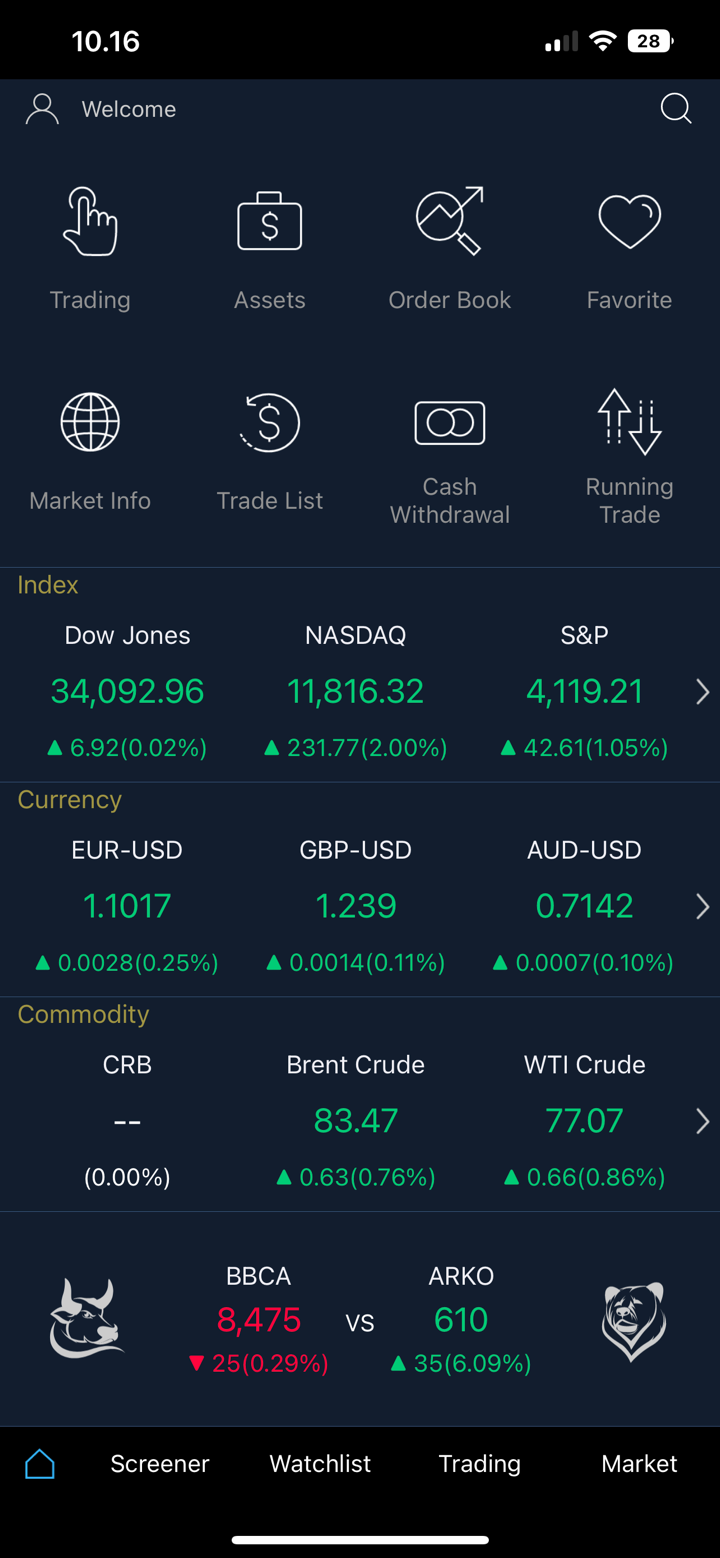

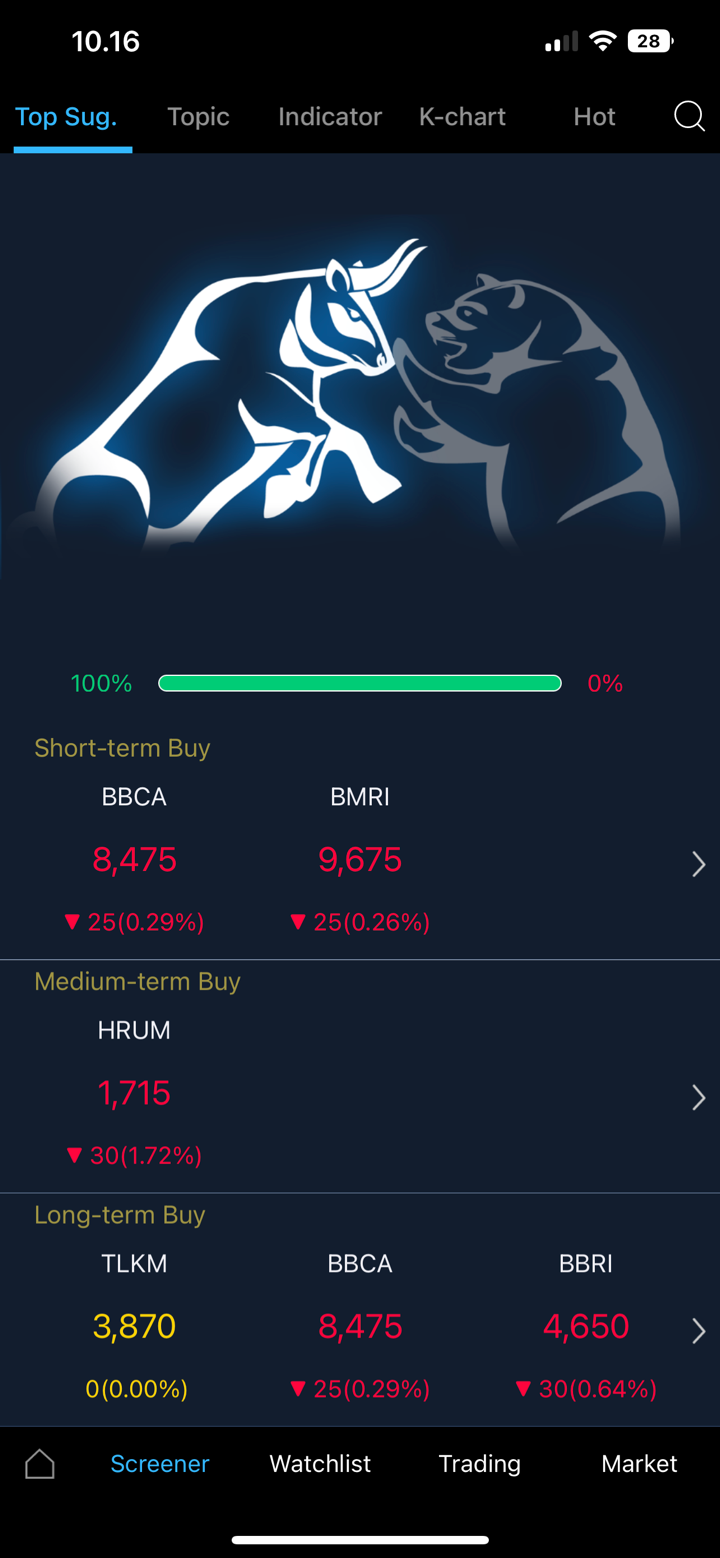

Yuanta offers a suite of trading platforms under the eWinner and YSHK SP Trader brands, designed for both desktop and mobile users.

