Company Summary

| Savexa Review Summary | |

| Founded | 2015 |

| Registered Country/Region | Comoros |

| Regulation | Not Regulated |

| Market Instruments | Forex, Commodities, Indices, Cryptocurrencies, Stocks, Metals |

| Demo Account | / |

| Leverage | Up to 1:400 |

| Spread | From 2.5 pips (Classic account) |

| Trading Platform | WebTrader |

| Minimum Deposit | / |

| Customer Support | Live Chat, Contact Form |

| Phone: +447822107974 | |

| Email: support@savexa.com | |

| Social Media: Facebook, Twitter, Instagram, YouTube, LinkedIn | |

| Regional Restrictions | The USA, Canada, Russia, Belarus, Iran, Iraq, North Korea, Europe, the United Kingdom |

Savexa Information

Founded in 2015, registered in Comoros, Savexa is a trading platform. It offers access to a diverse range of market instruments, including forex, commodities, indices, cryptocurrencies, stocks, and metals. The platform supports high leverage of up to 1:400 and provides flexible spreads. Trading is conducted on the WebTrader platform.

Pros and Cons

| Pros | Cons |

| Negative balance protection | Not regulated |

| Various trading markets | Regional restrictions |

| Five account types | Demo accounts unavailable |

| Popular payment methods | Account maintenance fee charged |

| Live chat available |

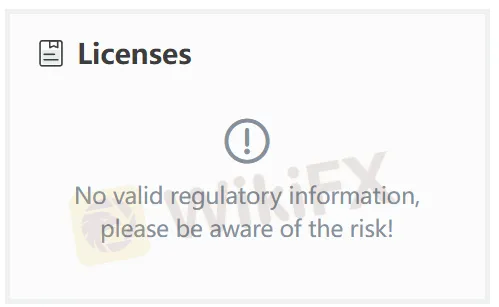

Is Savexa Legit?

Savexa claims to offer negative balance protection for all account types. However, it currently has not been regulated by any authorities. Please be aware of the risk!

What Can I Trade on Savexa?

Savexa claims to offer a diverse range of tradable products, including forex, commodities, indices, cryptocurrencies, stocks, and metals.

