Company Summary

| BaringsReview Summary | |

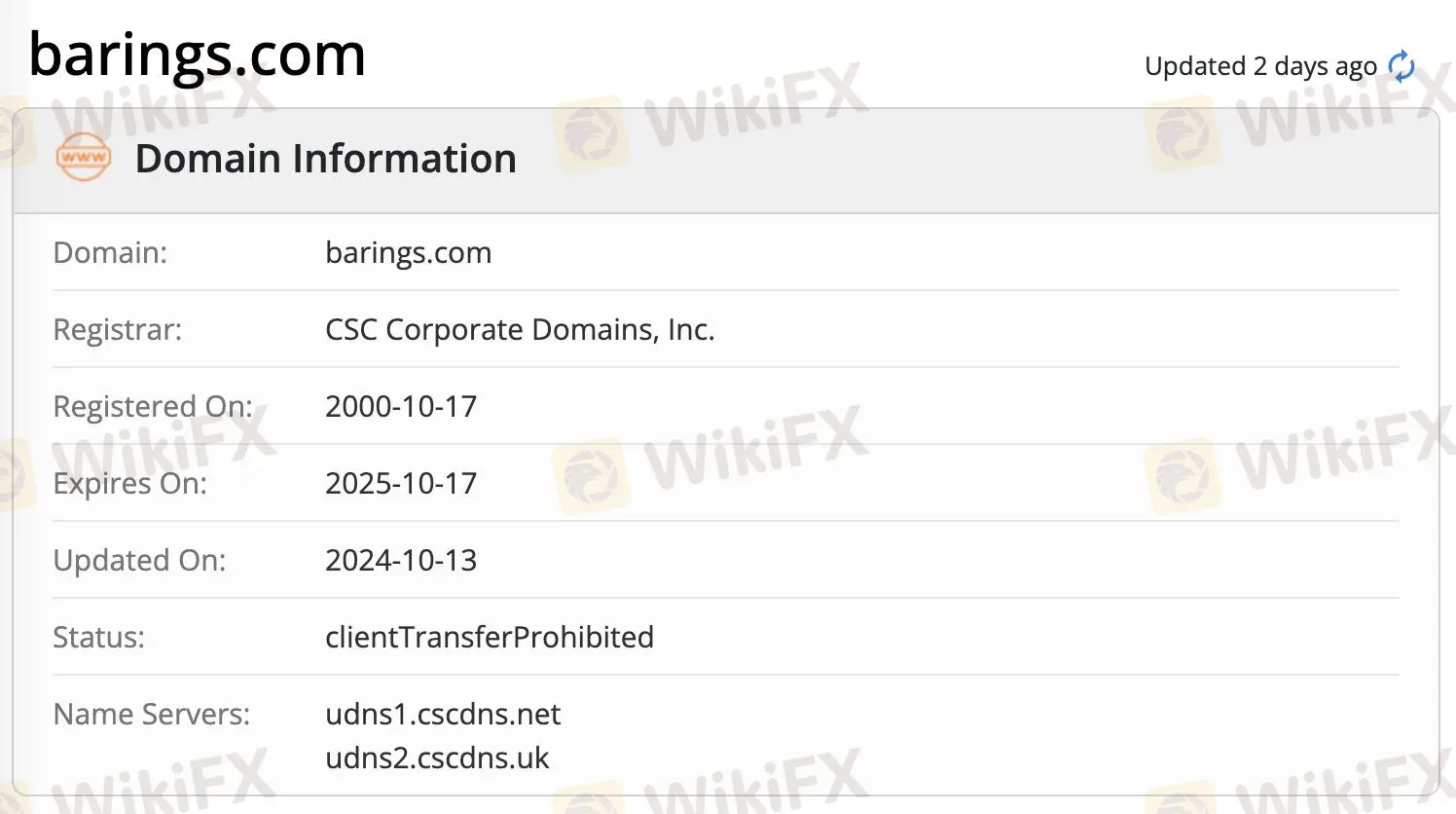

| Founded | 2000 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Services | Global Private Finance, Real Estate, Capital Solutions, Diversified Alternative Equity |

| Customer Support | Contact form |

| Phone: +852 2841 1411 (Global business development); +852 2973 3440 (Institutional Sales Team) | |

| Email: HongKong.Sales@barings.com; BDG.HK.Institutional@barings.com | |

| Twitter, YouTube and LinkedIn | |

| Address: 32/F, Two Pacific Place,88 Queensway, Admiralty, Hong Kong | |

Barings Information

Barings is a financial investment service company registered in Hong Kong while at the same time has gloabl reach throughout the world. The company offers its traders a variety of investment services in Global Private Finance, Real Estate, Capital Solutions, Diversified Alternative Equity. The company is now under SFC (Securities and Futures Commission of Hong Kong) regulation with license No. AAJ177.

Pros and Cons

| Pros | Cons |

| SFC regulated | Lack of transparency |

| Diversified range of financial services | |

| Global reach |

Is Barings Legit?

Yes. Barings is regulated by the Securities and Futures Commission (SFC).

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | Baring Asset Management (Asia) Limited | Dealing in futures contracts | AAJ177 |

Services

Barings offers services in Global Private Finance, Real Estate, Capital Solutions, and Diversified Alternative Equity.