| Trading Platform | Supported | Available Devices |

| eWinner | ✔ | Web, PC, iOS, Android |

| YSHK SP Trader | ✔ | PC, iOS, Android |

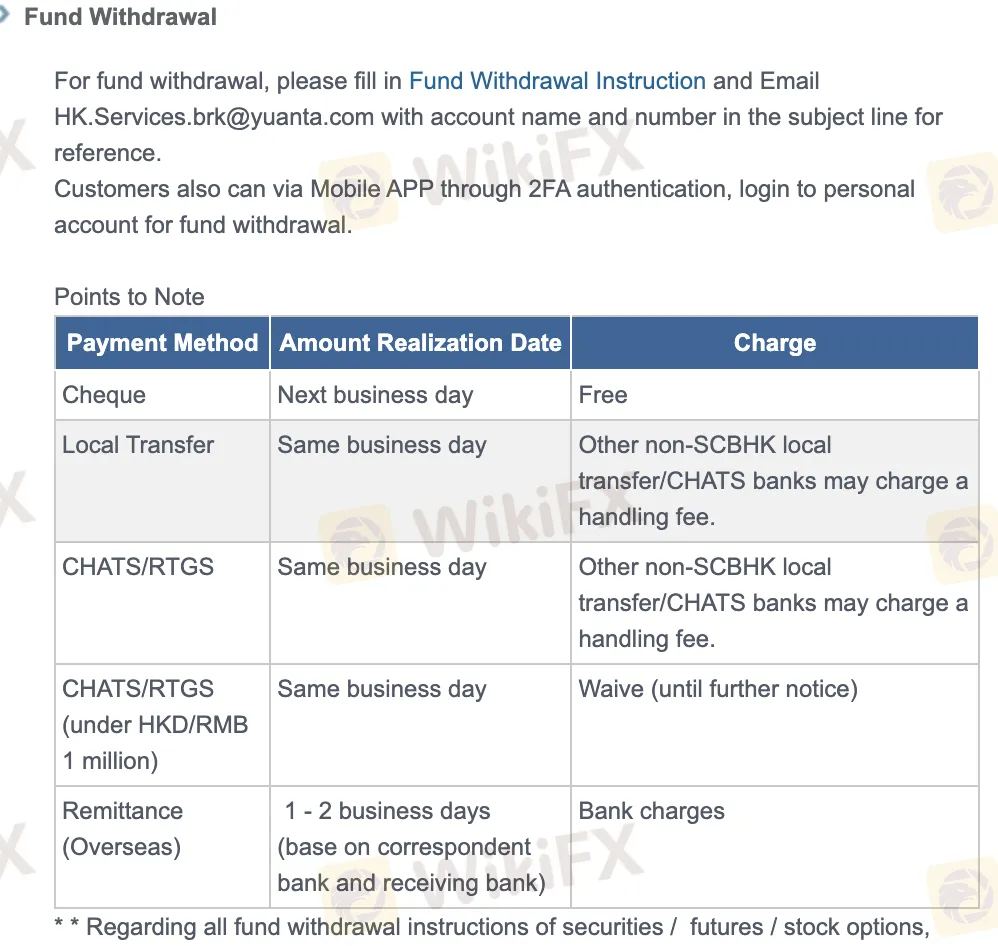

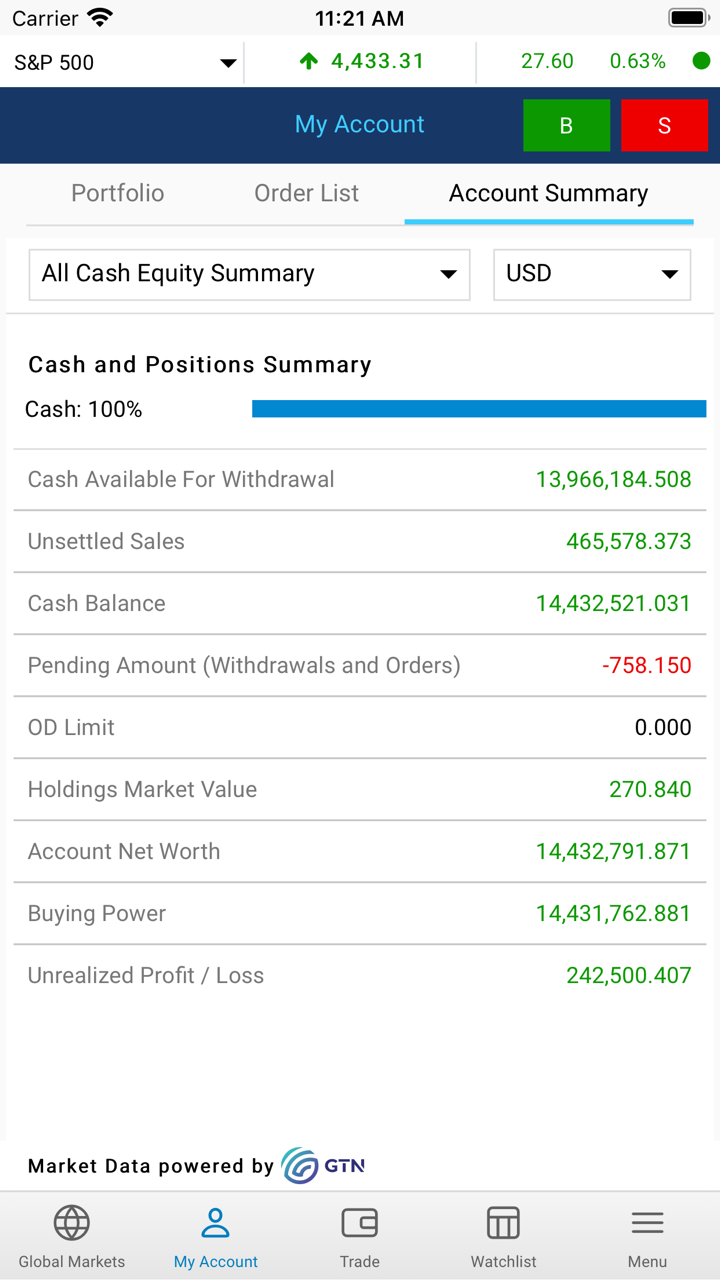

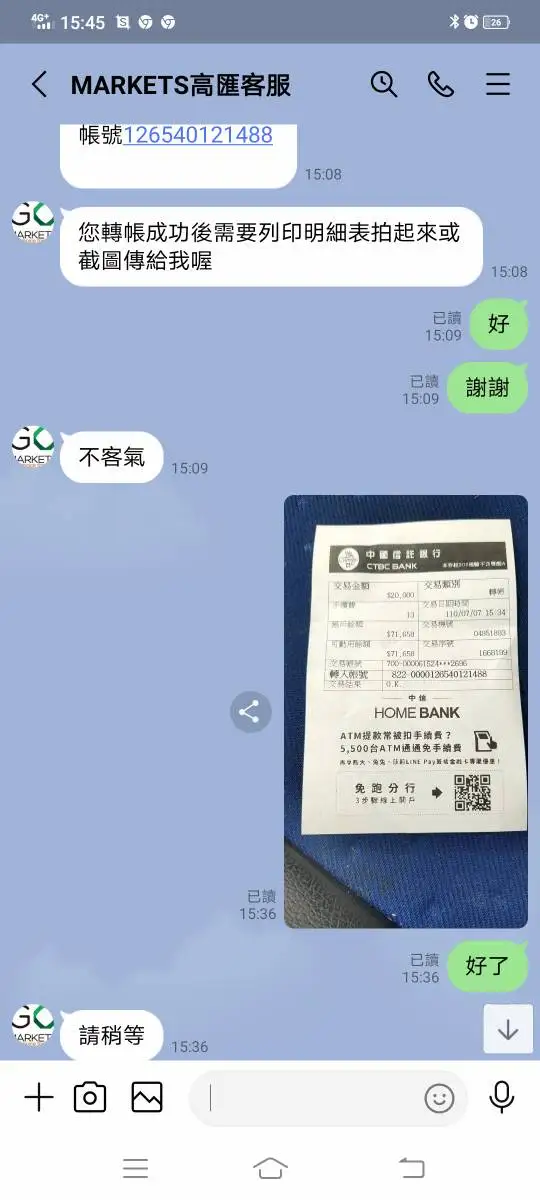

Deposit and Withdrawal

Yuanta does not charge deposit or withdrawal fees directly, but third-party banks may impose charges depending on the method (especially for CHATS/RTGS and overseas remittance). No specific minimum deposit amount is mentioned in the policy.

| Payment Method | Fees (Yuanta) | Processing Time | Notes |

| Cheque Deposit | 0 | Next business day | Cheque copy & receipt with account info required |

| Local Bank Transfer | 0 (via SCBHK), others may charge | Same business day | SCBHK transfers free; non-SCBHK/CHATS may incur fees |

| CHATS/RTGS | Waived under HKD/RMB 1 million (temp.) | Larger amounts may incur third-party charges | |

| Overseas Remittance | Yuanta: 0; Bank charges apply | 1–2 business days (depends on correspondent bank) | Full bank and SWIFT details required per currency |

| Mobile App (2FA) | 0 | Same day (if before cutoff) | Withdrawal via mobile app requires authentication |

| Email Instruction | 0 | Processed on same or next business day | Must email with account name & number before cutoff (5:00pm HKT) |