| Trading Assets | Available |

| forex | ✔ |

| commodities | ✔ |

| metals | ✔ |

| indices | ✔ |

| stocks | ✔ |

| cryptocurrencies | ✔ |

| bonds | ❌ |

| options | ❌ |

| ETFs | ❌ |

| funds | ❌ |

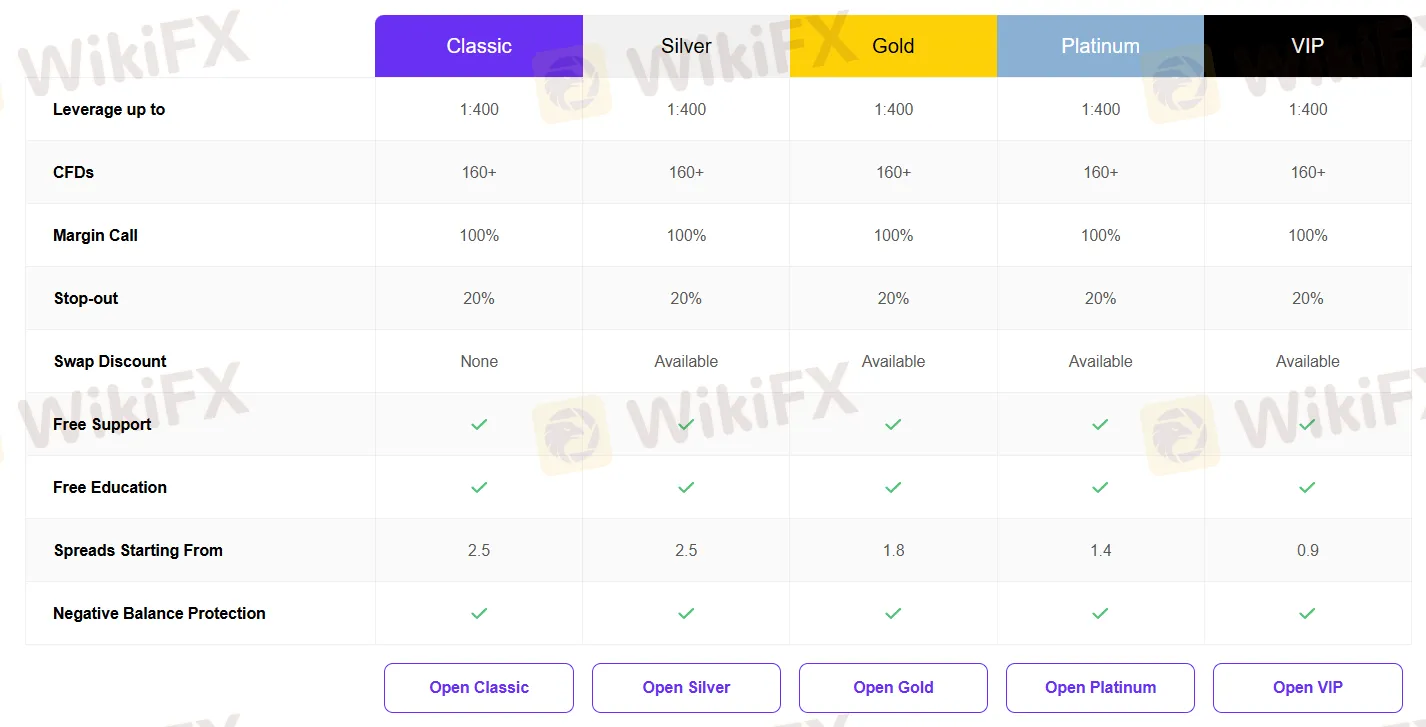

Account Type & Fees

There are five account types available on Savexa: Classic, Silver, Gold, Platinum, and VIP. An inactivity fee is charged for accounts that remain inactive for a specified period.

| Account Type | Classic | Silver | Gold | Platinum | VIP |

| Spread from | 2.5 pips | 2.5 pips | 1.8 pips | 1.4 pips | 0.9 pips |

| Stop-out | 20% | 20% | 20% | 20% | 20% |

| Swap Discount | None | Available | Available | Available | Available |

Margin & Leverage

Savexa offers 100% margin call and leverage up to 1:400 for all account types. Please note that high leverage can amplify not only profits but also losses.

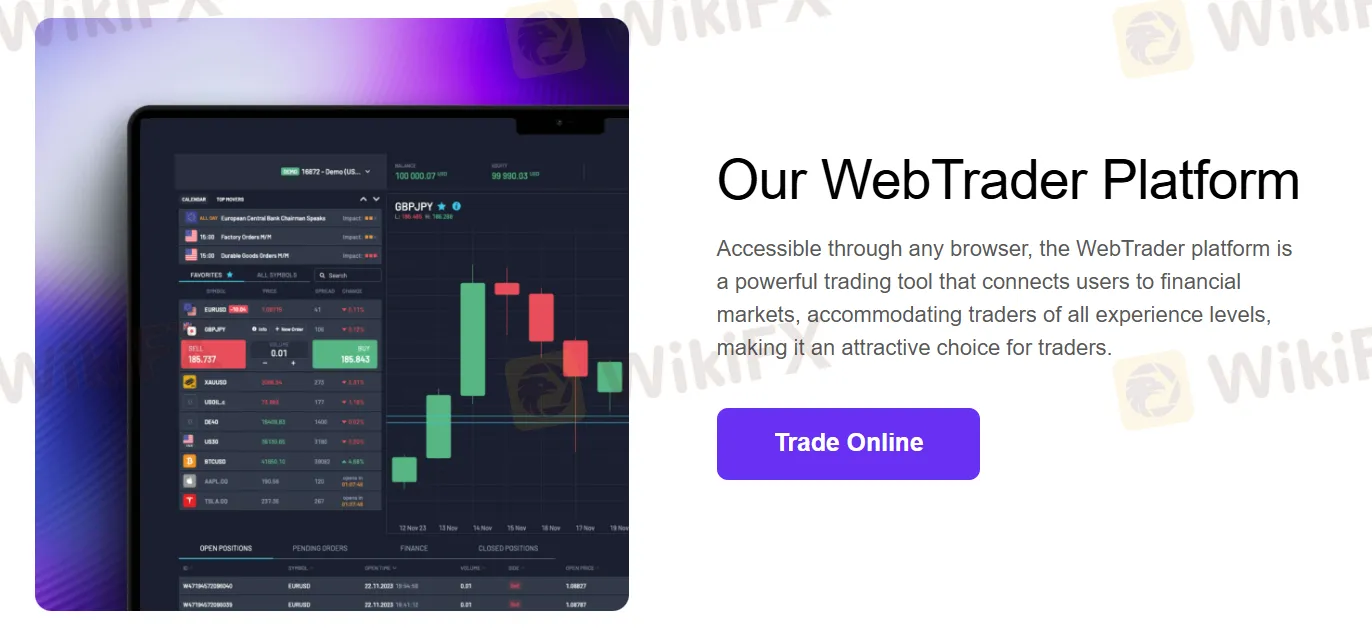

Trading Platform

Savexa offers its own WebTrader platform, which it claims to be a powerful trading tool that connects users to financial markets. You can explore real-time data, advanced analysis tools, and personalized insights to trade from anywhere, backed by expert guidance along the way.

| Trading Platform | Supported | Available Devices | Suitable for |

| WebTrader | ✔ | Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

The minimum withdrawal amount is 10 USD for credit cards and 100 USD for wire transfers. For e-wallets, any amount covering the fee is acceptable.

| Withdrawal Options | Minimum Withdrawal |

| Credit Cards | $10 |

| Wire Transfers | $100 |

Withdrawals typically take 8 to 10 business days, depending on the trader's banks processing time.